Market Overview:

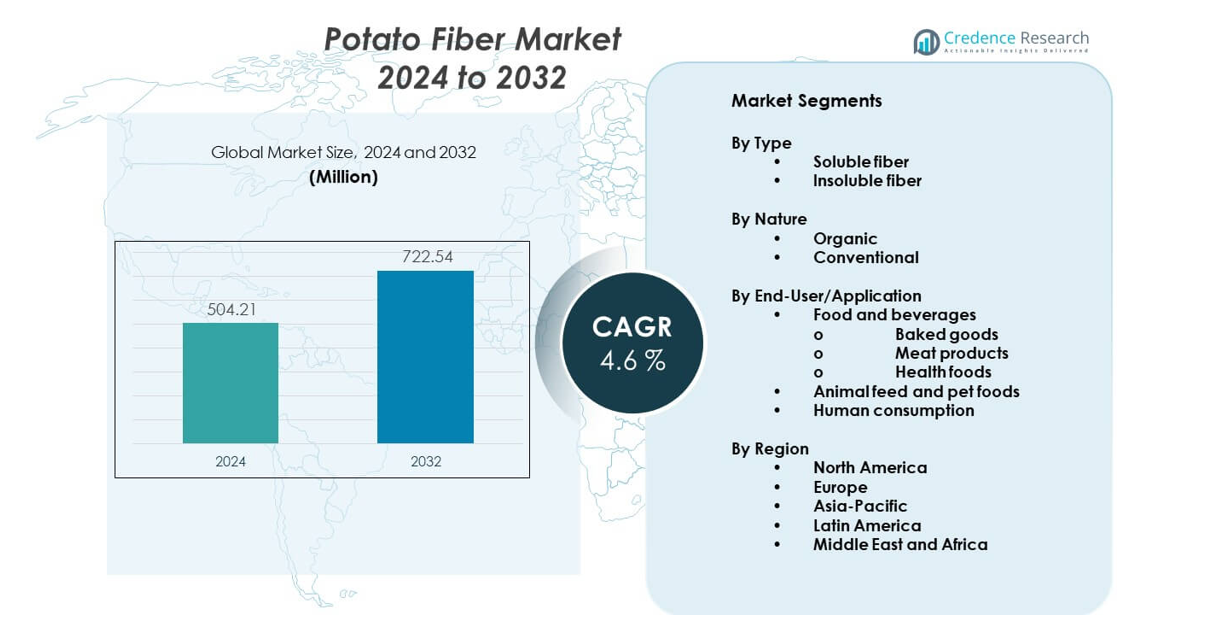

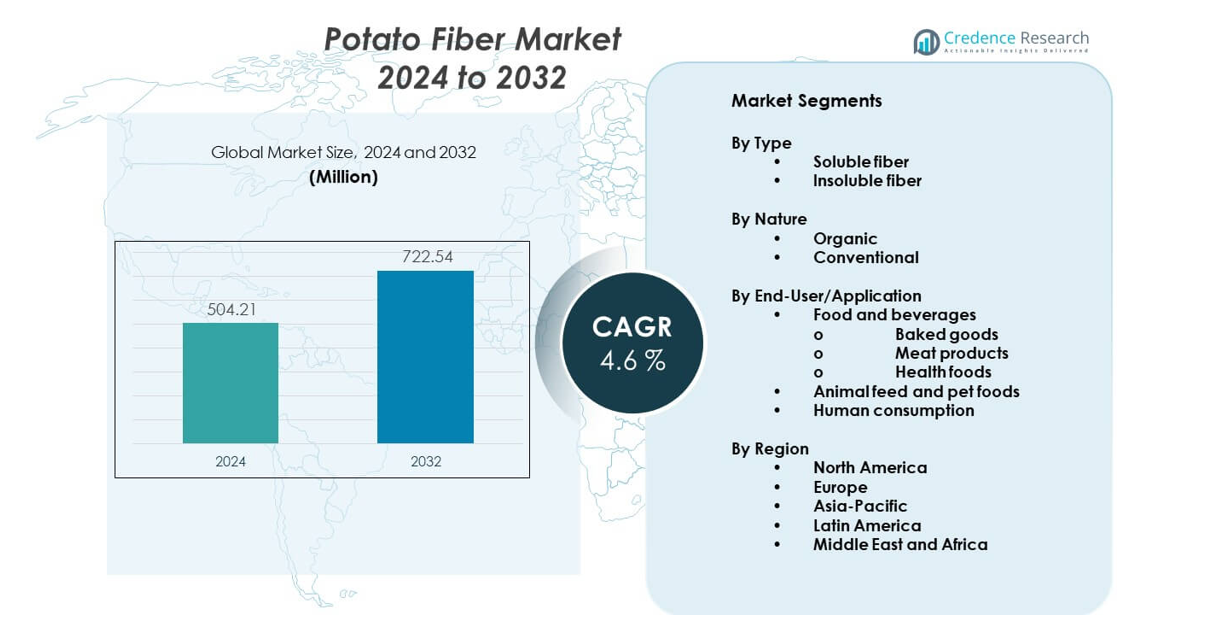

The Potato Fiber Market is projected to grow from USD 504.21 million in 2024 to an estimated USD 722.54 million by 2032, with a CAGR of 4.6% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Potato Fiber Market Size 2024 |

USD 504.21 million |

| Potato Fiber Market, CAGR |

4.6% |

| Potato Fiber Market Size 2032 |

USD 722.54 million |

Rising demand for high-fiber and natural ingredients drives market growth. Consumers prefer clean-label foods with digestive health benefits. Potato fiber supports gut health and satiety claims. Food processors value its neutral taste and strong water-binding capacity. The ingredient improves texture in baked goods and meat alternatives. Growth in plant-based diets supports wider use. Manufacturers also seek allergen-free fiber sources. Potato fiber meets gluten-free and vegan requirements. Cost efficiency from byproduct utilization further supports adoption across food applications.

Europe leads the market due to strong potato processing industries and clean-label adoption. Countries such as Germany, France, and the Netherlands show steady demand. North America follows with growing use in functional foods and meat alternatives. The United States drives innovation in fiber-enriched products. Asia-Pacific is an emerging region with rising health awareness and food processing expansion. China and India show increasing interest in dietary fiber ingredients. Latin America and the Middle East remain developing markets with gradual adoption.

Market Insights:

- The Potato Fiber Market reached USD 504.21 million in 2024 and is projected to reach USD 722.54 million by 2032, expanding at a CAGR of 4.6% during the forecast period.

- Europe leads with about 38% share due to strong potato processing and clean-label adoption, followed by North America at 27% driven by functional foods, and Asia-Pacific at 23 supported by food manufacturing growth.

- Asia-Pacific is the fastest-growing region with a 23% share, driven by rising processed food demand, expanding potato processing capacity, and growing dietary fiber awareness.

- By end-user, food and beverages account for nearly 62% share, led by baked goods, meat products, and health foods due to texture and fiber enrichment needs.

- By type, insoluble fiber holds around 58% share for bulking and digestive benefits, while soluble fiber represents about 42% driven by moisture retention applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand For Clean-Label And Natural Food Ingredients

The Potato Fiber Market benefits from rising clean-label food demand across global food categories. Consumers prefer simple ingredient lists and natural sources in everyday products. Food brands reformulate recipes to remove synthetic additives and fillers. Potato fiber supports clear labelling and natural positioning in packaged foods. Manufacturers value its plant-based and recognizable origin. The ingredient fits vegan and allergen-free product lines. Retailers promote transparency to build consumer trust. This shift supports steady long-term fiber demand.

- For instance, Avebe reports that its potato fiber ingredients contain over 90% dietary fiber content and support E-number–free formulations, helping food brands meet clean-label standards.

Growing Use Of Fiber In Processed And Functional Foods

The Potato Fiber Market gains support from increasing fiber enrichment across processed foods. Food manufacturers add fiber to improve nutritional profiles and health appeal. Potato fiber enhances texture without altering taste. The ingredient suits bakery, snacks, and ready meals. Meat alternatives use it to improve structure and bite. Functional foods target digestive health positioning. Manufacturers prefer versatile fiber sources across formats. These uses strengthen adoption across food applications.

- For instance, Emsland Group states that its Emfibre® potato fiber shows water-binding capacity above 600%, enabling fiber enrichment while maintaining product texture in baked and processed foods.

Cost Efficiency And By-product Utilization In Food Processing

The Potato Fiber Market benefits from cost efficiency linked to by-product use. Potato fiber originates from processing side streams. This approach reduces overall food waste volumes. Producers improve raw material utilization across operations. Lower production costs support competitive pricing. Sustainability targets influence sourcing decisions. Food processors favor circular production models. Efficiency goals support continued fiber adoption.

Compatibility With Gluten-Free And Plant-Based Diet Trends

The Potato Fiber Market aligns with shifting dietary preferences worldwide. Gluten-free product demand continues to rise. Potato fiber offers safe use in such formulations. Plant-based diets increase demand for alternative binders. Manufacturers replace animal-derived ingredients. The fiber supports moisture retention in vegan foods. Product developers value formulation flexibility. Diet trends sustain stable market demand.

Market Trends:

Innovation In Food Texture Enhancement Applications

The Potato Fiber Market shows strong focus on texture enhancement innovation. Manufacturers use fiber to improve mouthfeel and structure. Bakery products gain moisture stability benefits. Snack producers improve consistency and shelf quality. Meat alternatives rely on fiber for firmness. Food labs test new formulation blends. Texture optimization supports premium positioning. Innovation shapes competitive strategies.

- For instance, Roquette confirms that its potato-based texturizing fibers improve gel strength and reduce cooking loss in meat analogues, with internal trials showing moisture retention improvements exceeding 20%.

Expansion Into Pet Food And Feed Applications

The Potato Fiber Market expands beyond human food uses. Pet food brands seek digestive health solutions. Potato fiber supports gut health in pets. Feed producers explore functional fiber benefits. The ingredient fits natural pet nutrition trends. Manufacturers value gentle fiber sources. Pet owners prefer clean formulations. This expansion diversifies demand streams.

- For instance, J. Rettenmaier & Söhne GmbH highlights that its VITACEL® potato fiber grades support stool quality in pet food, offering high insoluble fiber levels and proven swelling capacity above 10 ml/g.

Growth Of Sustainable Ingredient Sourcing Strategies

The Potato Fiber Market reflects sustainability-focused sourcing trends. Food brands prioritize low-waste ingredient options. Potato fiber supports circular economy goals. Sustainability audits guide supplier selection. Environmental reporting influences material choices. Brands highlight responsible sourcing claims. Consumers respond to eco-friendly messaging. Sustainability remains a key trend.

Advancement In Fiber Processing And Quality Control

The Potato Fiber Market benefits from processing technology upgrades. Producers improve fiber purity and consistency. Stable quality supports large-scale food production. Advanced drying methods enhance performance. Standardized grades simplify formulation work. Food safety compliance gains importance. Producers invest in modern equipment. Processing advances strengthen credibility.

Market Challenges Analysis:

Variability In Raw Material Supply And Quality

The Potato Fiber Market faces challenges from raw material variability. Potato harvest quality changes by season. Weather conditions affect fiber yield. Processing consistency becomes harder to maintain. Producers manage supply chain uncertainty. Quality variation impacts food formulations. Manufacturers expect stable specifications. Supply control remains challenging.

Competition From Alternative Dietary Fiber Sources

The Potato Fiber Market competes with multiple fiber alternatives. Citrus and oat fibers hold strong positions. Inulin and pea fiber gain popularity. Buyers compare cost and performance. Switching barriers remain low. Suppliers must prove functional advantages. Differentiation becomes critical. Competition slows rapid penetration.

Market Opportunities:

Rising Demand From Emerging Processed Food Markets

The Potato Fiber Market finds opportunity in emerging economies. Urbanization increases packaged food consumption. Local brands seek affordable fiber options. Potato processing capacity continues to expand. Food safety standards improve ingredient quality. Manufacturers explore regional sourcing. Dietary awareness rises among consumers. Emerging markets support growth.

Product Development In Nutraceutical And Wellness Foods

The Potato Fiber Market gains potential from wellness-focused products. Nutraceutical brands target digestive health benefits. Potato fiber supports satiety and gut claims. Powder formats suit supplement use. Clean-label positioning attracts health-focused buyers. Manufacturers develop fiber-enriched blends. Wellness retail channels expand globally. This segment offers long-term opportunity.

Market Segmentation Analysis:

By Type

The Potato Fiber Market shows clear differentiation between soluble and insoluble fiber types. Soluble fiber supports moisture retention and texture improvement in processed foods. Food manufacturers prefer this type for bakery and ready-to-eat products. Insoluble fiber offers bulking properties and digestive support. This type suits health-focused formulations and fiber-enriched foods. Producers select fiber types based on functional needs. Product performance drives segment demand. Both types support broad food applications.

- For instance, Lyckeby Starch AB reports that its insoluble potato fiber grades deliver high water absorption and stable particle structure, supporting digestive functionality in fiber-fortified foods.

By Nature

The Potato Fiber Market includes organic and conventional variants. Organic potato fiber attracts clean-label and premium food brands. Certified sourcing supports natural and wellness product positioning. Conventional potato fiber holds wider adoption due to cost efficiency. Large-scale food processors prefer stable supply and pricing. This segment supports mass-market food production. Price sensitivity influences buyer choice. Nature-based segmentation shapes procurement strategies.

- For instance, Agrana states that its conventional potato fiber production leverages integrated starch processing, enabling consistent quality output at industrial scale while maintaining food-grade certification compliance.

By End-User/Application

The Potato Fiber Market serves diverse end-use industries. Food and beverages dominate overall consumption. Baked goods use potato fiber for moisture control and shelf stability. Meat products rely on fiber for texture and binding support. Health foods apply fiber for digestive benefits. Animal feed and pet foods adopt it for gut health support. Human consumption remains strong through functional food formats. End-user diversity sustains stable market demand.

Segmentation:

By Type

- Soluble fiber

- Insoluble fiber

By Nature

By End-User/Application

- Food and beverages

- Baked goods

- Meat products

- Health foods

- Animal feed and pet foods

- Human consumption

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe

Europe holds the largest share of the Potato Fiber Market, accounting for about 38% of global demand. Strong potato processing capacity supports steady raw material availability. Clean-label food adoption remains high across Western Europe. Food manufacturers integrate potato fiber into bakery and meat alternatives. Sustainability policies encourage byproduct utilization. Germany, France, and the Netherlands lead regional consumption. Established food regulations support consistent quality standards.

North America

North America represents nearly 27% of the Potato Fiber Market share. The region benefits from high demand for functional and fiber-enriched foods. Consumers show strong interest in digestive health products. Food processors use potato fiber in snacks and plant-based foods. The United States leads regional adoption due to product innovation. Canada supports growth through clean-label trends. Strong retail distribution sustains market presence.

Asia-Pacific And Rest Of The World

Asia-Pacific accounts for around 23% of the Potato Fiber Market and shows the fastest growth pace. Rising processed food consumption supports demand expansion. China and India drive growth through food manufacturing scale. Health awareness improves dietary fiber adoption. Latin America and LAMEA together hold about 12% share. These regions show gradual uptake in packaged foods. Expanding potato processing capacity supports future growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Emsland Group

- Avebe

- Rettenmaier & Söhne GmbH (JRS)

- Lyckeby Starch AB

- Roquette Frères S.A.

- Agrana

- BI Nutraceuticals

- Ingredion Germany GmbH

- KMC

- Sanacel

Competitive Analysis:

The Potato Fiber Market shows moderate competition with a mix of global and regional players. Leading companies focus on product consistency, supply reliability, and functional performance. Firms invest in processing efficiency to ensure stable fiber quality. Portfolio diversification across food and non-food applications supports revenue stability. Strategic partnerships with food manufacturers strengthen market reach. Players emphasize clean-label positioning to meet buyer expectations. Innovation centers on texture performance and moisture control. Competitive advantage depends on sourcing strength and long-term customer contracts.

Recent Developments:

- In July 2025, Royal Avebe partnered with TNO and Wageningen University & Research to develop innovative 3D food printing technology using potato starch as the primary ingredient. This strategic collaboration aims to pioneer renewable, potato-based printing filaments that will serve as biodegradable alternatives for circular economy applications in food production. The partnership represents a significant milestone in developing plant-based meat substitutes through advanced 3D printing technology, with TNO developing a prototype 3D printer capable of achieving high production speeds while maintaining scalability.

- In June 2025, Ingredion Germany GmbH, as part of AGRANA’s partnership, obtained regulatory clearance for its planned joint venture with AGRANA Stärke GmbH. Through this joint venture, INGREDION Germany GmbH will acquire 49% equity shares in S.C. AGFD Țăndărei s.r.l., and both companies will jointly invest EUR 35 million to expand starch production capabilities in Romania. This strategic expansion is designed to meet growing demand for texture solutions across Europe, Africa, and the Middle East while reducing dependence on imports and improving supply chain sustainability.

- In June 2025, AGRANA and INGREDION Germany GmbH obtained regulatory clearance for their planned joint venture, which was initially announced in September 2024. The joint venture agreement commits both companies to jointly invest EUR 35 million (approximately US$40 million) in expanding starch production in Țăndărei, Romania. Construction of the plant expansion began in June 2025 with an expected completion timeline of 2.5 years, and the plant will immediately begin producing products in support of the joint venture upon construction initiation.

- In May 2025, KMC amba signed a new distribution partnership with UK-based Daymer Ingredients Limited to increase the availability of its clean-label and specialty starch products within the British food manufacturing sector. Under this agreement, Daymer will initially focus on distributing KMC’s native potato starches, with plans to expand the offering to include modified and functional starches tailored for specific industrial food applications. The collaboration is expected to support manufacturers seeking plant-based and allergen-free alternatives to traditional animal-derived ingredients.

Report Coverage:

The research report offers an in-depth analysis based on By Type, By Nature, and By End-User/Application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for clean-label ingredients will support steady market expansion.

- Food manufacturers will increase fiber use in reformulated products.

- Plant-based food growth will strengthen application scope.

- Processing improvements will enhance fiber consistency.

- Sustainability goals will favor byproduct-based ingredients.

- Pet food adoption will expand non-human applications.

- Emerging markets will show rising consumption levels.

- Product innovation will focus on texture performance.

- Supply chain partnerships will gain importance.

- Regulatory alignment will support broader acceptance.