Market Overview

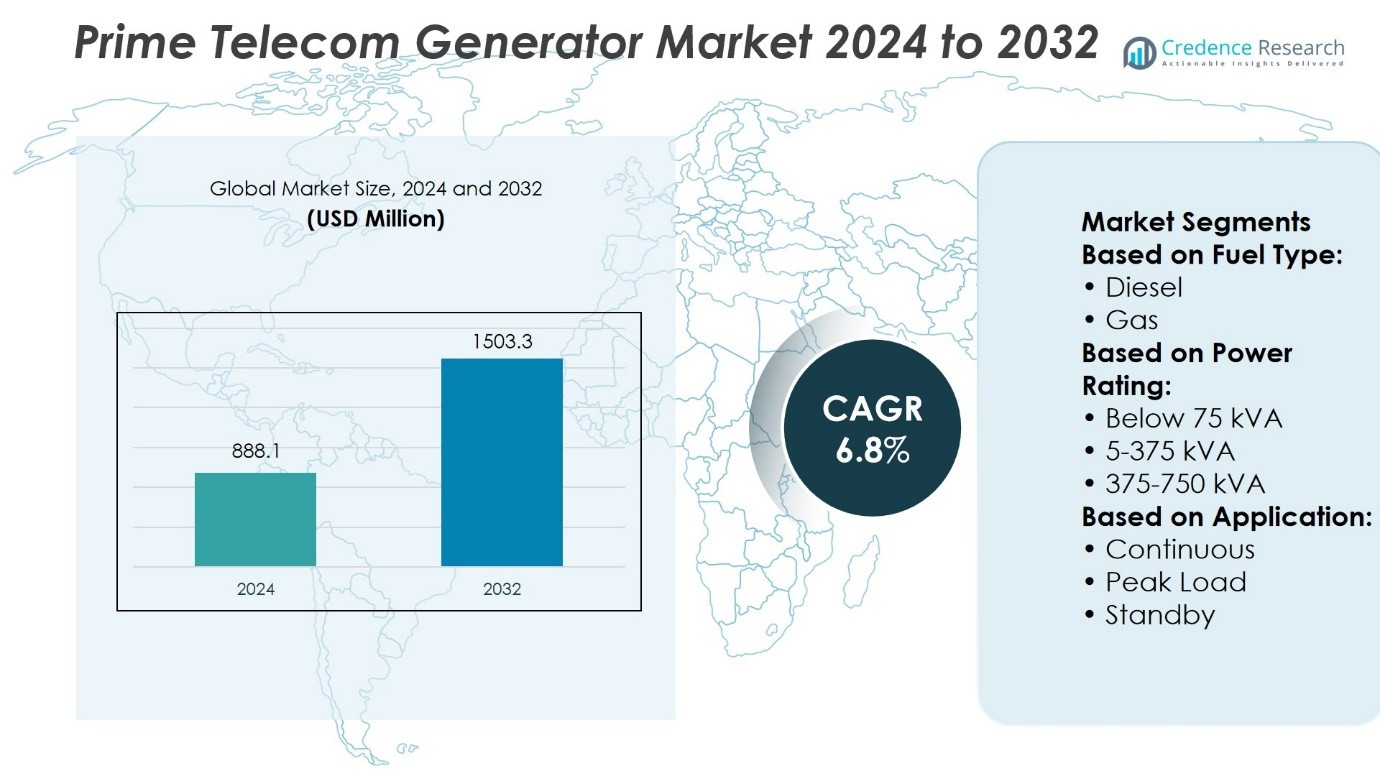

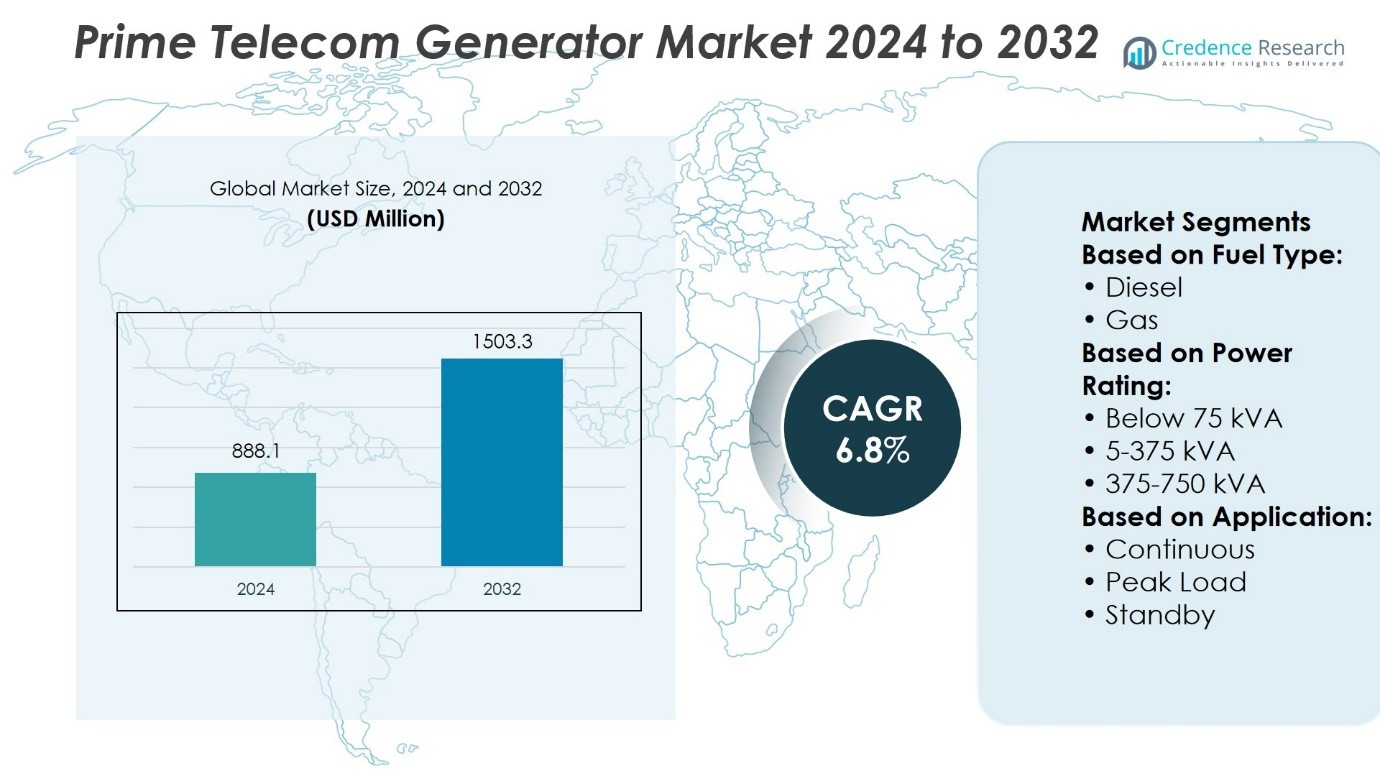

Prime Telecom Generator Market size was valued at USD 888.1 million in 2024 and is anticipated to reach USD 1503.3 million by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Prime Telecom Generator Market Size 2024 |

USD 1503.3 Million |

| Prime Telecom Generator Market, CAGR |

6.8% |

| Prime Telecom Generator Market Size 2032 |

USD 1503.3 Million |

The Prime Telecom Generator Market grows with rising demand for uninterrupted connectivity, expansion of 5G infrastructure, and increasing reliance on telecom towers in remote and urban locations. It benefits from the need for reliable backup power in areas with unstable grids and from resilience measures against extreme weather disruptions. The market shows a clear trend toward hybrid solutions that integrate diesel, gas, solar, and battery systems, improving efficiency and reducing emissions. It also reflects adoption of digital monitoring technologies that enhance operational control, lower maintenance costs, and support telecom operators in meeting sustainability and performance targets.

The Prime Telecom Generator Market demonstrates strong regional adoption, with Asia Pacific leading due to extensive telecom expansion, followed by North America and Europe where reliability and regulatory compliance drive demand. Latin America and the Middle East & Africa show steady growth from rural coverage and off-grid deployments. Key players strengthen competition through global reach, product innovation, and service networks, including Aggreko, Atlas Copco AB, Caterpillar, Cummins Inc., Generac Power Systems, FG Wilson, Kohler Co., MAHINDRA POWEROL, GREEN POWER SYSTEMS s.r.l., and AGG Power Technology (UK) Co., Ltd.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Prime Telecom Generator Market size was valued at USD 888.1 million in 2024 and is projected to reach USD 1503.3 million by 2032, at a CAGR of 6.8%.

- Rising demand for uninterrupted telecom connectivity and 5G rollout drives market adoption across urban and rural networks.

- Growing trend of hybrid systems with diesel, gas, solar, and battery integration supports efficiency and sustainability goals.

- Competitive landscape features global and regional players focusing on product innovation, fuel efficiency, and after-sales service networks.

- High operational costs, emission compliance pressures, and fuel supply challenges act as restraints for market growth.

- Asia Pacific leads in share due to rapid network expansion, followed by North America and Europe with strong reliability and compliance focus.

- Latin America and Middle East & Africa show steady growth supported by rural coverage projects and off-grid telecom deployments.

Market Drivers

Rising Dependence on Uninterrupted Power for Telecom Infrastructure

The Prime Telecom Generator Market grows with the increasing reliance of telecom operators on continuous power supply. Modern communication networks support data-heavy applications, 5G rollout, and IoT connectivity, all of which require stable energy. Power outages directly affect service quality and customer retention, creating demand for reliable backup solutions. Telecom towers in both urban and remote areas adopt generators to maintain consistent performance. It ensures that downtime is minimized and network reliability is preserved. The push for energy resilience strengthens generator adoption across multiple telecom regions.

- For instance, GREEN POWER SYSTEMS s.r.l. delivered more than 1,200 diesel and gas generator units ranging from 10 kVA to 800 kVA for European telecom operators, with each installation capable of providing continuous backup for up to 72 hours without refueling, ensuring stable operations during grid instability.

Expansion of 5G and Broadband Networks Driving Power Demand

The rapid deployment of 5G and expansion of broadband networks intensify energy requirements. The Prime Telecom Generator Market benefits from the need to support higher power loads at telecom sites. Each new site adds to operational complexity, and generators provide the backup capacity required for seamless operations. It enables operators to keep pace with growing customer expectations for speed and connectivity. The shift toward densified networks further amplifies the necessity of standby and prime power sources. Continuous power availability supports the success of large-scale telecom infrastructure investments.

- For instance, Caterpillar’s Cat XQ330 mobile generator delivers 264 kW of prime output and 288 kW of standby output, with a runtime of, based on its integrated fuel tank capacity making it well-suited for sustained telecom tower support during extended power interruptions.

Increasing Rural and Remote Telecom Deployments Boosting Generator Use

Expanding telecom coverage into rural and remote areas amplifies the demand for backup solutions. Grid power in such regions often remains unreliable or unavailable, making generators essential. The Prime Telecom Generator Market supports operators by ensuring consistent service in these challenging locations. It offers flexibility to power base stations, microwave links, and small cell towers where conventional energy infrastructure is limited. Reliable generator systems maintain network continuity even under harsh conditions. Rural connectivity initiatives from governments and private firms accelerate generator deployment.

Rising Focus on Energy Security and Operational Reliability

Telecom operators prioritize energy security to safeguard operations against unpredictable outages. The Prime Telecom Generator Market addresses this need by offering robust power solutions tailored to the telecom environment. It enhances operational reliability by delivering uninterrupted power during grid failures or surges. Telecom operators adopt generators with higher fuel efficiency and smart monitoring capabilities to control costs and improve dependability. Ensuring uninterrupted service is critical to maintaining customer satisfaction and regulatory compliance. Growing emphasis on operational resilience drives continuous investments in generator technologies.

Market Trends

Integration of Hybrid Power Solutions with Telecom Generators

The Prime Telecom Generator Market reflects a steady move toward hybrid power systems that combine diesel, gas, and renewable sources. Operators seek to balance reliability with sustainability by reducing dependence on a single energy type. It creates opportunities for systems that integrate solar panels or battery storage with conventional generators. Hybrid deployment improves fuel efficiency and reduces emissions, aligning with environmental targets. Telecom sites in off-grid or weak-grid regions benefit the most from these solutions. The trend strengthens the position of generators as part of a diversified power strategy.

- For instance, Mahindra Powerol is a manufacturer of diesel generator sets (gensets) for various sectors, including telecom, with a range from 5 kVA up to 625 kVA.

Adoption of Remote Monitoring and Smart Control Systems

Telecom operators increasingly require advanced monitoring capabilities for power equipment. The Prime Telecom Generator Market incorporates IoT-enabled controls that provide real-time performance data and predictive maintenance alerts. It allows operators to manage fleets of generators across thousands of dispersed sites with greater efficiency. Remote monitoring reduces downtime and lowers operational costs by anticipating faults before they occur. Smart control systems also optimize fuel consumption and improve service reliability. The adoption of such digital features sets new benchmarks for generator performance in telecom applications.

- For instance, Cummins’ PowerCommand Cloud™ system enables 24/7 remote monitoring and management of generator systems via web or mobile devices, offering real‑time visibility into engine status, alternator metrics, transfer‑switch positions, and load levels with secure, interface‑based access.

Transition Toward Low-Emission and Cleaner Fuel Generators

Growing regulatory pressure and sustainability commitments shape investment decisions for telecom power systems. The Prime Telecom Generator Market advances with the adoption of generators designed for low emissions and alternative fuels. It includes the use of natural gas, biofuels, and cleaner combustion technologies. Operators adopt these solutions to meet environmental standards without compromising reliability. Telecom firms also highlight their sustainability credentials by shifting toward greener energy practices. The focus on environmentally compliant generators drives continuous product innovation across the sector.

Increasing Use of Modular and Scalable Generator Systems

The telecom industry demands scalable power solutions to match the growth of network infrastructure. The Prime Telecom Generator Market responds with modular systems that can be adapted to various site requirements. It enables operators to deploy flexible units that support small cell sites as well as large base stations. Modular designs reduce installation time and simplify maintenance in dispersed locations. Telecom operators benefit from the ability to expand capacity quickly in line with network expansion. This trend ensures generators remain integral to future-ready telecom infrastructure.

Market Challenges Analysis

Rising Operational Costs and Fuel Supply Constraints

The Prime Telecom Generator Market faces challenges from rising operational expenses linked to fuel price volatility and supply chain disruptions. Generators often require significant fuel consumption, which creates long-term cost burdens for telecom operators managing thousands of sites. It becomes more difficult in remote areas where transportation and storage costs are higher. Unreliable fuel delivery can cause service interruptions and reduce network stability. Operators struggle to balance the need for uninterrupted power with the financial strain of maintaining continuous fuel supplies. These factors limit the ability of smaller telecom providers to adopt large-scale generator solutions.

Environmental Regulations and Emission Compliance Pressures

Tightening environmental standards present a major hurdle for generator deployment in telecom operations. The Prime Telecom Generator Market must adapt to stricter emission limits imposed by governments and regulatory authorities. It pushes manufacturers to redesign products that comply with low-emission requirements without compromising performance. Compliance often requires costly technology upgrades, which increase procurement expenses for operators. Telecom companies also face reputational risks if they fail to meet sustainability commitments. Pressure to shift toward renewable integration and cleaner fuels creates both technical and financial challenges for widespread adoption of generators in telecom networks.

Market Opportunities

Expansion of Telecom Infrastructure in Emerging Economies

The Prime Telecom Generator Market offers strong opportunities through the rapid expansion of telecom networks in developing regions. Governments and private operators continue to extend coverage into rural and underserved areas where grid power remains inconsistent. It creates sustained demand for generators to secure reliable energy for base stations and mobile towers. Population growth and rising smartphone penetration amplify the need for wider connectivity, strengthening investments in power backup solutions. Telecom providers seek scalable and cost-efficient generator systems to support this expansion. The growth of new telecom sites across Asia, Africa, and Latin America reinforces long-term opportunities for generator adoption.

Advancement of Hybrid and Renewable-Integrated Generator Solutions

Technological progress creates new possibilities for cleaner and more efficient telecom power systems. The Prime Telecom Generator Market benefits from the integration of hybrid solutions that combine conventional generators with solar, wind, or battery storage. It enables operators to reduce fuel dependency while improving reliability in remote and off-grid areas. Hybrid systems align with global sustainability commitments and regulatory frameworks, creating opportunities for innovation and differentiation. Manufacturers that invest in smart control features and renewable integration strengthen their competitive edge. The shift toward eco-friendly generator solutions positions the market for sustainable growth in the telecom sector.

Market Segmentation Analysis:

By Fuel Type

The Prime Telecom Generator Market divides into diesel, gas, and other fuel categories. Diesel generators hold a strong position due to their reliability and established use across telecom sites. They remain critical in regions with unstable grids and limited renewable penetration. Gas-based units gain traction as operators look for cleaner alternatives with lower emissions. It supports telecom operators working in areas with natural gas availability and environmental regulations. Other fuels, including biofuels, present opportunities where sustainability targets and cost efficiency align with operator priorities.

- For instance, FG Wilson’s telecom-grade genset, models in the 6.8 kW to 25 kW range—include the FG100 control panel with built-in remote monitoring. This enables operators to receive alerts and performance data directly from the network operations center (NOC), supported by fuel tanks of up to 2,000 liters, reducing the frequency.

By Power Rating

Generators in the Prime Telecom Generator Market segment by output capacity: below 75 kVA, 75–375 kVA, 375–750 kVA, and above 750 kVA. Units below 75 kVA serve small telecom towers and micro-sites, providing compact and flexible solutions. Systems rated 75–375 kVA dominate medium-scale operations, powering larger base stations with balanced cost and performance. The 375–750 kVA category addresses high-load demands in network hubs and data-intensive telecom facilities. It ensures power reliability for multiple tower clusters or advanced equipment in metropolitan locations. Generators above 750 kVA focus on large-scale deployments where centralized backup capacity is essential for uninterrupted service.

- For instance, Kohler’s KH300 generator delivers a standby output of 300 kVA and a prime output of placing it firmly in the 75–375 kVA segment. On the higher end, Kohler’s 500REOZJB model offers a similar standby output to meet higher power demands for critical applications such as hospitals, data centers, and industrial facilities.

By Application

Application segments of the Prime Telecom Generator Market include continuous, peak load, and standby use. Continuous power systems support telecom sites in areas with no reliable grid infrastructure, maintaining uninterrupted service. Peak load generators provide additional support during periods of high energy demand, protecting equipment from overloads. Standby units represent a critical segment, offering immediate power during outages and ensuring consistent network availability. It plays an important role for telecom operators who require seamless service continuity across rural and urban networks. The diversity of applications underlines the broad operational relevance of telecom generators across different network environments.

Segments:

Based on Fuel Type:

Based on Power Rating:

- Below 75 kVA

- 5-375 kVA

- 375-750 kVA

Based on Application:

- Continuous

- Peak Load

- Standby

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds about 30% of the Prime Telecom Generator Market. The region benefits from strong 5G network expansion, high internet penetration, and the need for uninterrupted telecom services. Telecom operators and tower companies deploy prime generators to secure power supply during outages caused by storms, wildfires, and other grid disruptions. The market also sees demand from rural areas where grid power is not always stable. Operators invest in advanced diesel and gas generators with remote monitoring features to reduce downtime. Government regulations on network reliability also encourage continuous use of prime generators across the region.

Europe

Europe accounts for around 15% of the Prime Telecom Generator Market. Strict emission regulations in the European Union shape demand for gas-powered and low-emission diesel units. Telecom operators in Western and Eastern Europe use prime generators to maintain reliable connectivity across expanding mobile and broadband networks. The trend toward sustainable solutions encourages hybrid deployment with renewable energy sources. Northern Europe focuses on cold-resistant equipment, while Southern markets rely on backup power during summer demand peaks. Strong service infrastructure and multi-country contracts also support market adoption in Europe.

Asia Pacific

Asia Pacific dominates with nearly 45% of the market. Rapid expansion of telecom infrastructure in China, India, Japan, and Southeast Asia continues to drive generator demand. Rural electrification programs and large-scale rollout of 4G and 5G networks require dependable backup power for towers in both cities and remote regions. Many sites in Asia rely on diesel generators due to weak or unreliable grid access. Hybrid solutions combining solar and battery with prime generators are also gaining adoption to reduce operating costs. The scale of telecom expansion makes Asia Pacific the largest regional market, with high growth potential in both urban and rural networks.

Latin America

Latin America represents about 6% of the market. The region faces challenges of unstable electricity supply, especially in rural and remote areas. Prime generators are used extensively to ensure reliable service for telecom towers in countries such as Brazil, Mexico, and Argentina. Operators prefer diesel systems for their durability and ease of fuel availability. Growing mobile coverage expansion projects and rural connectivity programs further drive adoption. Hybrid generators are being tested in some areas to reduce long-term costs. Telecom operators in the region rely on rugged systems that can handle difficult terrain and inconsistent grid support.

Middle East & Africa

The Middle East & Africa contributes roughly 4% of the Prime Telecom Generator Market. Telecom networks in this region depend heavily on generators due to weak or absent grid infrastructure in many areas. Harsh climates in deserts and high temperatures create demand for durable, heat-resistant equipment. Many operators adopt diesel-based systems, but solar-diesel hybrid solutions are increasing, especially for remote towers. Fuel supply and security challenges also make reliable generators critical for uninterrupted services. Telecom expansion projects across Africa and Gulf nations continue to create opportunities for generator deployment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Prime Telecom Generator Market players including Aggreko, Atlas Copco AB, Caterpillar, Cummins, Inc., FG Wilson, Generac Power Systems, Inc., GREEN POWER SYSTEMS s.r.l., Kohler Co., MAHINDRA POWEROL, and AGG POWER TECHNOLOGY (UK) CO., LTD. The Prime Telecom Generator Market is characterized by strong competition where companies focus on innovation, operational reliability, and sustainability. Firms differentiate through advanced fuel-efficient designs, hybrid-ready systems, and digital monitoring solutions that improve fleet management for telecom operators. Competition extends beyond product portfolios to include service contracts, maintenance efficiency, and global distribution reach. Market leaders invest in R&D to develop low-emission technologies that meet tightening regulatory standards while ensuring high performance. Emerging participants strengthen their positions by targeting rural and developing regions with cost-effective and rugged solutions. Strategic partnerships, rental models, and integrated energy management platforms also shape the competitive landscape, making service quality and adaptability as critical as generator performance itself.

Recent Developments

- In June 2024, Caterpillar expanded its commercial power solutions portfolio with the introduction of Cat CG260 gas gensets which is engineered to run on hydrogen fuel. These gensets are available in 12- and 16-cylinder models and are certified to handle up to 25% hydrogen gas content by volume.

- In May 2024, Aggreko has launched the POWERMX range, featuring the first-ever three-engine, 1.35MVA generator within a single ISO 20 ft container, designed to provide flexible, efficient, and scalable power solutions. This innovative system, tailored for energy-intensive industries, autonomously adjusts power output to meet varying demands, optimizing fuel efficiency and minimizing emissions, while enhancing resilience and overcoming grid limitations.

- In April 2024, Cummins Power Generation has introduced the C2750D6E and C3000D6EB generator sets, extending their Centum Series, powered by Cummins’ QSK78 engine, these models deliver 2750kW and 3000kW, respectively, and are designed for critical applications including data centers and healthcare facilities. With fast start performance, robust load handling, and a compact design for space optimization, they are ideal for high-demand environments.

Market Concentration & Characteristics

The Prime Telecom Generator Market demonstrates moderate concentration, with a mix of global manufacturers and regional suppliers shaping competition. It is defined by a balance between multinational corporations that dominate through scale, technology, and service networks, and smaller firms that capture share in cost-sensitive or emerging markets. The market reflects characteristics of high entry barriers due to regulatory compliance, capital requirements, and established distribution channels. It emphasizes durability, efficiency, and adaptability to diverse telecom environments ranging from urban hubs to remote off-grid sites. It also reflects growing demand for hybrid solutions and low-emission technologies, aligning with sustainability priorities of telecom operators. Service quality, long-term maintenance contracts, and supply chain resilience remain central characteristics influencing purchasing decisions. This combination of global leadership, regional specialization, and evolving regulatory frameworks defines the competitive structure and operational dynamics of the sector.

Report Coverage

The research report offers an in-depth analysis based on Fuel Type, Power Rating, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow with the expansion of 5G networks and densification of telecom sites.

- Hybrid generator solutions with solar and battery integration will see wider adoption.

- Low-emission and cleaner fuel generators will gain preference due to stricter regulations.

- Remote monitoring and IoT-enabled controls will become standard features in deployments.

- Rural and off-grid telecom expansion will continue to drive prime generator installations.

- Compact and modular generator designs will support flexible tower infrastructure needs.

- Rental and energy-as-a-service models will strengthen presence in developing markets.

- Investment in durability and climate-specific designs will rise in harsh environment regions.

- Service networks and long-term maintenance contracts will remain key competitive factors.

- Sustainability commitments by telecom operators will accelerate adoption of green power technologies.