| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Printing Inks Market Size 2024 |

USD 19,441.4 million |

| Printing Inks Market, CAGR |

7.53% |

| Printing Inks Market Size 2032 |

USD 34,816.7 million |

Market Overview

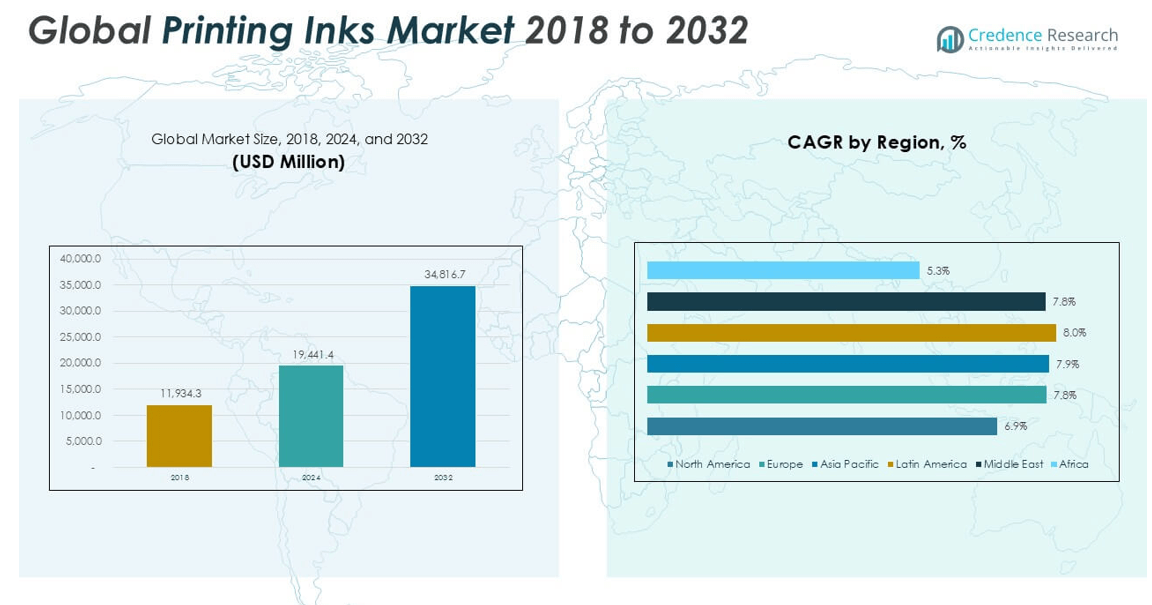

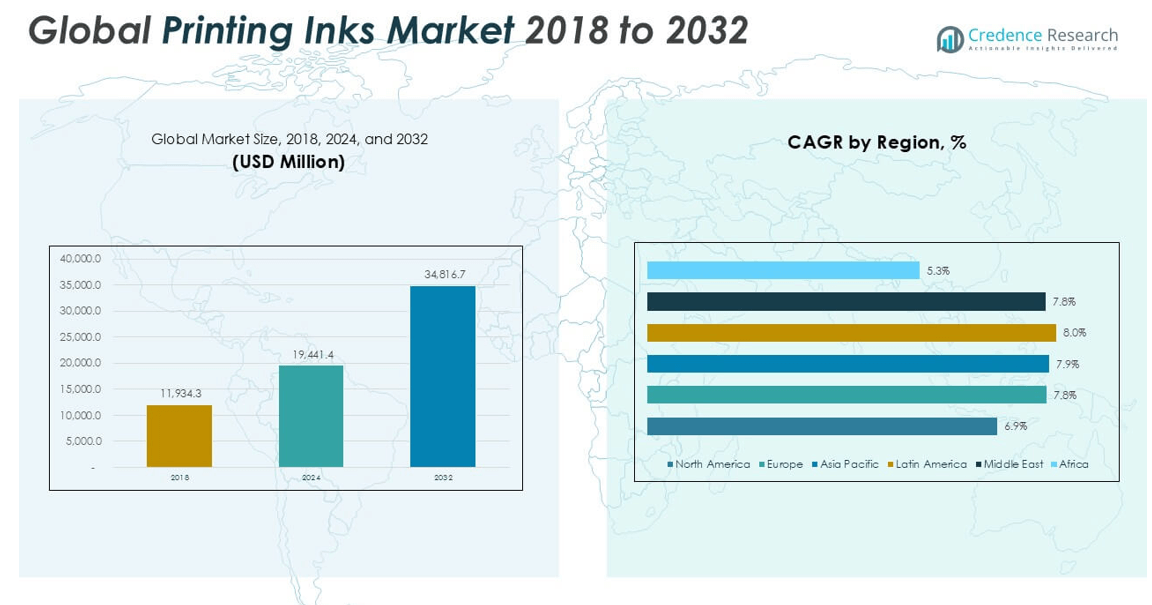

The Global Printing Inks Market is projected to grow from USD 19,441.4 million in 2024 to an estimated USD 34,816.7 million by 2032, with a compound annual growth rate (CAGR) of 7.53% from 2025 to 2032.

Key drivers fueling the market include the rising consumption of packaging products in food & beverage, cosmetics, and pharmaceuticals, which demand attractive and functional printing. Technological advancements in inkjet and flexographic printing methods are enhancing speed, print quality, and cost efficiency, further driving adoption. Moreover, the market is witnessing a shift towards sustainable and bio-based inks, propelled by regulatory pressures and growing environmental consciousness among manufacturers and consumers. Trends such as digital label printing, personalization, and growth in flexible packaging are also contributing to market momentum.

Geographically, Asia Pacific leads the global market due to its strong manufacturing base, rising disposable incomes, and growing retail sector, particularly in China and India. North America and Europe follow, driven by technological innovation and sustainable product development. Key players operating in the global printing inks market include DIC Corporation, Sun Chemical Corporation, Flint Group, Siegwerk Druckfarben AG & Co. KGaA, and Sakata INX Corporation, who continue to invest in R\&D and strategic partnerships to strengthen their global presence.

Market Insights

- The Global Printing Inks Market is expected to grow from USD 19,441.4 million in 2024 to USD 34,816.7 million by 2032, registering a CAGR of 7.53% from 2025 to 2032.

- Rising demand for premium and functional packaging in food, beverage, cosmetics, and pharmaceutical sectors is a primary growth driver.

- Advances in inkjet, flexographic, and UV printing technologies are improving speed, efficiency, and print quality across industries.

- Increased environmental regulations and consumer preference for eco-friendly packaging are pushing demand for water-based and biodegradable inks.

- Fluctuating prices of raw materials like pigments and solvents continue to challenge manufacturers by increasing production costs.

- Asia Pacific leads the market with over 35% share in 2024, supported by industrial growth, expanding packaging demand, and a strong manufacturing base.

- Latin America and the Middle East are witnessing strong growth potential due to rising e-commerce, urbanization, and investment in flexible packaging solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Packaging and Labeling Industries Supports Market Expansion

The Global Printing Inks Market is benefiting from the rapid growth in packaging and labeling industries. The increased use of flexible packaging across food, beverage, cosmetics, and pharmaceutical sectors has led to a surge in demand for high-performance inks. Brands are investing in visually appealing, informative, and durable labels to improve shelf presence and regulatory compliance. This shift toward premium packaging solutions continues to drive innovations in ink formulations and print quality. The market is also witnessing increased use of specialty inks for tamper-evident and security labels. These factors together create a steady need for reliable and high-quality printing inks.

- For instance, more than 4,000,000 metric tons of printing inks were consumed globally for packaging and labeling applications, with the Asia Pacific region accounting for the largest share due to the surge in flexible packaging for food and consumer goods.

Technological Advancements in Printing Methods Drive Ink Innovation

Technological progress in digital, flexographic, and UV printing methods is enhancing the adoption of advanced inks. High-speed inkjet printers require inks with quick-drying properties and excellent adhesion, which pushes manufacturers to develop performance-focused formulations. UV-curable and water-based inks are replacing traditional solvent-based products in many sectors due to improved efficiency and environmental benefits. The Global Printing Inks Market is responding by expanding its product range to support faster turnaround times and reduced operational costs. Hybrid printing technologies also demand inks that can perform well across multiple substrates. This trend is promoting continuous innovation and customization in ink production.

- For instance, a 2024 global survey of printing companies found that over 1,200,000 digital and flexographic printers were installed worldwide, with more than 600,000 tons of UV-curable nd water-based inks used annually in packaging and labeling, reflecting the rapid adoption of advanced printing technologies and ink formulations.

Environmental Regulations Encourage Adoption of Sustainable Inks

Tightening environmental regulations across regions are pushing manufacturers to shift from solvent-based to eco-friendly alternatives. Government initiatives and sustainability goals in packaging sectors are influencing purchasing decisions. The market is seeing a rising demand for water-based, soy-based, and biodegradable inks. The Global Printing Inks Market is adapting by investing in low-VOC and non-toxic ink solutions. Companies are reformulating products to align with circular economy principles. These changes align with consumer preference for sustainable and safe packaging.

Growth in E-Commerce and Personalization Fuels Digital Printing Ink Demand

The expansion of e-commerce is increasing the demand for customized and short-run printing solutions. Brands now require tailored packaging and labels to support direct-to-consumer channels. Digital printing meets this need through fast and cost-efficient production. The Global Printing Inks Market is experiencing growth in digital inks that deliver high resolution, vibrant colors, and quick application. Personalization in marketing materials and retail packaging is further supporting this trend. This shift is positioning digital printing inks as a crucial segment in the evolving print industry.

Market Trends

Shift Toward Sustainable and Bio-Based Inks Reshapes Product Development

Sustainability has become a major trend in the Global Printing Inks Market, influencing the way inks are developed and adopted. Manufacturers are moving away from petroleum-based products and focusing on water-based, soy-based, and vegetable oil-based inks. These alternatives help reduce volatile organic compound (VOC) emissions and support environmental compliance. Brands are increasingly selecting inks that align with green packaging goals and consumer expectations. Governments in key markets are implementing strict environmental guidelines that encourage sustainable printing practices. This trend is reshaping product portfolios and driving investment in cleaner, biodegradable formulations.

- For instance, in 2024, more than 68,000 tonnes of soy-based and vegetable oil-based printing inks were produced globally, with over 12,000 brands in North America and Europe adopting these inks for packaging and publication printing, as documented in company production data and government environmental reports.

Strong Growth in Digital Printing Drives Demand for Specialized Inks

Digital printing continues to gain traction across various industries due to its flexibility, efficiency, and ability to produce short-run, customized outputs. The Global Printing Inks Market is seeing increased demand for inks used in inkjet and electrophotographic printing processes. These inks must offer excellent print resolution, quick drying time, and compatibility with a range of substrates. The rise in e-commerce, variable data printing, and promotional packaging is contributing to the shift from traditional to digital solutions. It is encouraging ink manufacturers to develop products tailored to digital workflows. This trend is expected to intensify with the continued growth of online retail and personalized marketing.

- For instance, in 2024, more than 1,900,000 digital printing presses were in operation worldwide, consuming over 310,000 tonnes of specialized digital inks annually for applications in packaging, labels, and commercial printing, according to industry association surveys and equipment manufacturer shipment records.

Rising Demand for Functional and Specialty Inks in Industrial Applications

Functional inks with properties such as conductivity, UV resistance, and heat sensitivity are gaining attention in industrial sectors. The Global Printing Inks Market is expanding into areas like printed electronics, smart packaging, and security printing. These applications require inks that serve beyond aesthetics, offering added utility and protection. Security inks, for instance, help verify authenticity and deter counterfeiting. Smart packaging incorporates thermochromic or photochromic inks to enhance user interaction and ensure product integrity. This trend is pushing the market into high-performance ink development across niche applications.

Advancements in UV-Curable and Water-Based Technologies Improve Performance

Improved UV-curable and water-based ink technologies are replacing solvent-based systems in various print environments. The Global Printing Inks Market is responding with innovations that enhance color vibrancy, print speed, and environmental safety. UV inks cure instantly under light exposure, enabling faster production and superior adhesion on non-porous materials. Water-based inks are gaining favor in packaging and publication printing due to lower emissions and safer handling. It is becoming standard for printers to adopt these advanced technologies to meet regulatory and performance demands. This evolution supports high-quality, high-volume output across multiple substrates and print formats.

Market Challenges

Volatility in Raw Material Prices Increases Production Costs and Reduces Margins

Fluctuations in the prices of key raw materials such as pigments, solvents, and resins pose a major challenge to the Global Printing Inks Market. The industry relies heavily on petrochemical derivatives, which are subject to global oil price movements and supply disruptions. Unpredictable costs make it difficult for manufacturers to maintain stable pricing or long-term contracts. It affects profit margins and can delay product development or innovation. Smaller players often struggle to absorb these costs, which limits their competitiveness. Manufacturers must continually adapt sourcing strategies to manage cost fluctuations effectively.

- For instance, raw material costs account for 40 to 50 units out of every 100 units of total manufacturing costs in the printing inks sector.

Stringent Environmental Regulations Limit Use of Conventional Ink Formulations

Governments worldwide are enforcing strict regulations on emissions, hazardous chemicals, and waste disposal in the printing industry. The Global Printing Inks Market faces increasing pressure to eliminate VOCs and heavy metals from ink formulations. Compliance requires significant investment in R\&D and production upgrades, which not all companies can afford. It also restricts the use of certain high-performing solvent-based inks that have long been standard in commercial and packaging applications. These regulatory demands may slow down market entry for new players. Companies must navigate complex compliance landscapes while maintaining product performance and cost-efficiency.

Market Opportunities

Expansion of Packaging Sector in Emerging Economies Creates New Growth Avenues

Rapid urbanization, rising disposable incomes, and growth in organized retail are boosting demand for packaging in emerging markets. The Global Printing Inks Market can capitalize on this shift by supplying high-quality inks for flexible, rigid, and specialty packaging. Consumer brands are investing in attractive and functional packaging to capture attention and enhance product differentiation. This demand drives the need for advanced printing solutions that offer vibrant colors, durability, and compliance with food safety standards. It creates opportunities for regional ink manufacturers to expand capacity and product offerings. Collaborations with local converters and packaging firms can strengthen market presence and supply chain integration.

Innovation in Eco-Friendly Inks Offers Competitive Advantage in Green Markets

Growing awareness around sustainability presents an opportunity for companies to lead with eco-friendly ink solutions. The Global Printing Inks Market is well-positioned to meet the demand for water-based, biodegradable, and low-VOC inks in industries such as food, cosmetics, and pharmaceuticals. Brands are seeking environmentally responsible partners that align with their sustainability goals. Companies that invest in green technologies and certifications can gain a distinct market edge. It allows manufacturers to enter premium segments and secure long-term contracts with global brands. Expanding product lines to include non-toxic and recyclable formulations will attract a broader, environmentally conscious customer base.

Market Segmentation Analysis

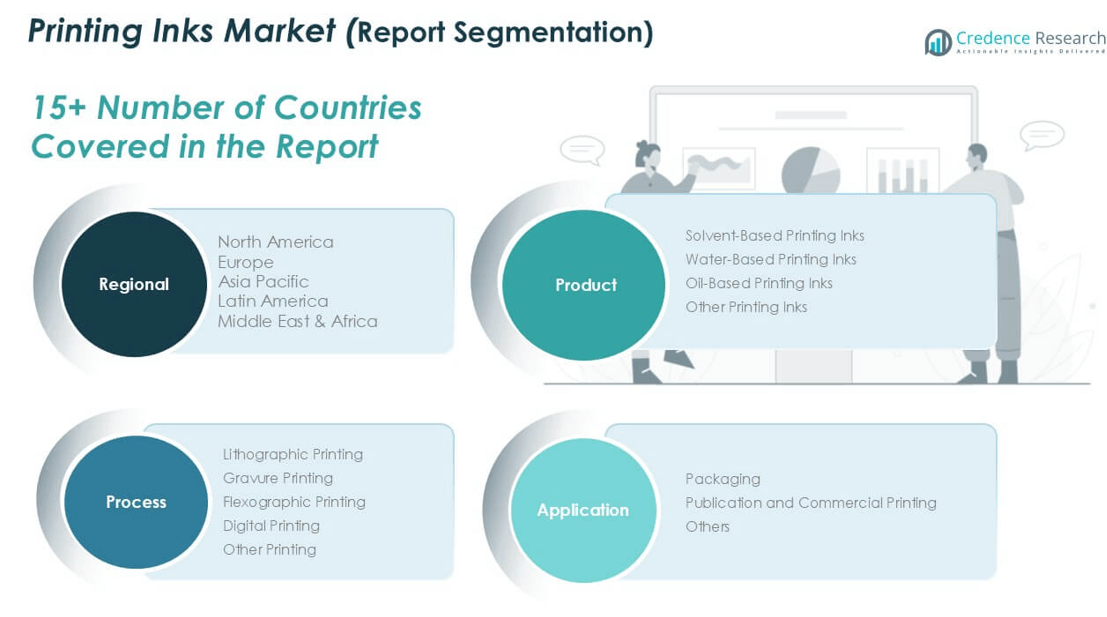

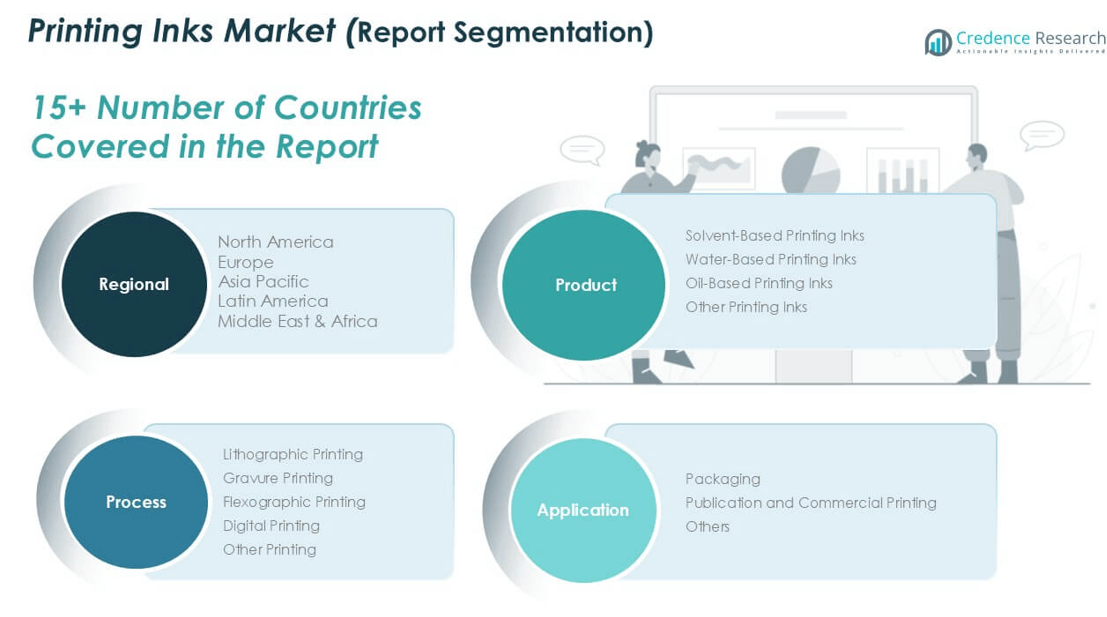

By Product

The Global Printing Inks Market includes solvent-based, water-based, oil-based, and other ink types. Solvent-based inks hold a significant share due to their durability, fast drying, and compatibility with various substrates, especially in outdoor and industrial printing. Water-based inks are gaining traction because of their low environmental impact and suitability for packaging and publication. Oil-based inks remain relevant in traditional printing applications, offering rich pigment retention and stability. Other inks, including UV-curable and soy-based variants, are seeing increased demand driven by sustainability goals and advancements in specialty printing.

- For instance, global production of solvent-based printing inks exceeded 2.1 million metric tons, while water-based inks accounted for approximately 1.5 million metric tons, oil-based inks for 820,000 metric tons, and UV-curable and soy-based inks together surpassed 400,000 metric tons in the same year.

By Process

The market is segmented by printing processes into lithographic, gravure, flexographic, digital, and others. Lithographic printing holds a major share due to its wide use in publishing and packaging. Gravure printing is preferred for high-volume, high-quality applications like magazines and decorative printing. Flexographic printing is expanding rapidly in the packaging industry due to its versatility and fast turnaround. Digital printing is growing fastest, driven by demand for short-run, customized outputs and e-commerce packaging. It supports variable data printing and enables efficient production in various sectors.

- For instance, according to global print industry data from 2023, more than 20 trillion lithographic prints were produced worldwide, compared to 8 trillion gravure prints, 11 trillion flexographic prints, and over 3 trillion digital prints across all major sectors.

By Application

The Global Printing Inks Market finds key applications in packaging, publication and commercial printing, and others. Packaging dominates the market, driven by demand from food, beverage, pharmaceutical, and personal care sectors. It requires high-performance inks that offer color consistency, adhesion, and regulatory compliance. Publication and commercial printing continue to contribute, though digital media has reduced traditional print volumes. Other applications include textiles, electronics, and security printing, which are expanding with the adoption of functional and specialty inks. These diverse uses strengthen the market’s long-term growth potential.

Segments

Based on Product

- Solvent-Based Printing Inks

- Water-Based Printing Inks

- Oil-Based Printing Inks

- Other Printing Inks

Based on Process

- Lithographic Printing

- Gravure Printing

- Flexographic Printing

- Digital Printing

- Other Printing

Based on Application

- Packaging

- Publication and Commercial Printing

- Others

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Printing Inks Market

The North America Printing Inks Market reached USD 3,471.67 million in 2024 and is projected to grow to USD 5,918.84 million by 2032, expanding at a CAGR of 6.9%. It accounts for approximately 17.8% of the global market share in 2024. The market is driven by the growing demand for sustainable inks and advanced packaging solutions, particularly in the United States and Canada. Strong technological infrastructure supports the adoption of digital and UV-curable printing methods. The region also benefits from a well-established commercial printing sector and strong regulatory frameworks that promote eco-friendly formulations. It continues to invest in R\&D to meet environmental and performance standards.

Europe Printing Inks Market

Europe’s market stood at USD 4,308.48 million in 2024 and is expected to reach USD 7,892.95 million by 2032, growing at a CAGR of 7.8%. It represents approximately 22.2% of the global Printing Inks Market share. The region is known for its strong sustainability initiatives and preference for water-based and biodegradable inks. Countries like Germany, France, and the UK lead in packaging and specialty printing. The European Union’s environmental regulations have accelerated the shift to low-VOC and non-toxic formulations. It also shows steady growth in digital printing for commercial and industrial applications.

Asia Pacific Printing Inks Market

Asia Pacific leads the global market with a 2024 value of USD 6,876.97 million and is forecasted to reach USD 12,641.95 million by 2032, growing at a CAGR of 7.9%. It holds the largest share at 35.4% of the global market. China, India, and Japan drive growth due to high consumption in packaging, electronics, and textiles. Rising urbanization, increasing consumer goods demand, and expanding industrial activity support market expansion. The region is also experiencing a shift toward digital and flexographic printing. It remains a key hub for both manufacturing and end-use consumption.

Latin America Printing Inks Market

Latin America’s market is projected to grow from USD 2,249.64 million in 2024 to USD 4,178.01 million by 2032 at a CAGR of 8.0%, the highest among all regions. It accounts for approximately 11.6% of the global market share. Brazil and Mexico are the largest contributors, supported by expanding packaging and label printing activities. The region is witnessing gradual adoption of sustainable inks, encouraged by local regulations and rising environmental awareness. Growth in e-commerce and urban retail formats also boosts demand. It presents untapped potential for global players investing in eco-ink solutions.

Middle East Printing Inks Market

The Middle East market is valued at USD 1,067.33 million in 2024 and is expected to reach USD 1,953.22 million by 2032, growing at a CAGR of 7.8%. It holds a 5.5% share of the global Printing Inks Market. The demand comes primarily from packaging and commercial printing in countries like the UAE and Saudi Arabia. Ongoing infrastructure development and rising disposable incomes contribute to market expansion. There is also growing interest in UV-curable and solvent-free inks to meet regional sustainability goals. It offers opportunities for ink manufacturers focused on high-performance and climate-adaptive formulations.

Africa Printing Inks Market

Africa’s market is set to grow from USD 1,467.27 million in 2024 to USD 2,231.75 million by 2032, recording a CAGR of 5.3%. It represents 4.2% of the global market share. South Africa, Nigeria, and Egypt drive the regional demand through growing packaging needs and commercial print media. The market is still developing, with increasing awareness of eco-friendly printing and local production capabilities. Infrastructure gaps and limited access to advanced technologies pose challenges. It remains a promising market for long-term investments in digital and sustainable ink solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- DIC Corporation

- Flint Group

- Royal Dutch Printing Ink

- Sakata Inx

- Siegwerk Druckfarben AG & Co. KGaA

- Sun Chemical

- T\&K Toka

- Toyo Ink S.C. Holdings

- Wikoff Color

Competitive Analysis

The Global Printing Inks Market is highly competitive, with key players focusing on innovation, sustainability, and strategic expansion. Companies like DIC Corporation, Sun Chemical, and Flint Group dominate with diverse product portfolios and global manufacturing capabilities. It is seeing increased investment in eco-friendly and digital printing technologies to meet regulatory and consumer demands. Smaller players compete by offering niche products and tailored services in regional markets. Mergers, acquisitions, and partnerships are common strategies to strengthen distribution networks and expand technological capabilities. Market leaders are also prioritizing R\&D to develop advanced formulations that perform across substrates and printing processes.

Recent Developments

- In April 2025, Flint Group announced their participation in FTA INFOFLEX 2025, where they will showcase their NC-free and compostable ink and coating solutions for labels and flexible packaging. The company’s participation highlights their commitment to sustainable solutions within the packaging industry.

- In June 2025, Siegwerk Druckfarben AG & Co. KGaA introduced the SICURA Litho Pack UV offset ink series, specifically designed for the EMEA region. This new series features CMR-free and deinkable formulations for paper, board, and plastic substrates, aligning with sustainability goals and brand owner guidelines.

Market Concentration and Characteristics

The Global Printing Inks Market exhibits a moderately consolidated structure, with a few major players controlling a significant share of the market. It is characterized by intense competition, high product differentiation, and strong focus on innovation. The market includes both global manufacturers with diversified portfolios and regional firms offering specialized solutions. Technological advancements, sustainability trends, and regulatory compliance shape product development and pricing strategies. Barriers to entry are moderate due to capital-intensive production and strict environmental regulations. The market operates under long-term supply agreements, particularly in packaging and commercial printing sectors, where consistency and performance are critical

Report Coverage

The research report offers an in-depth analysis based on Product, Process, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for water-based, soy-based, and biodegradable inks will increase as regulations tighten and sustainability becomes a key purchasing criterion.

- Rising adoption of digital printing across packaging, textiles, and commercial segments will drive demand for high-performance digital inks globally.

- With expanding industrial activity and strong packaging demand, Asia Pacific will maintain its dominance and lead global ink consumption.

- Flexible packaging applications in food, personal care, and healthcare sectors will push consistent demand for solvent-based and UV-curable inks.

- Growth in online retail and personalized packaging will boost short-run and variable data printing, creating opportunities for digital ink producers.

- Manufacturers will prioritize low-VOC, heavy-metal-free inks to comply with global environmental norms and improve workplace safety.

- Innovative applications like printed electronics, security packaging, and temperature-sensitive labeling will open new revenue channels for specialty ink producers.

- Advancements in printhead design, ink chemistry, and automation will improve print speed, resolution, and cost-efficiency across sectors.

- Regions like Latin America, the Middle East, and Africa will attract investments as local demand for packaging and publishing solutions rises.

- Global players will continue forming partnerships, acquisitions, and joint ventures to expand their geographic reach and diversify product portfolios.