Market Overview

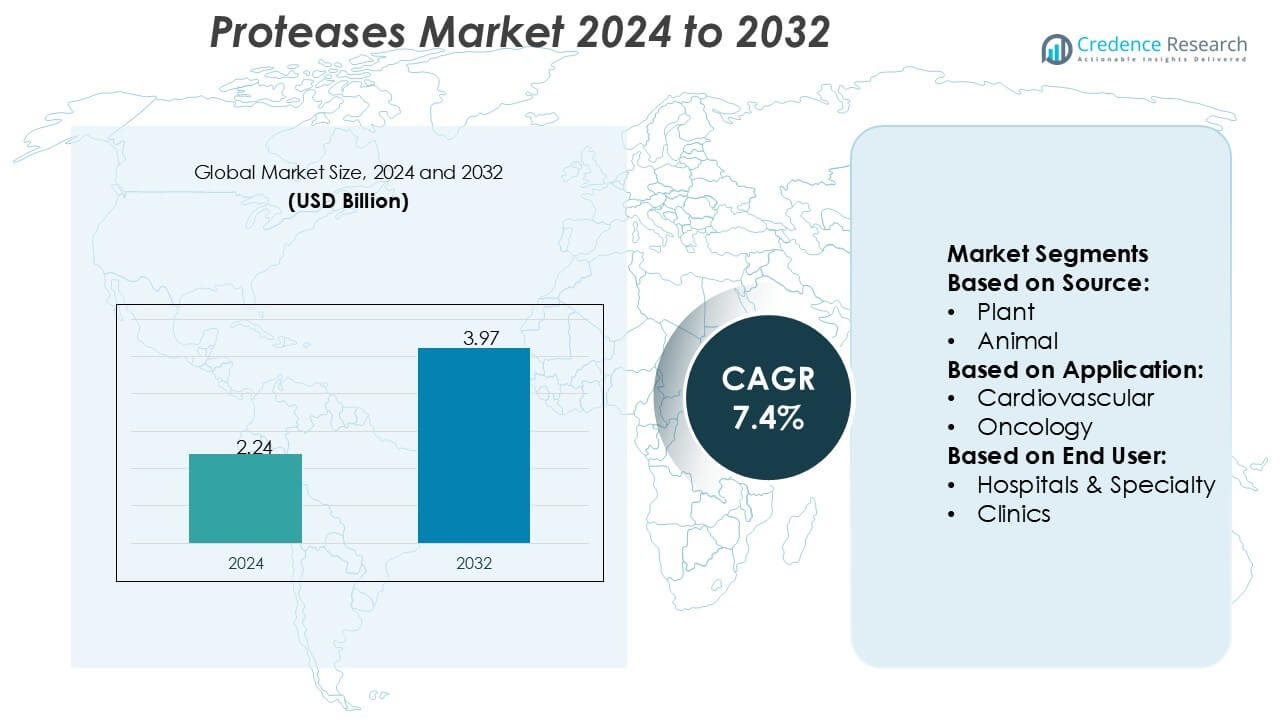

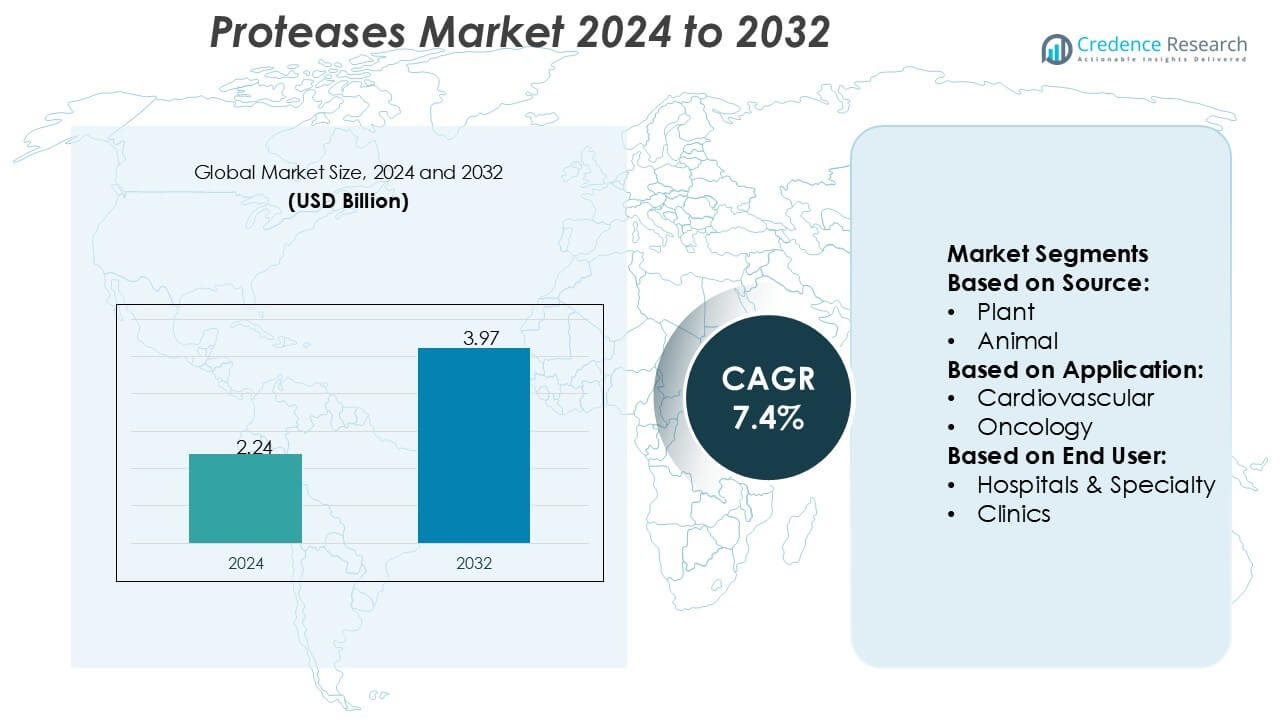

Proteases Market size was valued USD 2.24 billion in 2024 and is anticipated to reach USD 3.97 billion by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Proteases Market Size 2024 |

USD 2.24 Billion |

| Proteases Market, CAGR |

7.4% |

| Proteases Market Size 2032 |

USD 3.97 Billion |

The proteases market is driven by top players including Sanofi, Amicogen, BASF, Biocatalysts, DuPont, Specialty Enzymes & Probiotics, Novozymes, Codexis, Roche Holding, and Advanced Enzymes. These companies focus on innovation, sustainable enzyme production, and strategic collaborations to strengthen their positions across pharmaceutical, biotechnology, food, and industrial applications. Novozymes and DuPont emphasize microbial proteases, while Roche Holding and Sanofi drive therapeutic advancements. BASF and Codexis focus on biotechnology and industrial solutions, while emerging players expand into functional food and nutraceutical segments. Regionally, Asia-Pacific leads the global proteases market with a 30% share, supported by rapid industrialization, strong enzyme manufacturing capacity, and growing demand from healthcare and food processing industries.

Market Insights

Market Insights

- The proteases market size was USD 2.24 billion in 2024 and is projected to reach USD 3.97 billion by 2032, growing at a CAGR of 7.4% during the forecast period.

- Market growth is driven by increasing use in pharmaceuticals, biotechnology, and food industries, supported by rising demand for enzyme-based therapies and functional foods.

- A key trend is the shift toward microbial proteases, which hold 54% share, due to cost-effectiveness, scalability, and sustainability, with companies investing in advanced enzyme engineering.

- The market faces restraints from high production and purification costs, coupled with stringent regulatory approvals that delay product launches and limit adoption in price-sensitive regions.

- Asia-Pacific leads with a 30% regional share, supported by rapid industrialization, large-scale enzyme manufacturing, and growing healthcare demand, while North America holds 34% share driven by advanced R&D and strong biopharmaceutical infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source

The microbial segment dominates the proteases market, holding a share of nearly 54%. Microbial proteases are widely adopted due to cost-effective production, high stability, and scalability across diverse industrial processes. Their applications span pharmaceuticals, food processing, and biotechnology, where demand for efficient and controlled enzymatic activity is high. The growing need for sustainable and animal-free sources also drives preference for microbial proteases over plant and animal variants. Increasing innovation in fermentation and recombinant technologies further strengthens this segment’s leadership in the market.

- For instance, Fresenius Kabi undertook a multi-stage expansion of its Melrose Park, Illinois facility, representing an investment of over $250 million. The project, completed in phases, included the addition of five new automated aseptic filling lines, one of which was for cytotoxic products.

By Application

Oncology represents the leading application segment, capturing a 32% market share. Proteases play a critical role in cancer treatment through targeted therapies, drug delivery, and diagnostic support. Demand is fueled by rising cancer prevalence and the push for advanced, enzyme-based therapeutics. Ongoing research highlights proteases’ role in tumor progression and immune regulation, making them vital for new drug pipelines. Growing investment in oncology R&D and partnerships between pharmaceutical companies and research institutes continue to boost this segment’s dominance.

- For instance, Amgen’s ENDEAVOR trial data showed that patients receiving Kyprolis (carfilzomib) plus dexamethasone achieved median progression-free survival of 18.7 months, compared to 9.4 months in the Velcade plus dexamethasone arm.

By End User

Pharmaceutical and biotechnology industries account for the largest share, commanding 47% of the proteases market. These industries rely heavily on proteases for drug development, enzyme-based therapies, and biopharmaceutical manufacturing. The demand is propelled by rising adoption of biologics, precision medicine, and recombinant proteins. Companies also leverage proteases for large-scale fermentation and production of therapeutic proteins. Strong funding support, regulatory approvals, and collaborations with research organizations further reinforce the dominance of this end-user segment, ensuring continued growth in adoption.

Key Growth Drivers

Rising Demand in Pharmaceuticals and Biotechnology

The pharmaceutical and biotechnology industries are driving the proteases market through expanding use in drug development, enzyme-based therapies, and biologics production. Proteases play an essential role in protein engineering, targeted drug delivery, and disease treatment, especially in oncology and autoimmune disorders. The growing adoption of biologics and precision medicine further increases reliance on protease-based solutions. Strong investments from pharmaceutical companies and biopharma startups continue to accelerate innovation, reinforcing the significance of proteases as vital components in therapeutic pipelines.

- For instance, Aurobindo’s biosimilars pipeline, managed by its subsidiary CuraTeQ Biologics, consists of 14 molecules (primarily in oncology and immunology). Aurobindo is also expanding its portfolio of complex generics, including injectables, peptides, and other specialty products, with a robust pipeline in development.

Expanding Applications in Food and Beverage Industry

Proteases are increasingly used in the food and beverage industry to enhance product quality, shelf life, and nutritional value. They support processes such as protein hydrolysis, meat tenderization, dairy modification, and brewing, which are essential to improving efficiency and meeting consumer demand for processed and functional foods. Rising consumption of protein-rich diets and the trend toward healthier food choices contribute to steady market growth. The demand for sustainable and plant-based products also drives innovation in protease formulations tailored for food processing.

- For instance, Gland Pharma’s in-house complex injectable pipeline includes 19 products, of which 9 ANDAs have been filed and 6 launched. The company also holds a co-development pipeline of 15 products (6 in the 505(b)(2) pathway and 9 in the ANDA pathway), reflecting its capacity to progress multiple complex formulations in parallel.

Advancements in Enzyme Engineering and Biotechnology

Continuous advancements in enzyme engineering and biotechnology are fueling the development of next-generation proteases with improved stability, specificity, and cost efficiency. Recombinant DNA technology and microbial fermentation enable scalable production of tailored enzymes that meet industrial needs across healthcare, food, and biofuel sectors. Engineered proteases offer resistance to extreme pH and temperature, broadening their usability in diverse environments. These technological breakthroughs enhance product performance while reducing reliance on traditional sources, supporting greater adoption across multiple industries and creating long-term growth opportunities.

Key Trends & Opportunities

Shift Toward Sustainable and Animal-Free Proteases

The market is witnessing a strong trend toward sustainable, microbial, and plant-based proteases, reducing dependence on animal-derived enzymes. This shift is supported by regulatory pressure, rising ethical concerns, and consumer demand for eco-friendly products. Microbial proteases are preferred for their high yield, cost-effectiveness, and reduced environmental impact. The trend presents opportunities for manufacturers to innovate in enzyme design and align with sustainability goals. Companies focusing on green biotechnology and renewable sources are well-positioned to capture new market opportunities.

- For instance, Bristol Myers Squibb commits up to $674 million in milestone funds to its collaboration with VantAI to generate generative AI-designed molecular glues, linking computational design to real-world therapeutic advances.

Integration of Proteases in Precision Medicine and Diagnostics

Proteases are gaining attention in precision medicine and diagnostics due to their role in disease progression, biomarker identification, and targeted therapy. Their ability to regulate cellular processes makes them valuable in oncology and autoimmune treatments. Protease-based diagnostic kits and therapeutic agents are increasingly developed, supported by strong research funding. This trend creates opportunities for partnerships between academic institutes and biotech firms to advance clinical applications. The growing emphasis on personalized healthcare further strengthens proteases’ role in next-generation medical solutions.

- For instance, Amneal’s collaboration with Apiject expands its blow-fill-seal (BFS) platform capacity to produce 250 to 300 million units annually, with scaling potential beyond 400 million units.

Key Challenges

High Production and Purification Costs

Despite technological progress, the proteases market faces cost-related challenges in large-scale production and purification. Manufacturing microbial and recombinant proteases requires advanced bioprocessing systems, fermentation setups, and downstream purification, which increase expenses. These costs limit adoption, especially in price-sensitive markets such as food processing and emerging economies. Ensuring affordability while maintaining enzyme activity and stability remains a key barrier. Companies are under pressure to optimize production processes and invest in cost-reduction strategies to expand market penetration.

Stringent Regulatory Frameworks

Regulatory requirements for enzyme-based products present a significant challenge in the proteases market. Approvals for therapeutic and industrial applications demand extensive safety, efficacy, and environmental testing, which increase time-to-market and compliance costs. Variations in regulations across regions further complicate product development and global expansion. Manufacturers must align with pharmaceutical, food safety, and biotechnology standards to gain acceptance. These hurdles often slow innovation and limit smaller players’ ability to compete, creating barriers for new entrants in the competitive protease landscape.

Regional Analysis

North America

North America holds a 34% share of the proteases market, driven by advanced pharmaceutical and biotechnology industries. The region benefits from strong R&D investments, high adoption of enzyme-based therapies, and a growing focus on precision medicine. Proteases are widely applied in drug development, clinical diagnostics, and biopharmaceutical production. The U.S. leads due to its robust healthcare infrastructure and the presence of leading enzyme manufacturers. Canada contributes with expanding food processing and research activities. Supportive regulatory frameworks and consistent demand from industrial applications ensure sustained market growth across North America.

Europe

Europe accounts for 27% of the global proteases market, with strong demand from healthcare, food, and industrial sectors. Germany, France, and the U.K. are key contributors, driven by advanced healthcare systems and innovation in enzyme-based therapeutics. The European market also emphasizes sustainable protease production, aligning with regional regulations on eco-friendly practices. Food and beverage manufacturers increasingly integrate proteases to improve processing efficiency and meet consumer demand for healthier, functional foods. Strong collaborations between academic institutions and biotech firms strengthen Europe’s leadership in innovation, maintaining its competitive edge in protease development and adoption.

Asia-Pacific

Asia-Pacific dominates with a 30% market share, led by countries like China, India, and Japan. Rapid industrialization, expanding pharmaceutical manufacturing, and growing consumption of processed foods drive demand for proteases. China leads in large-scale enzyme production supported by low-cost manufacturing and strong domestic demand. India is emerging with investments in biotechnology and increasing adoption of enzyme applications in healthcare and agriculture. Japan focuses on advanced research and specialty enzyme solutions. Rising healthcare spending, a growing middle-class population, and supportive government initiatives for biotech further fuel protease market expansion across the region.

Latin America

Latin America holds a 6% share of the proteases market, with Brazil and Mexico as major contributors. The market benefits from growing food and beverage processing industries, particularly in dairy and brewing. Brazil’s expanding biotechnology research and healthcare sector support adoption of protease-based solutions. Mexico shows demand growth in processed foods and pharmaceutical applications. Despite limited infrastructure compared to developed regions, foreign investments and regional collaborations in enzyme research strengthen growth potential. Rising consumer awareness about health and nutrition also supports opportunities for protease applications in functional foods and therapeutic areas across Latin America.

Middle East & Africa

The Middle East & Africa region represents 3% of the proteases market, with demand concentrated in South Africa, the UAE, and Saudi Arabia. Market growth is driven by rising healthcare investments, food industry expansion, and increasing adoption of biopharmaceuticals. South Africa plays a key role with developing biotechnology research and healthcare applications. The UAE and Saudi Arabia focus on food processing and industrial biotechnology, aligning with diversification strategies. However, limited infrastructure and high import reliance challenge rapid adoption. International partnerships and government support for healthcare modernization continue to create growth opportunities in the region.

Market Segmentations:

By Source:

By Application:

By End User:

- Hospitals & Specialty

- Clinics

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The proteases market features strong competition among key players such as Sanofi, Amicogen, BASF, Biocatalysts, DuPont, Specialty Enzymes & Probiotics, Novozymes, Codexis, Roche Holding, and Advanced Enzymes. The proteases market is highly competitive, characterized by rapid innovation, strategic partnerships, and continuous investment in research and development. Companies focus on developing advanced enzyme formulations with improved stability, specificity, and cost efficiency to meet the growing demand across pharmaceuticals, biotechnology, food, and industrial applications. The market is shaped by rising adoption of microbial and recombinant proteases, supported by advancements in enzyme engineering and sustainable production methods. Competition also intensifies as firms seek to differentiate through tailored solutions, large-scale production capabilities, and entry into emerging markets, reinforcing the market’s dynamic and evolving landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sanofi

- Amicogen

- BASF

- Biocatalysts

- DuPont

- Specialty Enzymes & Probiotics

- Novozymes

- Codexis

- Roche Holding

- Advanced Enzymes

Recent Developments

- In March 2025, IFF and Kemira announced the formation of Alpha Bio, a joint venture to scale production of sustainable biobased materials using enzymatic technology. The news outlines their commitment to replacing fossil-based polymers with enzyme-enabled biopolymers derived from plant sugars.

- In February 2025, Novonesis announced an agreement with dsm-firmenich to dissolve the Feed Enzyme Alliance and undertake full control of its sales and distribution activities. As part of the agreement, Novonesis will pay a total cash consideration.

- In October 2024, HLB Group acquired Genofocus, a producer of specialty enzymes for customized industrial applications. The company obtained a 26.48% stake in Genofocus and secured management control.

- In August 2024, Lallemand Inc. announced the completion of an equity investment in Livzym Biotechnologies (“Livzym”) as part of a strategic collaboration in the industrial enzymes sector.

Report Coverage

The research report offers an in-depth analysis based on Source, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The proteases market will expand with rising adoption in pharmaceutical and biotechnology applications.

- Microbial proteases will continue to dominate due to cost-effectiveness and scalability.

- Oncology will remain a key therapeutic area driving demand for protease-based therapies.

- Food and beverage applications will grow as consumers demand functional and protein-rich foods.

- Advances in enzyme engineering will create more stable and efficient protease formulations.

- Sustainable and animal-free proteases will gain traction under strict environmental regulations.

- Emerging economies will present strong opportunities through expanding biopharma and food industries.

- Diagnostic and precision medicine applications will increase reliance on protease-based solutions.

- Strategic collaborations and mergers will strengthen innovation pipelines and market reach.

- Regulatory harmonization will shape global expansion and market competitiveness for protease products.

Market Insights

Market Insights