Market Overview

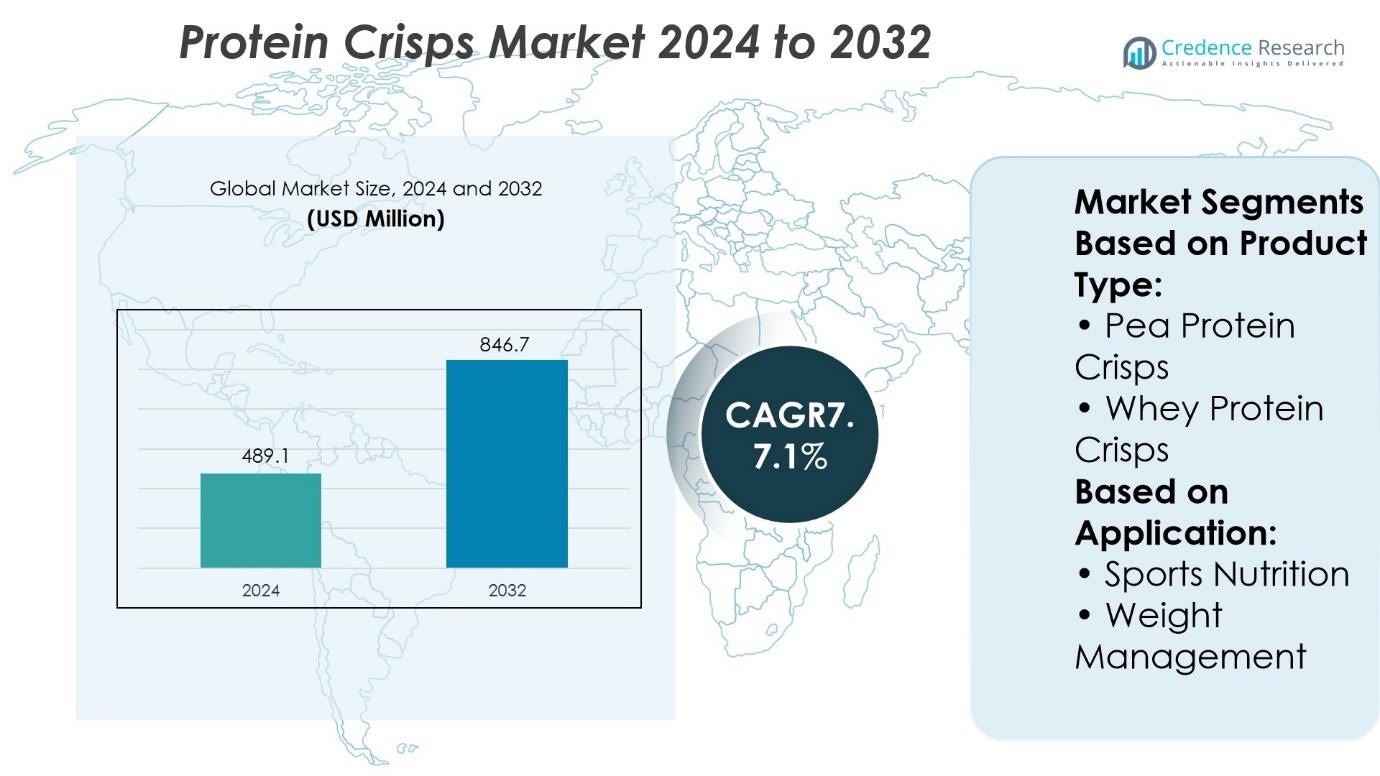

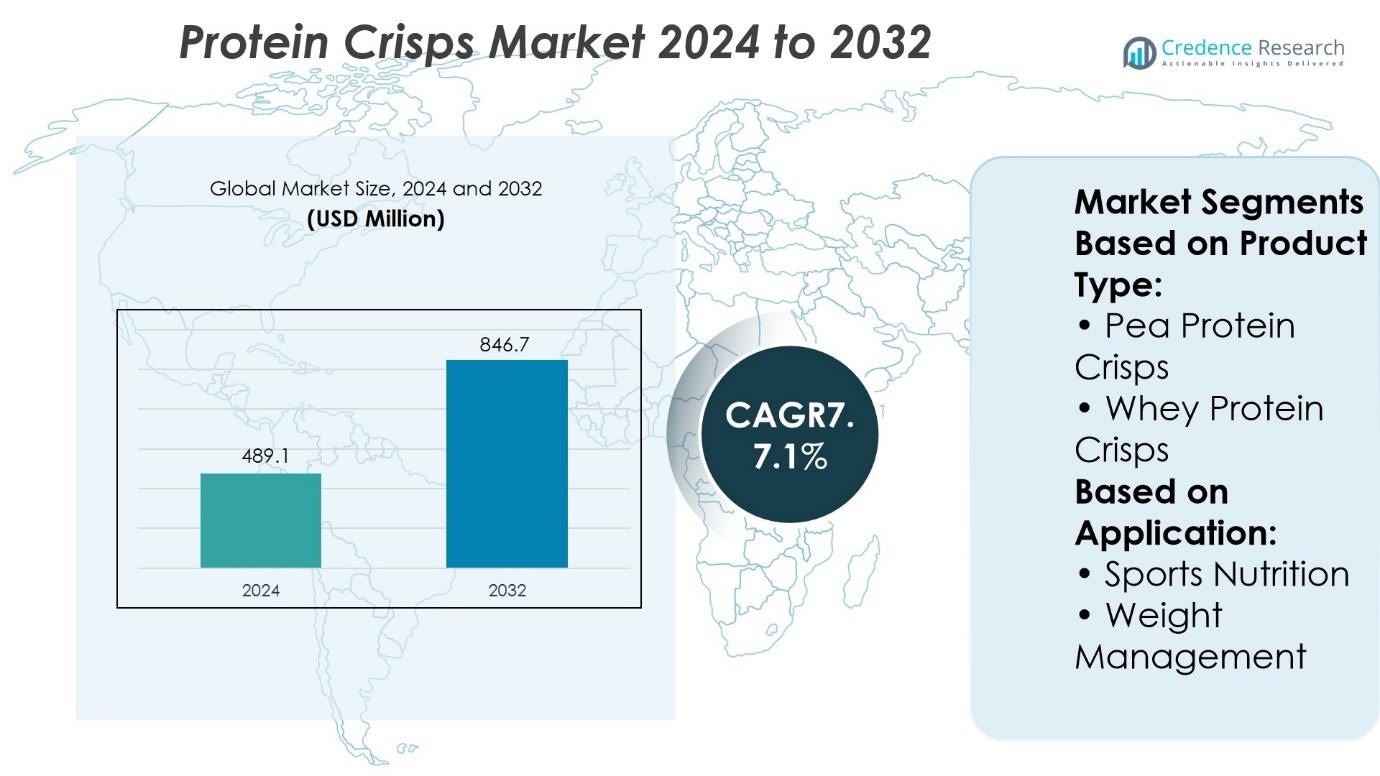

Protein Crisps Market size was valued at USD 489.1 million in 2024 and is anticipated to reach USD 846.7 million by 2032, at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Protein Crisps Market Size 2024 |

USD 489.1 Million |

| Protein Crisps Market, CAGR |

7.1% |

| Protein Crisps Market Size 2032 |

USD 846.7 Million |

The Protein Crisps Market grows on strong drivers such as rising health awareness, increasing demand for high-protein snacks, and expanding adoption in sports nutrition and weight management. It benefits from consumer preference for convenient, nutrient-dense foods that support active lifestyles and controlled diets. Plant-based innovations strengthen its appeal, while clean-label and allergen-free formulations align with evolving dietary preferences. Trends highlight growing penetration through e-commerce, direct-to-consumer channels, and partnerships with fitness programs. It also advances through flavor diversification, sustainable sourcing, and packaging innovations, positioning protein crisps as a functional and mainstream snacking solution with strong global growth potential.

The Protein Crisps Market shows strong geographical presence, with North America leading through high consumer awareness and Europe following with demand for clean-label and plant-based options. Asia-Pacific emerges as the fastest-growing region supported by urbanization and rising fitness participation, while Latin America and the Middle East & Africa record steady adoption. Key players such as General Mills Inc., PepsiCo, Nestlé, Post Holdings Inc., and MYPROTEIN drive competition through innovation, global distribution, and targeted nutrition-focused product portfolios.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Protein Crisps Market size was valued at USD 489.1 million in 2024 and is anticipated to reach USD 846.7 million by 2032, at a CAGR of 7.1%.

- Rising health awareness and demand for high-protein snacks drive consistent market growth.

- Trends highlight strong momentum for plant-based innovations, clean-label products, and allergen-free formulations.

- Competition intensifies as global and niche players focus on innovation, flavor variety, and direct-to-consumer strategies.

- Market restraints include high production costs, raw material price volatility, and limited awareness in emerging regions.

- North America leads the market, Europe shows strong demand for sustainable and plant-based options, and Asia-Pacific emerges as the fastest-growing region.

- Key players such as General Mills Inc., PepsiCo, Nestlé, Post Holdings Inc., and MYPROTEIN expand global presence through innovation and strategic distribution.

Market Drivers

Rising Health Awareness and Shift Toward High-Protein Diets

Consumers increasingly adopt high-protein snacks to support weight management and muscle recovery. The Protein Crisps Market benefits from rising awareness of nutrition-focused lifestyles in both developed and emerging regions. It gains traction among gym-goers, athletes, and office workers seeking convenient protein-rich alternatives to traditional chips. Brands highlight protein content per serving, creating differentiation in a competitive snack segment. Growing preference for balanced macronutrient intake supports consistent product demand. It positions protein crisps as a staple in the functional snacking category.

- For instance, Nestlé launched its “Yes!” protein bars line with crisps made from pea protein, each containing 10 grams of plant-based protein per serving, and reported sales surpassing 12 million units.

Expansion of Plant-Based Protein Sources in Snack Innovation

Manufacturers explore soy, pea, and lentil proteins to deliver sustainable and allergen-free crisps. The Protein Crisps Market reflects consumer demand for clean-label, plant-forward formulations that align with ethical and environmental priorities. It fosters innovation in flavor, texture, and ingredient sourcing to broaden product portfolios. Brands promote gluten-free, vegan-friendly, and non-GMO claims to capture diverse consumer segments. Expanding protein crop supply chains create reliable inputs for large-scale production. It strengthens the value proposition of plant-based protein crisps in retail channels.

- For instance, PepsiCo reported that its Off The Eaten Path plant-based snack line, which includes pea protein crisps, generated sales of USD 91 million in 2023 across North America, highlighting the strong adoption of sustainable protein snacking alternatives.

Strong Retail Penetration and E-Commerce Acceleration

Supermarkets, hypermarkets, and specialty nutrition stores expand shelf space for protein-enriched snacks. The Protein Crisps Market also thrives through rapid growth of e-commerce platforms and subscription models. It gains visibility through direct-to-consumer strategies, targeted promotions, and influencer-driven campaigns. Retailers allocate more space to functional snacks, highlighting protein crisps as premium yet accessible choices. Online marketplaces provide analytics-driven product placement and cross-selling opportunities. It ensures wide accessibility across both mainstream and niche consumer groups.

Continuous Product Innovation and Strategic Brand Positioning

Companies invest in flavor variety, texture enhancement, and packaging formats to sustain consumer interest. The Protein Crisps Market reflects dynamic brand positioning through partnerships with fitness communities and wellness influencers. It integrates convenience with nutritional appeal, reinforcing brand trust and loyalty. Multinational players expand distribution in key regions through mergers and strategic alliances. Product launches target younger demographics that value on-the-go, high-protein snack options. It reinforces the competitive edge of brands investing in long-term innovation pipelines.

Market Trends

Growing Demand for Functional Snacking With Nutritional Transparency

Consumers increasingly prefer snacks that provide measurable health benefits. The Protein Crisps Market reflects this trend with clear labeling of protein grams per serving and transparent ingredient sourcing. It supports informed purchasing decisions by highlighting gluten-free, low-carb, and high-fiber claims. Brands leverage packaging to educate consumers on the nutritional profile of protein crisps. The focus on functional benefits strengthens consumer trust across competitive snack categories. It creates steady alignment between brand positioning and evolving dietary expectations.

- For instance, Quest Nutrition’s Protein Chips feature 19 grams of protein per pack, as stated on packaging across mainstream retailers.

Expansion of Flavor Innovation and Regional Taste Customization

Manufacturers experiment with bold, region-specific flavors to expand consumer appeal. The Protein Crisps Market shows a steady rise in launches featuring spicy, ethnic, and fusion-inspired varieties. It attracts diverse demographics by catering to local flavor preferences alongside global classics. Companies deploy limited-edition seasonal flavors to stimulate repeat purchases. Flavor diversity differentiates protein crisps from standard chips and supports premium positioning. It ensures continuous consumer engagement in an evolving snack landscape.

- For instance, Pure Protein recently introduced a Frank’s RedHot–flavored protein crisp variant that delivers 12 grams of protein per serving, as noted in the product launch announcement.

Increased Focus on Sustainable Sourcing and Eco-Friendly Packaging

Environmental concerns drive demand for snacks with responsible production methods. The Protein Crisps Market emphasizes sustainable protein sources such as peas, lentils, and chickpeas. It also incorporates recyclable and compostable packaging solutions to reduce environmental impact. Brands invest in supply chain traceability, ensuring sustainable farming practices for protein crops. Eco-conscious claims resonate with younger demographics that prioritize ethical choices. It positions protein crisps as both health-forward and environmentally responsible snack options.

Rising Influence of Digital Marketing and Direct-to-Consumer Channels

Digital platforms shape brand visibility and consumer engagement in the functional snack category. The Protein Crisps Market benefits from targeted campaigns that highlight protein content, taste, and lifestyle fit. It leverages social media influencers, fitness partnerships, and wellness blogs to drive awareness. Subscription models and online marketplaces increase trial opportunities for niche brands. Direct-to-consumer channels provide valuable feedback on flavor performance and packaging design. It enables rapid adaptation of product strategies in a competitive environment.

Market Challenges Analysis

High Production Costs and Complex Supply Chain Dependencies

The Protein Crisps Market faces significant pressure from high raw material costs and specialized manufacturing processes. It relies on protein isolates and concentrates that demand advanced extraction methods, raising overall production expenses. Limited availability of plant-based protein inputs such as pea or chickpea protein can create supply chain bottlenecks. Companies struggle to balance affordability with quality, especially when targeting price-sensitive consumers. Distribution across multiple regions requires compliance with diverse food safety regulations, adding to operational complexity. It creates barriers for smaller brands aiming to compete with established multinational players.

Intense Market Competition and Consumer Perception Challenges

Competition from traditional snacks and other high-protein alternatives limits growth potential for emerging brands. The Protein Crisps Market competes not only with chips and crackers but also with protein bars and shakes. It faces the challenge of convincing consumers that crisps can deliver the same nutritional value with appealing taste and texture. Brand loyalty is difficult to establish in a crowded functional snack space with frequent new launches. High marketing and promotional investments are necessary to capture attention in retail and online channels. It forces companies to differentiate through strong innovation pipelines and clear nutritional positioning.

Market Opportunities

Expansion Into Health-Oriented Retail and E-Commerce Channels

The Protein Crisps Market holds strong opportunity in health-focused retail outlets and digital platforms. It benefits from partnerships with gyms, wellness chains, and specialty nutrition stores that position protein crisps directly in front of target audiences. E-commerce creates room for niche flavors, trial packs, and subscription models that build long-term consumer loyalty. Global platforms provide smaller brands with scalable access to multiple regions without heavy upfront distribution costs. Retailers seek high-protein options to expand functional snack portfolios, creating more shelf space for innovative products. It enables brands to increase reach and visibility among consumers prioritizing healthier snacking options.

Product Diversification and Alignment With Lifestyle Trends

Opportunities exist in expanding protein crisps into meal replacement formats and specialized diets such as keto, paleo, and vegan. The Protein Crisps Market can leverage consumer interest in functional ingredients by integrating superfoods, probiotics, or added fiber. It allows brands to create premium extensions that command stronger margins in competitive retail spaces. Collaborations with fitness influencers and lifestyle brands enhance awareness and credibility. International expansion into emerging markets with growing health-conscious populations broadens growth potential. It positions protein crisps as adaptable solutions aligned with evolving dietary and lifestyle demands.

Market Segmentation Analysis:

By Product Type

The Protein Crisps Market demonstrates strong growth across product categories, with pea protein crisps gaining notable traction for their plant-based profile and allergen-free appeal. It appeals to consumers seeking sustainable, vegan-friendly options while addressing sensitivities related to lactose or gluten. Whey protein crisps remain dominant due to their complete amino acid profile and long-standing presence in sports nutrition. It provides a higher protein concentration, which aligns with demand for muscle recovery and athletic performance enhancement. Both product types support innovation in snack formulations, enabling brands to diversify portfolios in line with evolving dietary preferences and health-conscious consumption.

- For instance, Chicago Bar Company sold over 78 million protein crisp units globally in 2024, with its top‑selling crisps.

By Application

The Protein Crisps Market shows strong application potential in sports nutrition and weight management, supported by rising health awareness and demand for functional snacks. In sports nutrition, it fulfills the need for convenient, high-protein formats that aid muscle recovery and endurance, with whey protein crisps leading due to their proven amino acid profile and pea protein crisps expanding as plant-based options gain credibility. In weight management, it supports calorie control and satiety through low-carbohydrate, nutrient-dense formulations, where pea protein crisps appeal to clean-label and vegan consumers while whey protein crisps remain trusted for preserving lean mass. Together, both applications drive broader consumer acceptance and position protein crisps as integral to active lifestyle and wellness-oriented diets.

- For instance, Simply Good Foods Company disclosed that in fiscal 2024, its Quest Protein Chips line generated sales exceeding 100 million units, confirming the robust consumer uptake of whey-based protein crisps in sports-focused snacking.

Segments:

Based on Product Type:

- Pea Protein Crisps

- Whey Protein Crisps

Based on Application:

- Sports Nutrition

- Weight Management

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Protein Crisps Market, accounting for 36% of global revenue in 2024. The region benefits from strong consumer awareness of protein-enriched snacks and a mature sports nutrition sector. It has witnessed rapid adoption of high-protein foods across mainstream retail, gyms, and e-commerce platforms. Whey protein crisps dominate due to strong integration with established fitness and nutrition brands, while pea protein crisps are gaining traction among vegan and lactose-intolerant populations. The United States leads consumption, supported by innovation in functional snacks and continuous product launches tailored for weight management and active lifestyles. Canada contributes through rising demand for plant-based proteins, aligning with consumer focus on health and sustainability. The region’s strong retail infrastructure and brand visibility reinforce its dominance in shaping global trends.

Europe

Europe represents 29% of the Protein Crisps Market, making it the second-largest regional contributor. The region benefits from a highly health-conscious population and stringent food labeling standards that encourage demand for clean-label, functional products. It experiences rapid growth in plant-based protein crisps, driven by countries like the United Kingdom, Germany, and France where vegan and flexitarian diets are widely adopted. Whey protein crisps also maintain a strong foothold in sports nutrition, particularly among fitness enthusiasts and professional athletes. The European market reflects a balance between indulgence and nutrition, with snack manufacturers promoting protein crisps as both healthy and flavorful alternatives. Expansion through supermarket chains, fitness centers, and specialty health stores ensures wide distribution. The region’s commitment to sustainability further accelerates adoption of pea protein crisps, aligning with environmentally conscious purchasing behavior.

Asia-Pacific

Asia-Pacific commands 22% of the Protein Crisps Market and emerges as the fastest-growing region due to rapid urbanization, rising disposable income, and growing participation in fitness activities. It reflects increasing consumer interest in functional foods and convenient snacking formats that support active lifestyles. Countries like China, Japan, and India drive this demand through expanding middle-class populations and strong growth in health and wellness sectors. Whey protein crisps are gaining popularity in urban centers, particularly among younger demographics seeking quick energy and recovery solutions. Pea protein crisps, while in earlier stages of adoption, show strong potential as awareness of plant-based diets rises. Expansion of e-commerce and health-focused retail outlets enables broad market penetration. Multinational players are investing heavily in localized product development to meet regional taste preferences and cultural dietary needs, enhancing long-term growth opportunities.

Latin America

Latin America holds 8% of the Protein Crisps Market, with growth supported by increasing health awareness and changing dietary patterns. Brazil and Mexico dominate consumption, driven by rising fitness participation and demand for protein-rich diets. It reflects a growing preference for convenient, affordable snacks that balance indulgence with nutritional value. Whey protein crisps maintain dominance due to established availability through sports nutrition channels, while plant-based alternatives are gradually entering the market. Distribution expansion through supermarkets and online platforms plays a key role in strengthening accessibility. Local manufacturers are beginning to innovate with regionally sourced proteins, enhancing product diversity. Despite lower penetration compared to developed markets, Latin America demonstrates consistent growth potential as awareness of weight management and healthy snacking continues to spread.

Middle East & Africa

The Middle East & Africa accounts for 5% of the Protein Crisps Market, reflecting steady but emerging adoption. It benefits from growing urbanization and increased interest in fitness and wellness, particularly in Gulf Cooperation Council (GCC) countries. Whey protein crisps dominate sales due to higher consumer familiarity, while pea protein crisps are gradually gaining visibility among health-conscious and younger populations. Limited product availability and higher pricing present challenges, yet expansion of international brands into urban centers improves accessibility. South Africa contributes to regional demand through a growing sports nutrition sector and rising adoption of high-protein foods. The region demonstrates potential for long-term growth as awareness of balanced nutrition and functional snacks continues to expand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Protein Crisps Market features including General Mills Inc., WK Kellogg Co, PepsiCo, Post Holdings Inc., Quest Nutrition & WorldPantry.com LLC, ProtiDiet, Premier Nutrition Company LLC, Power Crunch, MYPROTEIN (The Hut Group), and Nestlé. The Protein Crisps Market demonstrates intense competition shaped by innovation, consumer engagement, and strategic expansion. Companies focus on developing high-protein, low-carbohydrate formulations that meet the rising demand for sports nutrition and weight management solutions. Plant-based alternatives gain momentum as clean-label and vegan-friendly products attract health-conscious consumers. Digital marketing and e-commerce platforms play a critical role in brand positioning, with firms emphasizing convenience and direct-to-consumer models to strengthen market reach. Investments in flavor diversification, sustainable sourcing, and functional ingredients drive differentiation, while partnerships with fitness programs and retailers enhance visibility. The competitive landscape continues to evolve through innovation, product reformulation, and global distribution strategies that secure long-term growth.

Recent Developments

- In May 2025, Quaker (U.S) launched its Protein Granola Bars, integrating whey protein crisps for a crunchy texture. Available in Cookies & Cream and Peanut Butter & Chocolate flavors, each bar provides 10 g protein and is sold at Kroger and Walmart.

- In December 2024, General Mills Inc. announced the expansion of its protein product line with the launch of Cheerios Protein. This new cereal variety features 8 grams of protein per serving and is available in Strawberry and Cinnamon.

- In November 2024, Quest Nutrition & WorldPantry.com LLC announced a partnership with USA Rugby, becoming the official protein snack partner for the national teams, including the USA Eagles and the Women’s Sevens Team.

- In November 2024, Origin Nutrition (India) rolled out Mojo Pops, high protein, compression popped pea crisps in flavors like Pudina Chutney, Sour Cream & Onion, and Tomato.

Market Concentration & Characteristics

The Protein Crisps Market reflects moderate concentration, with a mix of multinational corporations and specialized nutrition brands competing for consumer share. It shows strong influence from established food and beverage companies that leverage global distribution networks and brand recognition to secure dominance, while niche players carve out space through innovation in plant-based formulations and targeted marketing. It emphasizes differentiation through nutritional profiles, flavor innovation, and clean-label positioning to meet rising consumer demand for functional and healthy snacking. Market characteristics highlight a balance between mass-market offerings and premium segments, with expanding adoption across sports nutrition, weight management, and mainstream retail channels. It remains shaped by evolving dietary preferences, regional health trends, and rapid product innovation, creating a competitive but opportunity-rich environment.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for protein-rich snacks among health-conscious consumers.

- Plant-based protein crisps will gain stronger adoption driven by vegan and flexitarian lifestyles.

- Innovation in clean-label and allergen-free formulations will shape product development.

- Sports nutrition will remain a major driver supported by growing fitness participation.

- Weight management applications will strengthen demand for low-carbohydrate, high-protein snacks.

- E-commerce and direct-to-consumer channels will enhance product accessibility and brand engagement.

- Flavor diversification will play a key role in attracting mainstream consumers.

- Sustainability in sourcing and packaging will influence consumer purchasing decisions.

- Strategic collaborations with fitness and wellness programs will expand market visibility.

- Regional expansion in Asia-Pacific and Latin America will create new growth opportunities.