Market Overview

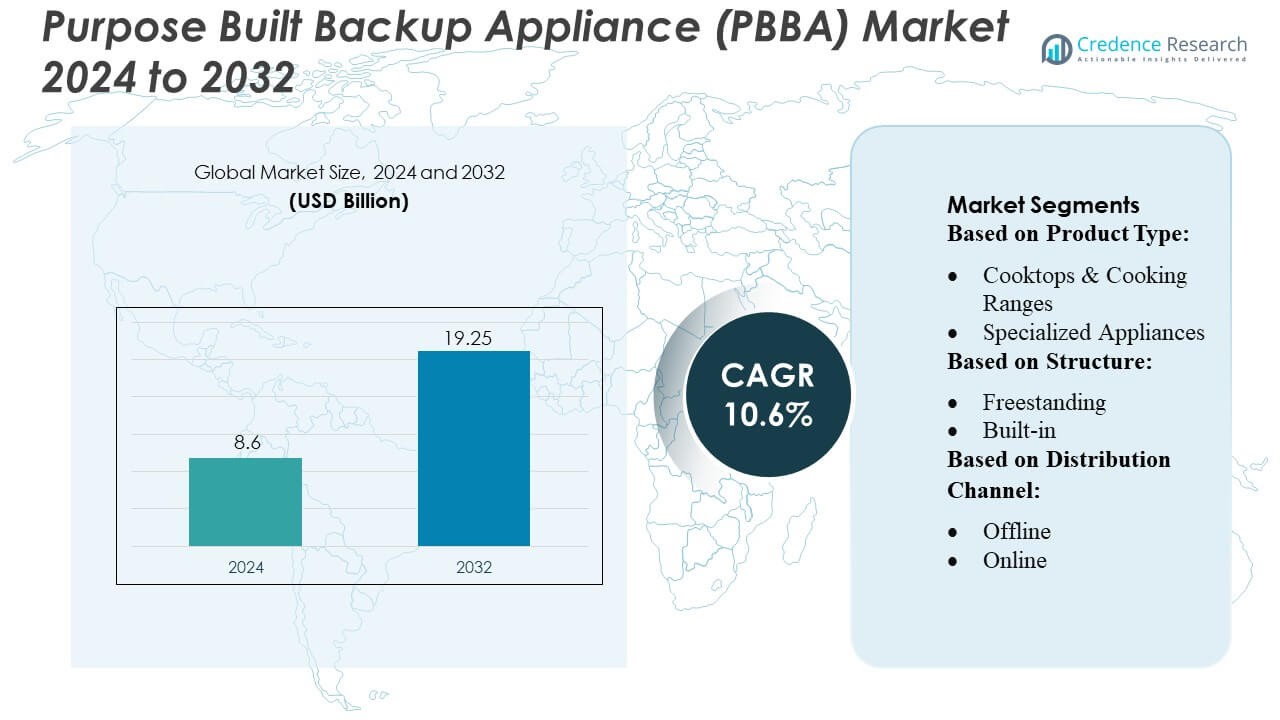

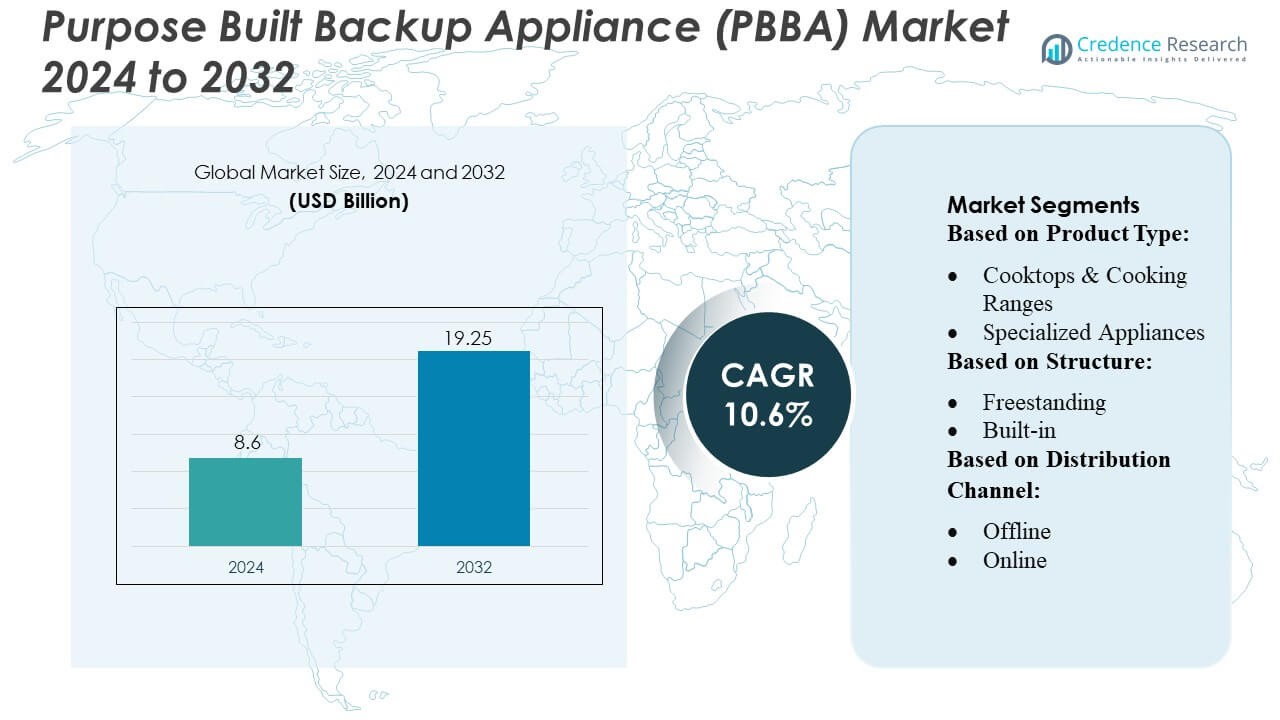

Purpose Built Backup Appliance (PBBA) Market size was valued USD 8.6 billion in 2024 and is anticipated to reach USD 19.25 billion by 2032, at a CAGR of 10.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Purpose Built Backup Appliance (PBBA) Market Size 2024 |

USD 8.6 Billion |

| Purpose Built Backup Appliance (PBBA) Market, CAGR |

10.6% |

| Purpose Built Backup Appliance (PBBA) Market Size 2032 |

USD 19.25 Billion |

The Purpose Built Backup Appliance (PBBA) market is dominated by leading companies such as Midea Group, Whirlpool Corporation, Sharp Corporation, Panasonic Corporation, LG Electronics Inc., Robert Bosch GmbH, Samsung Electronics Co. Ltd., Electrolux AB, Haier Smart Home Co., Ltd., and Miele. These players compete through continuous innovation, high-capacity storage solutions, advanced deduplication, and seamless integration with cloud and hybrid infrastructures. North America emerges as the leading region, holding a market share of approximately 35%, driven by widespread adoption of enterprise backup solutions, stringent data protection regulations, and the presence of key vendors. Strong investment in R&D, coupled with a focus on scalable and secure PBBA systems, positions these companies to capture growth opportunities while addressing evolving enterprise needs for data security, business continuity, and operational efficiency across the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Purpose Built Backup Appliance (PBBA) market size was valued at USD 8.6 billion in 2024 and is projected to reach USD 19.25 billion by 2032, growing at a CAGR of 10.6% during the forecast period.

- Market growth is driven by rising data volumes, increasing adoption of cloud and hybrid IT infrastructures, and demand for advanced backup features such as deduplication, encryption, and automated recovery.

- North America leads the market with a 35% share, followed by Europe and APAC, supported by stringent data protection regulations, technological advancements, and enterprise investments in secure backup solutions.

- Key players compete through innovation, scalable high-capacity appliances, strategic partnerships, and integration with cloud services, enhancing market competitiveness and segment leadership across enterprise and SMB applications.

- Market restraints include high initial deployment costs, complexity of system integration, and cybersecurity challenges, which may limit adoption in cost-sensitive regions such as MEA and Latin America.

Market Segmentation Analysis:

By Product Type:

In the Purpose Built Backup Appliance (PBBA) market, the Cooktops & Cooking Ranges segment leads with a significant share, driven by high adoption in enterprise and mid-sized data centers seeking integrated storage solutions. Its dominance stems from robust performance, simplified management, and enhanced data protection capabilities tailored for large-scale workloads. Specialized Appliances follow, catering to niche requirements such as high-speed deduplication and encryption. Ovens, while smaller in market share, are gaining traction due to compact design and energy-efficient storage operations, offering targeted solutions for backup-intensive environments.

- For instance, Midea’s global R&D investment exceeded 43 billion yuan during the past 3 years, enabling development of advanced smart‑home and industrial‑grade appliances that support interoperability across product lines.

By Structure:

Freestanding PBBA systems dominate the market with the highest share, attributed to flexibility in deployment and scalability across heterogeneous IT environments. These systems allow enterprises to expand storage capacity without major infrastructural changes, making them ideal for dynamic data growth. Built-in solutions, although smaller in share, are preferred in tightly integrated IT setups where seamless compatibility with existing servers and software stacks is critical. Drivers for structural adoption include rapid deployment, ease of maintenance, and cost optimization across multi-site operations.

- For instance, Whirlpool operates 40 manufacturing and technology centers globally and employs 44,000 people, enabling it to produce a wide range of freestanding appliances at scale.

By Distribution Channel:

Offline distribution channels hold the largest share in the PBBA market due to strong reseller networks, on-site consultation, and service support that enhance buyer confidence. Enterprise clients prefer offline channels for complex installations and personalized solutions. Online channels are experiencing growth driven by digital procurement trends, faster delivery cycles, and comparative pricing transparency. Key drivers for channel preference include technical support availability, after-sales services, and ease of integration with enterprise IT infrastructure, ensuring minimal downtime and optimized storage performance.

Key Growth Drivers

- Rising Data Volume and Storage Needs

The exponential growth of enterprise data, driven by cloud adoption, IoT, and AI workloads, fuels demand for purpose-built backup appliances. Organizations increasingly require high-capacity, reliable, and secure storage solutions to ensure data availability and compliance. PBBA systems, with integrated deduplication, replication, and fast recovery features, address these needs efficiently. This surge in data-centric operations across industries acts as a primary driver, pushing enterprises to invest in scalable and performance-optimized backup infrastructures.

- For instance, Panasonic’s energy unit has supplied over 19 billion automotive battery cells globally — enough for around 3.7 million electric vehicles — supporting the global shift to EVs.

- Enhanced Data Protection and Regulatory Compliance

Stringent data privacy regulations and the critical need for disaster recovery solutions propel PBBA adoption. These appliances offer advanced encryption, automated backups, and seamless data integrity verification, helping organizations meet compliance mandates and avoid data loss penalties. The growing focus on cybersecurity and regulatory adherence in sectors like finance, healthcare, and government reinforces investment in PBBA systems as a secure, auditable, and resilient storage strategy.

- For instance, LG’s SW Testing Laboratory obtained accreditation under the Korea Laboratory Accreditation Scheme (KOLAS), enabling LG to issue IoT‑device cybersecurity test reports compliant with the European standard ETSI EN 303 645 and TS 103 701.

- Technological Advancements in PBBA Systems

Continuous innovation in PBBA technology, including improved deduplication algorithms, NVMe storage integration, and AI-driven storage management, enhances system performance and operational efficiency. These advancements reduce recovery time objectives (RTOs) and streamline backup operations, attracting enterprises seeking modernized storage infrastructures. Enhanced interoperability with hybrid IT environments and simplified management interfaces further drive market adoption, making PBBA a preferred solution for complex, high-demand backup requirements.

Key Trends & Opportunities

- Cloud-Integrated PBBA Solutions

Integration of cloud storage with PBBA systems is emerging as a key trend, enabling hybrid backup strategies. Enterprises leverage cloud connectivity for off-site replication, disaster recovery, and cost optimization while retaining on-premises control over critical data. This hybrid approach offers flexibility, faster data retrieval, and multi-tiered storage management, presenting growth opportunities for vendors developing cloud-ready and seamlessly integrated PBBA solutions tailored to evolving enterprise IT landscapes.

- For instance, Bosch reports that globally it employs roughly 86,800 associates in research and development, including nearly 48,000 software engineers — reflecting substantial in-house capacity to design, deploy, and manage complex IoT + cloud + data-services infrastructure at scale.

- AI and Automation in Backup Operations

Artificial intelligence and automation are increasingly applied in PBBA solutions to optimize storage utilization, predict failures, and streamline recovery processes. Predictive analytics and automated workload distribution reduce manual intervention, improve efficiency, and enhance system reliability. The adoption of intelligent management software creates opportunities for vendors to differentiate offerings, drive operational efficiency, and provide actionable insights for enterprise IT teams, boosting overall PBBA market growth.

- For instance, Electrolux secured an energy‑sourcing profile where 94% of electricity used across its manufacturing operations comes from renewable sources, and 64% of total energy (electricity + other energy) comes from renewables.

- Expansion in Emerging Economies

Emerging markets with growing IT infrastructure investment present untapped potential for PBBA adoption. Increased digitalization, SMB growth, and awareness of data protection solutions drive demand in regions such as Asia-Pacific, Latin America, and the Middle East. Vendors focusing on affordable, scalable, and easy-to-deploy appliances can capitalize on these expanding markets, creating new revenue streams while addressing local enterprise needs for secure, high-performance backup systems.

Key Challenges

- High Initial Investment and Operational Costs

The upfront cost of PBBA systems, including hardware, software licenses, and maintenance, can deter small and mid-sized enterprises from adoption. Operational expenses, such as power, cooling, and management overhead, further increase total cost of ownership. Organizations must weigh performance benefits against budget constraints, and vendors face the challenge of offering cost-effective solutions without compromising on scalability, reliability, or advanced feature sets required by enterprise environments.

- Complexity in Integration with Existing IT Infrastructure

Integrating PBBA systems into heterogeneous IT environments can be technically challenging, particularly in legacy setups. Compatibility issues with existing storage networks, applications, and cloud platforms can delay deployment and increase support requirements. Ensuring seamless integration, minimal disruption, and efficient workflow management remains a significant hurdle for vendors and enterprises alike, impacting adoption rates despite the growing need for advanced backup and recovery solutions.

Regional Analysis

North America

North America leads the PBBA market with a significant share of approximately 35%, driven by rapid digital transformation and high adoption of cloud-integrated backup solutions. Enterprises prioritize data protection and disaster recovery, prompting investments in advanced PBBA systems with high deduplication and encryption capabilities. U.S.-based companies dominate deployment, leveraging hybrid IT infrastructures and regulatory compliance mandates such as HIPAA and GDPR. The region’s strong presence of key vendors, coupled with continuous innovation in storage efficiency and automated backup technologies, further reinforces market growth, making North America the largest and most technologically advanced PBBA market globally.

Europe

Europe accounts for roughly 25% of the global PBBA market, supported by increasing enterprise focus on data security, GDPR compliance, and hybrid storage strategies. Germany, the UK, and France drive demand for high-performance, scalable appliances that integrate seamlessly with existing IT infrastructures. Organizations emphasize cost optimization through efficient deduplication, automated backup, and multi-tier storage solutions. The presence of regional vendors and partnerships with global PBBA providers accelerates adoption, while growing awareness of ransomware threats fuels investment in resilient backup architectures. Overall, Europe demonstrates steady growth, balancing technological advancement with regulatory-driven requirements.

Asia-Pacific (APAC)

The APAC region holds an estimated 22% market share, witnessing rapid PBBA adoption due to expanding IT infrastructure, cloud migration, and digitalization initiatives. Countries such as China, India, Japan, and Australia lead demand for high-capacity appliances capable of handling large-scale enterprise data. Increasing government initiatives for smart cities and data protection compliance drive investments in secure and efficient backup solutions. The growing presence of both global and local vendors ensures competitive pricing and technology availability. As organizations in APAC embrace hybrid and multi-cloud environments, the region is positioned for accelerated PBBA growth in the coming years.

Latin America

Latin America contributes approximately 10% to the PBBA market, with Brazil and Mexico as primary adopters. Enterprises focus on securing growing volumes of business-critical data while improving operational efficiency through automated backup systems. Regional growth is supported by increasing awareness of data protection regulations and rising demand for hybrid cloud solutions. Local IT service providers and partnerships with global PBBA vendors enhance market penetration. While cost sensitivity influences procurement decisions, organizations are gradually investing in high-performance appliances with features like deduplication and rapid recovery, positioning Latin America as a steadily expanding segment of the global PBBA market.

Middle East & Africa (MEA)

The MEA region represents around 8% of the global PBBA market, driven by growing digitalization across banking, government, and telecom sectors. Countries such as the UAE, Saudi Arabia, and South Africa lead adoption of enterprise backup solutions to ensure data integrity, regulatory compliance, and business continuity. Market growth is propelled by investments in cloud-enabled and high-capacity storage appliances, along with partnerships between regional IT service providers and global PBBA vendors. Increasing awareness of cybersecurity threats and data protection mandates further encourages deployment, positioning MEA as an emerging market with promising growth potential in the enterprise backup infrastructure segment.

Market Segmentations:

By Product Type:

- Cooktops & Cooking Ranges

- Specialized Appliances

By Structure:

By Distribution Channel:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Purpose Built Backup Appliance (PBBA) market is highly competitive, led by key players such as Midea Group, Whirlpool Corporation, Sharp Corporation, Panasonic Corporation, LG Electronics Inc., Robert Bosch GmbH, Samsung Electronics Co. Ltd., Electrolux AB, Haier Smart Home Co., Ltd., and Miele. The Purpose Built Backup Appliance (PBBA) market is characterized by intense competition driven by technological innovation, product reliability, and service differentiation. Vendors focus on developing high-capacity appliances with advanced features such as data deduplication, encryption, automated backup, and seamless integration with hybrid and cloud infrastructures. Market growth is fueled by strategic initiatives including mergers, acquisitions, and collaborations with cloud service providers to expand regional presence. Companies are investing heavily in R&D to enhance appliance performance, optimize storage efficiency, and reduce total cost of ownership. Additionally, evolving regulatory requirements and rising cybersecurity concerns are pushing providers to deliver resilient, compliant, and secure backup solutions. This competitive environment is expected to continue driving innovation and differentiation across the global PBBA market, benefiting enterprise customers with more sophisticated and reliable storage solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Midea Group

- Whirlpool Corporation

- Sharp Corporation

- Panasonic Corporation

- LG Electronics Inc.

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Electrolux AB

- Haier Smart Home Co., Ltd.

- Miele

Recent Developments

- In February 2025, Sharp introduced the Celerity High-Speed Oven, cooking whole chicken three times faster through rapid radiant and convection technology.

- In October 2024, Daewoo announced its plan to launch over 100 consumer appliance products in India, targeting the increasing demand from nuclear families and dual-income households.

- In August 2024, Samsung launched 10 large-capacity Bespoke AI washing machines in India, which use AI features like AI Wash, AI EcoBubble, and AI Energy Mode to improve cleaning and energy efficiency.

- In June 2024, LG Electronics launched nine new microwave oven models in India, which are available through retail and online platforms starting at INR 26,499. The new range includes seven Scan to Cook series models and two premium Objet series models, all featuring LG’s ThinQ connectivity.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Structure, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Enterprises will increasingly adopt hybrid and cloud-integrated PBBA solutions to enhance data protection.

- Advanced features like automated backup, deduplication, and encryption will drive appliance innovation.

- Rising data volumes from IoT, AI, and big data applications will boost demand for high-capacity PBBA systems.

- Continuous R&D will focus on improving storage efficiency and reducing total cost of ownership.

- Regulatory compliance and data privacy requirements will influence deployment strategies across industries.

- Small and medium enterprises will increasingly invest in scalable PBBA solutions.

- Strategic partnerships and collaborations with cloud providers will expand market reach.

- Energy-efficient and environmentally friendly appliances will gain prominence in future offerings.

- Increasing cybersecurity threats will accelerate investment in resilient and secure backup solutions.

- Regional markets in APAC and MEA will witness faster adoption due to digitalization initiatives and infrastructure growth.