Market Overview

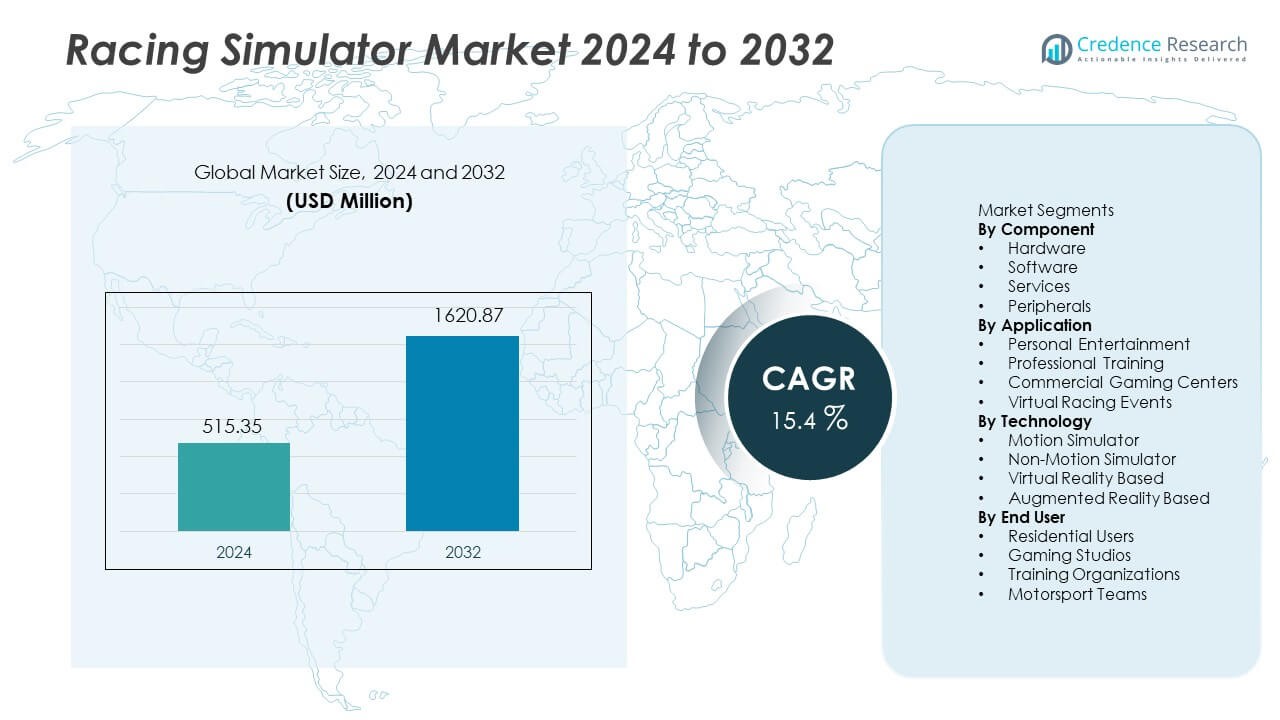

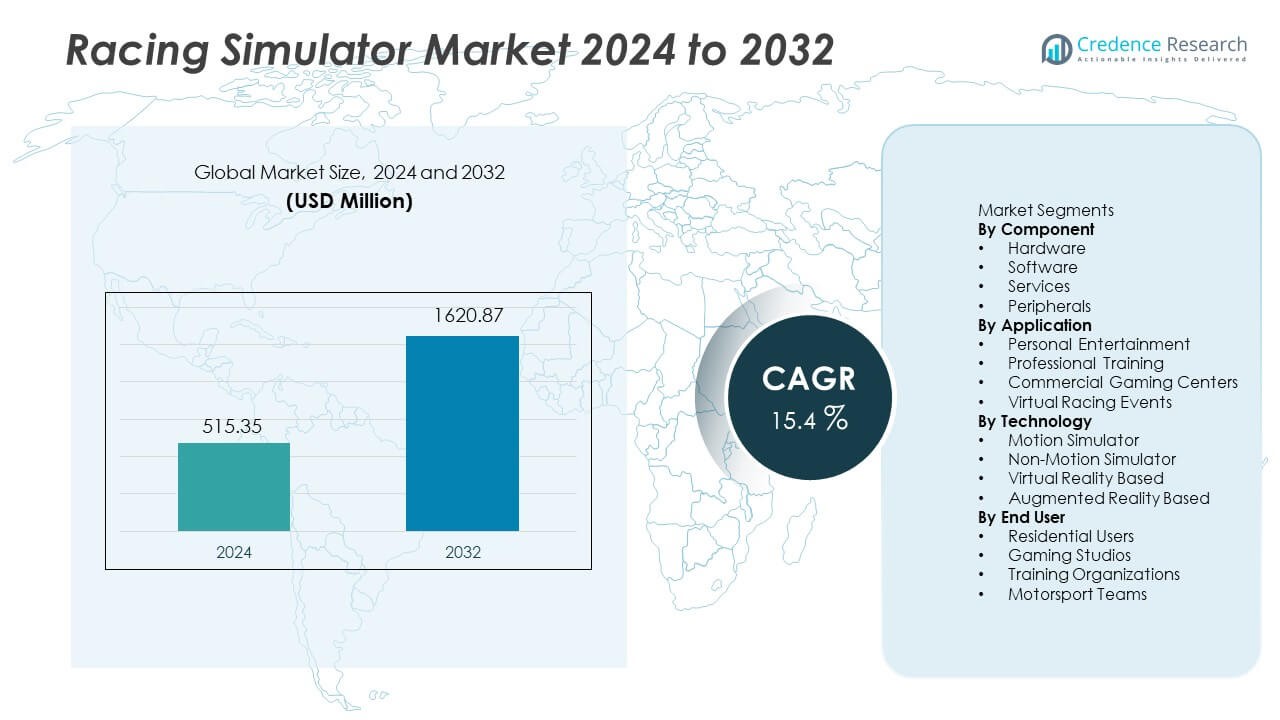

The Racing Simulator market reached USD 515.35 million in 2024. The market is expected to reach USD 1,620.87 million by 2032, growing at a CAGR of 15.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Racing Simulator market Size 2024 |

USD 515.35 Million |

| Racing Simulator market , CAGR |

15.4% |

| Racing Simulator market Size 2032 |

USD 1,620.87 Million |

The Racing Simulator market features major players such as Logitech, Thrustmaster, Fanatec, Playseat, SimXperience, CXC Simulations, Next Level Racing, Reiza Studios, SimLab, and D-BOX Technologies, offering advanced steering systems, motion rigs, and VR-enabled platforms for immersive racing experiences. North America leads the global landscape with 34% share, supported by strong esports adoption, high consumer spending, and professional motorsport training demand. Europe follows with significant growth from established racing leagues and rising simulator usage in professional driver development. Companies continue focusing on high-performance hardware, enhanced haptic feedback, and VR integration to strengthen market presence in both home and commercial segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Racing Simulator market reached USD 515.35 million in 2024 and is projected to reach USD 1,620.87 million by 2032, expanding at a 15.4% CAGR during the forecast period.

- Rising demand for immersive home entertainment, stronger esports participation, and growing simulator adoption in professional motorsport training drive long-term market expansion, while hardware leads the component segment with 48% share due to high demand for wheels, pedals, and motion platforms.

- Virtual reality remains the primary technology with 53% share, supported by enhanced visual immersion, growing affordability of VR devices, and rapid adoption across personal and commercial gaming platforms.

- Competition intensifies as leading companies invest in advanced haptic systems, upgraded motion rigs, and high-performance steering technologies, while high equipment cost and technical setup complexity act as major restraints in price-sensitive markets.

- North America leads with 34% share, followed by Europe at 28%, Asia Pacific at 22%, Latin America at 9%, and the Middle East and Africa at 7%, supported by esports growth and expanding gaming infrastructure across regions.

Market Segmentation Analysis:

By Component

The hardware sub-segment holds 48% share of the component market. Demand comes from advanced wheels, pedals, motion rigs, and chassis used to improve realism for both home setups and professional use. Software, services, and peripherals follow with smaller shares, supported by steady upgrades and after-sales needs. Rising spending on immersive racing experience and growth in high-spec rigs drive hardware leadership. The sub-segment benefits from strong replacement demand and wider availability of premium simulator systems.

- For instance, Logitech introduced TRUEFORCE feedback that processes up to 4000 updates each second to deliver higher road texture detail.

By Application

The personal entertainment sub-segment accounts for 42% share of the application market. Growth comes from gaming adoption at home and strong traction of esports engagement. This segment benefits from easier access to simulator platforms and growing popularity of competitive online racing. Commercial gaming centers and virtual racing events attract group usage and tournaments, while professional training remains focused on motorsport teams. Broader consumer appeal keeps personal entertainment ahead of other sub-segments.

- For instance, Thrustmaster’s parent company reported that the brand’s sales recently experienced a downturn, following a previous period where customer inventories were elevated.

By Technology

The virtual-reality based sub-segment leads with 53% share of the technology market. VR demand rises due to improvements in display quality, head-tracking, and immersive gameplay features. User preference for deeper simulation experience drives continuous adoption across both gaming and training applications. Motion simulator technology follows, supported by demand for professional racing practice and high-end enthusiast setups. AR and non-motion platforms hold smaller positions due to higher cost or limited consumer awareness.

Key Growth Drivers

Expanding Gaming and Esports Adoption

Global interest in competitive gaming pushes demand for realistic racing platforms. Esports events attract large audiences and support investment in advanced simulator setups. Gaming studios promote online tournaments that engage both casual and skilled users. Home adoption rises due to improved affordability of hardware and immersive gameplay quality. Continuous updates in racing titles encourage repeat purchase of peripherals and VR devices. This trend strengthens long-term simulator demand.

- For instance, Fanatec disclosed its annual online sales revenue was over a hundred million dollars in its last reported annual volume.

Rapid Shift Toward Immersive Hardware Systems

Users seek lifelike motion, steering response, and tactile feedback during simulation. Hardware makers focus on performance upgrades that enhance realism. Racing fans value premium wheels, pedals, and chassis that deliver stronger control. Professional drivers also use advanced rigs for training and race preparation. This behavior increases sales of high-end simulator systems. The shift supports greater hardware innovation and replacement demand across regions.

- For instance, Next Level Racing confirmed its Motion Platform V3 provides two degrees of freedom motion with actuator travel of 150 mm, increasing sensory immersion.

Growing Use in Driver Training and Motorsport Practice

Racing teams rely on simulators to improve driver skill and race strategy. Training organizations use realistic models to test track conditions and racing lines. Virtual platforms reduce cost linked with physical track practice and fuel consumption. Motorsport academies adopt simulators for safe learning environments. Growing preference for data-driven coaching boosts professional usage. Training integration expands demand beyond casual gaming.

Key Trends and Opportunities

Increasing Integration of Virtual Reality Platforms

VR platforms create deep immersion through improved visuals and head tracking. Users enjoy realistic cockpit views and dynamic racing environments. VR developers focus on better resolution and wider field of view. Affordable headsets accelerate mass usage in home setups. Commercial centers deploy VR systems for group racing experiences. Integration of VR widens growth opportunities across gaming and training markets.

- For instance, Meta Quest 3 delivers display resolution of 2064×2208 pixels per eye, which increases cockpit clarity for racing titles.

Development of Multiplayer and Cloud-Based Racing Experiences

Multiplayer platforms enable online competition and shared race events. Cloud gaming removes hardware limits and improves access for global users. Connected systems support shared leaderboards and real-time communication. Developers invest in cross-platform compatibility to reach wider audiences. The shift encourages subscription services for frequent content updates. Cloud racing opens new revenue streams for publishers and simulator providers.

- For instance, Microsoft Xbox Cloud Gaming operates across numerous data center regions, enabling multiplayer gaming sessions, though competitive performance is limited by inherent latency in the service.

Key Challenges

High Cost of Advanced Hardware Systems

Premium motion rigs, pedals, and chassis often cost high amounts. Price barriers limit adoption among casual buyers and young gamers. Commercial centers also manage significant investment for multiple simulator units. Limited affordability slows large scale penetration in developing regions. Hardware makers aim to lower production cost through modular components. High pricing remains a major challenge for wider adoption.

Technical Complexity and Compatibility Issues

Different hardware brands follow varied standards and firmware rules. Users face setup challenges when integrating wheels, pedals, and VR devices. Compatibility gaps reduce smooth usage across platforms and racing titles. Technical complexity demands frequent system updates and user learning. New users may avoid simulators when installation becomes difficult. Simplified systems and better integration remain key improvement areas.

Regional Analysis

North America

North America holds 34% share of the Racing Simulator market, supported by strong adoption of advanced gaming systems and high disposable income among consumers. Esports events and professional motorsport organizations continue to expand simulator use for training and race preparation. Home users invest in high-performance hardware, including motion rigs and VR accessories. The United States remains a major hub due to tech innovation and rising interest in competitive online racing. Continuous product upgrades offered by leading gaming brands further reinforce regional leadership.

Europe

Europe accounts for 28% share driven by a large motorsport culture and established racing leagues. Regional demand benefits from significant interest in Formula racing and expanding esports tournaments across the United Kingdom, Germany, Italy, and France. Professional driving academies adopt advanced simulators to improve learning efficiency, while gaming centers integrate high-spec hardware to attract visitors. Consumer spending on VR and immersive experiences continues rising across key European markets. The region also benefits from hardware suppliers focused on quality engineering and high performance design.

Asia Pacific

Asia Pacific holds 22% share with rising gaming participation across China, Japan, South Korea, and Australia. Regional growth comes from expanding esports communities, strong gaming culture, and increasing investment in VR entertainment centers. Young consumers show high enthusiasm for immersive gaming platforms and online competitions. Gaming hardware brands experience increasing sales of wheels, pedals, and VR systems as affordability improves. Emerging digital racing events continue to attract new players, while professional motorsport programs drive interest in simulation-based training.

Latin America

Latin America captures 9% share supported by increasing penetration of home gaming systems and growing interest in competitive virtual racing. Brazil and Mexico lead demand due to expanding gaming communities and rising VR adoption. Commercial gaming centers introduce advanced racing platforms to attract users, while online racing events gain popularity among young players. Limited affordability remains a barrier to rapid hardware growth, yet gradual price declines encourage broader adoption. Local distributors and online retailers contribute to rising product availability.

Middle East and Africa

The Middle East and Africa represent 7% share with demand led by Gulf countries adopting immersive entertainment systems and advanced gaming centers. Commercial locations deploy premium racing simulators to offer differentiated experiences in malls and entertainment venues. Rising interest in esports encourages investment in multiplayer and VR-based racing platforms. Home adoption improves at a slower pace due to higher equipment cost. Increased participation in international motorsport events further promotes simulator usage across selected markets.

Market Segmentations:

By Component

- Hardware

- Software

- Services

- Peripherals

By Application

- Personal Entertainment

- Professional Training

- Commercial Gaming Centers

- Virtual Racing Events

By Technology

- Motion Simulator

- Non-Motion Simulator

- Virtual Reality Based

- Augmented Reality Based

By End User

- Residential Users

- Gaming Studios

- Training Organizations

- Motorsport Teams

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape includes Logitech, Thrustmaster, Fanatec, Playseat, SimXperience, CXC Simulations, Next Level Racing, Reiza Studios, SimLab, and D-BOX Technologies. The competitive environment focuses on advanced motion platforms, immersive VR support, and premium steering and pedal systems designed for both home and professional usage. Key vendors expand product lines with improved haptic feedback, dynamic chassis, and motion systems that simulate real track conditions. Companies invest in gaming partnerships and esports sponsorships to increase global visibility and product adoption. Hardware differentiation remains a critical strategy as players compete on build quality, material performance, and compatibility with leading racing titles. Vendors also enhance online distribution and direct-to-consumer channels to reach global gaming audiences. Continuous product upgrades, faster technology cycles, and increasing integration with professional motorsport drive intense rivalry across established and emerging brands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Logitech G introduced its RS50 racing sim hardware – a direct-drive wheelbase, pedals, and modular wheel system – aimed at serious sim-racers.

- In September 2023, Fanatec released a new version of its quick-release system: QR2 (available in Lite, Standard, and Pro versions) to replace the older QR1.

- In September 2023, Logitech G and Playseat introduced the Playseat Challenge X – Logitech G Edition, a racing simulator chair developed in collaboration with Logitech G.

- In August 2023, Cooler Master launched the Dyn X, a professional-grade racing simulation cockpit. The system is indeed described as a revolutionary advancement in the field, co-developed with professional drivers to provide an authentic experience.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, Technology, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as esports adoption grows across global demographics.

- VR and motion integration will expand immersive racing experiences.

- Simulator usage by motorsport academies will strengthen professional demand.

- Subscription gaming platforms will support recurring revenue streams.

- Home-based simulator setups will increase due to improved affordability.

- AI-enabled telemetry will support realistic training modules.

- Hardware upgrades will focus on stronger haptic and motion systems.

- Cloud-based racing platforms will widen access for new users.

- Competitive product launches will intensify hardware innovation cycles.

- Regional growth will improve as online racing tournaments expand.