Market Overview

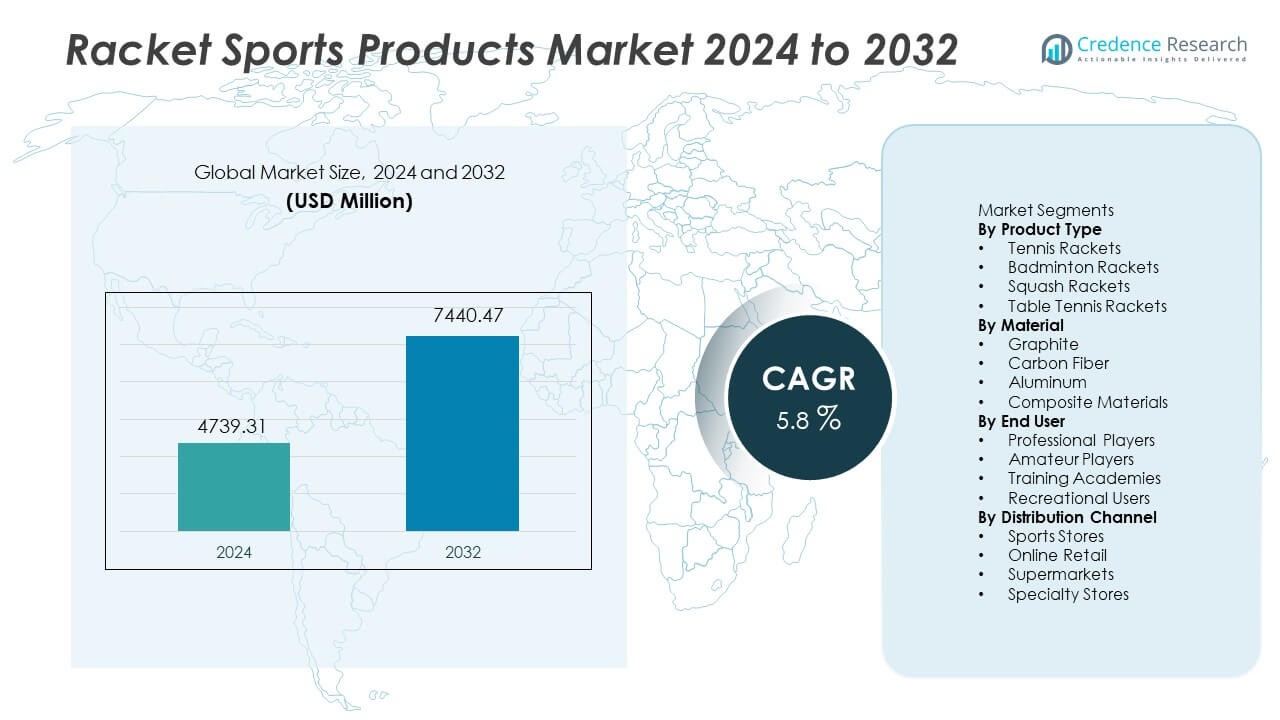

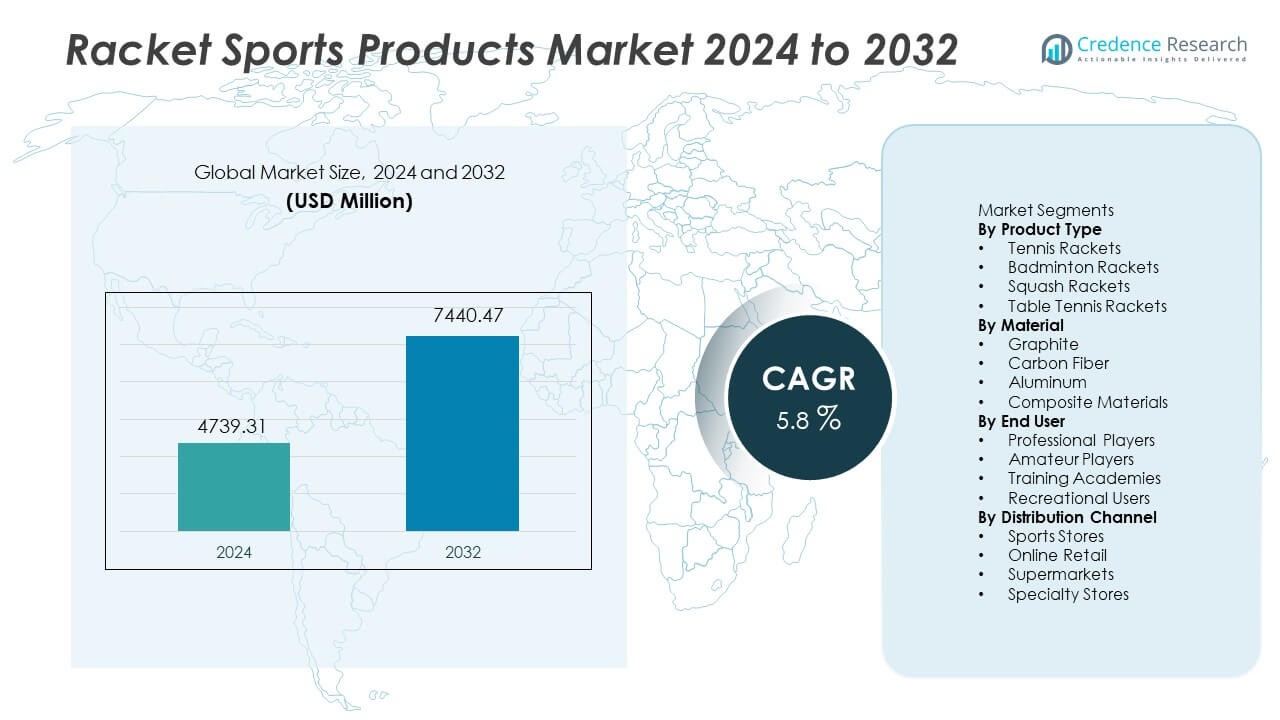

The Racket Sports Products market reached USD 4,739.31 million in 2024. The market is expected to reach USD 7,440.47 million by 2032, growing at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Racket Sports Products market Size 2024 |

USD 4,739.31 Million |

| Racket Sports Products market, CAGR |

5.8% |

| Racket Sports Products Market Size 2032 |

USD 7,440.47 Million |

The Racket Sports Products market features leading players such as Yonex, Wilson Sporting Goods, Babolat, Head NV, Prince Sports, Tecnifibre, Carlton Sports, Li-Ning, Victor Sports, and Dunlop Sport, offering performance-driven rackets for tennis, badminton, squash, and table tennis. Asia Pacific leads the global market with 33% share, driven by large participation in badminton and table tennis, strong community sports culture, and rapid expansion of training academies. Europe follows with major tennis adoption and organized club structures. Key players continue to invest in lightweight materials, carbon technology, and vibration control systems to address professional and amateur performance needs across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Racket Sports Products market reached USD 4,739.31 million in 2024 and is projected to reach USD 7,440.47 million by 2032, expanding at a 5.8% CAGR during the forecast period.

- Rising participation in tennis and badminton, expanding fitness awareness, and increasing sales in schools and training academies drive steady market demand, while tennis rackets lead the product type segment with 41% share across global sales.

- Manufacturers focus on lightweight graphite and carbon fiber designs to enhance swing control and comfort, supporting advanced racket integration trends among professional and amateur users.

- Competition strengthens as global brands invest in high-performance materials, vibration reduction, and professional sponsorships, while high pricing of premium models and frequent replacement needs act as restraints in price-sensitive markets.

- Asia Pacific leads with 33% share, followed by Europe at 30%, North America at 27%, Latin America at 6%, and the Middle East and Africa at 4%, reflecting strong sports adoption supported by commercial and recreational participation.

Market Segmentation Analysis:

By Product Type

The tennis rackets sub-segment holds 41% share of the product segment, driven by strong global participation in tennis leagues, professional tournaments, and recreational play. Growing interest in international events and youth coaching programs increases sales of performance-based tennis rackets. Badminton and table tennis gain traction in Asia, supported by school sports and indoor gaming culture, while squash remains a smaller niche in commercial sports clubs. The tennis category continues to lead due to wider adoption across all age groups and active promotion by international sports bodies. Product innovation in lightweight frames and vibration control further strengthens tennis rackets’ leadership.

- For instance, Yonex uses Nanometric DR technology in the EZONE series to provide increased flex and repulsion, which helps lower vibration transmission. This material enhances frame snapback and works with other systems, like Quake Shut Gel in the handle, to offer an impressive level of comfort and dampening.

By Material

Graphite dominates the material segment with 38% share, supported by its lightweight handling and strong durability. Carbon fiber follows due to premium usage among competitive players seeking enhanced swing speed. Aluminum remains common among beginners due to lower price points and easier handling. Composite materials expand slowly within professional sports training centers that demand advanced rigidity and precision. Graphite leadership continues as manufacturers integrate advanced shock absorption and torsion control technologies. The trend toward lighter and stronger racket materials increases demand for graphite-based models across both professional and amateur players.

- For instance, Babolat’s Pure Aero uses graphite construction, integrated with materials like flax fibers, to balance stiffness for powerful baseline strokes with added feel and vibration dampening.

By End User

Amateur players represent the leading end-user group, holding 46% share driven by growing participation in recreational sports and community clubs. Demand rises due to health awareness, school sports activities, and casual weekend play. Professional players account for a smaller but premium segment, purchasing advanced materials and performance-tuned rackets. Training academies support rising youth participation, while recreational users shop for affordable models through online channels. Amateur dominance continues because of widespread access to open sports facilities and coaching programs at local levels. Rising consumer preference for fitness-based sports supports further growth across amateur categories.

Key Growth Drivers

Rising Participation in Global Sporting Activities

Growing interest in racket-based sports drives strong demand across schools, clubs, and recreational centers. Tennis and badminton programs continue increasing in popularity due to awareness of fitness and wellness. International tournaments, youth competitions, and televised sports events elevate participation rates among young players. Sports federations promote community sporting events that encourage greater adoption of racket sports. This participation growth significantly supports long-term demand for beginner and advanced rackets across major global markets.

- For instance, Wilson has established partnerships and programs to supply junior tennis rackets and other equipment to school academies and youth organizations. These efforts, sometimes in collaboration with partners like the YMCA and USTA Foundation, aim to increase access to sports for underserved youth.

Growing Investments in High-Performance Materials

Manufacturers invest in advanced materials such as graphite and carbon fiber for improved swing control and shock absorption. Performance-focused designs enhance racket stability and reduce weight. Professional players push demand for precision-built models, while amateur users adopt lightweight products for better playability. These innovations strengthen premium product adoption and encourage replacement purchases. Material improvements play a key role in differentiating brands and improving competitive advantage.

- For instance, Head confirmed that its Graphene 360 lay-up improves torsional rigidity and offers greater stability in internal validation tests compared with earlier Graphene XT models, according to the company’s technical notes.

Expansion of Online Sporting Goods Retail

Online retail platforms widen access to global brands and premium racket categories. Easy comparison of models, faster product availability, and frequent promotional offers attract consumers worldwide. Digital channels support strong sales among amateurs and recreational users, especially in emerging economies. E-commerce platforms also expand demand for accessories including strings, grips, and racket bags. This trend accelerates adoption of branded and professional-grade racket products.

Key Trends and Opportunities

Shift Toward Lightweight and Ergonomic Designs

Players increasingly prefer lightweight rackets that deliver improved handling and reduced fatigue during intensive play. Manufacturers introduce ergonomic grip systems and vibration control technologies that support player comfort. Professional players influence amateur users to adopt advanced material technologies. This shift toward comfort and control design opens strong opportunities for premium racket producers. Enhanced durability and power transmission continue attracting advanced-performance buyers.

- For instance, Tecnifibre lists its T-Fight ISO 305 with a measured unstrung mass of 305 grams and balance of 32.5 centimeters in official technical documentation, helping competitive users maintain fast swing timing.

Expansion of Training and Coaching Ecosystems

Training academies expand across schools and commercial centers, offering structured racket sports coaching. Community sports programs and school-level sports infrastructure increase product adoption for beginner and intermediate categories. Online tutorials and digital coaching platforms motivate young players to take up racket sports. This development enlarges consumer base and increases recurring racket purchases linked with skill progression. Strong opportunities arise in emerging regions investing heavily in sports training.

- For instance, Li-Ning, as a prominent Chinese sports brand that operates various sports parks and centers across China, is widely involved in local sports promotion and youth development, which includes supporting the general expansion of badminton facilities and coaching pathways nationwide.

Key Challenges

High Price of Premium and Professional Models

Premium racket models feature advanced materials, which increase overall product pricing. Many beginners find professional models difficult to afford, slowing adoption in price-sensitive regions. Manufacturers must balance premium innovation with cost-effective product development. Price barriers influence consumer shift toward aluminum and entry models, limiting higher-end sales. High price remains a persistent barrier in emerging markets.

Short Product Life and Frequent Replacement Needs

Rackets experience frequent wear due to intensive usage, environmental factors, and string tension. Professional and amateur players may require replacement after limited playing cycles. This increases total cost of ownership and discourages adoption of high-end models among recreational users. Manufacturers work to improve durability without raising cost. Frequent replacement remains a challenge for long-term user retention in premium segments.

Regional Analysis

North America

North America holds 27% share of the Racket Sports Products market, supported by strong participation in tennis, squash, and emerging growth in pickleball. The United States leads demand due to a well-developed sports culture, organized tournaments, and higher spending on branded sporting equipment. Universities and clubs introduce structured coaching programs that promote youth participation and premium racket purchases. Recreational sports participation continues to increase as fitness awareness rises. Major brands expand online retail channels to reach a wider customer base across the region. Strong demand for lightweight and professional-grade materials supports premium sales growth.

Europe

Europe accounts for 30% share, driven by widespread adoption of tennis and badminton across recreational and professional levels. Countries such as Germany, France, Spain, and the United Kingdom maintain strong tennis club networks and national championship events that stimulate equipment demand. European players also display strong preference for graphite and carbon fiber rackets aligned with performance needs. Government-supported sports development programs expand youth tournaments and school sports. Specialty sports stores maintain strong influence, while online sales continue rising across the region. Growing popularity of racket sports as leisure fitness strengthens long-term regional demand.

Asia Pacific

Asia Pacific holds 33% share and stands as the fastest-growing regional market, led by China, Japan, India, and South Korea. High popularity of badminton and table tennis drives significant volume demand among schools, academies, and community sports complexes. Local tournaments and international events boost participation among young players. Manufacturers introduce affordable product ranges for beginners, while premium rackets gain traction among competitive users. Growth in online retail platforms expands accessibility in major markets. Rising participation in school-level competitions and coaching programs strengthens long-term adoption across the region.

Latin America

Latin America captures 6% share supported by rising interest in tennis, badminton, and growing recreational activities across Brazil, Mexico, and Argentina. Government sports initiatives and community sports clubs promote entry-level participation in racket-based sports. Affordability influences strong demand for aluminum and composite rackets within amateur categories. E-commerce platforms improve access to branded equipment across urban areas. Growth in indoor sports centers and coaching academies encourages recurring product purchases. Recreational players increasingly choose lightweight and beginner-friendly racket types, while professional categories expand gradually.

Middle East and Africa

The Middle East and Africa represent 4% share, supported by expanding commercial sports complexes and premium leisure activities across Gulf countries. International schools promote tennis and badminton as part of academic fitness initiatives. Recreational users drive demand for beginner categories, while professional participation remains limited but growing. Higher pricing of premium graphite and carbon fiber rackets restricts widespread adoption in developing markets. Online shopping and imported sporting goods increase product availability across major urban centers. Growing interest in organized school tournaments and community fitness programs gradually pushes demand for racket products across the region.

Market Segmentations:

By Product Type

- Tennis Rackets

- Badminton Rackets

- Squash Rackets

- Table Tennis Rackets

By Material

- Graphite

- Carbon Fiber

- Aluminum

- Composite Materials

By End User

- Professional Players

- Amateur Players

- Training Academies

- Recreational Users

By Distribution Channel

- Sports Stores

- Online Retail

- Supermarkets

- Specialty Stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape includes Yonex, Wilson Sporting Goods, Babolat, Head NV, Prince Sports, Tecnifibre, Carlton Sports, Li-Ning, Victor Sports, and Dunlop Sport. The market remains competitive due to strong product innovation, brand positioning, and heavy promotion through global sports sponsorships. Leading companies focus on lightweight materials, vibration reduction, and power-enhancing frame designs to meet advanced player needs. Partnerships with professional athletes strengthen brand recognition and influence consumer preferences. Manufacturers expand product lines across beginner, intermediate, and professional categories to meet diverse demand levels. Online retail channels and direct-to-consumer platforms help brands improve international reach and supply availability. Companies also invest in material research such as graphite, carbon fiber, and composite frames to enhance performance and differentiate premium offerings. The competitive landscape continues evolving as brands introduce performance-driven, ergonomic, and durability-focused racket designs across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Yonex

- Wilson Sporting Goods

- Babolat

- Head NV

- Prince Sports

- Tecnifibre

- Carlton Sports

- Li-Ning

- Victor Sports

- Dunlop Sport

Recent Developments

- In September 2025, Yonex launched the third-generation Astrox 99 series globally.

- In March 2025, Head NV released the Radical 2025 series featuring Auxetic 2.0.

- In January 2025, Babolat released Pure Drive Gen11 with updated feel and power.

- In December 2023, Yonex Co., Ltd. officially unveiled the ECLIPSION 5 tennis shoe series, which was specifically tailored for intermediate and advanced players.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as recreational sports participation grows worldwide.

- Lightweight and ergonomic racket designs will gain wider adoption.

- Online retail channels will expand access to premium racket brands.

- Training academies will boost recurring product purchases among young players.

- Growth in indoor sports facilities will support badminton and table tennis usage.

- Professional sponsorships will influence consumer preference for performance models.

- Carbon fiber and composite materials will strengthen premium product demand.

- Fitness awareness will push more adults toward racket-based activities.

- Emerging markets will invest more in school-level sports infrastructure.

- Regional participation will increase through sports federations and community programs.