Market Overview

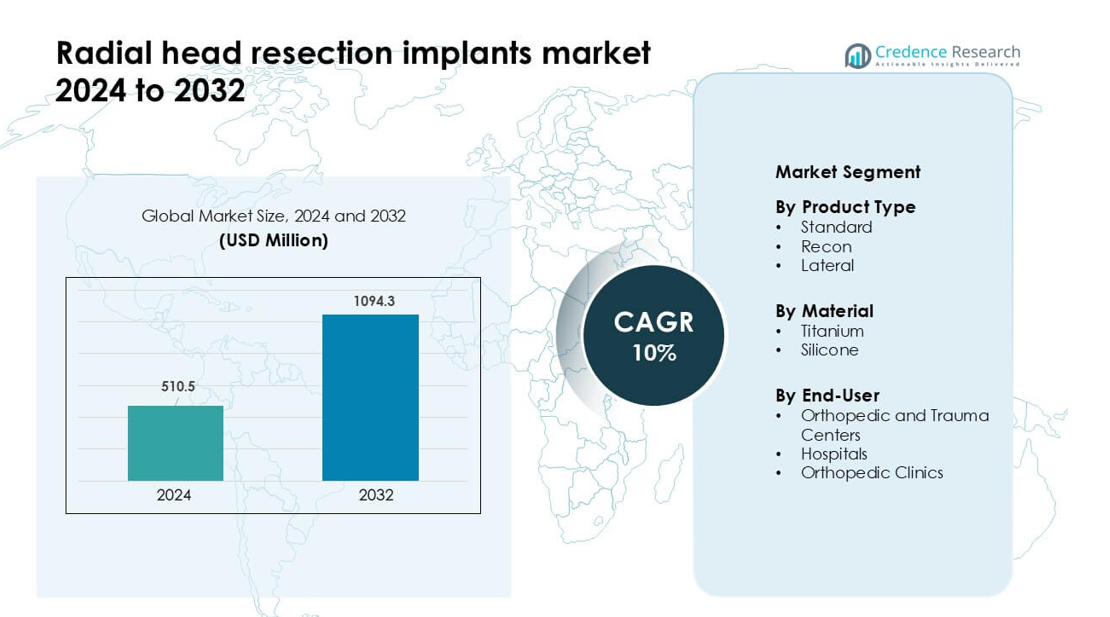

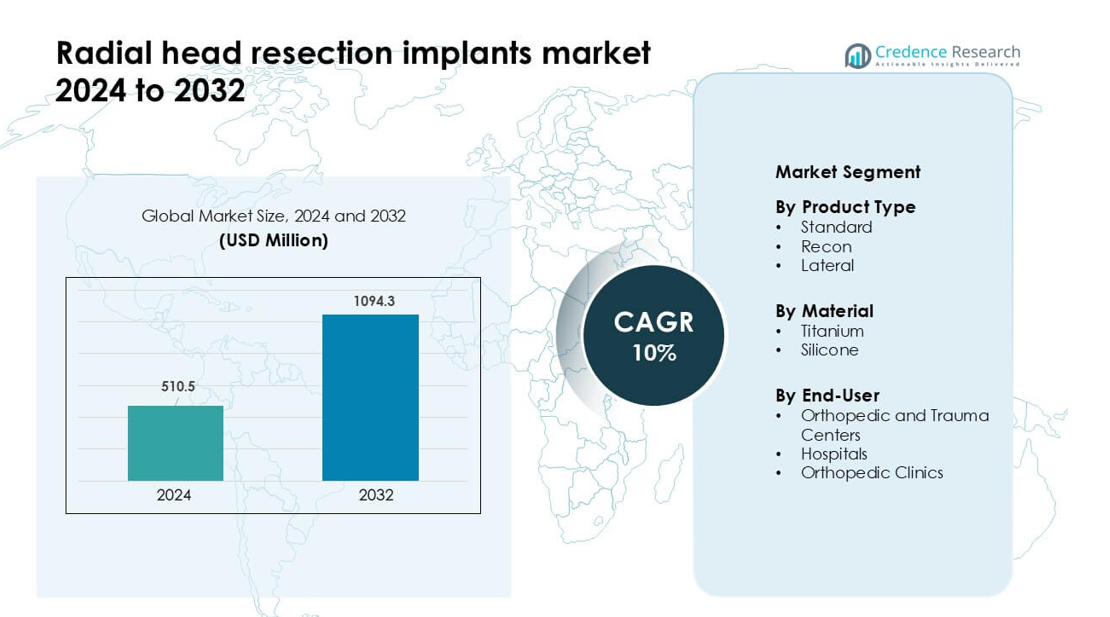

Radial head resection implants market was valued at USD 510.5 million in 2024 and is anticipated to reach USD 1094.3 million by 2032, growing at a CAGR of 10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Radial Head Resection Implants Market Size 2024 |

USD 510.5 million |

| Radial Head Resection Implants Market, CAGR |

10% |

| Radial Head Resection Implants Market Size 2032 |

USD 1094.3 million |

Top players in the radial head resection implants market include Auxein Medical, Acumed, Smith & Nephew Plc, J&J Medical Devices, Wright Medical Technology, Integra LifeSciences, Biomet, Toier, and Medartis AG, all competing through advanced titanium implant systems, modular designs, and strong clinical training programs. These companies focus on improving anatomical fit, reducing revision rates, and expanding global distribution. North America led the market in 2024 with a 38% share, supported by high surgical volumes, advanced trauma care infrastructure, and rapid adoption of next-generation orthopedic implants. The region’s strong reimbursement systems and established orthopedic networks continue to reinforce its leadership.

Market Insights

- The radial head resection implants market reached USD 510.5 million in 2024 and is projected to hit USD 1094.3 million by 2032, registering a 10% CAGR during the forecast period.

- Demand grows due to rising elbow fracture cases, preference for early surgical intervention, and strong adoption of titanium implants, with standard product type holding about 57% share in 2024.

- Key trends include wider use of modular designs, improved biomechanical engineering, and growing interest in patient-specific implants that enhance joint stability and reduce revision

- Competition is driven by players such as Auxein Medical, Acumed, Smith & Nephew, J&J Medical Devices, Wright Medical Technology, Integra LifeSciences, Biomet, Toier, and Medartis AG, each expanding portfolios and surgeon-training programs.

- North America led the market with 38% share in 2024, followed by Europe with 29% and Asia-Pacific with 24%, supported by trauma center density, implant availability, and improving orthopedi

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Standard implants led the product type segment in 2024 with about 57% share. Surgeons favored standard radial head resection implants because these devices support predictable fixation, simple sizing, and lower complication risks in routine trauma cases. The design also suits a wide range of proximal radius injuries, which increased adoption across trauma centers. Recon implants gained steady use for complex fractures requiring enhanced stability, while lateral implants addressed select anatomical needs. However, standard implants remained dominant due to broad clinical compatibility, easier surgical workflow, and consistent post-operative outcomes across diverse patient groups.

- For instance, Zimmer Biomet L2L Radial Head System provides 108 unique head-stem combinations, with six head sizes and eighteen stem options (six diameters, each with three height options).

By Material

Titanium dominated the material segment in 2024 with nearly 64% share. Titanium implants attracted strong demand because the alloy offers high strength-to-weight ratio, strong corrosion resistance, and reliable biocompatibility. These features support long-term performance and allow surgeons to manage varied fracture patterns with reduced implant failure risk. Silicone materials held a smaller share, mainly used for specific reconstructive needs due to their flexibility. Despite niche applications for silicone, titanium continued to lead the market because hospitals and clinics preferred durable materials that support stable fixation and faster functional recovery.

- For instance, Zimmer Biomet’s L2L Radial Head System features a smooth stem made of titanium alloy that comes in 6 stem diameters (5, 6, 7, 8, 9, and 10 mm). and three height options (+0, +2, +4 mm), enabling a total of 108 distinct stem configurations.

By End-User

Orthopedic and trauma centers commanded the end-user segment in 2024 with roughly 49% share. These centers handled a large volume of upper-extremity trauma, which increased the need for radial head resection implants with predictable surgical outcomes. The availability of skilled surgeons, advanced imaging, and specialized operating setups further supported rapid adoption. Hospitals followed with rising demand from emergency departments, while orthopedic clinics contributed moderate usage for follow-up procedures and selective cases. Trauma centers stayed ahead because their high caseload and advanced care pathways encouraged consistent use of standardized and high-performance implant systems.

Key Growth Drivers

Rising Incidence of Elbow Fractures and Trauma Cases

Global trauma cases involving the upper extremities continue to increase due to road accidents, sports injuries, workplace mishaps, and age-related fall events. Radial head fractures represent a significant share of elbow injuries, and many require surgical intervention when displacement or comminution is severe. This rise in caseload directly increases the demand for radial head resection implants across trauma centers and hospitals. Surgeons prefer resection implants to restore joint stability and prevent chronic pain or movement restrictions. Growth is further supported by expanding orthopedic trauma services in emerging economies, where improved emergency care access leads to higher treatment rates. Strong clinical acceptance and wider surgical indications reinforce steady market expansion.

- For instance, China has established a national trauma surveillance system in 126 hospitals to better understand the nation’s trauma-related injuries, which supports the existence of multi-hospital studies on trauma cases in the country.

Advancements in Implant Materials and Biomechanical Design

Recent progress in titanium processing, modular system engineering, and precision manufacturing strengthened the performance of radial head resection implants. These implants now offer improved anatomical compatibility, enhanced joint articulation, and reduced risks of implant loosening. Titanium implants remain preferred due to their strong durability, reliable osseointegration behavior, and lower failure rates under repetitive load. Manufacturers also focus on creating lightweight designs with smoother articulating surfaces to support faster rehabilitation. Innovations in CAD-based modeling allow surgeons to achieve better alignment and sizing during procedures. These engineering upgrades improve surgical outcomes and boost clinician confidence, which leads to faster adoption across high-volume trauma facilities.

- For instance, Stryker’s Evolve Radial Head system uses a cobalt chrome alloy for the radial head and stem components. The system’s design is based on a smooth, loose-fit stem that allows movement within the medullary canal, which helps the implant head articulate congruently with the capitellum.

Growing Preference for Early Surgical Intervention

Orthopedic guidelines increasingly encourage early stabilization of radial head injuries to prevent long-term mobility restrictions and elbow instability. Surgeons choose resection and implant-based reconstruction for cases where native radial head preservation is not viable. Early intervention supports improved functional recovery, fewer revision procedures, and shorter rehabilitation cycles, which appeals to both clinicians and patients. Trauma centers with advanced imaging and operative support now perform these procedures more consistently, driving implant demand. Rising patient awareness of surgical benefits also contributes to this growth. The shift toward proactive and evidence-based orthopedic care continues to reinforce market expansion worldwide.

Key Trend & Opportunity

Shift Toward Personalized and Patient-Specific Implants

The market is experiencing a shift toward customized implant solutions supported by 3D modeling, digital templating, and CT-based reconstruction. Manufacturers are exploring patient-specific radial head geometries to improve articulation, reduce implant wear, and achieve more natural biomechanics. Personalized implants present a strong opportunity for complex fracture management where standard sizing may not match anatomical variations. As imaging and design software become more accessible, trauma surgeons can pre-plan interventions more accurately. This trend also aligns with the rising demand for premium orthopedic solutions that minimize revision risk. Expansion of digital manufacturing capabilities provides a major opportunity for product differentiation and high-value offerings.

- For instance, Materialise’s patient-specific 3D-printed radial head implants allow surgeons to design implants based on individual CT scans, producing components with exact anatomical contours and cortical thicknesses between 1.2 mm and 2.0 mm.

Expansion of Trauma Care Infrastructure in Emerging Markets

Developing regions are investing heavily in trauma systems, advanced operating rooms, and orthopedic service capacity. This expansion increases the number of patients receiving timely surgical care for upper-limb fractures, including radial head injuries. Many countries in Asia-Pacific, Latin America, and the Middle East have upgraded emergency response frameworks and added new orthopedic specialists through training programs. These improvements present clear opportunities for implant suppliers to widen distribution networks. Growing preference for titanium-based systems and modular designs also opens long-term revenue potential. As healthcare spending rises and access improves, emerging markets will play a major role in future demand growth.

- For instance, The Anatomic Radial Head System is a real product, first launched around 2004, and used in many surgeries worldwide.

Increasing Focus on Post-Operative Rehabilitation Technologies

Rehabilitation plays a major role in restoring motion after radial head surgery, and new digital tools are transforming this phase of care. Opportunities are emerging in sensor-based rehab systems, virtual physiotherapy platforms, and remote-monitoring tools that track elbow mobility. These technologies support faster recovery and improve patient satisfaction, which indirectly strengthens demand for implant systems with predictable performance. Hospitals adopting integrated post-operative programs prefer implants with proven compatibility for structured rehab pathways. Manufacturers collaborating with digital-rehab providers can differentiate their offerings and create ecosystem-based solutions that improve long-term clinical outcomes.

Key Challenge

High Revision Risk in Complex Fractures and Improper Sizing

One of the major challenges in this market is implant failure due to improper sizing, malalignment, or biomechanical mismatch in complex fractures. Radial head anatomy varies widely across patients, and standard sizing systems may not fully match these variations. Poor alignment can lead to stiffness, instability, or degenerative changes, causing revision surgeries that burden both patients and care providers. Surgeons treating comminuted or multi-fragment fractures face higher technical difficulty during reconstruction. These risks slow adoption in some facilities and highlight the need for improved sizing systems, surgeon training, and patient-specific solutions.

Cost Constraints and Limited Access in Low-Resource Settings

Radial head resection implants, especially titanium-based systems, carry higher costs that limit adoption across low-income regions and smaller clinics. Budget constraints in public hospitals restrict procurement of advanced modular implant systems, even when clinical need exists. Limited insurance coverage, high import duties, and insufficient reimbursement policies further reduce patient access. Many facilities still rely on conservative management for injuries that could benefit from implant-based reconstruction. These financial and accessibility barriers create uneven global adoption and slow market penetration in developing healthcare ecosystems, posing a continuing challenge for manufacturers.

Regional Analysis

North America

North America dominated the radial head resection implants market in 2024 with nearly 38% share, supported by a high volume of trauma cases, strong orthopedic infrastructure, and widespread adoption of titanium-based implant systems. The region benefits from advanced surgical capabilities, well-trained specialists, and rapid integration of new implant designs. Growth is reinforced by strong reimbursement frameworks and the presence of leading orthopedic device manufacturers. Sports-related elbow injuries and road-traffic accidents further increase surgical demand. Continuous product innovation, faster clinical approvals, and extensive trauma center networks keep North America as the leading regional contributor to overall market expansion.

Europe

Europe accounted for about 29% share in 2024, driven by a mature orthopedic care system and strong adoption of evidence-based surgical protocols. Countries such as Germany, France, and the U.K. lead in radial head resection implant use due to high caseloads of elbow fractures among aging populations and active workers. Titanium implants remain preferred for their durability and compatibility with standardized treatment pathways. National guidelines supporting early surgical intervention also strengthen demand. Growing investments in outpatient orthopedic centers, along with broader access to advanced imaging, continue to support Europe’s steady market growth across both Western and Central regions.

Asia-Pacific

Asia-Pacific held nearly 24% share in 2024 and represents the fastest-growing regional market due to rising trauma cases, expanding hospital capacity, and increased adoption of modern orthopedic implants. Countries like China, India, Japan, and South Korea show strong demand growth driven by rapid urbanization, higher accident rates, and expanding orthopedic specialist pools. Improving healthcare infrastructure and wider insurance coverage also help boost surgical volumes. Local manufacturing growth, especially in titanium-based devices, supports cost efficiency and greater availability. Asia-Pacific’s large population base and growing preference for surgical reconstruction position the region as a key future driver of market expansion.

Latin America

Latin America captured roughly 6% share in 2024, supported by increasing investments in trauma care and growing adoption of implant-based elbow fracture treatments. Countries such as Brazil, Mexico, and Argentina lead demand due to expanding private healthcare networks and rising sports-related injuries. Adoption remains moderate because of cost constraints and uneven access to advanced implants. However, training programs for orthopedic surgeons and wider availability of titanium implants continue to strengthen regional uptake. Growth is also aided by improving diagnostic capabilities and greater awareness of early surgical intervention to prevent long-term functional loss in upper-extremity injuries.

Middle East & Africa

The Middle East & Africa region held about 3% share in 2024, reflecting steady but limited adoption of radial head resection implants due to budget constraints and variable access to specialized orthopedic services. Wealthier Gulf countries, including the UAE and Saudi Arabia, drive most regional demand with modern trauma centers and strong investment in orthopedic infrastructure. African markets remain slower due to economic limitations and reliance on conservative management for fracture care. However, expanding private hospitals, medical tourism, and interest in titanium-based implants create opportunities for gradual market growth across the region.

Market Segmentations:

By Product Type

By Material

By End-User

- Orthopedic and Trauma Centers

- Hospitals

- Orthopedic Clinics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Leading companies such as Auxein Medical, Acumed, Smith & Nephew Plc, J&J Medical Devices, Wright Medical Technology, Integra LifeSciences, Biomet, Toier, and Medartis AG shape the competitive landscape of the radial head resection implants market through product innovation, specialized implant designs, and strong surgeon engagement programs. Competition centers on titanium-based systems, modular sizing options, and improved anatomical fit to reduce complication risks. Many manufacturers invest in R&D to enhance implant stability, articulation, and long-term performance. Companies also strengthen their presence through surgeon training, trauma center partnerships, and expanded distribution networks in emerging markets. Regulatory approvals, clinical evidence, and product reliability remain key factors influencing market share. Market leaders continue to focus on improving implant ergonomics and broadening product portfolios to meet diverse fracture complexities, maintaining strong competitive momentum across global orthopedic markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Auxein Medical

- Acumed

- Smith & Nephew Plc

- J&J Medical Devices

- Wright Medical Technology

- Integra LifeSciences

- Biomet

- Toier

- Medartis AG

Recent Developments

- In November 2025, Acumed issued an updated Acumed Implants in the MR Environment guideline that details MR-conditional parameters for its Anatomic Radial Head System and Anatomic Radial Head Solutions 2, covering multiple stem and head sizes for radial head replacement. This update supports safer postoperative imaging for patients with Acumed radial head implants

- In October 2025, J&J Medical Devices (DePuy Synthes) Johnson & Johnson announced plans to spin off its orthopaedics business into a standalone company, DePuy Synthes, which holds leading positions in joint reconstruction, trauma and extremities implants, including elbow and radial head systems. The separation is expected to sharpen strategic focus and could accelerate innovation and investment in radial head resection and replacement implants within the new orthopaedics entity.

- In October 2024, Auxein Medical showcased its orthopaedic and arthroscopy portfolio at the SICOT Orthopaedic World Congress 2024 in Belgrade, where visitors were shown instruments such as its radial head instrument set and related upper-extremity tools, reinforcing its presence in elbow and radial head reconstruction solutions.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for radial head resection implants will rise due to increasing trauma cases worldwide.

- Titanium-based systems will gain stronger adoption for their durability and compatibility.

- Modular and anatomically contoured implant designs will improve surgical precision.

- Patient-specific and 3D-modeled implants will expand in complex fracture management.

- Emerging markets will drive growth as trauma care infrastructure improves.

- Digital surgical planning tools will support better implant sizing and alignment.

- Companies will focus on reducing revision rates through enhanced biomechanics.

- Minimally invasive orthopedic procedures will increase implant utilization.

- Rehabilitation-integrated implant solutions will gain importance for faster recovery.

- Regulatory approvals and clinical evidence will influence competitive positioning and product expansion.