| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| RAIN RFID Solutions Market Size 2024 |

USD 3,227.7 million |

| RAIN RFID Solutions Market, CAGR |

5.10% |

| RAIN RFID Solutions Market Size 2032 |

USD 4,810.7 million |

Market Overview:

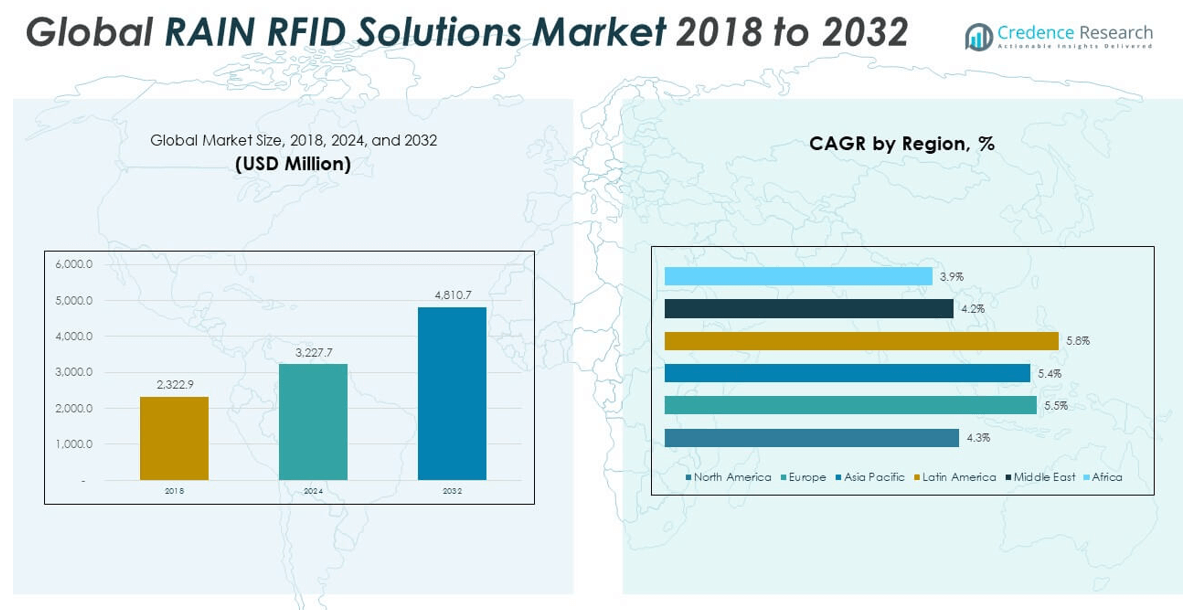

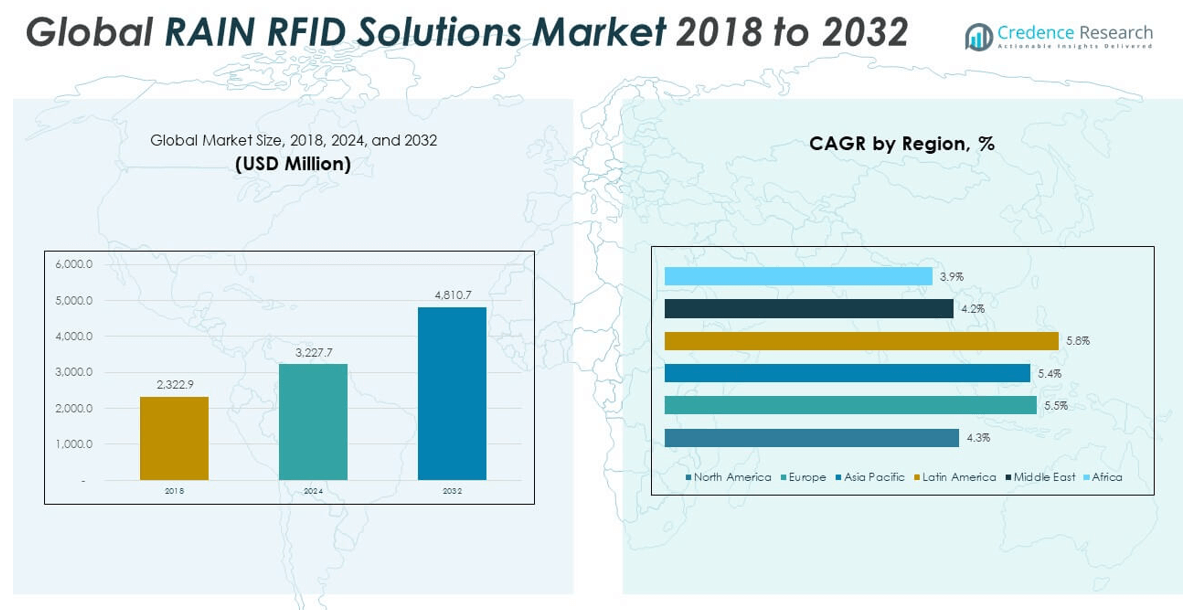

The RAIN RFID Solutions Market size was valued at USD 2,322.9 million in 2018 to USD 3,227.7 million in 2024 and is anticipated to reach USD 4,810.7 million by 2032, at a CAGR of 5.10% during the forecast period.

The RAIN RFID Solutions Market is driven by increasing demand for real-time visibility, automation, and data accuracy across critical industries such as retail, healthcare, logistics, and manufacturing. Organizations are adopting RAIN RFID to improve inventory management, track assets, and reduce human errors in supply chains. In retail, the need for accurate stock visibility and faster checkout processes has led to large-scale RAIN RFID deployments. In healthcare, it enhances patient safety by tracking medical equipment and medication. Technological advancements such as improved reader accuracy, longer read ranges, and more affordable RFID tags are accelerating adoption across small and mid-sized enterprises. The growing integration of RAIN RFID with IoT platforms and cloud-based analytics tools further boosts its appeal by enabling real-time data insights. In addition, government regulations on traceability and anti-counterfeiting are reinforcing the demand in pharmaceuticals and food sectors. Sustainability efforts also support its growth by helping reduce waste and optimize resource planning.

North America holds the largest share in the RAIN RFID Solutions Market, supported by early technology adoption, strong infrastructure, and significant retail and healthcare demand. The United States leads the region, with widespread use of RAIN RFID in inventory control, patient monitoring, and asset tracking. Europe follows with steady growth, particularly in countries like Germany, the UK, and France, where the technology is integrated into industrial automation and fashion retail. Asia-Pacific is the fastest-growing regional market, with China and India investing heavily in smart supply chains, manufacturing, and public infrastructure. Government support for digitization and smart city initiatives in Japan and South Korea further fuels regional expansion. Latin America and the Middle East & Africa show gradual adoption, led by applications in logistics, agriculture, and public services. Although their market share is smaller, rising digital transformation initiatives and infrastructure upgrades are expected to drive future RAIN RFID deployments in these regions.

Market Insights:

- The RAIN RFID Solutions Market was valued at USD 3,227.7 million in 2024 and is projected to reach USD 4,810.7 million by 2032, growing at a CAGR of 5.10%, supported by rising automation and asset tracking needs.

- Retail, logistics, and healthcare sectors are driving large-scale RAIN RFID adoption, using the technology for real-time visibility, inventory accuracy, and error reduction.

- Declining hardware costs and improved tag performance are enabling broader adoption, making RAIN RFID accessible to small and mid-sized enterprises in both developed and emerging markets.

- Integration with IoT and cloud analytics is transforming RAIN RFID into a strategic tool, delivering actionable insights for predictive maintenance, customer behavior, and asset optimization.

- Regulatory mandates for traceability and anti-counterfeiting are fueling demand, especially in pharmaceuticals and food industries where compliance and safety are top priorities.

- High initial costs and complex system integration remain key challenges, slowing adoption among budget-sensitive organizations and those lacking IT infrastructure.

- North America leads the market with strong infrastructure and early adoption, while Asia-Pacific emerges as the fastest-growing region, driven by investments in smart supply chains and public digitization efforts.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Real-Time Inventory Visibility and Operational Efficiency

The retail and logistics industries are increasingly adopting RAIN RFID solutions to enable real-time inventory tracking and reduce manual errors. These systems offer seamless monitoring of goods throughout the supply chain, improving accuracy and operational efficiency. By automating inventory updates, businesses reduce out-of-stock situations and enhance shelf availability. The ability to monitor assets and stock in motion has proven critical for fast-paced industries where timely data access affects revenue. The RAIN RFID Solutions Market benefits from this shift toward digital transformation, with enterprises seeking tools that offer immediate insights into asset location and status. It supports optimized stock planning and faster decision-making, particularly in multi-location operations. The growing emphasis on lean inventory models continues to boost demand for RFID integration.

- For example, Inditex, the parent company of Zara, implemented RAIN RFID technology across its global retail network to improve inventory management. The company shifted from performing inventory counts twice a year to conducting cycle counts every six weeks, significantly increasing inventory accuracy to near 100%. This frequent tracking enables faster stock replenishment and enhances overall supply chain efficiency.

Cost Reduction in RFID Tags and Infrastructure Enhances Scalability

The decreasing cost of RFID tags and supporting infrastructure is expanding adoption across sectors previously limited by budget constraints. Manufacturers have significantly lowered the price of passive UHF RFID tags, enabling scalable deployment across millions of items. Lower hardware costs, coupled with improved read accuracy, have encouraged usage in smaller retail chains, warehouses, and healthcare facilities. It has become feasible for mid-sized enterprises to benefit from RAIN RFID technology without heavy capital investments. Cloud-based platforms and mobile-compatible readers further ease implementation. The RAIN RFID Solutions Market is gaining traction as companies of various sizes realize cost-to-benefit advantages. The affordability factor is critical in making RFID technology mainstream in emerging economies.

- For instance, Marks & Spencer, a major UK retailer, reported a £500,000 reduction in stock holding costs within the first year of RFID implementation. RFID technology also reduced shrinkage by 25%, compared to a 10% reduction with barcodes, resulting in annual savings of £2.1 million for one major retailer.

Integration with IoT and Data Analytics Enhances Business Intelligence

Organizations are integrating RAIN RFID systems with IoT networks and analytics platforms to derive actionable insights from physical asset data. This integration helps track item movement, monitor environmental conditions, and analyze usage patterns in real time. Businesses leverage this intelligence for predictive maintenance, customer behavior analysis, and optimized resource allocation. It contributes to smarter decision-making by linking physical operations to digital systems. The RAIN RFID Solutions Market benefits from this convergence by becoming a foundational layer for enterprise-wide digital strategies. Real-time alerts and dashboards generated from RFID-enabled data enhance operational transparency. It supports the broader trend of digitization across sectors seeking intelligent, data-driven operations.

Regulatory Compliance and Anti-Counterfeiting Initiatives Drive Adoption

Tighter regulatory frameworks in industries such as pharmaceuticals, food, and aerospace have made traceability and item authentication essential. RAIN RFID offers a secure and efficient way to comply with mandates on tracking product origin, expiration, and distribution. It supports serialization and tamper-evidence, which are key requirements in preventing counterfeit goods. The RAIN RFID Solutions Market is witnessing strong growth from companies aiming to align with safety and compliance standards. Governments and industry bodies are actively encouraging RFID use to enhance transparency and consumer protection. This push from regulatory environments solidifies RFID’s role in risk mitigation. It creates long-term demand for robust item-level tracking and reporting systems.

Market Trends:

Expansion of RAIN RFID into Consumer Engagement and Smart Packaging

Brands are increasingly incorporating RAIN RFID technology into consumer-facing applications, especially in smart packaging and interactive retail environments. These solutions enable shoppers to access product information, authenticity verification, and promotions via smartphones or store kiosks. This shift aligns with growing consumer demand for transparency and digital engagement. It allows brands to enhance customer experiences and gather data on product interaction. The RAIN RFID Solutions Market is evolving to support both operational efficiency and customer engagement strategies. Retailers and manufacturers view smart packaging as a value-added feature that drives loyalty and differentiates products. This trend reinforces the transition of RAIN RFID from a backend logistics tool to a front-facing customer interface.

- For example, Decathlon Group has equipped over 100 million products annually with RAIN RFID tags, resulting in inventory accuracy improvements to over 98% and reducing out-of-stock events by 60% in pilot stores.

Integration with Blockchain for Secure Supply Chain Traceability

Companies are exploring the combination of RAIN RFID with blockchain technology to enhance end-to-end supply chain visibility and data integrity. Blockchain’s immutable ledger allows secure documentation of every transaction or movement associated with an RFID-tagged item. This combination addresses challenges related to fraud, tampering, and unauthorized access in high-value or regulated industries. It ensures transparency across supply chain networks, especially where multiple stakeholders handle products. The RAIN RFID Solutions Market is leveraging this trend to serve pharmaceutical, luxury goods, and food safety applications. Businesses prefer this layered approach to strengthen audit trails and traceability frameworks. It elevates trust and accountability across distribution ecosystems.

Growth of On-Metal and Harsh Environment Tags

Recent innovations have led to the development of RAIN RFID tags capable of functioning effectively on metal surfaces and in extreme environmental conditions. These tags are designed for use in industries such as oil and gas, automotive, aerospace, and heavy manufacturing, where traditional tags fail. The ability to track tools, parts, and equipment in rugged conditions expands the applicability of RFID technology. It opens new revenue streams for vendors catering to industrial and mission-critical sectors. The RAIN RFID Solutions Market benefits from this advancement by addressing previously untapped use cases. Businesses operating in demanding environments now consider RAIN RFID a viable asset-tracking solution. This trend significantly widens the market’s industrial footprint.

- For example, Beontag’s Confidex Ironside Flex and Ironside Fin tags, released in 2024, are IP68-rated and achieve read ranges up to 15 meters (50 feet) on metal, supporting asset tracking for pipes, tools, and cables in oil & gas and automotive sectors.

Adoption of RAIN RFID in Library Automation and Public Sector Services

Public institutions such as libraries, government archives, and transportation authorities are embracing RAIN RFID for automation and asset control. Libraries, in particular, use the technology for efficient book tracking, self-checkouts, and inventory audits. Government agencies deploy RFID in identification systems, document tracking, and secure access control. The RAIN RFID Solutions Market is expanding beyond commercial sectors into public service applications. These implementations improve operational workflows and reduce administrative burdens. It supports smart city initiatives where real-time data and secure asset tracking are crucial. The trend highlights growing institutional confidence in RFID’s reliability and scalability.

Market Challenges Analysis:

High Initial Implementation Costs and Integration Complexity Limit Adoption

Despite the long-term benefits, many organizations hesitate to adopt RAIN RFID due to the high upfront costs of tags, readers, and supporting infrastructure. Small and medium-sized enterprises often struggle to justify the capital expenditure required for full-scale deployment. Custom integration with legacy enterprise systems also adds complexity, increasing the time and technical resources needed for successful implementation. The RAIN RFID Solutions Market faces challenges when clients lack internal IT capabilities or dedicated RFID expertise. It often requires specialized consultation, which further elevates project costs. These barriers slow adoption in budget-constrained industries and emerging markets, limiting broader penetration despite the technology’s potential.

Interference Issues, Data Overload, and Standardization Gaps Impede Scalability

Environmental interference, such as metal surfaces and electromagnetic noise, continues to affect tag readability and system accuracy. Certain industrial and medical settings require advanced engineering to ensure consistent performance. The RAIN RFID Solutions Market encounters difficulties when handling vast volumes of tag-generated data, especially in large-scale deployments. Without robust data filtering and management tools, businesses risk being overwhelmed by low-value or redundant information. Lack of global standardization in RFID frequency regulations and protocols also complicates cross-border implementation. It creates compatibility issues across geographies and supply chains, requiring region-specific configurations. These technical and regulatory hurdles restrict the seamless scalability of RAIN RFID applications.

Market Opportunities:

Expansion into Healthcare, Pharmaceuticals, and Cold Chain Logistics

The growing need for real-time monitoring, product authentication, and compliance in healthcare and pharmaceutical sectors presents a strong opportunity for RAIN RFID. Hospitals and clinics require precise tracking of medical equipment, surgical instruments, and patient records. Pharmaceutical companies rely on serialization and secure traceability to prevent counterfeiting and comply with regulations like the DSCSA and EU FMD. Cold chain logistics also offers high-growth potential, where RFID-enabled sensors can ensure temperature-sensitive goods remain within safe thresholds. The RAIN RFID Solutions Market is well-positioned to support these requirements through accurate, non-intrusive tracking. It enables automated validation and alerts that reduce risks and improve operational transparency.

Rising Adoption in Emerging Markets and Public Infrastructure

Emerging economies are embracing digital transformation initiatives that create favorable conditions for RAIN RFID deployment. Governments are investing in smart cities, e-governance systems, and public asset management tools that benefit from RFID integration. Public transportation systems, utility networks, and document authentication processes increasingly use RFID for secure access and automation. The RAIN RFID Solutions Market finds new growth avenues where infrastructure modernization and regulatory digitization converge. It addresses identity verification, transit management, and civic inventory control with scalable solutions. Market players can benefit by targeting these applications with region-specific, cost-effective offerings.

Market Segmentation Analysis:

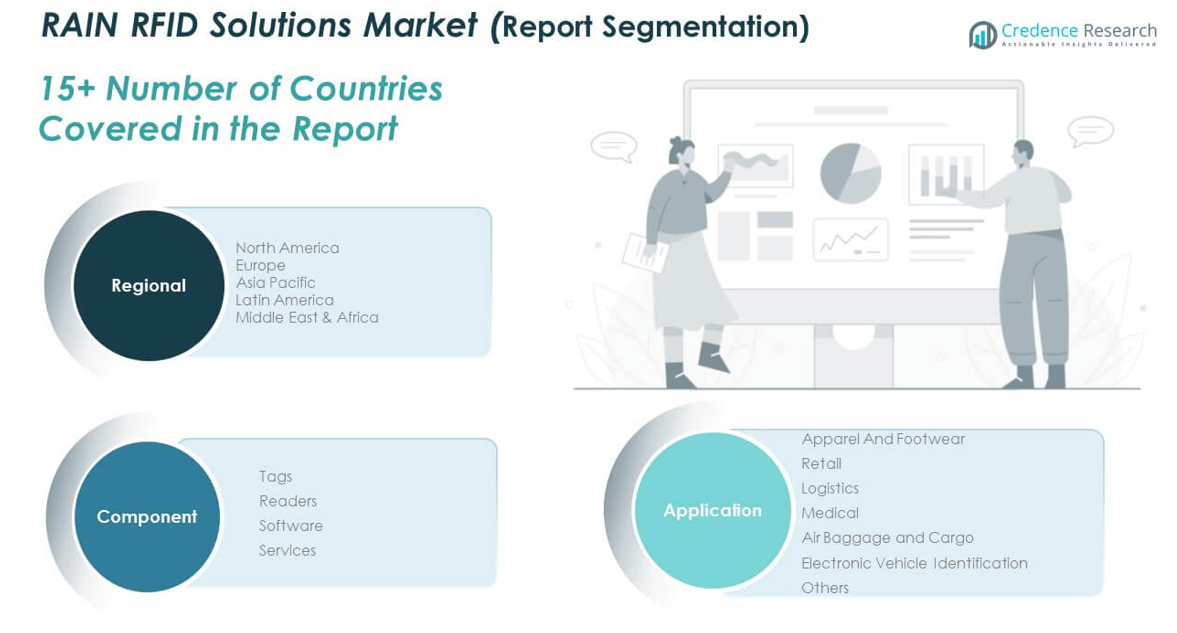

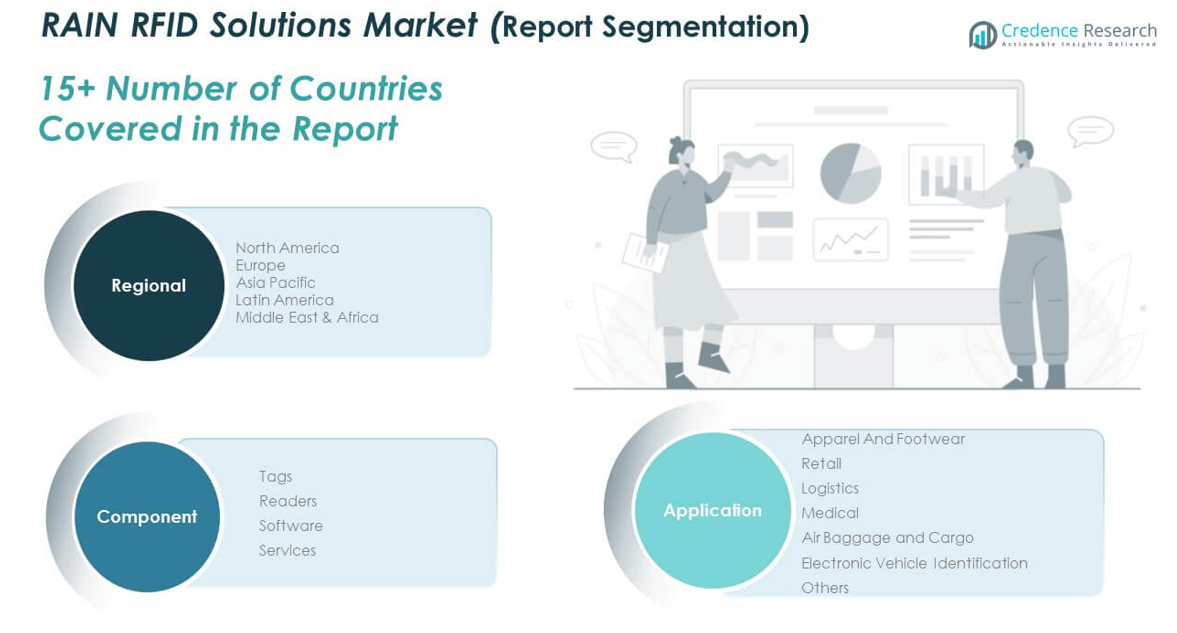

The RAIN RFID Solutions Market is segmented

By component into tags, readers, software, and services. Tags hold the largest share due to their widespread use across item-level tracking in retail, logistics, and manufacturing. Readers follow closely, driven by increased deployment in warehouse automation and inventory control systems. Software solutions are gaining traction as organizations require advanced platforms to manage and analyze RFID data. Services, including installation, maintenance, and consulting, support system integration and scalability across industries.

- For example, Amazon uses RAIN RFID readers in its “Just Walk Out” RFID lanes at select venues such as stadiums and event centers to enable cashierless checkout and real-time inventory control. These RFID-enabled lanes support seamless item tracking and efficient restocking in environments where tagged merchandise is used.

By application, the market is categorized into apparel and footwear, retail, logistics, medical, air baggage and cargo, electronic vehicle identification, and others. Retail leads the application segment, with large-scale adoption in inventory management and theft prevention. Apparel and footwear use RAIN RFID for item-level tracking, size verification, and supply chain visibility. Logistics sees rapid growth through its use in real-time shipment tracking and warehouse automation. The RAIN RFID Solutions Market also grows steadily in medical applications by supporting equipment tracking and patient safety. Air baggage handling and vehicle identification represent emerging areas with strong future potential.

- For instance, DHL Implements RAIN RFID for real-time shipment tracking and warehouse automation, improving asset visibility and reducing errors.

Segmentation:

By Component

- Tags

- Readers

- Software

- Services

By Application

- Apparel and Footwear

- Retail

- Logistics

- Medical

- Air Baggage and Cargo

- Electronic Vehicle Identification

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America RAIN RFID Solutions Market size was valued at USD 462.03 million in 2018 to USD 615.84 million in 2024 and is anticipated to reach USD 865.93 million by 2032, at a CAGR of 4.3% during the forecast period. North America holds approximately 29% of the global market share, driven by strong demand in retail, healthcare, and logistics. The U.S. leads the region, with large-scale deployments across major retail chains, hospital networks, and automated warehouses. Regulatory frameworks that promote traceability and electronic product codes have encouraged early adoption. The presence of leading RFID technology vendors and a mature digital infrastructure support consistent market growth. The RAIN RFID Solutions Market in this region benefits from innovation-focused investments and strategic partnerships that accelerate pilot-to-scale transitions. It continues to evolve with new applications in smart shelves, pharmaceutical compliance, and asset tracking.

Europe

The Europe RAIN RFID Solutions Market size was valued at USD 520.33 million in 2018 to USD 739.04 million in 2024 and is anticipated to reach USD 1,133.40 million by 2032, at a CAGR of 5.5% during the forecast period. Europe accounts for 26% of the global market share, with strong traction in the fashion, automotive, and industrial manufacturing sectors. Countries such as Germany, France, and the UK are at the forefront, integrating RAIN RFID into logistics automation, retail stock management, and returnable asset tracking. The European Union’s emphasis on circular economy principles and product lifecycle transparency fuels adoption. Retailers adopt RFID to meet sustainability goals, reduce waste, and improve supply chain visibility. The RAIN RFID Solutions Market in Europe grows steadily, supported by government-funded pilot projects and increasing regulatory compliance demands. It also expands into library automation and airport baggage handling systems.

Asia Pacific

The Asia Pacific RAIN RFID Solutions Market size was valued at USD 782.82 million in 2018 to USD 1,105.70 million in 2024 and is anticipated to reach USD 1,683.75 million by 2032, at a CAGR of 5.4% during the forecast period. Asia Pacific holds the 33% largest market share globally, led by China, Japan, India, and South Korea. Rapid industrialization, government smart city initiatives, and growth in retail and e-commerce sectors drive widespread deployment. China’s manufacturing ecosystem and India’s digital public infrastructure offer fertile ground for scalable implementation. The RAIN RFID Solutions Market in this region gains momentum through applications in metro rail ticketing, warehouse automation, and healthcare logistics. Local players and global vendors collaborate to deliver cost-effective, regionally optimized RFID solutions. The region continues to experience the fastest adoption curve due to its vast consumer base and industrial growth.

Latin America

The Latin America RAIN RFID Solutions Market size was valued at USD 244.37 million in 2018 to USD 353.94 million in 2024 and is anticipated to reach USD 556.12 million by 2032, at a CAGR of 5.8% during the forecast period. Latin America contributes around 7% of the global market share, with Brazil and Mexico being the major adopters. Key applications include retail inventory tracking, livestock identification, and warehouse management. Regional growth is supported by government digitization programs and the expansion of organized retail. The RAIN RFID Solutions Market in Latin America is gaining traction with pilot programs in agriculture and public sector logistics. Local supply chain disruptions and counterfeit prevention needs fuel RFID interest across consumer goods and pharmaceutical sectors. It represents a growing opportunity for vendors offering adaptable, low-cost deployments.

Middle East

The Middle East RAIN RFID Solutions Market size was valued at USD 181.65 million in 2018 to USD 241.06 million in 2024 and is anticipated to reach USD 336.75 million by 2032, at a CAGR of 4.2% during the forecast period. The region accounts for approximately 5% of the global market share, led by the UAE, Saudi Arabia, and Qatar. Investments in smart city infrastructure, logistics hubs, and airport modernization projects drive adoption. Government mandates for secure access control, vehicle tracking, and utility management support the market. The RAIN RFID Solutions Market in the Middle East benefits from technology-centric economic diversification programs. It sees growing interest in education, healthcare, and construction asset tracking. Regional governments promote public-private partnerships to deploy RFID in civic infrastructure projects.

Africa

The Africa RAIN RFID Solutions Market size was valued at USD 131.71 million in 2018 to USD 172.08 million in 2024 and is anticipated to reach USD 234.76 million by 2032, at a CAGR of 3.9% during the forecast period. Africa currently holds a 3% market share and represents an emerging region with untapped potential. Adoption is increasing in ports, mining operations, and cross-border logistics. South Africa leads in implementation, followed by Kenya and Nigeria, where RFID is used in retail security, livestock management, and education systems. Infrastructure gaps and cost barriers limit large-scale deployment, but international aid and government initiatives are addressing these challenges. The RAIN RFID Solutions Market in Africa is positioned for gradual growth as digital transformation initiatives expand. Pilot projects in agriculture and public health are paving the way for broader adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Impinj, Inc.

- NXP Semiconductors N.V.

- Walki Group Oy

- SMARTRAC N.V.

- ITL Group

- 7iD Technologies

- HID Global

- Hangzhou Century Link Technology Co., Ltd.

- Convergence Systems Limited (CSL)

- Invengo Technology Pte. Ltd.

- Xerafy (HK) Limited

- Other Key Players

Competitive Analysis:

The RAIN RFID Solutions Market features a competitive landscape led by both global technology providers and specialized RFID solution vendors. Key players include Impinj Inc., NXP Semiconductors, Zebra Technologies, Avery Dennison Corporation, and Alien Technology. These companies focus on product innovation, strategic partnerships, and vertical-specific deployments to strengthen their market presence. The market sees high competition in areas such as tag miniaturization, read accuracy, and system integration capabilities. It demands continuous improvement in performance, scalability, and cost-efficiency. Startups and regional players contribute to niche applications and localized solutions, intensifying price and service-level competition. The RAIN RFID Solutions Market evolves rapidly with advancements in cloud-based platforms, IoT connectivity, and data analytics integration. It offers significant opportunities for players that can provide flexible, end-to-end solutions tailored to industry-specific requirements. Strong brand recognition, technical support networks, and global distribution channels remain critical factors for long-term competitiveness.

Recent Developments:

- In June 2025, Bold Reuse and Avery Dennison launched a pilot program deploying RAIN RFID tags to track reusable cups across Portland’s Moda Center and Providence Park venues. The effort uses fixed and handheld readers to monitor cup lifecycle metrics like return rates, wash cycles, and inventory movement—helping reduce waste and improve reuse system efficiency

- In May 2025, Impinj, Inc. announced that its M800 series tag chips surpassed 5 billion lifetime shipments. The M800 series is a core component of RAIN RFID solutions, offering enhanced readability, increased tag read range, and advanced anti-counterfeiting features. The adoption of these chips by partners, with over 85 inlays launched and more than 40 certified by Auburn University’s ARC program, underscores their significance in the RAIN RFID ecosystem.

- In May 2025, Powercast won the “Best New Product” award at RFID Journal LIVE! for its wirelessly powered, battery-free RAIN RFID sensor tags designed for data center use. The innovation captures temperature, humidity, and light metrics without batteries.

Market Concentration & Characteristics:

The RAIN RFID Solutions Market exhibits a moderately concentrated structure, with a few dominant players controlling a significant portion of global revenue. Leading firms such as Impinj, NXP Semiconductors, and Zebra Technologies hold strong technological capabilities and broad international reach. It features high barriers to entry due to the need for specialized expertise, standard compliance, and scalable infrastructure. The market is characterized by rapid innovation cycles, strong emphasis on interoperability, and growing demand for integrated software-hardware ecosystems. It serves diverse end-use sectors, including retail, healthcare, logistics, manufacturing, and government. Vendor differentiation relies on factors such as tag performance, reader range, cloud connectivity, and application-specific customization. The RAIN RFID Solutions Market supports both high-volume deployments and niche applications, creating opportunities for global brands and regional providers alike.

Report Coverage:

The research report offers an in-depth analysis based on Component and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Global demand will rise due to increasing emphasis on real-time asset tracking across industries.

- Integration with IoT and AI platforms will unlock new use cases and operational efficiencies.

- Healthcare, pharma, and food sectors will accelerate adoption to meet traceability and compliance requirements.

- Growth in emerging markets will be driven by public infrastructure upgrades and smart city initiatives.

- On-metal and high-temperature tag development will expand applications in heavy industry and aerospace.

- Adoption in e-commerce and omnichannel retail will strengthen inventory visibility and order accuracy.

- Expansion of blockchain-RFID integration will enhance data security and product authenticity.

- Lower hardware costs will enable mid-sized businesses to deploy RAIN RFID at scale.

- Government mandates for anti-counterfeiting and product serialization will drive consistent investment.

- Cloud-based RFID management systems will support easier deployment and centralized control.