| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Real-Time Safety Monitoring Market Size 2024 |

USD 1,103.11 Million |

| Real-Time Safety Monitoring Market, CAGR |

8.23% |

| Real-Time Safety Monitoring Market Size 2032 |

USD 1,808.79 Million |

Market Overview

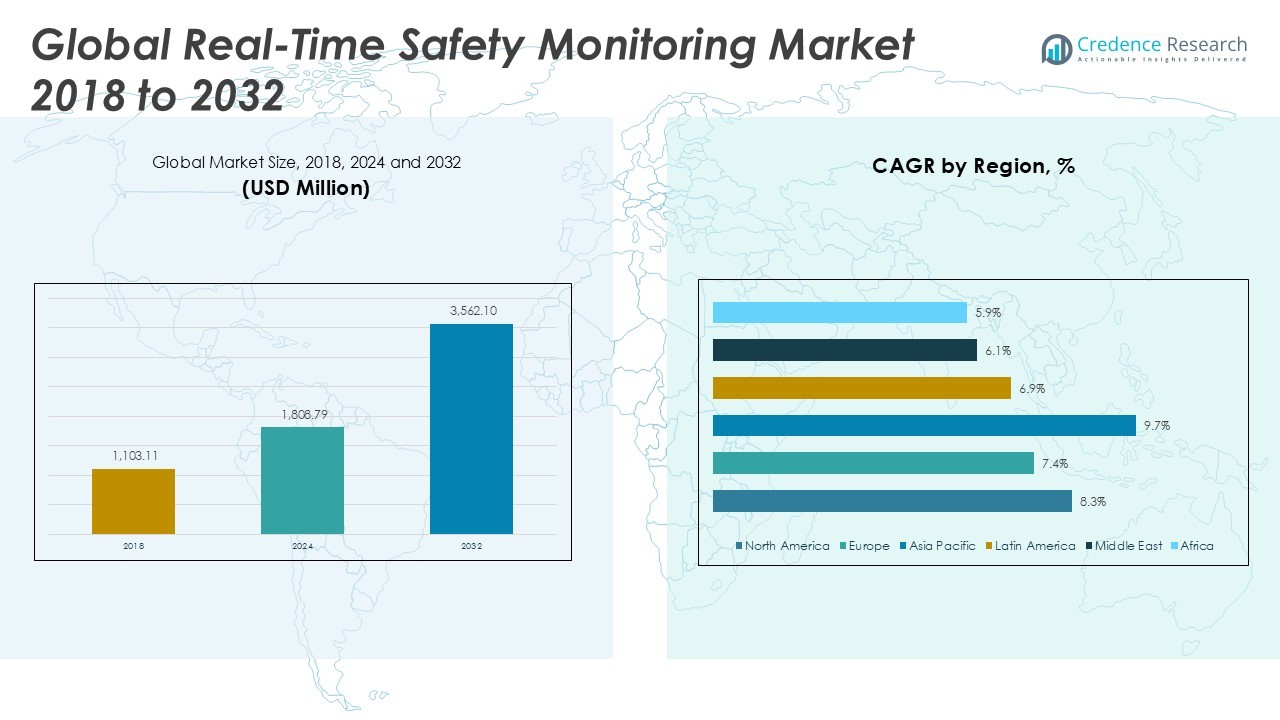

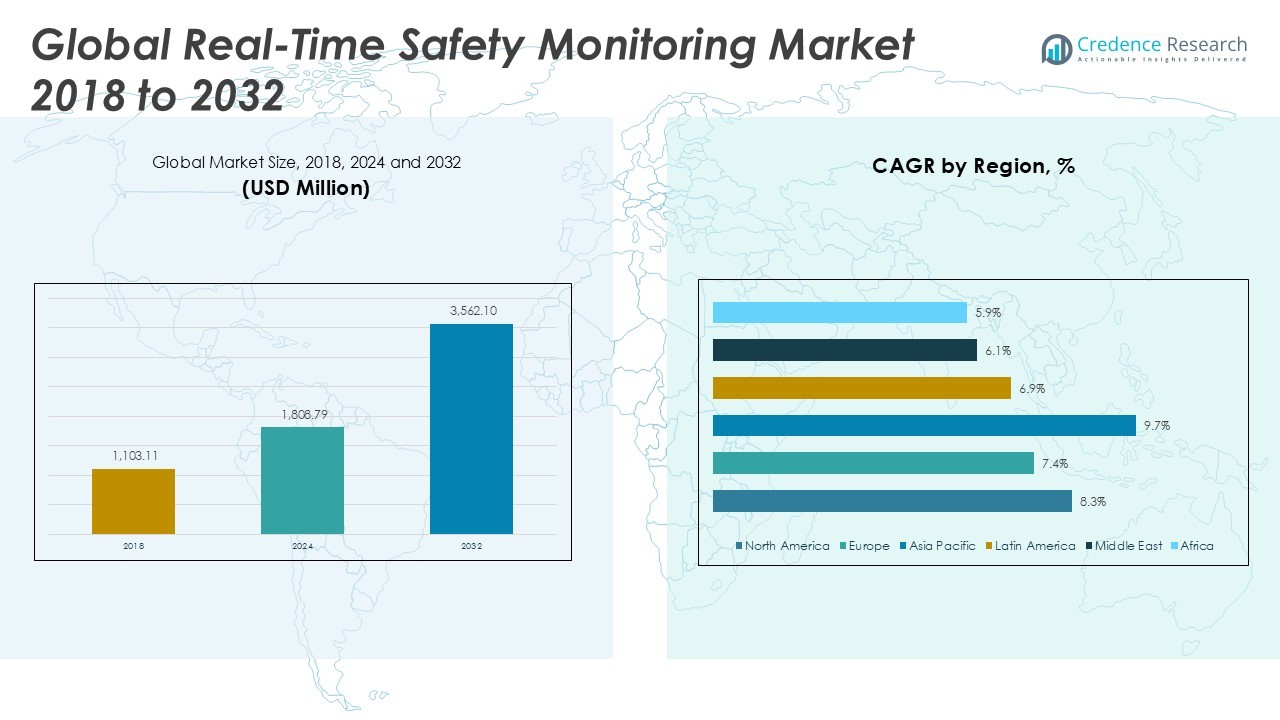

The Real-Time Safety Monitoring Market size was valued at USD 1,103.11 million in 2018, reached USD 1,808.79 million in 2024, and is anticipated to reach USD 3,562.10 million by 2032, at a CAGR of 8.23% during the forecast period.

The Real-Time Safety Monitoring Market is experiencing robust growth, driven by the increasing emphasis on workplace safety regulations, rising awareness about occupational hazards, and rapid advancements in sensor technologies. Organizations across industries are adopting real-time monitoring solutions to ensure compliance with stringent safety standards and to reduce incident response times. The proliferation of IoT-enabled devices and cloud-based analytics enhances the ability to monitor, analyze, and respond to safety threats instantly, fostering operational efficiency. Growing demand from sectors such as manufacturing, construction, and energy further accelerates market expansion as businesses prioritize employee well-being and risk mitigation. Key trends shaping the market include the integration of artificial intelligence for predictive safety analytics, adoption of wearable safety devices, and the development of user-friendly mobile applications that enable remote monitoring. These trends reflect a broader digital transformation in safety management, establishing real-time monitoring as a critical component of modern operational strategies.

The geographical analysis of the Real-Time Safety Monitoring Market highlights robust growth across North America, Europe, and Asia Pacific, with notable expansion in Latin America, the Middle East, and Africa. North America leads adoption, supported by advanced regulatory standards and a strong focus on workplace safety in the United States and Canada. Europe follows closely, with Germany, the United Kingdom, and France driving technological integration and digital transformation in industrial safety. Asia Pacific, led by China, Japan, and India, benefits from rapid industrialization and increased investments in smart infrastructure. Key players shaping the Real-Time Safety Monitoring Market include SafetyCulture, a pioneer in digital inspection and compliance tools; Honeywell International Inc., a global leader in safety automation and industrial solutions; and Blackline Safety, recognized for its innovation in connected safety wearables and cloud-based monitoring platforms. Siemens AG and Bosch Safety Systems also play a critical role in advancing safety technology worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Real-Time Safety Monitoring Market reached USD 1,808.79 million in 2024 and is projected to grow to USD 3,562.10 million by 2032, registering a CAGR of 8.23%.

- Rising enforcement of workplace safety regulations and growing awareness of occupational hazards are driving widespread adoption of real-time safety monitoring solutions across industries.

- Integration of advanced technologies such as AI, IoT, and cloud computing is transforming safety management, enabling predictive analytics, and improving incident response.

- Market leaders like SafetyCulture, Honeywell International Inc., Blackline Safety, and Siemens AG maintain a competitive edge through product innovation and strategic expansion in global markets.

- High initial implementation costs, integration challenges with legacy systems, and data privacy concerns act as primary restraints, particularly for small and medium-sized enterprises.

- North America dominates the market due to early adoption and strong regulatory frameworks, while Asia Pacific shows the fastest growth fueled by industrialization in China, India, and Japan.

- The market is characterized by increasing deployment of IoT-enabled wearables, user-friendly mobile applications, and tailored safety solutions for high-risk sectors such as manufacturing, oil and gas, and healthcare.

Market Drivers

Growing Regulatory Pressure and Stringent Safety Standards Across Industries

The Real-Time Safety Monitoring Market is witnessing substantial growth due to escalating regulatory scrutiny and the enforcement of strict safety standards across industries. Governments and international organizations impose rigorous guidelines to safeguard workers and assets, compelling companies to adopt advanced safety monitoring solutions. It helps organizations achieve compliance by providing immediate alerts and actionable data, reducing risks of violations and penalties. Frequent inspections and audits in sectors such as oil and gas, mining, and construction drive the adoption of automated safety platforms. Companies that implement real-time safety systems improve their ability to demonstrate regulatory compliance. It creates a proactive culture of safety, ensuring safer work environments and minimizing legal liabilities.

For instance, the U.S. Occupational Safety and Health Administration (OSHA) reported conducting more than 30,000 safety inspections in a single year, with companies found non-compliant facing thousands of violations.

Increasing Awareness of Occupational Hazards and Focus on Employee Well-Being

Heightened awareness of occupational hazards and a strong focus on employee well-being drive companies to invest in the Real-Time Safety Monitoring Market. Management teams seek to reduce workplace accidents, illnesses, and associated costs through continuous monitoring and rapid response mechanisms. It empowers safety officers to identify risks and intervene before incidents escalate. The growing prioritization of mental and physical health in the workplace motivates organizations to adopt these systems, supporting employee retention and productivity. Real-time data collection and analysis create transparency and foster trust among employees. It enables organizations to create a safer and more engaged workforce, directly supporting business objectives.

For instance, according to a European Agency for Safety and Health at Work survey, over 5,000 managers cited investment in monitoring systems as a leading factor in lowering accident rates in their organizations.

Integration of Advanced Technologies and Rise of IoT-Enabled Safety Solutions

The integration of advanced technologies such as IoT, artificial intelligence, and cloud analytics significantly enhances the value proposition of the Real-Time Safety Monitoring Market. It allows seamless connectivity between devices, enabling continuous tracking of environmental and worker-specific parameters. IoT-enabled wearables and sensors provide immediate feedback, making real-time interventions possible. The adoption of machine learning algorithms delivers predictive insights that preempt accidents and hazardous situations. Cloud platforms facilitate the centralized management of safety data, supporting scalability and data-driven decision-making. It positions real-time safety monitoring as a cornerstone of digital transformation initiatives across sectors.

Expansion Across High-Risk and Asset-Intensive Sectors Fuels Market Growth

Expansion into high-risk and asset-intensive sectors fuels the ongoing growth of the Real-Time Safety Monitoring Market. Industries such as manufacturing, energy, construction, and transportation increasingly rely on these solutions to protect workers and assets in dynamic environments. It addresses complex safety requirements by providing immediate alerts and compliance documentation. Growing investments in infrastructure projects and the modernization of existing facilities contribute to increased demand for real-time monitoring systems. Industry leaders recognize the return on investment achieved through reduced incidents and downtime. It solidifies real-time safety monitoring’s role as an indispensable tool for risk management and operational excellence.

Market Trends

Adoption of Artificial Intelligence and Predictive Analytics for Enhanced Safety Outcomes

The Real-Time Safety Monitoring Market is evolving with the integration of artificial intelligence and predictive analytics, transforming the way organizations manage safety. AI algorithms analyze large volumes of real-time data to identify emerging risks, predict potential hazards, and recommend corrective actions. It supports proactive safety management, enabling organizations to prevent accidents before they occur. Machine learning models adapt to new data and continuously refine safety protocols, improving outcomes over time. Companies benefit from faster incident detection and more accurate risk assessments. It drives the adoption of smarter, more responsive safety systems across multiple industries.

For instance, an industrial AI provider documented that AI-powered safety platforms analyzed millions of safety data points and identified over 800 early risk indicators in their client deployments.

Proliferation of IoT-Enabled Wearable Devices and Smart Sensors

IoT-enabled wearable devices and smart sensors are rapidly reshaping the Real-Time Safety Monitoring Market, offering continuous surveillance of both environmental and physiological parameters. Wearables track worker movements, exposure to hazardous substances, and vital signs, while sensors monitor air quality, temperature, and noise levels. It provides safety officers with immediate alerts and actionable insights, supporting swift intervention when unsafe conditions arise. This trend enables more granular, real-time visibility into workplace safety. Organizations can make informed decisions and tailor safety protocols to specific risks. It establishes a new standard for personal and environmental monitoring in hazardous settings.

For instance, SafetyCulture highlighted that over 15,000 IoT-based wearable safety devices were deployed across multiple construction and mining sites in the past year.

Integration of Cloud-Based Platforms and Centralized Safety Management

Cloud-based platforms are gaining prominence in the Real-Time Safety Monitoring Market, providing centralized access to safety data, analytics, and incident reports. Organizations leverage these platforms to unify disparate safety systems and streamline reporting processes. It allows for real-time collaboration among teams, regardless of geographic location, and supports faster decision-making. Enhanced data security and scalability appeal to organizations of all sizes. The trend toward cloud adoption enables continuous system updates and integration with other enterprise tools. It advances operational efficiency and strengthens regulatory compliance.

Focus on User-Friendly Interfaces and Mobile Application Development

A growing focus on user-friendly interfaces and mobile applications defines the latest trends in the Real-Time Safety Monitoring Market. Intuitive dashboards and mobile apps empower field workers and managers to access safety information on the go. It enhances engagement, ensures rapid reporting of incidents, and improves communication throughout the organization. Developers prioritize ease of use, making it easier to implement safety protocols and respond to alerts. Mobile integration supports flexible, location-independent safety management. It accelerates the shift toward digital safety solutions and broadens market accessibility.

Market Challenges Analysis

High Implementation Costs and Integration Barriers Restrict Market Penetration

The Real-Time Safety Monitoring Market faces significant challenges due to the high costs associated with initial implementation and system integration. Many organizations, particularly small and medium-sized enterprises, hesitate to invest in advanced monitoring solutions due to budget constraints and uncertain return on investment. It often requires substantial capital outlays for devices, software, and employee training, which can delay adoption. Integrating real-time safety platforms with legacy systems and diverse operational processes further complicates deployment. Organizations encounter compatibility issues and require specialized technical expertise, making seamless integration a persistent hurdle. These factors collectively restrict market penetration and slow the pace of technological adoption.

Data Privacy, Security Concerns, and Skill Gaps Undermine Adoption Rates

Concerns about data privacy and cybersecurity present ongoing obstacles for the Real-Time Safety Monitoring Market. Organizations collect and transmit vast amounts of sensitive data, raising fears of unauthorized access, data breaches, and regulatory non-compliance. It prompts the need for robust encryption, secure cloud infrastructure, and strict data governance policies. Skill gaps among the workforce also hinder the effective use of advanced monitoring systems. Many employees lack familiarity with digital tools and require extensive training to utilize these platforms fully. The combination of privacy risks and skill shortages creates resistance to widespread adoption and limits the market’s full potential.

Market Opportunities

Expanding Applications in Emerging Industries and Remote Work Environments

The Real-Time Safety Monitoring Market presents significant opportunities through its expanding applications in emerging industries and remote work environments. Growth in sectors such as renewable energy, autonomous vehicles, and smart manufacturing opens new avenues for real-time safety solutions. It allows organizations to maintain safety oversight even in decentralized or hazardous locations, supporting evolving workplace models. Increased adoption of remote work and distributed teams heightens the need for digital safety platforms capable of monitoring off-site personnel. Organizations leveraging these solutions can enhance operational efficiency while safeguarding employee well-being. The versatility of real-time safety monitoring positions it for strong growth in diverse, modern industries.

Integration with Advanced Analytics and Customized Solutions for Specific Needs

Integration with advanced analytics and the development of customized solutions offer further opportunities for the Real-Time Safety Monitoring Market. It enables organizations to extract deeper insights from safety data, supporting predictive maintenance and targeted risk mitigation strategies. Customizable platforms can address unique safety requirements in specialized fields such as healthcare, logistics, and mining. Partnerships with technology providers and continued investment in R&D drive innovation, expanding the market’s addressable scope. Real-time safety monitoring solutions tailored to industry-specific challenges attract a broader customer base. The shift toward data-driven, adaptive systems unlocks new value for organizations seeking comprehensive safety management.

Market Segmentation Analysis:

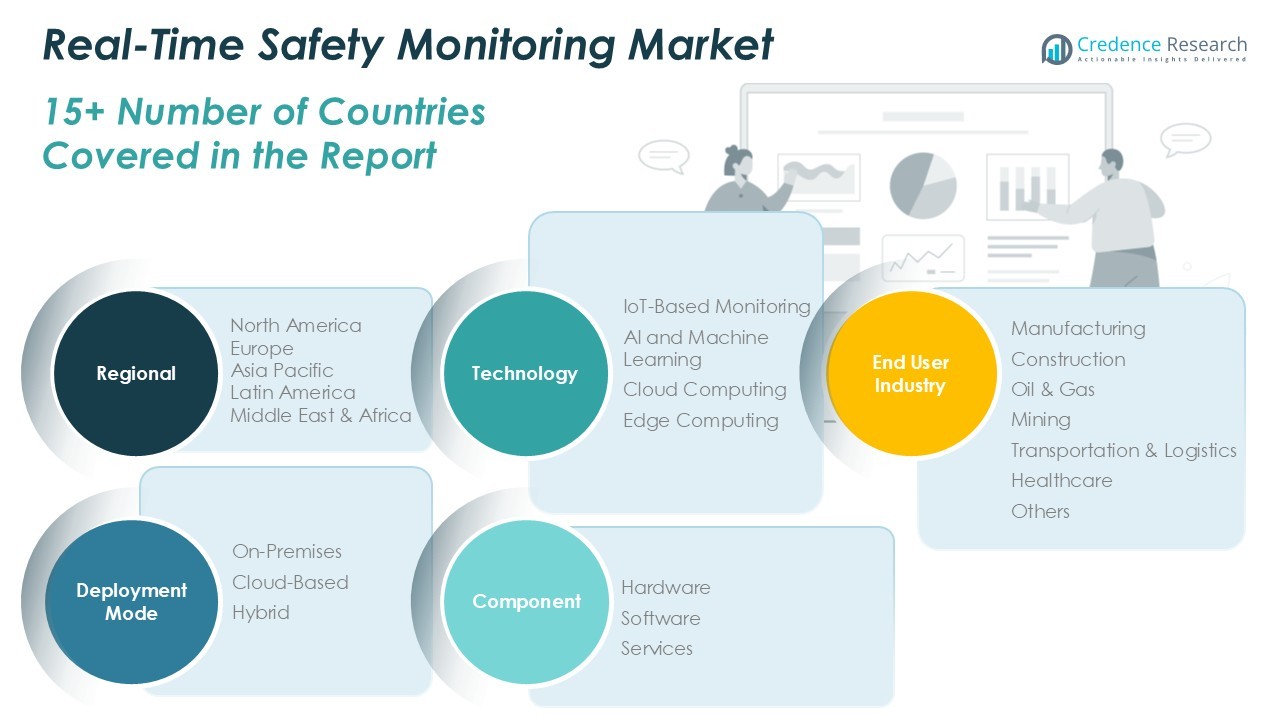

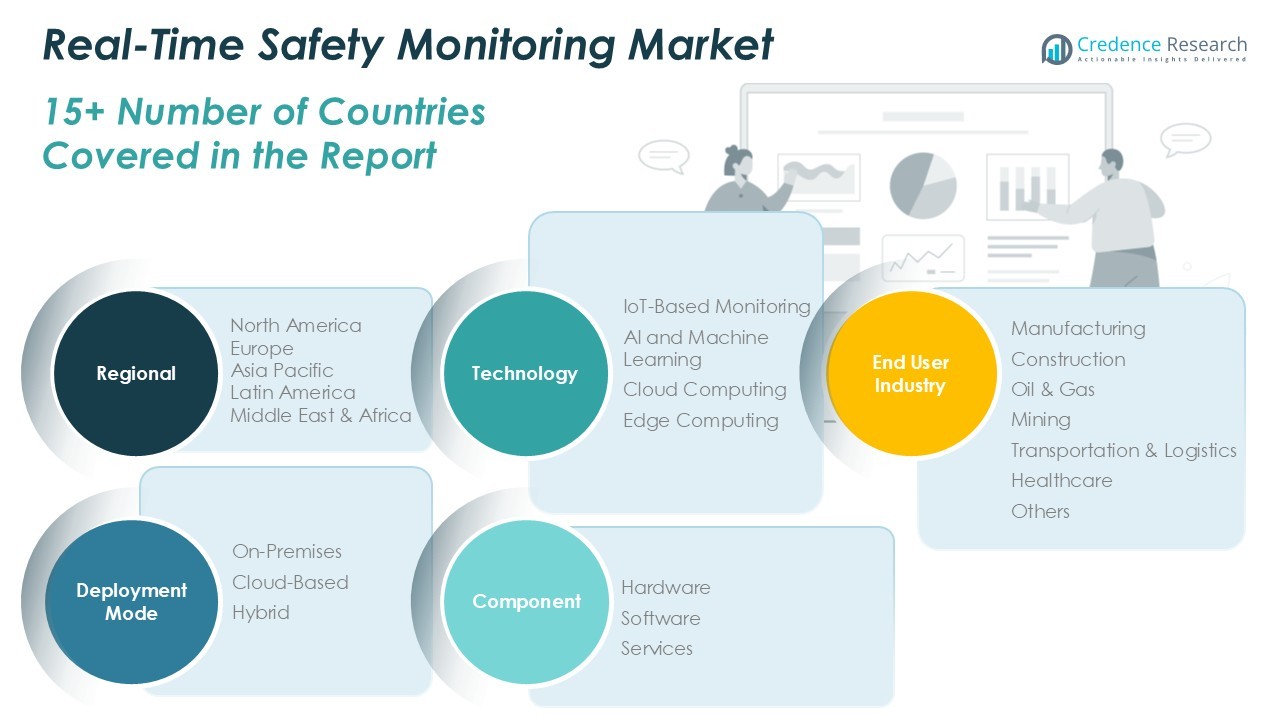

By Technology:

The Real-Time Safety Monitoring Market demonstrates strong momentum across IoT-based monitoring, AI and machine learning, cloud computing, and edge computing. IoT-based monitoring serves as the foundation, providing continuous real-time data on equipment, environments, and personnel through interconnected devices. AI and machine learning technologies elevate safety management by analyzing large volumes of data to predict hazards and automate critical alerts. Cloud computing facilitates centralized data storage and easy access to analytics from any location, supporting flexible and scalable deployment. Edge computing enables organizations to process safety data locally at the source, reducing latency and supporting instant decision-making in high-risk environments.

For instance, a leading survey by a European research group found that over 1,000 organizations have integrated IoT-based monitoring, while more than 600 have adopted AI-driven safety analytics for predictive incident prevention.

By End User Industry:

The Real-Time Safety Monitoring Market shows diverse adoption patterns across manufacturing, construction, oil and gas, mining, transportation and logistics, healthcare, and other sectors. Manufacturing and construction companies lead in implementing real-time monitoring solutions to manage compliance and protect workers in dynamic, hazardous settings. The oil and gas sector relies on advanced safety systems for remote site monitoring and incident prevention in challenging conditions. Mining operations benefit from real-time data on environmental parameters and worker health, reducing accident rates. Transportation and logistics firms use these solutions for fleet safety and regulatory compliance. Healthcare organizations utilize real-time monitoring to ensure patient and staff safety, especially in critical care environments. Other industries, including utilities and public services, turn to these systems for comprehensive risk management.

For instance, SafetyCulture reported that over 4,000 manufacturing plants and 2,500 construction sites have integrated real-time safety systems for improved compliance and incident response.

By Deployment Mode:

The Real-Time Safety Monitoring Market segments into on-premises, cloud-based, and hybrid models. On-premises deployments remain favored by organizations prioritizing strict control over sensitive safety data and infrastructure. Cloud-based solutions attract companies seeking cost efficiency, rapid deployment, and remote accessibility. Hybrid deployments combine the strengths of both models, offering data flexibility, improved security, and operational continuity. Each deployment mode supports varying operational priorities, enabling organizations to tailor safety monitoring to their unique requirements. It strengthens risk management strategies and supports regulatory compliance across diverse operational landscapes.

Segments:

Based on Technology:

- IoT-Based Monitoring

- AI and Machine Learning

- Cloud Computing

- Edge Computing

Based on End User Industry:

- Manufacturing

- Construction

- Oil & Gas

- Mining

- Transportation & Logistics

- Healthcare

- Others

Based on Deployment Mode:

- On-Premises

- Cloud-Based

- Hybrid

Based on Component:

- Hardware

- Software

- Services

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Real-Time Safety Monitoring Market

North America Real-Time Safety Monitoring Market grew from USD 436.10 million in 2018 to USD 706.89 million in 2024 and is projected to reach USD 1,396.36 million by 2032, reflecting a compound annual growth rate (CAGR) of 8.3%. North America is holding a 39% market share. The United States leads adoption, supported by Canada and Mexico, as regulatory frameworks and advanced digital infrastructure accelerate uptake. Industries such as manufacturing, oil and gas, and healthcare drive strong demand, while stringent safety standards compel investment in advanced solutions. Market growth benefits from ongoing technological innovation, early integration of IoT, and focus on occupational health.

Europe Real-Time Safety Monitoring Market

Europe Real-Time Safety Monitoring Market grew from USD 310.35 million in 2018 to USD 490.39 million in 2024 and is expected to reach USD 908.74 million by 2032, achieving a CAGR of 7.4%. Europe holds a 26% market share. Germany, the United Kingdom, and France serve as major markets, supported by robust safety legislation and the rapid modernization of industrial sectors. The region emphasizes worker welfare, digital transformation, and cross-border regulatory alignment, leading to widespread adoption in manufacturing, mining, and logistics. It gains momentum from growing investments in smart technologies and compliance-focused initiatives.

Asia Pacific Real-Time Safety Monitoring Market

Asia Pacific Real-Time Safety Monitoring Market grew from USD 239.75 million in 2018 to USD 422.31 million in 2024 and is anticipated to reach USD 930.12 million by 2032, registering a CAGR of 9.7%. Asia Pacific is holding a 26% market share. China, Japan, and India are the leading countries, propelled by rapid industrialization, urban development, and growing awareness of workplace safety. Expanding manufacturing bases and infrastructure projects fuel market demand. It benefits from increasing investment in smart factory solutions and government programs aimed at enhancing occupational safety standards.

Latin America Real-Time Safety Monitoring Market

Latin America Real-Time Safety Monitoring Market grew from USD 62.15 million in 2018 to USD 100.85 million in 2024 and is projected to achieve USD 179.50 million by 2032, with a CAGR of 6.9%. Latin America holds a 5% market share. Brazil and Mexico anchor the regional market, supported by the mining, construction, and oil and gas industries. Efforts to improve workplace safety standards and modernize operational practices create demand for advanced monitoring solutions. It faces moderate adoption due to varying regulatory environments and economic conditions but maintains steady growth potential.

Middle East Real-Time Safety Monitoring Market

Middle East Real-Time Safety Monitoring Market grew from USD 32.62 million in 2018 to USD 49.13 million in 2024 and is forecast to reach USD 82.50 million by 2032, reflecting a CAGR of 6.1%. The Middle East commands a 2% market share. Saudi Arabia and the United Arab Emirates are key countries, driven by large-scale infrastructure, oil and gas projects, and stringent government safety mandates. Organizations focus on protecting workforce and assets in complex environments, fueling adoption of real-time safety solutions. It benefits from national visions and investment in smart city development.

Africa Real-Time Safety Monitoring Market

Africa Real-Time Safety Monitoring Market grew from USD 22.14 million in 2018 to USD 39.24 million in 2024 and is projected to reach USD 64.88 million by 2032, registering a CAGR of 5.9%. Africa holds a 2% market share. South Africa, Nigeria, and Egypt are leading markets, supported by investment in mining, energy, and construction sectors. Adoption rates remain lower due to infrastructure and budget constraints, but gradual policy reforms and modernization efforts are driving steady uptake. It has long-term growth potential as awareness of safety compliance and digital transformation expands.

Key Player Analysis

- SafetyCulture

- Lytx

- Trio Mobil

- RAE Systems

- Blackline Safety

- Seeing Machines

- Honeywell International Inc.

- Siemens AG

- Bosch Safety Systems

- Draegerwerk AG & Co. KGaA

Competitive Analysis

The competitive landscape of the Real-Time Safety Monitoring Market is shaped by a group of innovative and globally recognized companies that consistently invest in advanced safety solutions and digital technologies. Leading players such as SafetyCulture, Lytx, Trio Mobil, RAE Systems, Blackline Safety, Seeing Machines, Honeywell International Inc., Siemens AG, Bosch Safety Systems, and Draegerwerk AG & Co. KGaA maintain strong market positions through a combination of product innovation, strategic partnerships, and expansion into high-growth regions. These companies offer comprehensive portfolios that span IoT-enabled devices, cloud-based monitoring platforms, AI-driven analytics, and wearable safety solutions, addressing diverse safety requirements across industries. Intense rivalry drives improvements in system connectivity, data accuracy, and user experience, setting new benchmarks for safety performance. Companies prioritize developing flexible platforms that integrate seamlessly with both legacy and modern enterprise systems, addressing the operational realities of different industries. Customization and real-time support capabilities also serve as key differentiators, helping firms secure contracts in highly regulated sectors. As market maturity increases, emphasis on digital transformation and predictive safety analytics continues to fuel competition, encouraging ongoing advancements and the introduction of next-generation solutions.

Recent Developments

- In April 2022, Cority announced the launch of two solutions to help guide organizations through the digital transformation of their EHS programs: Cority’s Learning Management Solution and Cority Academy. The new learning management solution will help organizations engage and empower employees with relevant, dynamic, data-driven EHS training to meet employee needs.

- In April 2022, Wolters Kluwer’s Enablon unveiled the next generation of vision platform software, featuring enhancements that empower organizations to be more responsible, productive, and safe. Enablon has released Version 9.4 of its integrated risk management platform. Version 9.4 of the Enablon Vision Platform features enhancements enabling greater collaboration and integration, streamlining communications and mobility, and more.

- In March 2022, Honeywell unveiled the Honeywell Safety Watch, a robust real-time location solution (RTLS) designed for industrial operations. Integrated with Honeywell OneWireless infrastructure, it offers enhanced features, including extended battery life, extended transmission range, and a business rule engine for improved safety, compliance, and productivity in Industry 4.0 settings.

Market Concentration & Characteristics

The Real-Time Safety Monitoring Market demonstrates moderate to high market concentration, with a select group of established companies holding significant influence due to their strong technological expertise and global reach. It is characterized by rapid innovation, where firms consistently enhance their solutions through integration of IoT, AI, and cloud computing to address evolving industry needs. The market features high barriers to entry, driven by the need for substantial capital investment, compliance with complex regulatory standards, and the demand for continuous product development. Customers expect real-time data accuracy, system reliability, and scalability, compelling vendors to maintain rigorous quality and service standards. The market serves diverse sectors, including manufacturing, construction, oil and gas, and healthcare, each requiring tailored solutions that support compliance and risk mitigation. It reflects a strong orientation toward digital transformation, where demand for advanced analytics, predictive safety capabilities, and mobile access drives both product differentiation and customer loyalty.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Technology, End User Industry, Deployment Mode, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Real-Time Safety Monitoring Market is projected to grow steadily through 2032, driven by increasing demand for advanced safety solutions across various industries.

- Integration of AI and machine learning technologies enhances predictive capabilities, enabling proactive risk management and accident prevention.

- Adoption of IoT-enabled devices and wearable technologies facilitates continuous monitoring of environmental and physiological parameters, improving workplace safety.

- Cloud-based platforms offer scalable and centralized data management, supporting real-time analytics and remote accessibility for safety monitoring systems.

- Stringent regulatory requirements and compliance standards across industries necessitate the implementation of real-time safety monitoring solutions.

- High initial investment costs and integration challenges with existing systems may hinder market adoption, particularly among small and medium-sized enterprises.

- North America leads in market adoption due to advanced infrastructure and regulatory frameworks, while Asia Pacific exhibits rapid growth fueled by industrialization and urbanization.

- The construction sector shows significant potential for safety monitoring solutions, driven by the need to enhance site safety and comply with regulations.

- Collaboration between technology providers and industry stakeholders fosters innovation and the development of customized safety monitoring solutions.

- Ongoing advancements in sensor technologies and data analytics are expected to further propel the Real-Time Safety Monitoring Market, offering enhanced safety outcomes across various sectors.