Market Overview

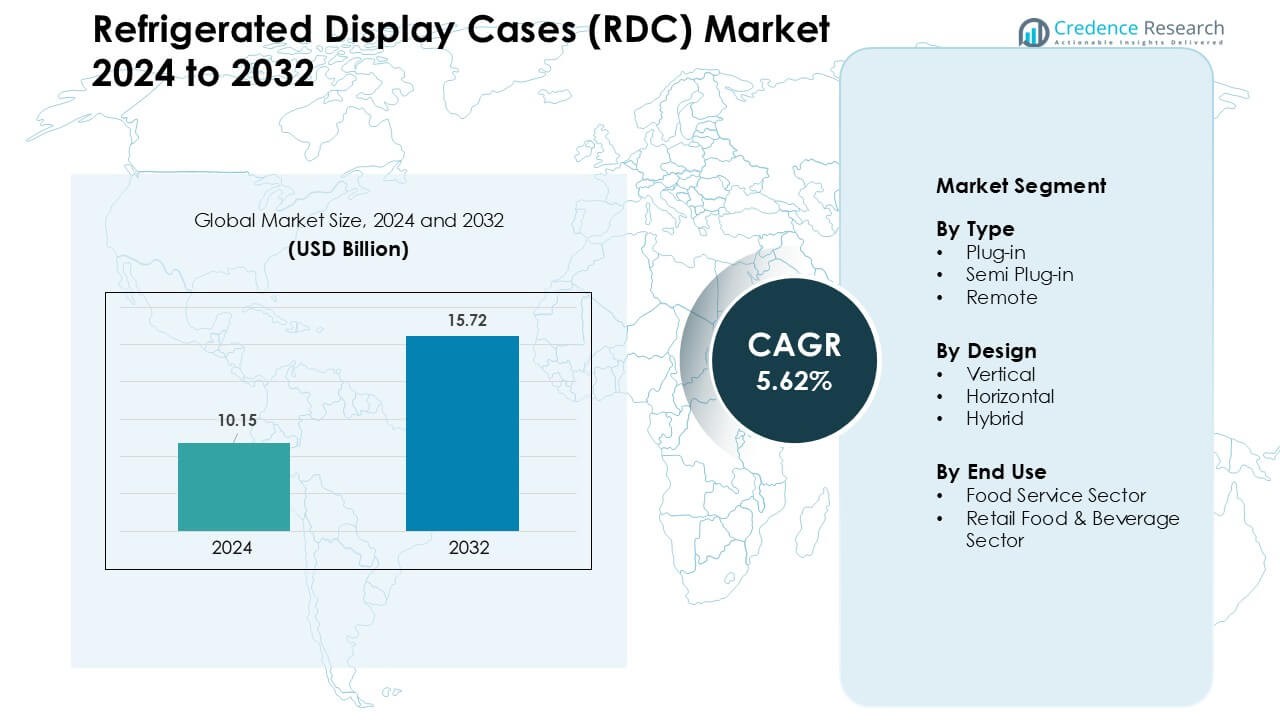

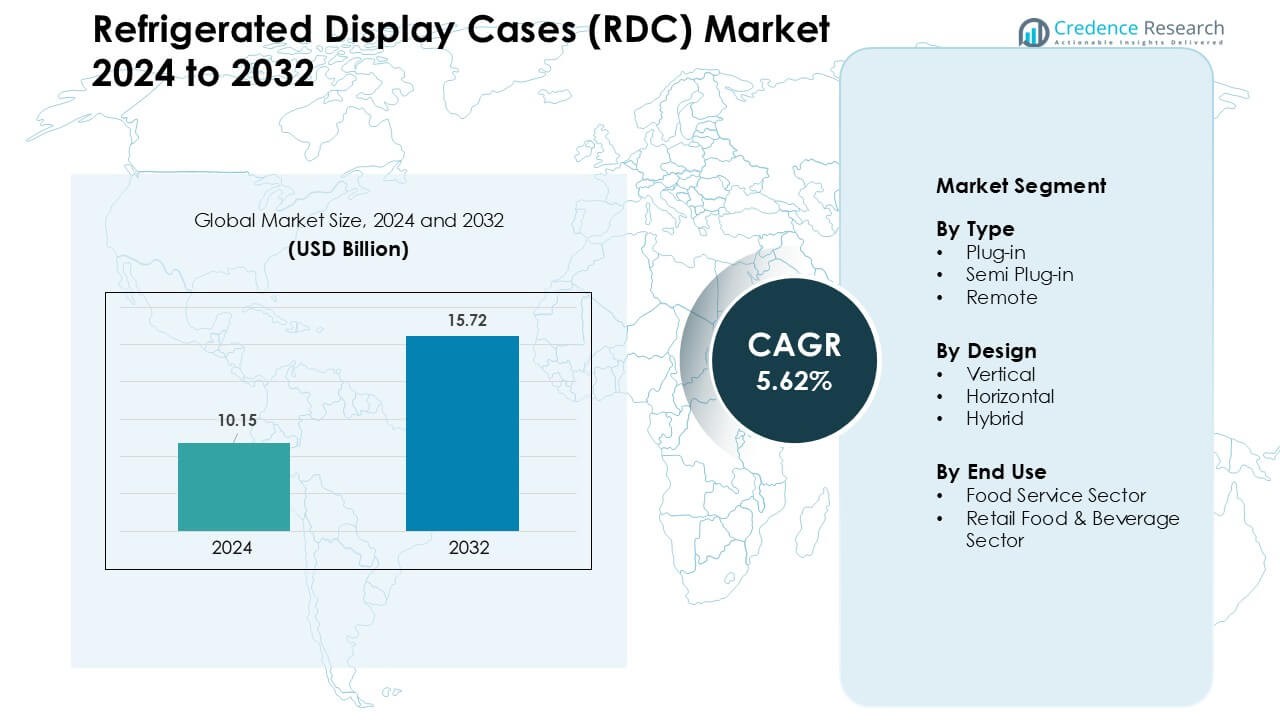

Refrigerated Display Cases (RDC) Market was valued at USD 10.15 billion in 2024 and is anticipated to reach USD 15.72 billion by 2032, growing at a CAGR of 5.62 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Refrigerated Display Cases (RDC) Market Size 2024 |

USD 10.15 Billion |

| Refrigerated Display Cases (RDC) Market, CAGR |

5.62 % |

| Refrigerated Display Cases (RDC) Market Size 2032 |

USD 15.72 Billion |

The Refrigerated Display Cases (RDC) Market is shaped by leading companies such as AHT Cooling Systems GmbH, Lennox International Inc., Liebherr Group, Haier Group, Carrier Commercial Refrigeration, Dover Corporation, Hussmann Corporation, Metalfrio Solutions S.A., Danfoss A/S, and Epta S.p.A. Refrigeration. These players compete through energy-efficient systems, low-GWP refrigerants, smart monitoring, and modular designs that support modern retail layouts. Strong retailer partnerships and continuous upgrades in vertical and plug-in formats strengthen their market reach. North America remained the leading region in 2024 with about 34% share, supported by advanced supermarket networks, strict food safety rules, and rapid adoption of IoT-enabled refrigeration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Refrigerated Display Cases (RDC) Market reached USD 10.15 billion in 2024 and is projected to hit USD 15.72 billion by 2032, growing at a CAGR of 5.62%.

- Demand grew as retailers expanded chilled food, ready-to-eat meals, and beverage assortments, supporting strong adoption of plug-in units, which held about 48% share in 2024.

- Trends focused on energy-efficient systems, low-GWP refrigerants, and IoT-enabled monitoring as supermarkets upgraded fleets to cut operating costs and improve temperature stability.

- Competition remained strong among AHT Cooling Systems, Lennox International, Liebherr, Haier, Carrier, Dover, Hussmann, Metalfrio, Danfoss, and Epta, each expanding through efficient designs, modular layouts, and smart controls.

- North America led the market with about 34% share in 2024, supported by strict food safety rules and strong retail modernization, while the retail food & beverage sector dominated end use with nearly 61% share.

Market Segmentation Analysis:

By Type

Plug-in units dominated the type segment in 2024 with about 48% share due to easy installation, low upfront setup needs, and strong demand from small retailers and cafés. These systems gained traction because buyers preferred flexible placement and reduced installation downtime. Semi plug-in formats expanded as energy-efficient heat-exchange designs lowered operating loads in compact stores. Remote systems grew in large supermarkets that needed stable temperature control and centralized refrigeration. Growth across all types reflected rising cold-chain standards and wider use of ready-to-eat and fresh food categories.

- For instance, AHT Cooling Systems a major global manufacturer of supermarket freezers continues to supply plug‑in refrigeration and freezer systems for small‑format stores, reflecting strong plug-in demand among retailers with limited floor space.

By Design

Vertical refrigerated display cases led the design segment in 2024 with nearly 52% share, supported by high product visibility and strong use in supermarkets and convenience stores. Retailers preferred vertical units because they maximize shelf capacity in tight layouts and support impulse buying. Horizontal cases grew in bakeries and meat sections that needed wide-top access and improved product handling. Hybrid designs saw steady adoption as mixed merchandising zones combined vertical reach-in sections with lower chilled wells. Design selection shifted as stores optimized space, energy savings, and customer flow patterns.

- For instance, Carrier Commercial Refrigeration has emphasized vertical‑design cases in recent installations because their compact upright footprint supports better space utilization in convenience‑store formats and even smaller supermarkets, which often operate within constrained retail floor areas.

By End Use

The retail food & beverage sector dominated the end-use segment in 2024 with about 61% share, driven by supermarket expansion, growth in convenience stores, and rising sales of chilled meals, dairy, and beverages. Retailers upgraded fleets to energy-efficient RDCs to lower power use and meet sustainability rules. The food service sector grew as cafés, QSR chains, and bakeries expanded grab-and-go offerings that required stable chilled environments. Strong consumer interest in fresh, ready-to-eat items pushed operators to adopt modern cooled displays that enhance hygiene, visibility, and product turnover.

Key Growth Drivers

Growing Demand for Fresh and Chilled Food Products

Rising consumption of fresh, ready-to-eat, and convenience food has become a major driver for the Refrigerated Display Cases (RDC) Market. Supermarkets, convenience stores, and cafés expanded chilled assortments as consumers shifted toward healthier meals, grab-and-go snacks, fresh bakery items, and premium beverages. This shift increased placement of vertical and plug-in systems that support high turnover and strong product visibility. Urban lifestyles boosted demand for packaged salads, fresh meat, dairy, and cut fruits, which require stable cooling throughout the day. Retailers also expanded chilled zones to reduce spoilage and maintain quality standards. Growth in quick-service restaurants further accelerated adoption as chains needed compact RDCs for fast-moving menu items. These preferences pushed brands to invest in energy-efficient and modular systems that maintain temperature consistency.

- For instance, a trend report on chilled and deli foods globally indicates that a significant share of consumer demand comes from categories such as meat, dairy, snacks, and ready meals, reinforcing the need for reliable chilled display infrastructure in retail outlets to cater to diverse perishable categories.

Expansion of Modern Retail and Supermarket Networks

Global retail modernization significantly strengthened RDC adoption, especially in emerging markets where supermarket penetration continues to rise. Retail chains increased floor space for chilled assortments, leading to large-scale installation of vertical and hybrid designs. Convenience store growth also played a major role as operators prioritized compact plug-in cases that ensure quick placement and flexible merchandising. Modern retailers focused on product presentation and hygiene, making RDCs essential for premium displays. Many chains upgraded to high-efficiency units to comply with sustainability targets and reduce long-term operating costs. This transition supported wider use of remote systems that maintain stable temperatures across longer aisles. Retail competition further pushed stores to enhance visibility, reduce manual handling, and offer diverse chilled products, driving stronger investment in RDC fleets.

- For instance, a 2024 market study reported that supermarkets held about 52% share of the global refrigerated display‑case market application segment, reflecting how expansion of modern retail networks underpins RDC demand worldwide.

Stricter Food Safety, Energy, and Sustainability Regulations

Tighter standards for food safety and energy consumption encouraged major upgrades across the RDC market. Governments set new rules on refrigerants, insulation efficiency, and temperature control, pushing retailers to adopt modern systems with improved sensors and low-GWP cooling gases. Energy-efficient RDCs helped operators reduce utility bills while meeting sustainability targets. Many regions mandated phase-outs of high-emission refrigerants, accelerating the shift to CO₂-based or hydrocarbon systems. These rules encouraged manufacturers to focus on inverter compressors, LED lighting, and improved airflow designs. Retailers upgraded old fleets to avoid compliance issues and reduce product loss caused by temperature fluctuations. Strict cold-chain requirements in dairy, meat, and beverages also shaped purchasing decisions.

Key Trends & Opportunities

Rise of Smart, Connected, and IoT-Enabled Refrigeration

Digital transformation created strong opportunities in the RDC market as operators adopted IoT-based monitoring, predictive maintenance, and cloud-connected temperature tracking. Smart RDCs helped retailers reduce energy waste, avoid spoilage, and detect equipment failures before they occur. Sensors enabled real-time visibility of compressor loads and product temperatures, improving compliance and lowering operational risk. These upgrades strengthened appeal among supermarkets that manage large fleets across multiple outlets. Remote monitoring also supported labor efficiency as staff relied on automated alerts rather than manual checks. Manufacturers responded with advanced controllers, adaptive defrost logic, and algorithms that adjust cooling cycles based on load. These innovations positioned smart RDCs as a high-value investment for modern retail.

- For instance, a multinational cold‑chain solutions provider Axino Solutions (in collaboration with Semtech’s LoRa® connectivity) offered a vendor‑agnostic temperature‑monitoring platform that claims the ability to detect the core temperature of food items within one degree Celsius using sensors placed inside coolers enabling precise, continuous monitoring of perishable goods, regardless of the original cooling‑equipment manufacturer.

Growing Adoption of Energy-Efficient and Eco-Friendly Designs

Energy-efficient and sustainable refrigeration solutions gained strong traction as retailers prioritized lower carbon footprints and long-term cost savings. High energy prices encouraged adoption of LED lighting, improved insulation, and variable-speed compressors. Growth in hydrocarbon and CO₂-based refrigerants aligned with global regulations, offering lower emissions and better cooling efficiency. Retailers invested in hybrid and semi plug-in systems that reduce heat discharge and enhance store comfort. Many operators replaced older fleets to meet sustainability goals and achieve operating-cost reductions. Manufacturers focused heavily on green engineering and materials that support longer equipment life and lower maintenance needs. This shift created strong momentum for eco-friendly RDCs across large retail networks.

- For instance, Embraco a global refrigeration‑technology brand in 2024 delivered variable‑speed condensing units using hydrocarbon refrigerant R290 for refrigerated food displays. Their case studies showed up to 53% energy savings compared with older fixed‑speed, HFO‑based systems a dramatic reduction in power consumption for display‑case operations.

Opportunity in Store Redesign and Premium Product Merchandising

Rising focus on store aesthetics and premium merchandising also opened new opportunities in the RDC market. Retailers revamped layouts to enhance shopper flow and highlight high-margin categories such as fresh bakery, specialty dairy, craft beverages, and ready meals. This trend increased demand for sleek, transparent, and customizable RDC models. Flexible plug-in units supported seasonal displays, while hybrid models allowed more creative product zones. Premium stores adopted units with frameless doors, curved glass, and low-noise operation to improve customer experience. Growth in gourmet and health-focused retail formats further pushed interest in visually appealing chilled displays. These upgrades boosted demand for design-driven refrigeration.

Key Challenges

High Energy Consumption and Operating Cost Burden

Despite efficiency improvements, RDCs still account for a major share of energy use in retail stores, making operating cost a key challenge. Large supermarkets run multiple units continuously, creating high electricity loads that strain budgets. Smaller retailers struggle to justify investments in advanced RDCs due to limited capital and rising power tariffs. High energy use also increases carbon emissions, pushing operators to balance cost, compliance, and sustainability. Maintenance costs add pressure as compressors, fans, and temperature-control components demand regular service. For many operators, retrofitting or replacing outdated RDC fleets remains financially challenging.

Complexity of Installation, Maintenance, and Technical Integration

RDC systems require specialized handling, which creates challenges for operators with limited technical expertise. Remote refrigeration setups need complex pipework, precise refrigerant charging, and professional installation teams. Maintenance demands increase when integrating IoT sensors, smart controllers, and energy-management systems. Lack of skilled technicians in emerging markets slows adoption of advanced RDC technologies. Downtime caused by technical issues can lead to product loss, reduced sales, and high repair bills. Manufacturers face challenges standardizing components across diverse store formats, which complicates scalability and increases long-term servicing needs.

Regional Analysis

North America

North America led the Refrigerated Display Cases (RDC) Market in 2024 with about 34% share, supported by strong supermarket networks, high adoption of energy-efficient refrigeration, and strict food safety regulations. Retailers upgraded fleets to hydrocarbon and CO₂-based systems as sustainability targets tightened. Growth in convenience stores and grab-and-go dining boosted demand for plug-in and vertical cases. Quick-service restaurant expansion also increased adoption of compact RDCs. Investments in smart, IoT-enabled refrigeration further strengthened regional leadership, with operators focusing on predictive maintenance, temperature monitoring, and lower operating costs across supermarkets, hypermarkets, and specialty food retail formats.

Europe

Europe held around 29% share in 2024, driven by advanced cold-chain standards, strong regulatory pressure on refrigerants, and early adoption of CO₂-based systems. Supermarkets across Germany, France, Italy, and the UK invested in low-GWP RDCs to comply with F-Gas rules. High disposable incomes supported growth in premium food formats that rely on modern chillers for fresh bakery, dairy, and specialty beverages. Retailers prioritized energy savings, prompting upgrades to LED lighting, variable-speed compressors, and closed-door designs. The rise of convenience and discount chains further accelerated demand for flexible and efficient vertical and hybrid display cases.

Asia-Pacific

Asia-Pacific accounted for the largest regional growth momentum with roughly 28% share in 2024, fueled by rapid urbanization, supermarket expansion, and rising consumption of chilled and ready-to-eat food. China, India, Japan, and Southeast Asia saw strong investment in plug-in and semi plug-in cases due to flexible installation needs. Retail modernization increased demand for energy-efficient RDCs as chains focused on lowering long-term electricity costs. Growth in QSRs, bakery chains, and specialty beverage outlets further supported adoption. Government regulations on food hygiene and cold storage strengthened market penetration across developing economies.

Latin America

Latin America captured nearly 6% share in 2024, supported by supermarket expansion in Brazil, Mexico, and Chile, along with rising demand for chilled bakery, dairy, and beverage products. Retailers invested in affordable plug-in units that support flexible placement and low installation costs. Growth of convenience chains and QSR brands boosted adoption of compact vertical models. Economic fluctuations limited large-scale RDC upgrades, but sustainability programs encouraged gradual adoption of energy-efficient units. Rising urban consumption and modernization of food retail formats continued to push demand across key countries.

Middle East & Africa

The Middle East & Africa region accounted for about 3% share in 2024, with growth driven by rising hospitality projects, expanding hypermarket chains, and increasing interest in chilled bakery and beverage products. GCC countries adopted advanced RDCs to support premium food retail and strict temperature control in high-heat environments. Remote and hybrid systems gained traction in large supermarkets, while plug-in models dominated small urban stores. Energy-efficiency initiatives encouraged operators to shift toward LED-lit and low-emission systems. Market adoption across Africa grew steadily as food retail formalized and cold-chain infrastructure improved.

Market Segmentations:

By Type

- Plug-in

- Semi Plug-in

- Remote

By Design

- Vertical

- Horizontal

- Hybrid

By End Use

- Food Service Sector

- Retail Food & Beverage Sector

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Refrigerated Display Cases (RDC) Market features major players such as AHT Cooling Systems GmbH, Lennox International Inc., Liebherr Group, Haier Group, Carrier Commercial Refrigeration, Dover Corporation, Hussmann Corporation, Metalfrio Solutions S.A., Danfoss A/S, and Epta S.p.A. Refrigeration. These companies compete through advanced energy-efficient designs, low-GWP refrigerant adoption, and strong portfolios of plug-in, semi plug-in, and remote systems. Manufacturers focus on LED lighting, variable-speed compressors, and connected controls that enhance temperature stability and reduce operating costs. Many players expand through partnerships with supermarkets and convenience chains to support fleet upgrades and sustainability programs. Strong investments in IoT-enabled monitoring, modular layouts, and customized merchandising features help brands differentiate in a market driven by regulatory compliance, food safety, and retail modernization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AHT Cooling Systems GmbH

- Lennox International Inc.

- Liebherr Group

- Haier Group

- Carrier Commercial Refrigeration

- Dover Corporation

- Hussmann Corporation

- Metalfrio Solutions S.A.

- Danfoss A/S

- Epta S.p.A. Refrigeration

Recent Developments

- In August 2025, Lennox International Inc. Expanded its HVAC / parts & supplies footprint by signing an agreement to acquire the HVAC division of NSI Industries (Duro Dyne, Supco brands) a deal that strengthens Lennox’s channel/parts capabilities which can influence service/support for commercial refrigeration and RDC customers.

- In June 2025, Epta S.p.A. Refrigeration launched UNIT, an Iarp-branded refrigerated display case designed around circular-economy principles, using modular design for disassembly, recyclable materials, and natural refrigerant R600a to cut lifecycle impacts while improving serviceability and energy efficiency for food and beverage retail.

- In April 2025, Lennox’s EMEA commercial/refrigeration operations were restructured / rebranded following earlier transactions (Lennox EMEA activity and rebranding to LFB Group noted in industry press), affecting the regional footprint of its Heatcraft/related refrigeration businesses.

Report Coverage

The research report offers an in-depth analysis based on Type, Design, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see faster adoption of energy-efficient RDCs as retailers cut power use.

- Low-GWP and natural refrigerants will gain wider acceptance due to strict environmental rules.

- IoT-enabled monitoring and predictive maintenance will become standard features across new installations.

- Remote and semi plug-in systems will expand as supermarkets optimize cooling loads and store comfort.

- Compact plug-in units will grow in convenience stores and QSR chains seeking flexible placement.

- Advanced insulation, LED lighting, and variable-speed compressors will shape next-generation designs.

- Premium food merchandising will drive demand for sleek, frameless, and customizable RDC models.

- Retailers will invest more in temperature stability to reduce spoilage and meet safety norms.

- Emerging markets will accelerate purchases as modern retail formats expand.

- Replacement demand will rise as aging fleets are phased out for greener and smarter solutions.