Market Overview:

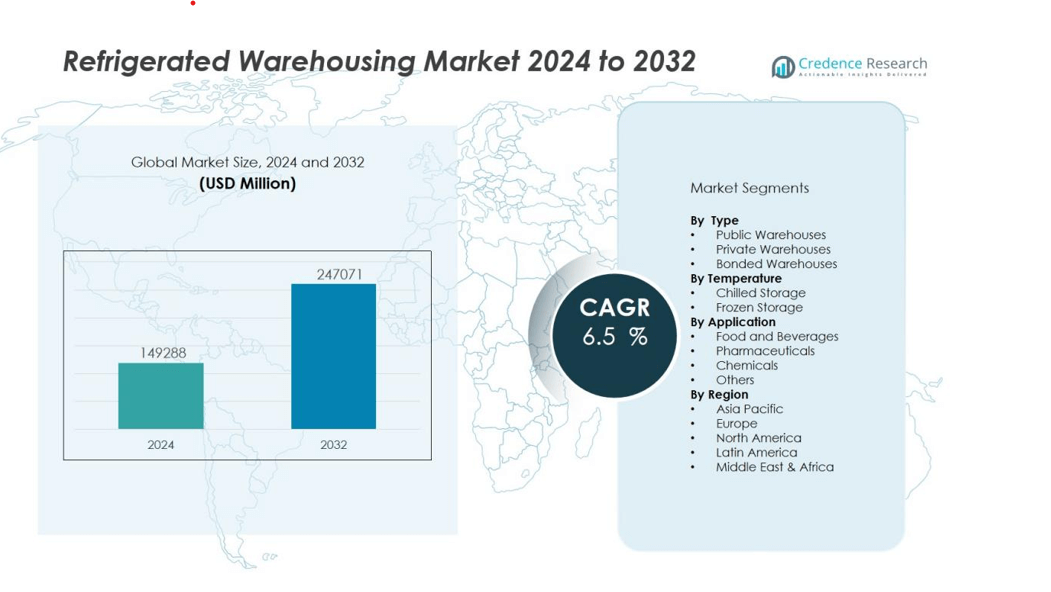

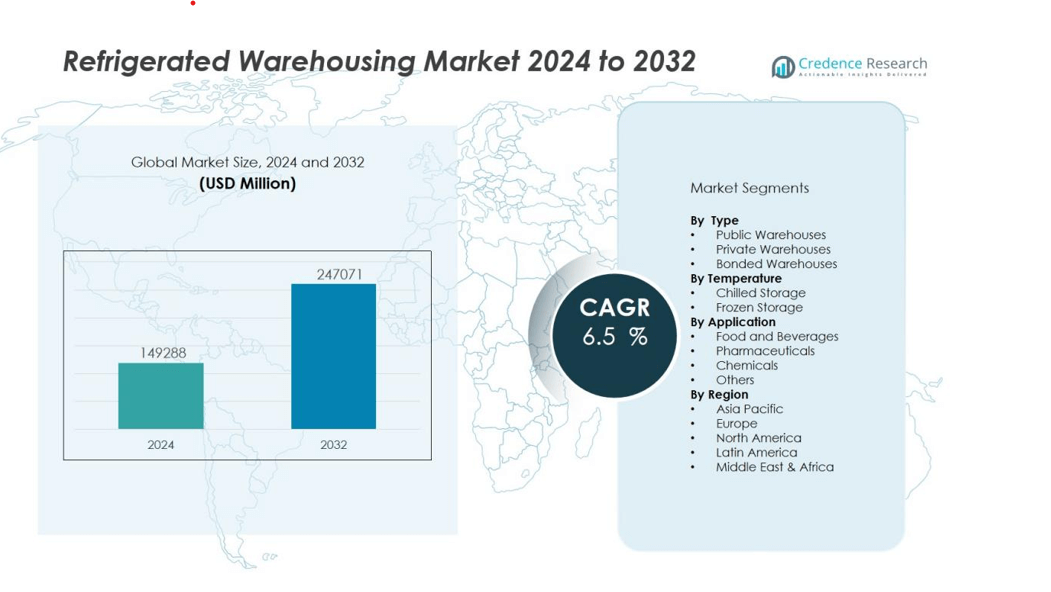

The refrigerated warehousing market size was valued at USD 149288 million in 2024 and is anticipated to reach USD 247071 million by 2032, at a CAGR of 6.5 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Refrigerated Warehousing Market Size 2024 |

USD 149288 million |

| Refrigerated Warehousing Market, CAGR |

6.5% |

| Refrigerated Warehousing Market Size 2032 |

USD 247071 million |

Market growth is driven by rising global consumption of processed and frozen foods, increasing pharmaceutical exports, and strict regulations for temperature-controlled storage. Technological advancements, including automated storage and retrieval systems, energy-efficient refrigeration, and IoT-enabled monitoring solutions, are improving operational efficiency and inventory management. Additionally, the expansion of e-commerce grocery delivery services and growing demand for bio-pharmaceutical cold storage are creating new opportunities for market players.

Regionally, North America dominates the refrigerated warehousing market due to well-established cold chain infrastructure, high demand for frozen food products, and advanced logistics capabilities. Asia-Pacific is expected to witness the fastest growth, driven by urbanization, rising disposable incomes, and increasing investment in cold storage facilities in emerging economies such as China and India. Europe maintains steady growth, supported by strict food safety regulations and expanding cross-border trade in perishable goods.

Market Insights:

- The refrigerated warehousing market was valued at USD 149,288 million in 2024 and is projected to reach USD 247,071 million by 2032, growing at a CAGR of 6.5% from 2024 to 2032.

- Rising global consumption of processed, frozen, and perishable foods is driving demand for temperature-controlled storage across retail, foodservice, and export sectors.

- Expanding pharmaceutical and biotechnology cold chain requirements are increasing the need for specialized facilities for biologics, vaccines, and other temperature-sensitive products.

- Technological advancements such as IoT-enabled monitoring, automated storage systems, and energy-efficient refrigeration are improving operational efficiency and reducing product loss.

- Growth of e-commerce grocery delivery and direct-to-consumer food services is creating demand for flexible, strategically located cold storage hubs for last-mile distribution.

- Sustainability trends are encouraging adoption of natural refrigerants, green-certified warehouses, and renewable energy-powered refrigeration systems.

- North America holds 36% market share due to its advanced cold chain infrastructure, while Asia-Pacific is the fastest-growing region driven by urbanization, rising incomes, and significant investment in modern cold storage facilities, with Europe maintaining steady growth supported by strict food safety and environmental regulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Perishable Food and Beverage Storage:

The refrigerated warehousing market is benefiting from a sustained increase in global consumption of perishable goods, including fresh produce, dairy products, meat, and seafood. It supports supply chains by maintaining quality, safety, and shelf life through temperature-controlled storage. Growing urbanization and changing dietary preferences toward frozen and ready-to-eat meals are further expanding storage requirements. The market is also driven by retail and foodservice sectors that rely heavily on reliable cold storage infrastructure to meet year-round demand for seasonal products.

- For instance, Lineage announced the development of two fully automated greenfield cold storage warehouses equipped with its LinOS execution system, which will add over 80 million cubic feet of refrigerated capacity.

Expansion of Pharmaceutical and Biotechnology Cold Chain Requirements:

Pharmaceuticals, vaccines, and biologics require precise temperature control to maintain efficacy and comply with stringent regulatory standards. The refrigerated warehousing market plays a critical role in supporting these requirements, particularly for temperature-sensitive drugs and biologics. Increasing global trade in biopharmaceutical products and rising vaccine distribution efforts have amplified the demand for specialized cold storage facilities. The market is also benefiting from investments in advanced monitoring systems to ensure compliance with Good Distribution Practices (GDP).

- For instance, BioLegend implemented an automated cold storage system using OPEX’s Perfect Pick HD, efficiently managing 2,990 totes at 39°F with a total capacity of 6,500 cubic feet and enabling 1,200 tote transactions per hour, demonstrating high-precision control for biopharmaceutical warehousing.

Technological Advancements in Refrigeration and Warehouse Automation:

Innovations in refrigeration systems, automation, and digital monitoring are enhancing operational efficiency in refrigerated warehouses. It is now common for facilities to integrate IoT-enabled temperature sensors, automated storage and retrieval systems, and energy-efficient cooling technologies. These advancements reduce operational costs, improve space utilization, and minimize product spoilage. The adoption of renewable energy-powered refrigeration systems is also gaining traction, aligning with sustainability goals and environmental regulations.

Growth of E-Commerce and Direct-to-Consumer Grocery Delivery Services:

The rapid growth of online grocery and meal delivery services is creating new opportunities for the refrigerated warehousing market. It supports last-mile delivery networks by providing strategically located storage hubs that maintain product freshness during distribution. Rising consumer preference for home-delivered fresh and frozen goods has increased demand for smaller, flexible cold storage facilities. This trend is encouraging retailers and logistics companies to expand their temperature-controlled infrastructure across both urban and regional markets.

Market Trends:

Adoption of Automation, IoT, and Data-Driven Cold Chain Management:

The refrigerated warehousing market is witnessing a strong shift toward automation, IoT integration, and advanced data analytics to improve operational efficiency and reliability. It now incorporates automated storage and retrieval systems, robotics, and conveyor technologies to optimize space utilization and reduce labor dependency. IoT-enabled temperature and humidity sensors provide real-time monitoring, ensuring regulatory compliance and minimizing product loss. Data analytics is increasingly being used to forecast demand, manage inventory, and optimize energy consumption. Cloud-based warehouse management systems are also enabling greater transparency and coordination across the cold chain. These technologies are helping operators improve service quality while reducing operational costs.

- For instance, Bem Brasil successfully deployed a pallet shuttle-based automated storage and retrieval system, enabling efficient management of over 33,000 pallets at its cold storage facility.

Focus on Sustainability and Energy-Efficient Refrigeration Solutions:

Sustainability has become a central trend in the refrigerated warehousing market, with operators investing in eco-friendly infrastructure and low-carbon refrigeration systems. It is adopting natural refrigerants, energy-efficient compressors, and solar-powered facilities to meet environmental regulations and corporate sustainability goals. Demand for green-certified warehouses is increasing as retailers and manufacturers seek partners that align with their ESG objectives. Facilities are also implementing heat recovery systems, LED lighting, and smart energy management platforms to reduce overall consumption. This push toward sustainable operations is gaining momentum in regions with strict climate policies and growing consumer demand for environmentally responsible supply chains. The trend is reshaping investment priorities and encouraging long-term operational transformation.

- For instance, Lineage Logistics deployed IoT-enabled sensors across 120 facilities, driving a 34 percent reduction in annual energy consumption through data-driven optimizations.

Market Challenges Analysis:

High Operational Costs and Energy Consumption Pressures:

The refrigerated warehousing market faces significant challenges from high operational expenses, primarily driven by energy-intensive refrigeration systems. It requires continuous temperature control, leading to substantial electricity consumption and elevated utility costs. Rising energy prices and the need to maintain compliance with environmental regulations further add to financial strain. Operators must invest in energy-efficient technologies, but such upgrades demand high upfront capital, which can deter smaller players. Balancing operational efficiency with cost management remains a persistent concern for the industry.

Workforce Shortages and Infrastructure Limitations;

A shortage of skilled labor for operating and maintaining advanced refrigerated facilities is impacting service quality and operational capacity. The refrigerated warehousing market also encounters infrastructure constraints in emerging regions, where cold chain networks remain underdeveloped. It is difficult to meet the growing demand for temperature-controlled storage when transport and distribution infrastructure lag behind. Seasonal demand fluctuations further strain capacity planning and resource allocation. Addressing these issues requires both workforce training initiatives and strategic investment in modern, well-connected facilities.

Market Opportunities:

Expansion of E-Commerce-Driven Cold Chain Logistics:

The rise of online grocery, meal kit services, and direct-to-consumer food delivery is creating significant growth potential for the refrigerated warehousing market. It can capitalize on the demand for strategically located, flexible cold storage facilities that support last-mile delivery. Retailers and logistics providers are seeking partnerships with cold storage operators to maintain product freshness and meet rapid delivery expectations. The expansion of omnichannel retail strategies is further increasing the need for integrated cold chain solutions. This trend opens opportunities for investment in micro-fulfillment centers and regional cold storage hubs.

Growing Demand for Pharmaceutical and Biotech Cold Storage Solutions:

The global pharmaceutical and biotechnology sectors are expanding, creating strong demand for highly specialized temperature-controlled facilities. The refrigerated warehousing market can benefit by offering storage solutions for vaccines, biologics, and other temperature-sensitive products. It can adopt advanced monitoring systems and GDP-compliant infrastructure to serve this high-value segment. Increasing international trade in biopharmaceuticals and rising healthcare investments in emerging markets further strengthen growth prospects. The shift toward personalized medicine and cell and gene therapies is also expected to fuel demand for advanced cold chain capabilities.

Market Segmentation Analysis:

By Type:

The refrigerated warehousing market is segmented into public warehouses, private warehouses, and bonded warehouses. Public warehouses dominate due to their accessibility for multiple clients, cost-effectiveness, and flexibility in storage duration. Private warehouses are preferred by large retailers, food processors, and pharmaceutical companies seeking greater control over inventory and operations. Bonded warehouses serve importers and exporters requiring secure storage under customs supervision.

- For instance, Lineage Logistics’s Hazleton, Pennsylvania, public cold storage facility leverages three automated storage-and-retrieval cranes to move pallets within its 386,000-square-foot building, handling 85,000 pallet positions under LinOS execution software for seamless logistics operations.

By Temperature:

The market operates across chilled and frozen storage segments. Chilled storage is essential for fresh produce, dairy, and beverages that require moderate temperature control to maintain freshness. Frozen storage holds a larger share, catering to long-term preservation of meat, seafood, processed foods, and certain pharmaceuticals. It demands higher energy capacity and advanced insulation systems to maintain ultra-low temperatures.

- For instance, NewCold operates 25 highly automated frozen warehouses across three continents, offering a combined storage capacity exceeding 1,994,500 pallet positions with proprietary technology for enhanced energy efficiency.

By Application:

The refrigerated warehousing market serves food and beverages, pharmaceuticals, chemicals, and other temperature-sensitive products. The food and beverage segment remains the largest, supported by rising demand for frozen meals, dairy products, and seasonal produce. The pharmaceutical segment is expanding rapidly with the growth of biologics, vaccines, and other cold chain-dependent drugs. The chemical segment includes specialty chemicals that require temperature stability for safety and efficacy. Each application segment drives specific operational and compliance requirements for warehouse operators.

Segmentations:

By Type:

- Public Warehouses

- Private Warehouses

- Bonded Warehouses

By Temperature:

- Chilled Storage

- Frozen Storage

By Application:

- Food and Beverages

- Pharmaceuticals

- Chemicals

- Others

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America :

North America holds 36% market share in the refrigerated warehousing market, supported by advanced logistics networks and well-developed cold chain infrastructure. The region benefits from strong demand for frozen and processed food products, high per capita consumption of dairy and meat, and established retail distribution systems. It is witnessing continuous investment in automation, energy-efficient refrigeration, and temperature-monitoring technologies to enhance service quality. The pharmaceutical sector further drives demand, with specialized facilities for biologics, vaccines, and other temperature-sensitive drugs. Regulatory compliance with food safety and pharmaceutical storage standards ensures a competitive edge for regional operators. Cross-border trade with Canada and Mexico also sustains cold storage demand.

Asia-Pacific :

Asia-Pacific accounts for 34% market share in the refrigerated warehousing market, driven by urbanization, rising disposable incomes, and growing consumption of frozen and convenience foods. China, India, and Southeast Asian countries are witnessing large-scale investment in modern cold chain infrastructure to reduce post-harvest losses and meet export standards. It is also experiencing significant growth in pharmaceutical cold storage due to increased production and export of generic drugs and vaccines. Government initiatives supporting food safety and cold chain development are further enhancing market potential. E-commerce grocery delivery growth is accelerating demand for strategically located cold storage hubs. Regional players are adopting advanced monitoring and automation solutions to improve operational efficiency.

Europe:

Europe holds 20% market share in the refrigerated warehousing market, supported by stringent food safety and environmental regulations. The region emphasizes sustainable operations, with operators adopting natural refrigerants, energy-efficient systems, and green-certified warehouses. It has a mature cold chain network serving retail, foodservice, and pharmaceutical sectors across the EU. Cross-border trade within the European single market fuels consistent demand for temperature-controlled storage. Growth in organic and specialty food exports is also influencing storage requirements. Investments in smart warehouse technologies are enabling greater transparency and energy optimization across the supply chain.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players Analysis:

Competitive Analysis:

The refrigerated warehousing market is moderately consolidated, with global leaders and specialized regional operators competing for market share. Key players include LINEAGE LOGISTICS HOLDING, LLC, Americold Logistics, Inc., CONESTOGA COLD STORAGE, NewCold, Tippmann Group, Burris Logistics, and NICHIREI CORPORATION. It is driven by the ability of operators to provide reliable, temperature-controlled storage supported by advanced monitoring systems and automation. Leading companies focus on expanding capacity, enhancing geographic coverage, and investing in energy-efficient refrigeration technologies to improve competitiveness. Strategic mergers, acquisitions, and partnerships are common, enabling faster market penetration and service diversification. Competition also revolves around regulatory compliance, operational efficiency, and customer service quality. Players with strong cold chain integration, robust infrastructure, and advanced technology adoption hold a distinct advantage in retaining and attracting high-value clients across food, pharmaceutical, and specialty product segments.

Recent Developments:

- In April 2025, Lineage Logistics revealed its plan to design, build, and operate two fully automated cold storage warehouses for Tyson Foods, using its proprietary warehouse execution technology in major U.S. distribution markets.

- In July 2025, Americold Logistics was recognized as a 2025 Green Supply Chain Partner by Inbound Logistics.

- In April 2023, FreezPak Logistics entered into partnership with BG Capital to develop a large cold-storage facility near Houston, Texas, as part of its network expansion strategy.

Market Concentration & Characteristics:

The refrigerated warehousing market is moderately consolidated, with a mix of global logistics leaders, regional operators, and specialized cold storage providers competing for market share. It is characterized by high capital requirements, advanced technological integration, and strict regulatory compliance for food safety and pharmaceutical storage. Leading players focus on expanding capacity, adopting automation, and implementing energy-efficient refrigeration systems to enhance competitiveness. The market shows steady long-term demand, driven by food, beverage, and pharmaceutical sectors, which ensures stable revenue streams. Strategic partnerships, mergers, and acquisitions are common, enabling operators to expand geographic reach and service capabilities. Competitive differentiation often relies on service reliability, location advantage, and advanced temperature monitoring solutions.

Report Coverage:

The research report offers an in-depth analysis based on Type, Temperature, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The refrigerated warehousing market will expand with rising demand for perishable food storage in both developed and emerging economies.

- Pharmaceutical cold chain needs will strengthen, driven by biologics, vaccines, and temperature-sensitive therapeutics.

- Automation and robotics adoption will increase, improving efficiency and reducing dependency on manual labor.

- IoT-enabled temperature and humidity monitoring will become standard for regulatory compliance and product safety.

- Energy-efficient and sustainable refrigeration technologies will gain preference, aligning with environmental regulations and corporate ESG goals.

- E-commerce grocery and meal delivery growth will boost demand for strategically located urban cold storage hubs.

- Investments in micro-fulfillment centers will rise to support rapid last-mile distribution of fresh and frozen goods.

- Emerging markets will see accelerated cold chain infrastructure development supported by government initiatives and foreign investments.

- Strategic mergers, acquisitions, and partnerships will reshape competitive dynamics and expand service capabilities.

- Advanced data analytics will optimize inventory management, reduce waste, and improve operational decision-making in cold storage facilities.