Market Overview

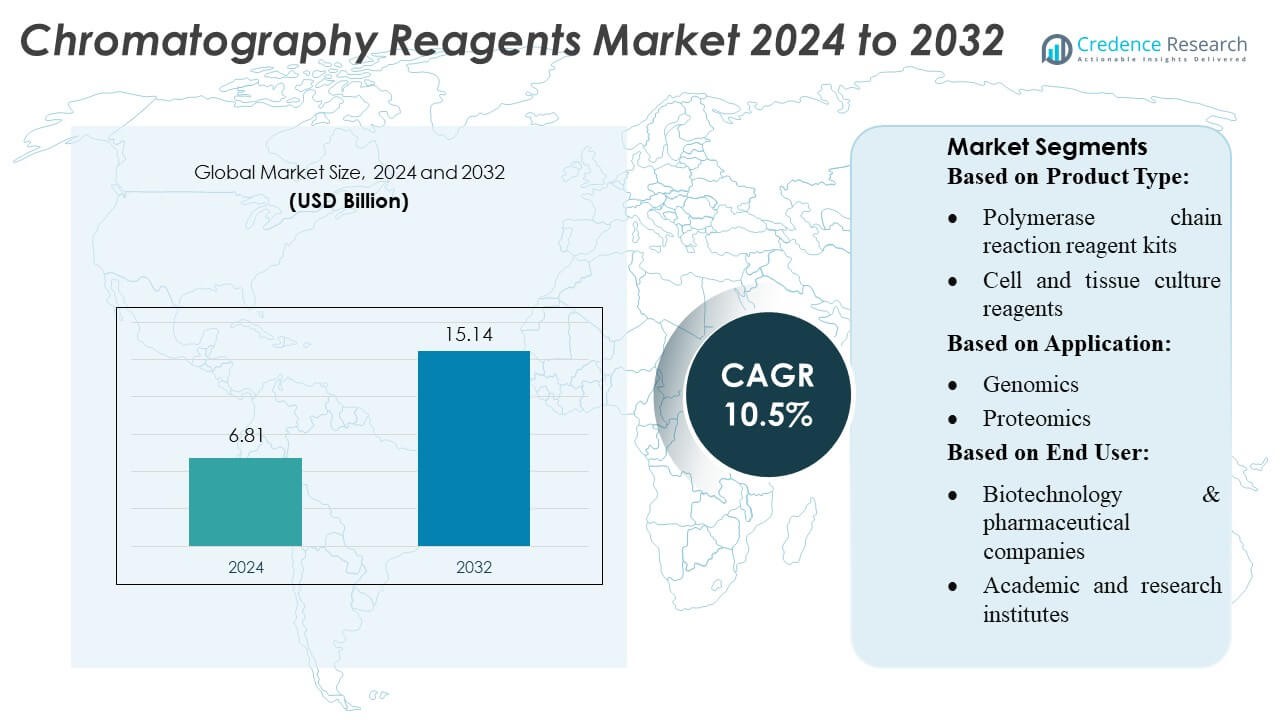

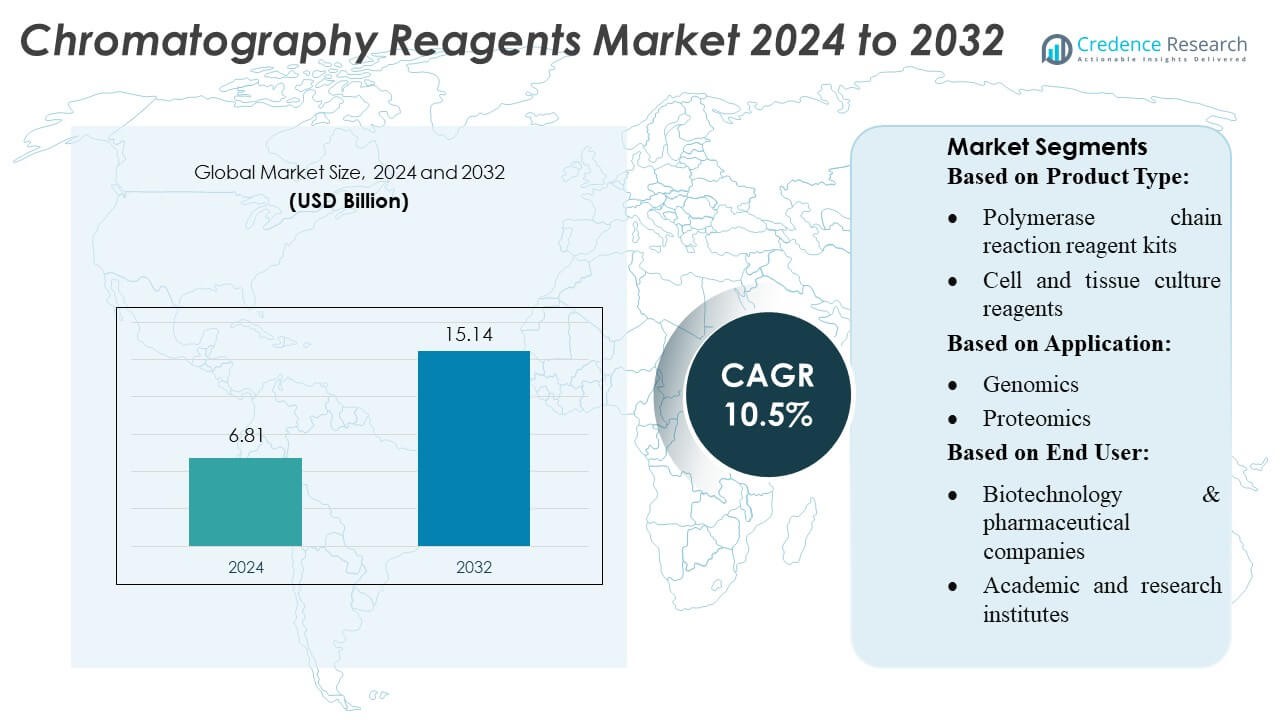

Chromatography Reagents Market size was valued USD 6.81 billion in 2024 and is anticipated to reach USD 15.14 billion by 2032, at a CAGR of 10.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chromatography Reagents Market Size 2024 |

USD 6.81 Billion |

| Chromatography Reagents Market, CAGR |

10.5% |

| Chromatography Reagents Market Size 2032 |

USD 15.14 Billion |

The chromatography reagents market is characterized by strong competition among global analytical and life-science suppliers that focus on high-purity solvents, buffer systems, and LC–MS–optimized formulations to support advanced drug development and biopharmaceutical workflows. Leading companies strengthen their positions through continuous innovation, expansion of application-specific reagent portfolios, and investments in automation-ready solutions for high-throughput laboratories. Regionally, North America dominates the market with approximately 38% share, driven by its advanced research infrastructure, high biopharma R&D spending, and stringent regulatory standards that require consistent, high-quality chromatographic performance across pharmaceutical, biotechnology, and diagnostic applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The chromatography reagents market was valued at USD 6.81 billion in 2024 and is projected to reach USD 15.14 billion by 2032, growing at a CAGR of 10.5% during the forecast period.

- Market growth is driven by rising biopharmaceutical R&D activities, increased adoption of LC–MS workflows, and expanding demand for high-purity reagents used in biologics development and precision medicine.

- Key trends include rapid movement toward automation-ready reagent kits, high-throughput chromatography systems, and the expansion of LC–MS–grade solvent portfolios for advanced analytical applications.

- Competitive intensity remains high as global suppliers innovate in ultra-pure solvents, buffer systems, and specialized derivatization agents, while also strengthening partnerships and global distribution networks.

- Regionally, North America holds a dominant 38% share, while chromatography reagents used in drug discovery represent the leading application segment with the largest share, supported by strict regulatory standards and strong pharmaceutical manufacturing activity.

Market Segmentation Analysis:

By Product Type

In the product-type segmentation of the chromatography reagents market, the chromatography reagents sub-segment dominates, accounting for a substantial share of the overall reagents market. This dominance is driven by the critical role of solvents, buffers, ion-pair reagents, and derivatization agents in essential chromatographic techniques such as liquid chromatography, gas chromatography, and supercritical fluid chromatography. The growth is underpinned by rising pharmaceutical and biopharmaceutical R&D, where high-performance separation purity and method sensitivity are mandatory. These drivers are reinforced by increasing regulatory quality control requirements and increased demand from large-molecule purification workflows.

- For instance, Illumina’s NovaSeq X reagent chemistry supports high-throughput workflows by enabling up to 26 billion reads per run, requiring precise upstream chromatographic QC steps to ensure batch-to-batch reagent consistency.

By Application

When segmented by application, drug discovery and development represent the leading sub-segment in the chromatography reagents market. This segment captures the largest share because chromatographic analysis is integral for pharmaceutical companies to identify, purify, and validate novel drug candidates. The demand is further propelled by accelerating pipelines in oncology, biologics, and cell & gene therapies, combined with stricter impurity profiling and complex molecule characterization. In addition, the ability of advanced chromatography to deliver high resolution and reproducibility supports its dominant position in preclinical and clinical research operations.

- For instance, Promega’s HisLink™ Protein Purification Resin provides a nickel-chelated macroporous silica matrix with more than 20 mmol Ni per ml of settled resin, enabling capture of up to 35 mg of histidine-tagged protein per ml of resin under gravity or low-pressure flow.

By End-User

In terms of end users, biotechnology and pharmaceutical companies lead the chromatography reagents market, holding the highest market share. These companies rely heavily on chromatographic techniques across all phases — from discovery and process development to quality control and GMP manufacturing. Their dominant role is supported by significant R&D spending, increasing clinical trials, and stringent regulatory demands. Moreover, expanding biologics production, such as monoclonal antibodies and recombinant proteins, further propels their consumption of chromatography reagents for purification and analytical workflows.

Key Growth Drivers

- Rising Biopharmaceutical Production and Purification Needs

The expanding biopharmaceutical sector strongly drives demand for chromatography reagents, as companies increasingly rely on high-purity separation processes for monoclonal antibodies, recombinant proteins, and vaccines. Large-scale biologics manufacturing requires highly efficient buffer systems, ion-exchange reagents, and affinity ligands to ensure regulatory-compliant purity levels. Growing investment in advanced downstream purification platforms and the global expansion of biologics manufacturing facilities further accelerate reagent consumption, positioning chromatography as a critical enabler of next-generation therapeutic development.

- For instance, F. Hoffmann-La Roche Ltd. supplies Benzonase® Endonuclease through its CustomBiotech division, a nuclease preparation with an activity of 250 U/µl capable of reducing residual host-cell DNA in downstream purification to below 10 pg per mg of protein, significantly improving chromatographic clarity and process reliability.

- Increasing Adoption of Analytical Chromatography in Drug Development

Pharmaceutical and biotech firms continuously increase their reliance on chromatography for impurity profiling, pharmacokinetic studies, metabolite identification, and stability testing, which significantly boosts reagent demand. As drug pipelines expand across oncology, immunotherapy, and rare diseases, companies require more robust analytical workflows supported by high-performance solvents, buffer additives, and derivatization agents. Rising regulatory scrutiny on product quality and analytical validation strengthens usage across preclinical and clinical stages, making chromatography reagents indispensable in drug discovery and development processes.

- For instance, Takara Bio’s Capturem™ His-Tagged Purification Maxiprep Columns enable rapid chromatographic purification with a binding capacity of up to 2.5 mg of His-tagged protein in under 15 minutes, providing high-throughput, high-resolution performance that strengthens modern analytical development workflows.

- Growth of Omics Research and Precision Medicine

Expanding genomics, proteomics, and metabolomics research amplifies the need for advanced chromatographic separation to analyze complex biomarkers, molecular signatures, and therapeutic targets. Precision medicine initiatives stimulate investments in LC-MS and GC-MS workflows, increasing consumption of high-grade reagents with superior consistency and sensitivity. Rising government research funding and academic-industry collaborations further strengthen demand. As omics-based diagnostics and personalized therapies gain traction, chromatography reagents become essential for high-resolution molecular characterization and large-scale sample processing.

Key Trends & Opportunities

- Growing Shift Toward High-Performance and Ultra-High-Purity Reagents

Manufacturers increasingly offer ultra-high-purity solvents, low-UV-cutoff buffers, and LC-MS-grade additives to support advanced analytical platforms. This trend is driven by the need for enhanced sensitivity, reduced background noise, and improved reproducibility in complex separations. Opportunities are emerging for suppliers that can provide low-residue, low-metal, and low-particulate reagent lines compatible with high-resolution mass spectrometry. As both regulatory expectations and analytical complexity rise, demand for premium reagent grades continues to strengthen globally.

- For instance, QIAGEN’s Ni-NTA Agarose resin provides a binding capacity of up to 50 mg of 6xHis-tagged protein per ml of resin, enabling highly purified eluates with minimal metal ion leakage, supporting stringent MS-grade analytical requirements.

- Expansion of Automated and High-Throughput Chromatography Workflows

Automation in laboratories is accelerating adoption of reagents optimized for robotic liquid handling, continuous chromatography, and integrated purification systems. High-throughput screening in biopharma and increased sample volumes in clinical research create opportunities for reagent suppliers to develop pre-validated formulations suited for automated platforms. This trend also includes demand for ready-to–use buffer concentrates, single-use purification reagents, and pre-packaged solvent systems that reduce preparation time and contamination risks.

- For instance, Merck KGaA’s Eshmuno® CP-FT resin supports fully automated continuous bioprocessing with a dynamic binding capacity of over 60 g/L for Fc-fusion proteins, enabling significantly higher throughput and reduced cycle times in modern purification workflows.

- Increasing Use of Green and Sustainable Chromatography Reagents

A shift toward environmentally responsible laboratory operations encourages the development of low-toxicity solvents, biodegradable additives, and recycled solvent systems. Companies explore bio-based reagents and reduced-hazard eluents to minimize waste generation and comply with sustainability targets. Regulatory bodies promoting green chemistry further accelerate adoption. Suppliers offering eco-friendly formulations, solvent-saving packaging, and waste-reduction technologies gain competitive advantage, creating strong opportunities in sustainability-driven markets.

Key Challenges

- High Cost of Advanced Reagents and Analytical Instruments

The high price of ultra-pure solvents, derivatization agents, and specialty reagents used in high-sensitivity chromatography limits adoption, particularly among small laboratories and academic research institutions. Additionally, chromatography instruments such as UHPLC and LC-MS systems require substantial capital investment and ongoing maintenance, raising total operational costs. These financial barriers slow market penetration and force users to limit reagent consumption or adopt lower-grade alternatives, hampering optimal analytical performance.

- Technical Complexity and Skilled Workforce Shortage

Chromatographic workflows require advanced expertise for reagent preparation, method optimization, system calibration, and troubleshooting. Many regions face a shortage of trained analysts, which leads to operational inefficiencies and inconsistent data quality. Complex reagent handling, contamination risks, and stringent quality control requirements further intensify these challenges. Limited technical proficiency also slows the adoption of cutting-edge technologies, affecting overall productivity in pharmaceutical, biotech, and research laboratories.

Regional Analysis

North America

North America holds the largest share of the chromatography reagents market, accounting for about 35–38% of global revenue. The region benefits from strong biopharmaceutical R&D activity, advanced analytical laboratories, and high adoption of LC, GC, and MS-based workflows. The U.S. leads due to extensive biologics manufacturing, strict regulatory standards, and continuous investments in analytical quality control. Growing use of chromatography in drug development, clinical testing, and environmental monitoring further strengthens North America’s dominant position.

Europe

Europe represents the second-largest regional market with an estimated 28–30% share. The region’s growth is supported by well-established biotech clusters, academic research institutions, and strong emphasis on regulatory-compliant analytical testing. Countries such as Germany, the U.K., and France drive significant demand for high-purity reagents used in pharmaceuticals, food safety, and environmental analysis. Increasing interest in green chromatography, high-resolution analytical techniques, and harmonized quality standards sustains Europe’s steady demand for advanced chromatography reagents.

Asia Pacific

Asia Pacific is the fastest-growing region, holding around 22–25% of the global market and rapidly gaining share. Expansion of pharmaceutical manufacturing, rising biologics production, and government-backed investments in R&D infrastructure drive high demand for chromatography reagents. China, India, Japan, and South Korea are leading adopters due to increasing quality testing requirements in healthcare, food safety, and environmental monitoring. Growing adoption of LC-MS and automated chromatography systems further elevates reagent consumption across the region.

Latin America

Latin America accounts for approximately 6–8% of the chromatography reagents market, with steady growth supported by expanding pharmaceutical production and food–agriculture testing needs. Brazil and Mexico lead regional demand as they modernize laboratory infrastructure and strengthen regulatory compliance. Increasing use of chromatography in environmental testing, clinical diagnostics, and forensic analysis contributes to rising reagent consumption. Improving distribution networks for laboratory supplies also supports accessible and reliable reagent availability across the region.

Middle East & Africa

The Middle East & Africa (MEA) region holds a smaller share of around 4–6%, but adoption of chromatography reagents continues to grow. Demand is driven by investments in healthcare diagnostics, petrochemical quality testing, and water analysis laboratories. Countries such as the UAE, Saudi Arabia, and South Africa show increasing uptake of chromatography systems and associated high-purity reagents. Improving laboratory accreditation standards and gradual modernization of research facilities support long-term market development in the region.

Market Segmentations:

By Product Type:

- Polymerase chain reaction reagent kits

- Cell and tissue culture reagents

By Application:

By End User:

- Biotechnology & pharmaceutical companies

- Academic and research institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The chromatography reagents market features a highly competitive landscape led by major players such as Illumina, Inc., Promega Corp., F. Hoffmann-La Roche Ltd., Takara Bio, Inc., QIAGEN, Merck KGaA, Thermo Fisher Scientific, New England Biolabs, Bio-Rad Laboratories, and Agilent Technologies, Inc. The chromatography reagents market remains highly competitive, characterized by continuous product innovation, expanding application breadth, and increasing emphasis on high-performance analytical quality. Companies focus on developing ultra-pure solvents, advanced buffer systems, and LC-MS–optimized formulations to meet growing demand from biopharmaceutical research, precision medicine, and regulatory-driven quality control workflows. The market is shaped by rising investments in automated and high-throughput chromatography systems, prompting suppliers to offer ready-to-use reagent kits and standardized formulations that reduce variability and improve reproducibility. Additionally, firms strengthen their global distribution networks, enhance technical support capabilities, and pursue strategic partnerships to capture expanding opportunities in biologics production, omics research, and advanced diagnostic development.

Key Player Analysis

- Illumina, Inc.

- Promega Corp.

- Hoffmann-La Roche Ltd.

- Takara Bio, Inc.

- QIAGEN

- Merck KGaA

- Thermo Fisher Scientific

- New England Biolabs

- Bio-Rad Laboratories

- Agilent Technologies, Inc.

Recent Developments

- In October 2025, Gujarat University received a grant of ₹10 crore under the Pradhan Mantri Uchchatar Shiksha Abhiyan (PM-Usha) to enhance its research infrastructure. The funding will be used to acquire advanced scientific instruments for various science departments, empowering students and faculty to carry out cutting-edge research within the university premises.

- In June 2025, Bio-Techne announced a distribution agreement with the U.S. Pharmacopeia (USP) to sell USP reference standards alongside its analytical instruments. This collaboration allows researchers and manufacturers to use USP’s reference materials, such as those for monoclonal antibodies and AAV gene therapies, with Bio-Techne’s analytical solutions like the Maurice system, streamlining the characterization and quality control of these complex biological drugs.

- In April 2025, Japan’s Shimadzu announced the merger of its European group companies Alsachim SAS (ALC) and Biomaneo SAS (BMO) with Alsachim as the surviving company. The new consolidated entity was named Shimadzu Chemistry and Diagnostics SAS (SCHD).

- In September 2024, FUJIFILM Irvine Scientific added key products from FUJIFILM Wako Chemicals U.S.A. to its life sciences portfolio through an alignment of commercial operations. This was part of a larger strategy to provide end-to-end solutions across the drug development lifecycle.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as biopharmaceutical companies increase demand for high-purity reagents used in biologics and vaccine development.

- Adoption of LC-MS and advanced analytical platforms will accelerate the need for ultra-high-grade solvents and buffer systems.

- Automation in laboratories will drive demand for ready-to-use, pre-validated chromatography reagent kits.

- Rising investment in omics research will expand applications for specialized reagents in genomics, proteomics, and metabolomics.

- Regulatory emphasis on quality testing will strengthen the use of chromatography across pharmaceuticals and diagnostics.

- Sustainability initiatives will encourage development of low-toxicity, eco-friendly reagent formulations.

- Emerging markets will witness rapid uptake of chromatography reagents as lab infrastructure improves.

- Growth of personalized medicine will increase demand for high-resolution analytical reagents.

- Integration of digital tools and smart workflow systems will support more consistent reagent performance.

- Strategic collaborations between reagent suppliers and instrument manufacturers will enhance product innovation and market reach.