Market Overview

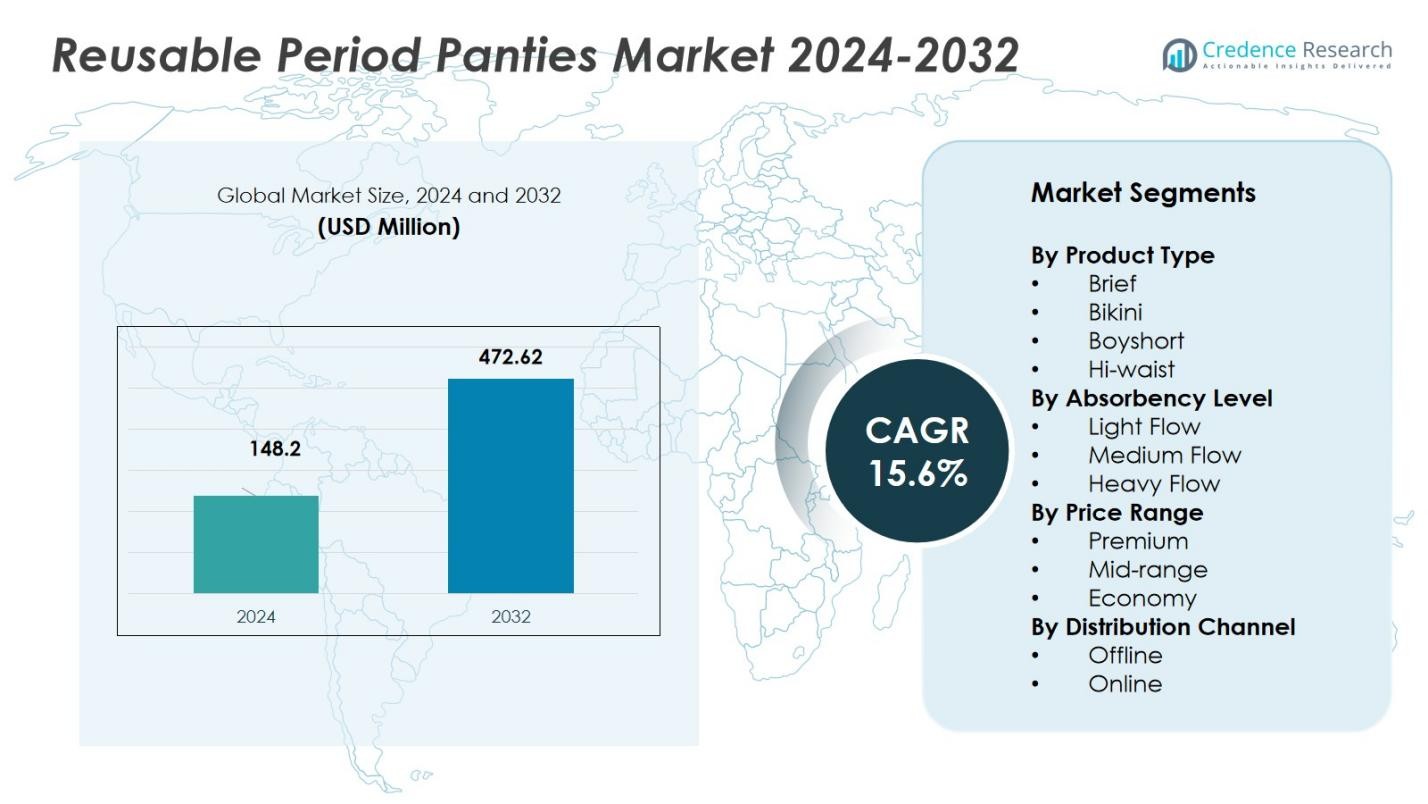

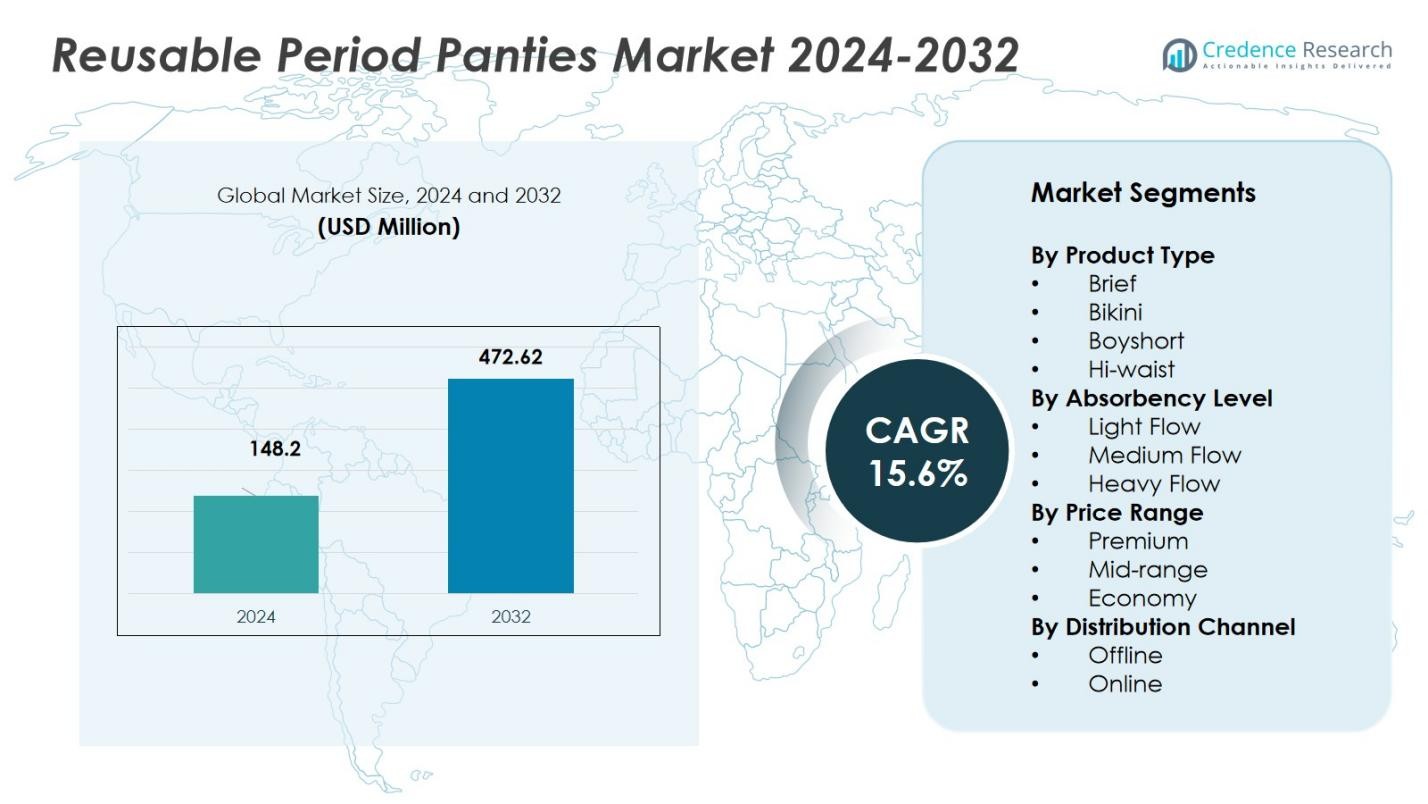

The Reusable Period Panties Market size was valued at USD 148.2 million in 2024 and is anticipated to reach USD 472.62 million by 2032, at a CAGR of 15.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Reusable Period Panties Market Size 2024 |

USD 148.2 Million |

| Reusable Period Panties Market, CAGR |

15.6% |

| Reusable Period Panties Market Size 2032 |

USD 472.62 Million |

The Reusable Period Panties Market is led by key players such as Neione, Ruby Love, Proof, Knix Wear, Inc., Rael, and Saalt, LLC. These companies dominate the market by offering innovative and sustainable menstrual products that cater to a wide range of consumer preferences, from absorbency levels to product types. North America holds the largest market share at 39.1% in 2024, driven by high consumer awareness of sustainability and increasing demand for eco-friendly alternatives. Europe follows with a significant share of 28.4%, supported by a strong cultural inclination toward environmental responsibility and higher disposable incomes. Asia Pacific, with a market share of 18.9%, is the fastest-growing region, fueled by rising urbanization and growing awareness of menstrual hygiene. As the market evolves, these leading companies continue to innovate, ensuring widespread adoption and penetration across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Reusable Period Panties Market was valued at USD 148.2 million in 2024 and is projected to grow at a CAGR of 15.6%.

- Growing environmental awareness and increasing demand for sustainable menstrual products drive adoption, as more consumers opt for reusable, eco‑friendly period solutions over disposable sanitary products.

- Enhanced fabric technologies such as moisture‑wicking, odor control, leak‑proof designs and expanding e‑commerce channels reflect a trend toward comfort, performance, and accessibility across diverse consumer segments.

- Industry leaders including Neione, Ruby Love, Proof, Knix Wear, Rael, and Saalt expand their offerings in styles, absorbency, and price ranges, intensifying competition and pushing mid‑size and emerging brands to innovate or enter niche segments.

- North America leads geographically with 39.1% market share in 2024, followed by Europe at 28.4% and Asia Pacific at 18.9%; within product types, the Brief sub‑segment commands 42% share, while Medium Flow absorbency and Premium price range dominate their respective segments at 38% and 45%.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

The product type segment of the Reusable Period Panties Market is segmented into Brief, Bikini, Boyshort, Hi-waist, and Others. The Brief sub-segment holds the largest market share, accounting for 42% in 2024, driven by its broad appeal for everyday wear and comfort. Consumer preference for versatility and the ability to provide full coverage contributes significantly to its dominance. The Boyshort and Hi-waist sub-segments follow closely, appealing to specific consumer needs for additional support and coverage. As demand for sustainable, comfortable, and stylish period panties grows, the Brief segment is expected to continue leading the market.

- For instance, Hi-waist period panties are gaining traction, as reflected in product launches focused on providing better coverage and abdomen support, highlighted by companies such as Thinx incorporating high-waist designs for added security during menstruation.

By Absorbency Level

The absorbency level segment includes Light Flow, Medium Flow, and Heavy Flow options. The Medium Flow sub-segment leads the market with a 38% share in 2024, reflecting its wide usage among consumers with average menstrual flow. This popularity is driven by the versatility of Medium Flow products, which cater to a broad range of customers, offering a balance between comfort and functionality. Heavy Flow panties are also gaining traction due to the growing demand for products that provide greater protection, while Light Flow items are preferred for lighter days or spot protection.

- For instance, Procter & Gamble’s focus on ultra-thin sanitary pads that provide discreet protection for lighter flow days while maintaining absorbency.

By Price Range

In the price range segment, Premium, Mid-range, and Economy categories drive market segmentation. The Premium segment dominates with a 45% share in 2024, fueled by rising consumer demand for high-quality, eco-friendly materials and superior comfort. Premium products often feature advanced technology, such as odor control and leakproof designs, appealing to environmentally conscious consumers. The Mid-range and Economy segments cater to budget-conscious buyers, with the Mid-range sub-segment offering a balance between quality and price, while the Economy sub-segment is attracting a growing customer base seeking affordability without compromising on functionality.

Key Growth Drivers

Increasing Consumer Awareness of Sustainability

A major growth driver for the Reusable Period Panties Market is the growing awareness of sustainability. As consumers become more environmentally conscious, they are shifting away from disposable period products toward reusable alternatives. This trend is bolstered by the rising concern over the environmental impact of single-use sanitary products, which contribute significantly to landfill waste. Reusable period panties are positioned as an eco-friendly solution, attracting environmentally aware consumers who seek to reduce waste while maintaining comfort and hygiene during menstruation.

- For instance, Eve Essentials partnered with SASMIRA to launch eco-friendly, compostable period panties in India that address pollution caused by disposable pads, reducing landfill waste.

Rising Demand for Comfort and Convenience

The growing demand for comfort and convenience is another key driver for the Reusable Period Panties Market. Consumers increasingly prefer period products that offer both functionality and comfort, leading to a surge in the adoption of reusable panties. These products are designed to provide a superior fit, breathable fabrics, and all-day comfort. This shift reflects a broader movement toward products that align with a busy lifestyle, where easy-to-use, leakproof, and odor-resistant solutions are highly valued, driving substantial growth in the market.

- For instance, Thinx, a leading brand, reports that their period panties are designed with breathable modal fabrics and multi-layer leak protection technology to provide all-day comfort and confidence.

Cost-Effectiveness Over Time

Cost-effectiveness is driving the increasing adoption of reusable period panties. Despite a higher upfront cost compared to disposable alternatives, the long-term savings associated with reusable products make them an attractive choice for consumers. As reusable panties can last for several years, they provide significant cost savings in the long run. This financial advantage, combined with their eco-friendly benefits, appeals to budget-conscious individuals, further accelerating market growth and driving consumer preference for reusable options over time.

Key Trends & Opportunities

Rise in Personalization and Product Innovation

Personalization and product innovation represent significant opportunities in the Reusable Period Panties Market. Manufacturers are increasingly focusing on creating a variety of styles, sizes, and absorbency levels to cater to individual consumer needs. Additionally, technological advancements are enabling the development of period panties with enhanced features, such as antimicrobial properties, moisture-wicking fabrics, and improved leakproof designs. This innovation allows brands to appeal to a broader consumer base, enhancing product appeal and driving market expansion through personalized solutions for different flow types and lifestyle preferences.

- For instance, Knix offers inclusive sizing with gender-neutral designs and specialized overnight protection products, addressing lifestyle preferences and expanding market reach.

Growth in E-Commerce and Online Retail

The growth of e-commerce and online retail is a key trend in the Reusable Period Panties Market. With the increasing shift toward online shopping, many consumers prefer to purchase period panties from the convenience of their homes. E-commerce platforms offer a wide range of brands, product types, and pricing options, allowing consumers to compare and select based on their preferences. This trend is supported by enhanced online marketing, customer reviews, and detailed product descriptions, creating a favorable environment for the market to reach a broader and more diverse customer base.

- For instance, Modibodi, known for its reusable period underwear, credits its success to positive customer reviews and expanding e-commerce presence, which allowed it to reach a broader and diverse consumer base effectively.

Key Challenges

Cultural and Societal Barriers

Cultural and societal barriers remain a significant challenge for the Reusable Period Panties Market. In many regions, menstruation remains a taboo subject, and there is a lack of open discussion about menstruation products, which can hinder the adoption of reusable alternatives. Traditional disposable products dominate due to long-established cultural norms and practices. Overcoming these barriers requires education and awareness campaigns to normalize the use of reusable period products and promote their benefits. Until these societal perceptions change, market growth may remain limited in certain regions.

Challenges in Consumer Adoption Due to Perceived Inconvenience

Despite the advantages of reusable period panties, some consumers still perceive them as inconvenient compared to traditional disposable options. Concerns about cleaning, drying, and the maintenance of reusable panties often deter potential users. While these products are designed to be durable and easy to maintain, overcoming these perceptions requires clear communication about their practical benefits, ease of use, and long-term cost savings. Educating consumers on the convenience of care and maintenance is essential to fostering wider adoption and expanding market penetration.

Regional Analysis

North America

North America holds the leading position in the global Reusable Period Panties Market, with a revenue share of 39.1% in 2024. High menstrual-hygiene awareness, widespread acceptance of sustainable menstrual products, and rising demand for comfort and convenience underpin this dominance. Consumers in the U.S. and Canada increasingly prefer leak-proof, reusable underwear over traditional menstrual products, reflecting shifting preferences toward eco-friendly and health-conscious solutions. Robust retail and online distribution channels further enhance accessibility and support sustained growth in the region.

Europe

Europe represents a significant portion of the reusable period panties market, contributing 28.4% of the global market share in 2024. The region benefits from a strong cultural inclination toward sustainability and environmental responsibility—factors that favor reusable feminine-hygiene product adoption. Progressive regulatory frameworks and relatively high per-capita income levels support consumer willingness to invest in premium, eco-friendly menstrual wear. Additionally, easy access through diverse retail channels and growing hygiene awareness contribute to steady uptake of reusable period underwear across major markets such as Germany, the U.K., and France.

Asia Pacific

Asia Pacific is the fastest-growing region in the Reusable Period Panties Market, with an anticipated market share of 18.9% in 2024. The region’s growth is driven by rising urbanization, expanding middle-class populations, increasing female workforce participation, and growing awareness about menstrual hygiene. Countries like China and India show strong growth potential as consumers become more receptive to sustainable menstrual products. The region’s vast population base and rapidly evolving retail and e-commerce infrastructure provide a fertile ground for market expansion. Increased affordability and rising environmental consciousness are also accelerating adoption.

Central & South America

The Central & South America region holds a market share of 6.2% in 2024 and presents emerging opportunities for reusable period panties. Supported by a growing middle class and increasing awareness of menstrual health, the region is experiencing gradual demand for sustainable menstrual wear. As disposable incomes rise and lifestyle trends evolve, more consumers are turning to eco-friendly menstrual solutions. With expanding e-commerce penetration and awareness campaigns on menstrual hygiene, the region is expected to witness gradual growth, offering potential for market expansion in the coming years.

Middle East & Africa (MEA)

The Middle East & Africa region currently accounts for a smaller share of the global reusable period panties market, contributing 7.4% in 2024. Market growth in MEA is constrained by lower awareness, cultural taboos around menstruation, and limited retail infrastructure. However, as sustainability becomes a more prominent concern and public health initiatives promote menstrual hygiene, the region may see gradual increases in acceptance and adoption of reusable menstrual underwear. Incremental improvements in education, urbanization, and access to retail channels will be key to unlocking growth potential in MEA.

Market Segmentations:

By Product Type

- Brief

- Bikini

- Boyshort

- Hi-waist

By Absorbency Level

- Light Flow

- Medium Flow

- Heavy Flow

By Price Range

- Premium

- Mid-range

- Economy

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global Reusable Period Panties Market is led by key players such as Neione, Ruby Love, Proof, Knix Wear, Inc., Rael, and Saalt, LLC. These companies are intensifying competition through continuous product innovations, expanding their distribution channels, and offering a wide variety of styles, absorbency levels, and price points. Market leaders like Knix and Neione focus on brand recognition and product variety, while emerging players like Ruby Love and Proof target niche markets, catering to specific consumer needs such as affordability or specialized absorbency. Sustainability and eco-friendly materials have become a critical differentiator as consumers increasingly prioritize environmental responsibility. Competitive pressure is growing as regional brands and new entrants offer innovative solutions, compelling established players to invest in R&D, enhance product offerings, and optimize marketing strategies. This dynamic environment is driving rapid growth and evolution in the reusable period panties market.

Key Player Analysis

- Ruby Love

- Rael

- Knix

- Dear Kate

- Organicup

- Saalt

- Lively

- Modibodi

- Proof

- Period Panteez

Recent Developments

- In February 2025 Healthfab – the startup behind reusable period panties -raised USD 1 million in a pre‑Series A funding round to scale operations and expand its product reach.

- In April 2024 Thinx rolled out styles featuring its new LeakSafe™ Barrier technology across its full product line, enhancing leak‑proof protection for up to 12 hours.

- In 2022 Modibodi partnered with PUMA to launch a co‑branded range of leak‑free period underwear and activewear, targeting women with active lifestyles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Absorbency Level. Price Range, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market for reusable period panties is expected to expand significantly as more consumers shift from disposable menstrual products to sustainable, eco‑friendly alternatives.

- Growing awareness about environmental impact and menstrual hygiene will continue to drive demand, with buyers increasingly valuing leak‑proof, reusable underwear that reduces plastic waste and long‑term costs.

- Innovations in fabric technology such as moisture‑wicking, odor‑control, antimicrobial treatments, and improved leak protection will improve comfort and performance, pushing broader adoption.

- Expansion of e‑commerce and online retail channels will make period panties more accessible globally, enabling brands to reach customers beyond traditional retail markets.

- Rising female workforce participation and increasing urbanization especially in emerging economies will fuel demand for convenient, reusable menstrual wear suitable for active and professional lifestyles.

- Growing acceptance and destigmatization of menstruation combined with increased menstrual hygiene education will foster wider adoption of reusable period panties across diverse demographics.

- Manufacturers are likely to expand product portfolios offering diverse sizes, absorbency levels, fits, and price ranges to cater to varied consumer needs and preferences.

- As cost‑effectiveness over time becomes more evident, mid-range and economy reusable panties will gain traction among budget-conscious consumers, widening market reach beyond premium buyers.

- Increasing regulatory and NGO support for menstrual health and sustainability, especially in developing regions, may boost adoption and market penetration in previously underpenetrated geographies.

- Collaborations between brands, health organizations, and retailers coupled with targeted awareness campaigns will play a key role in normalizing reusable menstrual products and accelerating market growth globally.

Market Segmentation Analysis:

Market Segmentation Analysis: