Market Overview

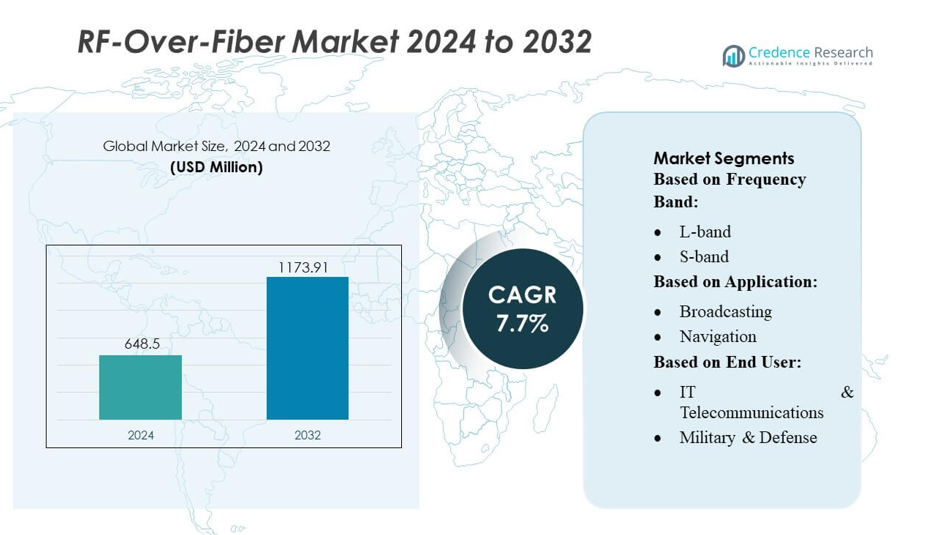

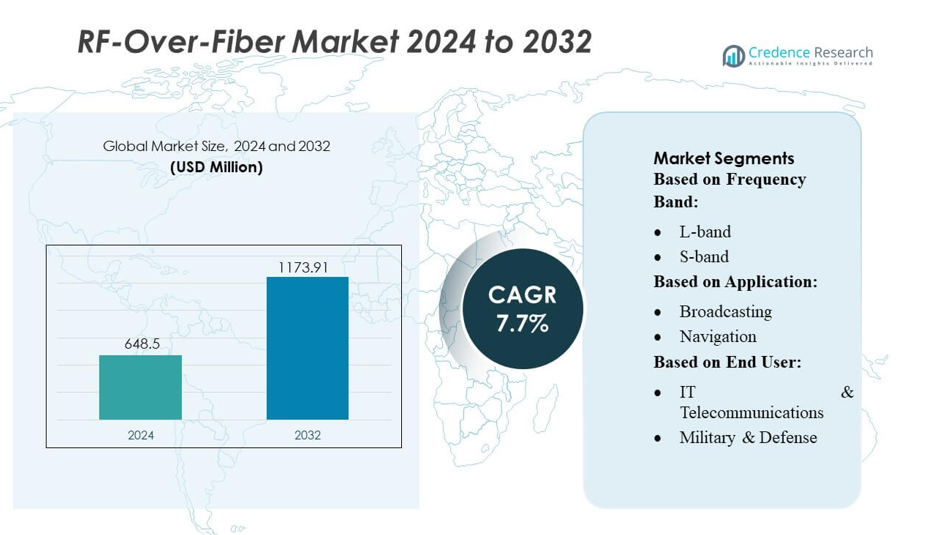

RF-Over-Fiber Market size was valued USD 648.5 million in 2024 and is anticipated to reach USD 1173.91 million by 2032, at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| RF-Over-Fiber Market Size 2024 |

USD 648.5 million |

| RF-Over-Fiber Market, CAGR |

7.7% |

| RF-Over-Fiber Market Size 2032 |

USD 1173.91 million |

The RF-Over-Fiber market is characterized by intense competition, with leading companies such as Murata Manufacturing Co. Limited, IQE plc, TDK Corporation, Renesas Electronics Corporation, Fujitsu Limited, Taiwan Semiconductor Manufacturing Co. Limited, Texas Instruments, Inc., ROHM Co., Ltd, Broadcom, Inc., and NXP Semiconductors driving innovation and expansion. These players focus on developing high-frequency optical components, miniaturized RF-over-fiber modules, and low-loss transmission solutions to meet rising demand across telecommunications, aerospace, defense, and industrial sectors. North America emerges as the leading region, capturing approximately 32% of the global market, driven by early adoption of 5G, advanced telecom infrastructure, and substantial defense investments. Strategic collaborations, continuous R&D, and deployment of high-capacity, low-latency networks position these companies to maintain competitive advantage while addressing the growing global need for secure and reliable RF-over-fiber communication solutions.

Market Insights

- The RF-Over-Fiber market was valued at USD 648.5 million in 2024 and is expected to reach USD 1173.91 million by 2032, growing at a CAGR of 7.7% during the forecast period.

- North America leads the market with a 32% share, driven by early 5G adoption, advanced telecom infrastructure, and high defense spending, followed by Asia-Pacific and Europe as key growth regions.

- Market growth is fueled by rising demand for high-capacity, low-latency networks across telecommunications, aerospace, defense, and industrial sectors, supported by miniaturized and low-loss RF-over-fiber solutions.

- Trends include integration with satellite and broadband networks, development of energy-efficient and compact modules, and expansion in emerging markets with increasing urbanization and infrastructure investments.

- The competitive landscape is intense, with key players focusing on innovation, R&D, strategic partnerships, and new product development, while challenges include high implementation costs and technical complexity in deploying RF-over-fiber solutions globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Frequency Band

The RF-Over-Fiber market segmented by frequency band highlights L-band as the dominant sub-segment, capturing approximately 35% of the market share in 2025. L-band adoption is driven by its extensive use in satellite communications, navigation, and aeronautical applications, where low atmospheric attenuation and wide coverage are critical. S-band and C-band follow closely, favored in radar and telecommunication networks. Growth across higher frequency bands such as X, Ku, and Ka is propelled by demand for high-capacity broadband transmission and next-generation satellite communication systems, emphasizing low latency and enhanced signal integrity.

- For instance, Murata Manufacturing has recently launched a high‑frequency filter based on its proprietary XBAR technology that supports passband frequencies from 5150 to 7125 MHz, with an insertion loss of 2.2 dB and a return loss of 17 dB.

By Application

In terms of application, telecommunications leads the RF-Over-Fiber market, accounting for roughly 40% of the market share, fueled by the rapid expansion of fiber-based mobile backhaul and 5G network deployments. Broadcasting and navigation applications maintain steady growth, leveraging RF-over-fiber solutions for long-distance signal distribution and satellite communication. Radar and broadband applications are increasingly adopting the technology for enhanced range and signal fidelity. Key drivers include the need for low-loss transmission over long distances, immunity to electromagnetic interference, and the push for more compact and integrated network infrastructure.

- For instance, LEO satellites are crucial for satellite-based 5G networks because they provide low latency, and Anritsu’s MT8000A is a 5G test platform that supports Non-Terrestrial Network (NTN) testing, which is essential for validating these LEO communications.

By End User

Within end-user segments, IT & Telecommunications dominates with an estimated 42% market share, driven by surging demand for high-speed, reliable data transmission in cloud computing, data centers, and 5G networks. Military & Defense is also a key adopter, utilizing RF-over-fiber for secure, resilient communication and advanced radar systems. Aerospace and industrial sectors are expanding usage for satellite links, telemetry, and precision sensing. Growth is supported by increasing network modernization initiatives, the push for low-latency connectivity, and the requirement for compact, high-performance RF transport solutions in challenging operational environments.

Key Growth Drivers

Expansion of 5G and Next-Generation Networks

The deployment of 5G and next-generation mobile networks is a major driver for the RF-Over-Fiber market. Operators increasingly rely on fiber-based RF transport to support high-capacity backhaul, low-latency communication, and seamless connectivity across dense urban and remote areas. The technology enables operators to transmit high-frequency signals over long distances with minimal loss, reducing infrastructure costs while enhancing network performance. Rapid global adoption of 5G, combined with the shift toward network densification and small-cell deployment, continues to fuel strong market demand.

For instance, MediaTek’s MT6825 chipset, compliant with 3GPP Release-17, operates in the L- and S-bands, facilitating two-way satellite communication for IoT applications.

Rising Demand from Aerospace and Defense Applications

Aerospace and defense sectors drive RF-Over-Fiber adoption due to the need for high-performance, secure, and interference-resistant communication systems. Military radar, surveillance, and electronic warfare applications benefit from low-loss, lightweight fiber solutions that maintain signal integrity under extreme conditions. Similarly, aerospace systems increasingly integrate RF-over-fiber for satellite communication, telemetry, and in-flight data transmission. Heightened global defense spending, modernization of military infrastructure, and growing adoption of unmanned systems are further expanding market growth opportunities in these critical end-user sectors.

For instance, SoftBank launched Eutelsat OneWeb satellite connectivity services in Japan. The company offers eight service plans with peak communication speeds up to 195 Mbps downlink and 32 Mbps uplink, utilizing the Low Earth Orbit (LEO) satellite constellation to provide high-speed, low-latency connectivity for enterprise and government use across Japan.

Increasing Broadband and Satellite Communication Requirements

The growth of broadband and satellite communication services contributes significantly to RF-Over-Fiber market expansion. Operators and service providers leverage the technology to transmit high-frequency signals over long distances efficiently, ensuring high data throughput and minimal signal degradation. Rising demand for direct-to-home broadcasting, satellite internet, and maritime communications is driving widespread adoption. Additionally, the push for compact, integrated network architectures and low-latency communication in urban and remote areas further reinforces the need for RF-over-fiber solutions across multiple applications.

Key Trends & Opportunities

Integration with Photonic and Hybrid Systems

The integration of RF-over-fiber solutions with photonic and hybrid optical-electrical systems is a growing trend. This approach enables higher bandwidth capacity, reduced signal loss, and more compact, energy-efficient deployments. Opportunities exist in next-generation radar, telecom backhaul, and satellite communication systems, where seamless integration can lower operational costs and improve performance. The trend toward hybrid architectures also supports scalable and flexible networks, meeting evolving user demands and enabling service providers to offer enhanced, multi-functional communication solutions.

For instance, Ericsson, Qualcomm Technologies, and Thales Alenia Space achieved a significant milestone by establishing a 3GPP-based end-to-end New Radio (NR) 5G non-terrestrial network (NTN) call using a lab-emulated low Earth orbit (LEO) satellite.

Expansion in Emerging Economies

Emerging markets in Asia-Pacific, Latin America, and Africa present significant growth opportunities. Rapid urbanization, expanding telecommunication infrastructure, and increasing demand for broadband services are driving RF-Over-Fiber adoption. Investments in modernized defense and aerospace networks further support market penetration. Regional governments and private players are actively deploying advanced fiber networks to meet connectivity needs, making these regions attractive for both established vendors and new entrants seeking to capture high-growth opportunities in underdeveloped but fast-growing markets.

For instance, Siemens’ digital twin and model‐based systems engineering (MBSE) solution for aerospace reports a 96% on-time delivery rate and a 90% reduction in labor hours during conceptual design.

Miniaturization and Low-Power Solutions

The trend toward compact, low-power RF-over-fiber solutions is creating opportunities in both commercial and defense sectors. Advances in miniaturized optical components and energy-efficient designs allow deployment in space-constrained environments, aircraft, and portable military systems. These solutions improve reliability while reducing weight and power consumption, aligning with industry demands for sustainable, high-performance communication systems. Vendors focusing on miniaturized, integrated modules are poised to gain a competitive edge as more applications demand lightweight, efficient, and scalable RF transmission networks.

Key Challenges

High Implementation and Maintenance Costs

High capital expenditure and operational costs pose a significant challenge for RF-Over-Fiber adoption. The technology requires specialized optical components, installation expertise, and ongoing maintenance to ensure signal integrity, particularly over long-distance or high-frequency networks. For smaller operators and industrial end-users, these costs can limit deployment. Additionally, system upgrades and integration with existing infrastructure may require significant investment, creating barriers for widespread adoption despite the clear performance advantages of RF-over-fiber solutions.

Technical Complexity and Signal Compatibility Issues

Technical complexity and compatibility with existing RF and optical infrastructure challenge market growth. Integrating RF-over-fiber solutions with legacy systems often requires custom engineering and precise calibration to prevent signal loss, latency, or interference. Variability in optical component quality, environmental conditions, and network topology can further complicate deployment. End-users, particularly in aerospace and defense, face stringent performance and reliability requirements, making technical expertise essential. These challenges necessitate ongoing innovation and skilled workforce availability to support market expansion.

Regional Analysis

North America

North America leads the RF-Over-Fiber market with an estimated 32% share in 2025, driven by advanced 5G deployment, strong defense spending, and mature telecommunications infrastructure. The United States spearheads growth through investments in satellite communications, radar systems, and fiber-based backhaul networks. Rising demand for high-capacity, low-latency networks and adoption of miniaturized, high-frequency optical components further support regional expansion. Strategic collaborations between vendors and service providers, combined with continuous infrastructure modernization, ensure North America remains a dominant market with steady growth prospects over the forecast period.

Asia-Pacific

Asia-Pacific holds around 28% of the market, emerging as the fastest-growing region. Growth is fueled by rapid urbanization, large-scale 5G and broadband deployments, and defense modernization programs. China, India, and Japan are key contributors, leveraging RF-over-fiber for telecom backhaul, satellite communications, and industrial applications. Government initiatives, rising R&D investment, and smart city projects further accelerate adoption. Increasing demand for low-latency, high-speed networks in both commercial and defense sectors positions Asia-Pacific as a high-potential region with strong long-term growth opportunities.

Europe

Europe accounts for approximately 25% of the RF-Over-Fiber market, supported by well-established aerospace, defense, and telecommunication sectors. Germany, France, and the UK drive adoption through investments in satellite communication, radar systems, and 5G backhaul infrastructure. Regulatory support for broadband expansion and low-emission networks enhances growth. The trend toward compact, integrated RF-over-fiber solutions improves signal reliability and reduces latency. Defense modernization programs and collaborative R&D projects across the region are expected to sustain moderate but steady growth, maintaining Europe’s significant position in the global market.

Latin America

Latin America contributes about 7% of the RF-Over-Fiber market. Growth is driven by expanding broadband networks, emerging defense infrastructure, and satellite communication projects in countries such as Brazil, Mexico, and Argentina. RF-over-fiber solutions are increasingly deployed for secure communications, telecom modernization, and industrial applications. Market expansion is supported by government initiatives and partnerships with global technology vendors, despite challenges related to high implementation costs and technical expertise limitations. The region is expected to experience gradual growth as connectivity and infrastructure projects continue to expand.

Middle East

The Middle East represents approximately 8% of the RF-Over-Fiber market. Investments in defense modernization, satellite communications, and advanced telecom networks in countries like Saudi Arabia, UAE, and Qatar drive adoption. Demand is particularly high for secure, high-speed, and low-latency RF transmission in both military and commercial applications. Strategic collaborations with global vendors and government-led infrastructure initiatives support growth. While high costs and specialized technical requirements pose challenges, continued focus on network modernization and regional connectivity projects is expected to sustain steady market growth over the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Frequency Band:

By Application:

By End User:

- IT & Telecommunications

- Military & Defense

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The RF-Over-Fiber market is highly competitive, with key players including Murata Manufacturing Co. Limited, IQE plc, TDK Corporation, Renesas Electronics Corporation, Fujitsu Limited, Taiwan Semiconductor Manufacturing Co. Limited, Texas Instruments, Inc., ROHM Co., Ltd, Broadcom, Inc., and NXP Semiconductors. The RF-Over-Fiber market is highly competitive, driven by continuous innovation and technological advancements. Companies are focusing on developing high-frequency optical components, low-loss fiber solutions, and miniaturized RF-over-fiber modules to meet the growing demand for high-capacity, low-latency networks. Strategic initiatives such as mergers and acquisitions, partnerships with telecom operators, defense agencies, and aerospace manufacturers, as well as geographic expansion, are shaping market dynamics. Vendors are increasing R&D investments to enhance product performance, reliability, and integration capabilities. The emphasis on scalable, energy-efficient, and cost-effective solutions is enabling companies to differentiate themselves, capture new applications, and maintain long-term competitiveness across commercial, industrial, and defense sectors globally.

Key Player Analysis

Recent Developments

- In November 2025, the Indian government issued notifications to revoke several existing Quality Control Orders (QCOs) on various polyester fibers and intermediates, including polyester staple fibers and yarns. This decision removed the mandatory Bureau of Indian Standards (BIS) certification requirement for both domestically produced and imported materials.

- In January 2025, Ambercycle and Benma Group announced a strategic partnership to increase the production of Cycora staple fibers for the global textile market. This collaboration leverages Benma’s manufacturing capabilities with Ambercycle’s circular material technology to provide a high-quality regenerated polyester alternative to virgin resources.

- In October 2024, CG Power, part of the Murugappa Group, acquired Renesas’ RF components business for entering the semiconductor design sector. The acquisition includes IP, tangible assets, and select employees in areas like semiconductor design, marketing, and applications.

Report Coverage

The research report offers an in-depth analysis based on Frequency Band, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of RF-over-fiber solutions will accelerate with the global expansion of 5G and next-generation networks.

- Demand for high-capacity, low-latency communication systems will continue to drive market growth across commercial and defense sectors.

- Integration with satellite communication and broadband networks will expand, supporting long-distance, reliable signal transmission.

- Miniaturized and energy-efficient RF-over-fiber modules will see increasing deployment in aerospace and industrial applications.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East will offer significant growth opportunities.

- Advancements in photonic and hybrid optical-electrical systems will enhance performance and bandwidth capabilities.

- Strategic collaborations between technology vendors and telecom or defense operators will shape market dynamics.

- Investment in research and development will drive innovation in low-loss, high-frequency fiber solutions.

- Demand for secure and interference-resistant communication networks will increase, particularly in defense and critical infrastructure.

- Market expansion will be supported by the trend toward integrated, scalable, and cost-effective RF-over-fiber solutions.