Market Overview:

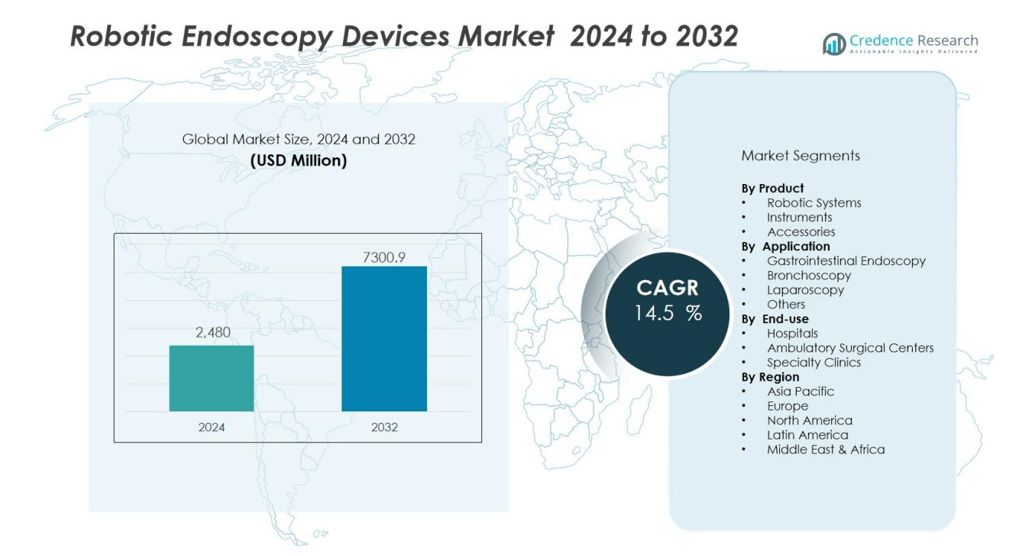

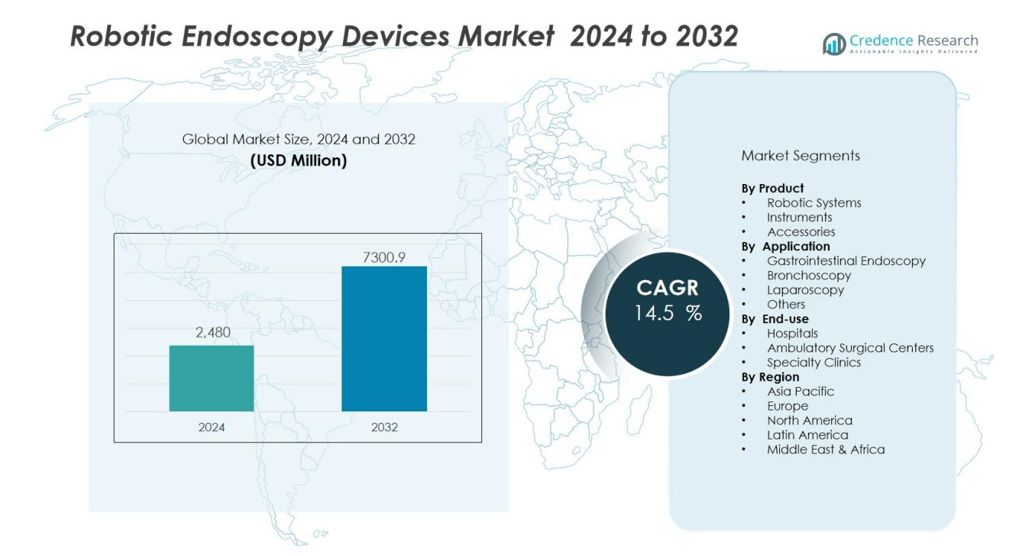

The robotic endoscopy devices market size was valued at USD 2,480 million in 2024 and is anticipated to reach USD 7300.9 million by 2032, at a CAGR of 14.5% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Robotic Endoscopy Devices Market Size 2024 |

USD 2,480 million |

| Robotic Endoscopy Devices Market, CAGR |

14.5% |

| Robotic Endoscopy Devices Market Size 2032 |

USD 7300.9 million |

Key drivers include the rising prevalence of gastrointestinal disorders, lung diseases, and cancers requiring advanced endoscopic solutions. Technological innovations, such as AI integration, enhanced imaging, and flexible robotic platforms, are accelerating adoption. Increasing patient preference for minimally invasive interventions, shorter hospital stays, and reduced recovery times also fuels demand. Growing investments from medical device companies and strategic collaborations with healthcare providers further strengthen the market outlook.

Regionally, North America leads the market, supported by advanced healthcare infrastructure, high patient awareness, and strong adoption of robotic surgical systems. Europe follows closely, driven by rising government healthcare spending and rapid adoption in leading economies like Germany and the U.K. Asia-Pacific is anticipated to register the fastest growth, fueled by increasing healthcare investments, expanding patient pools, and rapid adoption of advanced technologies across China, India, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The robotic endoscopy devices market was valued at USD 2,480 million in 2024 and will reach USD 7,300.9 million by 2032.

- Rising gastrointestinal and respiratory disorders continue to drive adoption of robotic-assisted diagnostic and surgical systems.

- Technological advances, including AI-based navigation, enhanced imaging, and flexible robotic arms, are improving clinical precision.

- Patient demand for minimally invasive procedures supports growth through faster recovery, smaller incisions, and improved outcomes.

- High system costs, training requirements, and limited reimbursement remain major barriers in smaller healthcare facilities.

- North America held 38% market share in 2024, while Europe followed with 29% and Asia-Pacific with 24%.

- Asia-Pacific is the fastest-growing region, driven by healthcare investments, larger patient pools, and expanding access to advanced treatments.

Market Drivers:

Rising Burden of Gastrointestinal and Respiratory Disorders:

The robotic endoscopy devices market benefits from increasing cases of gastrointestinal diseases, colorectal cancer, and chronic respiratory conditions. These disorders demand precise diagnostic and therapeutic solutions, which robotic-assisted systems deliver effectively. It offers enhanced accuracy, reduced invasiveness, and quicker patient recovery compared to conventional techniques. Growing awareness of early diagnosis further drives adoption across hospitals and specialty clinics.

- For instance, robotic colorectal surgery using the da Vinci Xi system showed significant clinical improvements with patients experiencing shorter hospital stays (mean: 5.5 ± 4.5 days for colon procedures versus 10.0 ± 11.9 days for conventional surgery) and reduced minor complication rates (6.0% versus 20.0% for colon procedures).

Advancements in Robotic-Assisted Endoscopic Technologies:

Continuous innovation in robotic platforms strengthens the growth of this market. Companies are integrating advanced imaging, AI-based navigation, and flexible robotic arms to improve precision and safety. It provides physicians with superior control during complex procedures, minimizing errors and complications. Such technological progress enhances clinical outcomes, encouraging wider acceptance among healthcare providers.

- For instance, Medtronic’s Hugo™ robotic-assisted surgery system achieved a remarkable 98.5% surgical success rate in their Expand URO clinical study, significantly exceeding the performance goal of 85% (p<0.0001) established from published literature.

Rising Demand for Minimally Invasive Procedures:

Patient preference for minimally invasive surgeries continues to rise globally. Robotic endoscopy systems support this shift by offering smaller incisions, reduced hospital stays, and faster recovery times. It enables healthcare providers to improve patient satisfaction while optimizing resource use. The trend is especially strong in oncology and gastroenterology, where early interventions significantly improve survival rates.

Expanding Healthcare Infrastructure and Investments:

The robotic endoscopy devices market benefits from strong investments in healthcare infrastructure, particularly in emerging economies. Governments and private providers are allocating funds to upgrade surgical capabilities and adopt advanced technologies. It aligns with the growing focus on improving patient outcomes and efficiency in clinical workflows. Strategic partnerships between medical device manufacturers and healthcare institutions further accelerate global adoption.

Market Trends:

Integration of Artificial Intelligence and Advanced Imaging in Robotic Platforms:

The robotic endoscopy devices market is witnessing rapid adoption of AI-powered technologies and advanced imaging systems. AI-based tools are improving navigation, enhancing lesion detection, and supporting real-time decision-making during procedures. It enables physicians to achieve higher precision while reducing the risk of missed diagnoses. High-definition 3D imaging and narrow-band imaging features are also being incorporated into robotic platforms, ensuring improved visualization of complex anatomical structures. The combination of robotics with AI enhances workflow efficiency and procedural safety. This trend is expanding opportunities for early disease detection, particularly in oncology and gastrointestinal applications.

- For instance, Intuitive Surgical’s da Vinci Xi robotic system achieves submillimetric accuracy with calibrated mean error of 0.97 mm, while Olympus’s ENDOANGEL AI system demonstrates real-time gastric cancer detection with 84.7% accuracy per lesion and 100% sensitivity.

Growing Adoption of Flexible Robotic Endoscopy and Outpatient Care Expansion:

Flexible robotic endoscopy systems are gaining popularity due to their ability to reach hard-to-access areas with greater accuracy. Hospitals and outpatient centers are embracing these solutions to improve patient throughput and reduce procedural complications. It aligns with the broader healthcare shift toward minimally invasive treatments and shorter recovery times. The expansion of outpatient care facilities across developed and emerging regions is fueling demand for compact, cost-efficient robotic systems. Companies are responding by introducing scalable devices that fit both high-volume hospitals and smaller clinics. This trend underscores the market’s focus on accessibility, affordability, and broader integration across healthcare ecosystems.

- For instance, the EndoMaster EASE robotic system demonstrated remarkable efficiency in colorectal endoscopic submucosal dissection with a median robotic dissection time of 49 minutes and achieved an 83.8% complete resection rate, while maintaining a technical success rate of 86.0% across 43 patients.

Market Challenges Analysis:

High Cost of Robotic Endoscopy Systems and Limited Accessibility:

The robotic endoscopy devices market faces challenges from the high cost of systems and procedures. Advanced robotic platforms require significant investment, making them less affordable for smaller hospitals and clinics. It limits access in low- and middle-income regions where healthcare budgets are constrained. The cost of training healthcare professionals and maintaining robotic systems adds further financial strain. Reimbursement limitations in certain countries also slow adoption rates. These economic barriers restrict widespread use despite proven clinical benefits.

Technical Limitations and Shortage of Skilled Professionals:

Robotic endoscopy systems, though advanced, face technical challenges such as equipment complexity and limited compatibility with existing clinical workflows. It often requires specialized training, which creates dependency on highly skilled operators. The global shortage of trained surgeons and technicians affects the pace of adoption. System downtime and potential technical errors during procedures can reduce confidence among healthcare providers. Concerns over data privacy and integration of AI-driven features also create hesitation in some markets. Addressing these limitations remains crucial for sustainable growth and broader acceptance.

Market Opportunities:

Expanding Role of Robotic Endoscopy in Early Disease Detection:

The robotic endoscopy devices market holds strong opportunities in early disease detection and preventive care. Rising incidences of gastrointestinal cancers and pulmonary disorders are increasing demand for accurate diagnostic solutions. It enables early intervention by providing enhanced visualization and precision-guided biopsies. Healthcare systems are investing in advanced technologies that support less invasive and more reliable screening methods. Growing patient awareness of preventive healthcare is further driving adoption. This creates favorable conditions for manufacturers to introduce innovative diagnostic platforms with AI-driven support tools.

Growth Potential in Emerging Economies and Outpatient Care Settings:

Emerging economies present untapped opportunities due to rising healthcare investments and infrastructure upgrades. Governments and private providers in Asia-Pacific, Latin America, and the Middle East are prioritizing advanced medical technologies. It aligns with the growing trend of establishing outpatient care centers that demand compact and cost-efficient robotic systems. Manufacturers are responding with scalable devices designed for smaller facilities and regional hospitals. The shift toward minimally invasive care in these markets opens avenues for broader adoption. Partnerships with local healthcare providers and distributors will further strengthen market penetration.

Market Segmentation Analysis:

By Product:

The robotic endoscopy devices market by product includes robotic systems, instruments, and accessories. Robotic systems dominate due to their integration with advanced imaging and navigation technologies. It provides physicians with higher precision and improved control during complex procedures. Instruments such as robotic arms and specialized tools support accuracy in diagnostics and surgery. Accessories like visualization devices and software platforms further enhance efficiency. Continuous product innovation strengthens this segment’s role in driving market adoption.

- For instance, Intuitive Surgical’s da Vinci 5 system brings over 10,000x more computing power than its predecessor and features 150 design innovations that deliver greater surgeon autonomy and advanced data analytics

By Application:

Applications in the market span gastrointestinal endoscopy, bronchoscopy, laparoscopy, and others. Gastrointestinal endoscopy holds the largest share due to the rising prevalence of colorectal cancer and other digestive disorders. It supports early disease detection, enabling improved patient outcomes. Bronchoscopy is gaining traction with rising cases of lung cancer and chronic respiratory diseases. Laparoscopy adoption is expanding in minimally invasive surgical practices across hospitals. Growing demand for precision-based treatments continues to elevate the role of robotic-assisted applications.

- For Instances, Aspero Medical’s Ancora-SB balloon overtube system received FDA clearance in 2023 and has been successfully deployed in hospitals, with the company securing $4.5 million in funding through the Anschutz Acceleration Initiative for further product development.

By End-use:

The robotic endoscopy devices market by end-use is segmented into hospitals, ambulatory surgical centers, and specialty clinics. Hospitals dominate the segment with large-scale adoption of advanced robotic platforms. It reflects strong investment capacity, broader patient volumes, and availability of skilled surgeons. Ambulatory surgical centers are emerging as a key growth area due to rising preference for outpatient procedures. Specialty clinics are focusing on niche applications, expanding access to targeted treatments. This diversification ensures balanced adoption across healthcare settings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentations:

By Product:

- Robotic Systems

- Instruments

- Accessories

By Application:

- Gastrointestinal Endoscopy

- Bronchoscopy

- Laparoscopy

- Others

By End-use:

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

By Region:

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America:

North America accounted for 38% market share in 2024, leading the global landscape. The robotic endoscopy devices market in this region benefits from advanced healthcare infrastructure and strong adoption of robotic-assisted procedures. It is supported by favorable reimbursement policies and growing patient awareness of minimally invasive treatments. The presence of key industry players and continuous R&D investments further strengthen growth. Hospitals and specialty clinics in the U.S. and Canada are actively integrating robotic platforms to improve clinical outcomes. Government initiatives focusing on cancer screening and early diagnostics add to the regional momentum.

Europe:

Europe secured 29% market share in 2024, establishing its position as a key contributor. The region benefits from strong healthcare systems in countries like Germany, France, and the U.K. It is driven by high adoption of innovative technologies and increasing demand for advanced surgical solutions. Supportive regulatory frameworks and government funding for healthcare digitization further fuel growth. Hospitals across Western Europe are investing in robotic-assisted platforms to improve efficiency and patient safety. Eastern Europe is also witnessing increased adoption due to growing investments in healthcare infrastructure. Partnerships between medical device firms and healthcare providers continue to expand market reach.

Asia-Pacific:

Asia-Pacific captured 24% market share in 2024, emerging as the fastest-growing region. The robotic endoscopy devices market here is supported by rising investments in healthcare infrastructure and increasing patient demand for advanced treatments. It is further fueled by the growing prevalence of gastrointestinal and respiratory diseases in China, India, and Japan. Rising government healthcare initiatives and private sector investments are creating favorable conditions. Hospitals and clinics across the region are adopting robotic systems to meet the rising burden of chronic diseases. Local manufacturing and distribution partnerships are also reducing costs, enhancing accessibility. The region’s strong focus on adopting minimally invasive procedures ensures sustained growth.

Key Player Analysis:

- Intuitive Surgical

- Novus Health Products R&D Consultancy

- Asensus Surgical US, Inc.

- Medtronic

- CMR Surgical Ltd.

- Olympus Corporation

- KARL STORZ SE & Co. KG, Tuttlingen

- Brainlab AG

- Virtuoso Surgical, Inc.

Competitive Analysis:

The robotic endoscopy devices market is highly competitive with global leaders and emerging innovators shaping its direction. Key players include Intuitive Surgical, Novus Health Products R&D Consultancy, Asensus Surgical US, Inc., Medtronic, CMR Surgical Ltd., and Olympus Corporation. It is defined by strong investments in research and development, enabling the launch of advanced robotic platforms with AI integration and improved imaging capabilities. Companies focus on expanding their product portfolios to address both diagnostic and therapeutic applications. Strategic partnerships with healthcare providers and research institutions strengthen their market presence while ensuring better clinical outcomes. Market leaders emphasize affordability and accessibility to capture demand in both developed and emerging economies. Competition continues to intensify with new entrants offering cost-effective solutions and flexible robotic systems. This dynamic landscape drives innovation and accelerates the adoption of robotic-assisted procedures across hospitals, specialty clinics, and ambulatory surgical centers.

Recent Developments:

- In January 2025, Intuitive Surgical announced plans to establish a direct presence in Italy, Spain, Portugal, Malta, and San Marino by acquiring their da Vinci and Ion distribution businesses in these regions.

- In August 2024, Asensus Surgical completed its acquisition by KARL STORZ Group, making Asensus a subsidiary and expanding KARL STORZ’s capabilities in surgical robotics.

- In July 2025, Medtronic achieved CE Mark approval for its expanded MiniMed 780G System, now accessible to a wider range of insulin-dependent diabetes patients.

Report Coverage:

The research report offers an in-depth analysis based on Product, Application, End-use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The robotic endoscopy devices market will expand with stronger adoption in diagnostic and therapeutic procedures.

- AI-driven imaging and navigation tools will enhance precision, supporting better clinical decision-making.

- Hospitals and specialty clinics will continue investing in robotic systems to reduce procedure risks.

- Patient demand for minimally invasive treatments will accelerate integration of flexible robotic endoscopes.

- Emerging economies will witness stronger uptake due to healthcare infrastructure investments and training initiatives.

- Collaborations between medical device manufacturers and healthcare providers will support innovation and accessibility.

- Outpatient care centers will adopt compact robotic systems, driving growth beyond large hospitals.

- Data integration with hospital information systems will improve workflow efficiency and patient monitoring.

- Regulatory approvals for advanced robotic systems will expand availability in global markets.

- Continuous R&D efforts will focus on cost-effective solutions, making robotic endoscopy more accessible.