Market Overview:

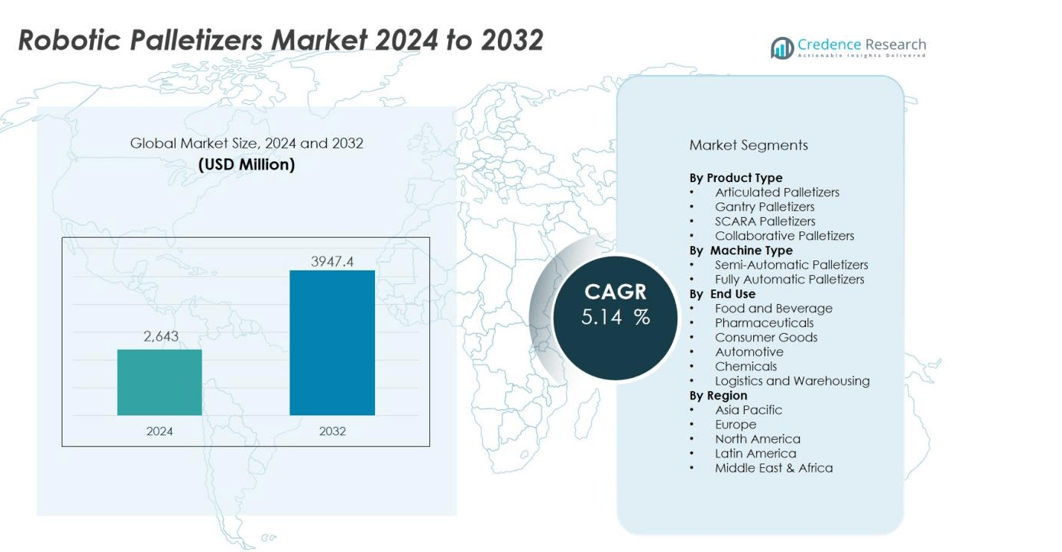

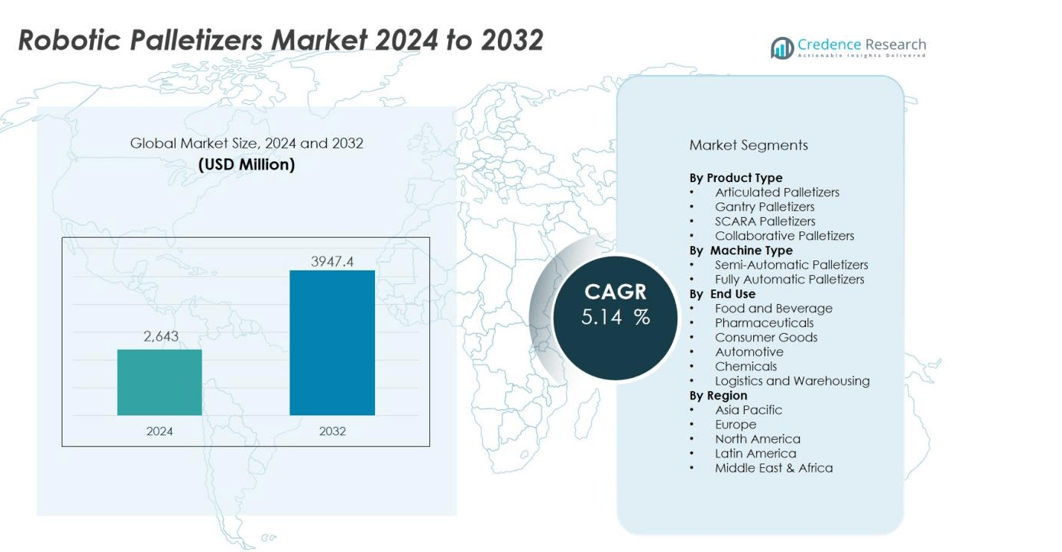

The robotic palletizers market size was valued at USD 2,643 million in 2024 and is anticipated to reach USD 3947.4 million by 2032, at a CAGR of 5.14 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Robotic Palletizers market Size 2024 |

USD 2,643 million |

| Robotic Palletizers market, CAGR |

5.14% |

| Robotic Palletizers market Size 2032 |

USD 3947.4 million |

Key growth drivers include the need for improved operational efficiency, reduced labor costs, and enhanced workplace safety. Robotic palletizers provide consistency, speed, and accuracy, helping manufacturers streamline supply chain operations. Rising demand for flexible systems that can handle varying package sizes and weights is also fueling adoption. Integration of AI, machine vision, and IoT capabilities is further improving accuracy and adaptability, making these solutions essential for modern automated warehouses and production facilities.

Regionally, North America and Europe lead the market due to high automation adoption, strong manufacturing bases, and established logistics networks. Asia-Pacific is projected to grow the fastest, supported by expanding industrialization, booming e-commerce, and government initiatives promoting smart manufacturing in China, India, and Southeast Asia. Emerging regions such as Latin America and the Middle East are gradually adopting robotic palletizers, particularly in food processing and retail sectors, offering new opportunities for market players.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The robotic palletizers market was valued at USD 2,643 million in 2024 and is expected to reach USD 3,947.4 million by 2032, growing at a CAGR of 5.14%.

- Automation adoption in manufacturing and warehousing is a primary driver, helping companies reduce manual intervention and increase efficiency.

- Workplace safety and labor shortages are accelerating demand, as robotic palletizers reduce injury risks and maintain productivity.

- Flexible palletizing systems capable of handling diverse package sizes and weights are gaining importance in industries with varied production needs.

- Integration of AI, IoT, and machine vision is enhancing accuracy, enabling predictive maintenance, and improving adaptability.

- North America led with 34% share in 2024, followed by Europe at 29%, supported by advanced automation infrastructure and strict labor regulations.

- Asia-Pacific held 27% share in 2024 and is projected to grow fastest, driven by industrialization, e-commerce, and smart manufacturing initiatives, while Latin America and Middle East & Africa accounted for 10% with steady adoption.

Market Drivers:

Rising Demand for Automation in Manufacturing and Warehousing:

The robotic palletizers market is driven by the rapid adoption of automation in manufacturing and warehousing sectors. Companies are focusing on minimizing manual intervention to enhance efficiency and reduce operational costs. Automated palletizing solutions provide consistent performance, improve throughput, and ensure precision in handling repetitive tasks. It is becoming a preferred choice for industries looking to modernize supply chain and production operations.

Growing Focus on Workplace Safety and Labor Shortages:

Workplace safety concerns and a shortage of skilled labor are major drivers for robotic palletizer adoption. Industries are under pressure to reduce workplace injuries caused by manual lifting and repetitive palletizing work. Automated systems address these challenges by reducing physical strain on workers and minimizing accidents. It supports businesses in maintaining productivity while dealing with limited workforce availability.

- For instance, ABB’s IRB 460 robotic palletizer handles up to 2,190 cycles per hour with a 60 kg load, significantly reducing manual handling risks and easing labor constraints.

Increasing Need for Flexibility in Packaging and Material Handling:

Industries are producing a wide range of products that require diverse packaging solutions. The robotic palletizers market benefits from demand for flexible systems that can manage different package sizes, shapes, and weights. These solutions allow manufacturers to adapt quickly to changing production needs without frequent equipment adjustments. It improves operational agility and supports the growing trend of product customization.

- For instance, A FANUC M-410iC/185 palletizing robot, like those used in automated snack food facilities, is capable of performing up to 1,700 standard palletizing cycles per hour

Integration of Advanced Technologies to Enhance Efficiency:

The integration of AI, machine vision, and IoT technologies is transforming robotic palletizers into smarter systems. These advancements improve accuracy, enable predictive maintenance, and enhance adaptability to dynamic production environments. Companies gain real-time visibility into operations, enabling better planning and decision-making. It strengthens the role of robotic palletizers as a core element of digitalized manufacturing and logistics strategies.

Market Trends:

Adoption of Collaborative and Flexible Palletizing Systems:

The robotic palletizers market is witnessing a strong trend toward collaborative and flexible systems. Industries are deploying palletizers that can work alongside human operators, improving efficiency without compromising safety. These cobot-based solutions reduce floor space requirements and adapt easily to varying production demands. Manufacturers are also investing in multi-functional palletizers capable of handling mixed case and high-speed applications. It reflects the growing emphasis on versatility to meet diverse packaging and distribution needs.

- For Instance, The FANUC CR-15iA is a 15 kg payload collaborative robot that can be used for palletizing, among other applications, and enables human-robot collaboration on compact production lines.

Growing Role of Digitalization and Sustainability in Operations:

Digitalization and sustainability are shaping the next phase of growth in robotic palletizers. Integration of IoT and AI tools allows companies to monitor performance, optimize maintenance, and reduce downtime. Predictive analytics enables efficient resource use, aligning with corporate goals to improve productivity. Sustainability initiatives are driving demand for energy-efficient palletizing systems and eco-friendly operations. It demonstrates how automation aligns with environmental goals while enhancing long-term cost savings.

- For instance, KUKA’s KR QUANTEC series achieved an average 30% reduction in power consumption per cycle via optimized motion planning and regenerative braking. For instance, the FANUC M-410iB/700 dedicated palletizing robot runs at just 1 kW average power—80% less than a conventional 6-axis palletizer—over a 20 hr/day schedule.

Market Challenges Analysis:

High Initial Investment and Integration Complexity:

The robotic palletizers market faces challenges due to high upfront costs and complex integration requirements. Many small and mid-sized enterprises struggle to justify large capital expenditure despite long-term efficiency benefits. Integration with existing production lines demands specialized expertise, which raises implementation costs further. It can slow adoption in industries with limited budgets or older infrastructure. Businesses also encounter difficulties in training employees to operate and maintain advanced palletizing systems effectively.

Maintenance Needs and Resistance to Automation Adoption:

Maintenance requirements and operational downtime present another barrier for wider adoption of robotic palletizers. Companies must invest in regular servicing, spare parts, and technical support to ensure consistent performance. Downtime during repairs impacts production schedules, creating concerns for manufacturers with high-volume operations. It also faces resistance in regions where manual labor remains abundant and cost-effective. Cultural barriers, fear of job losses, and limited technical awareness restrict adoption in certain markets, despite proven efficiency gains.

Market Opportunities:

Expansion Across E-Commerce and Food Supply Chains:

The robotic palletizers market offers strong opportunities through the expansion of e-commerce and food supply chains. Growing demand for faster delivery and efficient logistics drives investments in automated palletizing solutions. Companies in retail, grocery, and food processing are adopting these systems to handle rising order volumes. It enables businesses to streamline warehouse operations while maintaining consistency in packaging. The trend creates opportunities for vendors to design compact, high-speed, and flexible palletizers that fit diverse distribution needs.

Growth Potential in Emerging Economies and Smart Manufacturing Initiatives:

Emerging economies are investing heavily in automation and industrial modernization, creating new opportunities for robotic palletizers. Governments in Asia-Pacific, Latin America, and the Middle East are promoting smart manufacturing to improve competitiveness. Rising labor costs and safety regulations further encourage companies to shift toward automated palletizing systems. It positions the market to expand beyond traditional regions into new industrial hubs. Vendors focusing on affordable, scalable, and technologically advanced solutions are well placed to capture demand in these growing markets.

Market Segmentation Analysis:

By Product Type:

The robotic palletizers market by product type is segmented into articulated, gantry, SCARA, and collaborative palletizers. Articulated robots dominate due to their flexibility, speed, and ability to handle complex palletizing tasks. Gantry palletizers are preferred in industries requiring high load capacity and large-scale operations. SCARA palletizers find niche applications where compact design and moderate speed are essential. Collaborative palletizers are expanding in demand due to safe human-machine interaction and suitability for small-scale industries. It highlights a shift toward versatile and space-efficient systems that cater to diverse industrial requirements.

- For instance, the Yamaha YK400XR SCARA robot operates at speeds up to 6,000 mm/sec, combining space-saving design with reliable throughput for applications like assembly and material handling in electronics manufacturing

By Machine Type:

The market by machine type includes semi-automatic and fully automatic palletizers. Fully automatic palletizers hold the larger share due to their ability to deliver continuous, high-speed operations with minimal human input. Industries such as food and beverage, logistics, and pharmaceuticals are key adopters of these machines to reduce costs and improve accuracy. Semi-automatic palletizers remain relevant for small and mid-sized enterprises with limited automation budgets. It reflects the balance between cost efficiency and operational needs, driving choices based on scale of production.

- For instance, FANUC Robotics’ M-410 series fully automatic palletizer is capable of high-speed operation, with some models handling significantly more than 700 cycles per hour, which significantly improves throughput and reduces manual labor.

By End Use:

The robotic palletizers market by end use covers food and beverage, pharmaceuticals, consumer goods, automotive, chemicals, and logistics. Food and beverage industries lead adoption to manage rising packaging volumes and ensure product consistency. Logistics and e-commerce sectors are witnessing rapid uptake due to rising demand for fast, reliable order fulfillment. Pharmaceuticals and consumer goods are adopting palletizers to meet stringent handling standards and growing product diversity. It is also finding applications in automotive and chemical sectors that require durable and efficient palletizing systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentations:

By Product Type:

- Articulated Palletizers

- Gantry Palletizers

- SCARA Palletizers

- Collaborative Palletizers

By Machine Type:

- Semi-Automatic Palletizers

- Fully Automatic Palletizers

By End Use:

- Food and Beverage

- Pharmaceuticals

- Consumer Goods

- Automotive

- Chemicals

- Logistics and Warehousing

By Region:

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America and Europe:

North America held 34% share of the robotic palletizers market in 2024, while Europe accounted for 29%. Both regions dominate due to advanced manufacturing infrastructure and widespread automation adoption. Companies in automotive, food and beverage, and logistics sectors rely on robotic palletizers to enhance efficiency and maintain global competitiveness. Strict labor safety regulations and rising labor costs further accelerate automation investments. It is also supported by the presence of leading robotics manufacturers and strong R&D initiatives. The integration of AI and digital tools across industries continues to strengthen adoption in these regions.

Asia-Pacific:

Asia-Pacific represented 27% share of the robotic palletizers market in 2024, with growth accelerating in China, India, and Japan. Strong industrialization, booming e-commerce, and government initiatives promoting smart factories are driving adoption. Manufacturers in these economies are focusing on scalable, cost-effective automation to meet rising production volumes. It benefits from expanding food processing, consumer goods, and electronics industries that demand flexible palletizing solutions. Growing investment in logistics infrastructure and warehouse automation further supports adoption. Companies in this region are emerging as both key adopters and competitive suppliers.

Latin America and Middle East & Africa:

Latin America and Middle East & Africa together held 10% share of the robotic palletizers market in 2024. These regions are witnessing steady adoption in food, beverage, and retail sectors. Companies are investing in automation to improve efficiency and meet rising consumer demand. It faces challenges due to budget limitations, yet growing labor costs and supply chain modernization support adoption. Governments in these regions are encouraging industrial automation to improve competitiveness. The gradual integration of robotic palletizers is expected to expand steadily in the coming years.

Key Player Analysis:

- FANUC CORPORATION

- KUKA AG

- KION GROUP AG

- ABB Ltd.

- Schneider Packaging Equipment Company, Inc.

- Krones AG

- Honeywell International Inc.

- Doosan Robotics, Inc.

- Kaufman Engineered Systems

- Omron Corporation

Competitive Analysis:

The robotic palletizers market is characterized by strong competition among global automation leaders and specialized equipment providers. Key players include FANUC CORPORATION, KUKA AG, KION GROUP AG, ABB Ltd., Schneider Packaging Equipment Company, Inc., and Krones AG. These companies compete by offering advanced robotic solutions that focus on speed, precision, and adaptability to diverse packaging requirements. It emphasizes innovation in AI, machine vision, and collaborative robotics to strengthen product portfolios and expand market reach. Strategic mergers, acquisitions, and partnerships help players enhance regional presence and serve industries such as food, beverage, logistics, and consumer goods. Companies are also investing in sustainable and energy-efficient designs to align with environmental goals. With rising demand across emerging economies, competitive intensity is expected to increase, driving further innovation and cost-effective solutions tailored for small and mid-sized enterprises.

Recent Developments:

- In June 2025, FANUC CORPORATION launched the enhanced next-generation ROBOGUIDE robot simulation software, advancing virtual commissioning and simulation for their robotics solutions.

- In February 2025, KUKA AG formed a partnership with Dassault Systèmes, incorporating the Dassault 3DEXPERIENCE platform into KUKA’s mosaixx digital industrial software ecosystem.

- In January 2025, KION GROUP AG entered a partnership with NVIDIA and Accenture to optimize supply chain operations using AI-powered robots and digital twins, announced at CES 2025.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Machine Type, End Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand for robotic palletizers will rise with growing automation in manufacturing and logistics.

- Companies will adopt flexible palletizing solutions to handle mixed case and customized packaging needs.

- Integration of AI and machine vision will enhance accuracy, speed, and adaptability of systems.

- Energy-efficient palletizers will gain traction as industries align with sustainability goals.

- Vendors will design compact and mobile palletizing units for small and mid-sized enterprises.

- Predictive maintenance enabled by IoT connectivity will reduce downtime and improve reliability.

- E-commerce growth will drive higher adoption of robotic palletizers in warehouses and distribution centers.

- Emerging economies will provide strong opportunities through government-backed smart manufacturing initiatives.

- Partnerships between robotics suppliers and logistics providers will accelerate system deployment.

- Continuous innovation in cobot-based palletizers will strengthen collaboration between human operators and machines.