Market Overview

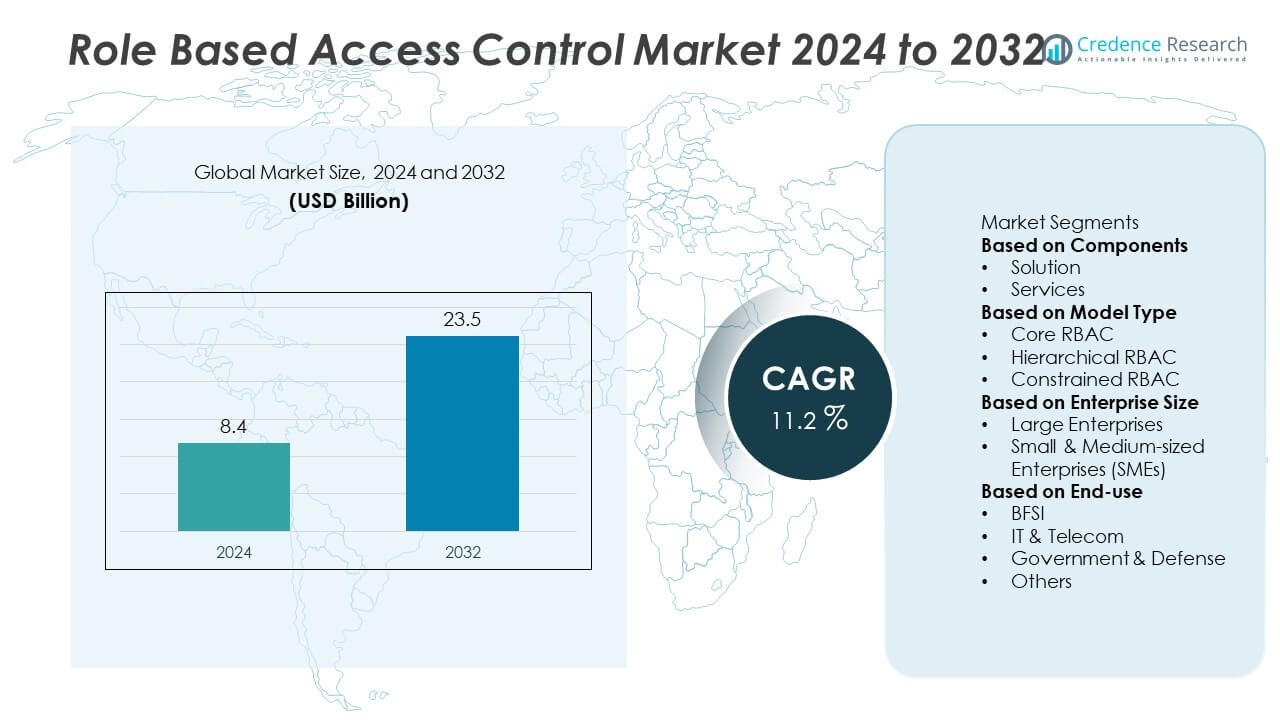

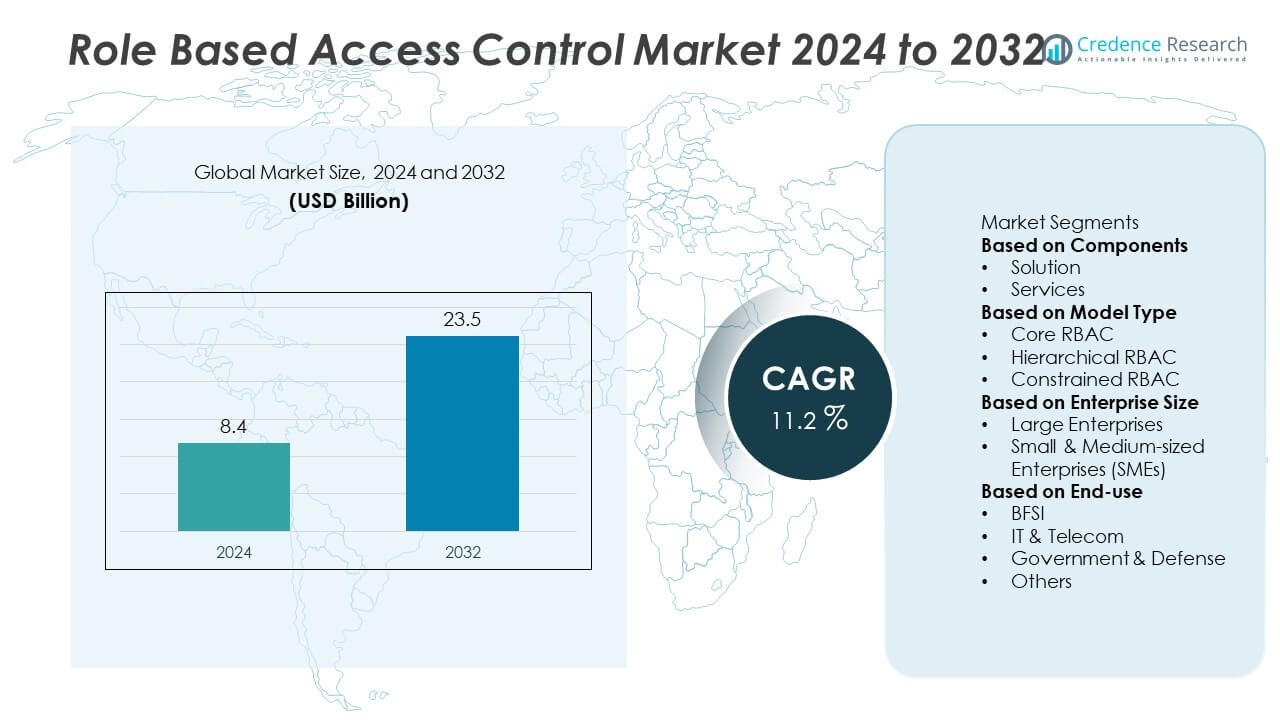

The Role Based Access Control (RBAC) Market was valued at USD 8.4 billion in 2024 and is projected to reach USD 23.5 billion by 2032, growing at a CAGR of 11.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Role Based Access Control (RBAC) Market Size 2024 |

USD 8.4 Billion |

| Role Based Access Control (RBAC) Market, CAGR |

11.2% |

| Role Based Access Control (RBAC) Market Size 2032 |

USD 23.5 Billion |

The role-based access control market is led by major players such as Oracle Corporation, Microsoft Corporation, IBM Corporation, Amazon Web Services, Inc., CyberArk Software Ltd., Broadcom Inc., Dell EMC, Okta, Inc., JumpCloud Inc., and Micro Focus International plc. These companies dominate the market through advanced IAM integrations, AI-driven policy automation, and scalable cloud-based RBAC solutions. Their focus on enhancing compliance, identity security, and zero-trust frameworks supports enterprise-wide adoption. North America led the global market in 2024 with a 41% share, supported by strong regulatory enforcement and high enterprise digitalization, followed by Europe with 27% and Asia-Pacific with 23%, driven by rapid cloud adoption and expanding cybersecurity investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The role-based access control market was valued at USD 8.4 billion in 2024 and is projected to reach USD 23.5 billion by 2032, growing at a CAGR of 11.2% during the forecast period.

- Increasing regulatory compliance requirements and rising concerns over data breaches are driving demand for RBAC solutions across enterprises globally.

- Cloud-based and AI-integrated RBAC systems are emerging as key trends, enabling automated policy enforcement and real-time access monitoring.

- Leading companies such as Oracle, Microsoft, IBM, and CyberArk are focusing on innovation in zero-trust architectures, cloud security, and identity management platforms to strengthen market competitiveness.

- North America led with a 41% share in 2024, followed by Europe (27%) and Asia-Pacific (23%), while by component, the solution segment held a 67% share, driven by large-scale enterprise deployment for access governance and compliance management.

Market Segmentation Analysis:

By Components

The solution segment dominated the role-based access control market in 2024 with a 67% share, driven by increasing adoption of identity and access management platforms across enterprises. RBAC solutions enable centralized control over user permissions, reducing the risk of unauthorized access and data breaches. The growing complexity of IT infrastructures, coupled with rising compliance requirements, fuels demand for automated access control systems. Organizations in sectors such as BFSI, healthcare, and government are deploying RBAC solutions to enhance operational security, ensure regulatory compliance, and streamline user authentication processes across hybrid and cloud environments.

- For instance, Oracle Corporation’s Identity Governance Suite, which provides granular RBAC controls, manages user provisioning and entitlement access for numerous enterprise clients. The software is highly scalable and can handle millions of identities, roles, and entitlements for a single organization.

By Model Type

The core RBAC segment held the largest share of 46% in 2024, owing to its simplicity, scalability, and cost-effectiveness for managing access rights. It provides a structured framework for assigning permissions based on roles rather than individuals, improving efficiency and minimizing administrative overhead. Enterprises favor this model for its ease of integration with existing IT systems and ability to enforce consistent access policies. The rising implementation of digital identity governance and zero-trust architectures further strengthens the adoption of core RBAC frameworks in both on-premises and cloud-based applications.

- For instance, CyberArk Software Ltd. secures millions of privileged accounts globally through its Privilege Cloud platform, which is designed to reduce unauthorized privilege escalations and improve audit readiness for regulated industries.

By Enterprise Size

The large enterprises segment accounted for a 59% share in 2024, driven by the need to manage complex user hierarchies and secure sensitive data across global operations. These organizations rely on RBAC solutions to handle high volumes of access requests and maintain compliance with industry-specific standards. The increasing adoption of multi-cloud strategies and remote working models necessitates advanced role management capabilities. Large corporations in finance, manufacturing, and IT services are leading adopters, investing heavily in scalable and automated RBAC systems to ensure seamless user access while maintaining strict security governance.

Key Growth Drivers

Rising Focus on Data Security and Regulatory Compliance

The growing number of cyberattacks and data breaches is pushing organizations to adopt RBAC systems for improved access governance. Companies must comply with global data protection regulations such as GDPR, HIPAA, and ISO 27001, driving demand for structured access control solutions. RBAC enables enterprises to enforce role-based permissions, ensuring that employees access only necessary resources. The increasing need for secure user authentication across cloud platforms and enterprise applications continues to strengthen the adoption of RBAC systems across industries.

- For instance, IBM Security Verify integrates with identity and access management (IAM) tools to help manage compliance-driven RBAC policies across hybrid cloud workloads, and the overall platform is certified for ISO 27001.

Growing Adoption of Cloud and Hybrid Infrastructures

The rapid migration toward cloud-based ecosystems has significantly increased access control complexities. RBAC solutions offer seamless integration across multi-cloud and hybrid environments, enabling centralized control of user roles and privileges. Enterprises are prioritizing cloud-native RBAC frameworks to manage access to SaaS and IaaS resources. The rise of digital transformation initiatives and remote workforce expansion further amplifies the need for scalable, automated access management tools that enhance visibility and reduce security vulnerabilities in distributed environments.

- For instance, AWS Identity Center enables RBAC configuration through permission sets, which are centrally managed and used to grant access to a user or group across multiple AWS accounts within an organization.

Expanding Use of Identity and Access Management (IAM) Systems

Integration of RBAC into IAM platforms is emerging as a key growth catalyst. Modern IAM systems incorporate RBAC capabilities to streamline user provisioning, authentication, and authorization. This integration enhances accountability and supports compliance through automated audit trails. Enterprises are deploying RBAC-enabled IAM systems to improve operational efficiency while minimizing insider risks. The growing emphasis on zero-trust security models and identity-centric cybersecurity strategies continues to drive the adoption of RBAC solutions across sectors such as BFSI, IT, and healthcare.

Key Trends & Opportunities

Emergence of AI-Driven and Automated Access Management

Artificial intelligence and machine learning are revolutionizing RBAC solutions by enabling predictive access control and anomaly detection. AI-driven systems can dynamically adjust user permissions based on behavioral analytics, improving security and reducing manual workload. Automation also ensures real-time compliance monitoring and faster onboarding processes. As organizations embrace digital transformation, integrating AI into RBAC frameworks presents opportunities for enhanced scalability, accuracy, and proactive threat mitigation in enterprise security management.

- For instance, Microsoft uses machine learning algorithms, trained on trillions of signals processed across its security products daily, to provide intelligent recommendations for least-privilege role adjustments during access reviews. This capability assists administrators in ensuring that users retain the right level of access, strengthening security.

Increasing Adoption of Zero-Trust Architecture

The shift toward zero-trust security principles is driving RBAC implementation in modern enterprises. RBAC aligns with zero-trust frameworks by enforcing least-privilege access and continuous authentication. Companies are integrating RBAC with network segmentation, multi-factor authentication, and privileged access management systems to strengthen defenses. The growing focus on securing remote work, IoT devices, and cloud-native applications is expected to fuel demand for RBAC solutions that provide dynamic and contextual access control capabilities.

- For instance, Broadcom’s Symantec Identity Security enables zero-trust principles for identity and access management, ensuring RBAC-driven access verification for distributed workforce environments.

Key Challenges

Complex Implementation and Role Management

Deploying RBAC in large enterprises often involves complex configurations due to extensive role hierarchies and overlapping permissions. Managing thousands of user roles across departments can lead to administrative inefficiencies and potential access conflicts. Frequent organizational changes require continuous role updates, increasing operational burden. Enterprises need automated role-mining tools and governance policies to simplify implementation. Without proper planning, role explosion and misconfiguration can compromise both security and compliance objectives.

Integration with Legacy Systems and Multi-Cloud Environments

Many organizations struggle to integrate RBAC frameworks with legacy IT systems and diverse cloud platforms. Older infrastructures often lack compatibility with modern access control protocols, creating visibility and security gaps. The coexistence of on-premises and cloud applications further complicates role synchronization and policy enforcement. Enterprises must invest in flexible, API-driven RBAC solutions to enable interoperability. Overcoming these integration challenges is critical for achieving unified access governance across heterogeneous IT ecosystems.

Regional Analysis

North America

North America dominated the role-based access control market in 2024 with a 41% share, driven by stringent data security regulations and rapid adoption of digital identity management systems. The United States leads due to early implementation of advanced IAM and zero-trust security frameworks across sectors such as BFSI, healthcare, and government. The region’s mature cloud ecosystem and high cybersecurity spending further strengthen RBAC adoption. Growing concerns over insider threats and regulatory mandates like HIPAA and CCPA are prompting enterprises to integrate RBAC into hybrid and multi-cloud security strategies.

Europe

Europe accounted for a 27% share in 2024, supported by strict data protection regulations such as GDPR and increasing digitalization across enterprises. The United Kingdom, Germany, and France lead market demand with strong emphasis on compliance-driven access management. Organizations are implementing RBAC solutions to improve accountability and streamline permission management across distributed teams. The rise of remote work and cloud-based collaboration tools has accelerated adoption of secure access control systems. Ongoing investments in cybersecurity infrastructure and identity governance solutions continue to drive market expansion across the region.

Asia-Pacific

Asia-Pacific held a 23% share in 2024, driven by rapid digital transformation and expansion of IT infrastructure in countries such as China, India, and Japan. Increasing adoption of cloud computing, e-governance platforms, and fintech applications is boosting RBAC implementation. Enterprises across the region are integrating RBAC into IAM and network security systems to mitigate growing cyber threats. Government initiatives promoting data protection frameworks and rising demand for compliance automation solutions support market growth. The region’s expanding enterprise ecosystem and focus on securing digital identities are positioning it as a major growth hub.

Latin America

Latin America represented a 5% share in 2024, fueled by growing awareness of data privacy and cybersecurity risks among enterprises. Brazil and Mexico lead regional adoption due to rising demand for secure access management in finance, telecom, and government sectors. Increasing adoption of cloud-based enterprise platforms and compliance with evolving data protection laws support market expansion. However, limited cybersecurity infrastructure and budget constraints among small enterprises remain challenges. Strategic partnerships with global security vendors and cloud service providers are expected to accelerate RBAC adoption across the region.

Middle East & Africa

The Middle East & Africa accounted for a 4% share in 2024, supported by growing investments in digital security and identity management infrastructure. The UAE and Saudi Arabia are leading adopters, driven by national cybersecurity initiatives such as Vision 2030 and the Dubai Cyber Security Strategy. Rising digital transformation across government, energy, and banking sectors is driving RBAC deployment. In Africa, South Africa and Kenya are emerging markets as organizations strengthen data access governance. Increasing awareness of insider threats and expanding cloud penetration are expected to enhance RBAC adoption across the region.

Market Segmentations:

By Components

By Model Type

- Core RBAC

- Hierarchical RBAC

- Constrained RBAC

By Enterprise Size

- Large Enterprises

- Small & Medium-sized Enterprises (SMEs)

By End-use

- BFSI

- IT & Telecom

- Government & Defense

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the role-based access control market includes key players such as Oracle Corporation, CyberArk Software Ltd., JumpCloud Inc., Dell EMC, Amazon Web Services, Inc., Micro Focus International plc, Microsoft Corporation, Broadcom Inc., IBM Corporation, and Okta, Inc. These companies are driving market growth through advancements in identity and access management (IAM) technologies, zero-trust frameworks, and AI-powered access governance platforms. Leading vendors are focusing on cloud-native RBAC solutions that integrate seamlessly across hybrid infrastructures. Strategic collaborations, product launches, and acquisitions are strengthening their positions in the cybersecurity ecosystem. Companies are also prioritizing automation and compliance-driven access control to meet evolving regulatory requirements. Continuous investments in analytics-based monitoring, multi-factor authentication, and machine learning are enabling enterprises to enhance security, minimize insider threats, and improve operational efficiency in access governance systems globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Oracle Corporation

- CyberArk Software Ltd.

- JumpCloud Inc.

- Dell EMC

- Amazon Web Services, Inc.

- Micro Focus International plc

- Microsoft Corporation

- Broadcom Inc.

- IBM Corporation

- Okta, Inc.

Recent Developments

- In October 2025, Oracle also updated its Fusion Applications AI Agent to strictly enforce role-based access control across named data objects and user tasks.

- In June 2025, Oracle Corporation introduced ACLs (Access Control Lists) for OCI Cache clusters, enabling fine-grained role-based access control for Redis instances.

- In May 2025, Microsoft added the “Microsoft Graph Data Connect Administrator” role within its built-in RBAC role set, enabling organizations to delegate data-connect management separately from full admin privileges.

- In February 2025, Okta, Inc. made its Workflows Role-Based Access Control feature generally available in production, enabling granular role-based definitions in its automation platform.

Report Coverage

The research report offers an in-depth analysis based on Components, Model Type, Enterprise Size, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for RBAC solutions will rise as organizations strengthen data security frameworks.

- Integration with zero-trust architectures will become a standard practice across enterprises.

- Cloud-based RBAC systems will dominate due to scalability and centralized control.

- AI and automation will enhance policy management and access decision-making efficiency.

- Enterprises will adopt RBAC to meet stricter global compliance and privacy regulations.

- SMEs will increasingly deploy RBAC through affordable SaaS-based security platforms.

- Hybrid and multi-cloud environments will drive innovation in unified access governance.

- Vendors will focus on interoperability with IAM and privileged access management systems.

- Cybersecurity investments will expand in critical sectors such as BFSI and healthcare.

- North America and Asia-Pacific will continue leading market growth through digital transformation initiatives.