Market Overview

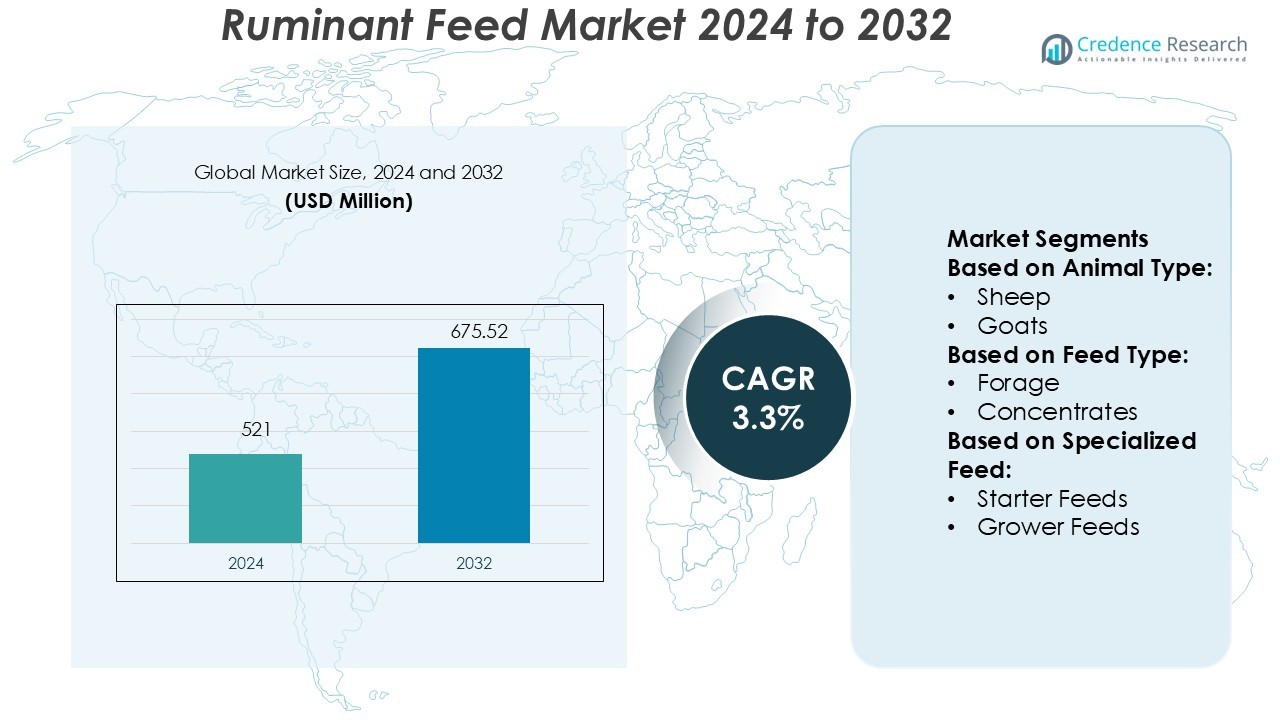

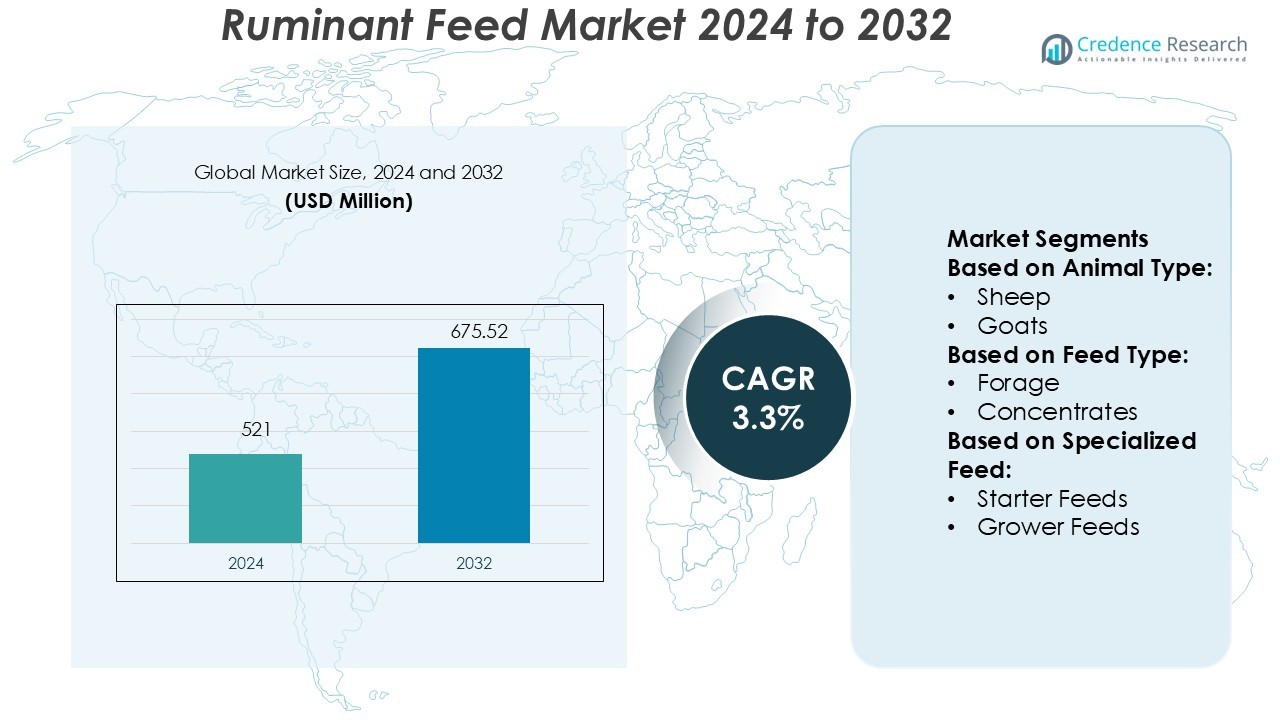

Ruminant Feed Market size was valued USD 521 million in 2024 and is anticipated to reach USD 675.52 million by 2032, at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ruminant Feed Market Size 2024 |

USD 521 Million |

| Ruminant Feed Market, CAGR |

3.3% |

| Ruminant Feed Market Size 2032 |

USD 675.52 Million |

The ruminant feed market is shaped by strong competition among top players such as JBS S.A, De Heus, Cargill Inc., ForFarmers, Haid Group, Archer Daniels Midland (ADM), Charoen Pokphand Foods, BRF Ingredients, Bentoli, and Land O Lakes Feed. These companies focus on advanced feed formulations, strategic capacity expansions, and sustainable ingredient sourcing to strengthen their market position. Asia Pacific leads the global market with a 34% share, driven by rapid livestock growth and increasing dairy and meat consumption in countries such as China, India, and Australia. Strong distribution networks, strategic alliances, and technological innovations enable leading firms to maintain a competitive edge in this high-demand region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Ruminant Feed Market size was valued at USD 521 million in 2024 and is projected to reach USD 675.52 million by 2032, growing at a CAGR of 3.3%.

- Rising demand for high-quality dairy and meat products is driving the adoption of nutrient-rich and functional feed solutions across key livestock segments.

- Companies are focusing on advanced feed formulations, sustainable sourcing, and technology integration to strengthen competitiveness and expand their market reach.

- Volatility in raw material prices and strict regulatory requirements are key restraints impacting production costs and market stability.

- Asia Pacific leads with a 34% market share, followed by North America and Europe, while dairy feed holds the largest segment share, supported by rapid livestock expansion and strong distribution networks.

Market Segmentation Analysis:

By Animal Type

Cattle dominate the ruminant feed market with a significant market share due to their high population and commercial value. Dairy cattle hold a major portion of this share, driven by rising milk production and growing demand for high-yield breeds. Feed formulations for dairy cattle focus on nutrient density to enhance milk quality and yield. Beef cattle follow, supported by expanding meat consumption and export opportunities. Sheep and goats contribute steadily, particularly in regions with strong traditional farming practices. This segmentation reflects the industry’s focus on productivity, quality output, and feed efficiency.

- For instance, De Heus reports that it produces over 7 million tons of animal feed annually in more than 70 countries, with one processing line in the Netherlands running at 15 tons/hour and expanded capacity equipment reaching up to 20 tons/hour.

By Feed Type

Concentrates lead the feed type segment, capturing the largest share of the market. Their dominance stems from precise nutrient composition and ease of digestibility, which boosts growth and milk yield. Concentrates support higher feed conversion ratios, making them vital in intensive farming systems. Forage remains essential for maintaining rumen health and digestion, especially in pasture-based systems. Mixed rations are gaining traction due to their balanced nutrition and ability to improve herd performance. The shift toward performance-oriented diets supports the growing demand for concentrate-based ruminant feeds.

- For instance, Cargill’s Nutrition System processes more than 3 million ingredient samples annually and operates nearly 600 connected instruments globally for nutrient measurement, enabling precise concentrate formulation.

By Specialized Feed

Grower feeds account for the largest share within specialized feed categories, supported by their role in improving weight gain and growth rates during key development stages. Starter feeds are essential for early rumen development and immunity building, ensuring strong animal performance in later stages. Finisher feeds focus on optimizing final body weight and meat quality for beef cattle and other meat-producing ruminants. The rising adoption of precision feeding practices, along with commercial farm expansion, is driving demand for grower feeds. Producers prioritize efficient feed conversion to improve profitability.

Key Growth Drivers

Rising Demand for High-Quality Animal Protein

The growing global demand for dairy and meat products is boosting the ruminant feed market. Consumers are seeking higher protein intake, driving livestock producers to improve productivity. Nutritionally balanced feed supports faster growth, improved milk yield, and better animal health. This trend is particularly strong in developing countries where per capita meat and dairy consumption is increasing. Farmers are adopting scientifically formulated feed to maximize output and ensure consistent quality, creating steady demand for ruminant feed products across key markets.

- For instance, ForFarmers conducts more than 40 to 50 research projects per year in its innovation programme to develop tailored feed solutions for dairy and beef cattle.

Expansion of Commercial Livestock Farming

The steady shift from traditional farming to commercial livestock operations is a major driver. Commercial farms require structured feeding systems to ensure uniform growth and disease resistance. This has increased the use of high-performance feeds designed to support optimal health and productivity. Better feed conversion efficiency helps farmers reduce operational costs while increasing yield. Investments in modern feeding infrastructure and precision farming techniques are also reinforcing market growth, particularly in Asia Pacific and Latin America.

- For instance, ADM has launched its digital service platform SINCRO, which in Mexico enabled an egg-producer to improve eggshell quality by 10 % and add more than US 200 000 in annual profit.

Technological Advancements in Feed Formulation

Technological innovation in feed production is enabling customized and nutrient-rich ruminant diets. Feed manufacturers are using advanced formulations that enhance digestibility, improve nutrient absorption, and reduce environmental impact. Automated mixing, pelleting, and quality control systems support consistency in feed output. Enzyme-based additives and probiotics are also gaining attention for their role in improving gut health and reducing methane emissions. These advancements support sustainable livestock farming, helping producers meet both productivity and environmental goals.

Key Trends & Opportunities

Shift Toward Functional and Specialty Feeds

Producers are increasingly focusing on functional feeds designed for specific outcomes such as higher milk yield, faster weight gain, or improved immunity. This shift is opening opportunities for premium feed segments that provide value-added benefits. Demand for starter and grower feeds is rising, especially in dairy farming. Feed enriched with vitamins, minerals, and probiotics is also gaining ground due to its role in improving animal health and reducing veterinary costs.

- For instance, CPF, as part of a probiotic innovation initiative, conducted research on 125,000 probiotic strains in collaboration with world-class research houses. This research aimed to address common poultry diseases, and the 9 strongest microbial strains were selected for feed formulation to support internal immunity and gut health in chickens.

Growing Adoption of Sustainable Feed Solutions

Sustainability is becoming a core focus in ruminant feed production. Companies are exploring low-carbon ingredients, precision feeding technologies, and alternative protein sources. This helps reduce methane emissions and enhance resource efficiency. Governments are supporting sustainable agriculture practices through incentives and regulations. This trend is driving innovation in eco-friendly feed products and positioning sustainability as a strong competitive advantage.

- For instance, BRF Ingredients’ parent company, BRF S.A., has committed to reaching net-zero greenhouse gas emissions by the year 2040 and has set targets, verified by the Science Based Targets initiative (SBTi), to reduce Scope 1 and Scope 2 emissions by 52.7% by 2032 and Scope 3 emissions by 30% by 2032, both based on a 2020 baseline.

Digitalization in Livestock Management

Digital tools are transforming how farmers manage feeding systems. Smart sensors, automated feeders, and AI-based monitoring allow precise nutrient delivery and real-time health tracking. These technologies reduce waste and improve efficiency, making them attractive to large-scale farms. The integration of data analytics into feed management is also enabling better decision-making, improving overall productivity and profitability.

Key Challenges

Volatility in Raw Material Prices

The feed industry depends on commodities like corn, soy, and grains. Price fluctuations in these inputs significantly impact production costs and profit margins. Global supply disruptions, climate change, and geopolitical tensions can amplify volatility. This makes it difficult for manufacturers to maintain stable pricing and profit levels. Small and medium-scale producers are particularly vulnerable to such cost pressures.

Regulatory Compliance and Environmental Concerns

Stringent regulations on feed ingredients, safety standards, and environmental impacts are challenging producers. Feed manufacturers must comply with multiple national and international guidelines, increasing operational complexity and costs. Rising scrutiny of methane emissions and waste disposal practices adds further pressure. Companies that fail to meet these requirements risk penalties, market restrictions, or reputational damage, making compliance a critical challenge.

Regional Analysis

North America

North America holds a 24% market share in the global ruminant feed market. The region benefits from well-developed livestock farming systems, particularly in the United States and Canada. High adoption of precision feeding technologies and advanced nutrition solutions strengthens productivity and quality. Dairy and beef cattle farming dominate the feed demand, supported by strong export activity. Producers are focusing on functional feed solutions to enhance milk yield and meat quality. Strategic collaborations between feed manufacturers and large-scale farms are further driving regional growth, ensuring strong market presence and steady expansion across North American markets.

Europe

Europe accounts for 21% of the global market share, supported by strong regulatory frameworks and sustainable agriculture practices. Countries such as Germany, France, and the Netherlands lead production with advanced livestock management systems. The region places high emphasis on quality feed, animal welfare, and environmental sustainability. Farmers are adopting feed additives that enhance digestibility and reduce greenhouse gas emissions. Strict regulations on feed composition drive innovation and premium product demand. Europe’s mature dairy industry and growing meat exports continue to sustain ruminant feed demand, supported by well-established distribution channels and government-backed sustainability programs.

Asia Pacific

Asia Pacific dominates the ruminant feed market with a 34% market share, driven by rapid livestock expansion in China, India, and Australia. Rising meat and dairy consumption, coupled with population growth, fuels strong demand for quality feed. The region is witnessing increased investment in modern farming techniques and advanced nutrition. Small and medium-scale farms are adopting commercial feed solutions to boost productivity. Government support for livestock development and growing private sector investments further accelerate market growth. The region’s strong production base and expanding export capacity position Asia Pacific as the global growth engine for ruminant feed.

Latin America

Latin America holds a 12% market share, with Brazil and Argentina driving growth through large-scale beef and dairy farming operations. The region benefits from abundant feed raw materials, supporting cost-effective production. Livestock producers are increasingly shifting toward structured feeding programs to enhance weight gain and milk yield. Export demand for beef products further drives feed consumption. While the adoption of advanced feed technologies remains moderate, increasing investments in farm modernization and sustainable practices are creating growth opportunities. The region’s growing role as a key beef exporter supports continued demand for efficient and nutritionally balanced feed solutions.

Middle East & Africa

The Middle East & Africa (MEA) region accounts for 9% market share, with growing livestock farming in Gulf countries and parts of Sub-Saharan Africa. Rising demand for dairy products and meat is encouraging feed imports and local production expansion. Governments are investing in food security and modernizing farming systems. Dry climatic conditions limit local raw material availability, increasing reliance on imports for feed ingredients. However, ongoing infrastructure investments and partnerships with global feed producers are strengthening supply chains. As feed formulation technologies spread in the region, MEA is expected to witness steady growth in structured ruminant feeding systems.

Market Segmentations:

By Animal Type:

By Feed Type:

By Specialized Feed:

- Starter Feeds

- Grower Feeds

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The ruminant feed market is highly competitive, with key players including JBS S.A, De Heus, Cargill Inc., ForFarmers, Haid Group, Archer Daniels Midland (ADM), Charoen Pokphand Foods, BRF Ingredients, Bentoli, and Land O Lakes Feed. The ruminant feed market is characterized by intense competition and rapid innovation. Companies are focusing on enhancing product quality, nutritional value, and sustainability to strengthen their market position. Strategies such as capacity expansion, technology integration, and precision nutrition are becoming central to market growth. Advanced formulations targeting improved milk yield, weight gain, and animal health are gaining significant traction. Producers are increasingly adopting digital solutions for feed optimization and farm management, improving traceability and efficiency. Sustainability initiatives, including the use of eco-friendly ingredients and emission-reducing additives, are also driving differentiation. Continuous investments in R&D, strategic alliances, and product diversification further shape the competitive landscape.

Key Player Analysis

Recent Developments

- In July 2025, China’s Juncao technology gains ground in Rwanda and helping many farmers to produce mushroom and livestock feed while being sustainable and increasing the food security. The technology known as Juncao technology.

- In July 2025, Farmers in Africa or harvesting insects and using them for animal feed. Locusts are normally considered as a distructive thing for the crops but the new startup is using them and turning it into animal feed.

- In September 2024, Growel Group announced a strategic expansion into the growing pet food sector with the launch of its new pet food brand, Carniwel. Carniwel aims to meet the rising demand for premium pet nutrition at affordable prices, providing a range of products tailored to the specific needs of both small and large breed dogs.

- In June 2023, Evonik launches updated Biolys® product for animal feeds. The new Biolys® provides a higher concentration of L-lysine (an 80 percent ratio to Lysine HCl) compared to the current version’s 60 percent L-lysine and Lysine source with the lowest carbon footprint available on the feed additives market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Animal Type, Feed Type, Specialized Feed and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-quality animal protein will continue to drive feed innovation.

- Sustainable and low-carbon feed solutions will gain stronger market adoption.

- Precision feeding technologies will improve productivity and reduce waste.

- Functional and specialty feeds will see rising demand across dairy and beef segments.

- Digital tools and AI integration will enhance feed management efficiency.

- Strategic partnerships will expand distribution and strengthen market presence.

- Regulatory focus on feed quality and safety will increase product standardization.

- Emerging markets will play a key role in driving global feed demand.

- R&D investment will accelerate the development of nutrient-rich formulations.

- Eco-friendly ingredients and alternative proteins will reshape the competitive landscape.