Market Overview

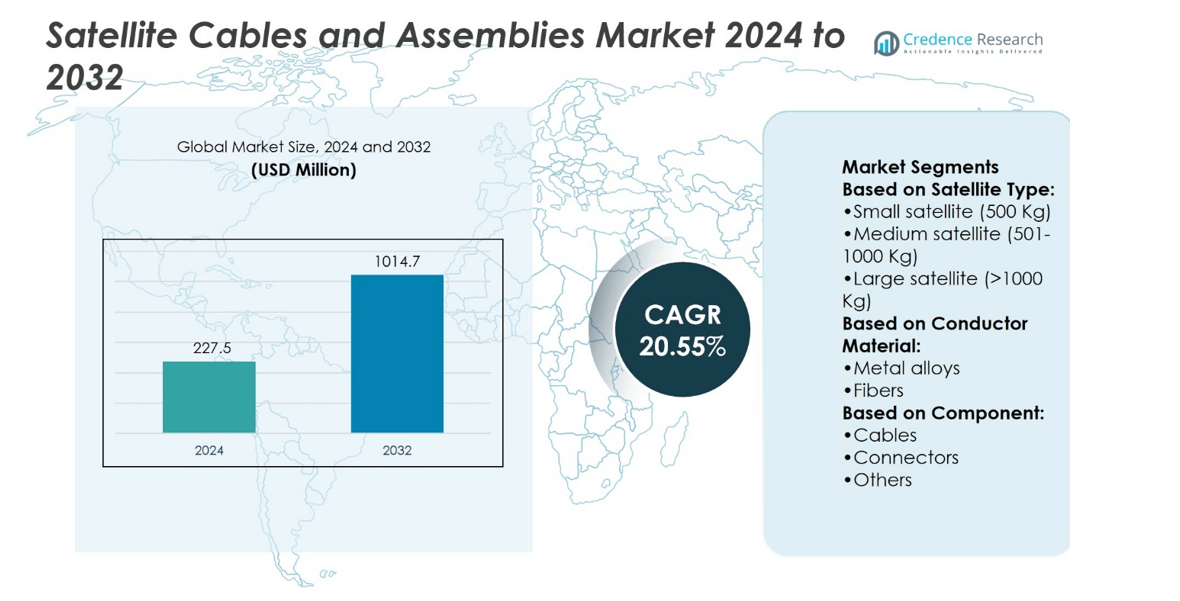

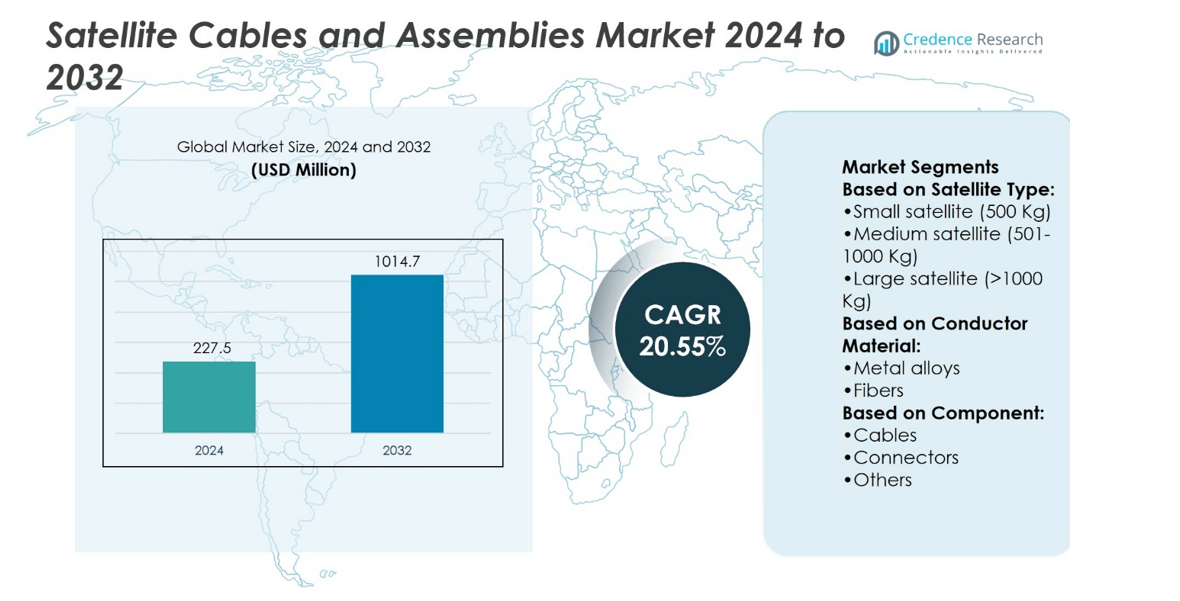

Satellite Cables and Assemblies Market size was valued at USD 227.5 million in 2024 and is anticipated to reach USD 1014.7 million by 2032, at a CAGR of 20.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Satellite Cables and Assemblies Market Size 2024 |

USD 227.5 million |

| Satellite Cables and Assemblies Market, CAGR |

20.5% |

| Satellite Cables and Assemblies Market Size 2032 |

USD 1014.7 million |

The Satellite Cables and Assemblies Market is driven by rising satellite launches, expanding LEO constellations, and growing demand for high-speed data transmission. Increasing adoption of lightweight, radiation-resistant, and thermally stable materials supports mission reliability and efficiency. The market also benefits from advancements in fiber optic technology, miniaturization of assemblies, and customized interconnects tailored for mission-specific needs. Trends highlight the shift toward smart cable systems with monitoring features, greater reliance on fiber optics, and expanding private sector participation. Continuous innovation and stronger collaborations with satellite operators ensure the industry aligns with evolving commercial, defense, and scientific space applications.

North America leads the Satellite Cables and Assemblies Market with strong government and private investments, followed by Europe with robust ESA-driven projects and Asia-Pacific showing rapid expansion through China, India, and Japan. Latin America and the Middle East & Africa hold smaller but growing shares, supported by communication and defense initiatives. Key players shaping the market include TE Connectivity, Amphenol Corporation, Nexans, W. L. Gore & Associates, Axon’ Cable, Carlisle Interconnect Technologies, Leoni AG, AFL, Habia Cable, and Radiall.

Market Insights

- The Satellite Cables and Assemblies Market was valued at USD 227.5 million in 2024 and is projected to reach USD 1014.7 million by 2032, growing at a CAGR of 20.55%.

- Rising satellite launches, growing LEO constellations, and demand for high-speed data transfer drive market growth.

- Advancements in fiber optic technology, miniaturized assemblies, and smart cable systems define key market trends.

- Strong competition exists with players focusing on innovation, lightweight materials, and mission-specific cable designs.

- High development costs, stringent space requirements, and supply chain constraints act as major restraints.

- North America leads with strong investments, followed by Europe with ESA-backed projects and Asia-Pacific’s rapid expansion.

- Latin America and Middle East & Africa show smaller but growing shares, driven by defense and communication initiatives, while key players include TE Connectivity, Amphenol Corporation, Nexans, W. L. Gore & Associates, Axon’ Cable, Carlisle Interconnect Technologies, Leoni AG, AFL, Habia Cable, and Radiall.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Satellite Launch Activities Driving Cable Demand

The rising number of satellites launches fuels demand for specialized cables and assemblies. It supports the increasing use of satellites for communication, navigation, and Earth observation. Growing deployment of low Earth orbit constellations requires advanced interconnect solutions. Manufacturers focus on developing lightweight and durable cables to meet mission reliability. Higher payload integration further increases the need for custom assemblies. The Satellite Cables and Assemblies Market gains steady growth from this expanding space activity.

- For instance, Meggitt PLC’s Model 3075M6 cable assembly operates in high-temperature environments up to 482°C (900°F) and has been used in nuclear reactor applications. Additionally, their Model 3076A cable assembly is designed for extreme temperatures up to 650°C (1200°F).

Rising Demand for High-Speed Data Transmission

The need for high-speed data transfer accelerates cable and assembly innovation. It supports the bandwidth requirements of modern satellites in broadband, defense, and scientific missions. Fiber optic cables are increasingly adopted due to lower latency and high throughput. Space agencies and private operators invest in advanced interconnects to ensure uninterrupted communication. Miniaturization of assemblies allows efficient integration into compact satellite platforms. Growing data traffic continues to push manufacturers toward high-performance cable designs.

- For instance, Smith’s Interconnect’s SpaceNXT™ Q cable assemblies have been used in over 150 satellite applications, totaling more than 40 miles of assemblies. These assemblies are pre-tested and qualified for space orbit environments, providing highly reliable technology and lower cost of ownership.

Increasing Adoption of Commercial Space Applications

The expansion of commercial space programs drives significant demand for reliable cable systems. It supports industries like telecommunications, remote sensing, and global positioning services. Private operators seek scalable and cost-effective interconnects to match rapid satellite deployment. Partnerships between manufacturers and commercial launch companies strengthen innovation pipelines. Customized solutions tailored for flexible mission requirements are gaining traction. Growing commercial interest ensures long-term market sustainability and rising procurement volumes.

Advancements in Cable Materials and Designs

Technological advancements in cable materials and design improve durability and performance. It enhances resistance against radiation, extreme temperatures, and vacuum conditions in space. Manufacturers adopt fluoropolymer and composite materials to ensure longer mission lifespans. Innovations in shielding and insulation reduce electromagnetic interference. Lightweight structures improve payload efficiency without compromising strength. The Satellite Cables and Assemblies Market benefits from continuous R&D investments and strong aerospace engineering support.

Market Trends

Rising Integration of Fiber Optic Cables

Fiber optic technology adoption is a key trend across satellite interconnect systems. It provides higher data transfer rates, minimal signal loss, and greater bandwidth. Operators prefer fiber optic assemblies to handle increasing satellite communication loads. It improves efficiency in broadband, defense, and scientific missions requiring real-time data. The Satellite Cables and Assemblies Market leverages this transition to address modern connectivity needs. Growing investment in optical interconnects highlights a shift from traditional copper-based designs.

- For instance, Nexans’ aerospace cables are designed for extreme conditions, with certain high-temperature versions capable of withstanding up to 260°C or 310°C. The specific temperature ratings and weight reductions vary depending on the product, materials used (such as aluminum conductors for weight savings), and application.

Growing Focus on Miniaturization and Lightweight Designs

Manufacturers emphasize compact and lightweight assemblies to optimize satellite payload capacity. Smaller satellites and mega-constellations require space-efficient interconnect solutions. It drives innovation in cable architecture without compromising strength or durability. Lightweight assemblies improve fuel efficiency and reduce launch costs. The trend strengthens the appeal of next-generation materials such as composites and fluoropolymers. Market players align designs with industry demand for efficiency and scalability.

- For instance, Cinch Connectivity Solutions’ Dura-Con™ Space Screened Micro-D Cable Assemblies conform to M83513 requirements and utilize a highly reliable twist pin contact design and machined sockets for durable, 7-point contact.

Increasing Customization for Mission-Specific Needs

The demand for tailored cable assemblies expands with diverse satellite applications. Commercial, defense, and scientific missions require unique interconnect specifications. It encourages manufacturers to provide customizable solutions with flexible configurations. Advanced insulation, shielding, and thermal resistance are integrated to address harsh conditions. Customization enhances reliability in critical functions like propulsion, navigation, and imaging. The trend underlines a shift toward precision engineering and client-focused manufacturing strategies.

Expansion of Private Sector Participation

The growing role of private companies shapes industry development and innovation. New entrants accelerate competition with cost-effective cable and assembly solutions. It pushes established players to enhance R&D and strengthen partnerships. Startups focus on rapid production methods and affordable alternatives for satellite constellations. The Satellite Cables and Assemblies Market benefits from the influx of venture capital and global collaborations. This trend ensures broader adoption across commercial space applications and next-generation satellite networks.

Market Challenges Analysis

High Cost of Development and Stringent Space Requirements

The development of satellite cables and assemblies involves significant costs due to specialized materials and advanced engineering. It must withstand extreme temperatures, radiation exposure, and vacuum conditions in orbit. These demanding requirements limit the use of conventional components and increase design complexity. The Satellite Cables and Assemblies Market faces challenges in balancing cost efficiency with mission reliability. Extended testing and certification further add to time and expenses. High entry barriers restrict smaller firms from entering the industry and slow innovation cycles.

Supply Chain Constraints and Limited Material Availability

Global supply chain disruptions create delays in sourcing advanced materials and specialized components. It impacts the timely delivery of cables and assemblies for satellite integration. Limited availability of fluoropolymers, composites, and radiation-resistant insulation compounds hinders production scalability. The dependency on a small number of suppliers increases vulnerability to shortages. Manufacturers face pressure to secure long-term supply agreements to mitigate risks. These challenges highlight the need for stronger regional supply networks and diversified sourcing strategies.

Market Opportunities

Expansion of Low Earth Orbit (LEO) Satellite Constellations

The rapid deployment of LEO satellite constellations creates strong growth opportunities for cable and assembly providers. These constellations require extensive interconnect systems to support broadband, navigation, and Earth observation services. It drives demand for lightweight, high-capacity cables tailored for compact satellite designs. Growing interest from private players and government agencies strengthens the opportunity pipeline. Manufacturers investing in advanced insulation, miniaturization, and thermal-resistant materials can capture wider market share. The Satellite Cables and Assemblies Market gains momentum from the scalability needs of global connectivity initiatives.

Rising Adoption of Advanced Materials and Smart Assemblies

Innovations in material science open new possibilities for next-generation interconnects. It enables cables to withstand higher stress while maintaining efficiency in harsh space environments. The adoption of fluoropolymer coatings, radiation-resistant compounds, and hybrid composites expands performance capabilities. Integration of smart features such as built-in sensors for real-time monitoring creates additional value. These advancements align with increasing demand for mission-specific and long-duration satellite operations. Growing opportunities exist for manufacturers that combine durability, intelligence, and lightweight design in their offerings.

Market Segmentation Analysis:

By Satellite Type

The Satellite Cables and Assemblies Market shows distinct demand across satellite types. Small satellites below 500 Kg hold significant growth due to their use in Earth observation, communication, and research missions. It requires compact and lightweight interconnects tailored for tight payload spaces. Medium satellites between 501 and 1000 Kg serve defense, navigation, and remote sensing applications, creating steady demand for reliable cable solutions. Large satellites above 1000 Kg contribute heavily with advanced interconnect needs for long-duration and high-power missions. This segment values durability, thermal resistance, and high-capacity transmission features in assemblies. Each satellite type drives unique requirements, creating opportunities for specialized product development.

- For instance, Huber+Suhner’s MINI250™H cable assembly operates at frequencies up to 26 GHz and has been used in various satellite applications, including payload integration and antenna signal transmission. The cable’s design allows it to withstand temperature variations from -55°C to +125°C and to endure mechanical stresses such as vibration and bending, ensuring reliable performance in space environments.

By Conductor Material

Material choice plays a critical role in cable performance and longevity. Metal alloys dominate due to their strength, durability, and conductivity under harsh orbital conditions. It ensures efficient signal transmission while providing resilience against extreme temperature fluctuations. Fibers are gaining traction with increasing adoption of optical cables for high-speed data transfer. Their lighter weight and reduced signal loss make them ideal for broadband and scientific satellites. This material transition highlights a growing trend toward advanced fiber integration in interconnect systems. Both materials address different mission profiles, balancing performance with cost.

- For instance, Axon’ Cable’s Micro-D connectors, compliant with ESCC 3401/029 EPPL2, feature a compact 1.27 mm (0.050″) contact spacing. These connectors, which use the highly reliable twist pin contact technology, are qualified for space applications and are designed to be resistant to the shock and vibration of launch and the harsh space environment.

By Component

Cables remain the core component of the market, supporting a wide range of satellite functions. Round cables lead in adoption due to their flexibility, shielding, and ease of installation. It serves most power and signal transmission needs across satellite classes. Flat or ribbon cables find growing demand in compact satellites where space efficiency is critical. Connectors hold strong importance, ensuring secure and reliable transmission links in high-vibration environments. Other components, including specialized insulators and shielding solutions, complement performance by enhancing durability and minimizing interference. Each component category contributes to ensuring mission safety and consistent satellite operation.

Segments:

Based on Satellite Type:

- Small satellite (500 Kg)

- Medium satellite (501-1000 Kg)

- Large satellite (>1000 Kg)

Based on Conductor Material:

Based on Component:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Satellite Cables and Assemblies Market, accounting for nearly 35% of the global revenue. The region benefits from strong investments in space exploration, defense programs, and commercial satellite deployments. It is home to leading aerospace players, cable manufacturers, and system integrators supporting NASA, the U.S. Department of Defense, and private operators such as SpaceX. Rising adoption of low Earth orbit (LEO) constellations for broadband connectivity further drives demand for advanced cable assemblies. Companies in this region emphasize lightweight designs, miniaturization, and fiber-based solutions to enhance performance. Strong government funding, private investment, and rapid commercialization of space continue to reinforce North America’s dominant position in the market.

Europe

Europe represents about 25% of the global market share, driven by active participation from both government agencies and private operators. The European Space Agency (ESA) plays a central role in supporting regional projects, alongside national initiatives in countries such as Germany, France, and the United Kingdom. It demonstrates strong demand for specialized cable assemblies in Earth observation, navigation, and scientific research satellites. European firms are highly focused on developing radiation-resistant materials and innovative fiber optic interconnects to improve reliability. Collaboration between cable manufacturers and satellite integrators enhances product customization to meet mission-specific needs. This regional ecosystem ensures steady growth through research-driven advancements and increasing satellite deployment.

Asia-Pacific

Asia-Pacific holds close to 20% of the global market share, showing rapid growth with expanding satellite programs. Countries like China, India, and Japan play leading roles through government-backed projects and private investments. It supports rising demand for cables and assemblies in navigation, communication, and defense satellites. India’s ISRO and China’s CNSA contribute significantly to cable requirements through frequent satellite launches. Regional players are increasingly adopting fiber optic systems to manage high-speed data transmission in large-scale projects. Growing collaborations with global aerospace firms strengthen local supply capabilities, ensuring Asia-Pacific emerges as a highly competitive hub for satellite interconnect solutions.

Latin America

Latin America accounts for nearly 10% of the global market share, supported by gradual development in satellite communication and space initiatives. Brazil and Argentina lead the region with government-backed programs focusing on Earth monitoring and telecommunication. It shows growing interest in adopting advanced cable assemblies for both civilian and defense projects. Local manufacturers face challenges in scaling production, creating opportunities for global players to expand partnerships. Investments in satellite broadband networks to improve rural connectivity add momentum to cable demand. The region remains at an early growth stage but demonstrates significant potential for future expansion.

Middle East & Africa

The Middle East & Africa contributes around 10% of the global market share, driven by investments in defense, telecommunication, and weather monitoring satellites. Countries such as the United Arab Emirates and South Africa lead regional adoption with expanding space programs. It shows rising reliance on high-performance cable assemblies to support data-intensive missions. Government initiatives to diversify economies and build space capabilities strengthen demand for interconnect solutions. Limited domestic manufacturing capacity creates reliance on imports and collaborations with international suppliers. The region continues to grow steadily as new projects enhance satellite capabilities and expand applications across industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Prysmian Group

- Meggitt PLC

- Smith’s Group PLC

- Amphenol Corporation

- Cicoil Flat Cables

- Nexans SA

- Cinch Connectivity Solutions

- Huber+Suhner

- Eaton Corporation

- Axon’ Cable SAS

Competitive Analysis

The Satellite Cables and Assemblies Market include Prysmian Group, Meggitt PLC, Smith’s Group PLC, Amphenol Corporation, Cicoil Flat Cables, Nexans SA, Cinch Connectivity Solutions, Huber+Suhner, Eaton Corporation, and Axon’ Cable SAS. The Satellite Cables and Assemblies Market is defined by strong innovation, advanced material development, and mission-specific engineering. Companies focus on designing lightweight, high-performance solutions that can withstand radiation, vacuum, and extreme thermal conditions in orbit. Continuous investment in research enables the integration of fiber optics, radiation-resistant compounds, and miniaturized assemblies tailored for compact satellites. Partnerships with space agencies, defense organizations, and commercial satellite operators strengthen market positioning and drive new product adoption. The competition also emphasizes reducing costs while ensuring mission reliability, pushing manufacturers to expand production efficiency and global supply capabilities. This environment fosters rapid advancements and ensures that the market evolves in line with growing satellite deployment worldwide.

Recent Developments

- In May 2025, Cicoil Flat Cables assemblies are used on the space shuttle, supersonic missiles, and industrial robotics, in some of the most demanding applications continues to innovate with advanced designs tailored for space and satellite applications, focusing on miniaturization, durability, and efficient data transfer capabilities.

- In April 2025, Smith’s Group PLC through its Smith’s Interconnect division expanded its manufacturing capacity for high-quality cable harness solutions in the EMEA region, addressing rising demand in satellite communications and defense sectors.

- In November 2024, HUBER+SUHNER launched satellite communication Multifunf flex cables to replace the semi-rigid category. These cables can be used for aerial systems of military and civilian planes, and they allow 18 GHz, 30 GHz, and 33 GHz operational frequencies with high thermal phase performance.

- In July 2024, Samtec launched a new Nitrowave coax cable assembly. Nitrowave is Samtec’s new, phase- and amplitude-stable coaxial cable. This innovative product is designed to meet the demanding requirements of various applications, ensuring reliability and durability in challenging environments.

Report Coverage

The research report offers an in-depth analysis based on Satellite Type, Conductor Material, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for lightweight and miniaturized cable assemblies will rise with small satellite adoption.

- Fiber optic cables will gain momentum to support high-speed data transmission in satellite missions.

- LEO constellations will drive large-scale demand for advanced interconnect solutions.

- Customization of cables and connectors will expand to meet mission-specific requirements.

- Radiation-resistant and thermally stable materials will dominate future product development.

- Private sector participation will accelerate innovation and competitive intensity in the market.

- Integration of smart cables with monitoring capabilities will become more common.

- Regional supply chain development will reduce dependency on limited global suppliers.

- Strategic partnerships between manufacturers and satellite operators will increase.

- Continuous R&D investments will ensure better performance and long-term mission reliability.