Market Overview

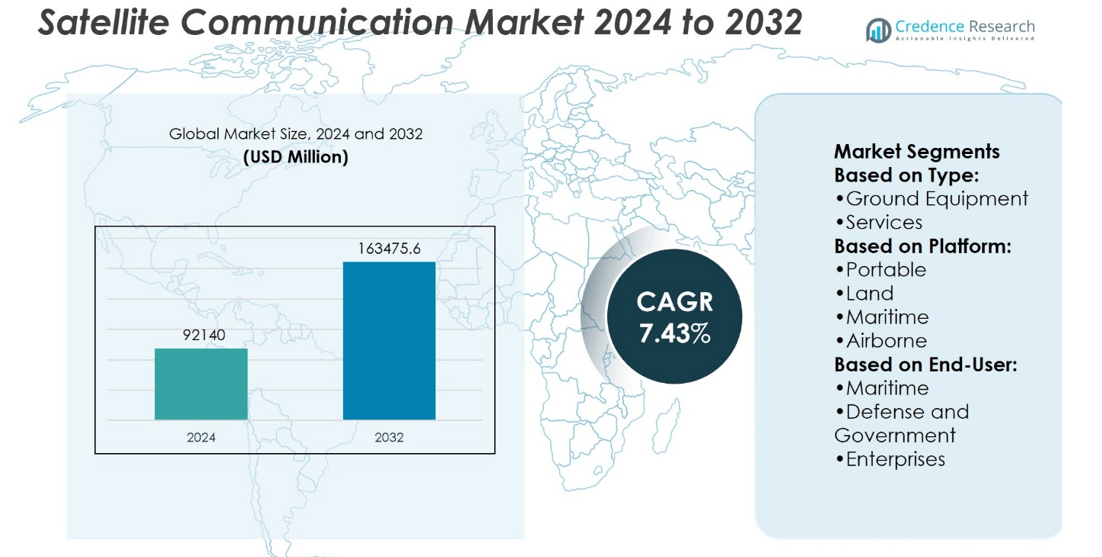

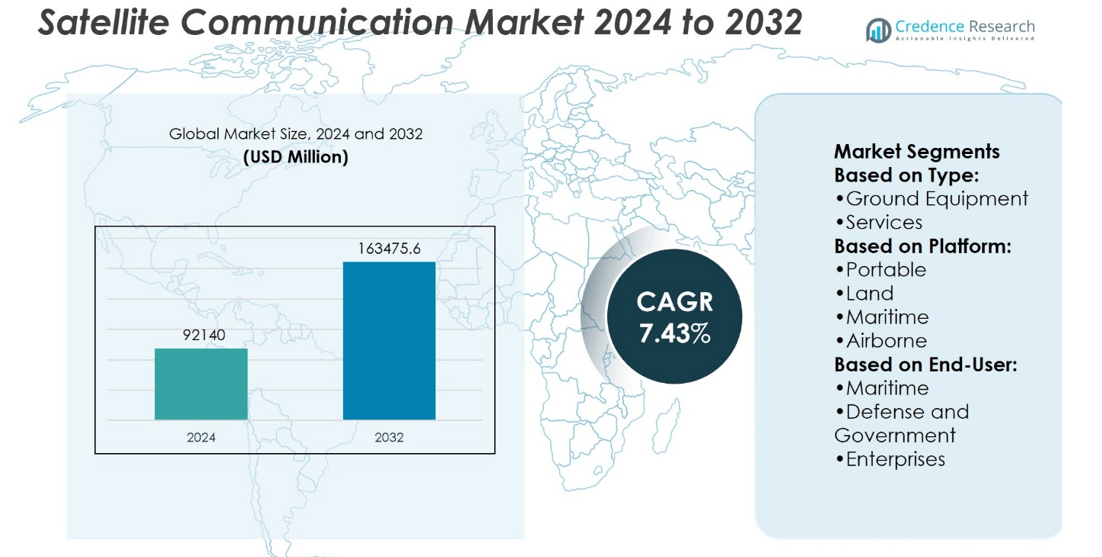

Satellite Communication Market size was valued at USD 92140 million in 2024 and is anticipated to reach USD 163475.6 million by 2032, at a CAGR of 7.43% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Satellite Communication Market Size 2024 |

USD 92140 million |

| Satellite Communication Market, CAGR |

7.43% |

| Satellite Communication Market Size 2032 |

USD 163475.6 million |

The satellite communication market is driven by increasing demand for global connectivity, especially in remote and underserved areas. Technological advancements in high-throughput satellites (HTS) and low Earth orbit (LEO) constellations are improving service quality and network efficiency. The growing adoption of satellite-based broadband across industries like aviation, defense, and maritime further fuels market expansion. Trends such as the rise of the Internet of Things (IoT), hybrid satellite networks combining different orbits, and government initiatives to improve communication infrastructure are also contributing to the market’s growth, while enhancing security features remains a key focus.

The satellite communication market shows significant growth across regions, with North America leading due to advanced infrastructure and government investments. Europe follows closely, driven by initiatives like the European Space Agency. The Asia-Pacific region, led by China and India, is rapidly expanding due to increasing satellite deployments. Key players such as Viasat, SES S.A., Intelsat, and Iridium Communications are pivotal in shaping the global landscape, driving technological advancements and expanding service coverage across various sectors worldwide.

Market Insights

- The Satellite Communication Market size was valued at USD 92,140 million in 2024 and is anticipated to reach USD 163,475.6 million by 2032, at a CAGR of 7.43% during the forecast period.

- The growing demand for global connectivity, especially in remote and underserved areas, is a key market driver.

- Advancements in high-throughput satellites (HTS) and low Earth orbit (LEO) constellations are improving service quality and network efficiency.

- The adoption of satellite-based broadband in industries like aviation, defense, and maritime continues to fuel market growth.

- Trends like the rise of IoT, hybrid satellite networks, and government-backed communication infrastructure initiatives are contributing to market expansion.

- Enhancing security features within satellite communication systems is an ongoing priority.

- North America leads the market, followed by Europe and a rapidly expanding Asia-Pacific region, with key players shaping the competitive landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for High-Speed Internet Connectivity

The demand for high-speed internet access is rapidly driving the Satellite Communication Market. This surge is particularly evident in rural and underserved areas, where traditional terrestrial infrastructure is either insufficient or unavailable. Satellite communication offers an effective solution for delivering broadband services to remote locations. Many governments and private companies are investing in satellite technology to bridge the digital divide. The increased adoption of 4G and 5G networks globally is also contributing to this growth.

- For instance, Honeywell’s JetWave system achieved full-duplex data rates exceeding 40 megabits per second during airborne tests using both GEO and MEO satellites, with seamless switching between orbits in under 30 seconds.

Expansion of Internet of Things (IoT) Applications

The proliferation of the Internet of Things (IoT) is significantly impacting the Satellite Communication Market. As more devices become connected, reliable communication networks are essential for the seamless transfer of data. Satellites are becoming increasingly critical in providing wide-area coverage and linking IoT devices in hard-to-reach regions. The growth of smart cities, autonomous vehicles, and industrial automation further supports the need for satellite-based communication networks.

- For instance, Viasat’s IoT Nano service—powered by ORBCOMM’s OGx technology—supports two-way non-IP messaging with message sizes up to 1 megabyte. Small event messages typically arrive with latency under 15 seconds, while larger file bursts reach speeds up to 16 kilobits per second.

Advancements in Satellite Technology

Technological advancements are also playing a major role in driving the Satellite Communication Market. New developments in low-Earth orbit (LEO) satellites have made communication more efficient and cost-effective. These advancements allow for reduced latency and enhanced data transmission capabilities. Satellite constellations, such as SpaceX’s Starlink, are revolutionizing the industry by providing global coverage with high-speed, low-latency services. These innovations are fostering further market expansion, especially in regions where traditional internet infrastructure is lacking.

Rising Need for Secure Communication Channels

Security concerns surrounding data privacy and communication integrity are driving the Satellite Communication Market’s growth. Satellites provide a more secure medium for sensitive data transmission compared to terrestrial networks, which are vulnerable to hacking. Industries such as defense, aerospace, and government entities are increasingly relying on satellite communication for secure communication and data sharing. The need for reliable, encrypted communications continues to push the adoption of satellite technology in these sectors.

Market Trends

Increasing Adoption of Low Earth Orbit (LEO) Satellites

One of the significant trends shaping the Satellite Communication Market is the increasing deployment of Low Earth Orbit (LEO) satellites. These satellites offer reduced latency compared to traditional geostationary satellites, improving communication efficiency. LEO constellations, such as SpaceX’s Starlink, provide global internet coverage with high-speed connectivity. Their ability to offer services in remote and rural areas is accelerating market adoption. Companies are focused on expanding these constellations to enhance global internet access and improve bandwidth for various sectors, including telecommunications and IoT.

- For instance, Qualcomm teamed up with Ericsson and Thales Alenia Space and successfully executed a 5G NR non-terrestrial network (NTN) call over a simulated LEO channel, managing Doppler shifts and handovers in a controlled lab environment—with real-time voice and video possible during the trial.

Growth of Satellite-based 5G Networks

The integration of satellite communication with 5G technology is a key trend in the Satellite Communication Market. Satellite networks are being used to extend 5G coverage in rural and remote locations where traditional infrastructure is unavailable. The combination of satellite and 5G technologies provides high-speed data transfer with low latency. It enables businesses to enhance their operations by providing consistent and uninterrupted connectivity across vast regions. This trend is transforming the way industries such as transportation, healthcare, and logistics operate, fostering greater connectivity and operational efficiency.

- For instance, the new NexusWave service has demonstrated significantly higher performance, achieving download speeds of up to 340 Mbps and upload speeds of up to 80 Mbps. This surpasses the capabilities of the original GX network, which your claim describes.

Enhanced Focus on Global Connectivity Solutions

Satellite communication is increasingly seen as a solution to global connectivity challenges. The growing demand for internet access in underserved regions is pushing the market to expand rapidly. Governments and private players are collaborating to launch satellite networks aimed at bridging the digital divide. Satellite services are enabling better education, healthcare, and economic opportunities in rural and remote locations. The focus on global connectivity is accelerating investments in satellite infrastructure and driving market growth.

Emergence of Hybrid Communication Systems

Hybrid communication systems that combine satellite communication with terrestrial networks are becoming more prevalent. These systems offer better coverage, reliability, and performance across various regions. By leveraging both satellite and terrestrial technologies, industries can ensure continuous communication, even during network failures or disruptions. The integration of these systems is gaining traction in sectors like aviation, maritime, and defense, where reliable communication is critical for operations. The trend highlights the industry’s move towards more versatile and robust communication solutions.

Market Challenges Analysis

High Capital and Operational Costs

One of the main challenges faced by the Satellite Communication Market is the high capital and operational costs associated with launching and maintaining satellites. The development of satellite infrastructure requires significant investments in research, technology, and equipment. Launching satellites into space is expensive, and maintaining them over their operational lifetime further escalates costs. Smaller players in the market often struggle to secure the necessary funding, which limits their ability to compete with established companies. These financial barriers can slow down the pace of innovation and expansion within the satellite communication sector.

Regulatory and Licensing Issues

The Satellite Communication Market also faces regulatory challenges that affect its growth and development. Satellite networks operate in specific frequency bands regulated by national and international bodies. Navigating these complex regulatory environments can be time-consuming and costly for companies entering new markets or expanding existing operations. Additionally, there is growing concern over space debris, which may result in stricter regulations on satellite launches. These regulatory hurdles could delay the deployment of new satellites and hinder efforts to expand global coverage and connectivity.

Market Opportunities

Expanding Applications in Remote and Rural Areas

The Satellite Communication Market presents significant opportunities in providing connectivity to remote and rural areas that lack access to traditional infrastructure. Governments and private companies are investing in satellite technology to address the digital divide by providing reliable broadband services in underserved regions. Satellite communication is essential for industries such as agriculture, education, and healthcare, where internet access plays a critical role in improving productivity and service delivery. Expanding satellite networks to these areas can unlock new markets, driving growth and fostering economic development in previously neglected regions.

Advancements in Satellite Technology and Services

Ongoing advancements in satellite technology create numerous opportunities for growth in the Satellite Communication Market. The deployment of Low Earth Orbit (LEO) satellite constellations is transforming communication by reducing latency and enhancing data transmission speeds. These innovations are opening doors for new services such as global internet coverage, enhanced IoT networks, and secure government communications. As technology improves, it becomes more cost-effective to deploy satellite networks, making it an attractive option for a wider range of industries. These advancements are driving market expansion and offering new revenue streams for companies within the sector.

Market Segmentation Analysis:

By Type

The Satellite Communication Market is divided into ground equipment and services. Ground equipment includes satellite terminals, antennas, and other devices that enable communication between satellites and terrestrial networks. Services include data transmission, satellite leasing, and network management. The growing demand for broadband services in remote areas fuels the need for ground equipment, while services are crucial for maintaining and operating satellite networks. This segmentation is driven by the increasing need for reliable communication infrastructure across industries.

- For instance, Boeing’s O3b mPOWER satellites each feature more than 5,000 steerable, flexible beams to direct coverage where needed. These beams support fully programmable payloads that dynamically allocate capacity and power in real time.

By Platform

The platform segment divides the market into portable, land, maritime, and airborne platforms. Portable platforms are becoming increasingly popular for personal and small-scale commercial use, such as remote work and emergency communications. Land-based platforms include fixed installations for business and government operations, often used in telecommunications. Maritime platforms serve the shipping industry, providing essential communication for navigation, safety, and cargo management. Airborne platforms support aviation, providing communication solutions for both commercial and military aircraft. These platforms address the growing demand for global connectivity across various environments and sectors.

- For instance, KVH offers the TracNet H30, a hybrid terminal just 37 cm wide and weighing 11.2 kg. It delivers satellite, cellular, and Wi-Fi connectivity with data speeds up to 6 Mb/s down and 2 Mb/s up.

By End-User

The end-user segment highlights the varied applications of satellite communication in different sectors. The maritime industry relies on satellite communication for navigation, weather updates, and communication in remote locations. The defense and government sector uses satellites for secure communication, surveillance, and reconnaissance. Enterprises, especially those operating in remote or challenging environments, leverage satellite communication for business continuity and connectivity. The media and entertainment industry relies on satellite services for broadcasting, content delivery, and live event coverage. Other end-user verticals, such as healthcare, mining, and oil & gas, also utilize satellite communication for operational efficiency in remote regions.

Segments:

Based on Type:

- Ground Equipment

- Services

Based on Platform:

- Portable

- Land

- Maritime

- Airborne

Based on End-User:

- Maritime

- Defense and Government

- Enterprises

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the satellite communication market, with 42.9% in 2024. The U.S. significantly contributes to this share, driven by a strong satellite infrastructure and key industry players like SpaceX and Boeing. The market in North America continues to expand, primarily due to growing demand for satellite broadband services, military applications, and government initiatives. This trend is expected to continue as the region sees ongoing advancements in satellite technology and commercial space exploration, maintaining a leading position in global satellite communication growth.

Europe

Europe is the second-largest market for satellite communication, accounting for a substantial portion in 2024. The region benefits from strong government-backed initiatives, such as the European Space Agency’s projects and the IRIS² satellite program. The focus on improving communication across remote and rural areas through satellite-based broadband is a key driver for growth. With an emphasis on secure communications and space-based infrastructure, Europe is set to experience steady growth, with increasing investments in satellite technology and collaborations among EU countries to enhance communication networks across the continent.

Asia-Pacific

The Asia-Pacific region is experiencing rapid growth in the satellite communication market, contributing significantly to global expansion. China and India are among the leading countries in this sector, with extensive investments in satellite constellations and space technologies. China’s market share is especially strong, representing nearly 47.3% of East Asia’s satellite communication market. India, with its growing space ambitions, is also witnessing an increase in satellite communication demand, particularly for broadband and telecommunication applications. The region’s market share is forecasted to rise steadily, with an expected share of 26% by 2034, as satellite technology continues to expand across developing countries.

Latin America

Latin America accounts for approximately 6.6% of the global satellite communication market. The region’s satellite communication sector is driven by efforts to improve connectivity in underserved and rural areas. Countries like Brazil and Mexico are actively investing in satellite infrastructure to meet the growing demand for broadband services. Latin America’s satellite communication market is expected to see gradual growth as more countries in the region adopt satellite-based technologies to support their telecommunications, media, and governmental needs.

Middle East & Africa

The Middle East and Africa (MEA) region holds around 6% of the global satellite communication market. This region is witnessing increasing investments in satellite infrastructure, particularly in Africa, where space initiatives like the African Space Agency are emerging. Countries such as South Africa, Angola, and Kenya are increasingly relying on satellite communication for rural broadband, security, and military applications. As these nations continue to develop their satellite networks and infrastructure, the MEA region is poised for moderate growth in the coming years, with a focus on expanding communication capabilities and improving satellite coverage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Honeywell International Inc. (U.S.)

- Viasat, Inc. (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- Inmarsat Global Limited (U.K.)

- Boeing (U.S.)

- KVH Industries, Inc. (U.S.)

- Cobham Limited (U.K.)

- Iridium Communications Inc. (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Communications and Power Technologies (U.S.)

Competitive Analysis

The satellite communication (SATCOM) market companies such as Viasat, SES S.A., Intelsat, Telesat, EchoStar, L3Harris Technologies, Iridium Communications, Qualcomm Technologies, KVH Industries, and Cobham Limited. The satellite communication (SATCOM) market is highly competitive, with several companies vying for dominance across various sectors, including commercial, military, and governmental applications. Market players focus on advancing satellite technology, such as high-throughput satellites, low Earth orbit constellations, and improved broadband services for remote and underserved areas. Companies are also pursuing strategic collaborations, acquisitions, and technological innovations to strengthen their market position and expand their global presence. The growing demand for reliable, high-speed connectivity across diverse industries, from defense to media, continues to drive market growth. As a result, the SATCOM industry is witnessing significant investment in infrastructure, satellite fleets, and next-generation technologies, all contributing to the market’s evolution. These efforts are expected to improve global communication networks and enhance service offerings in various regions, driving further competition in the sector.

Recent Developments

- In July 2025, Honeywell International Inc. successfully connected its new high-speed inflight connectivity system JetWave™ X over the Viasat satellite network. JetWave X is expected to complete development and certification by Q4 2025, unlocking full capabilities of Viasat’s global network including ViaSat-3 and GX satellites. Bombardier and Dassault have selected JetWave X with platform-specific availability expected in H2 2025.

- In April 2025, Viasat, Inc. advanced its multi-orbit services roadmap by signing an agreement with Telesat to integrate Telesat Lightspeed LEO Ka-band capacity into its multi-orbit network. This integration aims to enhance connectivity, reliability, and cost-effectiveness across Viasat’s mobility and defense business portfolios.

- In February 2025, Inmarsat Global Limited signed an agreement with A.P. Moller – Maersk to upgrade satellite communications across its global fleet of 340 container ships. Bandwidth enhancements will be rolled out between 2025 and 2026 as part of the “One SatCom” project to transform vessels into fully connected offices.

- In October 2023, Airbus and Northrop Grumman, a defense prime headquartered in the U.S., revealed the signing of a Memorandum of Understanding (MoU). This MoU aims to establish and enhance a strategic partnership in military satellite communications for the U.K.’s forthcoming wideband SKYNET military satellite communications program.

Report Coverage

The research report offers an in-depth analysis based on Type, Platform, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The satellite communication market is expected to experience steady growth, driven by increasing demand for global connectivity.

- Low Earth orbit (LEO) satellite constellations will play a key role in expanding broadband access to underserved regions.

- Technological advancements in high-throughput satellites (HTS) will improve network efficiency and service quality.

- The growth of IoT and M2M communication will drive the need for more robust satellite communication systems.

- There will be an increasing shift towards hybrid satellite networks combining GEO, LEO, and MEO orbits for enhanced coverage.

- Space-based broadband services will see heightened adoption in sectors like aviation, maritime, and defense.

- Strategic partnerships and mergers among satellite operators and telecom companies will increase market competitiveness.

- The growing trend of satellite communication for critical infrastructure and emergency response will boost market demand.

- Government initiatives and regulatory changes will accelerate the development of satellite-based communication infrastructure.

- Enhanced security features will be integrated into satellite communication systems to support sensitive government and military applications.