Market Overview

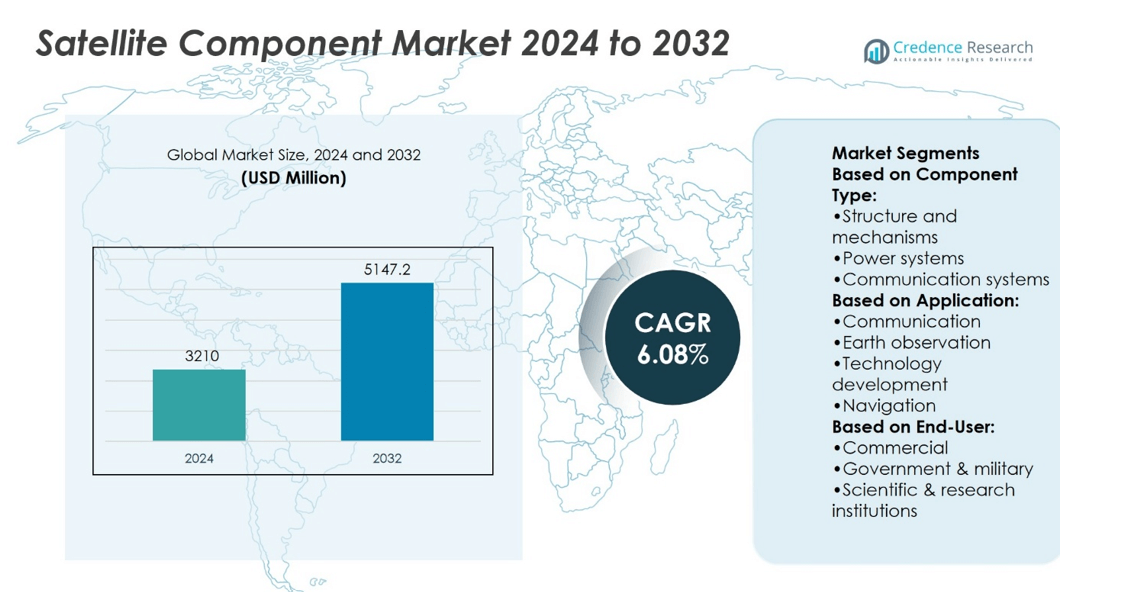

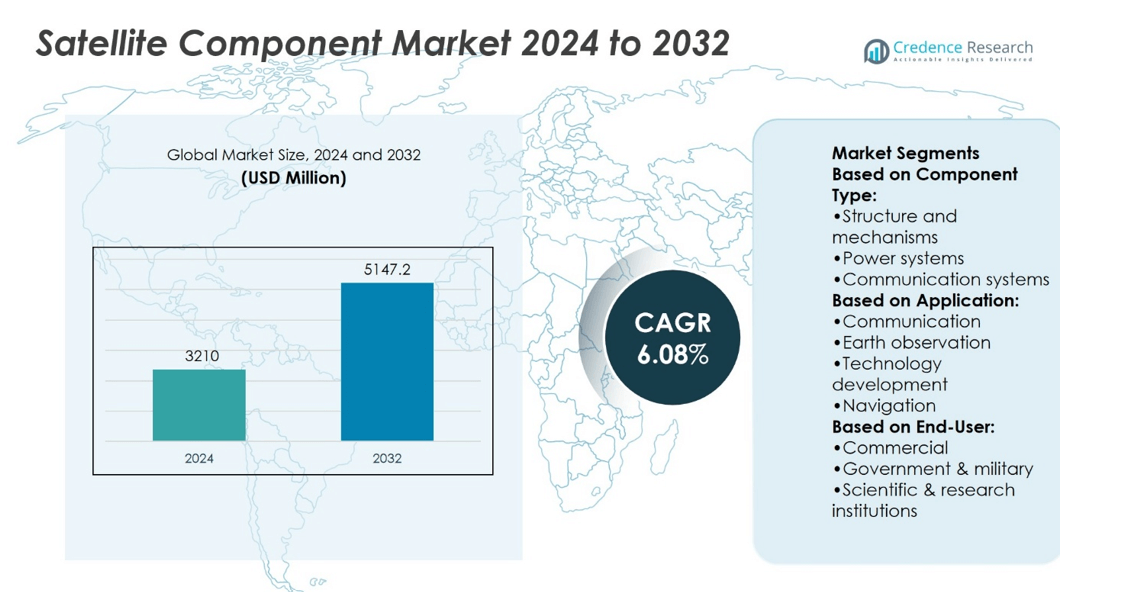

Satellite Component Market size was valued at USD 3210 million in 2024 and is anticipated to reach USD 5147.2 million by 2032, at a CAGR of 6.08% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Satellite Component Market Size 2024 |

USD 3210 million |

| Satellite Component Market , CAGR |

6.08% |

| Satellite Component Market Size 2032 |

USD 5147.2 million |

The Satellite Component Market is driven by rising demand for global connectivity, expanding deployment of Low Earth Orbit constellations, and growing applications in defense, communication, and Earth observation. Advancements in miniaturization, modular designs, and lightweight materials are shaping component innovation, enabling faster deployment and cost efficiency. The adoption of 3D printing and additive manufacturing enhances production capabilities, while the integration of IoT and 5G technologies increases reliance on advanced communication systems. Emphasis on sustainable operations and reusable components is influencing industry strategies, making innovation, efficiency, and resilience the key trends defining the market’s long-term growth trajectory.

The Satellite Component Market shows strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with North America holding the largest share due to advanced infrastructure and government investments. Europe follows with strong contributions from space programs, while Asia-Pacific grows rapidly with expanding satellite projects in China, India, and Japan. Key players shaping the market include Raytheon Technologies, Airbus Defence and Space, Lockheed Martin Corporation, Boeing Defense & Space, Honeywell International Inc., and Northrop Grumman Corporation.

Market Insights

- Satellite Component Market size was valued at USD 3210 million in 2024 and is expected to reach USD 5147.2 million by 2032, at a CAGR of 6.08%.

- Rising demand for global connectivity and LEO satellite constellations drives consistent market growth.

- Miniaturization, modular designs, and lightweight materials are shaping efficiency and cost-effective satellite solutions.

- Competitive landscape includes established players investing in innovation, partnerships, and advanced component portfolios.

- High development and launch costs remain key restraints, limiting adoption for smaller operators.

- North America holds the largest share, followed by Europe, with Asia-Pacific showing fastest growth.

- Defense, communication, and Earth observation sectors strongly influence demand, supported by IoT and 5G integration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Global Connectivity

The growing requirement for seamless global connectivity is a primary driver of the Satellite Component Market. Expanding internet penetration, especially in remote and underserved regions, has increased reliance on satellites for communication. Governments and private operators are investing in satellite infrastructure to bridge the digital divide. It provides a cost-effective solution for areas where terrestrial networks are not feasible. Advancements in component design enhance bandwidth efficiency and strengthen network reliability. This trend is pushing demand for advanced satellite components that can support high data transfer speeds and broader coverage.

- For instance, Lockheed Martin’s AEHF-6 satellite is part of a six-satellite constellation that supports data rates up to 8.192 Mbps (Extended Data Rate) over extremely high frequency (EHF) uplinks and super high frequency (SHF) downlinks.

Technological Advancements in Satellite Design

Innovation in satellite miniaturization and modular design is reshaping the Satellite Component Market. Smaller satellites equipped with advanced sensors, processors, and antennas deliver high performance with reduced launch costs. It enables faster deployment of constellations and supports more versatile missions. The adoption of 3D printing in component manufacturing increases efficiency and reduces production time. Use of lightweight materials such as composites improves durability and reduces payload weight. These developments are driving demand for cutting-edge components that align with evolving satellite architectures.

- For instance, IHI Aerospace developed a low-cost green propellant thruster using 3D printing technology for very small satellites. The company has published an application example indicating that using their low-toxic HNP propellant, a 50 kg satellite can maintain its orbital altitude for approximately two years with just 0.8 kg of propellant. For their 4N-class thruster, a 3D-printed prototype using Inconel 625 was developed and successfully tested with hydrazine, the traditional fuel, to verify the design.

Growing Role of Defense and Security Applications

Defense and security requirements are fueling expansion in the Satellite Component Market. Nations are deploying advanced satellites for intelligence, surveillance, and reconnaissance missions. It ensures real-time data sharing and secure communication across military operations. The need for resilient and jam-resistant components has grown with rising geopolitical tensions. Satellite components that enhance encryption and data protection are becoming essential. Military programs are focusing on integrating flexible and high-capacity components into space systems. This trend secures continuous growth for the market in defense applications.

Expansion of Commercial and Industrial Applications

Commercial sectors such as aviation, maritime, and energy are contributing to the growth of the Satellite Component Market. Companies are adopting satellite-enabled solutions for navigation, asset tracking, and logistics optimization. It helps organizations maintain efficiency and operational safety in challenging environments. The rapid adoption of IoT devices further boosts demand for reliable satellite components. Businesses seek hardware that can handle large volumes of interconnected devices with minimal latency. The industrial use of satellites for monitoring resources, pipelines, and infrastructure expands market opportunities. This broadening scope strengthens the role of satellite components in global industries.

Market Trends

Integration of Miniaturized Satellite Components

Miniaturization of satellite components is emerging as a key trend in the Satellite Component Market. Smaller, lighter parts reduce launch costs and allow deployment of large constellations. It supports frequent launches by private operators and government agencies. Compact components also increase flexibility in mission planning and satellite design. Manufacturers are focusing on integrating high-performance processors, sensors, and antennas within reduced sizes. This trend is driving innovation and strengthening the role of small satellites in multiple applications.

- For instance, Northrop Grumman’s GEOStar-3 bus supports payloads up to 1,000 kg and delivers up to 8,000 watts of power, enabling high-performance missions in a smaller form factor. The bus represents an evolution of the company’s GEOStar-2 platform and provides increased power capabilities for its payloads.

Adoption of Advanced Manufacturing Techniques

The use of 3D printing and additive manufacturing is transforming the Satellite Component Market. These methods shorten production cycles and improve design accuracy. It allows rapid prototyping of critical hardware with reduced material waste. Advanced techniques also support the production of customized components for specific missions. Lightweight composite materials enhance durability while reducing overall payload mass. The trend is expanding the efficiency of component manufacturing and improving scalability for satellite programs.

- For instance, Honeywell used ceramic 3D-printed molds to produce first-stage high-pressure turbine blades in just 7–8 weeks—down from the usual 1–2 years using traditional casting methods.

Growing Shift Toward Software-Defined Satellites

The adoption of software-defined technology is influencing the Satellite Component Market. Flexible components enable satellites to adapt functions after launch. It provides operators with the ability to reconfigure bandwidth and adjust coverage dynamically. The demand for programmable processors and reconfigurable antennas is growing across industries. This shift strengthens the operational lifespan of satellites by allowing upgrades without hardware replacement. The trend highlights a movement toward adaptable and cost-efficient satellite systems.

Rising Emphasis on Sustainable Space Operations

Sustainability is shaping trends in the Satellite Component Market. The focus on debris mitigation drives demand for components designed for controlled deorbiting. It supports safe disposal of satellites and reduces risks in orbital environments. Manufacturers are also developing parts that consume less power and extend system efficiency. Reusable launch systems encourage the design of durable and modular satellite components. Global space policies are reinforcing the need for responsible component production. This trend ensures the market evolves in alignment with long-term sustainability goals.

Market Challenges Analysis

High Development and Launch Costs

One of the major challenges in the Satellite Component Market is the high cost of development and launch. Designing advanced components requires extensive research, precision engineering, and compliance with strict quality standards. It creates significant financial barriers for smaller companies and startups. Launch expenses further add to the overall cost, making affordability a limiting factor for many operators. The pressure to reduce costs while ensuring performance and reliability remains constant. This challenge restricts faster adoption of new technologies and slows expansion in emerging markets.

Technical Complexity and Supply Chain Constraints

The technical complexity of satellite components presents another key challenge for the Satellite Component Market. Manufacturing advanced sensors, processors, and antennas demands specialized skills and high-end facilities. It increases dependency on a limited pool of suppliers and raises risks of delays. Geopolitical tensions and trade restrictions have further strained the availability of critical materials. Ensuring consistent quality across a global supply chain remains difficult. These factors create hurdles for timely delivery of components and affect large-scale satellite deployment. This challenge compels industry players to focus on supply chain resilience and technology standardization.

Market Opportunities

Expansion of LEO Constellations and Broadband Access

The growing deployment of Low Earth Orbit constellations is creating major opportunities in the Satellite Component Market. LEO networks demand advanced antennas, power systems, and processors to deliver reliable connectivity. It opens opportunities for component suppliers to provide high-performance hardware supporting large constellations. Expanding broadband coverage in rural and underserved areas further increases demand for scalable and cost-efficient components. Governments and private operators are investing heavily in LEO infrastructure, driving consistent requirements for innovative parts. This trend positions component manufacturers to benefit from both commercial and government-backed projects.

Growth in Emerging Applications and Industry Partnerships

Emerging applications such as Earth observation, IoT connectivity, and satellite-enabled 5G present strong opportunities for the Satellite Component Market. Industrial sectors are adopting satellite services for monitoring, navigation, and asset tracking, creating steady demand for durable components. It encourages partnerships between satellite manufacturers, telecom providers, and technology firms. Collaborations drive innovation in modular and reconfigurable parts that meet diverse sector needs. Increased focus on sustainable space operations also opens markets for eco-friendly and reusable components. These opportunities highlight the expanding role of satellite components in advancing global connectivity and industry transformation.

Market Segmentation Analysis:

By Component Type

The Satellite Component Market is segmented into structure and mechanisms, power systems, communication systems, transponders, antennas, receivers and transmitters, propulsion systems, thermal control systems, and others. Structural components and mechanisms form the base of satellite integrity, ensuring durability under extreme space conditions. Power systems, including batteries and solar panels, play a vital role in delivering energy to all subsystems. Communication systems, transponders, and antennas drive high-speed data transfer across multiple platforms. Receivers and transmitters remain critical for signal management, while propulsion systems enable orbital maneuvering and station-keeping. Thermal control systems maintain stable operations under fluctuating space temperatures. These diverse components strengthen satellite performance across commercial, defense, and scientific missions.

- For instance, Boeing’s 702MP satellite bus supports payload power from 6 to 12 kW, and carries payload masses between 300 and 650 kg, enabling robust communications within a medium-power envelope.

By Application

In terms of applications, the Satellite Component Market covers communication, Earth observation, technology development, navigation, space science, and others. Communication remains the leading application, supported by growing demand for broadband and broadcasting services. Earth observation gains momentum with applications in climate monitoring, disaster management, and defense surveillance. Technology development focuses on experimental payloads and new satellite architectures. Navigation applications serve aviation, maritime, and logistics sectors by offering real-time tracking and global positioning. Space science supports deep space missions, astronomical studies, and planetary exploration. Other applications include education and pilot projects aimed at testing satellite capabilities.

- For instance, JONSA produces Ku-band VSAT antennas, such as the VSATE120 model, with a gain of 43.7 dBi at 14 GHz and 42.0 dBi at 12.75 GHz. The company’s total monthly production capacity, encompassing a variety of antenna products including DTH, VSAT, WISP, and maritime antennas, exceeds one million units.

By End User

End-user segmentation divides the Satellite Component Market into commercial, government and military, and scientific and research institutions. Commercial operators drive demand through projects in telecommunications, IoT, and media broadcasting. Government and military organizations focus on secure communication, defense surveillance, and national security missions. It drives investments in advanced, resilient components for critical operations. Scientific and research institutions invest in satellites for academic research, space experiments, and exploration programs. Each end user segment contributes uniquely to the market, broadening the scope for component suppliers. This segmentation highlights the diverse and expanding role of satellite components across global industries.

Segments:

Based on Component Type:

- Structure and mechanisms

- Power systems

- Communication systems

Based on Application:

- Communication

- Earth observation

- Technology development

- Navigation

Based on End-User:

- Commercial

- Government & military

- Scientific & research institutions

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest market share of the Satellite Component Market, accounting for over 35% of the global share. The region benefits from the presence of key players, advanced manufacturing facilities, and extensive government funding in satellite programs. The United States leads in both commercial and defense satellite deployments, supported by agencies such as NASA, the U.S. Department of Defense, and private companies including SpaceX, Boeing, and Lockheed Martin. It invests heavily in advanced communication systems, propulsion units, and thermal control technologies to support deep space missions and broadband constellations. Canada also contributes through Earth observation and scientific missions, strengthening regional demand for components. The robust supply chain and strong industry collaborations further drive growth in this region.

Europe

Europe represents around 25% of the Satellite Component Market share, supported by strong investments in space exploration and communication programs. The European Space Agency (ESA), along with national agencies such as CNES (France) and DLR (Germany), plays a central role in satellite projects. It has fostered advancements in propulsion systems, transponders, and antennas, enhancing the competitiveness of European manufacturers. Countries like France, Germany, and the United Kingdom lead in production and export of critical components. The growing emphasis on sustainable space operations also drives innovation in reusable and eco-friendly satellite parts. Europe’s collaboration on projects like Galileo for navigation and Copernicus for Earth observation underscores the region’s focus on technological leadership.

Asia-Pacific

Asia-Pacific accounts for nearly 20% of the Satellite Component Market, driven by rapid advancements in satellite technology across China, India, and Japan. China has launched large-scale constellations and invests in advanced communication systems and propulsion units. India’s ISRO continues to expand its presence with cost-effective satellite missions, supporting strong demand for power systems, antennas, and structural components. Japan emphasizes navigation and Earth observation projects, backed by cutting-edge technology development. It benefits from increasing partnerships with private firms and international collaborations that promote regional component production. The expanding role of satellites in communication, defense, and scientific exploration positions Asia-Pacific as a fast-growing contributor to the global market.

Latin America

Latin America holds about 8% of the Satellite Component Market share, with growth fueled by emerging communication and Earth observation needs. Countries such as Brazil and Mexico are investing in satellites for environmental monitoring, defense communication, and disaster management. It creates opportunities for structural components, antennas, and power systems tailored for regional requirements. Partnerships with international satellite manufacturers support technology transfer and capacity building. The demand for rural connectivity and navigation services further increases the importance of reliable components. Though smaller in share compared to other regions, Latin America shows strong potential for steady growth.

Middle East and Africa

The Middle East and Africa together represent nearly 7% of the Satellite Component Market share. Governments in this region are focusing on developing space programs to support national security, broadcasting, and communication infrastructure. The United Arab Emirates has made strides with initiatives such as the Mars mission, boosting demand for advanced satellite components. South Africa and Nigeria lead satellite deployments in Africa, with applications in agriculture, disaster monitoring, and navigation. It supports demand for communication systems, receivers, and transponders. Investments in satellite-based internet services to connect underserved areas are also expanding. While the market share is smaller, the region’s long-term prospects are improving with increasing space initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Satellite Component Market players include Raytheon Technologies, Boeing Defense, Space & Security, Airbus Defence and Space, Challenger Communications, Honeywell International Inc., IHI Corporation, JONSA TECHNOLOGIES CO., LTD., L3Harris Technologies, Lockheed Martin Corporation, and Northrop Grumman Corporation. The Satellite Component Market is characterized by intense competition, with companies focusing on innovation, efficiency, and mission adaptability. Firms are investing heavily in advanced communication systems, propulsion units, and lightweight structural designs to enhance satellite performance. The push for miniaturization and modular components is enabling faster deployment of constellations while reducing launch costs. Strong emphasis is placed on research and development to deliver high-capacity payloads, energy-efficient power systems, and resilient thermal control solutions. Competition also extends to partnerships and collaborations, where players align with governments, defense agencies, and commercial operators to expand market reach. The drive toward sustainability, cost reduction, and advanced manufacturing methods such as additive production further shapes the strategies adopted in this evolving market landscape.

Recent Developments

- In March 2025, Honeywell International Inc. actively showcases innovations in satellite electronics and power systems, including developments unveiled at SATELLITE 2025 in Washington, D.C. Honeywell’s new thermal management solutions and radiation-hardened components are gaining traction among manufacturers of small and medium satellite platforms.

- In December 2024, Lockheed Martin brings differentiated capabilities to support space technology trends like advanced communications, AI and human lunar, investing in miniaturized payloads, next-generation propulsion systems, and advanced secure communication modules for LEO, MEO, and GEO satellite missions. Lockheed Martin is also advancing AI integration in satellite operations for autonomous mission management.

- In April 2024, L3Harris Technologies sued supplier Moog Inc. over delays and defective satellite components, highlighting supply chain issues amid rising demand for small satellites in U.S. national security programs. The lawsuit underscores the strain on the satellite industry as the military accelerates the deployment of satellite constellations, revealing weaknesses in the production and delivery of critical components.

- In March 2023, astronomers from Indian Institute of Astrophysics (IIA) have developed a new low-cost star sensor that can help Cubesats find their orientation in space. The new instrument, ‘Starberry Sense’, is built using commercially-off-the-shelf components, and can be used for Cubesats and other small satellite missions in the future.

Report Coverage

The research report offers an in-depth analysis based on Component Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for global broadband connectivity.

- Low Earth Orbit constellations will drive consistent need for advanced satellite components.

- Miniaturized and modular designs will dominate future satellite architectures.

- Growth in IoT and 5G integration will boost demand for communication systems.

- Defense and security applications will continue to secure investments in resilient components.

- Additive manufacturing will reduce production costs and enable faster component development.

- Sustainability initiatives will increase adoption of eco-friendly and reusable satellite parts.

- Collaboration between private companies and government agencies will strengthen innovation pipelines.

- Space exploration and deep-space missions will generate demand for high-capacity power systems.

- Emerging economies will expand investments, creating new opportunities for component suppliers.