Market Overview

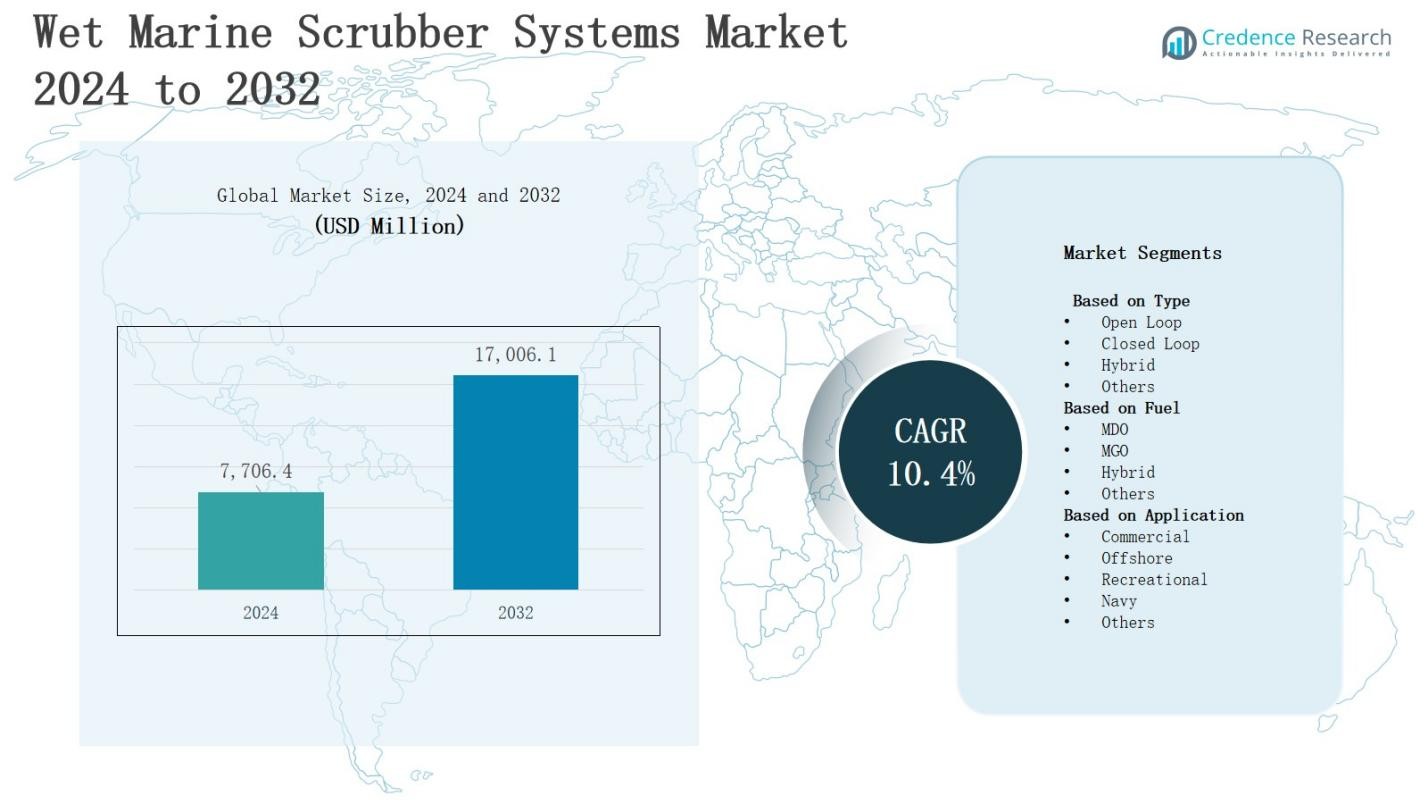

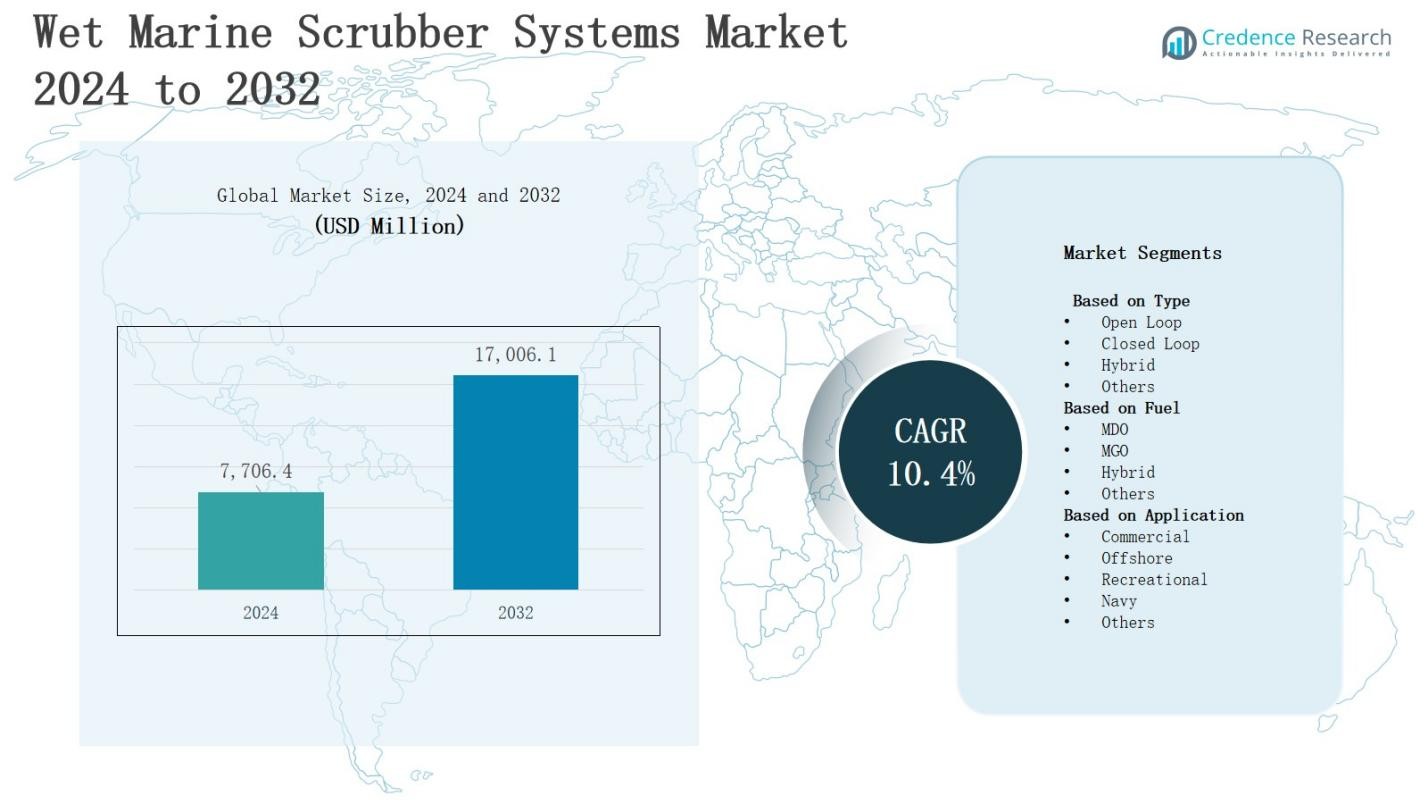

The wet marine scrubber systems market is projected to grow from USD 7,706.4 million in 2024 to USD 17,006.1 million by 2032, registering a strong CAGR of 10.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wet Marine Scrubber Systems Market Size 2024 |

USD 7,706.4 Million |

| Wet Marine Scrubber Systems Market, CAGR |

10.4% |

| Wet Marine Scrubber Systems Market Size 2032 |

USD 17,006.1 Million |

The wet marine scrubber systems market is driven by stringent international regulations on sulfur emissions from ships, rising adoption of exhaust gas cleaning systems, and the growing need for compliance with IMO 2020 standards. Shipping companies increasingly invest in scrubbers to balance operational efficiency and cost savings compared to low-sulfur fuels. Trends shaping the market include the integration of hybrid scrubber technologies, growing demand for open-loop and closed-loop systems, and increasing retrofitting activities in existing fleets. Advancements in water treatment technologies and a shift toward sustainable shipping practices further reinforce the market’s long-term growth potential.

The wet marine scrubber systems market demonstrates diverse geographical adoption, with Asia Pacific leading at 34% share, followed by Europe at 25% and North America at 20%. Latin America accounts for 10%, while the Middle East & Africa holds 11%. Growth is driven by strong shipbuilding capacity, strict environmental regulations, and expanding retrofit demand across global fleets. Key players include ALFA LAVAL, HAMON, Ecospray Technologies S.r.l., Elessent Clean Technologies Inc., Clean Marine, Fuji Electric Co., Ltd., Langh Tech Oy Ab, Hyundai Heavy Industries Co., Ltd., CR Ocean Engineering, Damen Shipyards Group, Duconenv, and DuPont.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The wet marine scrubber systems market is projected to grow from USD 7,706.4 million in 2024 to USD 17,006.1 million by 2032, at a CAGR of 10.4%.

- Stringent IMO 2020 sulfur emission regulations drive adoption, with shipowners investing in scrubbers as a cost-effective alternative to low-sulfur fuels.

- High fuel costs strengthen the case for scrubbers, enabling vessels to operate on cheaper high-sulfur fuel oil and improve long-term operational efficiency.

- Retrofitting projects dominate demand, while newbuild ship designs increasingly integrate scrubbers to ensure compliance and extend vessel viability.

- Advancements in hybrid and closed-loop technologies, water treatment solutions, and digital monitoring tools support efficiency and sustainable shipping practices.

- High installation costs, downtime during integration, and washwater discharge restrictions create challenges, alongside regulatory uncertainty in certain regions.

- Geographically, Asia Pacific leads with 34% share, followed by Europe at 25%, North America at 20%, Latin America at 10%, and the Middle East & Africa at 11%.

Market Drivers

Stringent Emission Regulations and Compliance Requirements

The wet marine scrubber systems market benefits strongly from international environmental regulations focused on reducing sulfur emissions from maritime transport. The International Maritime Organization (IMO) 2020 mandate limits sulfur content in marine fuel, compelling shipowners to adopt exhaust gas cleaning solutions. It provides a cost-effective alternative to low-sulfur fuel while ensuring compliance with environmental norms. Governments continue to enforce stricter emission laws, accelerating demand. Regulatory pressure ensures sustained market adoption across global shipping fleets.

- For instance, BW LPG, a prominent shipping company, equipped six of its newly acquired Very Large Gas Carriers (VLGCs) with marine scrubbers in 2024, reducing sulfur emissions to comply with IMO 2020 regulations while optimizing fuel costs.

Cost Efficiency and Operational Advantages

The wet marine scrubber systems market grows due to its ability to reduce long-term operational costs for shipping companies. High fuel costs encourage adoption since scrubbers allow vessels to operate on cheaper high-sulfur fuel oil while meeting compliance standards. It improves return on investment through fuel cost savings, making the technology attractive for bulk carriers and container ships. Shipowners prioritize efficient capital utilization, supporting steady uptake. Rising global trade volumes enhance adoption opportunities further.

- For instance, the MS Zaandam, operated by Holland America Line, demonstrated a 75% reduction in sulfur oxide emissions using an open loop seawater scrubber, allowing the ship to continue using high-sulfur fuel cost-effectively.

Expanding Retrofit and Newbuild Installations

The wet marine scrubber systems market gains momentum through growing demand for both retrofit projects and integration into new vessels. Retrofitting allows existing fleets to remain compliant without switching entirely to alternative fuels. It enables extended vessel life and ensures continued economic viability. Newbuild ships increasingly incorporate scrubbers into design specifications, reflecting long-term planning by shipowners. Expanding global shipbuilding activities drive forward-looking adoption. Market penetration increases steadily across key maritime hubs.

Technological Advancements and Sustainability Goals

The wet marine scrubber systems market advances through innovations in water treatment technologies, hybrid systems, and closed-loop configurations. These developments improve efficiency, reduce environmental footprint, and support sustainable shipping practices. It aligns with industry efforts to minimize pollution and achieve carbon-neutral goals. Technology providers invest in research to enhance operational reliability. Shipping companies view advanced scrubbers as a bridge toward cleaner energy alternatives. Sustainability imperatives continue to position scrubbers as a vital compliance solution.

Market Trends

Rising Preference for Hybrid and Closed-Loop Scrubber Systems

The wet marine scrubber systems market is witnessing a steady transition toward hybrid and closed-loop technologies that allow flexible operation in varying water conditions. Hybrid systems provide the dual benefit of switching between open-loop and closed-loop modes depending on regional restrictions. It helps ship operators comply with strict port regulations while maintaining cost efficiency. Closed-loop systems gain traction in environmentally sensitive zones where water discharge limitations are enforced. This flexibility enhances long-term adoption prospects globally.

- For instance, Alfa Laval’s PureSOx system, with nearly 15 years of hybrid operation experience, offers vessels both open-loop and closed-loop modes to optimize compliance and cost efficiency based on their sailing routes.

Growing Investments in Retrofitting Existing Vessels

The wet marine scrubber systems market experiences growth from strong demand for retrofitting projects across global fleets. Shipowners increasingly view retrofits as a practical solution to extend vessel compliance without major overhauls. It provides a cost-efficient pathway to meet IMO 2020 standards while retaining operational competitiveness. Retrofitting becomes particularly attractive for bulk carriers, oil tankers, and container ships with high fuel consumption. Expanding retrofit programs from major shipyards and service providers further accelerate adoption worldwide.

Integration of Digital Monitoring and Automation Solutions

The wet marine scrubber systems market is shaped by rising integration of digital monitoring tools, automation technologies, and advanced sensors. Smart monitoring platforms enable ship operators to track system performance, fuel savings, and regulatory compliance in real time. It strengthens operational transparency while minimizing downtime. Automated control systems enhance efficiency by optimizing water usage and emission filtration. Growing reliance on data-driven insights aligns with the shipping industry’s broader shift toward digital transformation and predictive maintenance.

- For instance, Valmet’s scrubber control system, built on the Valmet DNA platform, connects all scrubber-related data into one automated system, enabling operators to easily monitor emissions and water discharge compliance in real time from various locations on the vessel.

Sustainability-Driven Adoption Across Global Shipping Industry

The wet marine scrubber systems market is influenced by increasing alignment with global sustainability goals and cleaner shipping practices. Scrubber adoption helps reduce sulfur oxide emissions, contributing to climate change mitigation strategies. It supports the shipping industry’s transition toward greener energy without immediate reliance on alternative fuels. Stakeholders view scrubbers as a bridge technology until zero-emission solutions achieve scalability. Growing environmental awareness, coupled with corporate sustainability commitments, reinforces widespread adoption across international maritime trade.

Market Challenges Analysis

High Installation Costs and Operational Complexities

The wet marine scrubber systems market faces challenges due to significant upfront investment required for installation and integration. Many shipowners remain hesitant, particularly small and mid-sized operators with limited budgets. It requires vessel downtime during installation, which disrupts shipping schedules and increases indirect costs. Operational complexities also emerge, including the need for specialized crew training and maintenance protocols. These factors restrict adoption speed and influence decision-making among fleet operators evaluating long-term compliance strategies.

Environmental Concerns and Regulatory Uncertainty

The wet marine scrubber systems market encounters difficulties due to growing concerns about washwater discharge and its ecological impact. Several ports and coastal regions have imposed restrictions on open-loop scrubbers, creating uncertainty for shipowners. It forces companies to reconsider system choices and operational routes. Evolving regulations across different jurisdictions complicate compliance planning for global fleets. Environmental scrutiny intensifies pressure on manufacturers to develop cleaner solutions, while uncertainty about future standards limits widespread investment confidence.

Market Opportunities

Expansion Across Retrofitting and Newbuild Segments

The wet marine scrubber systems market holds strong opportunities through expansion in both retrofitting projects and new vessel constructions. Rising demand for compliance among older fleets encourages retrofit installations, while shipbuilders integrate scrubbers into design specifications for newbuilds. It creates a balanced growth pathway that supports short-term and long-term market penetration. Growing international trade volumes further enhance the need for compliant fleets. Shipyards, engineering firms, and service providers can capitalize by offering tailored retrofit packages and advanced installation solutions.

Advancements in Technology and Sustainable Shipping Goals

The wet marine scrubber systems market presents opportunities through innovation in hybrid technologies, improved water treatment solutions, and automation systems. It allows operators to optimize performance while aligning with stricter emission rules and sustainability objectives. Integration with digital monitoring platforms further enhances operational efficiency and transparency. Increasing pressure on the maritime sector to reduce environmental impact positions scrubbers as a vital bridge technology. Companies investing in next-generation systems will capture competitive advantage and expand global adoption potential.

Market Segmentation Analysis:

By Type

The wet marine scrubber systems market is segmented into open loop, closed loop, hybrid, and others. Open-loop scrubbers remain widely adopted due to their relatively lower installation cost and operational simplicity in international waters. Closed-loop systems gain preference in regions with strict washwater discharge regulations. Hybrid systems are increasingly favored for their flexibility to switch between modes depending on environmental conditions. It provides shipowners with compliance assurance across diverse routes and regulatory frameworks, supporting broader adoption.

- For instance, Wärtsilä’s open-loop scrubber system uses seawater’s natural alkalinity to neutralize sulfur oxides, offering an economical and environmentally friendly solution to meet IMO 2020 regulations.

By Fuel

Segmentation by fuel includes MDO, MGO, hybrid, and others. Marine diesel oil (MDO) and marine gas oil (MGO) dominate usage, driven by regulatory pressure to lower sulfur emissions. Hybrid fuel options are emerging to support efficient operation across varying regions and costs. It offers shipowners greater operational versatility while optimizing long-term expenses. The segment continues to expand with growing emphasis on compliance, cost savings, and operational sustainability across international shipping routes.

- For instance, Maersk, one of the world’s largest shipping companies, has reported significant use of MDO across its fleet to comply with IMO 2020 sulfur regulations while optimizing operational costs.

By Application

The wet marine scrubber systems market is categorized into commercial, offshore, recreational, navy, and others. Commercial shipping holds the largest share, driven by high demand for compliance across bulk carriers, tankers, and container vessels. Offshore vessels adopt scrubbers to meet regional regulatory frameworks while maintaining efficiency in exploration and production activities. Navy fleets integrate scrubbers to modernize operations and reduce environmental footprint. It reflects increasing demand for advanced systems across diverse maritime applications.

Segments:

Based on Type

- Open Loop

- Closed Loop

- Hybrid

- Others

Based on Fuel

Based on Application

- Commercial

- Offshore

- Recreational

- Navy

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The wet marine scrubber systems market in North America accounts for 20% of the global share, driven by strict emission control areas (ECAs) along U.S. and Canadian coasts. Enforcement of sulfur regulations compels shipowners to adopt scrubber technologies to remain compliant while operating on cost-effective fuels. It benefits from a strong presence of retrofitting facilities and established shipping routes. Offshore activities in the Gulf of Mexico further increase system deployment. Strong environmental oversight and technological advancement support continued growth.

Europe

Europe holds 25% of the wet marine scrubber systems market, supported by comprehensive emission regulations enforced in the Baltic and North Seas. Shipowners in the region prioritize hybrid and closed-loop systems to meet stringent water discharge restrictions. It gains momentum from advanced shipbuilding industries in Germany, Finland, and Italy. Demand extends across passenger ferries, cruise liners, and cargo ships. Growing focus on sustainable maritime operations and green shipping corridors strengthens market prospects in this region.

Asia Pacific

Asia Pacific leads the wet marine scrubber systems market with 34% share, driven by strong shipping activity in China, South Korea, and Japan. Large-scale shipbuilding capacity and rising exports contribute to rapid adoption. It expands further through government-backed initiatives supporting environmental compliance. Retrofitting activities dominate, while newbuild orders integrate advanced scrubber technologies. Rising demand from commercial shipping and offshore fleets ensures long-term growth. Regional dominance is reinforced by global trade reliance on Asia-based shipping networks.

Latin America

Latin America represents 10% of the wet marine scrubber systems market, influenced by growing maritime trade across Brazil, Mexico, and Argentina. Regional ports increase regulatory oversight, encouraging scrubber installations in cargo and tanker fleets. It benefits from expanding offshore oil exploration, where vessels seek compliance while operating efficiently. Limited shipbuilding capacity makes retrofits the preferred choice. Rising fuel costs enhance interest in cost-saving technologies, strengthening adoption momentum across regional operators and international carriers.

Middle East & Africa

The wet marine scrubber systems market in the Middle East & Africa holds 11% share, supported by high oil tanker traffic and expanding port infrastructure. Adoption is driven by international shipping routes passing through the Suez Canal and Arabian Gulf. It is influenced by regulatory harmonization with global emission standards. Offshore activities in West Africa and the Middle East further support demand. Growing focus on sustainable port operations and fuel cost optimization boosts regional growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The wet marine scrubber systems market is highly competitive with strong participation from global engineering firms, shipbuilders, and technology providers focusing on emission control solutions. Key players such as ALFA LAVAL, HAMON, Ecospray Technologies S.r.l., Elessent Clean Technologies Inc., Clean Marine, Fuji Electric Co., Ltd., Langh Tech Oy Ab, HYUNDAI HEAVY INDUSTRIES CO., LTD., CR Ocean Engineering, Damen Shipyards Group, Duconenv, and DuPont drive innovation through advanced designs, efficient installation services, and compliance-oriented technologies. It reflects intense rivalry where companies compete on system reliability, lifecycle cost, and adaptability to regional discharge regulations. Strategic partnerships, retrofitting programs, and integration of hybrid solutions further shape the competitive landscape, while continuous investment in water treatment and digital monitoring platforms enhances product differentiation. Market leaders strengthen their presence by leveraging global service networks, offering aftersales support, and aligning with evolving maritime sustainability goals, ensuring long-term positioning in an industry defined by regulatory compliance and operational efficiency.

Recent Developments

- In March 2023, Wärtsilä announced its first order for Carbon Capture and Storage (CCS)-Ready scrubber systems. These systems are designed with dedicated space, optimized utilities, and advanced control features that allow shipowners to retrofit full CCS units in the future.

- In September 2024, Color Line partnered with Wärtsilä to retrofit four Ro‑Pax vessels with hybrid scrubber systems, achieving a remarkable 98% reduction in sulfur oxide emissions.

- In July 2024, CR Ocean Engineering (CROE) partnered with Oberlin Filter Company to integrate low-maintenance filtration solutions into scrubber washwater systems, improving on-board water quality control .

Market Concentration & Characteristics

The wet marine scrubber systems market demonstrates moderate to high concentration, with a limited number of global players holding significant influence through advanced technologies, strong service networks, and compliance expertise. Leading companies such as ALFA LAVAL, HAMON, Ecospray Technologies S.r.l., Elessent Clean Technologies Inc., Clean Marine, Fuji Electric Co., Ltd., Langh Tech Oy Ab, Hyundai Heavy Industries Co., Ltd., CR Ocean Engineering, Damen Shipyards Group, Duconenv, and DuPont dominate competitive positioning. It reflects high entry barriers due to capital-intensive installation requirements, technical complexity, and regulatory-driven demand. Market characteristics include strong reliance on retrofitting solutions, growing preference for hybrid systems, and integration of digital monitoring tools to optimize operations. Regional variation in discharge rules influences system adoption, while global trade expansion reinforces long-term opportunities. Intense competition encourages continuous product innovation and sustainability-driven designs, ensuring that established manufacturers maintain leadership while addressing environmental scrutiny and evolving compliance expectations.

Report Coverage

The research report offers an in-depth analysis based on Type, Fuel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of hybrid and closed-loop systems will increase due to stricter discharge regulations in major ports.

- Retrofitting projects will remain a dominant revenue source as older fleets seek compliance solutions.

- Digital monitoring and automation will enhance operational efficiency and system reliability.

- Demand for scrubbers in newbuild vessels will expand with global shipbuilding growth.

- Environmental concerns will drive innovation in water treatment and eco-friendly scrubber technologies.

- Regional emission control areas will accelerate adoption across shipping routes.

- High fuel price volatility will continue to favor scrubber installation over low-sulfur fuel use.

- Regulatory uncertainty will influence system design choices and investment strategies.

- Key players will expand service networks and partnerships to strengthen market positioning.

- Sustainability commitments across the maritime industry will reinforce scrubbers as a transitional compliance solution.