Market Overview:

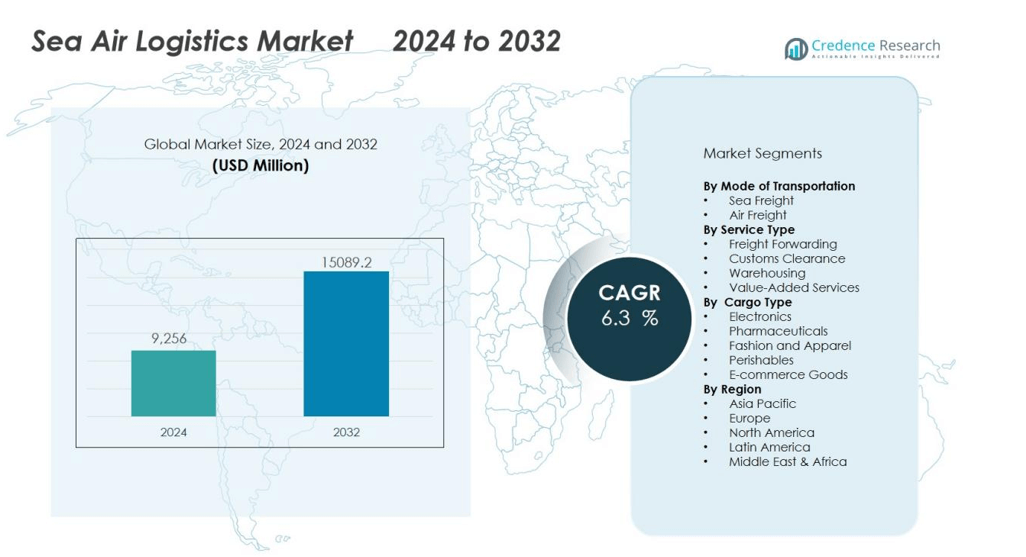

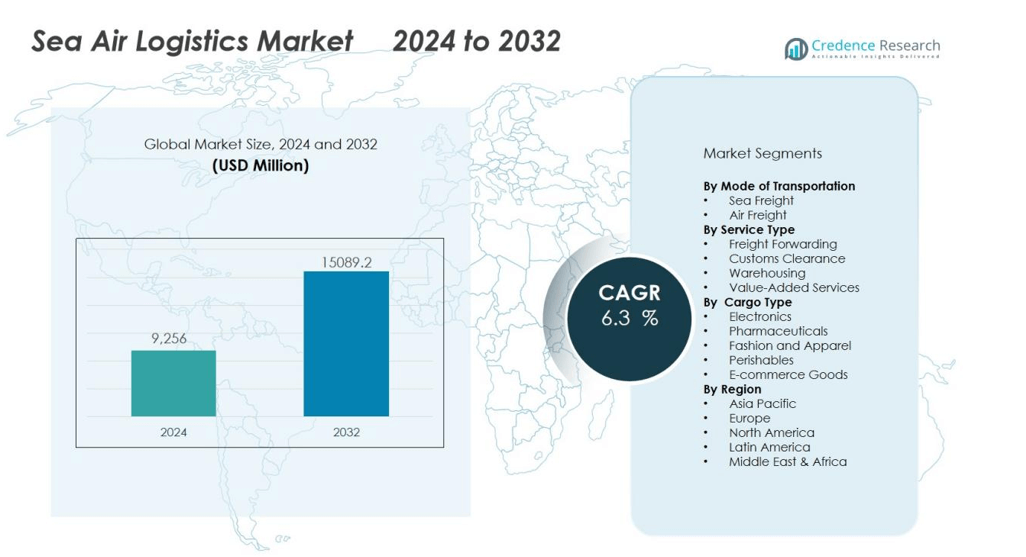

The sea air logistics market size was valued at USD 9,256 million in 2024 and is anticipated to reach USD 15089.2 million by 2032, at a CAGR of 6.3 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sea Air Logistics Market Size 2024 |

USD 9,256 million |

| Sea Air Logistics Market, CAGR |

6.3% |

| Sea Air Logistics Market Size 2032 |

USD 15089.2 million |

Key drivers of the market include rising e-commerce activities, heightened demand for faster delivery of consumer goods, and supply chain disruptions that push industries toward flexible transport solutions. Industries such as electronics, fashion, and healthcare rely on sea air logistics to balance cost and speed, supporting its adoption across major trade lanes. Technological integration, including real-time tracking and digital logistics platforms, further enhances efficiency and transparency, driving stronger demand from shippers and freight forwarders.

Regionally, Asia-Pacific holds the largest market share, supported by strong manufacturing hubs in China, India, and Southeast Asia. North America remains a significant market due to high import volumes and established logistics infrastructure. Europe shows steady growth, driven by cross-border trade and consumer-driven logistics demand. Emerging markets in the Middle East and Africa also provide growth opportunities, benefiting from strategic geographic positioning and rising investment in logistics infrastructure.

Market Insights:

- The sea air logistics market was valued at USD 9,256 million in 2024 and is projected to reach USD 15,089.2 million by 2032, growing at a CAGR of 3%.

- Rising e-commerce demand and consumer preference for faster delivery drive hybrid transport adoption.

- Companies use sea-air logistics to balance cost efficiency with delivery speed, strengthening supply chain resilience.

- Expansion of manufacturing hubs in China, India, and Southeast Asia fuels higher demand for multimodal solutions.

- Advanced digital platforms, IoT, and real-time tracking improve transparency and strengthen customer confidence.

- High operational costs, fuel price volatility, and cargo capacity constraints remain major industry challenges.

- Asia-Pacific leads with 32% share, followed by North America at 28% and Europe at 25%, supported by strong infrastructure and trade flows.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from E-commerce and Consumer Goods:

The rapid growth of e-commerce strongly supports the sea air logistics market. Retailers and brands need faster delivery models to meet consumer expectations, while also managing freight costs. Sea-air transport offers a balance between speed and affordability, making it a preferred choice for cross-border e-commerce shipments. It allows businesses to shorten lead times without relying solely on expensive air freight.

Cost Optimization with Speed Advantage:

Companies across industries use sea-air logistics to control transportation expenses while maintaining delivery efficiency. Air freight ensures faster transit for time-sensitive cargo, while sea freight provides lower costs for bulk movement. Combining both modes reduces overall logistics expenses while maintaining supply chain resilience. It strengthens the appeal of sea air logistics for industries with fluctuating demand patterns.

- For instance, Expeditors’ Integrated Sea-Air program can facilitate transit from Shanghai to Chicago in approximately 15 days, potentially lowering inventory-in-transit days by a significant margin compared to a standard all-ocean shipment. The faster transit is enabled by synchronizing vessel and flight schedules, which optimizes handoffs and reduces transshipment time.

Growth of Global Manufacturing Hubs:

Expanding production in Asia, particularly China, India, and Southeast Asia, creates strong demand for hybrid logistics models. Exporters rely on sea-air routes to deliver products quickly to consumer markets in North America and Europe. It helps businesses manage long distances while keeping shipping costs competitive. The integration of sea and air routes supports growing trade flows across continents.

- For instance, DB Schenker’s Sea-Air solution reduced transit time for shipments from Shanghai to Frankfurt to 18 days.

Technological Advancements in Logistics Networks:

The adoption of digital platforms and real-time tracking tools enhances transparency in sea-air transport. Automation, IoT devices, and AI-driven logistics systems allow companies to plan efficient routes and monitor cargo movement. It reduces delays and improves customer confidence in multimodal transport solutions. Technology continues to drive efficiency, making sea air logistics an attractive option for global trade.

Market Trends:

Integration of Digital Technologies and Smart Supply Chains:

The sea air logistics market is witnessing a strong trend toward digitalization and smart supply chain solutions. Freight forwarders and logistics providers are adopting AI, IoT, and blockchain to improve visibility and reduce inefficiencies. Real-time tracking systems allow businesses to monitor cargo movements across multiple transport modes with greater accuracy. Predictive analytics supports demand forecasting, reducing risks of delays and supply chain disruptions. Automation in customs clearance and documentation further shortens transit times. It enables companies to optimize routes while ensuring compliance with international trade regulations. The growing reliance on digital platforms is reshaping how stakeholders manage hybrid logistics operations.

- For instance, by June 2021, the TradeLens blockchain platform had tracked over 42 million container shipments and logged 2.2 billion event updates, delivering unprecedented end-to-end shipment visibility for carriers, ports, customs authorities, and logistics partners.

Sustainability and Expansion of Global Trade Routes:

Sustainability is becoming a critical trend influencing multimodal logistics strategies worldwide. Companies are under pressure to cut carbon emissions, and sea-air transport provides a greener option compared to full air freight. It reduces fuel usage while still ensuring faster delivery than ocean-only shipping. At the same time, investments in logistics hubs across the Middle East, Africa, and Southeast Asia are expanding trade connectivity. Strategic locations like Dubai and Singapore are strengthening their roles as key sea-air transfer points. This expansion supports global trade flows while improving cost and time efficiency. The shift toward eco-friendly practices and diversified trade routes defines the evolving landscape of sea air logistics.

- For instance, Singapore Changi Airport handled 1.99 million tonnes of air cargo in 2024, a 14.6% increase from the prior year, reflecting its pivotal role as a major air-sea logistics hub in Southeast Asia.

Market Challenges Analysis:

High Operational Costs and Complex Coordination:

The sea air logistics market faces challenges from high operational costs linked to multimodal transport. Coordinating sea and air freight requires advanced planning, multiple service providers, and efficient hub operations. Rising fuel prices and airport handling charges further increase total expenses, reducing profit margins for logistics firms. It also demands specialized infrastructure and expertise, which smaller operators often lack. Limited standardization across customs procedures and documentation creates delays that reduce efficiency. Businesses must balance cost-saving goals with the need for reliable, timely deliveries.

Capacity Constraints and Supply Chain Disruptions:

Limited cargo capacity in both sea and air freight poses a significant challenge for hybrid transport. Global supply chain disruptions, such as port congestion or flight cancellations, impact sea-air operations more than single-mode logistics. It creates uncertainty for shippers managing time-sensitive goods like electronics and pharmaceuticals. Seasonal demand spikes strain available routes and lead to higher freight rates. Weather conditions and geopolitical tensions further increase risks, limiting the flexibility of multimodal solutions. These challenges push logistics providers to constantly adapt strategies while ensuring service quality remains consistent.

Market Opportunities:

Expanding Role in E-commerce and Time-Sensitive Industries:

The sea air logistics market offers strong opportunities through the rising influence of e-commerce and high-value sectors. Retailers, fashion brands, and electronics manufacturers need faster yet cost-effective transport models to meet consumer demand. Sea-air solutions enable businesses to strike a balance between speed and affordability while serving international markets. Pharmaceuticals and healthcare also benefit from multimodal logistics, where timely delivery is critical. It provides flexibility for industries that cannot rely solely on ocean freight due to long transit times. Growth in these industries continues to expand the customer base for hybrid logistics providers.

Strategic Growth Across Emerging Trade Hubs:

Emerging logistics hubs in the Middle East, Africa, and Southeast Asia are creating opportunities for global connectivity. Investments in port and airport infrastructure strengthen multimodal transfer capabilities in these regions. It positions cities like Dubai, Doha, and Singapore as pivotal sea-air gateways. Expanding trade routes between Asia, Europe, and North America further support the adoption of sea-air solutions. Companies can leverage these hubs to optimize supply chains and reduce congestion at traditional ports. The rising importance of these regions highlights future potential for market expansion and competitive differentiation.

Market Segmentation Analysis:

By Mode of Transportation:

The sea air logistics market leverages both sea and air freight to balance cost and speed. Sea freight handles bulk goods at lower rates, while air freight ensures faster delivery for time-sensitive cargo. It creates efficiency for industries that require cost control without compromising timelines. Multimodal routes connecting Asia, Europe, and North America remain the strongest contributors to market growth.

- For Instance, Accur8 Distribution leveraged Maersk’s Sea-Air solution on shipments between Asia and Colombia, resulting in savings of more than 15 days in transit time. This reduced the overall door-to-door transit from over 25 days to approximately 10 days.

By Service Type:

Services in sea-air logistics include freight forwarding, customs clearance, warehousing, and value-added logistics. Companies depend on integrated service providers to ensure seamless transfer between ports and airports. It helps reduce delays while maintaining supply chain visibility. Technology-driven platforms are further improving service reliability with real-time updates and advanced tracking solutions.

- For instance, DB Schenker’s AI-powered customs workflow—implemented with Customaite—cut multi-line declaration preparation time from several hours to as little as 20 minutes per shipment, a 90% reduction in processing time.

By Cargo Type:

Cargo handled in sea-air logistics ranges from electronics and pharmaceuticals to fashion goods and perishables. Industries prefer this model to ship goods that demand both speed and cost optimization. It is increasingly used for e-commerce products, where timely delivery influences customer satisfaction. Perishable goods such as food and flowers also benefit from hybrid transport, which ensures freshness while reducing high costs of full air freight.

Segmentations:

By Mode of Transportation:

By Service Type:

- Freight Forwarding

- Customs Clearance

- Warehousing

- Value-Added Services

By Cargo Type:

- Electronics

- Pharmaceuticals

- Fashion and Apparel

- Perishables

- E-commerce Goods

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America:

North America holds a market share of 28% in the sea air logistics market, supported by strong import and export activities. The region benefits from advanced logistics infrastructure and established trade corridors with Asia and Europe. High demand for time-sensitive shipments in industries like pharmaceuticals, electronics, and retail strengthens adoption. It is further supported by strong e-commerce growth that pushes logistics providers to optimize delivery times. Major airports and seaports in the United States and Canada play a crucial role in ensuring seamless multimodal operations. Investments in digital logistics systems improve transparency and efficiency, reinforcing the region’s market position.

Europe:

Europe accounts for a market share of 25%, driven by its strategic position between Asia and North America. Strong cross-border trade and high consumer demand create steady need for multimodal transport solutions. The region benefits from major hubs such as Frankfurt, Amsterdam, and Paris that act as transfer points. It supports industries such as fashion, automotive, and consumer electronics that depend on reliable supply chains. Sustainability regulations in Europe encourage companies to adopt sea-air routes to reduce carbon emissions. Growth in Eastern European trade adds further opportunities for logistics providers across the continent.

Asia-Pacific:

Asia-Pacific holds the largest market share of 32%, fueled by its role as a global manufacturing hub. Rising exports from China, India, South Korea, and Southeast Asia create strong demand for hybrid logistics models. It provides cost-efficient and timely solutions for companies shipping to Europe and North America. Expanding e-commerce activity across the region further strengthens reliance on multimodal transport. Strategic locations such as Singapore and Hong Kong act as key gateways for sea-air connections. Infrastructure investments and digital adoption continue to reinforce Asia-Pacific’s leading position in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Horizon International Cargo

- SNCF Logistics

- Sea-Air Logistics

- Rosan Sea Air Services

- Sea Air Logistics India

- Canada Sea Air Logistics Inc

- Titan Sea & Air Services

- LavinStar Logistics

Competitive Analysis:

The sea air logistics market is highly competitive with both global and regional players focusing on efficiency and network expansion. Key companies include Horizon International Cargo, SNCF Logistics, Sea-Air Logistics, Rosan Sea Air Services, and Sea Air Logistics India. These firms strengthen their market presence by offering integrated services that combine sea and air freight with customs support and warehousing. It enables them to provide cost-effective and time-efficient solutions across major trade corridors.Competition is shaped by technological adoption, with leading players investing in digital platforms, real-time tracking, and predictive analytics. Partnerships with airlines, shipping companies, and logistics hubs further enhance service reliability and global connectivity. It helps companies maintain strong customer relationships while expanding their international reach. The competitive landscape is expected to intensify as demand grows in e-commerce, pharmaceuticals, and high-value industries, creating opportunities for innovation and strategic alliances among service providers.

Recent Developments:

- In November 2025, Two new companies, Hexafret and Technis, officially assumed the operations and maintenance of SNCF Fret, France’s national rail freight service, as part of a government-mandated restructuring following a European Commission investigation into state aid.

- In May 2025, Horizon International Cargo announced that Jeff McCorstin was appointed as CEO of Horizon Group, effective March 31, 2025, succeeding the prior leadership and signifying a strategic leadership transition for the company.

Report Coverage:

The research report offers an in-depth analysis based on Mode of Transportation, Service Type, Cargo Type and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The sea air logistics market will continue to expand as global trade volumes increase.

- Growing e-commerce and demand for faster delivery will strengthen the role of multimodal solutions.

- Logistics providers will invest in advanced digital platforms to enhance efficiency and transparency.

- Sustainability goals will push companies to adopt sea-air transport as a greener alternative to full air freight.

- Emerging logistics hubs in the Middle East and Southeast Asia will play a vital role in global connectivity.

- Investments in port and airport infrastructure will improve transfer efficiency between sea and air networks.

- Industries such as electronics, pharmaceuticals, and fashion will increasingly rely on sea-air routes.

- Supply chain disruptions and congestion will highlight the need for flexible multimodal transport strategies.

- Partnerships between airlines, shipping companies, and logistics providers will grow to strengthen integrated service offerings.

- Rising adoption of AI, IoT, and predictive analytics will shape smarter, more resilient sea-air logistics operations.