Market Overview

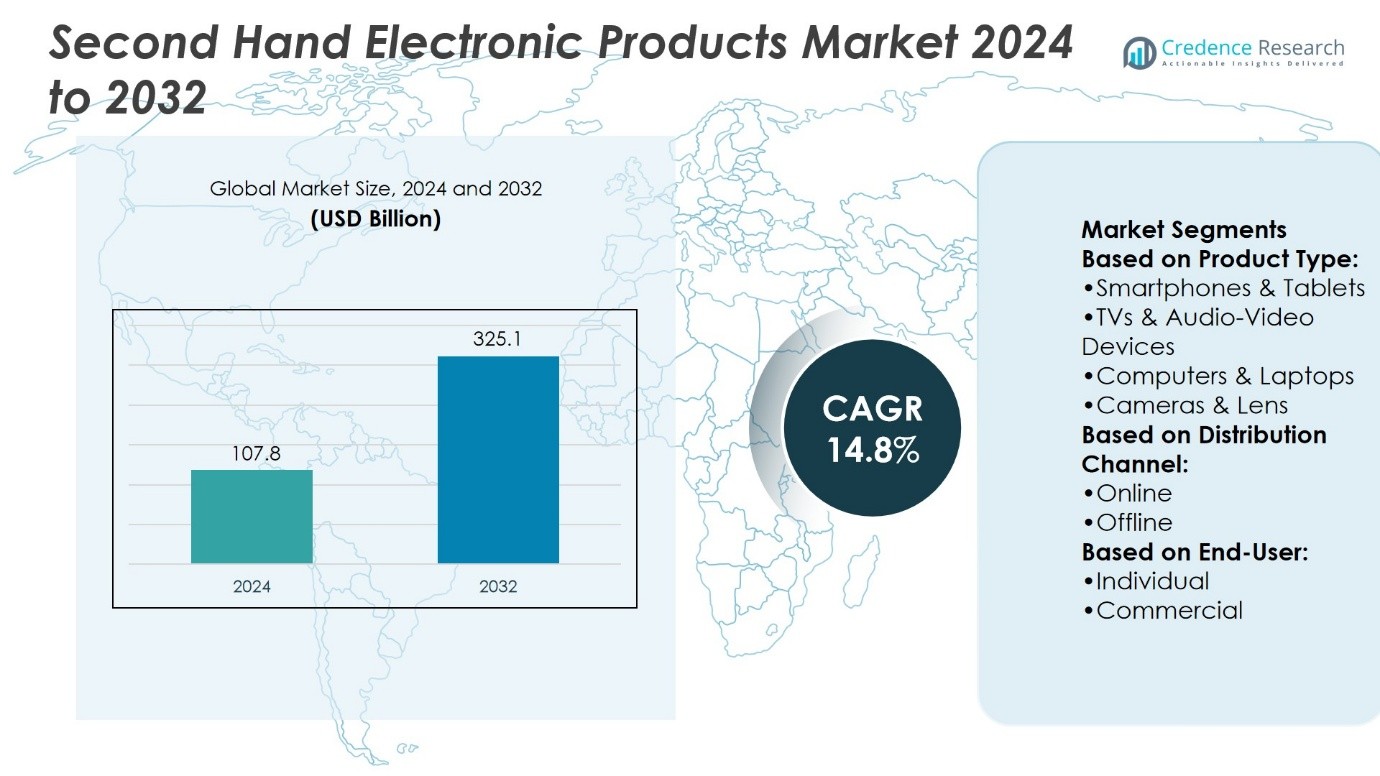

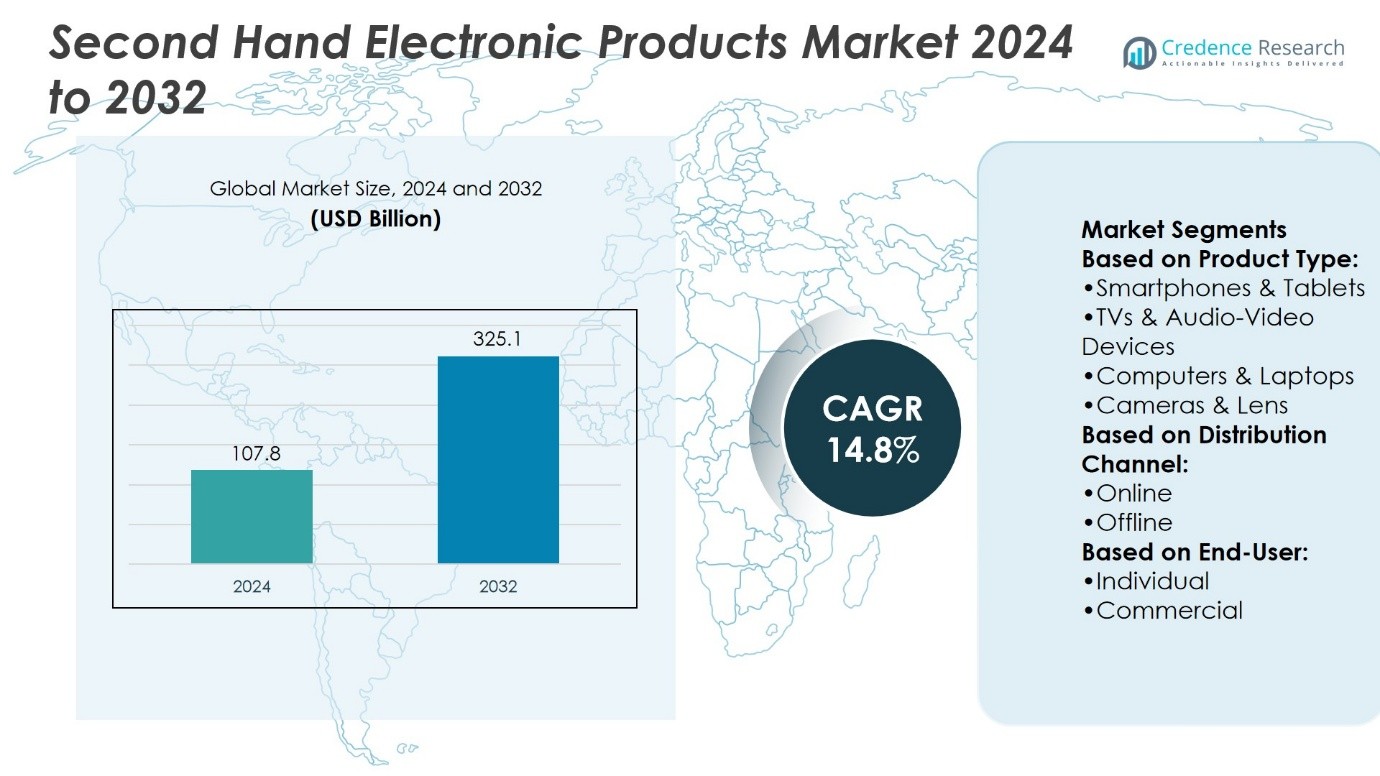

Second-Hand Electronic Products Market size was valued at USD 107.8 billion in 2024 and is anticipated to reach USD 325.1 billion by 2032, at a CAGR of 14.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Second-Hand Electronic Products Market Size 2024 |

USD 107.8 Billion |

| Second-Hand Electronic Products Market , CAGR |

14.8% |

| Second-Hand Electronic Products Market Size 2032 |

USD 325.1 Billion |

The Second-Hand Electronic Products Market grows through strong drivers such as rising demand for affordable technology, increasing awareness of e-waste reduction, and expanding acceptance of certified refurbished devices. It benefits from rapid digitalization, which fuels online resale platforms offering secure transactions, transparent grading, and warranty-backed products. Consumer trust strengthens as refurbishment technologies improve quality and reliability, encouraging repeat purchases. Sustainability goals and circular economy initiatives further push adoption across regions. The market also reflects trends like diversification into new product categories and rising participation from both individuals and businesses, creating consistent opportunities for long-term growth and expansion.

The Second-Hand Electronic Products Market shows strong geographical presence, with North America and Europe leading due to established resale networks and sustainability-driven consumer behavior, while Asia-Pacific records the fastest growth from rising digital adoption and price-sensitive buyers. Latin America and the Middle East & Africa also contribute steadily with increasing demand for affordable devices. Key players shaping the market include Amazon, eBay Marketplace, Facebook Marketplace, Shopify, OfferUp, Poshmark Marketplace, ThreadUp Marketplace, Tradesy Marketplace, Mercari, Inc., and Olx, each enhancing accessibility and consumer trust.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Second-Hand Electronic Products Market size was valued at USD 107.8 billion in 2024 and is projected to reach USD 325.1 billion by 2032, growing at a CAGR of 14.8%.

- Strong drivers include rising demand for affordable devices, growing awareness of e-waste reduction, and wider acceptance of certified refurbished products.

- Market trends highlight rapid digitalization, growth of online resale platforms, transparent grading systems, and warranty-backed offerings that build consumer trust.

- Competitive analysis shows intense rivalry among global and regional players focusing on affordability, convenience, and sustainability-driven models.

- Market restraints include inconsistent product quality, regulatory complexities, and challenges in establishing trust with first-time buyers.

- Regional analysis shows North America and Europe leading due to mature resale networks, while Asia-Pacific grows fastest from digital adoption and price sensitivity.

- Latin America and Middle East & Africa show steady growth, driven by affordability needs and expanding online platforms.

Market Drivers

Growing Demand for Affordable Technology

The increasing consumer demand for cost-effective gadgets drives strong growth in the Second-Hand Electronic Products Market. Many buyers, especially students and young professionals, seek functional devices at a fraction of the cost of new ones. It provides an accessible option for individuals who cannot justify or afford the high price of brand-new electronics. The market benefits from a wide range of products including smartphones, laptops, and tablets, which retain usability long after first use. It also gains traction as consumers become more comfortable purchasing certified refurbished devices. This trend expands the customer base and strengthens resale platforms globally.

- For instance, CCS Insight reports that 46.8 million second-hand mobile devices were sold globally during the fourth quarter of 2023—highlighting how the used-device market continues to thrive even amid declining new-device shipments.

Environmental Awareness and Sustainability Goals

Rising awareness of e-waste and environmental concerns encourages more consumers to choose pre-owned electronics. Governments and organizations promote circular economy initiatives, which place second-hand products as a sustainable choice. It reduces landfill waste while extending the lifecycle of electronic devices. Corporations also endorse refurbished electronics in their sustainability strategies, fueling broader acceptance. This environmental shift positions the market as a key player in reducing electronic waste. It aligns consumer choices with global sustainability goals and builds long-term market resilience.

- For instance, Gazelle, a prominent certified refurbisher of pre-owned electronics, reported having processed and purchased over 2 million used devices from more than 1 million customers by late 2014, showcasing significant scale in refurbished device circulation.

Technological Advancements in Refurbishment Processes

Enhanced refurbishment techniques and diagnostic tools improve the reliability of second-hand electronics. Companies now provide advanced quality checks, extended warranties, and certification processes that boost consumer trust. It addresses previous concerns about durability and product performance in pre-owned goods. Automated testing and advanced repair methods ensure that refurbished devices perform at competitive standards. Online platforms invest in technology-driven inspection and grading systems to assure transparency. This development encourages repeat purchases and creates a more structured, trusted resale ecosystem.

Expansion of E-Commerce and Resale Platforms

The rapid growth of digital marketplaces accelerates the visibility and reach of the second-hand electronics sector. Leading e-commerce players integrate resale sections, making refurbished devices more accessible to mainstream audiences. It benefits from strong logistics and secure payment systems that build customer confidence. Platforms like Amazon Renewed, eBay, and regional startups enhance competition and improve service standards. Mobile apps specializing in peer-to-peer resale also expand consumer engagement. The wider availability of second-hand electronics through digital platforms ensures consistent market growth and strengthens consumer adoption.

Market Trends

Rising Integration of Online Platforms and Marketplaces

The Second-Hand Electronic Products Market is experiencing a significant shift toward online-first business models. E-commerce platforms and dedicated resale marketplaces are streamlining transactions between sellers and buyers. It benefits from features such as verified listings, secure payment systems, and buyer protection policies. The convenience of browsing large product catalogs with transparent pricing attracts a wider consumer base. Companies that focus on customer experience and warranty assurance build strong credibility. This trend is transforming second-hand electronics into a mainstream purchase choice rather than a niche option.

- For instance, over 250 million refurbished smartphones were sold globally in recent years, with Apple and Samsung leading that segment.

Increasing Acceptance of Refurbished and Certified Devices

Consumer trust in pre-owned electronics is strengthening through certification and warranty-backed programs. Companies provide refurbished devices that undergo rigorous quality testing, making them almost equivalent to new products in performance. It helps overcome the perception gap that second-hand products lack durability or reliability. Leading players emphasize transparency in grading systems and provide extended service options. These practices not only build customer confidence but also encourage repeat purchases. Growing adoption of certified refurbished electronics continues to expand the addressable customer base.

- For instance, Circular Computing provides remanufactured laptops that pass a 360-point quality check and report a Return Merchandise Authorisation rate under 3 per thousand unit.

Growing Influence of Sustainability and Circular Economy

Environmental considerations are shaping the future direction of the resale industry. The push toward reducing e-waste encourages both consumers and businesses to adopt second-hand devices. It plays a crucial role in extending product life cycles and minimizing electronic waste. Governments and organizations support recycling and reuse programs, which further strengthen this market trend. Sustainability-conscious buyers prefer pre-owned devices that align with eco-friendly values. This momentum positions second-hand electronics as a central component of circular economy strategies worldwide.

Expansion into Emerging Markets and New Product Categories

Emerging economies are witnessing rapid adoption of second-hand electronics due to price sensitivity and high demand for technology. The market is expanding beyond smartphones and laptops to include smartwatches, gaming consoles, and home appliances. It allows wider consumer segments to access modern technology at reduced costs. Local players and regional e-commerce platforms are capitalizing on this opportunity by offering affordable refurbished options. Growing internet penetration supports online resale activity in these markets. This diversification of products and geographies strengthens long-term market potential.

Market Challenges Analysis

Quality Assurance and Consumer Trust Issues

The Second-Hand Electronic Products Market faces challenges in maintaining consistent product quality and customer confidence. Many buyers remain skeptical about the performance and lifespan of used devices, especially when warranties or certifications are absent. It often struggles with counterfeit products, hidden defects, and lack of standardized grading systems. These factors create hesitation among first-time buyers and limit broader adoption. While refurbishment practices have improved, variations in vendor reliability continue to affect market credibility. Building trust through transparent policies and reliable after-sales service is critical for overcoming this barrier.

Supply Constraints and Regulatory Complexity

The market encounters difficulties in securing a stable supply of high-demand products, particularly premium smartphones and laptops. Limited availability often drives up prices, reducing the value proposition for buyers. It also operates within complex regulatory environments, where import restrictions, tax policies, and e-waste regulations differ across regions. Compliance with safety and environmental standards increases operational costs for businesses. Informal and unorganized sellers in certain regions further complicate efforts to establish a structured ecosystem. Addressing these challenges requires coordinated efforts between manufacturers, policymakers, and resale platforms to strengthen long-term market stability.

Market Opportunities

Expanding Consumer Base through Affordability and Accessibility

The Second-Hand Electronic Products Market holds significant opportunity in attracting price-sensitive consumers who seek reliable technology at lower costs. Affordable access to premium devices such as smartphones, laptops, and gaming consoles appeals to students, young professionals, and small businesses. It creates growth potential by enabling wider adoption of digital tools in emerging markets where new electronics remain out of reach for many. Expanding payment options, installment plans, and trade-in programs strengthen this opportunity. Retailers and platforms that highlight affordability while ensuring product quality can capture a larger share of this growing segment. This shift establishes second-hand electronics as a mainstream alternative to new purchases.

Growth Potential in Sustainability and Business Partnerships

Environmental awareness offers long-term opportunities for resale companies to align with global sustainability agendas. The market plays a vital role in reducing e-waste, making it attractive to both governments and eco-conscious consumers. Partnerships between manufacturers, retailers, and certified refurbishers open avenues for structured trade-in programs and recycling initiatives. It can expand further by tapping into corporate demand, where businesses seek cost-efficient technology while meeting sustainability targets. Integration of advanced refurbishment technologies also enhances product reliability and resale value. These opportunities position the sector to grow as both a consumer-driven and environmentally responsible industry.

Market Segmentation Analysis:

By Product Type

The Second-Hand Electronic Products Market demonstrates strong diversity in product categories such as TVs and audio-video devices, computers and laptops, and cameras and lenses. TVs and audio-video devices continue to attract steady demand from households upgrading to new entertainment systems while selling older models. Computers and laptops dominate the segment, driven by rising digital adoption across both individuals and organizations. It gains traction as frequent hardware and software updates shorten life cycles, increasing the availability of pre-owned devices. Cameras and lenses appeal to professional photographers and hobbyists who value high-quality equipment at competitive prices. Each category plays a critical role in expanding the consumer base and balancing overall market demand.

- For instance, Dell Technologies processed and resold more than 1.3 million refurbished laptops and desktops through its Asset Recovery Services in 2023.

By Distribution Channel

The market operates effectively across online and offline channels, each shaping consumer behavior differently. Online platforms are witnessing rapid growth, supported by secure payment systems, transparent listings, and warranty-backed refurbished devices. It benefits from the convenience of browsing extensive product ranges on global e-commerce marketplaces and specialized resale apps. Offline channels remain vital in regions where direct product inspection and physical assurance build consumer trust. Local shops and organized refurbishers strengthen customer relationships through personalized service. Both online and offline networks complement each other by meeting varied buyer expectations and expanding accessibility across markets.

- For instance, CeX (Complete Entertainment Exchange) operates over 600 physical stores across more than 10 countries and four continents, alongside a robust online platform. This demonstrates the effectiveness of combining both models for buying, selling, and exchanging used electronics and entertainment products.

By End User

The end-user landscape highlights two distinct groups: individuals and commercial buyers. Individual consumers represent the largest demand share, as affordability and access to premium brands drive interest in second-hand electronics. It resonates strongly with students, young professionals, and budget-conscious families seeking modern devices at lower prices. Commercial demand is expanding, with businesses purchasing bulk refurbished laptops, desktops, and other electronics to reduce operational costs. Startups and small enterprises find value in reliable second-hand devices that support daily operations while aligning with sustainability goals. Together, individual and commercial demand reinforces market growth and demonstrates adaptability to diverse user requirements.

Segments:

Based on Product Type:

- Smartphones & Tablets

- TVs & Audio-Video Devices

- Computers & Laptops

- Cameras & Lens

Based on Distribution Channel:

Based on End-User:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a significant share of the Second-Hand Electronic Products Market, accounting for nearly 32% of the global market. The region benefits from high consumer purchasing power and strong adoption of refurbished electronics through structured online platforms. It gains momentum from initiatives by major e-commerce players and certified refurbishers that emphasize quality assurance, extended warranties, and trade-in programs. Growing awareness of e-waste management also supports demand, as consumers align with sustainability goals. Commercial demand is strong, with enterprises adopting bulk refurbished laptops and desktops to lower costs. The United States dominates the regional landscape, supported by well-established distribution networks and advanced recycling policies. Canada contributes steadily, driven by rising acceptance of eco-friendly consumption patterns.

Europe

Europe captures about 27% of the Second-Hand Electronic Products Market, supported by strong environmental regulations and sustainability-driven consumer behavior. It benefits from the European Union’s emphasis on the circular economy, which encourages reuse and refurbishment of electronic goods. Demand is particularly strong in Germany, France, and the United Kingdom, where consumers actively choose certified refurbished devices. Market players in the region invest in advanced refurbishment technologies to meet strict quality standards. Online marketplaces have gained traction, but offline retail outlets continue to hold relevance for consumers who prefer physical product evaluation. Growing demand across individual and commercial segments highlights the region’s balanced adoption. Europe remains a leader in shaping global standards for second-hand electronics trade.

Asia-Pacific

Asia-Pacific represents the fastest-growing region, with around 24% share of the global market. Rising population, growing digital penetration, and demand for affordable technology drive significant adoption. It gains strength from rapid urbanization in countries like India, China, and Indonesia, where price-sensitive consumers seek reliable second-hand devices. Online platforms dominate the distribution structure, supported by widespread smartphone penetration and mobile-based resale applications. Local refurbishers and unorganized sellers remain active, but structured marketplaces are expanding to build consumer trust. The region also benefits from strong supply availability, as frequent upgrades to newer models increase the volume of used devices. Asia-Pacific demonstrates strong potential to outpace other regions in the coming years with its expanding customer base and rapid digital transformation.

Latin America

Latin America accounts for roughly 9% of the Second-Hand Electronic Products Market, supported by growing affordability concerns and rising demand for cost-effective devices. Countries such as Brazil and Mexico lead the regional market, with strong engagement in both online and offline resale platforms. It faces challenges from limited formal refurbishing infrastructure, but the demand for affordable electronics continues to expand. Consumer adoption is driven by younger populations who actively seek premium smartphones and laptops at reduced costs. Small businesses and startups also participate by purchasing bulk refurbished equipment to control expenses. The region shows steady development, with digital platforms expected to strengthen organized growth. Latin America’s market potential lies in bridging the gap between unorganized and formal resale systems.

Middle East & Africa

The Middle East & Africa holds close to 8% of the global market share. Growth is supported by rising smartphone penetration, expanding internet access, and increased digital awareness among young consumers. It benefits from the demand for budget-friendly electronics in markets with limited purchasing power for new devices. Countries such as South Africa, the UAE, and Nigeria are emerging hubs for resale activity. Offline channels dominate in rural and semi-urban regions where physical inspection remains a priority. Online platforms are gradually gaining traction, particularly in urban centers with rising e-commerce adoption. The region faces challenges related to regulatory frameworks and supply inconsistencies, but it demonstrates long-term growth potential through expanding digital ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mercari, Inc.

- Tradesy Marketplace

- Poshmark Marketplace

- eBay Marketplace

- ThreadUp Marketplace

- Olx

- OfferUp

- Amazon

- Shopify

- Facebook Marketplace

Competitive Analysis

The Second-Hand Electronic Products Market features such as Amazon, eBay Marketplace, Facebook Marketplace, Shopify, OfferUp, Poshmark Marketplace, ThreadUp Marketplace, Tradesy Marketplace, Mercari, Inc., and Olx. The Second-Hand Electronic Products Market is highly competitive, driven by platforms that focus on affordability, accessibility, and consumer trust. Companies strengthen their position by offering verified listings, secure payment systems, and warranty-backed products that increase buyer confidence. The market thrives on the growing popularity of e-commerce, where digital platforms provide convenience, wide product ranges, and transparent pricing. Offline channels also contribute by catering to consumers who prefer physical inspection before purchase, ensuring a balanced competitive environment. Players differentiate through customer service, sustainability initiatives, and efficient logistics networks that enhance overall user experience. This competitive environment pushes continuous innovation, making refurbished and second-hand electronics more reliable, accessible, and attractive to a broad consumer base.

Recent Developments

- In August 2025, ThredUp released its fourth annual impact report detailing environmental, social, and governance strategy and progress.

- In November 2023, Amazon opened a new retail store located at the Brunswick Center in Central London, which they refer to as ‘The Second Chance Store’. This shop advertises various secondhand goods including kitchen and household appliances.

- In September 2023, eBay Deutschland GmbH launched eBay Lokal, an initiative designed to promote local trades within the platform. This new feature is a redesign of current offerings and product features on eBay.de aimed at improving the local selling, buying, and pickup processes.

- In February 2023, Shopify, a Canada-based multinational e-commerce company, collaborated with UPS to offer domestic shipping options to merchants in the country. UPS is leading company that offers shipping and logistics services.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with growing consumer demand for affordable electronic devices.

- Online resale platforms will strengthen dominance through secure payments and warranty-backed offerings.

- Offline channels will remain relevant in regions where physical product inspection builds trust.

- Consumer trust will improve with advanced refurbishment processes and transparent grading systems.

- Sustainability initiatives will drive wider adoption as awareness of e-waste management increases.

- Emerging economies will fuel strong growth due to rising digital penetration and price-sensitive consumers.

- Product categories will diversify beyond smartphones and laptops into wearables, gaming consoles, and smart home devices.

- Partnerships between manufacturers, retailers, and refurbishers will support structured trade-in programs.

- Corporate demand will increase as businesses seek bulk refurbished equipment to cut costs and meet sustainability goals.

- Technology-driven platforms will enhance user experience with AI-based verification and streamlined logistics.