Market Overview

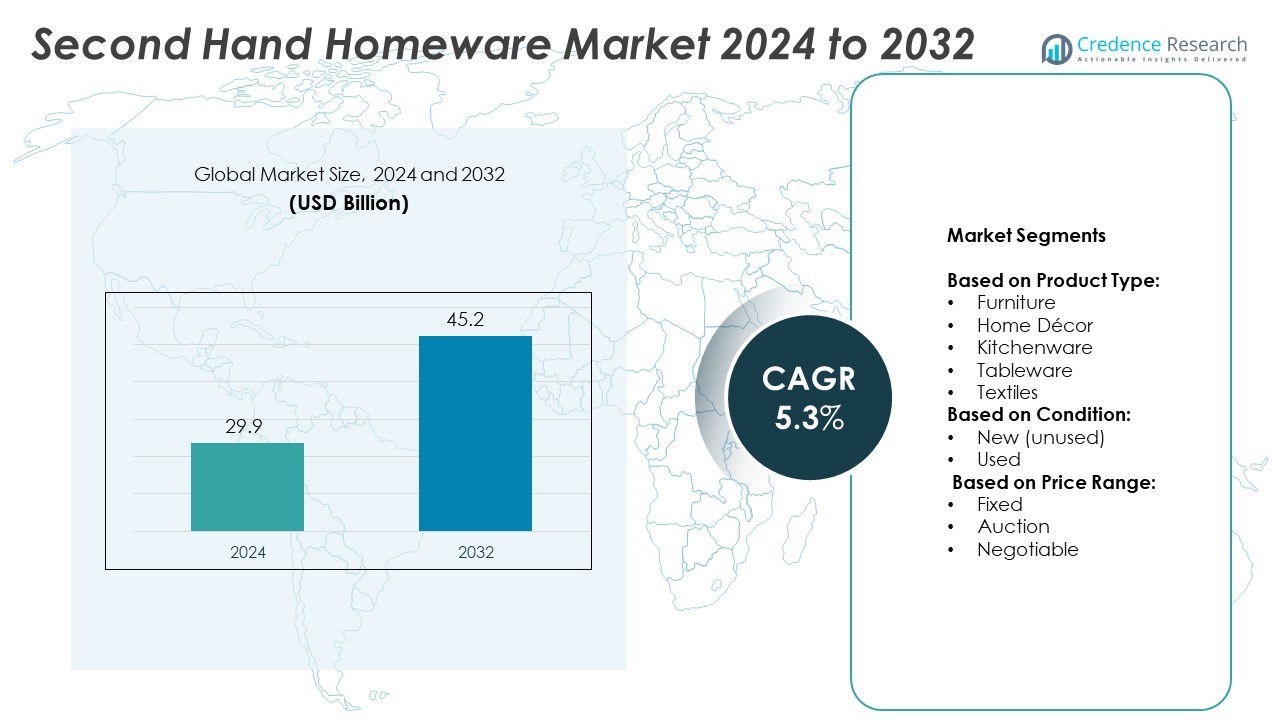

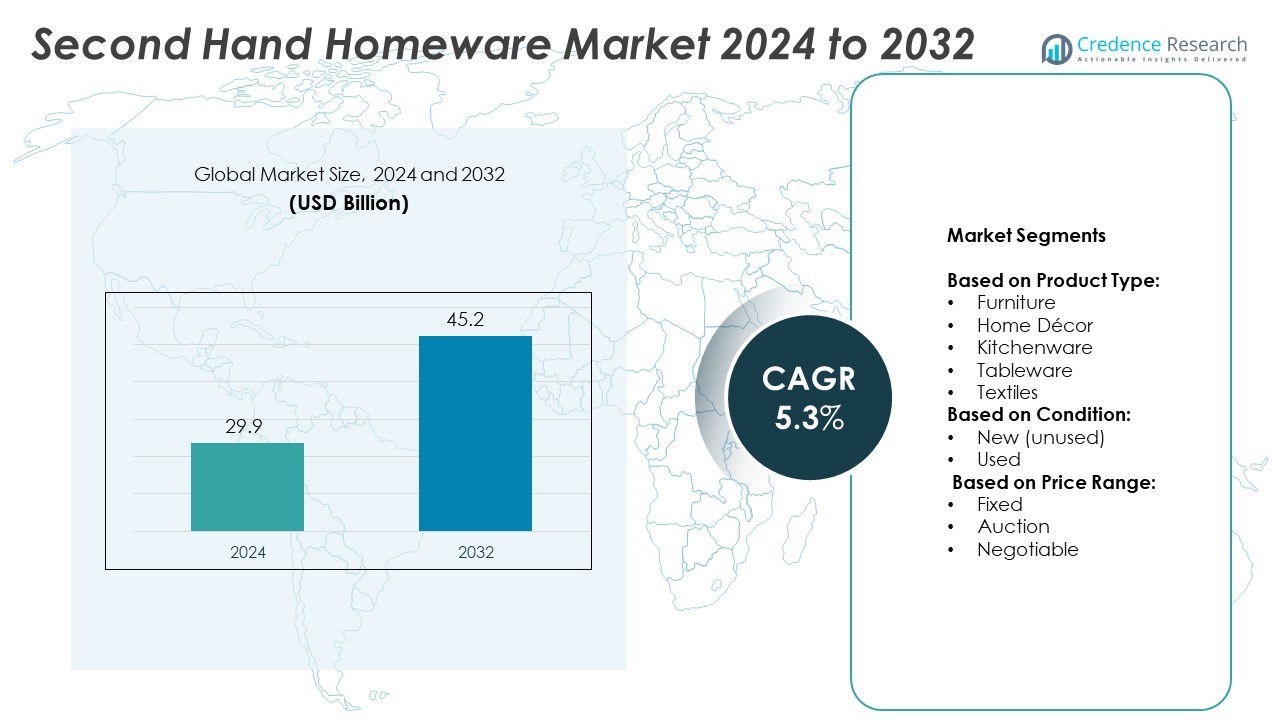

Second Hand Homeware Market size was valued at USD 29.9 billion in 2024 and is anticipated to reach USD 45.2 billion by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Second Hand Homeware Market Size 2024 |

USD 29.9 Billion |

| Second Hand Homeware Market , CAGR |

5.3% |

| Second Hand Homeware Market Size 2032 |

USD 45.2 Billion |

The Second Hand Homeware market is driven by rising sustainability awareness, increasing affordability demand, and the rapid growth of digital resale platforms. Consumers prefer pre-owned furniture, décor, and kitchenware to reduce environmental impact and save costs. Brands focus on quality assurance, refurbishment, and circular economy initiatives to attract eco-conscious buyers. Advanced technologies, including AI-powered personalization and virtual showrooms, enhance customer experiences. Growing online marketplaces, social media influence, and shifting lifestyle preferences further accelerate market expansion across global regions.

The Second Hand Homeware market shows strong growth across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific leads in adoption due to rising urbanization and digital platform expansion, while North America and Europe benefit from established resale infrastructures and sustainability-driven consumer behavior. Companies like AptDeco, Wayfair, IKEA Retail, and eBay focus on enhancing digital experiences, expanding refurbishment programs, and forming strategic partnerships to strengthen their presence and meet evolving consumer demands globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Second Hand Homeware market was valued at USD 29.9 billion in 2024 and is projected to reach USD 45.2 billion by 2032, growing at a CAGR of 3% during the forecast period.

- Growing consumer demand for affordability and sustainability drives the adoption of second-hand furniture, home décor, kitchenware, and textiles across global markets.

- Advancements in digital platforms, AI-driven personalization, and virtual visualization tools enhance customer experiences and simplify product discovery for buyers and sellers.

- The market is competitive, with leading players like AptDeco, Wayfair, IKEA Retail, eBay, The RealReal, and Vinterior Group focusing on innovation, strategic partnerships, and expansion.

- Quality assurance, logistics challenges, and trust-building remain key restraints, as inconsistent product conditions and delivery issues affect consumer confidence in resale platforms.

- Asia Pacific leads market expansion due to urbanization and digital adoption, while North America and Europe benefit from strong resale infrastructure and eco-conscious consumer preferences.

- Growing social media influence, refurbishment initiatives, and sustainability-focused marketing campaigns further shape consumer behavior and fuel market penetration across developed and emerging regions.

Market Drivers

Rising Consumer Preference for Sustainable and Affordable Homeware

The Second Hand Homeware market grows due to rising consumer focus on sustainability and affordability. Buyers choose pre-owned products to reduce environmental impact and manage expenses effectively. Retailers highlight quality, durability, and extended product life to attract eco-conscious customers. Social awareness and online campaigns strengthen the adoption of reused items. Brands integrate sustainability-driven marketing to meet evolving consumer expectations. It supports the demand for affordable furniture, décor, and kitchenware while reducing waste generation.

- For instance, Meesho reported 187 million unique annual transacting users as of December 2024.

Expansion of Digital Platforms and Online Marketplaces

E-commerce platforms boost the growth of the Second Hand Homeware market by improving accessibility. Consumers prefer browsing curated collections through user-friendly mobile apps and websites. Companies develop AI-powered search tools for personalized recommendations and faster product discovery. Partnerships with logistics providers enable faster and safer doorstep delivery. Trust-building initiatives, including product authentication and buyer protection, encourage higher transactions. It enhances consumer confidence and drives repeat purchases, supporting digital-first shopping experiences.

- For instance, Idle Fish (Alibaba’s Xianyu) achieved over 4 million product postings daily in 2024.

Growing Influence of Circular Economy Initiatives

Government policies and brand-led initiatives accelerate the Second Hand Homeware market adoption. Several countries promote reuse and recycling to achieve sustainability goals. Brands introduce take-back programs, resale collaborations, and refurbishment services to extend product life cycles. Manufacturers invest in designing durable products compatible with secondary markets. Increased awareness about resource optimization attracts both consumers and businesses. It strengthens industry participation in responsible consumption and waste reduction practices globally.

Impact of Social Media and Shifting Consumer Lifestyles

Social media drives the popularity of the Second Hand Homeware market by showcasing trends and styling ideas. Influencers and content creators demonstrate affordable home transformations using pre-owned products. Lifestyle changes, including remote work and urban living, increase demand for budget-friendly homeware. Peer-to-peer selling platforms and community-driven marketplaces enable faster buying and selling. Younger consumers value uniqueness and customization in second-hand purchases. It encourages greater market penetration and supports a shift toward value-driven consumption.

Market Trends

Integration of Technology and AI-Driven Personalization

The Second Hand Homeware market evolves with the adoption of advanced technologies and AI-powered solutions. Online marketplaces implement intelligent algorithms to improve product recommendations and customer experiences. Virtual reality tools enable buyers to visualize furniture and décor in real environments. Companies introduce smart search filters to simplify discovery based on price, quality, and style. Sellers gain better visibility through automated pricing tools and dynamic inventory updates. It enhances shopping convenience and supports faster purchase decisions across digital platforms.

- For instance, Vestiaire Collective, a pre-owned fashion platform founded in 2009, has authenticated millions of luxury fashion items to build trust among its global buyers. The company has confirmed that it has sold 12 million items since its inception. Its authentication process blends human expertise from trained authenticators with AI to verify items.

Rise of Organized Resale Platforms and Brand Collaborations

Organized resale platforms accelerate the expansion of the Second Hand Homeware market by improving trust and transparency. Leading brands collaborate with resale marketplaces to offer certified refurbished items. Product verification systems ensure quality standards, encouraging more consumers to purchase second-hand products confidently. Loyalty programs and subscription models create repeat buying opportunities for customers. Strategic partnerships expand access to premium collections at competitive prices. It strengthens customer relationships and drives structured growth in the resale ecosystem.

- For instance, Depop has approximately 5 million active buyers, and its app engagement is supported by AI-driven personalized recommendations and integrated payment solutions.

Shift Toward Premium and Vintage Homeware Segments

The Second Hand Homeware market experiences rising demand for premium and vintage product categories. High-quality furniture, antiques, and designer décor attract consumers seeking exclusivity and long-lasting value. Collectors and interior enthusiasts actively explore curated selections from trusted online and offline channels. Brands invest in dedicated platforms targeting luxury resale buyers. Personalized marketing campaigns showcase unique styles, encouraging greater engagement with niche audiences. It enables sellers to capture higher margins while expanding into value-driven customer segments.

Sustainability-Driven Consumer Behavior Transformation

Sustainability goals influence purchasing choices within the Second Hand Homeware market, reshaping consumer demand patterns. Eco-conscious buyers prioritize durable, reusable, and upcycled products over mass-produced alternatives. Companies highlight circular economy initiatives and ethical sourcing to enhance brand credibility. Product refurbishment services gain traction, reducing overall waste in the industry. Social campaigns educate consumers about the environmental benefits of second-hand consumption. It creates a long-term shift in buying preferences and supports a more responsible homeware ecosystem.

Market Challenges Analysis

Quality Assurance and Trust-Building Barriers

The Second Hand Homeware market faces significant challenges in maintaining consistent product quality and authenticity. Buyers hesitate when product details lack proper verification or clear condition descriptions. Many resale platforms struggle to implement effective quality-checking mechanisms across large inventories. Damaged or counterfeit items reduce customer confidence and discourage repeat purchases. Companies invest in advanced authentication tools and strict inspection policies to address these issues. It requires continuous improvements in transparency and trust-building to strengthen consumer adoption.

Logistics, Pricing, and Market Fragmentation Issues

The Second Hand Homeware market encounters operational hurdles related to logistics and pricing control. Delivery delays, high shipping costs, and fragile item handling remain persistent concerns for both buyers and sellers. Competitive pricing between organized resale platforms and local marketplaces creates profitability challenges. Smaller vendors struggle to manage inventory efficiently while meeting evolving consumer expectations. Market fragmentation limits the development of standardized practices across regions and sales channels. It demands strategic collaboration, better infrastructure, and technological integration to enhance efficiency and growth potential.

Market Opportunities

Expansion Through Digital Platforms and Cross-Border Resale

The Second-Hand Homeware market presents strong opportunities through growing digital adoption and cross-border trade. Online platforms enable wider access to curated inventories and attract global customers seeking affordable products. Companies invest in AI-driven personalization and virtual showroom features to enhance shopping experiences. International resale channels open new markets for premium furniture, décor, and collectibles. Partnerships with logistics providers improve faster and safer delivery for fragile items. It creates new revenue streams while strengthening brand visibility across diverse customer segments.

Rising Demand for Sustainable and Value-Driven Homeware Solutions

The Second Hand Homeware market benefits from increasing demand for sustainable and eco-friendly alternatives. Consumers prefer refurbished, upcycled, and pre-owned products that support waste reduction goals. Brands introduce dedicated refurbishment programs to extend product lifecycles and capture growing sustainability-focused buyers. Community-driven resale networks enable peer-to-peer transactions, driving stronger engagement and loyalty. Eco-conscious marketing campaigns influence younger demographics prioritizing affordability and environmental responsibility. It encourages long-term market growth by aligning consumer behavior with global sustainability initiatives.

Market Segmentation Analysis:

By Product Type:

The Second Hand Homeware market shows strong growth across diverse product categories, with furniture holding a dominant share. Demand for high-quality second-hand furniture increases due to affordability and durability factors. Home décor items, including wall art, lighting, and decorative accessories, gain popularity among consumers seeking unique styles. Kitchenware and tableware segments attract budget-conscious buyers looking for premium brands at lower prices. Textiles, such as curtains, rugs, and bedding, drive adoption through rising interest in sustainable materials. It highlights the shift toward affordable, stylish, and environmentally conscious living solutions.

- For instance, in 2023, ThredUp expanded its Resale-as-a-Service (RaaS) platform, leveraging its technology for partner brands. The company has processed over 172 million items since its inception and partnered with over 50 retailers by mid-2023 to help them launch their own resale programs. This strengthens confidence in the secondhand apparel market by making it easier for brands and customers to participate in resale.

By Condition:

The market divides into new (unused) and used product categories, with used items holding the largest share. Many consumers prefer lightly used products to access premium quality at reduced costs. Retailers enhance product presentation through proper refurbishing and quality inspection before resale. The demand for new, unused products sourced from overstock, canceled orders, and surplus inventory continues to grow steadily. Sellers offering transparent condition reports and certifications gain higher trust from buyers. It emphasizes the importance of quality assurance in driving repeat purchases and customer loyalty.

- For instance, Trove’s brand-led recommerce efforts delivered real environmental value. Its partners saved 2 million kg of CO₂e and diverted over 200,000 kg of waste from landfills through scalable resale programs. Trove’s platform enables brands to drive revenue while cutting environmental impact.

By Price Range:

The Second Hand Homeware market caters to diverse pricing preferences through fixed, auction, and negotiable models. Fixed pricing dominates organized online platforms, where buyers value transparency and quick decision-making. Auction-based models attract collectors and premium buyers seeking rare or vintage homeware pieces. Negotiable pricing thrives in peer-to-peer marketplaces and local resale platforms, offering greater flexibility. Sellers use dynamic pricing strategies to stay competitive while maximizing value. It creates a balanced ecosystem where affordability and exclusivity coexist, supporting broader consumer participation.

Segments:

Based on Product Type:

- Furniture

- Home Décor

- Kitchenware

- Tableware

- Textiles

Based on Condition:

Based on Price Range:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 29% share of the Second Hand Homeware market in 2024, with the U.S. generating significant revenue from premium and mid-range resale items. The region leads due to strong e-commerce penetration, higher disposable income, and growing consumer focus on sustainable living. Buyers increasingly prefer pre-owned furniture, décor, and kitchenware for affordability and eco-friendly value. Major platforms like eBay, AptDeco, and IKEA’s resale programs play a crucial role in driving adoption. Urban lifestyles fuel demand for space-saving, multi-functional furniture and home essentials. It highlights how North America combines sustainability goals and digital growth to maintain leadership.

Europe

Europe accounts for a strong share of the Second Hand Homeware market, holding 29% of global revenue in furniture categories. A deep-rooted thrift culture and growing preference for sustainable alternatives drive market expansion across the region. Consumers actively seek unique, vintage, and high-quality pre-owned items through organized resale networks. Regulatory support for the circular economy boosts adoption, while online platforms enhance transparency and accessibility. Countries like Germany, France, and the UK dominate due to their advanced resale infrastructure. It reflects Europe’s shift toward stylish, eco-conscious consumption combined with affordability.

Asia Pacific

Asia Pacific commands the largest regional presence, holding 32.5% share of the Second Hand Homeware market, led by China, India, and Southeast Asia. Rapid urbanization, lifestyle changes, and rising income levels fuel higher adoption of second-hand products. Younger buyers prefer affordable, high-quality homeware, especially in urban centers with growing housing demand. Expanding online marketplaces simplify product discovery and build consumer confidence in resale ecosystems. Countries invest in digital payment systems and logistics to support seamless transactions. It demonstrates Asia Pacific’s leadership driven by affordability demand and digital accessibility.

Latin America

Latin America maintains a moderate share of the Second Hand Homeware market, with growing traction in countries like Brazil, Mexico, and Argentina. Rising middle-class populations and price-sensitive buyers fuel interest in affordable second-hand products. Online platforms expand access to a wider range of homeware options, complementing traditional local marketplaces. Economic challenges push consumers toward budget-friendly alternatives without compromising quality. Brands and startups in the region focus on curated collections and buyer trust-building initiatives. It highlights strong opportunities for structured growth through organized e-commerce and resale networks.

Middle East & Africa

Middle East & Africa represent a smaller yet growing share of the Second Hand Homeware market, supported by urbanization and increasing digital adoption. Countries like the UAE and South Africa experience rising resale activity, driven by expatriate demand and shifting lifestyles. Limited retail affordability pushes consumers to explore cost-effective second-hand options. Peer-to-peer marketplaces and social commerce platforms enable rapid expansion across urban centers. Improved logistics and payment systems continue to encourage structured market development. It signals steady growth potential supported by evolving consumer awareness and digital integration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AptDeco

- Trove Marketplace

- Wayfair

- Kaiyo

- Vinterior Group

- eBay

- The RealReal

- OfferUp

- IKEA Retail

- Goodwill Industries International

- 1stDibs

- Mercari

- Chairish

- Rejuvenation

- Letgo

Competitive Analysis

The Second Hand Homeware market is highly competitive, with key players including AptDeco, Trove Marketplace, Wayfair, Kaiyo, Vinterior Group, eBay, The RealReal, OfferUp, IKEA Retail, Goodwill Industries International, 1stDibs, Mercari, Chairish, Rejuvenation, and Letgo driving market growth. These companies focus on expanding digital platforms, improving user experiences, and strengthening resale ecosystems through advanced technologies. E-commerce marketplaces integrate AI-driven personalization and virtual visualization tools to enhance product discovery and customer engagement. Many players invest in authentication processes and quality verification to build trust among buyers and sellers. Sustainable resale programs and furniture refurbishment initiatives gain traction, attracting eco-conscious consumers. Companies collaborate with logistics providers to ensure seamless delivery of bulky homeware products and improve operational efficiency. Strategic acquisitions, partnerships, and regional expansions help brands capture diverse consumer bases. Increasing mobile adoption supports peer-to-peer transactions, enabling faster scaling of resale marketplaces globally. It highlights the market’s shift toward integrated, technology-driven, and sustainability-focused business models that improve customer loyalty and accelerate growth opportunities across regions.

Recent Developments

- In October 2024, AptDeco The company unveiled a white‑label resale service enabling retailers to create branded resale websites using AptDeco’s logistics and platform tools.

- In 2024, Ingka Group, the biggest IKEA retailer, has started testing IKEA Preowned, a digital second-hand marketplace to help customers connect.

- In May 2023, Ingka Group acquired Made4net, a prominent provider of supply chain software solutions based in the U.S., specializing in retail fulfillment. This strategic move aimed to enhance Ingka Group’s order fulfillment capabilities, ensuring a seamless end-to-end customer experience. This acquisition is expected to result in one of the largest implementations of a Warehouse Management Solution (WMS) on a global scale, significantly boosting operational capacity.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Condition, Price Range and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing consumer demand will drive wider adoption of pre-owned furniture, décor, and household items.

- Digital platforms will expand capabilities with AI-powered search, personalization, and virtual showrooms.

- Resale ecosystems will integrate refurbishment and authentication services to build customer trust.

- Cross-border trade will rise, giving global access to curated and vintage homeware collections.

- Circular economy programs will gain traction, pushing brands to adopt take-back and resale initiatives.

- Sustainability-focused marketing will appeal to eco-conscious consumers and younger demographics.

- Omnichannel strategies will blend online marketplaces, pop-up stores, and local drop-off points.

- Logistics improvements will ensure safer, faster delivery of fragile homeware items.

- Peer-to-peer marketplace growth will support localized, community-driven resale networks.

- Partnerships between retailers and resale platforms will scale second-hand offerings within mainstream retail channels.