Market Overview

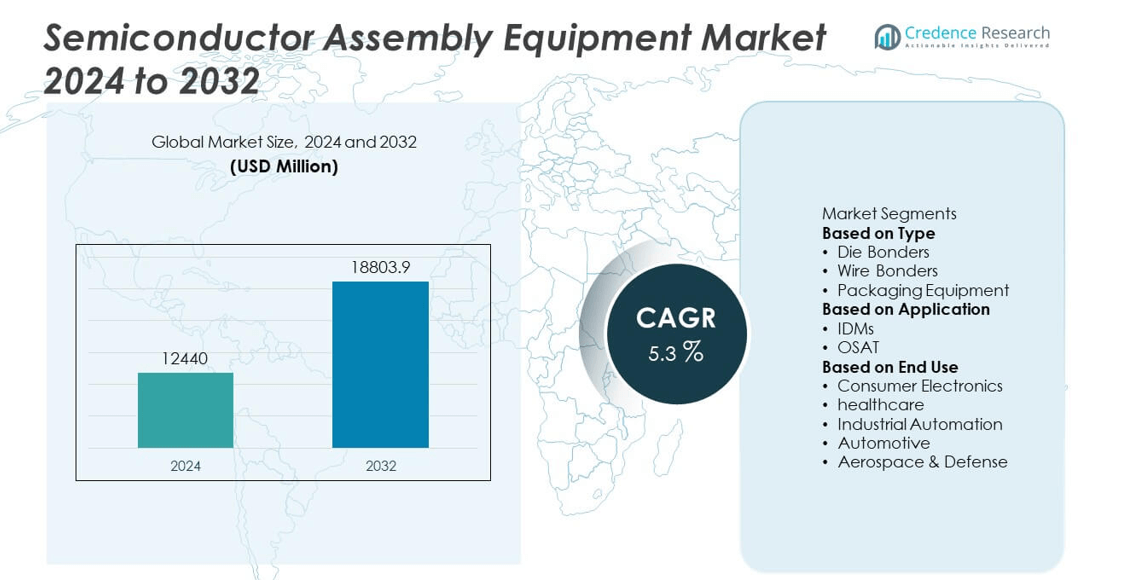

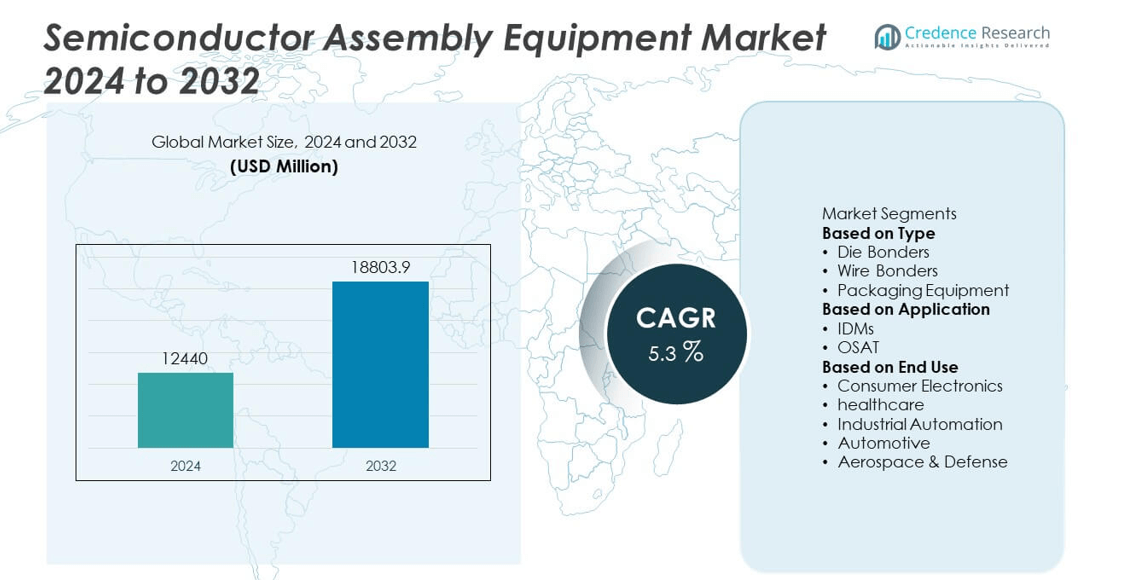

The Semiconductor Assembly Equipment Market was valued at USD 12,440 million in 2024 and is anticipated to reach USD 18,803.9 million by 2032, growing at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Semiconductor Assembly Equipment Market Size 2024 |

USD 12,440 million |

| Semiconductor Assembly Equipment Market, CAGR |

5.3% |

| Semiconductor Assembly Equipment Market Size 2032 |

USD 18,803.9 million |

The Semiconductor Assembly Equipment Market grows through strong demand for advanced consumer electronics, electric vehicles, and 5G infrastructure. Rising adoption of miniaturized devices and heterogeneous integration pushes manufacturers to invest in precision packaging technologies.

The Semiconductor Assembly Equipment Market demonstrates strong geographical spread across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads in innovation, supported by advanced R&D facilities and strong adoption in automotive, aerospace, and consumer electronics. Europe strengthens demand with its robust automotive industry and focus on industrial automation and renewable energy applications. Asia-Pacific dominates as the global hub of semiconductor manufacturing, with Taiwan, South Korea, China, and Japan driving large-scale production and packaging advancements. Latin America and the Middle East & Africa show steady growth through expanding digital infrastructure and industrial diversification. Key players shaping the market include Applied Materials, a leader in semiconductor assembly solutions; ASM Pacific Technology, known for advanced packaging and bonding systems; Kulicke & Soffa Industries, Inc. (K&S), specializing in wire bonding equipment; and Disco Corporation, recognized for precision dicing and cutting technologies. These companies anchor innovation and competitiveness worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Semiconductor Assembly Equipment Market was valued at USD 12,440 million in 2024 and is projected to reach USD 18,803.9 million by 2032, growing at a CAGR of 5.3% during the forecast period.

- Demand is driven by growth in consumer electronics, electric vehicles, and advanced computing devices that require precise assembly and packaging solutions.

- Market trends highlight adoption of advanced packaging such as wafer-level packaging, flip-chip, and 3D integration, along with growing automation and smart manufacturing practices.

- Competitive dynamics are shaped by global leaders including Applied Materials, ASM Pacific Technology, Besi, Kulicke & Soffa, and Disco Corporation, who focus on technological innovation and production scalability.

- The market faces restraints such as high capital investment, complex manufacturing requirements, and supply chain vulnerabilities that affect timely delivery of advanced equipment.

- Regional growth is led by Asia-Pacific with large-scale production hubs in Taiwan, South Korea, China, and Japan, while North America and Europe expand through innovation in automotive, aerospace, and industrial automation.

- The market reflects an ongoing push toward sustainability, energy-efficient equipment, and digitalization, with vendors integrating robotics, IoT sensors, and predictive maintenance capabilities to improve efficiency and competitiveness.

Market Drivers

Rising Demand for Advanced Consumer Electronics and IoT Devices

The global surge in smartphones, tablets, wearables, and connected devices drives semiconductor demand. The Semiconductor Assembly Equipment Market grows as manufacturers expand capacity to meet miniaturization and high-performance needs. It supports precision assembly of microchips for compact, energy-efficient consumer electronics. The adoption of Internet of Things devices requires advanced packaging technologies to enable connectivity and low power consumption. Electronics makers invest in cutting-edge assembly lines to deliver reliable performance. Continuous upgrades in consumer technology push equipment manufacturers to innovate at faster cycles.

- For instance, Disco Corporation manufactures and sells equipment, not wafers. They are a supplier for the semiconductor industry, which processed over 30 million wafers per month globally in 2024. Disco’s precision dicing equipment helps cut these wafers into chips for electronics.

Expansion of Automotive Electronics and Electric Vehicle Adoption

Automotive semiconductors power sensors, infotainment, driver-assistance systems, and electric drivetrains. The Semiconductor Assembly Equipment Market benefits from rising semiconductor content per vehicle. It supports assembly of power devices, microcontrollers, and sensors that ensure vehicle safety and efficiency. Electric vehicles require high-performance chips for battery management and energy conversion. Manufacturers scale up investments to meet rising orders from automotive OEMs. Growth in vehicle automation strengthens demand for reliable and durable chip packaging solutions.

- For instance, Kulicke & Soffa (K&S) supplies equipment for the automotive semiconductor industry, including for EV production, and supports various integrations for components like sensors and power devices. In May 2024, the company announced a sizeable order for its advanced ball bonding systems, including the new RAPID™ Pro machines featuring ProSuite technology. News reports indicated that the sizeable order was for 1,000 RAPID™ Pro systems, with fulfillment scheduled over multiple quarters starting in the fourth fiscal quarter of 2024.

Advances in 5G Infrastructure and High-Performance Computing

Deployment of 5G networks and growth of data centers create strong demand for semiconductors. The Semiconductor Assembly Equipment Market evolves with advanced equipment needed to package chips for high bandwidth and low latency applications. It ensures accurate assembly for processors, RF components, and memory devices. Cloud computing, AI, and big data analytics require powerful chips with higher density and speed. Equipment vendors deliver solutions to handle complex packaging for high-performance systems. This trend supports consistent innovation and long-term investment in assembly tools.

Increasing Focus on Miniaturization and Heterogeneous Integration

Demand for compact devices and multi-functional chips accelerates innovation in semiconductor packaging. The Semiconductor Assembly Equipment Market grows through adoption of 3D packaging, wafer-level packaging, and system-in-package technologies. It enables manufacturers to combine multiple functionalities in a single chip for efficiency. Miniaturization requires highly precise assembly equipment with advanced alignment and bonding capabilities. Industries from healthcare to industrial automation seek smaller yet more powerful semiconductors. This need for integration strengthens opportunities for equipment makers offering advanced solutions.

Market Trends

Adoption of Advanced Packaging Technologies in Manufacturing

Manufacturers are moving toward advanced packaging techniques such as wafer-level packaging, flip-chip, and 3D integration. The Semiconductor Assembly Equipment Market supports these innovations with precise and automated tools. It enables higher chip performance, reduced power consumption, and improved thermal management. Advanced packaging addresses the demand for smaller, multifunctional devices. Equipment providers develop machines capable of handling finer geometries and complex assembly processes. This trend ensures continuous investment in next-generation packaging solutions.

- For instance, Besi announced in May 2025 that it secured follow-on orders for five TCB Next systems, with shipments scheduled for the second half of 2025, highlighting rising adoption of advanced thermo-compression bonding for heterogeneous integration.

Integration of Automation and Smart Manufacturing Practices

Automation is becoming central to semiconductor production lines to improve yield and reduce error rates. The Semiconductor Assembly Equipment Market reflects this shift with tools embedded with robotics, AI, and IoT sensors. It enhances efficiency by supporting predictive maintenance and real-time monitoring. Automation also helps lower operational costs while ensuring consistent quality. Manufacturers adopt smart manufacturing to meet the demands of high-volume production. The focus on digitalization strengthens the long-term competitiveness of semiconductor supply chains.

- For instance, Lam Research reported that its Systems and Applications Market is expanding to mid-30 percent of the global front-end equipment market, supported by automation-driven productivity gains in advanced packaging and AI chip manufacturing.

Growing Demand from Emerging Technologies such as AI and Edge Computing

Artificial intelligence, edge computing, and cloud services require high-performance chips with advanced designs. The Semiconductor Assembly Equipment Market adapts by providing solutions for high-density interconnects and faster signal processing. It plays a role in packaging GPUs, AI accelerators, and memory modules. These technologies demand chips capable of handling complex workloads with efficiency. Equipment manufacturers innovate to meet thermal and performance requirements of advanced processors. This trend aligns with the rising use of AI across multiple industries.

Focus on Sustainability and Energy-Efficient Equipment

Sustainability goals are influencing equipment design and manufacturing processes. The Semiconductor Assembly Equipment Market responds with energy-efficient tools that minimize resource consumption. It emphasizes reduced emissions and environmentally responsible production methods. Companies invest in greener technologies while improving throughput and reliability. Equipment capable of optimizing material usage and reducing waste is gaining adoption. This trend supports global sustainability initiatives and strengthens vendor competitiveness in environmentally conscious markets.

Market Challenges Analysis

High Capital Investment and Complex Manufacturing Requirements

The Semiconductor Assembly Equipment Market faces challenges from the significant capital required for advanced machinery. It demands substantial spending on research, development, and production facilities, which limits entry for smaller firms. Equipment design must meet strict standards for precision, scalability, and reliability. Manufacturers struggle to balance cost efficiency with innovation when integrating advanced packaging technologies. The complexity of maintaining high throughput while ensuring quality adds further burden. These financial and technical demands slow adoption for some companies.

Supply Chain Vulnerabilities and Skilled Workforce Shortage

Global supply chain disruptions affect the timely availability of critical components for assembly equipment. The Semiconductor Assembly Equipment Market is sensitive to fluctuations in raw materials, logistics bottlenecks, and geopolitical risks. It creates delays in production schedules and impacts delivery commitments. Another challenge is the shortage of skilled professionals trained in advanced semiconductor processes. Workforce gaps reduce operational efficiency and increase training costs for manufacturers. Addressing these vulnerabilities is essential to ensure stability and growth across the industry.

Market Opportunities

Rising Demand from Electric Vehicles and Renewable Energy Systems

The Semiconductor Assembly Equipment Market gains opportunities from the rapid adoption of electric vehicles and renewable energy technologies. It supports the production of power semiconductors used in battery management, charging systems, and energy conversion units. Governments and manufacturers are investing heavily in clean energy infrastructure, creating demand for high-performance chips. Equipment capable of handling wide bandgap materials such as silicon carbide and gallium nitride is in focus. These materials enable efficient power handling and extended device lifecycles. Vendors offering specialized assembly tools for these applications can secure long-term contracts and partnerships.

Expansion of Advanced Packaging for AI, 5G, and Healthcare Applications

The Semiconductor Assembly Equipment Market benefits from the growing adoption of AI, 5G connectivity, and digital healthcare solutions. It creates opportunities for packaging solutions that handle higher data speeds, lower latency, and energy efficiency. Demand for AI accelerators, medical imaging devices, and wearable health monitors expands the application base for semiconductor assembly. Equipment providers can innovate with system-in-package and 3D integration technologies to meet these needs. Continuous advancements in healthcare and communication sectors increase demand for reliable, high-density chip designs. Vendors that align equipment development with these high-growth industries gain strong competitive advantage.

Market Segmentation Analysis:

By Type

The Semiconductor Assembly Equipment Market is segmented into die bonders, wire bonders, flip-chip bonders, wafer-level packaging equipment, and testing and inspection systems. Die bonders and wire bonders remain widely used due to their essential role in connecting chips to substrates and ensuring electrical performance. It supports mass production of integrated circuits for diverse applications, from consumer electronics to automotive systems. Flip-chip bonders and wafer-level packaging systems are gaining traction with rising demand for miniaturization and 3D packaging technologies. Testing and inspection systems also hold importance as manufacturers prioritize defect detection and reliability. Vendors are innovating with equipment that delivers higher speed, precision, and automation to match complex semiconductor designs.

- For instance, In 2021, Kulicke & Soffa (K&S) experienced strong demand for its wire bonding equipment, which it supplies to the automotive, consumer, and industrial sectors. The company is widely considered a dominant player in the wire bonding market, and its growth in 2021 was driven by high demand for trailing-edge components, which are often assembled with wire bonding technology.

By Application

Applications of semiconductor assembly equipment span memory, logic, analog, power devices, and optoelectronics. The Semiconductor Assembly Equipment Market benefits strongly from growth in memory and logic applications, driven by data centers, cloud computing, and AI workloads. It supports the assembly of DRAM, NAND, and high-performance processors required for storage and computing. Power devices form another key application area, supported by demand in electric vehicles and renewable energy systems. Optoelectronics, including sensors and LEDs, gain adoption in smartphones, automotive lighting, and healthcare devices. The variety of applications underscores the broad role of advanced assembly tools across industries.

- For instance, In July 2025, Japan’s Disco Corporation reported net sales of ¥89.9 billion for its first fiscal quarter (April–June 2025). A significant portion of this revenue was driven by strong demand for its precision dicing and grinding equipment, particularly for the production of memory and logic chips used in generative AI and data center applications.

By End Use

End-use industries for semiconductor assembly equipment include consumer electronics, automotive, IT and telecom, healthcare, and industrial sectors. The Semiconductor Assembly Equipment Market remains heavily driven by consumer electronics, supported by rising demand for smartphones, wearables, and connected devices. It also benefits from rapid adoption in automotive, where electric drivetrains and advanced driver-assistance systems require more semiconductor content. IT and telecom expand demand through 5G infrastructure and high-performance networking systems. Healthcare contributes by integrating semiconductors into diagnostic equipment, imaging tools, and wearable health monitors. Industrial applications such as robotics and automation also increase usage, pushing demand for highly reliable and efficient assembly systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Type

- Die Bonders

- Wire Bonders

- Packaging Equipment

Based on Application

Based on End Use

- Consumer Electronics

- healthcare

- Industrial Automation

- Automotive

- Aerospace & Defense

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for around 33% of the Semiconductor Assembly Equipment Market in 2024, making it a leading region. The region benefits from strong semiconductor demand in advanced industries, including aerospace, defense, and consumer electronics. It supports growth with established players investing heavily in assembly equipment innovation. Leading companies in the U.S. expand capabilities in advanced packaging and automation to meet growing needs for AI chips and cloud computing processors. The region also gains momentum from rising semiconductor requirements in electric vehicles, driven by government incentives and adoption of clean energy. North America continues to hold a competitive edge due to advanced R&D infrastructure, robust supply chains, and higher investment in high-performance computing.

Europe

Europe holds approximately 22% of the Semiconductor Assembly Equipment Market in 2024, driven by strong adoption in automotive and industrial sectors. The region has a mature base for automotive semiconductors, with countries such as Germany, France, and Italy supporting high-volume demand. Equipment adoption grows as European automakers integrate more electronics into vehicles for safety, navigation, and electrification. The semiconductor sector also expands in industrial automation and renewable energy, increasing reliance on advanced assembly solutions. Governments in the European Union are actively funding semiconductor innovation through initiatives such as the European Chips Act, enhancing long-term growth potential. Europe’s strength lies in balancing regulatory standards, sustainability goals, and advanced manufacturing capabilities.

Asia-Pacific

Asia-Pacific dominates with around 37% of the Semiconductor Assembly Equipment Market in 2024, making it the largest region globally. The region benefits from its position as the manufacturing hub for global semiconductor production. Countries like Taiwan, South Korea, China, and Japan drive demand through their strong semiconductor fabrication industries. It gains traction from consumer electronics production, rapid digitalization, and the expansion of 5G infrastructure. Asia-Pacific is also at the forefront of advanced packaging innovations, with Taiwan leading in wafer-level packaging and South Korea focusing on memory chip assembly. The availability of a skilled workforce, government-backed investments, and large-scale production capacity make Asia-Pacific the most critical region for the industry.

Latin America

Latin America represents about 5% of the Semiconductor Assembly Equipment Market in 2024, reflecting gradual but steady growth. Demand is concentrated in Brazil and Mexico, supported by expansion in automotive and consumer electronics manufacturing. The region benefits from growing foreign investments in industrial infrastructure and digitalization. Equipment adoption is rising as enterprises focus on improving production efficiency and aligning with global semiconductor supply chains. Although the share remains smaller compared to other regions, it shows potential for future expansion as governments emphasize technology adoption. Growing connectivity and rising demand for renewable energy solutions also enhance semiconductor usage in the region.

Middle East & Africa

The Middle East & Africa account for around 3% of the Semiconductor Assembly Equipment Market in 2024, making it the smallest regional contributor. The region is at an early stage of semiconductor adoption, with demand mainly from telecommunications, oil and gas, and industrial automation. Countries in the Gulf Cooperation Council (GCC) invest in advanced technologies to diversify economies beyond oil dependency. South Africa also emerges as a growth hub, with adoption of semiconductors in automotive and renewable energy sectors. It demonstrates potential as infrastructure improves and governments expand focus on digital transformation. While the market share is limited, ongoing investments in technology parks and industrial zones promise gradual growth.

Key Player Analysis

Competitive Analysis

The competitive landscape of the Semiconductor Assembly Equipment Market is defined by leading players such as Applied Materials, ASM Pacific Technology, Besi, Disco Corporation, Kulicke & Soffa Industries, Inc. (K&S), Lam Research Corporation, Nikon Corporation, Plasma-Therm, Rudolph Technologies, Inc., and SCREEN Semiconductor Solutions Co., Ltd. These companies focus on expanding their product portfolios with advanced packaging technologies, wafer-level equipment, and automation solutions to meet rising demand for miniaturization and high-performance devices. They actively invest in research and development to deliver precision tools that support 3D integration, heterogeneous packaging, and next-generation semiconductors for applications in AI, 5G, and electric vehicles. Strategic collaborations, mergers, and partnerships strengthen their global presence and improve supply chain resilience. Vendors emphasize integration of robotics, IoT, and predictive maintenance features to enhance operational efficiency and customer value. With rising competition, these players differentiate through innovation, scalability, and customer-centric solutions, ensuring they remain at the forefront of semiconductor manufacturing advancements.

Recent Developments

- In July 2025, The Plasma-Therm introduced its PlasmaPOD® tool, offering capabilities of full-scale plasma systems at a reduced cost.

- In July 2025, Disco reported an 8.6 percent year‑over‑year revenue increase to ¥89.9 billion in Q1 2026, driven by strong demand for precision processing tools.

- In July 2025, Nikon began accepting orders for its Digital Lithography System DSP‑100, developed for advanced packaging and supporting large substrates up to 600 mm square at 1.0 µm resolution.

- In March 2025, SCREEN signed a strategic research and development agreement with imec to advance ecological semiconductor processing technologies.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- AI-powered inspection systems will enable faster detection of microscopic defects and improve yield reliability.

- Predictive maintenance tools will reduce unplanned downtime and increase equipment uptime in assembly facilities.

- Advanced packaging methods such as wafer-level and flip-chip technologies will dominate future assembly processes.

- Demand for chips in AI data centers, autonomous vehicles, and 5G networks will accelerate equipment upgrades.

- Sustainability initiatives will drive development of energy-efficient equipment with lower material waste.

- Modular and scalable systems will help manufacturers adapt quickly to evolving semiconductor designs.

- Smart manufacturing will integrate robotics, IoT sensors, and real-time diagnostics across production lines.

- Outsourced Semiconductor Assembly and Test providers will expand demand for flexible and high-volume solutions.

- Supply chain localization and resilience strategies will shape equipment deployment and production footprints.

- Cybersecurity and standard communication protocols in equipment will enhance factory safety and operational efficiency.