Market Overview

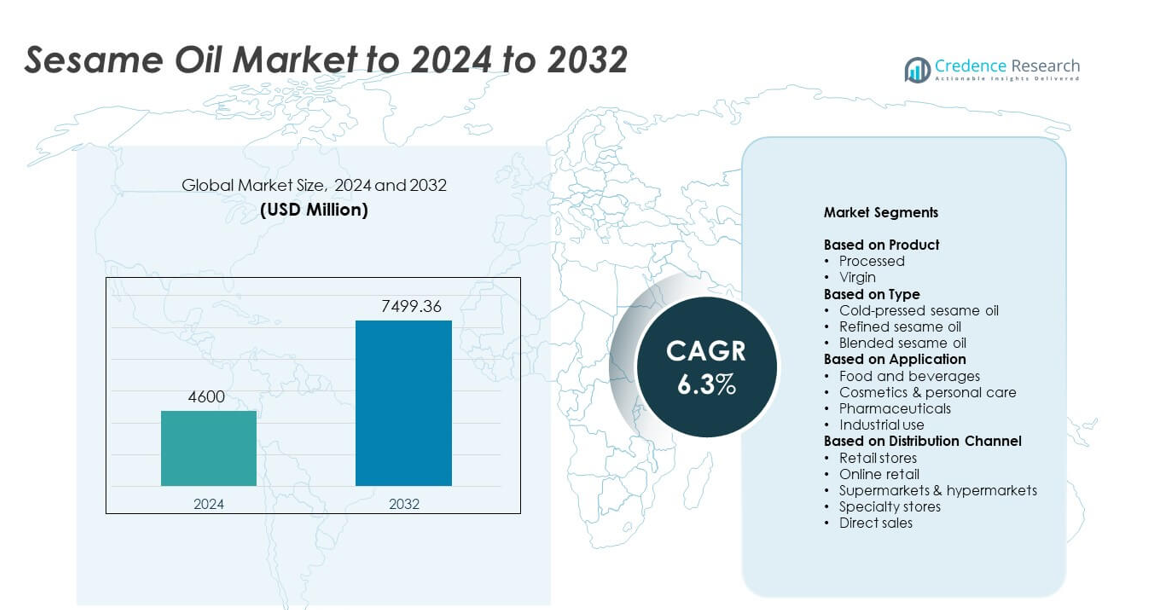

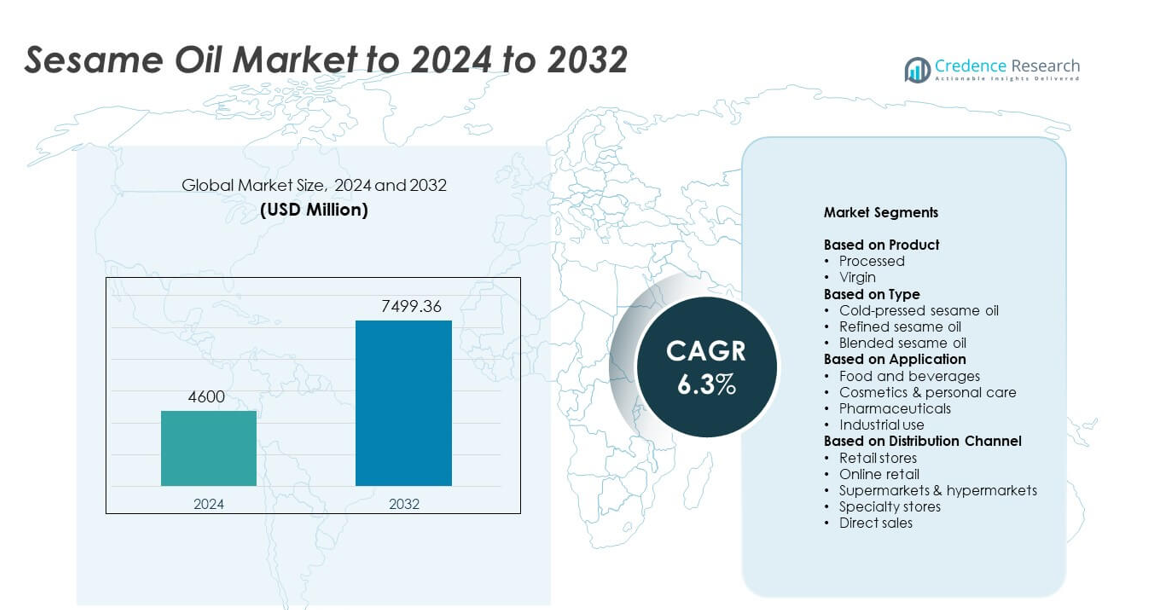

Sesame Oil Market size was valued USD 4600 million in 2024 and is anticipated to reach USD 7499.36 million by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sesame Oil Market Size 2024 |

USD 4600 million |

| Sesame Oil Market, CAGR |

6.3% |

| Sesame Oil Market Size 2032 |

USD 7499.36 million |

The Sesame Oil Market is driven by major players including Archer Daniels Midland Company, Bunge Limited, Cargill Inc., Borges International Group S.L.U., ConAgra Foods, Adams Group Inc., American Vegetable Oils Inc., Tradin Organic, Anhui Yanzhuang, and Takemoto Oil & Fat. These companies expand their portfolios through improved extraction methods, wider sourcing networks, and stronger presence in premium cold-pressed and organic categories. Asia Pacific remained the leading region in 2024 with about 38% share, supported by strong culinary use and large processing capacity. North America followed with nearly 29% share, driven by rising demand for natural and clean-label oils.

Market Insights

- The Sesame Oil Market reached USD 4600 million in 2024 and is projected to hit USD 7499.36 million by 2032 at a CAGR of 6.3%.

- Market growth is driven by rising use in food and beverages, which held about 72% share due to strong demand in processed foods, sauces, and restaurant cooking.

- Cold-pressed and organic variants are gaining traction as consumers shift toward natural, clean-label, and nutrient-rich oils across retail and online channels.

- Competition intensifies as major producers invest in better extraction efficiency, sustainable sourcing, and expanded premium product lines to strengthen market presence.

- Asia Pacific led the market with about 38% share, followed by North America at 29% and Europe at 24%, while processed sesame oil continued to dominate the product segment with roughly 68% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Processed sesame oil held the largest share in 2024 with about 68% share. Strong demand came from packaged food makers that rely on stable flavor, longer shelf life, and uniform quality. Processed variants support large-scale frying, seasoning blends, and ready-meal production, which keeps industrial use high. Virgin sesame oil grew at a steady pace due to rising clean-label demand and higher consumption in premium culinary products. Growth in home cooking and ethnic cuisine also supported interest in minimally processed options.

- For instance, Kadoya Sesame Mills Inc. reported an annual sesame seed processing capacity of over 48,000 tons in its 2023 operational disclosure, supporting rising demand for processed sesame oil globally.

By Type

Refined sesame oil dominated the market in 2024 with nearly 57% share. Food manufacturers prefer refined grades because they offer neutral taste, high smoke point, and consistent performance in large-batch cooking. Cold-pressed oil gained traction in health-focused segments, supported by higher nutrient retention and premium positioning. Blended sesame oil expanded slowly as brands promoted cost-effective combinations for mass retail. The shift toward stable frying oils and scalable processing methods kept refined grades in the lead.

- For instance, Flavor Full Co., Ltd. (also known as Flavor Full Foods Inc.) publicly documents its annual sesame oil production capacity as exceeding 7,000 metric tons.

By Application

Food and beverages accounted for the largest share in 2024 with about 72% share. Strong use in edible oils, snacks, instant foods, marinades, and Asian cuisine supported wide adoption. Growing retail demand for flavored and specialty oils also boosted this segment. Cosmetics and personal care expanded with rising use in moisturizers and hair oils due to natural emollient benefits. Pharmaceuticals and industrial use saw steady but smaller uptake driven by niche applications in topical formulations and lubricants.

Key Growth Drivers

Rising demand from food and beverage industries

Global consumption of packaged foods, sauces, dressings, and ready meals continues to expand, which boosts the use of sesame oil as a flavoring and cooking medium. Strong demand in Asian cuisines and growing adoption in Western households supports wider usage. Packaged snack producers also prefer sesame oil due to its stability and rich aroma. This steady rise in large-scale food processing strengthens long-term demand and positions the food and beverage sector as a major growth catalyst.

- For instance, Sesajal S.A. de C.V. in Mexico reports a daily sesame seed processing capacity of about 40 tons, supporting sesame oil production that feeds both domestic food manufacturers and export markets across Latin America and beyond.

Growing preference for natural and clean-label products

Consumers increasingly seek natural oils that offer health benefits and minimal processing. Sesame oil matches this need due to its antioxidant content and traditional wellness positioning. Cold-pressed variants gain strong traction in premium retail shelves as buyers move away from synthetic additives. The clean-label trend influences purchases across supermarkets and online channels. This shift supports steady market expansion and helps manufacturers promote higher-value natural and organic sesame oil products.

- For instance, Chee Seng Oil Factory in Singapore, a renowned household brand that is the top-selling sesame oil locally, distributes its sesame oil to more than 35 countries and operates FSSC 22000-certified facilities, aligning with strict clean-label and food-safety expectations in global retail

Expanding use in cosmetics and personal care

Beauty and personal care brands use sesame oil in moisturizers, hair oils, and skin treatments due to its emollient and antioxidant qualities. Rising interest in plant-based formulations strengthens demand in premium beauty categories. Growth in aromatherapy and natural spa products further supports market momentum. Many consumers prefer oils with traditional wellness roots, which enhances sesame oil’s appeal. This diversification into high-margin personal care applications acts as a strong growth driver.

Key Trends and Opportunities

Growth of cold-pressed and organic sesame oil

Premium buyers show strong interest in cold-pressed and organic variants due to their higher nutrient retention and chemical-free processing. Retailers expand shelf space for such oils, especially across urban markets and online platforms. This shift creates opportunities for producers to launch clean, high-quality formulations targeting health-conscious consumers. Branding focused on purity, origin, and traditional extraction methods gains traction. This trend supports value-driven growth and improves the market reach of artisanal and specialty sesame oils.

- For instance, Olivado sells extra virgin sesame oil in 250 ml bottles and promotes it as the only cold-pressed sesame oil on the New Zealand market, highlighting minimal processing and retention of natural sesamin and sesaminol.

Rising expansion in functional food and nutraceuticals

Sesame oil’s antioxidant properties support its adoption in functional foods, fortified blends, and nutraceutical formulations. Manufacturers explore new applications in immunity-focused products and wellness foods. Growth in preventive health habits encourages consumers to choose oils with natural bioactive compounds. This creates opportunities for brands to diversify into dietary supplements and herbal formulations using sesame extracts. The expansion of wellness-focused innovations accelerates long-term market potential across global markets.

- For instance, The Hain Celestial Group’s Spectrum brand offers organic sesame oil in 8 fl oz and 16 fl oz bottles, with each tablespoon providing 14 grams of fat and 120 calories, positioning the product for nutrient-dense, health-oriented cooking and functional diets.

Increasing penetration in pharmaceutical and topical applications

Pharmaceutical firms use sesame oil in ointments, emulsions, and topical therapies due to its soothing and anti-inflammatory effects. Rising investment in herbal and traditional medicine systems expands the opportunity base. Its compatibility with active ingredients supports wider formulation use. Growth in dermatology and pain-relief products further strengthens demand. These developments create strong prospects for manufacturers looking to enter specialized medical and therapeutic product categories.

Key Challenges

Price fluctuations due to unstable sesame seed supply

Sesame seed prices often rise due to climate variability, inconsistent harvests, and disruptions in key producing regions. This volatility increases production costs and reduces margin stability for processors. Many countries rely on imports, which exposes buyers to trade restrictions and freight fluctuations. These supply risks limit predictable pricing for manufacturers and end users. Long-term instability in raw material availability remains a major challenge for sustaining steady output.

Strong competition from alternative edible oils

Sesame oil competes with soybean, sunflower, mustard, and olive oils, many of which offer lower prices or broader global availability. Food manufacturers sometimes choose cheaper substitutes for mass-market products, which limits sesame oil penetration. Marketing differentiation becomes difficult in regions where sesame oil is less familiar. Price-sensitive consumers may also shift to alternative oils during cost spikes. This competitive pressure restricts widespread adoption across mainstream cooking and industrial applications.

Regional Analysis

North America

North America accounted for about 29% share in 2024, supported by rising demand for ethnic cuisines, premium edible oils, and clean-label products. Growth in Asian restaurants and wider retail penetration of cold-pressed oils boosted sales across the United States and Canada. Increasing consumer focus on natural ingredients strengthened adoption in both home cooking and packaged food categories. Expanding use in personal care items such as moisturizers and hair oils also contributed to steady demand. The region continues to advance due to strong distribution networks and growing awareness of the health benefits linked to sesame oil.

Europe

Europe held nearly 24% share in 2024, driven by rising interest in natural oils and plant-based diets. Strong culinary influence from Mediterranean and Middle Eastern cuisines supported consistent consumption across major countries such as Germany, France, and the United Kingdom. Premium retail channels expanded shelf space for organic and cold-pressed variants. Growth in clean beauty trends increased demand for sesame oil in skincare and haircare formulations. The region benefits from strong regulatory support for natural ingredients, which encourages manufacturers to introduce high-quality and sustainably sourced sesame oil products.

Asia Pacific

Asia Pacific dominated the Sesame Oil Market in 2024 with about 38% share, supported by strong consumption in China, India, South Korea, Japan, and Southeast Asia. Long-standing culinary traditions, high household use, and strong presence of sesame-based foods fuel demand. Expanding packaged food production also boosts uptake in processed forms. Growing interest in premium cold-pressed oils among urban consumers strengthens market expansion. The region benefits from its position as a major sesame seed producer and processor, which ensures strong supply availability and competitive pricing advantages across global markets.

Latin America

Latin America accounted for around 5% share in 2024, reflecting emerging but steady adoption across food and personal care sectors. Growing popularity of Asian cuisine and rising interest in natural cooking oils expanded demand in countries such as Brazil and Mexico. Local cosmetics brands increasingly use sesame oil in skin and hair formulations due to its emollient properties. Limited production capacity in the region leads to greater dependence on imports, yet expanding retail distribution supports market visibility. Rising wellness trends provide opportunities for higher-value cold-pressed and organic variants.

Middle East and Africa

Middle East and Africa captured nearly 4% share in 2024, supported by traditional culinary uses and rising processed food production. Countries in the Gulf region show increasing demand for premium oils due to higher disposable incomes and expanding modern retail outlets. Africa’s sesame seed production base, particularly in Ethiopia, Sudan, and Nigeria, supports strong export activity. Local consumption grows steadily as awareness of natural oils increases. Adoption in cosmetics and topical applications offers additional opportunities. However, uneven distribution networks and price volatility remain constraints to faster market expansion across the region.

Market Segmentations:

By Product

By Type

- Cold-pressed sesame oil

- Refined sesame oil

- Blended sesame oil

By Application

- Food and beverages

- Cosmetics & personal care

- Pharmaceuticals

- Industrial use

By Distribution Channel

- Retail stores

- Online retail

- Supermarkets & hypermarkets

- Specialty stores

- Direct sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Sesame Oil Market is shaped by leading companies such as Archer Daniels Midland Company, Bunge Limited, Cargill Inc., Borges International Group S.L.U., ConAgra Foods (Agrotech Foods Ltd.), Adams Group Inc., American Vegetable Oils Inc., Tradin Organic, Anhui Yanzhuang, and Takemoto Oil & Fat. The competitive environment reflects strong focus on quality enhancement, advanced refining, and expansion of cold-pressed and organic product lines. Producers invest in modern extraction technologies to improve yield consistency and reduce processing losses. Many firms strengthen global sourcing networks to mitigate seed price volatility and ensure reliable supply. Strategic partnerships with food manufacturers, cosmetic brands, and nutraceutical producers help expand end-use penetration. Companies also focus on sustainability certifications, cleaner production, and traceability to meet rising consumer expectations. Increased emphasis on premium oils and online distribution supports wider market reach, while continuous product innovation enhances brand positioning in both mature and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Archer Daniels Midland Company

- Bunge Limited

- Cargill Inc.

- Borges International Group S.L.U.

- ConAgra Foods (Agrotech Foods Ltd.)

- Adams Group Inc.

- American Vegetable Oils Inc.

- Tradin Organic

- Anhui Yanzhuang

- Takemoto Oil & Fat

Recent Developments

- In 2024, Tradin Organic partnered with the ESG (Environmental, Social, and Governance) solutions company Osapiens to ensure compliance with the European Union Deforestation Regulation (EUDR), emphasizing sustainability in sesame oil production.

- In 2024, Anhui Yanzhuang, a major Chinese producer, invested in modern cold-pressing and refining technologies to achieve higher yield and consistent quality of sesame oil, catering to both domestic and export markets.

- In 2024, Takemoto Oil & Fat continued expanding its production capacities to meet the global demand for premium, cold-pressed sesame oil variants.

Report Coverage

The research report offers an in-depth analysis based on Product, Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as demand rises for natural and clean-label edible oils.

- Cold-pressed and organic sesame oil will gain stronger traction in premium retail.

- Food processing companies will expand use due to stable flavor and heat performance.

- Personal care brands will increase adoption in skincare and haircare formulations.

- Pharmaceutical applications will grow with higher focus on plant-based ingredients.

- Online retail channels will boost global accessibility and consumer reach.

- Producers will invest in improved extraction and filtration technologies.

- Supply chain optimization will become essential due to raw material fluctuations.

- Blended formulations will rise as brands target cost-sensitive buyers.

- Strong consumption in Asia Pacific will continue to drive global market expansion.