Market Overview

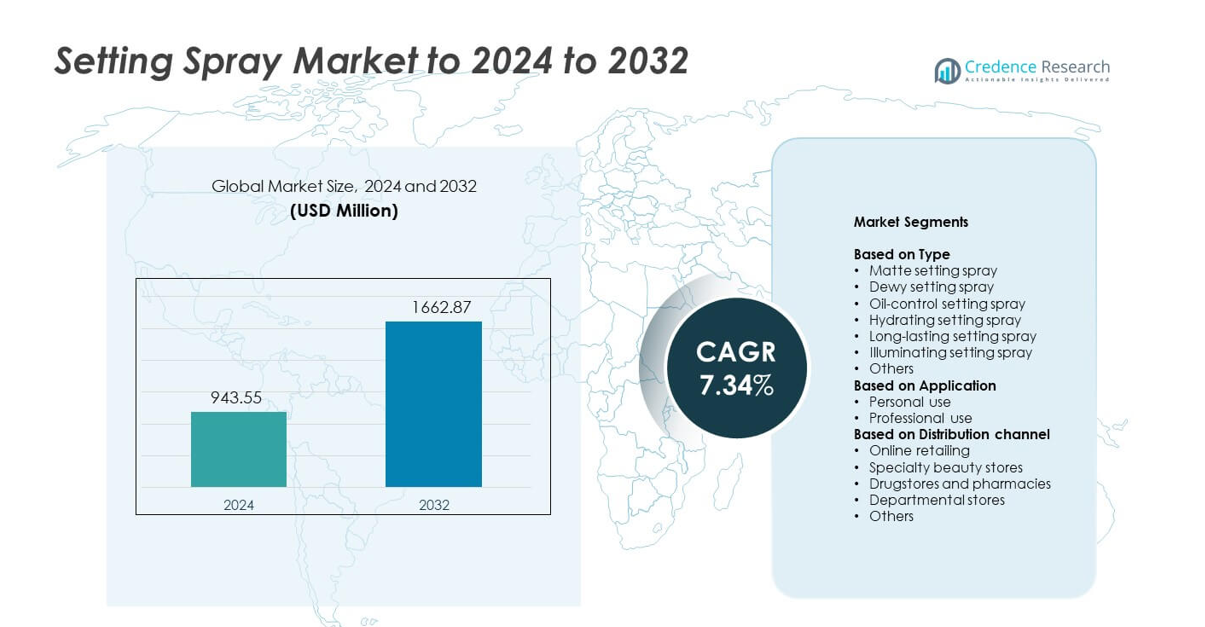

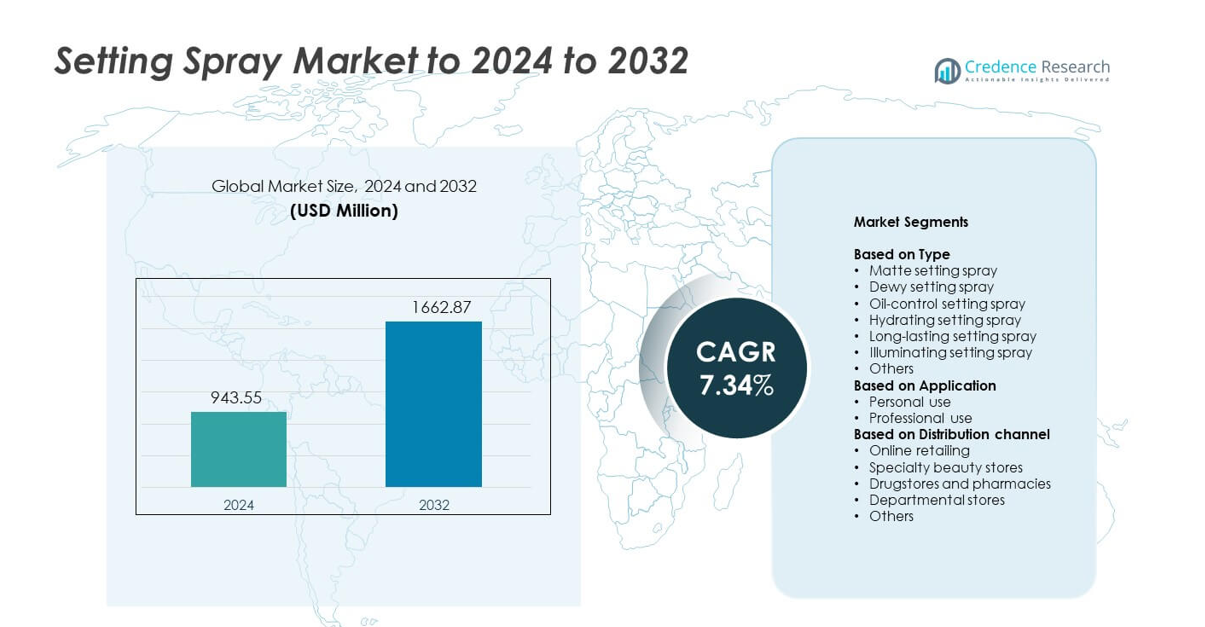

Setting Spray Market size was valued at USD 943.55 million in 2024 and is anticipated to reach USD 1662.87 million by 2032, at a CAGR of 7.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Setting Spray Market Size 2024 |

USD 943.55 million |

| Setting Spray Market, CAGR |

7.34% |

| Setting Spray Market Size 2032 |

USD 1662.87 million |

The Setting Spray Market is driven by major players such as LVMH, Anastasia Beverly Hills, Milani Cosmetics, Coty Inc, Huda Beauty, Ben Nye Inc, L’Oréal Group, AS Beauty, Pat McGrath, Kose Corporation, e.l.f. Beauty Inc, and Cover FX. These companies expand the market through advanced long-wear formulas, diverse finish options, and strong digital promotion. North America led the market in 2024 with about 36% share due to high makeup adoption and strong retail networks. Europe followed with nearly 27% share, supported by premium beauty demand, while Asia Pacific held around 24% and recorded the fastest growth.

Market Insights

- The Setting Spray Market reached USD 943.55 million in 2024 and is projected to hit USD 1662.87 million by 2032, growing at a CAGR of 7.34%.

• Rising daily makeup use and demand for long-wear performance drive adoption, with matte sprays holding the largest share at about 32%.

• Clean-label, skin-benefit, and climate-adapted sprays shape key trends as brands innovate with lightweight and multifunctional formulas.

• Strong competition comes from global beauty companies expanding digital marketing, premium lines, and micro-fine mist technologies while facing challenges related to ingredient sensitivity.

• North America led with 36% share in 2024, followed by Europe at 27% and Asia Pacific at 24%, while online retailing held the dominant distribution share at about 46%

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Matte setting spray held the leading position in 2024 with about 32% share. Strong demand came from consumers who prefer shine-free makeup that lasts through long hours, warm climates, and daily use. Matte formulas gained wider reach due to rising social media trends that highlight smooth, oil-free finishes. Oil-control and long-lasting sprays also grew as brands improved transfer resistance and humidity performance. Hydrating and illuminating sprays advanced within premium lines, but their reach stayed smaller due to niche usage needs and higher price points.

- For instance, NYX Professional Makeup’s Matte Finish Setting Spray is documented on its official product page as keeping makeup in place for up to 16 hours, with a breathable matte formula designed for all-day shine control, reinforcing the dominance of long-wear matte formats in daily use.

By Application

Personal use dominated the Setting Spray Market in 2024 with nearly 71% share. Growth came from rising daily makeup adoption, broader access to affordable products, and higher demand among young users. Personal routines shifted toward longer wear, which pushed consumers to adopt setting sprays as a core step. Professional use grew in salons, studios, and events, driven by makeup artists who require high-performance finishes. However, the segment stayed smaller as most volume sales continued to come from mass-market personal use purchases.

- For instance, Urban Decay’s All Nighter Waterproof Makeup Setting Spray is advertised by the brand as delivering up to 24 hours of makeup wear, which makes it a staple among both everyday consumers and professional artists who need reliable long-duration performance for events and long shifts.

By Distribution Channel

Online retailing led the market in 2024 with around 46% share. Strong growth came from influencer-driven marketing, fast product discovery, and easy comparison of new launches. E-commerce platforms expanded global reach for both premium and mass brands, boosting repeat purchases. Specialty beauty stores maintained a key role for experiential testing and in-store guidance, while drugstores supported budget shoppers. Departmental stores and other outlets held smaller shares as buyers shifted toward faster online buying and broader digital assortments.

Key Growth Drivers

Rising daily makeup adoption

Daily makeup use grew across young and working consumers, which increased demand for products that improve wear time and finish. Setting sprays gained traction as buyers sought long-lasting looks in warm and humid regions. Social media tutorials expanded awareness and pushed users to add setting sprays to routine steps. Brands also promoted lightweight and skin-friendly formulas, which further supported steady uptake in global markets.

- For instance, Benefit Cosmetics’ The POREfessional: Super Setter is positioned on Sephora as a multitasking mist that locks makeup for up to 16 hours, and its wide availability in both travel and full sizes supports frequent, everyday use among consumers who wear base makeup for extended workdays.

Expansion of premium and multifunctional formulas

Premium brands introduced innovative textures that combine hydration, oil control, and long-wear benefits in one spray. This shift boosted consumer interest in higher-performance options. Multifunctional products appealed to users seeking simple routines with reliable results, raising engagement across online platforms. The premium segment grew faster as shoppers favored high-quality ingredients and advanced claims supported by strong marketing campaigns.

- For instance, Charlotte Tilbury’s Airbrush Flawless Setting Spray is described on the brand’s site as priming and setting makeup for up to 16 hours while providing a hydrating, waterproof veil and an anti-pollution shield, illustrating how premium sprays now combine base extension, skincare-style benefits, and environmental protection in a single SKU.

Growth of e-commerce beauty channels

Digital platforms strengthened demand as buyers compared finishes, reviews, and shade effects with ease. Influencer content raised visibility across global regions, helping both new and established brands scale faster. Online stores expanded assortment depth and made limited-edition products widely accessible. Faster delivery and frequent discounts encouraged repeat purchases, placing e-commerce at the center of market growth.

Key Trends and Opportunities

Clean-label and skin-benefit formulations

Consumers shifted toward setting sprays with gentle, safer, and dermatologically tested ingredients. Brands developed sprays that provide skincare benefits such as hydration, soothing, and pollution defense. Hybrid formulas grew as buyers sought makeup that supports skin health while improving wear time. This trend opened opportunities for brands to expand product lines focused on sensitive and wellness-driven users.

- For instance, Clarins’ Fix’ Make-Up setting spray is marketed with a clinical study on 30 women showing 24-hour makeup hold

Rise of long-wear and climate-adapted sprays

Demand increased for sprays that withstand heat, sweat, and long hours, especially in warm climates and high-activity lifestyles. Brands invested in polymers that boost transfer resistance and durability. Climate-adapted sprays gained visibility in regions with humidity challenges, creating space for innovation in texture and hold. This trend allowed companies to differentiate through advanced performance claims.

- For instance, MAC Cosmetics’ Fix+ Stay Over Alcohol-Free 16Hr Setting Spray is described by the brand as keeping makeup in place for 16 hours and cites consumer testing on 122 women

Customization and shade-enhancing finishes

More consumers looked for setting sprays that enhance glow, soften matte effects, or refine overall tone. Brands launched illuminating, blurring, and micro-fine mist formats to meet diverse finish preferences. This created opportunities for targeted lines that match specific skin types and makeup styles. Personalization through varied finishes increased market depth across both mass and premium categories.

Key Challenges

Growing competition and brand saturation

The market saw rapid entry of new labels, which increased pressure on pricing and differentiation. Many products offer similar wear-long and finish claims, making it harder for brands to stand out. Marketing costs continued to rise as companies competed for visibility across social platforms. This saturation forced firms to focus on innovation and stronger brand positioning.

Concerns over ingredient sensitivity

Consumers became more aware of potential irritation from alcohol-heavy or fragrance-rich sprays. Regulatory scrutiny increased around certain preservatives used in long-wear formulas. These concerns drove buyers to check ingredient lists more closely, challenging brands that rely on older formulations. Companies faced pressure to reformulate without compromising performance, raising development costs and extending launch cycles.

Regional Analysis

North America

North America led the Setting Spray Market in 2024 with about 36% share. Strong demand came from high daily makeup usage, wide product availability, and frequent new launches from both premium and mass brands. The region’s strong e-commerce penetration and influencer-driven marketing also supported adoption. Consumers preferred long-wear and oil-control sprays due to diverse climate conditions and active lifestyles. Growth continued as brands expanded clean-label and skin-benefit formulas tailored to sensitive skin. The United States generated most sales, while Canada showed faster adoption in hydration-focused variants.

Europe

Europe accounted for nearly 27% share in 2024, supported by strong interest in premium beauty and clean cosmetic formulations. Demand grew in Western European countries where makeup users prefer lightweight, hydrating, and natural-finish sprays. Regulations encouraging safer cosmetic ingredients pushed brands to innovate within permissible limits. The region also saw growing online beauty sales that offered broad product visibility. Climate differences across northern and southern Europe supported varied preferences, from hydrating sprays to long-wear variants. Increased spending on skincare-driven makeup hybrids further strengthened Europe’s position.

Asia Pacific

Asia Pacific held about 24% share in 2024 and recorded the fastest expansion. High beauty engagement among young consumers and the influence of K-beauty trends boosted adoption. Users favored hydrating, dewy, and illuminating sprays due to regional preference for fresh, glowing finishes. Rising urbanization, heat, and humidity also increased demand for long-lasting and sweat-resistant variants. E-commerce growth and social media platforms accelerated product discovery across large markets such as China, Japan, and South Korea. Expanding middle-income groups and strong local brand innovation helped Asia Pacific gain momentum.

Latin America

Latin America captured around 8% share in 2024, supported by rising makeup culture across Brazil, Mexico, and Argentina. Consumers preferred setting sprays that offer durability in warm climates and support day-long wear. Growth in local beauty brands and increasing online retail penetration improved access to affordable options. Social media beauty trends encouraged wider trial of matte and long-wear sprays among young buyers. Economic fluctuations remained a restraint, but steady demand in mass-market ranges supported market stability. Expanding distribution in supermarkets and drugstores continued to widen reach.

Middle East and Africa

Middle East and Africa accounted for roughly 5% share in 2024 and showed steady growth. High temperatures and long outdoor hours increased preference for strong-hold and humidity-resistant sprays. Demand rose in urban centers such as the UAE, Saudi Arabia, and South Africa as consumers embraced global beauty trends. Premium and long-wear variants gained traction with rising disposable income and wider access to international brands. Online retailing supported product discovery across younger users. Despite lower penetration than other regions, adoption increased as beauty awareness and retail expansion improved.

Market Segmentations:

By Type

- Matte setting spray

- Dewy setting spray

- Oil-control setting spray

- Hydrating setting spray

- Long-lasting setting spray

- Illuminating setting spray

- Others

By Application

- Personal use

- Professional use

By Distribution channel

- Online retailing

- Specialty beauty stores

- Drugstores and pharmacies

- Departmental stores

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Setting Spray Market is shaped by leading beauty companies such as LVMH, Anastasia Beverly Hills, Milani Cosmetics, Coty Inc, Huda Beauty, Ben Nye Inc, L’Oréal Group, AS Beauty, Pat McGrath, Kose Corporation, e.l.f. Beauty Inc, and Cover FX. Competition centers on innovation in long-wear performance, lightweight textures, and skin-enhancing benefits as brands target both mass and premium buyers. Product lines expand through hydrating, matte, dewy, and illuminating finishes designed for varied climate conditions and daily use. Companies strengthen visibility through influencer collaborations, social media campaigns, and seasonal product drops. Clean-label shifts drive reformulation toward alcohol-free and sensitive-skin options, while e-commerce boosts global reach through faster launches and limited-edition collections. Manufacturers also invest in micro-fine mist technologies that offer smoother dispersion and improved setting efficiency. Growing consumer demand for hybrid skincare-makeup functions encourages ongoing development of advanced formulas that support durability, comfort, and personalization across diverse user segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LVMH

- Anastasia Beverly Hills

- Milani Cosmetics, Inc

- Coty Inc

- Huda Beauty

- Ben Nye, Inc.

- L’Oréal Group

- AS Beauty

- Pat McGrath

- Kose Corporation

- e.l.f. Beauty, Inc.

- Cover FX

Recent Developments

- In 2025, Pat McGrath introduced Glass 001 Legendary Glow Setting Spray, designed to create a radiant, glass-like finish.

- In 2025, Huda Beauty launched the Easy Bake Setting Spray, transforming their popular Easy Bake Powder into a lightweight, alcohol-free mist with rice starch, mineral clay, and five types of hyaluronic acid for 16-hour wear, oil control, and pore-blurring effects

- In 2024, Milani Cosmetics promoted their Make It Last Setting Spray through a major athlete partnership campaign, featuring Team USA stars like Sabrina Ionescu and Jordan Chiles ahead of the Paris Olympics to highlight its 24-hour waterproof and sweatproof performance

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as daily makeup use increases across young consumers.

- Brands will expand clean-label and skin-benefit setting spray portfolios.

- Demand will rise for long-wear sprays suited for heat and humidity.

- E-commerce will play a larger role in product visibility and global reach.

- Premium and multifunctional sprays will gain stronger traction.

- Innovation will focus on lightweight, alcohol-free, and sensitive-skin formulas.

- Personalization through varied finishes will strengthen brand differentiation.

- Emerging markets will adopt setting sprays faster due to social media influence.

- Regulatory pressure will encourage safer and more transparent formulations.

- Hybrid skincare-makeup sprays will shape future product development.