Market Overview

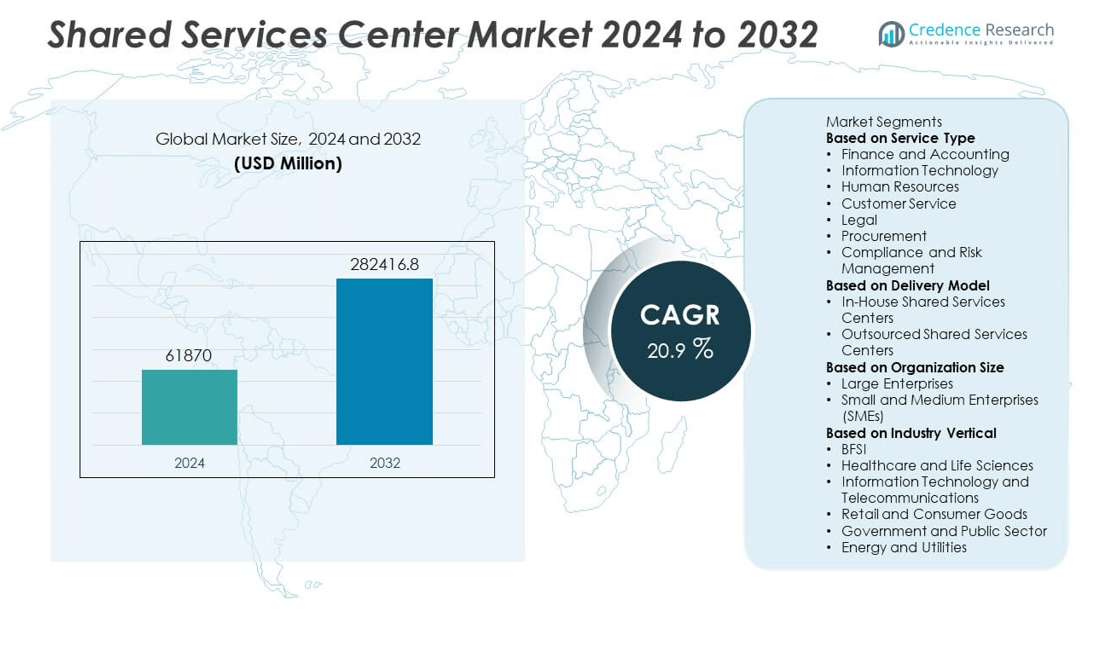

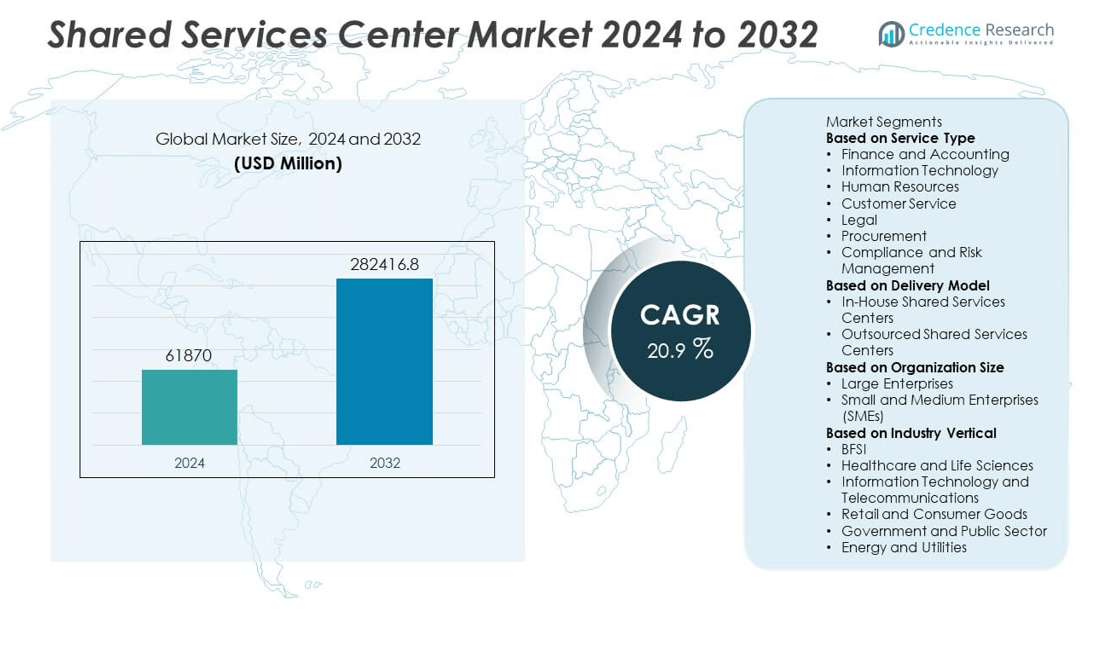

Shared Services Center Market size was valued at USD 61,870 million in 2024 and is anticipated to reach USD 282,416.8 million by 2032, growing at a CAGR of 20.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Shared Services Center Market Size 2024 |

USD 61,870 million |

| Shared Services Center Market, CAGR |

20.9% |

| Shared Services Center Market Size 2032 |

USD 282,416.8 million |

The Shared Services Center Market grows through strong demand for operational efficiency, cost optimization, and digital transformation. Organizations adopt centralized models to streamline finance, HR, procurement, and IT functions while ensuring compliance and scalability. It benefits from rising globalization and expansion of multi-function service delivery frameworks that support cross-border operations.

The geographical landscape of the Shared Services Center Market shows strong adoption across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads with advanced digital infrastructure and a concentration of multinational corporations centralizing finance, HR, and IT functions. Europe emphasizes compliance, data security, and process integration, with countries like Germany, the United Kingdom, and the Netherlands serving as key hubs. Asia-Pacific expands rapidly as global enterprises leverage skilled labor and cost advantages in India, China, and the Philippines. Latin America grows steadily, driven by nearshore demand from North American firms, while the Middle East & Africa build momentum through investments in digital transformation. Prominent players shaping the industry include Accenture plc, Genpact Ltd., Tata Consultancy Services Limited, and Capgemini SE, each driving innovation through automation, analytics, and cloud-based solutions to strengthen shared service delivery across sectors.

Market Insights

- The Shared Services Center Market was valued at USD 61,870 million in 2024 and is projected to reach USD 282,416.8 million by 2032, growing at a CAGR of 20.9% during the forecast period.

- The market benefits from strong demand for operational efficiency, process standardization, and centralized service delivery across finance, HR, procurement, and IT functions.

- Advanced technologies such as robotic process automation, artificial intelligence, and cloud-based platforms drive faster processing, improved accuracy, and cost reduction.

- Competitive analysis highlights the presence of global leaders such as Accenture, Genpact, Tata Consultancy Services, Infosys, Capgemini, IBM, and Deloitte, all investing in digital transformation and multi-function shared services.

- The market faces restraints including high integration costs, challenges in change management, data security concerns, and regulatory complexities that slow adoption for some enterprises.

- North America leads adoption due to mature digital infrastructure, while Europe emphasizes compliance-driven models, and Asia-Pacific grows rapidly with skilled labor and cost advantages. Latin America and the Middle East & Africa continue to show steady expansion supported by outsourcing demand and digital investment.

- Market insights underline a growing shift from transactional efficiency toward value-driven service delivery, with organizations focusing on workforce upskilling, cloud integration, and regional hubs to strengthen scalability and resilience.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Need for Operational Efficiency and Standardization

Organizations across industries adopt Shared Services Center Market solutions to streamline repetitive functions. Standardizing processes across finance, HR, and procurement improves control and reduces duplication. Centralized models provide consistent service delivery, which supports compliance with global standards. It creates measurable savings by consolidating fragmented functions into one structure. Companies also achieve faster response times through uniform workflows. This push for operational excellence continues to drive adoption among both large enterprises and mid-sized firms.

- For instance, Accenture implements performance testing and quality assurance protocols, with project leadership review, to meet client requirements. While a response time of under 2 seconds is a plausible target for critical applications, it is a project-specific goal.

Expansion of Global Business and Cross-Border Operations

Shared Services Center Market adoption increases as businesses expand across regions. Managing operations in multiple countries requires integrated service delivery frameworks. It provides centralized hubs that support diverse geographies and time zones. Such models improve oversight while reducing the burden of regional redundancies. Firms gain greater transparency in financial reporting and talent management. Cross-border trade growth further fuels demand for shared service models. This expansion makes the model an essential component of global strategies.

- For instance, Liberty Holdings, a South African financial services and insurance group, successfully consolidated claims, customer, and underwriting data that was previously stored across multiple, disparate back-end systems. The company’s digital transformation, carried out with technology partner MuleSoft, created a single, interoperable platform using an API-led approach. This enabled unified access to data for staff across the company’s regional operations.

Integration of Digital Transformation and Advanced Technologies

Digital transformation reshapes the Shared Services Center Market through automation and analytics. Robotic process automation reduces manual workloads and enhances transaction speed. Artificial intelligence supports predictive insights and better decision-making in service delivery. It enables centers to manage larger volumes with fewer errors and improved accuracy. Data analytics enhances visibility into key business functions. Organizations achieve scalable solutions by combining advanced platforms with centralized processes. This integration reinforces the strategic value of shared services.

Cost Optimization and Strategic Focus for Enterprises

Cost reduction remains a primary driver in the Shared Services Center Market. Consolidation of support functions allows organizations to cut overhead expenses. It frees resources for investment in customer-facing and revenue-generating activities. Shared services provide economies of scale that smaller units cannot achieve alone. Centralized operations also reduce vendor and resource duplication. The model enables leadership to focus on innovation and market growth. Enterprises continue to view shared services as a reliable path to efficiency.

Market Trends

Adoption of Intelligent Automation and Artificial Intelligence Solutions

The Shared Services Center Market evolves with the rapid adoption of automation and AI. Robotic process automation streamlines repetitive functions across finance, HR, and procurement. Machine learning tools enhance decision accuracy by analyzing large datasets. It reduces errors, accelerates processes, and improves service quality. AI-driven chatbots and virtual assistants transform employee and customer support interactions. Predictive analytics strengthens forecasting and compliance monitoring. This trend positions technology as a central driver of shared service efficiency.

- For instance, Between 2016 and 2020, Accenture identified over 10,000 automation process improvement opportunities through its internal automation platform, myWizard. This was done to drive efficiency for both Accenture’s internal operations and its clients.

Shift Toward Global Business Services and Multi-Function Models

Companies expand the Shared Services Center Market by moving beyond single-function operations. Enterprises integrate finance, IT, supply chain, and HR under one global model. It enables greater synergy and eliminates duplication across multiple departments. Centralized models allow faster adaptation to regulatory and regional requirements. Multi-function centers improve visibility, governance, and collaboration across global operations. Firms also achieve stronger cost management through unified platforms. The shift toward integrated models continues to redefine shared service strategies.

- For instance, IBM’s watsonx platform provides AI tools to thousands of companies worldwide, with offerings such as watsonx.ai for generative AI and Watson Assistant for customer service. Market analysis indicates that the number of clients for individual watsonx products varies significantly, but the technology is applied across many industries, including finance, healthcare, and retail, to drive business innovation.

Focus on Talent Development and Workforce Transformation

The Shared Services Center Market highlights workforce transformation to align with digital priorities. Companies invest in upskilling employees to handle analytics, automation, and strategic support. It creates a workforce that balances transactional efficiency with value-added services. Flexible work arrangements increase talent access across different geographies. Training programs focus on digital literacy and process improvement expertise. Organizations strengthen employee retention by offering career growth within shared services. Talent-driven strategies support scalability and sustainability of centralized operations.

Rising Importance of Cloud-Based Platforms and Cybersecurity Measures

The Shared Services Center Market embraces cloud adoption to improve scalability and flexibility. Cloud platforms support integration of diverse applications across global locations. It enables real-time access to data, ensuring faster decision-making and collaboration. Organizations adopt advanced cybersecurity solutions to safeguard sensitive information within centralized hubs. Compliance with global data protection laws drives investment in secure infrastructure. Cloud migration also reduces dependence on legacy systems. This trend ensures shared services remain resilient and future-ready.

Market Challenges Analysis

Complexities in Change Management and Organizational Alignment

The Shared Services Center Market faces challenges linked to change management across enterprises. Transitioning from decentralized models to centralized functions often meets resistance from staff and leadership. It requires strong communication and cultural alignment to maintain workforce morale. Diverse business units may resist standardization due to local practices and regulatory variations. Companies also struggle to redesign workflows while ensuring minimal disruption to daily operations. Achieving buy-in from multiple stakeholders remains a critical barrier. The complexity of aligning global teams slows the pace of transformation in many organizations.

Concerns Over Data Security, Compliance, and Technology Integration

The Shared Services Center Market encounters difficulties in protecting sensitive business data. It handles financial, employee, and operational records that demand high security standards. Cybersecurity threats and evolving compliance regulations create ongoing risks for centralized systems. Integrating legacy platforms with new digital tools complicates operations and increases costs. Companies often face delays in achieving full interoperability across functions and geographies. Limited technical expertise further hampers smooth adoption of advanced solutions. These challenges force organizations to balance efficiency gains with security and compliance priorities.

Market Opportunities

Expansion Through Digital Transformation and Advanced Analytics

The Shared Services Center Market offers significant opportunities through adoption of advanced digital tools. Automation, artificial intelligence, and data analytics enhance operational visibility and efficiency. It allows organizations to deliver faster, error-free services while reducing costs. Predictive insights from analytics support better decision-making in finance, HR, and supply chain. Companies also unlock opportunities to improve compliance and risk management through digital platforms. Scalable technology frameworks create flexible models that adapt to dynamic global demands. This transformation strengthens the role of shared services as a strategic business partner.

Growth Potential in Emerging Markets and Industry Diversification

The Shared Services Center Market presents strong potential in emerging economies with expanding business operations. Centralized hubs in regions like Asia-Pacific and Latin America provide cost advantages and access to skilled labor. It enables companies to extend services across wider geographies while maintaining quality. Rising demand across healthcare, retail, and energy sectors diversifies the market landscape. Industry-specific shared services create tailored solutions that support sector priorities. Organizations gain opportunities to standardize processes in industries traditionally reliant on local operations. This expansion drives both regional development and market penetration for global enterprises.

Market Segmentation Analysis:

By Service Type

The Shared Services Center Market divides into finance and accounting, human resources, IT services, procurement, and customer service. Finance and accounting hold a large share due to high demand for transaction processing, reporting, and compliance. Human resources services expand with growing emphasis on payroll, recruitment, and performance management. It drives efficiency by automating repetitive HR tasks while ensuring employee satisfaction. IT services support infrastructure management, cybersecurity, and system integration across industries. Procurement services focus on vendor management and cost optimization, while customer service solutions strengthen client interactions. Each service type continues to evolve with digital transformation and sector-specific requirements.

- For instance, Capgemini supports approximately 32 multi‑process HR transformation clients and serves around 820,000 employees through its People Experience services.

By Delivery Model

The Shared Services Center Market is structured around onshore, nearshore, and offshore delivery models. Onshore models appeal to firms prioritizing local control and regulatory compliance. Nearshore models provide geographic and cultural alignment with cost advantages compared to onshore setups. Offshore models dominate due to significant savings, global talent pools, and scalability. It enables organizations to centralize services in regions with skilled labor and lower costs. Hybrid delivery models are also emerging to balance efficiency with risk management. Companies select models based on industry focus, compliance demands, and operational strategy.

- For instance, Accenture increased procurement coverage within a client’s shared services center from roughly 65 percent to 85 percent by establishing a 70‑person offshore middle office team, significantly improving procurement governance.

By Organization Size

The Shared Services Center Market serves both large enterprises and small to medium-sized businesses. Large enterprises drive demand due to complex global operations requiring standardized service delivery. It allows them to consolidate multiple functions while improving governance and visibility. Small and medium-sized enterprises adopt shared services to reduce overhead and focus on core activities. They benefit from scalable platforms that support growth without heavy infrastructure investment. Large firms emphasize multi-function global business services, while smaller organizations focus on cost-effective, flexible solutions. Growing adoption across all sizes strengthens the overall market landscape and broadens the customer base.

Segments:

Based on Service Type

- Finance and Accounting

- Information Technology

- Human Resources

- Customer Service

- Legal

- Procurement

- Compliance and Risk Management

Based on Delivery Model

- In-House Shared Services Centers

- Outsourced Shared Services Centers

Based on Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Based on Industry Vertical

- BFSI

- Healthcare and Life Sciences

- Information Technology and Telecommunications

- Retail and Consumer Goods

- Government and Public Sector

- Energy and Utilities

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for the largest share of the Shared Services Center Market, holding around 38% of the total market in 2024. The region benefits from a mature business environment, advanced infrastructure, and high adoption of digital transformation solutions. It demonstrates strong demand for finance, accounting, IT, and HR shared services across industries such as banking, healthcare, retail, and manufacturing. Companies in the United States and Canada emphasize operational efficiency, governance, and compliance, which increases reliance on centralized service models. It also benefits from rapid deployment of automation, artificial intelligence, and cloud-based tools within shared service operations. The presence of leading multinational corporations and established service providers further strengthens adoption rates. Continuous investment in digital platforms and cybersecurity solutions ensures that North America remains a hub for innovation and operational excellence in shared services.

Europe

Europe represents the second-largest contributor, with a market share of about 29% in 2024. The region’s growth is supported by advanced regulatory frameworks, strong emphasis on compliance, and demand for sustainable business operations. Countries such as the United Kingdom, Germany, France, and the Netherlands remain central hubs for shared service activities. It demonstrates strong integration of multi-function service models, with organizations consolidating HR, finance, and procurement processes across European markets. The European Union’s focus on data protection and GDPR compliance increases demand for secure and transparent shared service operations. Shared services in Europe also gain traction in industries such as automotive, pharmaceuticals, and financial services, where efficiency and regulatory alignment are critical. The increasing use of nearshore and onshore delivery models highlights Europe’s preference for cultural alignment and regulatory adherence over cost alone.

Asia-Pacific

Asia-Pacific holds a significant and fast-growing share, representing 23% of the Shared Services Center Market in 2024. The region is recognized as a global hub for offshoring due to its cost advantages and skilled labor pool. Countries such as India, China, the Philippines, and Malaysia serve as leading destinations for shared service centers. It offers businesses competitive advantages through large-scale workforce availability, multilingual talent, and advanced digital infrastructure. Rapid industrialization and expansion of multinational corporations in the region create rising demand for centralized services in IT, HR, and finance. The region also embraces cloud-based platforms and digital transformation initiatives to support large-scale operations. Asia-Pacific is projected to expand its market share further due to strong investments in technology, continuous improvement in service delivery quality, and government initiatives supporting global business hubs.

Latin America

Latin America contributes a smaller but growing portion, accounting for around 6% of the global market in 2024. The region experiences rising demand for nearshore services, driven by cultural alignment and geographic proximity to North America. Countries such as Brazil, Mexico, Colombia, and Argentina play a central role in offering cost-effective and scalable solutions. It supports industries such as financial services, telecommunications, and healthcare, which require multilingual talent and regional expertise. Shared service models in the region are evolving to integrate advanced automation and cloud-based solutions. Despite infrastructure and political challenges, Latin America demonstrates strong growth potential due to increasing outsourcing demand. The shift toward service centralization supports regional competitiveness and creates new opportunities for multinational corporations.

Middle East & Africa

The Middle East & Africa hold the smallest share, representing about 4% of the Shared Services Center Market in 2024. The region is in the early stages of adoption, with growth driven by expanding infrastructure and rising investment in digital transformation. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa are leading adopters, focusing on finance, procurement, and IT services. It provides opportunities for enterprises seeking regional hubs that connect Europe, Asia, and Africa. The region faces challenges from limited availability of skilled labor and high reliance on imported expertise. However, government initiatives promoting economic diversification and digital innovation support market development. Shared services in this region are expected to grow steadily as enterprises seek efficient solutions for regional operations and compliance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Capgemini SE

- Infosys Limited

- Deloitte Touche Tohmatsu Limited

- International Business Machines Corporation

- WNS (Holdings) Ltd.

- Tata Consultancy Services Limited

- EXLService Holdings, Inc.

- Accenture plc

- Genpact Ltd.

- CGI, Inc

Competitive Analysis

The competitive landscape of the Shared Services Center Market is defined by leading players such as Accenture plc, Genpact Ltd., Deloitte Touche Tohmatsu Limited, Tata Consultancy Services Limited, WNS (Holdings) Ltd., CGI Inc., Capgemini SE, Infosys Limited, EXLService Holdings Inc., and International Business Machines Corporation. These companies focus on delivering integrated solutions that combine process expertise, advanced technology, and scalable delivery models. They strengthen their market presence through investments in automation, artificial intelligence, and cloud-based platforms that enhance efficiency and accuracy in shared service operations. Strategic partnerships, mergers, and acquisitions allow these players to expand capabilities and extend their global reach. Many also emphasize multi-function models that integrate finance, HR, procurement, and IT under a single framework to meet evolving client needs. With continuous focus on compliance, cybersecurity, and digital transformation, these companies drive innovation while maintaining operational resilience. Their ability to align service models with client-specific requirements ensures strong competitive positioning in a rapidly growing market.

Recent Developments

- In August 2025, Capgemini SE sought regulatory approval from India’s Competition Commission (CCI) to acquire Singapore‑based Cloud4C, a hybrid cloud platform services provider—expanding its cloud infrastructure and managed services presence.

- In August 2025, Infosys Limited inaugurated a new center of excellence at its Hubballi Development Center, focusing on advanced AI, cybersecurity, cloud solutions, and space technology. The facility forms part of its global network of “Living Labs,” supporting digital transformation across multiple industries.

- In July 2025, Capgemini SE announced its acquisition of WNS (Holdings) Ltd. in an all-cash deal worth about USD 3.3 billion (USD 76.50 per share), elevating its capability in AI-powered business process services and accelerating its generative and agentic AI initiatives.

- In June 2025, Capgemini SE partnered with Dai‑ichi Life Group to set up the insurer’s first Global Capability Centre (GCC) outside Japan, located in Hyderabad, India, to support digital transformation and strengthen AI, data analytics, and cybersecurity capabilities.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Delivery Model, Organization Size, Industry Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Shared services centers evolve into strategic partners that enhance enterprise agility.

- Organizations adopt hybrid models that blend captives, outsourcing, nearshoring, and remote work.

- Generative AI becomes a top investment, accelerating decision support and automation.

- Executives shift focus from cost-cutting toward delivering measurable strategic value.

- Shared services expand from core back-office tasks to include research, customer-facing, and analytic functions.

- Companies embrace multi-location strategies to build resilience and access top talent globally.

- Shared services operations guide workforce evolution through upskilling for digital and analytic roles.

- Intelligent automation, strong cybersecurity, and improved employee experiences shape future practices.

- Shared services centers lead enterprise innovation by becoming Global Capability Centres that drive transformation.

- Increasing collaboration between IT service firms and GCCs supports innovation and value creation.