Market Overview

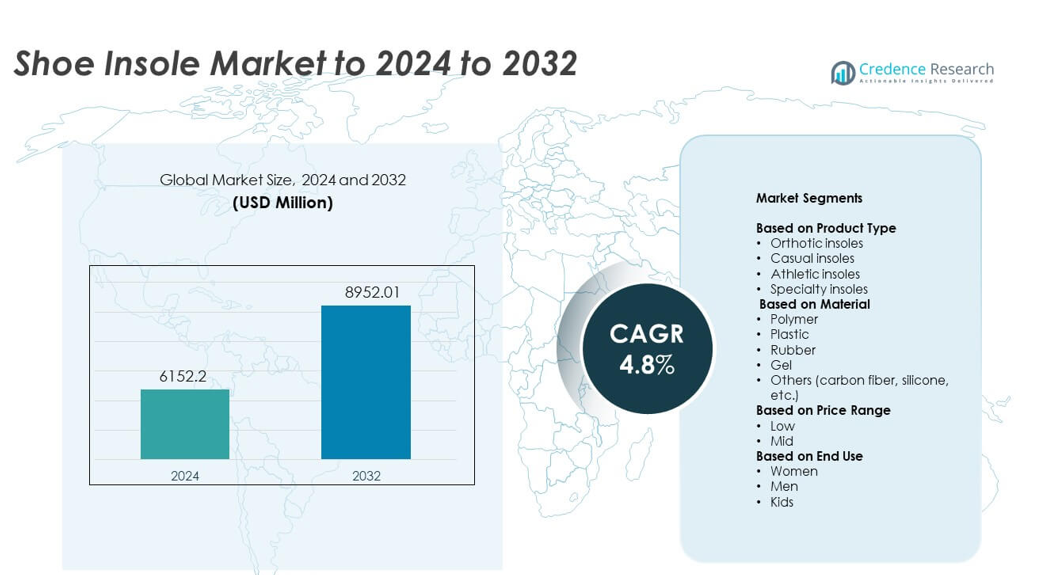

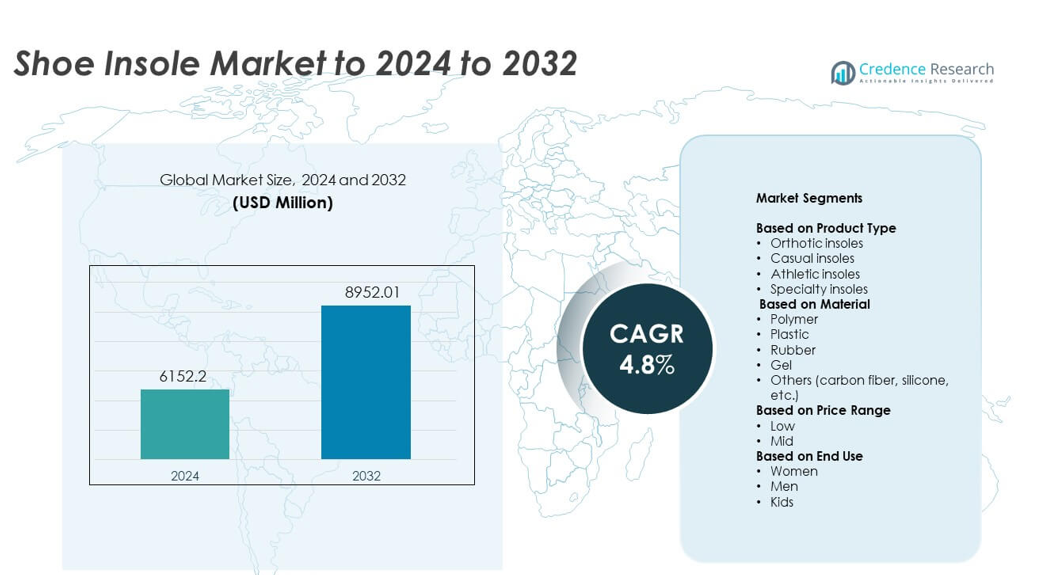

Shoe Insole Market size was valued at USD 6152.2 Million in 2024 and is anticipated to reach USD 8952.01 Million by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Shoe Insole Market Size 2024 |

USD 6152.2 Million |

| Shoe Insole Market, CAGR |

4.8% |

| Shoe Insole Market Size 2032 |

USD 8952.01 Million |

The Shoe Insole Market is shaped by leading players such as Superfeet Worldwide Inc., Texon International Group, SOLO Laboratories Inc., Bauerfeind AG, PowerStep, Spenco Medical Corporation, and Foot Science International. These companies compete through advanced material innovation, expanded orthotic offerings, and wider retail penetration. North America remained the leading region in 2024 with about 38% share, supported by strong adoption of premium insoles and rising awareness of foot health. Europe followed with a solid share driven by wellness-focused consumers, while Asia Pacific showed fast growth due to expanding sports participation and increasing demand for comfort-based footwear.

Market Insights

- The Shoe Insole Market was valued at USD 6152.2 Million in 2024 and is projected to reach USD 8952.01 Million by 2032, growing at a CAGR of 4.8%.

- Rising foot health issues and growing use of orthotic products drive steady demand across daily wear, sports, and medical applications.

- New trends include sustainable materials, premium comfort technologies, and smart insoles that enhance gait tracking and performance.

- Competition strengthens as key players expand product lines, improve cushioning systems, and adopt advanced polymer and gel materials to target wider user groups.

- North America led in 2024 with 38% share, Europe followed with 28%, and Asia Pacific held 24%; orthotic insoles dominated the product segment with 36% share due to strong demand for corrective and supportive solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Orthotic insoles led the Shoe Insole Market in 2024 with about 36% share. Growth came from rising cases of foot pain, plantar fasciitis, and diabetes-related foot issues that increased demand for corrective support. Brands expanded custom-fit and semi-custom solutions that enhance alignment and relieve pressure during daily use. Casual insoles also grew due to wide lifestyle adoption, while athletic insoles gained traction from sports participation. Specialty insoles served niche needs such as safety footwear and medical use but held a smaller share.

- For instance, a UK randomized trial comparing custom foot orthoses with prefabricated PowerStep devices for plantar heel pain followed patients for 8 weeks and found both groups, including the PowerStep insoles, showed statistically significant reductions in pain and disability scores at 4 and 8 weeks with p values reported below 0.0001, highlighting clinical backing for orthotic insole designs

By Material

Polymer-based insoles dominated this segment in 2024 with nearly 40% share. Strong demand came from lightweight structure, durability, and steady shock absorption that support both athletic and daily footwear. Polymer blends also allow better airflow and cushioning, which improve user comfort over long wear hours. Rubber and plastic options remained important for cost-focused buyers, while gel insoles gained traction for enhanced heel support. Premium materials such as carbon fiber and silicone stayed limited to specialty and performance-driven users.

- For instance, Sidas 3Feet High insoles are constructed from multi-material polymer components, including an EVA base and an ECO Ortholite layer, that support both performance and durability. The high arch version provides approximately 3.4 cm of arch support and incorporates a gel pad in the heel for shock absorption. While product guarantees and return periods vary by retailer, many offer at least a 30-day return period.

By Price Range

Mid-range insoles held the largest share in 2024 at about 42%. Buyers preferred balanced comfort, durability, and value, which positioned mid-priced options as ideal for both casual and orthotic use. Brands in this range offer advanced cushioning, arch support, and moisture control without premium pricing. Low-priced insoles served mass-market needs but lacked long-term support, while high-priced options attracted athletes and medical users seeking advanced performance materials and custom-fit benefits.

Key Growth Drivers

Rising Foot Health Concerns

Growing cases of plantar fasciitis, flat feet, and heel pain boosted demand for supportive insoles. Consumers now prefer corrective products that improve posture and reduce daily fatigue. Medical professionals also recommend orthotic insoles more often, which strengthens adoption across age groups. This trend helped expand premium and semi-custom insole categories.

- For instance, a clinical study on the effectiveness of Dr. Scholl’s Custom Fit orthotic inserts was conducted with 23 adults experiencing foot pain.

Expansion of Sports and Fitness Activities

Higher participation in running, gym training, and outdoor sports increased the need for shock-absorbing and performance-enhancing insoles. Athletic users seek better stability, impact control, and comfort, which drives strong demand for advanced materials. Brands are also launching sport-specific designs that improve energy return and reduce injury risks. This dynamic supports steady growth in the athletic insole segment.

- For instance, the PODOSmart system from Digitsole uses six pairs of smart insoles covering approximately UK sizes 3 to 11.5.

Growth of E-commerce and Customization

Online retail made insole comparison and selection easier, boosting awareness and accessibility. Custom-fit and 3D-scanned insoles also gained attention as users seek personalized comfort. Digital tools help match arch type, gait style, and foot pressure levels, improving product accuracy. This shift toward tailored solutions drives faster adoption across global markets.

Key Trends and Opportunities

Adoption of Smart and Sensor-Based Insoles

Smart insoles that track gait, pressure, and activity gained traction among fitness users and patients needing monitoring. These designs support injury prevention and early detection of foot complications. Rising interest in connected devices creates strong opportunities for brands to expand into digital health. This trend also helps companies differentiate in a competitive market.

- For instance, Moticon’s OpenGo Sensor Insole integrates 16 pressure sensors, a 3D accelerometer, and a 3D gyroscope, sampling data at rates up to 100 hertz and transmitting measurements wirelessly, turning the insole itself into a mobile biomechanical lab for sports science and clinical monitoring.

Shift Toward Sustainable and Recyclable Materials

Eco-focused consumers are pushing brands to adopt biodegradable foams, recycled polymers, and plant-based materials. Sustainable insoles appeal to buyers looking for low-impact alternatives without sacrificing comfort or durability. Companies adopting green materials also gain regulatory and brand-building advantages. This trend supports long-term market expansion and product innovation.

- For instance, OrthoLite reports that it now produces about 500 million pairs of foam insoles every year while keeping roughly 300 metric tons of recycled rubber out of landfills annually through its formulations, showing how large-scale insole suppliers are embedding measurable recycled content into core products.

Rising Demand for Premium Comfort Solutions

Users now look for enhanced cushioning, odor control, and moisture-management features in daily footwear. Premium comfort insoles address fatigue among workers, travelers, and older adults. This trend supports growth in high-value segments and motivates companies to improve advanced material technologies.

Key Challenges

Price Sensitivity in Low-Income Markets

Many buyers still prefer low-cost insoles, which limits adoption of advanced or specialized designs. High-quality materials and custom-fit technologies often raise production costs, making premium products less accessible. This price gap affects market penetration in developing regions. Brands face pressure to balance performance with affordability.

Lack of Standardization in Comfort and Fit

Foot shapes vary widely, making it hard for brands to design universal insole models. Poor fit can reduce comfort and lead to customer dissatisfaction. Inconsistent sizing and material response also increase product returns. This challenge pushes manufacturers to invest more in research, user testing, and flexible design systems.

Regional Analysis

North America

North America held the leading position in the Shoe Insole Market in 2024 with about 38% share. Strong demand came from high awareness of foot health, widespread use of orthotic products, and strong athletic participation. The region also benefits from advanced retail channels and rapid adoption of customized and premium insoles. Growing incidences of diabetes and obesity further increased the need for supportive and corrective solutions. Brands continue to expand through online platforms and clinic-based recommendations, supporting steady long-term growth.

Europe

Europe accounted for nearly 28% share of the Shoe Insole Market in 2024. Rising interest in wellness, posture correction, and ergonomic footwear strengthened demand across major countries. The region shows strong adoption of sustainable materials, which supports growth of eco-friendly insoles. A large elderly population also drives preference for comfort-focused and orthopedic designs. Athletic participation remains high, supporting demand for performance-based insoles. Expanding specialty retail outlets and podiatry clinics continue to shape regional market growth.

Asia Pacific

Asia Pacific held around 24% share of the Shoe Insole Market in 2024 and showed the fastest growth outlook. Rising disposable income, expanding sports culture, and growing awareness of foot health boosted adoption across China, India, and Southeast Asia. Mass-market insoles recorded strong demand, while premium and orthotic products gained traction in urban areas. E-commerce growth helped broaden access to varied insole types. Increasing cases of lifestyle-related foot issues further supported market expansion in the region.

Latin America

Latin America captured about 6% share of the Shoe Insole Market in 2024. Demand grew steadily with rising participation in sports and greater awareness of comfort-based footwear. Economic challenges slowed premium segment adoption, but mid-priced insoles remained popular. Brazil and Mexico saw increased interest in orthotic designs due to rising foot-related health concerns. Growing online retail channels and broader availability of global brands also improved access to advanced materials and designs.

Middle East and Africa

Middle east and africa represented nearly 4% share of the Shoe Insole Market in 2024. Growth came from increasing urbanization, higher spending on lifestyle products, and rising awareness of foot comfort in work environments. Countries with strong retail expansion saw faster adoption of both daily-wear and athletic insoles. The premium segment remains limited due to price sensitivity, but mid-range insoles continue to perform well. Gradual improvement in healthcare access supports demand for supportive and therapeutic insole solutions.

Market Segmentations:

By Product Type

- Orthotic insoles

- Casual insoles

- Athletic insoles

- Specialty insoles

By Material

- Polymer

- Plastic

- Rubber

- Gel

- Others (carbon fiber, silicone, etc.)

By Price Range

- Low (

- Mid (USD 25-USD 50)

- High (>USD 50)

By End Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Shoe Insole Market features active competition shaped by leading companies such as Superfeet Worldwide, Inc., Texon International Group, SOLO Laboratories, Inc., Bauerfeind AG, PowerStep, Spenco Medical Corporation, and Foot Science International. Market players focus on expanding product portfolios through advanced cushioning systems, improved arch-support technologies, and materials that enhance durability and comfort. Many brands invest in research to refine biomechanical performance and address foot conditions across varied user groups. E-commerce growth encourages firms to enhance digital visibility and offer personalized fitting tools. Sustainability trends also push manufacturers to adopt recycled and bio-based materials. Partnerships with podiatrists, sports clinics, and footwear brands further strengthen market positioning and help accelerate global expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2023, Foot Science International appointed Onyx Health as its medical education partner for Formthotics custom foot orthoses, supporting wider clinical use of its orthotic insoles.

- In 2022, Superfeet introduced two new removable insole lines tailored for snowboarders and skiers, adding thermal top covers and sport-specific support profiles for winter sports boots.

- In 2022, Texon unveiled Ecostrobe, a fully recycled, single-layer strobel and insole material, designed to reduce waste and simplify sustainable insole construction for footwear brands

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Price Range, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising demand for orthotic and therapeutic insoles due to growing foot health awareness.

- Athletic insoles will expand as sports and fitness participation increases across global regions.

- Premium comfort insoles will gain traction among workers, travelers, and aging populations.

- Smart sensor-based insoles will grow as digital health and activity tracking become mainstream.

- Sustainable materials will play a larger role as brands adopt recyclable and bio-based options.

- Custom-fit and 3D-printed insoles will gain wider acceptance through online platforms.

- Mid-range insoles will remain dominant as consumers seek balanced comfort and affordability.

- Clinics and podiatrists will influence higher adoption of corrective and supportive designs.

- E-commerce expansion will improve access and visibility for both global and local brands.

- Product innovation will focus on lighter materials, better cushioning, and longer durability.