Market Overview

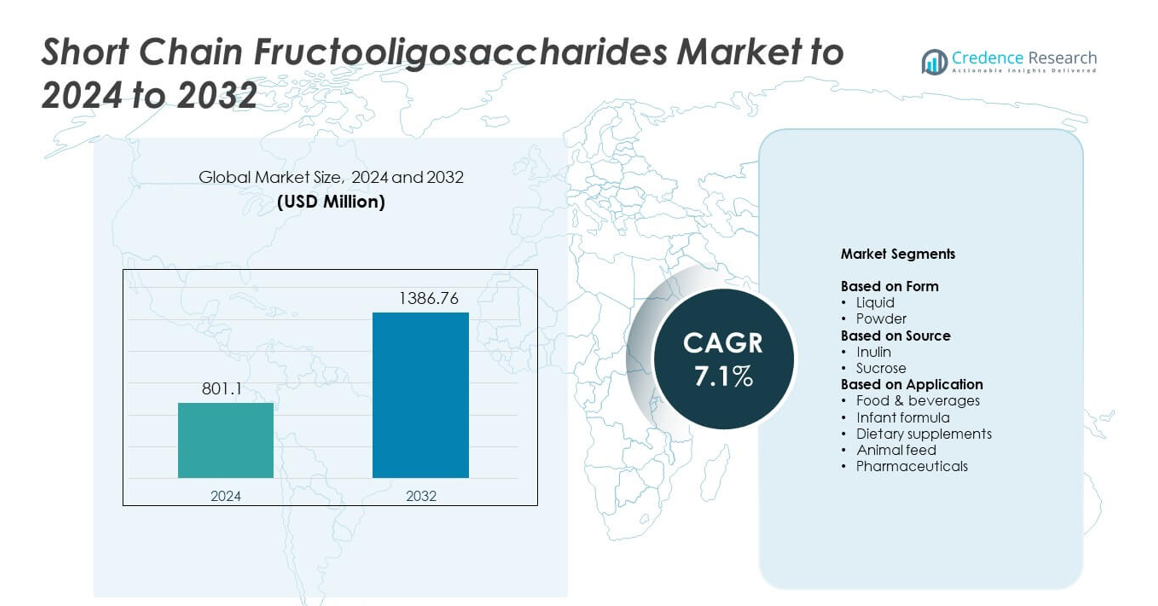

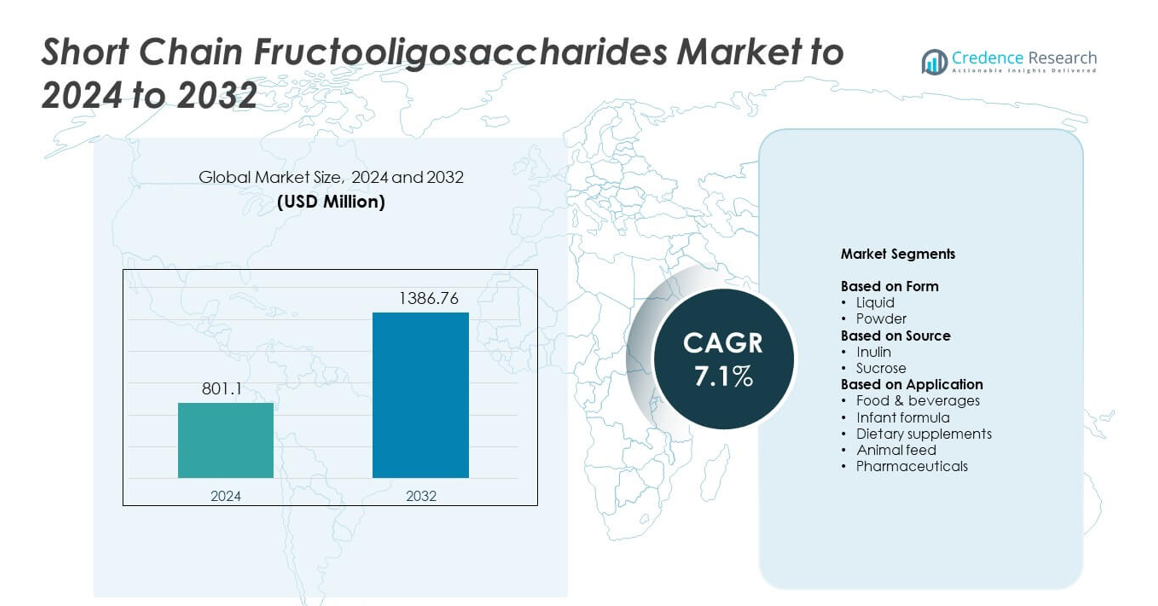

Short Chain Fructooligosaccharides Market size was valued at USD 801.1 million in 2024 and is anticipated to reach USD 1386.76 million by 2032, at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Short Chain Fructooligosaccharides Market Size 2024 |

USD 801.1 million |

| Short Chain Fructooligosaccharides Market, CAGR |

7.1% |

| Short Chain Fructooligosaccharides Market Size 2032 |

USD 1386.76 million |

The Short Chain Fructooligosaccharides Market includes major players such as Baolingbao Biology, Jarrow Formulas, Cargill Incorporated, Galam Ltd, Cosucra, Ingredion, Nutriagaves Group, Alkem Labs, and BENEO GmbH, each expanding capabilities to meet rising demand for prebiotic ingredients across food, infant formula, and dietary supplements. These companies strengthen their portfolios through advanced enzymatic processing, higher-purity offerings, and wider application support. Asia Pacific emerged as the leading region with about 34% share in 2024, driven by strong functional food consumption, large-scale infant formula production, and growing health awareness across major economies.

Market Insights

- Short Chain Fructooligosaccharides Market reached USD 801.1 million in 2024 and is projected to hit USD 1386.76 million by 2032 at a CAGR of 7.1%.

- Growth is driven by rising demand for digestive health products and expanding use of prebiotic fibers in food, beverages, supplements, and infant formula.

- Clean-label trends and adoption of low-sugar, fiber-rich formulations boost inclusion of FOS across bakery, dairy, plant-based, and wellness categories.

- Leading players enhance processing efficiency and product purity while expanding partnerships across nutrition and functional food sectors.

- Asia Pacific led the market with 34% share in 2024, followed by North America at 32% and Europe at 28%, while the powder form segment dominated with about 62% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Form

Powder led the Short Chain Fructooligosaccharides Market in 2024 with about 62% share. Strong demand came from its high stability, easy blending, and longer shelf life across packaged foods and dietary supplements. The powder format also supports efficient transport and bulk handling for large manufacturers. Liquid FOS grew at a steady pace due to rising use in beverages, syrups, and infant nutrition where fast dissolution is required. Growth across both forms is supported by rising clean-label demand and the shift toward prebiotic ingredients in global health and wellness products.

- For instance, Ingredion offers its NutraFlora short-chain fructooligosaccharide (scFOS) in both a highly concentrated syrup form (approximately 70% dry substance) and a powder form.

By Source

Inulin remained the dominant source in 2024 with nearly 70% share. Manufacturers preferred inulin-derived short chain FOS due to its strong availability, cost efficiency, and natural origin from chicory root. This source also supports higher purity and consistent composition, which helps formulators maintain stable taste and texture. Sucrose-derived FOS grew due to expanding production in Asia and its flexible processing advantages. Rising use of non-synthetic prebiotic fibers in functional foods continues to drive demand across both sources.

- For instance, Tata Chemicals specifies that its FOSSENCE short-chain fructooligosaccharide is manufactured by biotransformation of cane sugar and consists of molecules with a degree of polymerization between 3 and 5, confirming a sucrose-derived scFOS source profile.

By Application

Food and beverages held the leading position in 2024 with around 48% share. Growth came from increasing use of short chain FOS in bakery, dairy, beverages, and low-sugar formulations to enhance fiber intake and improve digestive support. Infant formula remained a strong contributor due to growing adoption of prebiotic blends that mimic human milk oligosaccharides. Dietary supplements expanded with rising gut-health awareness, while animal feed and pharmaceuticals added niche but stable demand. Clean-label trends and global consumer focus on digestive wellness continue to strengthen application growth.

Key Growth Drivers

Rising Demand for Digestive Health Products

Growing awareness of gut health and the role of prebiotics drives strong adoption of short chain fructooligosaccharides. Consumers now seek fiber-rich ingredients that support digestion and immunity, which boosts use in foods, beverages, and supplements. Brands expand functional product lines containing FOS due to its clean-label profile and strong safety record. This shift toward preventive health continues to raise demand across global markets.

- For instance, Tereos notes that a single teaspoon of its Actilight short-chain fructooligosaccharide provides dietary fibre equivalent to that found in 10 bananas, 700 grams of rye bread or 40 cloves of garlic, underlining how concentrated scFOS helps consumers increase fibre intake for gut health in small serving sizes.

Expansion of Infant Nutrition and Functional Formulations

Infant formula manufacturers increasingly add short chain fructooligosaccharides to mimic natural prebiotic activity found in human milk. This trend strengthens market growth as parents prefer formulas that support healthy gut flora and immunity. FOS also improves product stability and blends well with other nutrients, enhancing formulation flexibility. Rising birth rates in key regions and greater adoption of premium formula options support continued expansion.

- For instance, BENEO-Orafti documents that its Orafti oligofructose, produced from chicory root, has a degree of polymerization between 2 and 8 and is purified further to meet stringent quality requirements, explicitly including standards for infant nutrition, supporting its use in premium formula and toddler products.

Shift Toward Low-Sugar and Fiber-Enhanced Foods

Food producers adopt short chain fructooligosaccharides to reduce sugar while improving taste and texture. FOS provides mild sweetness and added fiber, which supports reformulation efforts in dairy, bakery, snacks, and beverages. Growing regulatory pressure on sugar reduction accelerates this trend. As consumers choose healthier alternatives with balanced nutrition, demand for FOS in food applications continues to grow.

Key Trends and Opportunities

Growth in Clean-Label and Plant-Based Product Development

Short chain fructooligosaccharides align well with clean-label, natural, and plant-based positioning. Brands use FOS to enhance fiber levels without altering flavor, which supports expansion in plant-based dairy, wellness beverages, and functional snacks. Consumers increasingly prefer transparent ingredient lists, creating strong opportunities for FOS suppliers to partner with manufacturers focused on natural product development. This trend expands application scope across mainstream retail categories.

- For instance, Nutriagaves de México offers a portfolio of Olifructine ingredients derived from blue agave. Their agave inulin products provide a range of fructans with a broad degree of polymerization (DP), typically from 3 up to around 42.

Advances in Prebiotic Research and Product Innovation

New studies on gut microbiome health encourage broader use of FOS in specialized nutrition. Manufacturers explore advanced blends that combine FOS with other prebiotics to deliver targeted digestive support. This research-driven innovation fuels opportunities in sports nutrition, medical foods, and immunity-boosting products. As scientific validation grows, brands gain confidence to include FOS in more value-added formulations.

- For instance, a 2024 Microbial Cell Factories study on the industrial FOS-producing fungus Aspergillus niger ATCC 20611 showed that engineered strains GOF-3 and DPOC-11 reduced glucose in the reaction mixture from 178.33 milligrams per millilitre to 89.33 milligrams per millilitre after 10 hours, demonstrating higher-purity fructooligosaccharide production through advanced bioprocess design.

Rising Demand in Animal Nutrition

Short chain fructooligosaccharides gain traction in animal feed due to their ability to support gut integrity and improve nutrient absorption. Producers focus on natural additives as alternatives to antibiotic growth promoters, boosting demand for prebiotic fibers. Growth in poultry and aquaculture production strengthens opportunities for FOS inclusion in feed blends. This expansion creates a new revenue channel for suppliers.

Key Challenges

High Production Cost and Complex Processing

Manufacturing short chain fructooligosaccharides requires advanced enzymatic processes and strict quality control. These factors raise production costs and limit access for price-sensitive markets. Smaller manufacturers face difficulties scaling operations due to equipment investment and purification requirements. Cost pressure affects competitiveness and may slow adoption in lower-margin food categories.

Regulatory Variations Across Global Markets

Different countries apply varied regulations for prebiotic claims, safety approvals, and labeling standards. These inconsistencies create barriers for manufacturers seeking global expansion. Companies must adjust product claims and formulations to meet regional rules, which increases compliance expenses. Slow approval timelines in some regions also delay market entry and affect innovation speed.

Regional Analysis

North America

North America held around 32% share of the Short Chain Fructooligosaccharides Market in 2024. Growth came from strong adoption of prebiotic fibers in functional foods, nutritional beverages, and dietary supplements. Rising consumer focus on gut health and clean-label ingredients supports steady expansion across major product categories. The United States leads regional demand due to high innovation activity and wider use in infant formula and wellness products. Increasing penetration in sports nutrition and reduced-sugar formulations continues to strengthen the market outlook.

Europe

Europe accounted for nearly 28% share in 2024, supported by mature demand for digestive health ingredients and strict nutrition standards. Manufacturers integrate short chain fructooligosaccharides into bakery, dairy, baby food, and plant-based products to meet rising fiber expectations. Regulatory encouragement toward reduced sugar and improved gut health further boosts inclusion in mainstream food categories. Countries such as Germany, the Netherlands, and the United Kingdom drive innovation in prebiotic-enriched products. Expanding applications in clinical nutrition and elderly care also enhance long-term growth.

Asia Pacific

Asia Pacific dominated the market in 2024 with about 34% share. Strong demand came from expanding infant formula production, rising functional food consumption, and increasing health awareness across China, Japan, South Korea, and India. Local manufacturers scale output of inulin- and sucrose-based FOS, improving regional supply and reducing production costs. Rapid urbanization and growing digestive health concerns drive wider use in beverages, snacks, and dietary supplements. The region continues to show the fastest growth due to large population size and rising spending on nutritional products.

Latin America

Latin America captured close to 4% share in 2024, supported by growing interest in digestive wellness and functional ingredients. Countries such as Brazil and Mexico witness rising adoption of short chain fructooligosaccharides in dairy, bakery, and beverage applications. Local food producers increasingly reformulate to meet consumer demand for higher fiber intake and reduced sugar. Awareness campaigns on gut health support market penetration, while expanding retail access to prebiotic supplements strengthens demand. Growth remains steady as manufacturers explore cost-effective FOS integration in mainstream foods.

Middle East and Africa

The Middle East and Africa held nearly 2% share in 2024. Market expansion remains gradual due to lower awareness of prebiotic benefits and limited local production capacity. However, rising demand for fortified foods, infant formula, and imported nutritional products supports incremental growth. Urban consumers show increasing interest in digestive health, which encourages food producers to add fiber-enhancing ingredients. Gulf countries lead adoption due to higher purchasing power and wider availability of functional foods. Improving healthcare access and nutrition education continues to create new opportunities for FOS inclusion.

Market Segmentations:

By Form

By Source

By Application

- Food & beverages

- Infant formula

- Dietary supplements

- Animal feed

- Pharmaceuticals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Short Chain Fructooligosaccharides Market features key players such as Baolingbao Biology, Jarrow Formulas, Cargill Incorporated, Galam Ltd, Cosucra, Ingredion, Nutriagaves Group, Alkem Labs, and BENEO GmbH. Companies in this space focus on expanding production capacity, improving enzymatic processing efficiency, and enhancing purity levels to meet rising global demand for high-quality prebiotics. Many manufacturers strengthen partnerships with food, beverage, infant nutrition, and supplement brands to support large-scale formulation needs. Firms also invest in research to validate digestive health benefits, improve product stability, and develop versatile FOS formats that blend smoothly across applications. Growing interest in clean-label and plant-based products drives innovation, while strategic distribution expansions help increase market reach. Regulatory compliance and alignment with global food safety standards remain priorities as companies work to access new regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Nutriagaves de México expanded its agave-derived FOS line with new organic-certified agave FOS products, targeting demand for low-glycemic, prebiotic sweeteners based on short-chain fructooligosaccharides.

- In 2023, BENEO expanded its portfolio with the launch of Beneo-scL85, a short-chain fructooligosaccharide (scFOS) ingredient in syrup form aimed at sugar reduction and fiber enrichment

Report Coverage

The research report offers an in-depth analysis based on Form, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for digestive health products will continue to rise across major regions.

- Use of FOS in infant formula will expand due to growing focus on gut microbiome support.

- Food and beverage manufacturers will increase FOS adoption for sugar reduction and fiber enrichment.

- Prebiotic research will drive new product formulations in medical and clinical nutrition.

- Supplement brands will scale FOS-based offerings as consumers seek natural wellness solutions.

- Plant-based and clean-label trends will boost integration of FOS in dairy alternatives and snacks.

- Animal nutrition applications will grow as producers shift toward natural gut-support solutions.

- Production capacity will increase as manufacturers invest in advanced enzymatic technologies.

- Regulatory clarity on prebiotic claims will support wider global market expansion.

- Rising awareness of microbiome health will drive long-term demand across all application segments.