Market Overview

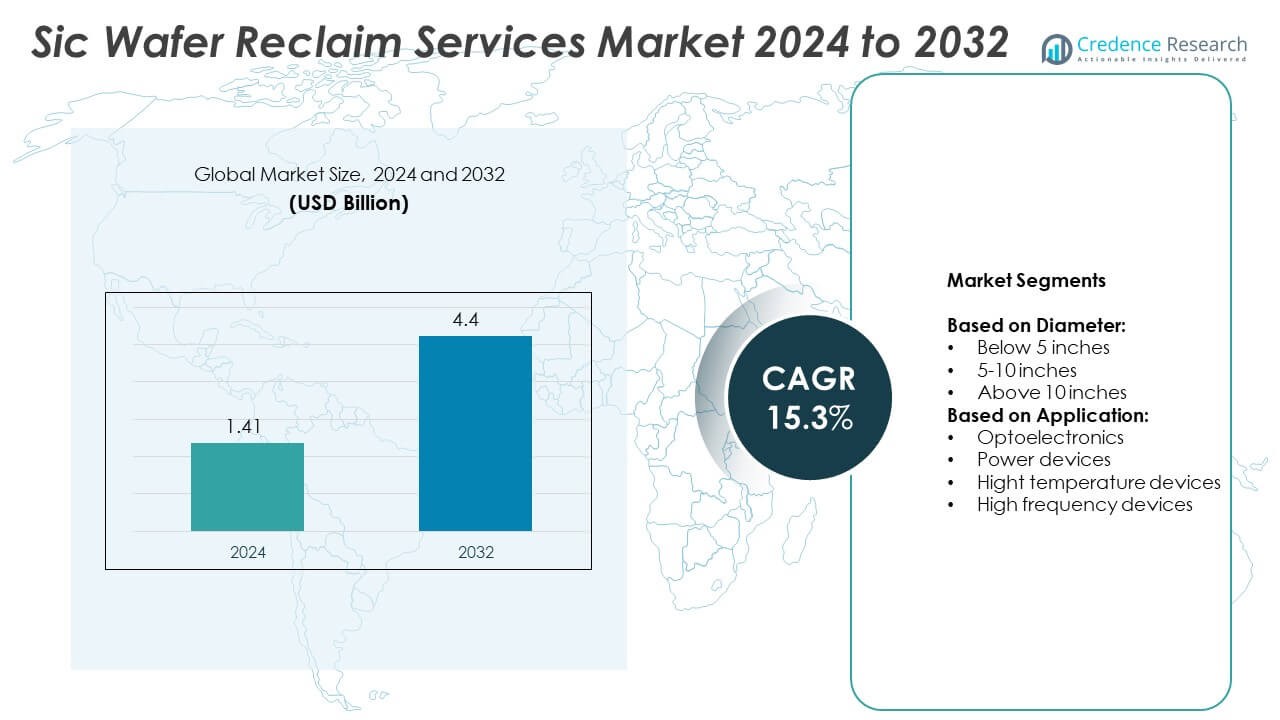

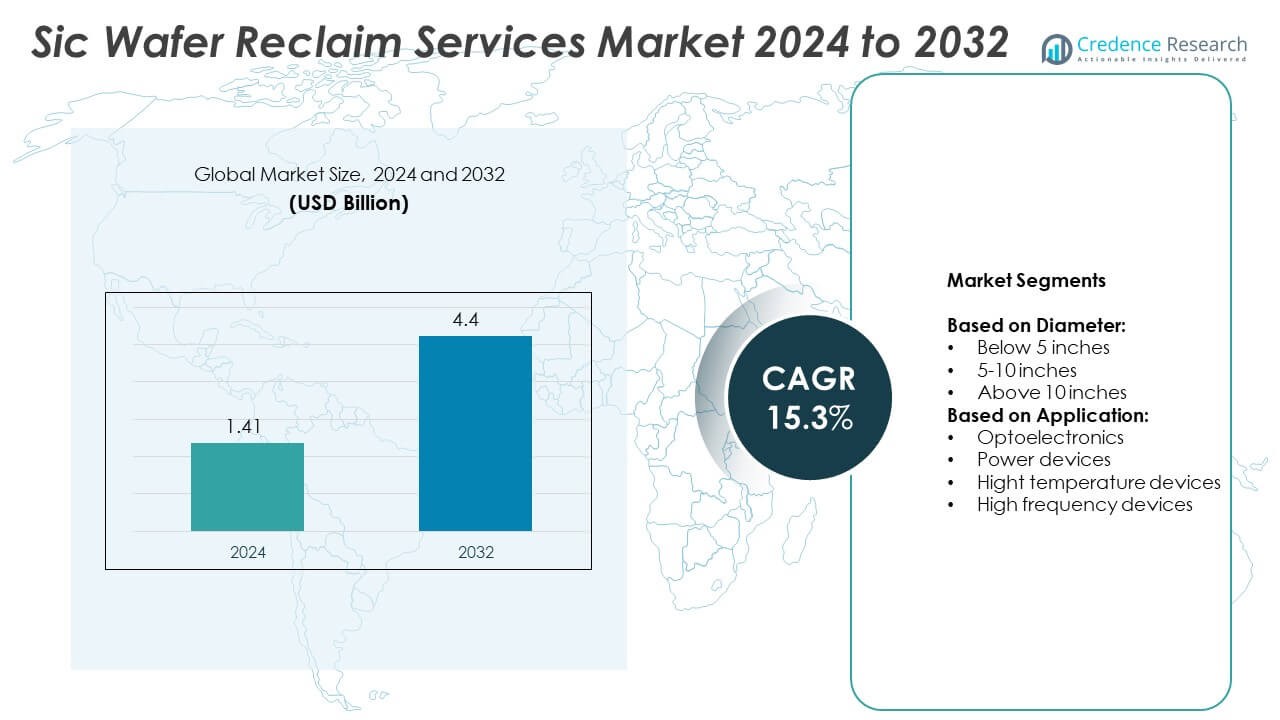

Sic Wafer Reclaim Services Market size was valued at USD 1.41 billion in 2024 and is anticipated to reach USD 4.4 billion by 2032, at a CAGR of 15.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sic Wafer Reclaim Services Market Size 2024 |

USD 1.41 Billion |

| Sic Wafer Reclaim Services Market, CAGR |

15.3% |

| Sic Wafer Reclaim Services Market Size 2032 |

USD 4.4 Billion |

The Sic Wafer Reclaim Services market grows due to rising demand for cost-efficient semiconductor production and sustainable manufacturing practices. Increasing use of SiC wafers in EVs, power devices, and high-frequency systems drives reclaim adoption. Manufacturers seek to reduce raw wafer dependency and optimize supply chains. Trends include automation in reclaim processes, regional service expansion, and tighter surface quality standards. Vendors invest in advanced polishing and inspection tools to meet industry-specific performance requirements and support long-term scalability.

Asia-Pacific leads the Sic Wafer Reclaim Services market, supported by a strong semiconductor manufacturing base in China, Japan, South Korea, and Taiwan. North America and Europe follow, driven by rising investments in electric vehicles, power electronics, and regional sustainability goals. Latin America and the Middle East & Africa show emerging potential, especially in smart grid and renewable energy projects. Key players active across these regions include RS Technologies Co., Ltd., Phoenix Silicon International Corporation, NOVA Electronic Materials, LLC, and TOPCO Scientific.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sic Wafer Reclaim Services market was valued at USD 1.41 billion in 2024 and is projected to reach USD 4.4 billion by 2032, growing at a CAGR of 15.3%.

- Strong demand for cost-effective semiconductor production and sustainability targets is driving reclaim service adoption.

- Increasing use of SiC in EVs, power modules, and 5G systems supports reclaim needs across multiple industries.

- Key players focus on automation, precision cleaning, and defect control to gain competitive advantage.

- Limited reclaim cycles, surface damage risks, and lack of standardization remain key challenges in global operations.

- Asia-Pacific leads the market with strong fabrication infrastructure, followed by North America and Europe with expanding local capacity.

- Vendors form long-term partnerships with fabs, invest in regional service centers, and align reclaim solutions with industry-specific quality demands.

Market Drivers

Rising Demand for Cost-Effective Semiconductor Manufacturing Solutions

The global semiconductor industry continues to face cost pressures linked to material wastage. Reclaimed silicon carbide (SiC) wafers help reduce production costs without sacrificing performance. Many manufacturers now prioritize reclaim services to extend wafer life and reduce spending on new substrates. It allows companies to support growing chip production while controlling capital expenses. The use of reclaimed wafers also lowers environmental impact by minimizing raw material use. The Sic Wafer Reclaim Services market benefits from this strong shift toward cost efficiency and sustainability.

- For instance, Micro Reclaim Technologies (MRT) offers reclaim services for SiC wafers in diameters of 2-inch, 3-inch, 4-inch, and 6-inch, delivering polished, epi-ready surfaces with roughness below 5 Å, enabling direct re-use for epitaxial regrowth

Growing Adoption of SiC-Based Power Electronics in EV and Renewable Sectors

The rapid expansion of electric vehicles and renewable energy drives demand for SiC power devices. SiC wafers support high-voltage, high-temperature operations with superior energy efficiency. Their integration in inverters, chargers, and power modules fuels higher consumption of wafers. It pushes OEMs to reclaim wafers to manage tight supply and reduce material waste. Manufacturers reclaim used wafers to meet production needs without waiting on fresh substrate supply. The Sic Wafer Reclaim Services market gains momentum due to strong traction in power semiconductor applications.

- For instance, Optim Wafer Services (OPTIM) brings over 30 years of experience in offering wafer reclaim services across test wafer diameters from 4-inch to 8-inch, serving both high-volume and low-volume semiconductor production needs

Limited Availability and High Cost of Raw SiC Substrates

Pure SiC substrates remain costly and difficult to produce at scale. Supply constraints have made reclaimed wafers a necessary option to maintain production flow. It enables chipmakers to maintain fabrication continuity without compromising device yield. Reclaim services extend substrate usability across multiple cycles, improving operational efficiency. Leading fabs actively invest in reclaim partnerships to buffer against supply risk. The Sic Wafer Reclaim Services market grows on the back of this industry-wide scarcity of raw SiC materials.

Focus on Circular Economy and Environmental Compliance

Environmental regulations and circular economy policies push manufacturers toward more sustainable operations. Reclaiming used wafers reduces landfill waste and lowers energy usage compared to new wafer production. It aligns with corporate sustainability goals and regulatory compliance mandates across regions. Major foundries view reclaim solutions as part of their long-term green strategy. It supports cleaner production models and improves overall environmental performance. The Sic Wafer Reclaim Services market sees strong demand from companies seeking to reduce carbon footprint and enhance resource efficiency.

Market Trends

Increasing Use of SiC Wafers in Next-Generation Power Devices

The shift toward high-efficiency power electronics fuels growing demand for SiC wafers. Applications in 5G base stations, EV inverters, and industrial power supplies rely on SiC’s superior performance. More fabs use reclaim services to manage wafer cost and availability. It supports faster time-to-market while meeting reliability standards. Device manufacturers reclaim wafers to avoid delays caused by limited fresh wafer stock. The Sic Wafer Reclaim Services market benefits from the expanding role of SiC in advanced power systems.

- For instance, PAM-XIAMEN expanded its SiC wafer portfolio to include 2-inch, 3-inch, 4-inch, 6-inch, and 8-inch wafers, supplying reclaim and epitaxy-ready services to global semiconductor fabs

Integration of Automated Reclaim Technologies in Wafer Processing

Vendors now offer automated reclaim systems to improve throughput and wafer recovery rates. These tools reduce manual errors, enhance yield, and allow scale-up for large fabs. It helps maintain consistent quality across multiple reclaim cycles. Robotics and machine learning tools are being added to identify micro-defects and optimize etching. Automation strengthens the reclaim process while keeping operational costs under control. The Sic Wafer Reclaim Services market sees strong alignment with these digital production trends.

- For instance, Shin-Etsu Chemical is a major supplier of semiconductor materials and has invested significantly in expanding its production capacity, particularly in its silicones business in 2023. While it is a leader in silicon wafers up to 300 mm.

Strong Focus on Surface Quality and Defect Control Standards

Chip manufacturers demand ultra-clean wafer surfaces with minimal contamination. Reclaim service providers use advanced polishing and cleaning methods to meet these needs. It ensures that reclaimed wafers match new ones in terms of surface integrity. Many fabs now certify reclaim quality for internal use in pilot and small-volume production. Standardization across reclaim procedures boosts customer trust and service adoption. The Sic Wafer Reclaim Services market evolves with tighter quality benchmarks and inspection protocols.

Regional Capacity Expansion and Strategic Supplier Partnerships

Asia-Pacific and North America see rising investments in reclaim facilities close to foundry hubs. Leading players form supply agreements to secure reclaim capacity and stabilize operations. It reduces logistics costs and shortens turnaround times for customers. Localized service centers improve flexibility in production cycles. Long-term contracts with fabs ensure steady reclaim demand across market cycles. The Sic Wafer Reclaim Services market adapts to region-specific capacity planning and strategic sourcing models.

Market Challenges Analysis

Limited Reclaim Cycles and Surface Degradation Risks

Each SiC wafer has a limited number of reclaim cycles before surface quality drops. The process often leads to micro-cracks, reduced thickness, or particle contamination. It affects the electrical properties and mechanical strength required in advanced power devices. Vendors must apply precise cleaning and polishing methods to avoid yield losses. It increases operational costs and reduces overall wafer availability. The Sic Wafer Reclaim Services market faces ongoing challenges in balancing reclaim efficiency with quality standards.

Lack of Standardization Across Reclaim Procedures and Quality Metrics

Global fabs follow different surface quality benchmarks and testing procedures. This variation slows down service scalability and creates gaps in trust between fabs and reclaim providers. It limits cross-regional supply partnerships and increases the risk of wafer rejection. Vendors need to invest in R&D and quality control to match each client’s criteria. It raises capital expenditure and affects service margins. The Sic Wafer Reclaim Services market must overcome these inconsistencies to support wider adoption.

Market Opportunities

Expansion of EV and Fast-Charging Infrastructure Creating Wafer Reclaim Demand

Electric vehicle production and fast-charging networks rely on high-performance SiC semiconductors. These applications consume large volumes of wafers, making reclaim services essential for cost control. Manufacturers look to reclaim wafers to meet rising output without increasing substrate expenses. It supports higher device yields while easing pressure on raw SiC supply chains. Tier-1 suppliers and fabs actively seek reclaim partners with proven quality systems. The Sic Wafer Reclaim Services market can capture growth from this expanding power electronics ecosystem.

Government-Led Sustainability Goals Encouraging Circular Manufacturing Models

Global policies now promote circular economy practices in semiconductor production. Reclaiming wafers aligns with environmental regulations and helps companies reduce resource use. Public and private incentives support low-carbon manufacturing initiatives across key regions. It positions reclaim providers as strategic partners in meeting eco-compliance and cost-saving goals. Investments in local reclaim facilities create opportunities for regional market entry and long-term contracts. The Sic Wafer Reclaim Services market benefits from this shift toward sustainable, resource-efficient manufacturing.

Market Segmentation Analysis:

By Diameter:

The 5–10 inches segment holds the largest share in the Sic Wafer Reclaim Services market. These wafers are widely used in high-power and high-frequency device production. Their balanced size supports efficient reclaim processes while maintaining mechanical strength. Many fabs prefer this range for its compatibility with mainstream production lines. It drives consistent demand for reclaim solutions that ensure uniform thickness and surface quality. The below 5 inches segment sees limited use, mainly in older or niche applications where smaller die sizes are acceptable. The above 10 inches segment remains nascent due to complex reclaim requirements and limited commercial deployment of such large-diameter SiC wafers.

- For instance, NOVASiC—a Soitec service—offers reclaim services for wide-bandgap wafers from 50 mm to 200 mm in diameter, with precision polishing capable of achieving 0.1 nm RMS surface roughness, and supports up to 10 reclaim cycles per wafer

By Application:

The power devices segment leads in application-based adoption, backed by the growing use of SiC in EVs, grid infrastructure, and industrial inverters. Reclaimed wafers help maintain supply and reduce costs for these power applications that demand high-volume throughput. The high-frequency devices segment follows closely, driven by telecom and 5G deployment. These applications require wafers with minimal defects and tight surface specifications. It supports the need for precision reclaim services capable of meeting such standards. The high-temperature devices segment shows rising potential, especially in aerospace and defense, where SiC’s thermal properties are critical. The optoelectronics segment uses reclaimed wafers in sensors, LEDs, and imaging systems, where surface clarity and purity remain top priorities. The Sic Wafer Reclaim Services market sees broad traction across these applications, each shaping reclaim service parameters and quality benchmarks.

- For instance, Rokko Electronics Co., Ltd. processes and reclaims SiC and all within ISO 9001 and ISO 14000 certified cleanroom conditions

Segments:

Based on Diameter:

- Below 5 inches

- 5-10 inches

- Above 10 inches

Based on Application:

- Optoelectronics

- Power devices

- Hight temperature devices

- High frequency devices

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a 31.5% share of the Sic Wafer Reclaim Services market. The region benefits from strong investments in semiconductor manufacturing and advanced power electronics. Major chipmakers and foundries across the U.S. and Canada actively use reclaim services to reduce wafer procurement costs. It supports large-scale electric vehicle programs and clean energy infrastructure that demand SiC-based power devices. Government-led sustainability initiatives also encourage circular manufacturing practices across the region. Local reclaim service providers continue to expand their processing capabilities to meet growing demand from automotive and defense sectors. The presence of leading fabs and R&D centers strengthens North America’s position in the reclaim value chain.

Europe

Europe accounts for 25.6% of the global Sic Wafer Reclaim Services market. Countries such as Germany, France, and the Netherlands lead adoption, driven by their emphasis on industrial decarbonization and high-efficiency power systems. Regional demand grows due to the use of SiC in rail systems, wind energy components, and automotive inverters. Leading European fabs collaborate with reclaim service firms to meet quality standards required for high-voltage applications. The European Union’s push for self-sufficiency in semiconductor materials strengthens local reclaim capacity. It allows OEMs to shorten lead times and reduce reliance on fresh SiC substrates. Reclaim services align well with the region’s environmental and circular economy goals.

Asia-Pacific

Asia-Pacific dominates with a 35.8% share in the Sic Wafer Reclaim Services market. The region leads in wafer fabrication and power device production, with major facilities located in China, Japan, South Korea, and Taiwan. Strong demand from automotive, consumer electronics, and industrial applications drives reclaim service growth. Regional governments invest heavily in SiC R&D and wafer processing infrastructure. It enables reclaim providers to adopt advanced cleaning, polishing, and inspection technologies at scale. The presence of local semiconductor giants ensures a consistent reclaim volume for high-temperature and high-frequency applications. Asia-Pacific also benefits from low operational costs and strong supply chain networks, making it the most competitive reclaim service hub globally.

Latin America

Latin America holds a 4.2% share of the Sic Wafer Reclaim Services market. The region sees emerging demand, mainly supported by Brazil and Mexico’s growing electronics manufacturing industries. Local reclaim services are limited, and most companies rely on imported solutions or external providers. However, expanding automotive assembly and clean energy initiatives boost interest in cost-efficient wafer reuse. Regional partnerships with North American or European reclaim vendors support technology transfer. It helps Latin American fabs manage production costs while complying with import restrictions and sustainability policies.

Middle East & Africa

The Middle East & Africa represents a 2.9% share of the global market. Adoption remains low, but key countries such as the UAE, Saudi Arabia, and South Africa show interest in power electronics linked to solar and smart grid projects. Limited local fabrication capacity slows direct reclaim service deployment. However, government strategies focused on semiconductor localization and technology diversification support future growth potential. Reclaim service firms may expand into this region through partnerships or logistics hubs to capture early demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- RS Technologies Co., Ltd.

- Phoenix Silicon International Corporation

- Semiconductor Industry Co.,Ltd.

- NOVA Electronic Materials, LLC

- Mimasu

- Pure Wafer

- TOPCO Scientific

- Scientech Corporation

- Kinik Company

Competitive Analysis

Key players in the Sic Wafer Reclaim Services market include RS Technologies Co., Ltd., Phoenix Silicon International Corporation, Semiconductor Industry Co., Ltd., NOVA Electronic Materials, LLC, Mimasu, Pure Wafer, TOPCO Scientific, Scientech Corporation, and Kinik Company.These companies compete by offering high-quality reclaim services with advanced cleaning, polishing, and inspection technologies. Many firms operate near major semiconductor hubs, reducing delivery time and improving customer support. Players focus on securing long-term partnerships with wafer fabs to ensure consistent service volumes. Some providers invest in fully automated reclaim lines to increase throughput and reduce defects. Innovation in handling larger wafer sizes and minimizing surface damage is a key differentiator. Regional expansion remains a core strategy to meet growing demand in Asia-Pacific and North America. Quality certifications, environmental compliance, and cost efficiency shape buyer decisions in this highly specialized segment. Vendors that align their services with power electronics and 5G manufacturing trends gain competitive edge. The market remains moderately fragmented, with global and regional players focusing on performance, reliability, and fast turnaround. Strategic alliances with original wafer suppliers and foundries further strengthen service offerings across application segments.

Recent Developments

- In 2025, Phoenix Silicon International’s board approved a substantial capital expenditure plan to accelerate capacity expansion (specific amount withheld).

- In 2024, RS Technologies announced a capital investment plan to increase production capacity at its Sanbongi Plant in Japan

- In 2024, Kinik highlighted its focus on strengthening its semiconductor polishing capabilities.

Report Coverage

The research report offers an in-depth analysis based on Diameter, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for SiC wafer reclaim services will grow with EV and power electronics expansion.

- Foundries will adopt advanced reclaim tools to reduce wafer costs and increase yields.

- Automation in reclaim processes will improve turnaround time and surface quality.

- Asia-Pacific will continue leading due to strong fabrication and device manufacturing base.

- North America and Europe will invest more in local reclaim capacity to reduce imports.

- Reclaim providers will offer customized services for high-frequency and high-temperature devices.

- Sustainability goals will push OEMs to integrate reclaim solutions into core operations.

- Equipment makers will develop reclaim systems for larger diameter SiC wafers.

- Partnerships between fabs and reclaim firms will secure long-term supply stability.

- Standardized reclaim quality benchmarks will boost customer confidence and service scalability.