Market Overview

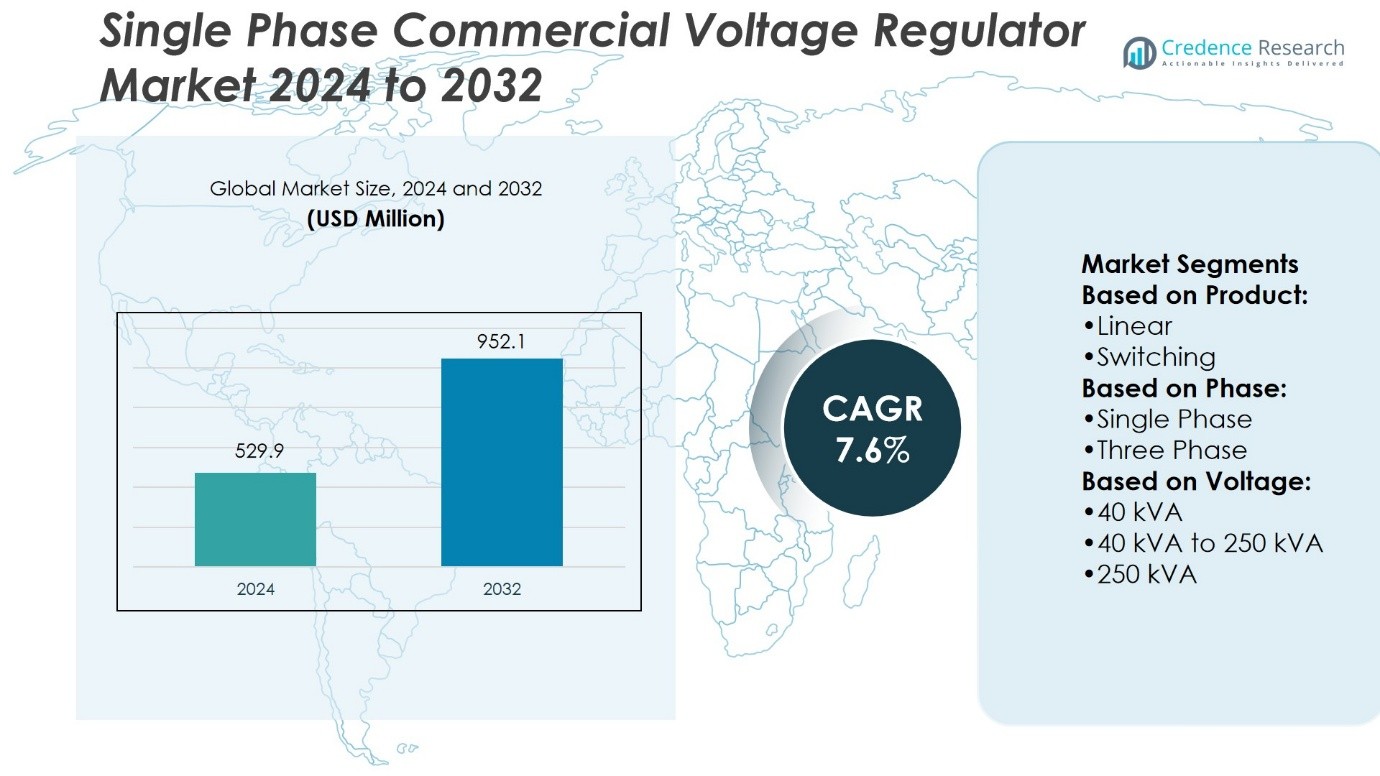

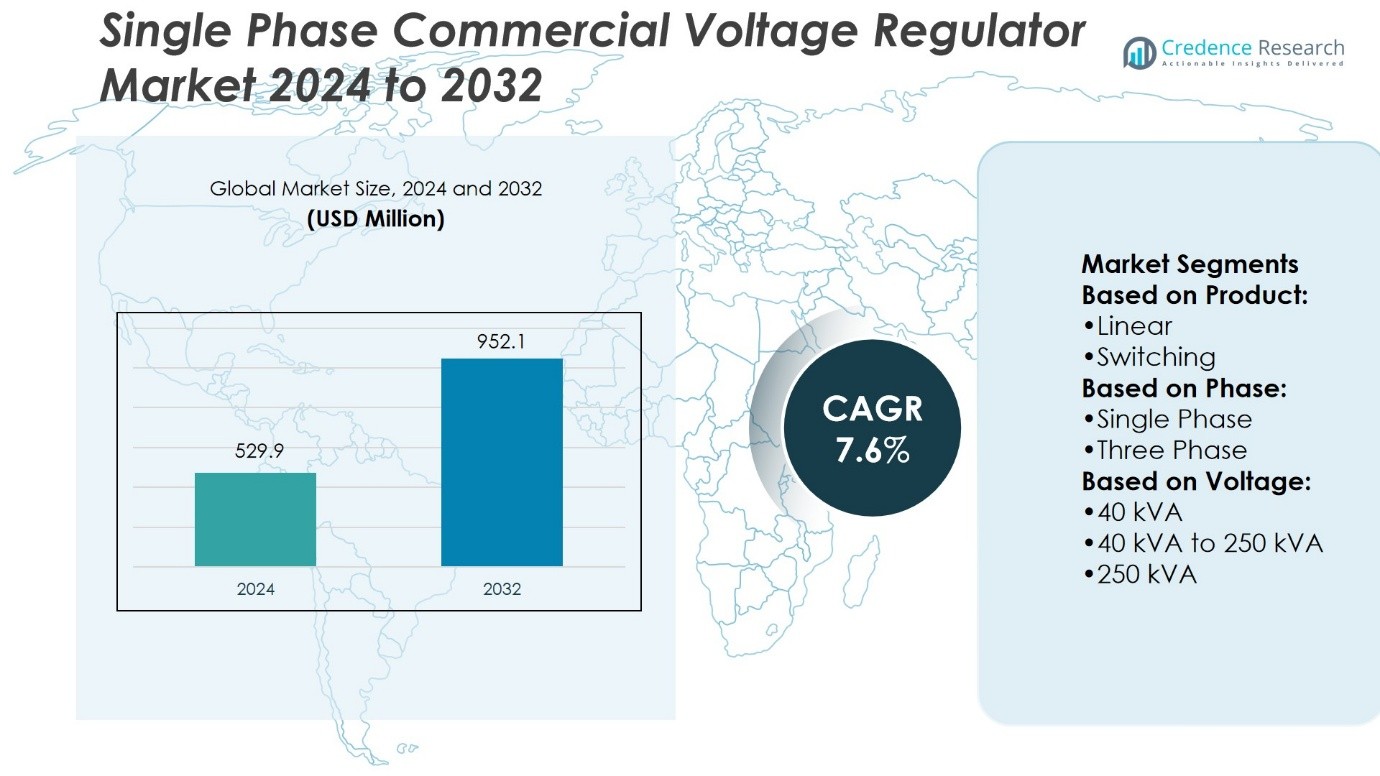

Single-Phase Commercial Voltage Regulator Market size was valued at USD 529.9 million in 2024 and is anticipated to reach USD 952.1 million by 2032, at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Single-Phase Commercial Voltage Regulator Market Size 2024 |

USD 529.9 Million |

| Single-Phase Commercial Voltage Regulator Market, CAGR |

7.6% |

| Single-Phase Commercial Voltage Regulator Market Size 2032 |

USD 952.1 Million |

The Single-Phase Commercial Voltage Regulator Market grows through strong drivers such as rising demand for stable power supply in commercial facilities, increasing reliance on sensitive electronic equipment, and the need to safeguard operations against voltage fluctuations. It gains further momentum from expanding infrastructure in emerging economies and the push for reliable energy solutions in urban areas. Key trends include adoption of smart and digitally controlled regulators, preference for compact and modular designs, and alignment with renewable and hybrid energy systems. It reflects a shift toward efficiency-focused, connected solutions that support long-term operational reliability in commercial environments.

The Single-Phase Commercial Voltage Regulator Market shows diverse geographical presence, with Asia Pacific leading due to rapid urbanization and growing commercial infrastructure, followed by North America and Europe driven by smart building adoption and efficiency regulations. Latin America and the Middle East & Africa present emerging opportunities supported by infrastructure investments and grid stability needs. Key players shaping competition include Eaton, General Electric, Infineon Technologies, Legrand, Microchip Technology, Analog Devices, Basler Electric, Purevolt, Hindustan Power Control System, and NXP Semiconductors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Single-Phase Commercial Voltage Regulator Market was valued at USD 529.9 million in 2024 and is projected to reach USD 952.1 million by 2032, at a CAGR of 7.6%.

- Rising demand for stable power supply in commercial facilities and reliance on sensitive equipment drive strong market growth.

- Adoption of smart and digitally controlled regulators, compact designs, and renewable integration defines major industry trends.

- Competition remains dynamic with global corporations and regional manufacturers focusing on innovation, cost efficiency, and digital integration.

- High sensitivity to power quality variations and pressure from alternative power conditioning solutions act as key restraints.

- Asia Pacific leads due to rapid urbanization and infrastructure expansion, while North America and Europe show steady adoption with efficiency regulations.

- Latin America and the Middle East & Africa offer emerging opportunities, with key players including Eaton, General Electric, Infineon Technologies, Legrand, Microchip Technology, Analog Devices, Basler Electric, Purevolt, Hindustan Power Control System, and NXP Semiconductors.

Market Drivers

Rising Demand for Stable Power Supply Across Commercial Facilities

The Single-Phase Commercial Voltage Regulator Market expands with the rising requirement for stable electricity in retail outlets, offices, and small industrial units. Frequent fluctuations in distribution networks create risks for sensitive equipment. Businesses seek devices that maintain constant output, protecting systems such as HVAC, lighting, and computing. It supports continuity of operations and reduces downtime in environments where reliability remains critical. Vendors emphasize dependable regulation solutions to meet the expectations of commercial users. The trend reinforces steady demand for Single-Phase units in diverse geographies.

- For instance, according to IEA, China is advancing the modernization and expansion of its power grids with an investment of 442 billion between 2021 and 2025. This initiative aims to enhance grid reliability, integrate renewable energy sources, and support growing electricity demand.

Integration of Advanced Control Features to Enhance Efficiency

Manufacturers innovate through digital monitoring, microprocessor-based controls, and user-friendly interfaces. These technologies provide precise voltage adjustments and improve energy use in commercial spaces. It enables facility managers to detect faults quickly and reduce operational losses. The Single-Phase Commercial Voltage Regulator Market reflects stronger interest in intelligent units that combine efficiency with cost control. Smart regulation also aligns with rising adoption of connected building infrastructure. Continuous development of compact and efficient systems positions the product as a preferred choice for long-term operation.

- For instance, the European Union finalized the alternative fuels infrastructure regulation (AFIR), requiring public fast chargers every 60 km along key transport corridors. Moreover, the UK maintains charging installation incentives and aims for 300,000 public chargers by 2030.

Expansion of Renewable Power Generation and Distributed Energy Systems

The growth of renewable sources such as solar panels creates irregular voltage patterns in commercial facilities. Voltage regulators ensure smooth integration of distributed power without damaging devices. It delivers consistent energy flow even when supply fluctuates sharply. Businesses adopting clean power depend on reliable Single-Phase regulators to stabilize generation at smaller scales. The market strengthens through demand from enterprises investing in renewable solutions. Manufacturers respond with designs compatible with hybrid and distributed grids.

Increasing Focus on Equipment Protection and Cost Optimization

Rising electricity disturbances result in costly failures of appliances and IT hardware. Voltage regulators extend the lifecycle of equipment, minimizing replacement expenses. It provides strong protection against surges, spikes, and dips that disrupt commercial operations. The Single-Phase Commercial Voltage Regulator Market benefits from the awareness of cost savings through preventative technology. Enterprises invest in reliable regulators to secure assets and reduce maintenance. This emphasis on safety and financial efficiency drives consistent adoption in the sector.

Market Trends

Growing Adoption of Smart and Digitally Controlled Regulators

The Single-Phase Commercial Voltage Regulator Market highlights a steady move toward smart models that integrate digital controllers and IoT features. Businesses adopt these systems for real-time voltage monitoring and fault diagnostics. It improves visibility across operations and reduces downtime. Digital regulators offer higher accuracy compared to traditional analog designs. Facility managers value predictive maintenance features that limit unexpected failures. The emphasis on connected and intelligent regulation systems defines a central trend in the market.

- For instance, the UAE announced plans to invest accounted 30 to 50 billion into constructing Europe’s biggest AI data center in France. This will be a key part of a larger AI partnership between the two countries. This center will act as the centerpiece of a new AI campus which will serve to intensify their collaboration in technology.

Rising Preference for Compact and Space-Efficient Designs

Commercial establishments increasingly prefer regulators that occupy less space without compromising performance. It allows easy integration in retail shops, office buildings, and service centers where available area remains limited. Manufacturers focus on lighter housings and modular layouts to meet this demand. Compact regulators maintain high efficiency while reducing installation complexity. Businesses benefit from simplified operations and lower infrastructure costs. The trend accelerates adoption in urban markets where space optimization is essential.

- For instance, the U.S. passed the Bipartisan Infrastructure Law, which put 1.2 trillion in federal spending for transportation, energy, and climate infrastructure projects primarily through state and local government.

Integration with Renewable and Hybrid Power Systems

The expansion of renewable energy sources influences the design of commercial voltage regulators. It ensures compatibility with distributed solar and hybrid backup systems. Businesses require equipment that stabilizes fluctuating input from renewable sources. Manufacturers develop models capable of handling variable supply without damaging sensitive electronics. The Single-Phase Commercial Voltage Regulator Market reflects this alignment with green power adoption. The trend underlines the importance of regulators in supporting clean energy transitions.

Emphasis on Energy Efficiency and Cost-Saving Features

Energy efficiency shapes purchasing decisions for commercial facilities investing in regulators. It drives demand for units designed to minimize energy losses while providing stable voltage. Advanced designs incorporate low-loss transformers and optimized circuits. Businesses adopt these regulators to reduce electricity expenses while protecting equipment. Vendors highlight lifetime cost benefits to strengthen competitiveness. The focus on efficiency remains a defining trend that guides innovation across the sector.

Market Challenges Analysis

High Sensitivity to Power Quality Variations and Maintenance Demands

The Single-Phase Commercial Voltage Regulator Market faces challenges due to variations in power quality that strain system performance. Voltage surges, harmonic distortions, and irregular grid conditions reduce regulator efficiency and lifespan. It creates pressure on businesses to invest in routine inspections and timely maintenance. Small commercial establishments often struggle with the costs of servicing and replacement parts. Manufacturers must address these issues through durable designs that can withstand harsh operating conditions. The challenge persists in regions where unstable grids are common and maintenance resources remain limited.

Rising Competition from Alternative Power Conditioning Solutions

The market also encounters pressure from alternative technologies such as uninterruptible power supplies and advanced solid-state stabilizers. It limits opportunities for conventional Single-Phase regulators in applications where integrated solutions provide both backup and regulation. Customers evaluate the long-term benefits of multifunctional systems, which may reduce reliance on standalone regulators. Vendors must differentiate their products with advanced features, energy efficiency, and lower lifecycle costs. The Single-Phase Commercial Voltage Regulator Market remains under competitive strain, requiring continuous innovation to retain its relevance. Cost pressures and changing customer expectations make this one of the most persistent challenges for industry players.

Market Opportunities

Expanding Demand from Emerging Economies and Commercial Infrastructure

The Single-Phase Commercial Voltage Regulator Market holds significant opportunity in emerging economies where commercial infrastructure is growing rapidly. Expanding retail outlets, healthcare centers, and small enterprises create consistent demand for reliable power regulation. It supports essential functions in environments where grid stability remains uncertain. Vendors can target these regions with cost-effective and durable solutions that address local power challenges. Urbanization and electrification programs further widen the adoption scope. Companies that align their offerings with regional infrastructure growth can capture strong opportunities for long-term expansion.

Increasing Alignment with Smart Building and Energy-Efficient Solutions

Integration of regulators into smart building ecosystems presents a growing opportunity for manufacturers. The Single-Phase Commercial Voltage Regulator Market benefits from the rising adoption of automation platforms that require energy-efficient, connected devices. It enables commercial facilities to improve operational efficiency while reducing long-term costs. Vendors that deliver intelligent regulators with IoT connectivity and real-time monitoring features stand to gain stronger market presence. The trend toward sustainable and efficient building systems creates new prospects for product innovation. Growing demand for smart, adaptive technologies positions Single-Phase regulators as essential tools in modern commercial environments.

Market Segmentation Analysis:

By Product

The Single-Phase Commercial Voltage Regulator Market divides into linear and switching products. Linear regulators remain popular for simple applications where low noise and steady output are essential. Their design supports reliable performance in small commercial systems requiring stable voltage without complex circuitry. Switching regulators gain strong traction due to their efficiency and adaptability across varied loads. It supports higher energy savings in environments with frequent fluctuations. Businesses adopt switching designs where efficiency, compact size, and advanced control are priorities.

- For instance, Canada directed over 40 million towards a CENGN initiative aimed at bolstering the telecommunications industry. The resources will be used for a living lab and AI network technology 5G applications development program.

By Phase

The market segmentation by phase covers Single-Phase and three phase regulators. Single-Phase regulators dominate smaller commercial establishments such as retail shops, clinics, and office buildings. These units remain critical in regions where distribution networks favor Single-Phase supply for light commercial operations. The Single-Phase Commercial Voltage Regulator Market shows consistent demand across this segment due to reliability and cost-effectiveness. Three phase regulators serve larger commercial complexes, manufacturing units, and data centers requiring higher load capacity. It provides strong voltage stability where industrial-scale operations depend on continuous power.

- For instance, during the first half of 2024, the U.S. added an estimated 14.1 GWh of energy storage capacity to the electric grid. This increase is in response to the growing need for more sophisticated storage systems to improve grid reliability, manage peak demand, and accelerate progress towards a decarbonized electricity supply.

By Voltage

The market further divides into 40 kVA, 40 kVA to 250 kVA, and 250 kVA capacity categories. Regulators rated 40 kVA support smaller facilities and localized operations such as small retail outlets and clinics. It ensures protection of essential equipment without high installation costs. The 40 kVA to 250 kVA segment addresses mid-sized commercial users including hotels, schools, and mid-level enterprises that demand moderate voltage stabilization. Units above 250 kVA meet the requirements of larger infrastructures such as hospitals, large office buildings, and industrial warehouses. Vendors design these systems to handle heavy loads and maintain uninterrupted service under demanding conditions.

Segments:

Based on Product:

Based on Phase:

Based on Voltage:

- 40 kVA

- 40 kVA to 250 kVA

- 250 kVA

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounts for nearly 28% share of the Single-Phase Commercial Voltage Regulator Market, driven by advanced commercial infrastructure and high demand for reliable power quality. The region benefits from a strong presence of technology providers and rapid adoption of smart building solutions. It demonstrates consistent demand from office complexes, healthcare facilities, and retail spaces that require stable voltage to protect sensitive electronics. It also reflects growth from renewable energy integration, where regulators ensure smooth connection of solar and distributed power into commercial grids. The presence of established players supports innovation in digital control and IoT-enabled regulators, positioning the region as a mature and reliable market.

Europe

Europe holds about 24% share of the Single-Phase Commercial Voltage Regulator Market, with demand shaped by stringent energy efficiency standards and modernization of commercial facilities. The region emphasizes regulatory compliance, particularly in countries with advanced building codes and sustainability targets. It relies heavily on regulators for commercial operations where stable voltage is required to align with strict operational safety norms. Vendors in Europe focus on compact, efficient designs that meet eco-friendly directives. It also benefits from infrastructure investments in Western and Central Europe, which drive steady adoption of both linear and switching regulators. The focus on environmental performance creates continuous opportunities for product upgrades across commercial applications.

Asia Pacific

Asia Pacific dominates with an estimated 32% share of the Single-Phase Commercial Voltage Regulator Market, supported by rapid urbanization and growing commercial infrastructure. Expanding retail outlets, educational institutions, and service-based industries drive extensive adoption across the region. It reflects strong demand from countries such as China, India, and Southeast Asia, where voltage instability is a persistent issue. The region benefits from rising investments in smart cities and renewable power projects, both of which require advanced regulators to maintain stable electricity for commercial users. Vendors see Asia Pacific as a key growth hub, with both global and regional manufacturers expanding production and distribution networks. The scale of construction and electrification programs ensures that the region remains the largest contributor to global market revenues.

Latin America

Latin America represents nearly 9% share of the Single-Phase Commercial Voltage Regulator Market, with demand supported by improving power distribution systems and expanding commercial activity. Countries such as Brazil, Mexico, and Chile show increasing adoption of regulators to address frequent power fluctuations in urban and semi-urban areas. It demonstrates rising demand from mid-sized enterprises, retail businesses, and healthcare facilities that require reliable power regulation. Market growth in this region benefits from government-backed electrification projects and private investments in commercial infrastructure. Vendors target Latin America with cost-effective regulator models that provide resilience against grid instability. This positions the region as an emerging market with steady long-term potential.

Middle East and Africa

The Middle East and Africa collectively contribute about 7% share of the Single-Phase Commercial Voltage Regulator Market, reflecting early-stage adoption in commercial sectors. Growing infrastructure development in the Gulf states, South Africa, and North Africa supports gradual uptake. It highlights strong demand from commercial facilities such as hotels, malls, and healthcare centers where stable power remains a necessity. Frequent voltage fluctuations in developing grids create opportunities for regulator deployment. Vendors view the region as a potential growth frontier, with rising investments in construction and commercial infrastructure providing momentum. It remains a market with untapped opportunities where strategic partnerships and localized manufacturing could expand presence significantly.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Legrand

- Infineon Technologies AG

- Purevolt

- Basler Electric Company

- NXP Semiconductors

- Hindustan Power Control System

- General Electric

- Microchip Technology Inc

- Analog Devices, Inc.

- Eaton

Competitive Analysis

The Single-Phase Commercial Voltage Regulator Market features include Legrand, Infineon Technologies AG, Purevolt, Basler Electric Company, NXP Semiconductors, Hindustan Power Control System, General Electric, Microchip Technology Inc, Analog Devices, Inc., and Eaton. The Single-Phase Commercial Voltage Regulator Market demonstrates strong competition driven by a combination of global corporations and regional manufacturers. The competitive environment is shaped by innovation in product design, expansion of distribution networks, and the push toward energy-efficient solutions. Larger multinational companies emphasize advanced regulator technologies that integrate digital monitoring, IoT compatibility, and enhanced safety features to meet modern commercial requirements. Semiconductor-focused firms concentrate on improving durability, reducing energy losses, and delivering compact solutions suitable for small and medium commercial facilities. Regional manufacturers strengthen the market by providing cost-effective and localized solutions that cater to unique voltage stability challenges in developing economies. Competition also extends into specialized applications, including renewable power integration and smart building infrastructure, where demand for intelligent regulators continues to rise.

Recent Developments

- In May 2024, Eaton opened a new manufacturing facility in Santiago de los Caballeros to boost its supply chain for renewable energy, energy storage systems, data centers, and EV infrastructure. The company further intends to increase the production of voltage regulators, transformers, and EV charging solutions to its head, and strengthen its leadership in the market.

- In April 2024, Infineon revealed an expansion of its automotive lineup with the launch of the PSoC 4 HVMS series, tailored to address the rising need for security and functional safety in entry-level microcontroller applications. This new series features high voltage capabilities, including a LIN/CXPI transceiver and a 12 V regulator, alongside advanced analog functions such as inductive sensing and CAPSENSE technology.

- In December 2023, Infineon released synchronous buck regulators with 20 A and 12 A ratings for DC-DC point-of-load applications. The regulators integrate a rapid constant on-time control scheme that improves performance by passively reducing the number of required components and optimizing board space.

- In March 2023, MaxLinear introduced a new switching regulator product, MXL76125, which has a 2-Bit Voltage Identification Pin (VID) allowing dynamic system power supply management on Wi-Fi 7 SoC devices.

Market Concentration & Characteristics

The Single-Phase Commercial Voltage Regulator Market reflects a moderately concentrated structure with a mix of multinational corporations and regional manufacturers. It features companies that compete on technology advancement, cost efficiency, and service reliability. Large global players dominate through broad product portfolios, digital integration, and established distribution networks, while smaller regional firms strengthen presence by offering localized, cost-effective solutions. It shows characteristics of steady demand driven by the need for stable power across commercial facilities, supported by growth in smart infrastructure and renewable integration. The market emphasizes durability, compact design, and energy efficiency, which define the core product attributes influencing customer decisions. Competition remains dynamic, with continuous innovation shaping performance standards and reinforcing the role of regulators as essential components in protecting commercial equipment and ensuring operational continuity.

Report Coverage

The research report offers an in-depth analysis based on Product, Phase, Voltage and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with the expansion of commercial infrastructure in emerging economies.

- Energy efficiency will remain a critical factor driving product innovation.

- Smart and IoT-enabled regulators will gain higher adoption in connected building systems.

- Compact and modular designs will strengthen appeal in space-constrained facilities.

- Integration with renewable and hybrid power systems will expand application scope.

- Digital monitoring and predictive maintenance features will become standard offerings.

- Regional manufacturers will continue to gain share by supplying cost-effective localized solutions.

- Competition will intensify with new entrants focusing on specialized commercial applications.

- Regulations on power quality and efficiency will accelerate product upgrades.

- Continuous investment in research and development will define the long-term competitiveness of leading players.