Market Overview

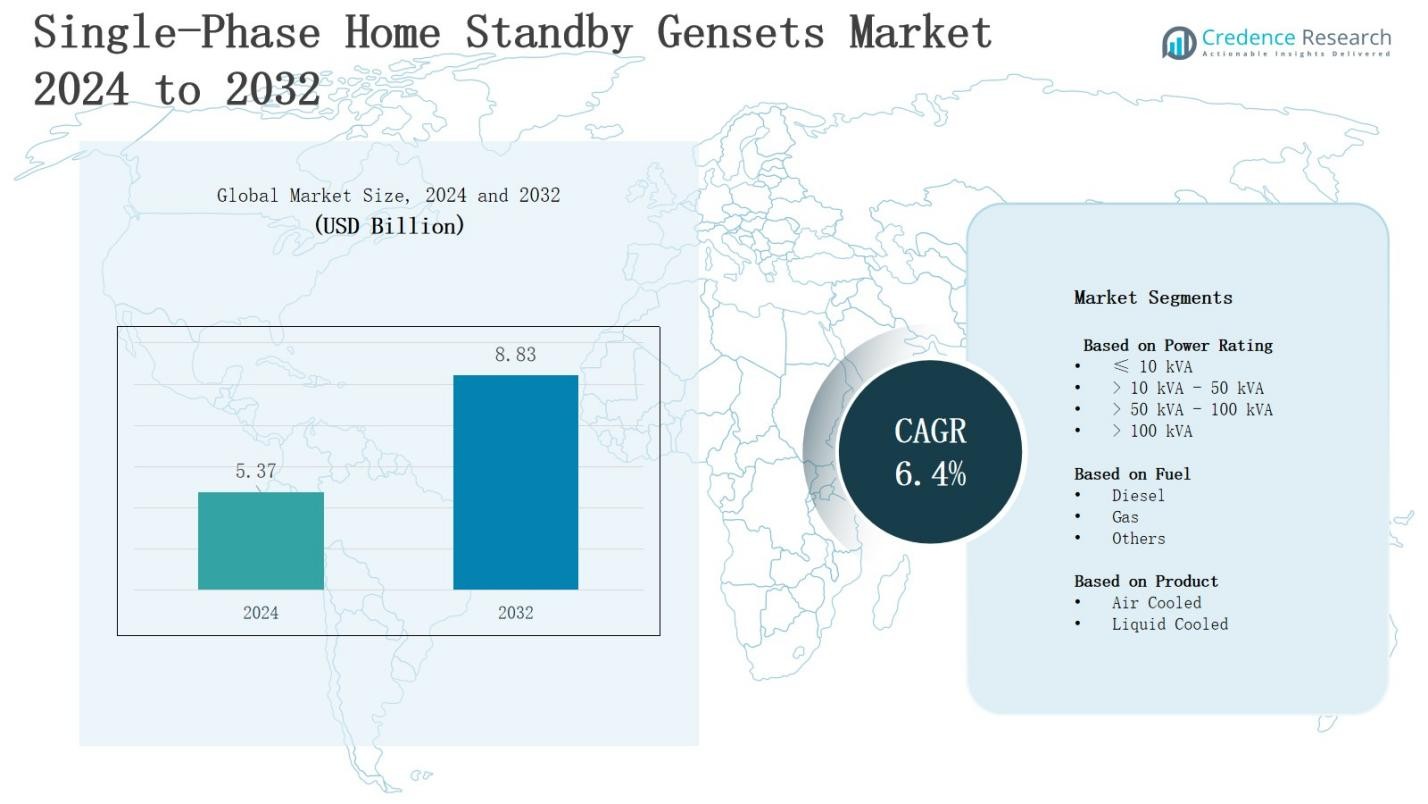

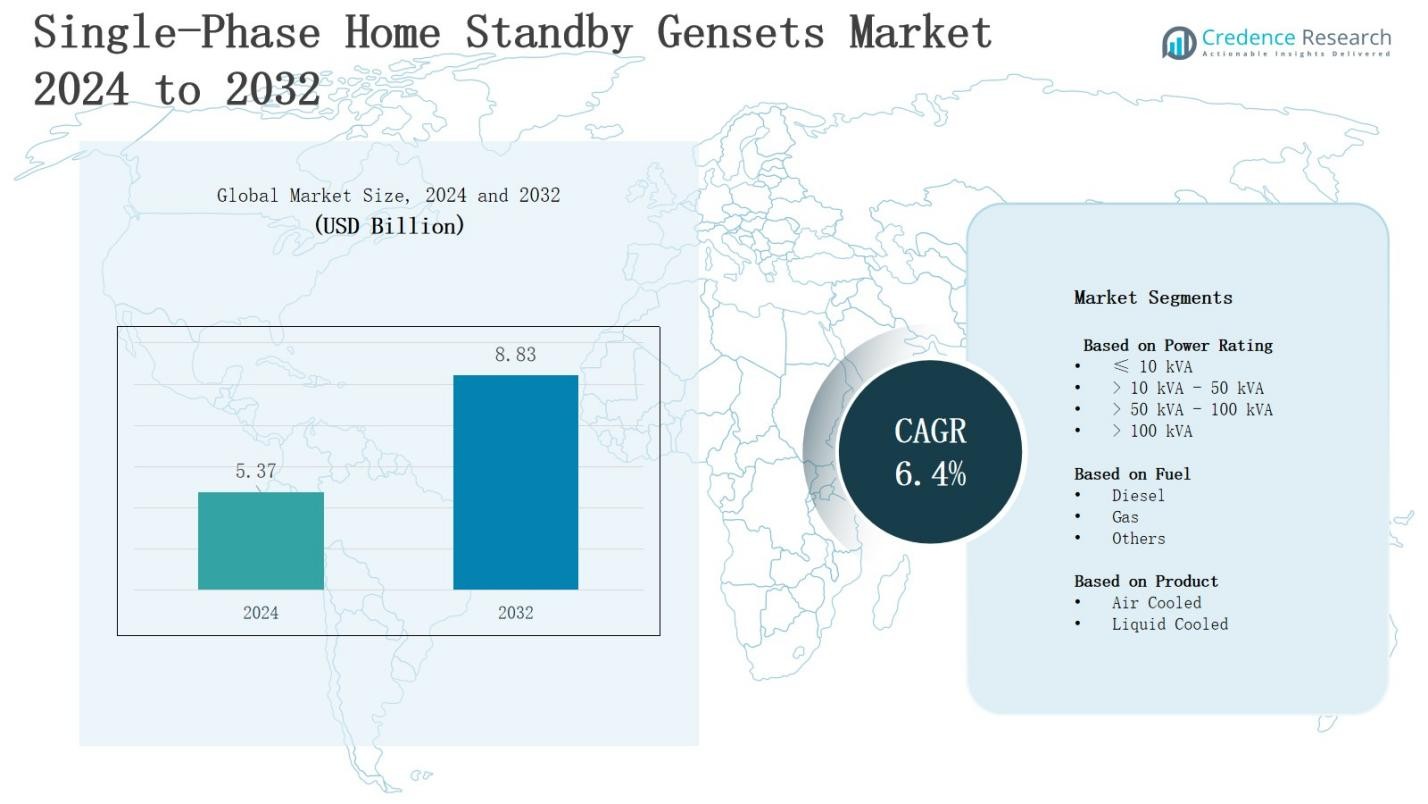

In the single-phase home standby gensets market, revenue is projected to grow from USD 5.37 billion in 2024 to USD 8.83 billion by 2032, registering a CAGR of 6.4%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Single-Phase Home Standby Gensets Market Size 2024 |

USD 5.37 Billion |

| Single-Phase Home Standby Gensets Market, CAGR |

6.4% |

| Single-Phase Home Standby Gensets Market Size 2032 |

USD 8.83 Billion |

The single-phase home standby gensets market is driven by increasing residential electricity demand, frequent power outages, and rising awareness of uninterrupted power solutions. Rapid urbanization and growing adoption of smart homes further fuel market expansion. Technological advancements, including quieter operation, fuel efficiency, and remote monitoring capabilities, enhance consumer appeal. Government incentives for backup power systems and infrastructure development in emerging regions also support growth. Additionally, the rising need for energy security and emergency preparedness during natural disasters boosts market adoption. Key trends include integration with renewable energy sources, IoT-enabled monitoring, and development of eco-friendly, low-emission gensets.

The single-phase home standby gensets market shows significant presence across North America, Europe, Asia Pacific, and the Rest of the World, driven by rising residential electricity demand and power reliability concerns. North America leads with high adoption of smart and eco-friendly gensets, while Europe emphasizes low-emission, regulation-compliant solutions. Asia Pacific offers growth potential in emerging residential markets, and the Rest of the World focuses on durable, fuel-efficient systems. Key players driving the market include Cummins, Caterpillar, Generac Power Systems, Kohler Co., Ashok Leyland, Kirloskar, Mahindra POWEROL, HIPOWER, Eaton, HIMOINSA, Champion Power Equipment, and Gillette Generators.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The single-phase home standby gensets market is projected to grow from USD 5.37 billion in 2024 to USD 8.83 billion by 2032, registering a CAGR of 6.4%, driven by rising residential electricity demand and frequent outages.

- The ≤10 kVA segment dominates with 45% share, preferred for small homes and compact urban residences, while >10 kVA–50 kVA holds 30%, and higher ratings serve multi-unit or high-demand households.

- Diesel gensets lead with 55% share due to availability and efficiency, gas-powered units hold 30% for cleaner urban usage, and other fuels, including hybrid and biofuel, account for 15% driven by sustainability initiatives.

- Air-cooled gensets hold 60% share for compact design, lower cost, and easy maintenance, while liquid-cooled units represent 40%, offering higher power, durability, and quieter operation for large homes or multi-unit buildings.

- Regionally, North America leads with 35% share, Europe 25%, Asia Pacific 30%, and the Rest of the World 10%, driven by urbanization, power reliability needs, smart home adoption, and demand for energy-efficient and eco-friendly solutions.

Market Drivers

Rising Residential Power Demand and Frequent Outages

The single-phase home standby gensets market experiences strong growth due to rising residential electricity demand and frequent power disruptions. Homeowners increasingly seek reliable backup power to maintain daily activities during outages. Urban expansion and population growth drive higher energy consumption, creating a need for dependable power solutions. It ensures uninterrupted operation of essential appliances, enhancing convenience and safety. Increasing construction of residential complexes and modern homes further boosts genset adoption in urban and semi-urban regions.

- For instance, in the United States, states like Florida, Texas, and California are seeing increased installations of home standby generators due to frequent hurricanes, heat waves, and wildfires causing power disruptions.

Technological Advancements and Efficiency Improvements

Technological innovations in the single-phase home standby gensets market enhance performance, reliability, and fuel efficiency. Manufacturers develop quieter, compact, and energy-efficient models to meet consumer expectations. Remote monitoring and automatic start-stop features provide ease of use and ensure consistent operation during power failures. It also supports integration with smart home systems, improving overall user experience. Continuous improvements in emissions control and low-noise operation make gensets more appealing to environmentally conscious consumers.

- For instance, Generac introduced its Guardian Series with Wi-Fi-enabled remote monitoring, allowing homeowners to track performance and receive maintenance alerts directly from their smartphones.

Government Policies and Incentives

Supportive government policies and incentives for backup power solutions stimulate market growth. Subsidies, tax benefits, and regulations promoting energy security encourage homeowners to invest in single-phase home standby gensets. It provides a stable revenue stream for manufacturers and expands market penetration in emerging regions. Public awareness campaigns and infrastructure development programs also drive adoption. Governments recognize the importance of uninterrupted power in residential areas, boosting investments and encouraging innovative solutions.

Energy Security and Emergency Preparedness

Concerns over energy security and disaster preparedness increase demand for reliable backup power systems. Single-phase home standby gensets ensure homes remain operational during natural calamities, grid failures, or unforeseen power interruptions. It supports critical appliances and maintains comfort and safety for households. Rising consumer awareness about emergency preparedness and personal safety motivates investments in reliable power solutions. Manufacturers focus on durability, ease of maintenance, and rapid deployment to meet growing residential needs.

Market Trends

Integration with Renewable Energy Sources

The single-phase home standby gensets market shows a growing trend toward integration with renewable energy systems, such as solar panels and wind turbines. It enables homeowners to maintain uninterrupted power while reducing dependency on conventional fuel. Manufacturers develop hybrid solutions that automatically switch between grid, renewable, and genset power. It improves energy efficiency and lowers operating costs. Consumers increasingly prioritize sustainable energy solutions that provide reliability without compromising environmental responsibility. This trend drives innovation in hybrid backup systems.

- For instance, Enphase Energy has developed an energy system where their IQ System Controller integrates with third-party standby generators and solar PV plus battery storage, enabling automatic generator start during grid outages and seamless power transition, enhancing resilience and efficiency for homeowners.

Adoption of Smart and IoT-Enabled Features

Smart and IoT-enabled gensets gain traction in the single-phase home standby gensets market due to increasing demand for connected home solutions. It allows remote monitoring, predictive maintenance, and automatic control through smartphones or home networks. Advanced sensors enhance operational safety and optimize fuel usage. Manufacturers focus on digital interfaces and cloud-based platforms to improve user experience. These features provide convenience, reduce downtime, and attract tech-savvy homeowners seeking modern power solutions for their residences.

- For instance, Taoglas offers an IoT-enabled Genset Insights platform that enables real-time monitoring and predictive maintenance, helping to optimize operational efficiencies and extend equipment life through cloud-based analytics.

Development of Low-Emission and Eco-Friendly Models

Environmental considerations shape the single-phase home standby gensets market, driving the development of low-emission, fuel-efficient models. It minimizes noise pollution and harmful exhaust emissions, meeting strict regulatory standards. Consumers increasingly prefer eco-friendly gensets that align with sustainable living practices. Manufacturers adopt advanced combustion technologies and alternative fuels to reduce carbon footprints. It enhances brand reputation and market acceptance. This trend ensures long-term compliance with evolving environmental regulations and consumer expectations.

Compact, Durable, and User-Friendly Designs

Design innovation dominates trends in the single-phase home standby gensets market, emphasizing compact, durable, and user-friendly models. It allows seamless installation in residential spaces without compromising performance. Manufacturers focus on lightweight materials, modular components, and easy maintenance access. It ensures reliability and convenience for homeowners. Noise reduction, automatic startup, and intuitive interfaces further enhance usability. These design improvements cater to urban households with limited space and rising demand for efficient, hassle-free backup power solutions.

Market Challenges Analysis

High Initial Investment and Maintenance Costs

The single-phase home standby gensets market faces challenges due to high initial investment and ongoing maintenance costs. It limits adoption among price-sensitive residential consumers. Installation expenses, including wiring, fuel storage, and safety measures, further increase the total cost of ownership. Regular servicing and parts replacement add to operational expenses. Homeowners often hesitate to invest without clear long-term savings or incentives. Manufacturers must focus on cost-effective solutions and extended warranties to overcome these financial barriers and encourage wider adoption.

Fuel Dependence and Regulatory Constraints

Fuel dependence and stringent regulatory requirements present challenges in the single-phase home standby gensets market. It relies primarily on diesel or natural gas, exposing users to price volatility and supply disruptions. Strict emission standards and local noise regulations increase compliance costs for manufacturers and consumers. Limited awareness of alternative fuel options reduces market flexibility. Companies must innovate cleaner, fuel-efficient solutions and navigate complex regulatory landscapes to maintain competitiveness. These factors collectively slow adoption and impact overall market growth.

Market Opportunities

Expansion in Emerging Residential Markets

The single-phase home standby gensets market presents significant opportunities in emerging residential markets with growing electricity demand and frequent power outages. It offers reliable backup solutions for new housing developments and urban expansion projects. Rising disposable incomes in these regions increase consumer willingness to invest in uninterrupted power systems. Manufacturers can capitalize on untapped markets by offering cost-effective, durable, and easy-to-install gensets. Strategic partnerships with local distributors and builders can further enhance market penetration and brand recognition.

Adoption of Smart and Sustainable Solutions

Growing interest in smart homes and eco-friendly technologies creates opportunities in the single-phase home standby gensets market. It supports integration with IoT-enabled systems, allowing remote monitoring and automated control. Consumers increasingly prefer low-emission, fuel-efficient models that align with sustainable living practices. Manufacturers can introduce hybrid gensets combining renewable energy sources and conventional power for enhanced efficiency. Innovations in compact design and noise reduction further attract urban homeowners. This trend opens avenues for product differentiation and long-term growth.

Market Segmentation Analysis:

By Power Rating

In the single-phase home standby gensets market, the ≤10 kVA segment dominates with a share of approximately 45%, driven by increasing adoption in small residential homes and compact urban residences. The >10 kVA – 50 kVA segment holds around 30%, catering to larger households and small commercial establishments. The >50 kVA – 100 kVA segment accounts for 15%, while the >100 kVA segment represents 10%, primarily used in high-demand or multi-unit residential complexes. Demand is fueled by reliability, ease of installation, and suitability for different household energy needs.

- For instance, Generac’s Guardian Series 7.5 kW home standby generator is widely adopted by homeowners in suburban U.S. residences, offering automatic transfer and Wi-Fi monitoring for households under 2,500 sq. ft.

By Fuel

Diesel-fueled gensets lead the single-phase home standby gensets market with a share of nearly 55%, due to fuel availability, higher efficiency, and robust performance in long-duration power outages. Gas-powered gensets account for 30%, preferred for cleaner emissions and urban residential use. Other fuels, including hybrid and biofuel options, hold a 15% share, driven by sustainability trends and regulatory encouragement for eco-friendly alternatives. It benefits from government incentives promoting low-emission solutions in residential areas.

By Product

Air-cooled gensets hold the largest share of approximately 60% in the single-phase home standby gensets market, favored for compact design, lower cost, and easy maintenance in residential applications. Liquid-cooled gensets account for 40%, suitable for higher power ratings and longer continuous operation in large homes or multi-unit buildings. It offers superior cooling efficiency, durability, and quieter operation. Demand growth in this segment is supported by rising preference for high-performance and reliable backup power solutions.

- For instance, Kohler’s 20RESCL liquid-cooled generator is designed for extended power supply in larger residences, offering improved durability and quieter performance.

Segments:

Based on Power Rating

- ≤ 10 kVA

- > 10 kVA – 50 kVA

- > 50 kVA – 100 kVA

- > 100 kVA

Based on Fuel

Based on Product

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a 35% share in the single-phase home standby gensets market, driven by high residential electricity consumption and frequent power outages in certain areas. It benefits from advanced infrastructure, strong purchasing power, and awareness of uninterrupted power solutions. Homeowners increasingly invest in backup systems for safety and convenience. Technological innovations, including smart and IoT-enabled gensets, further fuel adoption. The region sees steady growth in both urban and suburban households. Manufacturers focus on energy-efficient and low-noise models to meet consumer preferences. Rising interest in eco-friendly solutions also encourages market expansion.

Europe

Europe commands a 25% share of the single-phase home standby gensets market, supported by strict regulatory standards and growing demand for low-emission, reliable power solutions. It experiences frequent power interruptions in specific regions, motivating homeowners to install backup systems. Government incentives and sustainable energy initiatives boost adoption of hybrid and gas-powered gensets. Manufacturers emphasize compact, durable, and high-performance models for residential use. Rising integration with smart home technologies enhances usability. Consumers increasingly prioritize safety, efficiency, and regulatory compliance in purchasing decisions.

Asia Pacific

Asia Pacific accounts for a 30% share in the single-phase home standby gensets market, fueled by rapid urbanization, residential construction growth, and rising disposable income. It experiences frequent electricity interruptions in emerging markets, creating high demand for home backup solutions. Manufacturers focus on cost-effective and easy-to-install models suitable for small and medium-sized households. The region shows significant potential for diesel and hybrid gensets due to energy security concerns. Increasing awareness of smart and sustainable energy solutions supports market growth. It attracts both global and local players seeking residential market penetration.

Rest of the World

The Rest of the World holds a 10% share in the single-phase home standby gensets market, driven by increasing electricity demand and intermittent power supply in select regions. It includes Latin America, the Middle East, and Africa, where residential users seek reliable backup systems. Manufacturers provide durable, fuel-efficient, and compact gensets to meet local energy needs. Rising adoption of low-emission and eco-friendly technologies encourages sustainable residential solutions. Consumers increasingly invest in emergency preparedness and continuous power supply. It offers opportunities for expansion through partnerships and localized distribution strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- HIPOWER

- Cummins

- Mahindra POWEROL

- Kohler Co.

- Caterpillar

- Ashok Leyland

- Gillette Generators

- Eaton

- HIMOINSA

- Champion Power Equipment

- Generac Power Systems

- Kirloskar

Competitive Analysis

The single-phase home standby gensets market remains highly competitive, driven by innovation, product reliability, and strategic market presence. Key players including Cummins, Caterpillar, Generac Power Systems, Kohler Co., Ashok Leyland, Kirloskar, Mahindra POWEROL, HIPOWER, Eaton, HIMOINSA, Champion Power Equipment, and Gillette Generators focus on expanding their residential offerings and enhancing performance features. It experiences strong competition in efficiency, noise reduction, fuel type options, and smart home integration. Manufacturers invest in R&D to develop compact, durable, and eco-friendly gensets that meet regulatory standards and consumer expectations. It also benefits from partnerships, regional expansions, and targeted distribution strategies to increase market penetration. Differentiation through customer service, warranty programs, and maintenance support strengthens brand loyalty. Companies emphasize hybrid and IoT-enabled models to capture tech-savvy homeowners seeking reliable backup solutions. It encourages continuous innovation, creating opportunities for both established and emerging players to maintain a competitive edge in residential power backup solutions globally.

Recent Developments

- In January 2025, Generac launched its 28kW air-cooled home standby generator, featuring a 997cc engine, making it the most powerful air-cooled model in its class, with availability expected in the second half of 2025.

- In 2025, Cummins introduced the QuietConnect™ series, including the 25kW RS25, designed for single-phase residential applications with quieter operation and noise levels as low as 65dB.

- In October 2023, Briggs & Stratton launched the PowerProtect™ home standby generator line, ranging from 13kW to 26kW, equipped with NGMax™ technology for maximum natural gas power and extended warranty coverage.

Market Concentration & Characteristics

The single-phase home standby gensets market exhibits a moderately concentrated structure, with a mix of established global players and regional manufacturers competing for market share. It is dominated by key companies including Cummins, Caterpillar, Generac Power Systems, Kohler Co., Ashok Leyland, Kirloskar, Mahindra POWEROL, HIPOWER, Eaton, HIMOINSA, Champion Power Equipment, and Gillette Generators. It demonstrates high competition in product performance, fuel efficiency, noise reduction, and technological integration, including IoT-enabled and hybrid solutions. Market characteristics include strong demand in residential sectors, preference for low-maintenance and compact designs, and increasing adoption of eco-friendly and low-emission gensets. It relies on strategic partnerships, distribution networks, and after-sales service to strengthen brand loyalty. Continuous innovation, regulatory compliance, and adaptation to regional energy needs define competitive dynamics. Manufacturers focus on product differentiation and reliability to maintain a competitive edge in both mature and emerging markets.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Fuel, Product and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The single-phase home standby gensets market will see rising adoption in urban and suburban residential areas.

- Homeowners will increasingly prefer low-noise, compact, durable gensets for convenient and reliable backup power.

- Integration with smart home systems and IoT-enabled features will enhance monitoring and operational efficiency.

- Diesel and hybrid gensets will maintain dominance due to long-lasting performance and superior fuel efficiency.

- Eco-friendly, low-emission gensets will gain preference in environmentally conscious and regulation-driven residential markets.

- Emerging Asia Pacific and Rest of the World regions will present substantial growth opportunities for manufacturers.

- Companies will focus on remote monitoring, automated control, and predictive maintenance to improve user convenience.

- Rising concerns over energy security and emergency preparedness will increase residential genset investments globally.

- Continuous innovation will enhance fuel efficiency, reliability, durability, and ease of maintenance for end users.

- Strategic partnerships and localized distribution networks will strengthen market reach and long-term brand loyalty worldwide.