Market Overview

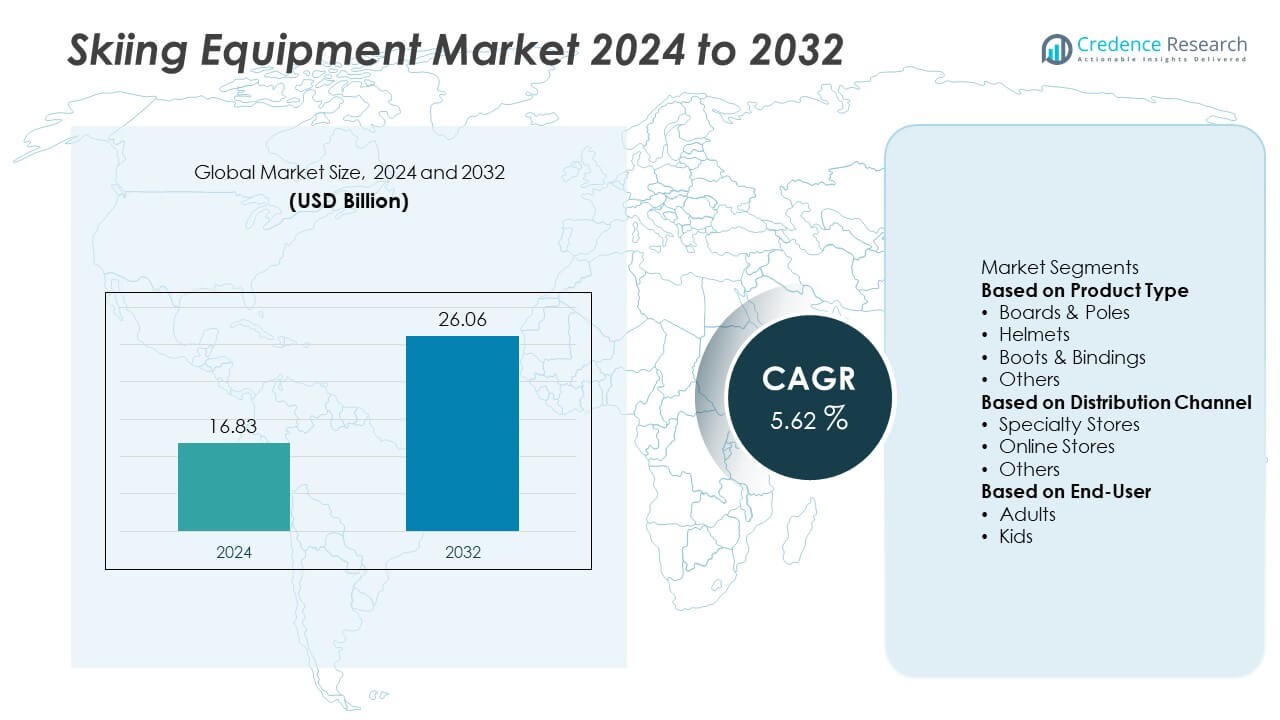

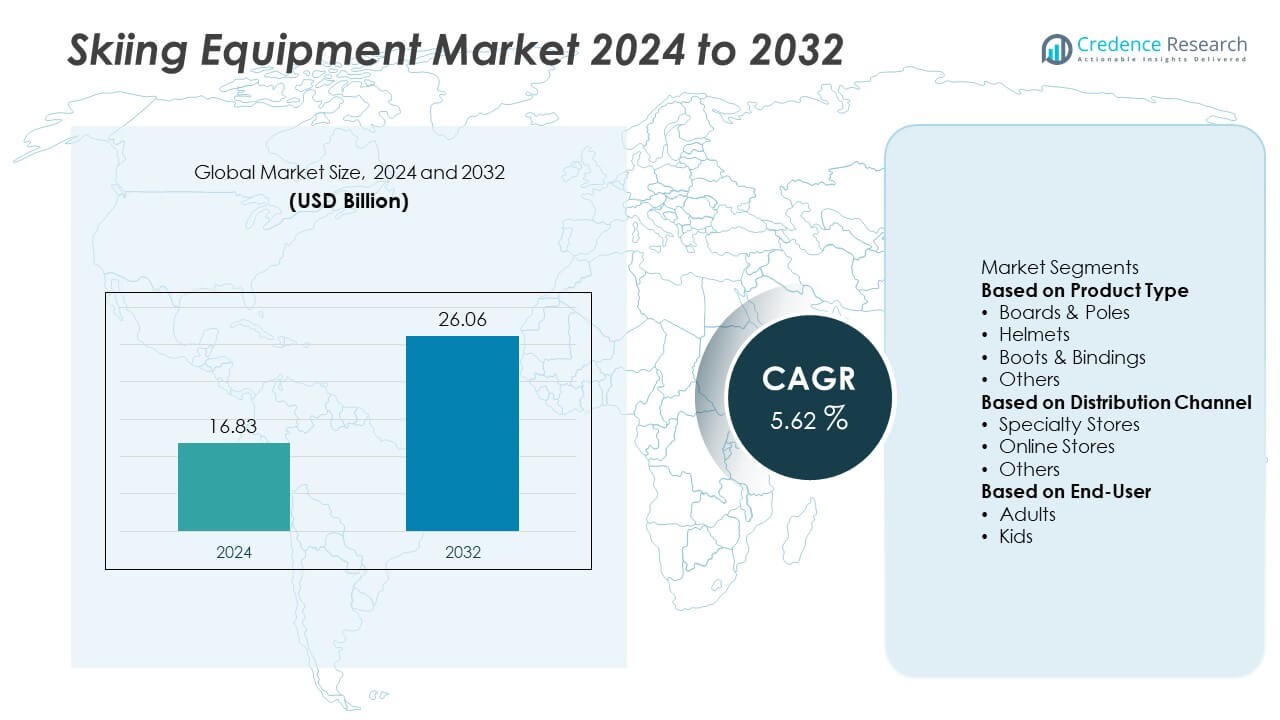

The Skiing Equipment market was valued at USD 16.83 billion in 2024 and is projected to reach USD 26.06 billion by 2032, growing at a CAGR of 5.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Skiing Equipment Market Size 2024 |

USD 16.83 Billion |

| Skiing Equipment Market, CAGR |

5.62% |

| Skiing Equipment Market Size 2032 |

USD 26.06 Billion |

The Skiing Equipment market is dominated by leading players such as Amer Sports Corporation, Rossignol Group, K2 Sports LLC, Fischer Sports GmbH, HEAD NV, Burton Snowboards, Elan Sports, Volkl Skis, Blizzard-Tecnica Group, and Scott Sports SA. These companies maintain strong market positions through continuous innovation in product design, lightweight materials, and safety enhancements. Strategic sponsorships with professional athletes and ski resorts further strengthen their brand visibility. North America leads the global market with a 37.4% share, driven by high participation in winter sports and strong tourism infrastructure, followed by Europe with a 33.8% share supported by established ski destinations and advanced equipment manufacturing hubs.

Market Insights

- The Skiing Equipment market was valued at USD 16.83 billion in 2024 and is projected to reach USD 26.06 billion by 2032, expanding at a CAGR of 5.62% during the forecast period.

- Growing participation in winter sports, adventure tourism, and recreational skiing is driving strong market demand globally.

- Lightweight and durable materials, along with eco-friendly and smart gear designs, are shaping key market trends across product segments.

- The market is competitive, with key players such as Amer Sports, Rossignol, and HEAD focusing on innovation, athlete partnerships, and e-commerce expansion to strengthen market presence.

- North America holds a 37.4% market share, followed by Europe with 33.8% and Asia-Pacific with 21.6%, while the boards and poles segment dominates with a 42.1% share due to high demand for advanced skiing performance and product versatility.

Market Segmentation Analysis:

By Product Type

The boots & bindings segment dominated the Skiing Equipment market in 2024, accounting for a 38.7% share. This dominance is driven by rising demand for advanced, comfortable, and performance-enhancing ski gear among both recreational and professional skiers. Manufacturers are focusing on lightweight designs, improved grip, and temperature-resistant materials to enhance durability and performance on varying terrains. Technological innovations such as adjustable flex and custom-fit liners are boosting consumer adoption. Increasing participation in alpine skiing and expanding winter tourism are further supporting segment growth globally.

• For instance, Rossignol Group introduced its Hi-Speed 120 HV GW boots featuring Dual Core Shell technology with a flex index of 120 and weight of 1.99 kg (per half pair), providing precise energy transmission and customizable stiffness for expert alpine skiers.

By Distribution Channel

The specialty stores segment held the largest 46.2% share of the Skiing Equipment market in 2024. Specialty stores remain the preferred distribution channel due to expert guidance, personalized fitting, and the availability of premium brands. Consumers seeking quality assurance and professional advice continue to rely on physical retail outlets. These stores also offer equipment rental and maintenance services, enhancing their market relevance. However, online sales are expanding rapidly due to convenience and attractive discounts, supported by digital retail platforms offering wide product accessibility and fast delivery options.

• For instance, Intersport partners with companies like SafeSize to expand premium retail presence across its network, offering on-site 3D boot-fitting systems capable of scanning feet with high precision to ensure precise customization and improve customer satisfaction.

By End-User

The adults segment accounted for a 72.4% share of the Skiing Equipment market in 2024. This segment’s dominance stems from higher participation rates among adult recreational and competitive skiers. Increased disposable income, growing interest in adventure sports, and the popularity of skiing vacations contribute to strong demand. Adult users prefer high-performance and durable gear tailored for alpine and cross-country skiing. Moreover, the rise of ski resorts and professional training programs across Europe, North America, and Asia-Pacific continues to drive sustained demand for premium and customized skiing equipment among adult enthusiasts.

Key Growth Drivers

Rising Popularity of Winter Sports and Tourism

The growing popularity of winter tourism and outdoor recreational activities is a major driver of the skiing equipment market. Increasing participation in skiing events and adventure holidays across Europe, North America, and Asia-Pacific is fueling product demand. Expanding ski resorts and government-backed tourism initiatives are promoting skiing as a mainstream leisure activity. Additionally, improved accessibility to ski destinations through better infrastructure and travel options is attracting more first-time and amateur skiers, strengthening the market for both professional and rental equipment.

• For instance, Atomic introduced the Live Fit 80 ski boots with a forefoot width of 102 mm and a listed boot weight of 1,868 g (size reference 26/26.5) to accommodate wider-fit customer segments entering the sport.

Technological Advancements in Ski Gear Design

Continuous innovation in materials and design is enhancing product performance, comfort, and safety. Manufacturers are developing lightweight, durable, and temperature-resistant equipment using advanced composites and carbon fiber. Smart technologies, including adjustable bindings and digital performance tracking systems, are improving user experience and efficiency. Custom-fit boots and ergonomic helmets further boost consumer appeal. These technological improvements not only cater to professionals but also attract new participants, driving overall market expansion across recreational and competitive skiing segments.

• For instance, a smart sensor system was developed to integrate into ski boots, measuring foot-pressure at three distinct points at a sampling rate of 100 Hz, achieving a centre-of-mass predictive accuracy of 92.7%, enabling real-time biofeedback for athletes.

Expansion of Rental and E-commerce Platforms

The rapid growth of online and rental distribution channels is reshaping the skiing equipment market. E-commerce platforms provide easy access to a wide range of brands and products, supported by discounts and home delivery services. Equipment rental services at ski resorts offer affordable and flexible options for casual skiers and tourists. This model reduces the need for ownership while maintaining accessibility to premium gear. The expansion of digital retail and rental models enhances market reach, particularly among younger and first-time participants worldwide.

Key Trends & Opportunities

Shift Toward Sustainable and Eco-friendly Equipment

Sustainability is becoming a defining trend in the skiing equipment industry. Manufacturers are increasingly using recycled and bio-based materials in skis, poles, and boots to reduce carbon footprints. Eco-friendly production methods and ethical sourcing practices are gaining consumer preference. Brands adopting sustainability initiatives, such as biodegradable coatings and renewable materials, are improving brand perception and competitiveness. This trend presents strong growth opportunities as environmentally conscious consumers continue to drive demand for greener outdoor sports equipment.

• For instance, Elan Sports launched its Ripstick Tour 104 Carbon skis using 100% FSC-certified wood cores and a carbon bridge reinforcement system weighing only 1,540 g per ski (180 cm length), reducing overall material use while maintaining torsional stability and downhill control.

Growing Adoption of Smart and Connected Gear

The integration of technology in skiing equipment is transforming user experience. Smart helmets with built-in communication systems, GPS-enabled trackers, and sensors in skis for performance analytics are gaining traction. These innovations help enhance safety, training efficiency, and performance monitoring for both professionals and recreational users. As wearable technology becomes more affordable, demand for connected skiing gear is expected to rise. Manufacturers leveraging digital innovation to create smart, data-driven products are well-positioned to capture this emerging opportunity.

• For instance, the PIQ ROBOT™ sensor system was developed as a multi-sport sensor that could be attached to equipment, including a mount for ski boots, capturing 13 axes of motion data per second to enable real-time performance analysis and personalized feedback through its companion mobile application.

Key Challenges

High Equipment and Maintenance Costs

The cost of high-quality skiing equipment remains a significant challenge for market growth. Advanced gear incorporating premium materials and technology tends to be expensive, limiting accessibility for casual or beginner skiers. In addition, maintenance and replacement costs add to overall expenditure, particularly for frequent users. These high costs often encourage consumers to opt for rentals instead of ownership. To address this challenge, manufacturers are focusing on cost-effective production methods and modular designs that balance affordability with durability.

Seasonal Dependency and Climate Challenges

The skiing equipment market is highly seasonal, depending on favorable weather and snow conditions. Climate change and rising global temperatures are shortening skiing seasons in several regions, impacting resort operations and reducing equipment demand. Unpredictable snowfall and warmer winters have led to a decline in outdoor participation rates in traditional markets. To counter these challenges, industry players are diversifying product offerings toward indoor ski facilities and artificial snow-based resorts to maintain steady revenue streams year-round.

Regional Analysis

North America

North America dominated the Skiing Equipment market in 2024 with a 39.4% share. The region’s leadership is driven by high participation in winter sports, well-developed ski resorts, and strong consumer spending on premium gear. The United States and Canada are major markets supported by extensive skiing infrastructure and professional training programs. Increasing tourism to destinations such as Colorado, Utah, and British Columbia continues to fuel demand. Additionally, the growing popularity of recreational skiing and advancements in lightweight, performance-oriented equipment are driving steady market expansion across North America.

Europe

Europe held a 33.8% share of the Skiing Equipment market in 2024, supported by a long-established skiing culture and widespread participation in alpine sports. Countries such as Switzerland, Austria, France, and Italy remain key hubs due to their extensive ski resorts and international tourism appeal. Strong demand for high-quality and customized equipment from both professionals and enthusiasts supports market growth. The region’s focus on sustainability and safety standards also promotes innovation in eco-friendly and durable skiing gear. Europe’s consistent snowfall and large-scale winter sporting events further reinforce its dominance in the global market.

Asia-Pacific

Asia-Pacific accounted for a 20.7% share of the Skiing Equipment market in 2024, driven by increasing winter sports participation and expanding tourism infrastructure. Countries like China, Japan, and South Korea are witnessing growing interest in skiing, supported by government initiatives promoting sports development and tourism. Rising disposable incomes and exposure to global winter events are encouraging more consumers to invest in ski gear. The region’s emerging ski resorts and hosting of international competitions, such as the Winter Olympics, continue to boost market visibility and long-term growth prospects.

Middle East & Africa

The Middle East and Africa region captured a 3.2% share of the Skiing Equipment market in 2024. Growth is driven by the rise of artificial and indoor skiing facilities in countries such as the United Arab Emirates, Qatar, and Saudi Arabia. Increasing tourism and investment in luxury sports experiences are fueling equipment demand. In Africa, participation remains limited but is gradually growing through winter sports awareness programs and tourism development. While natural snow conditions are scarce, the expansion of indoor ski resorts is helping sustain steady market growth across the region.

Latin America

Latin America held a 2.9% share of the Skiing Equipment market in 2024, supported by growing winter tourism and regional infrastructure improvements. Countries like Chile and Argentina lead the region with established ski destinations in the Andes Mountains. Rising middle-class income levels and increased interest in adventure sports are stimulating market activity. However, limited snowfall and high equipment costs remain key challenges. Expanding travel to North American and European ski resorts by Latin American tourists is contributing to steady demand for premium and rental skiing equipment within the region.

Market Segmentations:

By Product Type

- Boards & Poles

- Helmets

- Boots & Bindings

- Others

By Distribution Channel

- Specialty Stores

- Online Stores

- Others

By End-User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Skiing Equipment market features major players such as Amer Sports Corporation (Atomic, Salomon), Rossignol Group, K2 Sports LLC, Fischer Sports GmbH, HEAD NV, Burton Snowboards, Elan Sports, Volkl Skis, Blizzard-Tecnica Group, and Scott Sports SA. These companies compete through innovation in lightweight materials, advanced design, and improved safety features. Strategic collaborations with ski resorts and professional athletes enhance brand visibility and product performance. Market leaders are also focusing on expanding e-commerce and rental platforms to reach broader customer bases. Continuous R&D investments in composite materials, aerodynamic designs, and smart wearable integration are strengthening their product portfolios. Additionally, sustainability initiatives—such as eco-friendly materials and carbon-neutral production—are becoming central to competitiveness in this evolving winter sports equipment industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

• Amer Sports Corporation (Atomic, Salomon)

• Rossignol Group

• K2 Sports LLC

• Fischer Sports GmbH

• HEAD NV

• Burton Snowboards

• Elan Sports

• Volkl Skis

• Blizzard-Tecnica Group

• Scott Sports SA

Recent Developments

• In October 2025, Amer Sports Corporation (parent of Atomic and Salomon) launched its Winter 2025/26 apparel collection under the Atomic brand, expanding its range into technical skiwear beyond traditional ski equipment.

• In September 2025, Rossignol Group unveiled its “Super Project 2025” ski bindings series with an aluminium construction and pivoting heel system (Look Pivot 2.0 15 Super Edition) aimed at expert freestylers and freeriders.

• In February 2025, HEAD NV introduced its “RENEW” ski lineup made from renewable and recyclable materials, featuring a wood core reusable up to five times and a reported carbon footprint reduction of 26%.

• In January 2025, Blizzard‑Tecnica Group offered early access to its 2025/26 product line including the Thunderbird 82 LTD (82 mm waist, 15 m turn radius) and the Phoenix R14 Pro (76 mm waist, 14 m turn radius) for PSIA‐AASI members.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

1. Increasing interest in outdoor recreational activities will continue to boost skiing equipment demand.

2. Advancements in lightweight and high-performance materials will enhance user comfort and durability.

3. Expansion of ski tourism and winter sports destinations will drive equipment sales globally.

4. Integration of smart technologies such as sensors and GPS will improve safety and performance tracking.

5. Sustainability initiatives will lead to wider adoption of eco-friendly and recyclable materials.

6. Growth in rental and online retail platforms will make equipment more accessible to new users.

7. Rising participation of women and youth in skiing will diversify product portfolios.

8. Investment in marketing collaborations with professional athletes will strengthen brand visibility.

9. Emerging ski markets in Asia-Pacific will create new growth opportunities for manufacturers.

10. Continuous innovation in protective gear design will improve safety standards and user confidence.