Market Overviews

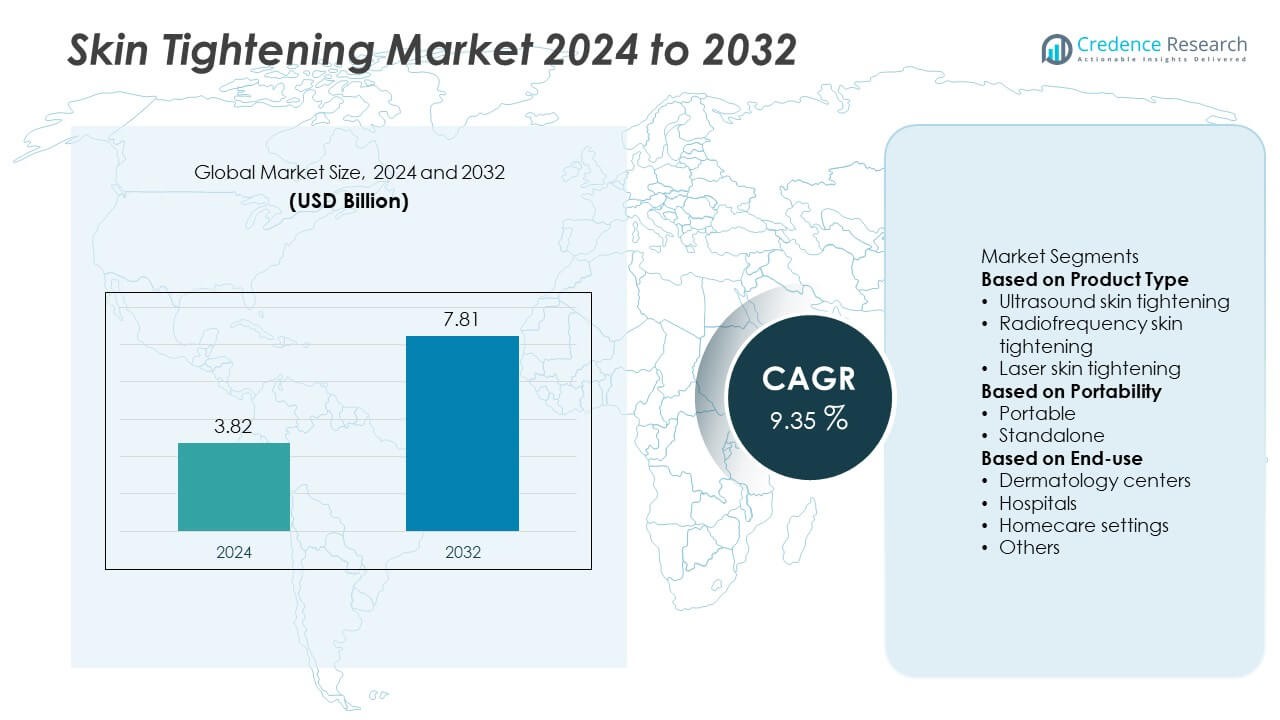

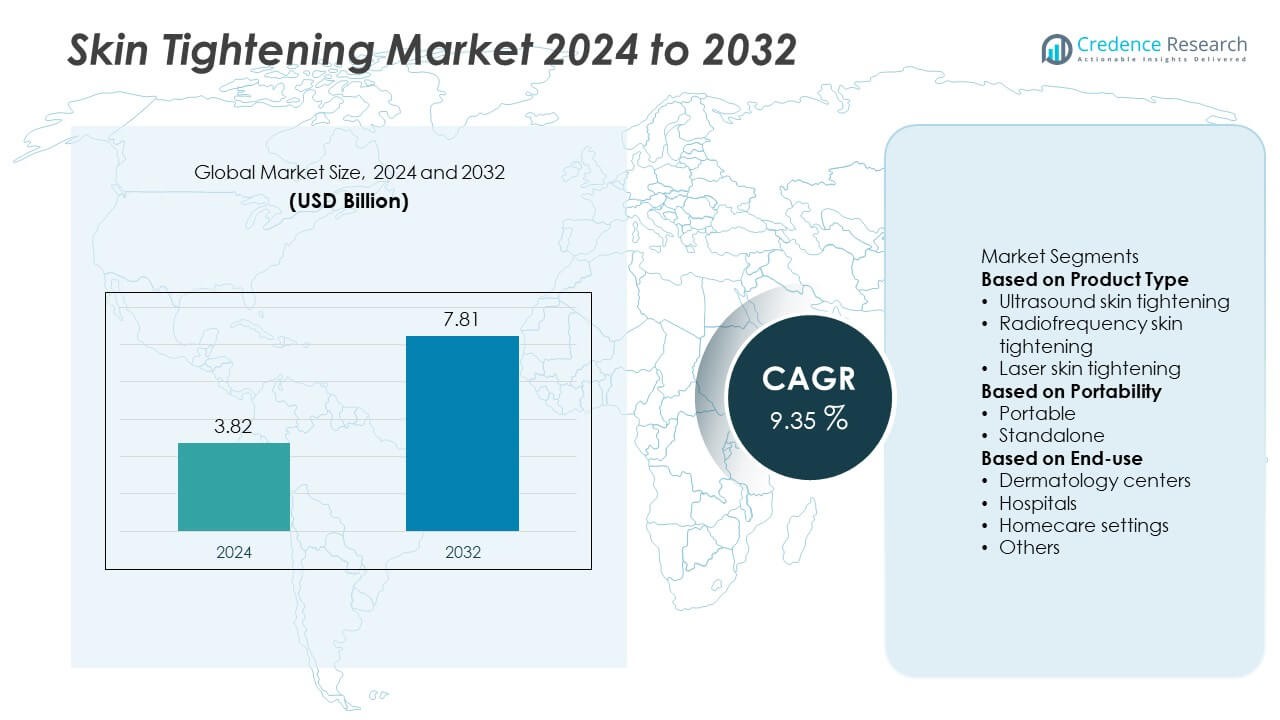

The global skin tightening market was valued at USD 3.82 billion in 2024 and is projected to reach USD 7.81 billion by 2032, growing at a CAGR of 9.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Skin Tightening Market Size 2024 |

USD 3.82 Billion |

| Skin Tightening Market, CAGR |

9.35% |

| Skin Tightening Market Size 2032 |

USD 7.81 Billion |

The skin tightening market is dominated by key players such as Cutera, Venus Concept, Merz Pharma, Cynosure Inc, Project E Beauty, Alma Lasers (Sisram), Lynton Lasers Limited, Solta Medical, Allergan, and BTL Industries. These companies lead through strong portfolios of radiofrequency, ultrasound, and laser-based devices. North America emerged as the leading region, holding 37.4% share in 2024, supported by high spending on aesthetic treatments and advanced clinical infrastructure. Europe followed with 28.6% share, driven by strong demand for non-surgical cosmetic solutions. Asia-Pacific is the fastest-growing region, capturing 24.8% share, fueled by rising consumer awareness and expanding access to affordable technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The skin tightening market was valued at USD 3.82 billion in 2024 and is projected to reach USD 7.81 billion by 2032, growing at a CAGR of 9.35%.

- Growth is driven by the rising preference for non-invasive procedures, technological advancements in radiofrequency and ultrasound systems, and growing awareness of anti-aging treatments among middle-aged consumers.

- Key trends include the expansion of portable home-use devices, integration of AI-based monitoring systems, and increased participation of men in aesthetic treatments.

- The market is competitive, with major players such as Cutera, Venus Concept, Merz Pharma, Cynosure, Alma Lasers, and Allergan focusing on innovation and strategic partnerships to expand their presence globally.

- Regionally, North America leads with 37.4% share, followed by Europe at 28.6%, while Asia-Pacific holds 24.8% share and remains the fastest-growing region. By product type, radiofrequency skin tightening dominates with 43.7% share, driven by safety and effective outcomes.

Market Segmentation Analysis:

By Product Type

The radiofrequency skin tightening segment dominated the market in 2024, holding around 43.7% share. Its dominance is driven by high efficacy, minimal recovery time, and long-lasting results compared to ultrasound and laser systems. The segment benefits from increasing consumer preference for non-invasive aesthetic procedures that improve skin elasticity without surgery. Advancements in monopolar and bipolar RF technologies enhance collagen remodeling, fueling adoption across dermatology and med-spa centers. The expanding use of combination RF and microneedling systems also supports strong demand among middle-aged populations seeking skin rejuvenation.

- For instance, Venus Concept launched the Venus Versa Pro™ platform featuring multipolar RF with SmartScan™ real-time temperature monitoring, capable of maintaining a consistent 43 °C epidermal surface temperature and delivering up to 150 J/cm² energy output to stimulate dermal collagen production effectively.

By Portability

The portable devices segment accounted for the largest share of approximately 58.4% in 2024, reflecting rising demand for home-based aesthetic treatments. Portables offer affordability, convenience, and ease of use for consumers preferring personal care over clinical visits. The surge in do-it-yourself beauty solutions, combined with technological miniaturization, drives their popularity. Manufacturers are introducing compact RF and ultrasound-based systems with safety certifications to meet regulatory standards. This trend aligns with growing consumer interest in at-home anti-aging devices, supported by e-commerce expansion and awareness of professional-grade portable equipment.

- For instance, Project E Beauty developed its LumaGlow RF Pro handheld skin-tightening device designed for safe, non-invasive dermal heating for home users.

By End-use

The dermatology centers segment led the market with nearly 39.2% share in 2024, supported by specialized expertise and advanced equipment availability. These centers attract patients seeking medically supervised, high-precision treatments. The presence of skilled dermatologists ensures better safety and effectiveness compared to home-use devices. The hospitals segment follows, driven by integration of aesthetic procedures into multidisciplinary care. Increasing awareness about skin rejuvenation, coupled with the availability of combination therapies such as laser and RF tightening, continues to strengthen demand across professional clinical settings.

Key Growth Drivers

Rising Demand for Non-Invasive Aesthetic Treatments

The growing preference for non-surgical cosmetic procedures is driving the skin tightening market. Consumers increasingly favor treatments that deliver visible results with minimal discomfort and downtime. Technologies such as radiofrequency, ultrasound, and laser-based systems meet this demand by providing effective and safe skin rejuvenation. The cultural shift toward preventive skincare and maintaining a youthful appearance continues to boost adoption across both men and women, particularly within urban and middle-aged populations.

- For instance, Cutera introduced the Secret RF fractional microneedling platform using 2 MHz bipolar RF energy and adjustable needle depths from 0.5 mm to 3.5 mm, enabling precise dermal heating and collagen stimulation while minimizing surface damage and recovery time.

Advancements in Energy-Based Technologies

Continuous innovation in energy-based aesthetic devices is enhancing treatment safety and efficiency. Modern systems integrate advanced temperature control, multi-polar radiofrequency, and focused ultrasound to achieve better collagen remodeling. The introduction of hybrid platforms combining different modalities enables practitioners to offer customizable results. These technological developments improve patient satisfaction, reduce adverse effects, and expand clinical applications, strengthening the market’s long-term growth potential across both facial and body contouring segments.

- For instance, Alma Lasers (Sisram Medical) launched the Alma Opus Plasma device combining fractional RF and plasma energy, delivering up to 45 mJ per microplasma dot with controlled pulse duration under 0.1 seconds, allowing precise epidermal ablation and dermal coagulation to enhance tightening and texture refinement.

Growing Awareness and Accessibility

Increasing awareness about the benefits of skin tightening procedures continues to boost demand worldwide. Widespread social media exposure and influencer marketing have made aesthetic treatments more mainstream. The availability of affordable portable devices and financing options has improved accessibility among middle-income consumers. Growing networks of dermatology clinics and aesthetic centers are also helping educate patients about safe procedures, resulting in stronger confidence and wider adoption of non-invasive treatments.

Key Trends & Opportunities

Expansion of At-Home Skin Tightening Devices

The popularity of home-use aesthetic devices has grown rapidly in recent years. Portable systems powered by radiofrequency, LED, or ultrasound technology appeal to consumers seeking convenience and privacy. These devices deliver measurable improvements without clinical visits, making them ideal for busy lifestyles. Enhanced safety certifications and easy-to-use designs have strengthened consumer trust, while e-commerce platforms continue to expand the global reach of at-home skincare solutions.

- For instance, Project E Beauty offers various devices for skincare treatments, such as an FDA-cleared Red Light Therapy LED Mask which utilizes red light emission at a verified wavelength of 630 nm.

Integration of AI and Smart Monitoring

The use of artificial intelligence in aesthetic technology is transforming treatment delivery. AI-enabled systems analyze skin texture, monitor temperature, and adjust parameters in real time to improve precision. These features enhance safety and deliver consistent outcomes. Manufacturers are incorporating smart feedback systems into devices, allowing practitioners and consumers to personalize sessions based on skin response. This digital integration represents a key opportunity for innovation and differentiation in the market.

- For instance, BTL Industries developed the EMFACE platform integrating AI-based impedance monitoring with a 2.5 kHz synchronized RF output and HIFES™ energy up to 0.6 Tesla, allowing automated energy modulation and uniform muscle stimulation to enhance lift and firmness consistency across facial zones.

Rising Male Participation in Aesthetic Procedures

An increasing number of men are adopting non-invasive skin tightening treatments. Growing awareness of personal appearance and professional presentation is reshaping demand patterns. Clinics and brands are now marketing treatments specifically designed for male skin types, focusing on firmness and jawline definition. This broadening demographic base offers new opportunities for service providers and helps diversify the consumer segment of the market.

Key Challenges

High Treatment Costs and Limited Reimbursements

The high cost of energy-based skin tightening procedures remains a key restraint. Advanced technology and the need for multiple sessions make treatments expensive for many consumers. Limited or no insurance coverage for cosmetic procedures further restricts accessibility. To address this, manufacturers and clinics are developing cost-effective solutions and flexible payment options to attract a broader customer base and support steady market growth.

Risk of Adverse Effects and Regulatory Barriers

Possible side effects, including burns or swelling, continue to raise safety concerns among consumers. Stringent regulatory frameworks across regions slow product approvals and increase compliance costs for manufacturers. Differences in device classification and certification standards across countries further complicate global expansion. To mitigate these challenges, companies are focusing on clinical validation, practitioner training, and transparent communication about treatment safety and efficacy.

Regional Analysis

North America

North America held the largest share of the skin tightening market, accounting for 37.4% in 2024. The region’s dominance stems from high consumer spending on cosmetic procedures and the strong presence of advanced aesthetic clinics. The U.S. leads due to rapid adoption of radiofrequency and ultrasound-based technologies and a growing preference for non-invasive treatments. Supportive regulatory approvals from the FDA and rising demand for at-home devices further enhance market penetration. Expanding awareness campaigns and the presence of established brands continue to drive sustained growth across the region.

Europe

Europe accounted for 28.6% share of the global skin tightening market in 2024, driven by high aesthetic awareness and advanced dermatology infrastructure. Countries such as Germany, France, and the U.K. lead due to their strong cosmetic industry and high procedure volumes. The popularity of non-surgical facial rejuvenation continues to grow among aging populations. Stringent quality regulations and high consumer trust in certified medical devices support market stability. Increasing adoption of energy-based systems in professional clinics and medical spas is further strengthening Europe’s market position.

Asia-Pacific

Asia-Pacific captured 24.8% share of the global market in 2024 and is the fastest-growing regional segment. Expanding middle-class income, rising beauty consciousness, and rapid urbanization are key growth factors. South Korea, Japan, and China dominate due to widespread acceptance of aesthetic enhancements and technological innovation. Local manufacturers are increasingly offering affordable and advanced devices, boosting accessibility. Social media influence and a strong emphasis on youthful appearance further stimulate demand. Growing investments in dermatology centers and training programs are expected to sustain strong regional momentum.

Latin America

Latin America accounted for 6.3% share of the global skin tightening market in 2024, supported by growing cosmetic awareness and expanding medical tourism. Brazil and Mexico lead the region due to well-developed aesthetic care infrastructure and rising disposable incomes. The increasing availability of non-invasive procedures and affordability of treatments attract both domestic and international clients. Growing influence of beauty standards and celebrity endorsements further drives demand. Continued investment in training programs and device certifications enhances market credibility across clinics and wellness centers.

Middle East & Africa

The Middle East & Africa region represented 2.9% share of the global market in 2024. Growth is supported by rising interest in cosmetic dermatology and increasing establishment of aesthetic clinics in the UAE, Saudi Arabia, and South Africa. Expanding medical tourism and adoption of Western beauty trends are key drivers. The growing female working population and awareness about advanced aesthetic technologies further boost demand. Despite higher equipment costs and limited practitioner expertise in some areas, the region shows strong potential for long-term expansion.

Market Segmentations:

By Product Type

- Ultrasound skin tightening

- Radiofrequency skin tightening

- Laser skin tightening

By Portability

By End-use

- Dermatology centers

- Hospitals

- Homecare settings

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the skin tightening market features key players such as Cutera, Venus Concept, Merz Pharma, Cynosure Inc, Project E Beauty, Alma Lasers (Sisram), Lynton Lasers Limited, Solta Medical, Allergan, and BTL Industries. These companies compete through continuous innovation in energy-based technologies, including radiofrequency, ultrasound, and laser systems. Strategic initiatives such as product launches, mergers, and global distribution partnerships strengthen their market positions. Leading firms focus on integrating AI-driven diagnostics, portable solutions, and multi-application devices to expand clinical and home-use segments. Increasing R&D investments enhance device safety, precision, and user comfort. Partnerships with dermatology clinics and medical spas also boost brand visibility and customer trust. The competitive environment is intensifying as new entrants target niche markets with cost-effective and user-friendly solutions. This dynamic competition drives technological advancement, pricing flexibility, and broader adoption of non-invasive aesthetic treatments across developed and emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cutera

- Venus Concept

- Merz Pharma

- Cynosure Inc

- Project E Beauty

- Alma Lasers (Sisram)

- Lynton Lasers Limited

- Solta Medical

- Allergan

- BTL Industries

Recent Developments

- In April 2025, Solta Medical (subsidiary of Bausch Health Companies Inc.) announced the launch of the Fraxel FTX™ dual-wavelength fractional laser system (1550 nm and 1927 nm) with a hand-piece redesigned to weigh 20% less than the prior model.

- In September 2024, Merz Aesthetics (a business of Merz Pharma GmbH & Co. KGaA) launched the Ultherapy PRIME platform featuring real-time imaging and treatment speeds improved by 20 minutes per session compared with the previous generation.

- In April 2023, BTL Industries, Inc. unveiled research and its latest innovation in skin-tightening and body-shaping devices during its 30-year anniversary event, highlighting the expansion of its HIFEM®/HIFES™ technologies in aesthetic applications.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Portability, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for non-invasive and minimally invasive aesthetic procedures will continue to rise.

- Technological innovations in radiofrequency and ultrasound devices will enhance treatment precision.

- Portable and home-use devices will gain stronger adoption among consumers.

- Integration of AI and smart sensors will improve treatment customization and safety.

- Clinics will increasingly adopt combination therapies for better aesthetic outcomes.

- Growing awareness of preventive skincare will expand the target consumer base.

- Emerging markets in Asia-Pacific and Latin America will drive the next growth phase.

- Strategic partnerships and acquisitions among key players will strengthen global presence.

- Manufacturers will focus on affordable and user-friendly device designs for broader accessibility.

- Regulatory harmonization and clinical standardization will improve consumer confidence and market transparency.