Market Overview

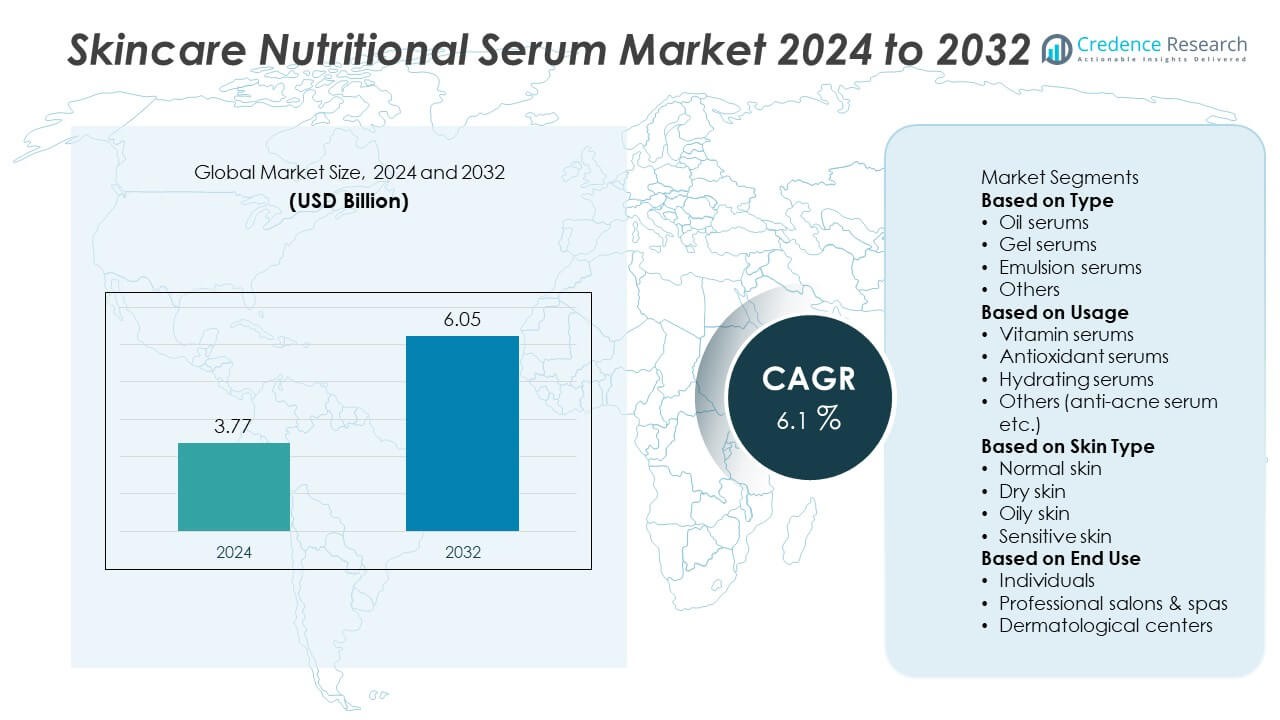

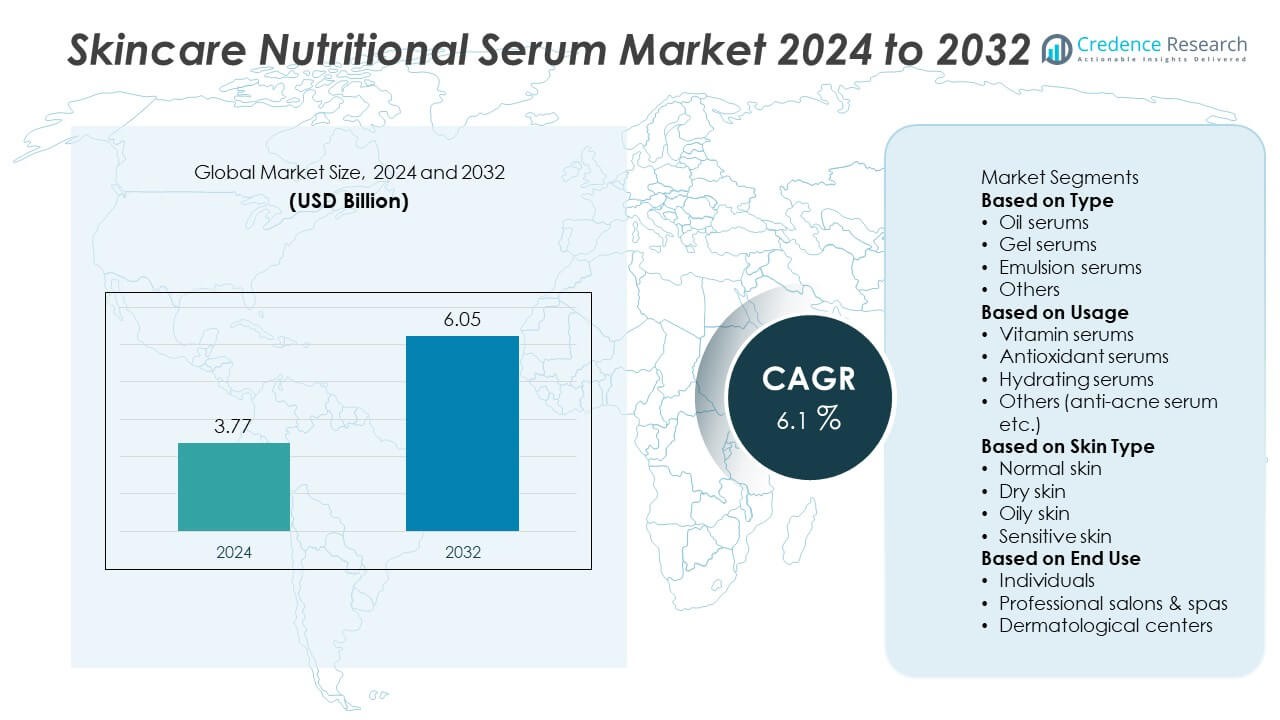

The Skincare Nutritional Serum market was valued at USD 3.77 billion in 2024 and is projected to reach USD 6.05 billion by 2032, expanding at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Skincare Nutritional Serum Market Size 2024 |

USD 3.77 Billion |

| Skincare Nutritional Serum Market, CAGR |

6.1% |

| Skincare Nutritional Serum Market Size 2032 |

USD 6.05 Billion |

The Skincare Nutritional Serum market is led by major players including NeoStrata, LifeVantage, Monpure, Oskia, Kerastase, Fig+Yarrow, Amorepacific, Auteur, Jeunesse, and EltaMD. These companies drive growth through innovation in vitamin-rich, antioxidant, and hydration-focused formulations. Brands emphasize natural ingredients and dermatologically tested serums to meet rising consumer demand for clean and functional skincare. North America leads the global market with a 38.4% share in 2024, driven by strong demand for premium and anti-aging products. Europe follows with a 29.7% share, supported by sustainable beauty trends and high consumer preference for science-backed, eco-conscious formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Skincare Nutritional Serum market was valued at USD 3.77 billion in 2024 and is projected to reach USD 6.05 billion by 2032, growing at a CAGR of 6.1%.

- Market growth is driven by increasing demand for vitamin-enriched, antioxidant, and hydrating serums targeting anti-aging and skin repair needs.

- Key trends include the rise of clean beauty, natural ingredient formulations, and personalized skincare driven by AI-based analysis tools.

- Leading players such as NeoStrata, Amorepacific, Oskia, and Kerastase focus on premium product innovation, sustainable packaging, and online expansion.

- Regionally, North America holds 38.4% share, followed by Europe with 29.7%, while the oil serums segment dominates with 39.2% share due to strong preference for nutrient-rich, high-absorption formulations.

Market Segmentation Analysis:

By Type

The oil serums segment dominated the Skincare Nutritional Serum market in 2024, holding a 39.2% share. This dominance is attributed to their high concentration of active ingredients and superior absorption, which enhance skin nourishment and radiance. Consumers increasingly prefer oil-based serums formulated with natural extracts such as argan, rosehip, and vitamin E for anti-aging and hydration benefits. The trend toward clean beauty and plant-derived skincare further supports segment growth. Gel and emulsion serums are also gaining traction due to their lightweight texture and suitability for humid climates.

- For instance, Oskia’s Restoration Oil Serum blends cold-pressed rosehip seed oil with 2,000 IU of vitamin E and CoQ10 per 30 mL bottle. Independent tests reported up to a 23 % reduction in trans-epidermal water loss within 14 days of use, confirming the serum’s efficacy in maintaining hydration and barrier integrity.

By Usage

The vitamin serums segment accounted for the largest 41.7% share of the Skincare Nutritional Serum market in 2024. These formulations, enriched with vitamins C, E, and B3, are highly valued for brightening skin tone and reducing pigmentation. Growing awareness of antioxidant protection and collagen stimulation supports their demand among both men and women. Brands are increasingly developing multi-vitamin blends targeting urban consumers exposed to pollution and UV damage. The hydrating serum segment is also growing rapidly, fueled by rising adoption among consumers with dry and combination skin types.

- For instance, NeoStrata’s 15% Vitamin C + PHA Serum delivers 15% L-ascorbic acid stabilized with 2% gluconolactone (PHA) and 1% feverfew extract. In a clinical study, participants noted a measurable improvement in skin luminosity within 1 week, with 98% observing brighter, more radiant skin. After 12 weeks of consistent daily application, 93% noted skin tone was dramatically more even.

By Skin Type

The dry skin segment led the Skincare Nutritional Serum market in 2024 with a 36.8% share. Its dominance is driven by increasing demand for moisture-retaining formulations that restore the skin barrier and prevent dullness. Serums containing hyaluronic acid, ceramides, and essential oils are highly preferred for deep hydration and elasticity improvement. The growing popularity of winter skincare routines and anti-aging products among older consumers strengthens this segment. Meanwhile, the sensitive skin segment is expanding as dermatologically tested and hypoallergenic serums gain wider acceptance among consumers with delicate skin conditions.

Key Growth Drivers

Rising Demand for Natural and Functional Ingredients

Consumers are increasingly favoring skincare nutritional serums infused with natural and active ingredients such as vitamins, antioxidants, peptides, and botanical oils. The shift toward clean beauty and ingredient transparency encourages brands to develop toxin-free formulations. Growing awareness of nutrient-based skincare that enhances skin health from within supports market growth. Companies are also introducing serums fortified with superfoods and plant-derived actives, catering to health-conscious and eco-aware consumers seeking both nourishment and visible results.

- For instance, Amorepacific’s IOPE Super Vital Serum Bio Ex Cell Power uses a patented Bio-seed™ extract enriched with 980 µg/mL flavonoids derived from soybean sprout cultures. Clinical testing across 60 participants recorded a 1.8-fold increase in dermal elasticity after 28 days of twice-daily application, confirming the potency of its plant-based antioxidant blend.

Expanding Anti-Aging and Preventive Skincare Segment

The rising focus on anti-aging and preventive skincare significantly drives the demand for nutritional serums. Consumers in their 20s and 30s are adopting serums to delay early signs of aging such as fine lines, dullness, and uneven texture. The use of vitamin C, retinol, and niacinamide-based serums is increasing in daily routines. The growing working population and exposure to pollution accelerate adoption. Brands promoting serums for daily repair and protection continue to strengthen market penetration across age groups.

- For instance, Jeunesse’s Luminesce products utilize an ingredient blend called APt-200 (Advanced Polypeptide Technology) which the company claims contains 200+ polypeptides and growth factors derived from adult stem cell media, produced through proprietary technology.

Growing Influence of E-commerce and Personalized Beauty

Online retail and AI-driven personalization are reshaping serum consumption patterns. Consumers increasingly purchase skincare products through digital platforms that offer ingredient insights, reviews, and virtual consultations. Personalized serum formulations based on skin type, tone, and lifestyle have become popular among millennials. Brands are leveraging data analytics and digital skin diagnostics to offer targeted nutrition-based skincare solutions. This digital transformation enhances accessibility and consumer engagement, driving steady growth in premium skincare segments worldwide.

Key Trends & Opportunities

Rising Popularity of Vitamin-Infused Serums

Vitamin-infused serums are gaining traction for their proven efficacy in brightening and protecting the skin. Vitamin C and niacinamide-based serums are witnessing strong adoption for improving elasticity and tone. Consumers are increasingly seeking multi-functional serums that combine hydration, antioxidant protection, and UV defense. Continuous product innovation and scientific validation of vitamin benefits are creating growth opportunities for established and emerging brands. The expanding use of vitamins in both premium and mass-market categories enhances the overall appeal of nutritional serums.

- For instance, LifeVantage’s TrueScience Perfecting Lotion contains a proprietary Nrf2 blend of plant extracts including milk thistle, green tea, turmeric, bacopa, and black pepper, rather than specific high concentrations of synthetic vitamin C and niacinamide.

Shift Toward Sustainable and Ethical Skincare Formulations

Sustainability is becoming a key opportunity for skincare serum manufacturers. Brands are focusing on recyclable packaging, cruelty-free testing, and ethically sourced ingredients. Eco-conscious consumers prefer products free from parabens, sulfates, and synthetic fragrances. Companies are investing in biodegradable formulations and plant-based actives to align with global sustainability goals. The growing consumer awareness of environmental impact and preference for green formulations continues to drive product innovation and brand differentiation in the skincare nutritional serum market.

- For instance, Kérastase’s Genesis Serum Anti-Chute Fortifiant is enriched with a potent combination of Edelweiss Native Cells and Ginger Root extract, ingredients known for protecting against daily aggressors and strengthening hair from the root.

Key Challenges

High Product Cost and Premium Pricing

The use of high-quality active ingredients and advanced formulations often makes nutritional serums expensive. Premium pricing limits accessibility among cost-sensitive consumers, especially in developing markets. While demand remains strong in urban centers, affordability challenges slow adoption in rural areas. Manufacturers face pressure to balance product efficacy with cost-effectiveness. The rising presence of low-cost alternatives and counterfeit products also threatens market share for established premium brands.

Regulatory and Formulation Complexity

Strict cosmetic regulations and formulation standards pose major challenges for manufacturers. Ensuring ingredient safety, stability, and efficacy requires significant R&D investment. Variations in regulatory norms across regions increase compliance costs and delay product launches. The need for dermatological testing and certification adds to the complexity. Moreover, the challenge of maintaining bioactive stability in vitamin and antioxidant serums affects product shelf life. These factors collectively slow innovation cycles and impact time-to-market for new product lines.

Regional Analysis

North America

North America held the largest share of 38.4% in the Skincare Nutritional Serum market in 2024. The region’s leadership is driven by a strong demand for premium skincare products emphasizing anti-aging and hydration. Consumers in the U.S. and Canada prefer vitamin-rich and antioxidant-based serums for skin repair and protection. The presence of major cosmetic brands, high disposable income, and increased awareness of ingredient transparency strengthen market growth. E-commerce platforms and dermatology clinics also contribute to steady sales, supported by rapid adoption of clean beauty and personalized skincare formulations.

Europe

Europe accounted for 29.7% share of the global Skincare Nutritional Serum market in 2024. Demand is driven by consumers’ preference for natural, eco-friendly, and scientifically validated skincare solutions. Countries such as France, Germany, and the U.K. lead in adopting serums infused with plant extracts and vitamins. Strict cosmetic regulations ensure product quality and transparency, enhancing consumer trust. The growing influence of sustainable beauty trends and cruelty-free certifications supports continuous product innovation. Luxury skincare brands and strong retail networks further boost the region’s dominance in premium serum consumption.

Asia Pacific

Asia Pacific captured 23.5% share of the Skincare Nutritional Serum market in 2024. Rapid urbanization, increasing disposable incomes, and rising awareness of skincare routines are fueling regional demand. Countries such as South Korea, Japan, and China dominate due to strong beauty cultures and innovation in multifunctional serums. Consumers prefer lightweight, fast-absorbing serums designed for humid climates. The popularity of K-beauty and J-beauty trends, along with the expansion of e-commerce, accelerates product adoption. Local brands are also introducing affordable, nutrient-enriched formulations that appeal to younger, health-conscious consumers.

Latin America

Latin America represented 5.1% share of the Skincare Nutritional Serum market in 2024. Brazil, Mexico, and Argentina lead regional consumption with growing awareness of daily skincare and sun protection. Expanding middle-class populations and social media influence are driving interest in serums with brightening and moisturizing properties. Local and international brands are focusing on vitamin-enriched and natural ingredient-based products suited for diverse skin types. Despite economic fluctuations, rising beauty consciousness and retail expansion continue to support steady market growth across urban centers in the region.

Middle East & Africa

The Middle East & Africa accounted for 3.3% share in the Skincare Nutritional Serum market in 2024. Increasing awareness of skincare and premium product availability drive market expansion in the UAE, Saudi Arabia, and South Africa. Hot and dry climates boost demand for hydrating and protective serums. Consumers prefer formulations with antioxidants and vitamins that combat dryness and UV damage. Growth in e-commerce and beauty retail outlets enhances accessibility to international brands. However, limited local manufacturing and higher import dependency still pose challenges for faster market penetration.

Market Segmentations:

By Type

- Oil serums

- Gel serums

- Emulsion serums

- Others

By Usage

- Vitamin serums

- Antioxidant serums

- Hydrating serums

- Others (anti-acne serum etc.)

By Skin Type

- Normal skin

- Dry skin

- Oily skin

- Sensitive skin

By End Use

- Individuals

- Professional salons & spas

- Dermatological centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Skincare Nutritional Serum market includes key players such as NeoStrata, LifeVantage, Monpure, Oskia, Kerastase, Fig+Yarrow, Amorepacific, Auteur, Jeunesse, and EltaMD. These companies compete through product innovation, ingredient transparency, and brand positioning across premium and mid-range segments. Leading brands focus on developing serums enriched with vitamins, antioxidants, peptides, and natural extracts to address diverse skin concerns such as aging, dryness, and sensitivity. Strategic collaborations, clean beauty certifications, and dermatological endorsements enhance brand credibility and global reach. Many players are also expanding through e-commerce channels, offering personalized formulations and digital skin diagnostics to strengthen consumer engagement. Continuous R&D investments and sustainable packaging initiatives are shaping competitive differentiation. Overall, competition remains intense as both established and emerging brands focus on combining science-backed efficacy with ethical and environmentally responsible formulations to meet evolving consumer expectations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- NeoStrata

- LifeVantage

- Monpure

- Oskia

- Kerastase

- Fig+Yarrow

- Amorepacific

- Auteur

- Jeunesse

- EltaMD

Recent Developments

- In March 2025, Amorepacific Corporation rolled out a new hydrating innovation in the Laneige brand — the “Bouncy & Firm Serum” to enhance skin bounce and firmness.

- In January 2025, LifeVantage hosted its annual Global Kickoff. Thousands of the company’s independent Consultants around the world joined the live broadcast to celebrate the company’s bold vision for 2025, which emphasized momentum, continued innovation, and international expansion of the MindBody GLP-1 System

- In March 2024, LifeVantage Corporation introduced its new TrueScience Activated Skin Care Collection. An in-house consumer study reported that 100% of participants showed a reduction in crow’s feet wrinkles and a reduction in fine lines and wrinkles after eight weeks of use, along with other significant improvements in overall skin appearance.

Report Coverage

The research report offers an in-depth analysis based on Type, Usage, Skin Type, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing demand for nutrient-enriched skincare products.

- Consumers will prefer serums combining hydration, repair, and anti-aging benefits.

- Natural and vegan formulations will gain higher acceptance across global markets.

- AI-based skin diagnostics will drive personalization in serum formulations.

- Brands will focus more on sustainable packaging and ethical ingredient sourcing.

- Online retail and influencer marketing will continue boosting product visibility.

- The vitamin-based serum category will strengthen its leadership position.

- Asia Pacific will witness rapid growth due to rising beauty awareness and affordability.

- Clinical validation and dermatological testing will become key purchase influencers.

- Companies will invest in biotechnology and plant-based actives to enhance product efficacy.