Market Overview

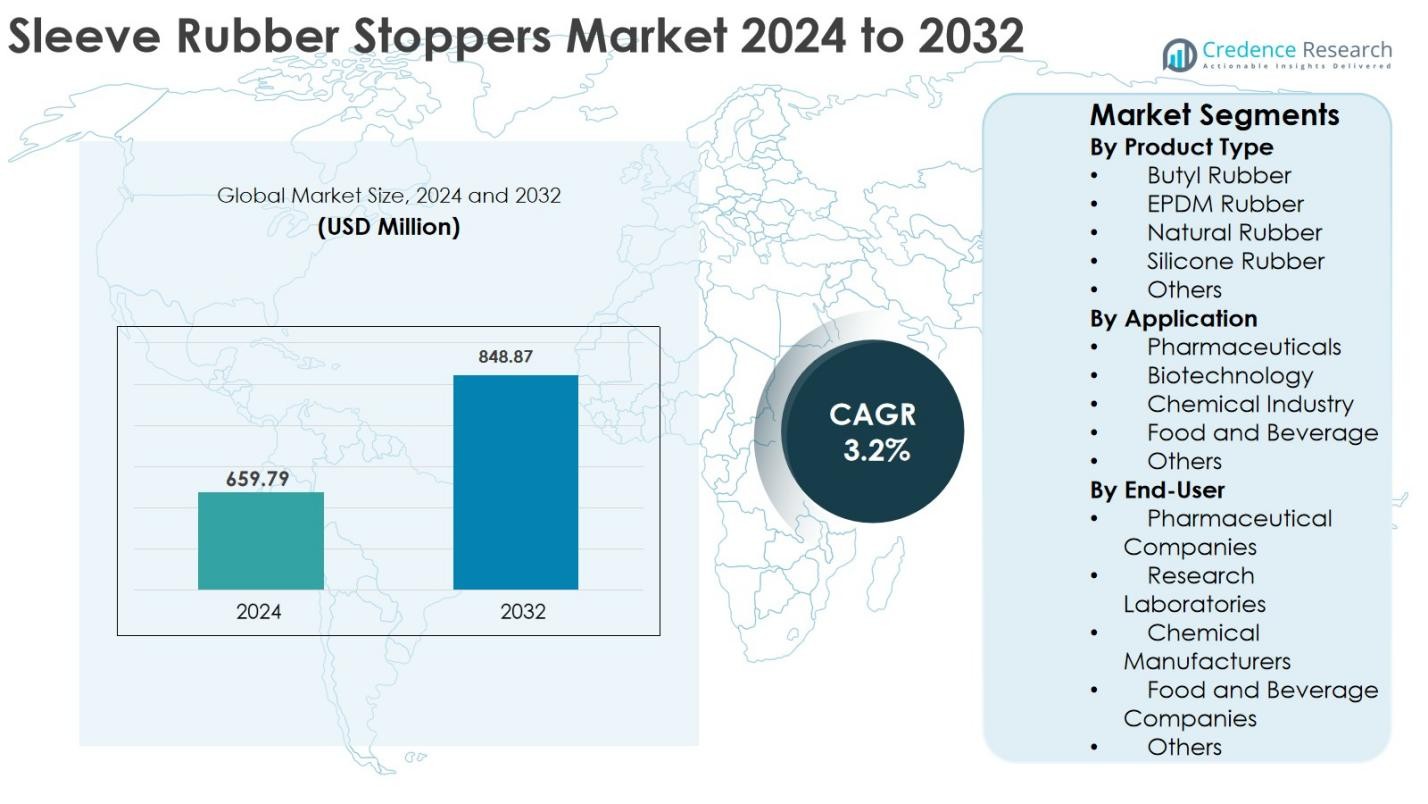

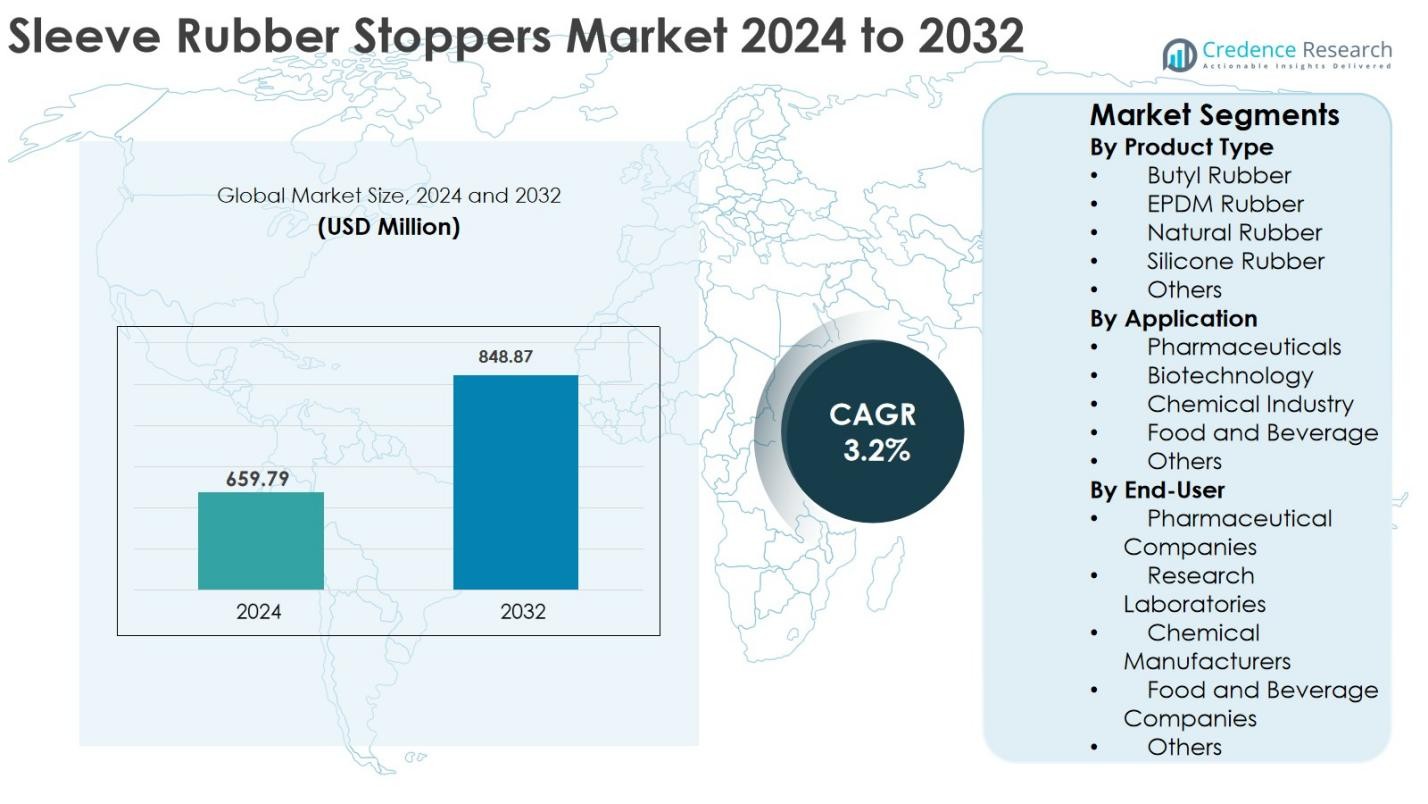

The Sleeve Rubber Stoppers Market size was valued at USD 659.79 million in 2024 and is anticipated to reach USD 848.87 million by 2032, expanding at a CAGR of 3.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sleeve Rubber Stoppers Market Size 2024 |

USD 659.79 Million |

| Sleeve Rubber Stoppers Market, CAGR |

3.2% |

| Sleeve Rubber Stoppers Market Size 2032 |

USD 848.87 Million |

Sleeve Rubber Stoppers market is dominated by established pharmaceutical packaging and elastomer manufacturers that focus on high-quality, regulatory-compliant closure solutions. Leading players such as West Pharmaceutical Services, Inc., AptarGroup, Inc., Datwyler Holding Inc., Nipro Corporation, Saint-Gobain Performance Plastics, DWK Life Sciences GmbH, and VWR International, LLC drive market growth through material innovation, coated stopper technologies, and strong partnerships with pharmaceutical companies. Regionally, North America leads the market with an exact share of 34.8% in 2024, supported by robust injectable drug production and strict regulatory compliance. Europe follows with 28.6% market share, driven by biologics manufacturing and quality-focused packaging standards, while Asia-Pacific holds 24.3%, supported by expanding pharmaceutical manufacturing capacity and rising vaccine production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Sleeve Rubber Stoppers market was valued at USD 659.79 million in 2024 and is projected to reach USD 848.87 million by 2032, expanding at a CAGR of 3.2% during the forecast period.

- Market growth is driven by rising injectable drug production, vaccine manufacturing, and increasing adoption of prefilled syringes, with butyl rubber emerging as the dominant segment holding 42.6% share in 2024 due to superior gas impermeability and chemical resistance.

- Key market trends include growing demand for high-purity and coated rubber stoppers and increased use in biologics packaging, while leading players such as West Pharmaceutical Services, AptarGroup, Datwyler, and Nipro focus on innovation and long-term pharmaceutical supply contracts.

- Market restraints include raw material price volatility, stringent regulatory validation, and lengthy approval processes, which increase production costs and limit rapid product modifications.

- Regionally, North America led with 34.8% share, followed by Europe at 28.6%, Asia-Pacific at 24.3%, Latin America at 7.1%, and Middle East & Africa at 5.2%, reflecting strong pharmaceutical manufacturing concentration in developed regions.

Market Segmentation Analysis:

By Product Type

The Sleeve Rubber Stoppers market by product type is led by Butyl Rubber, which accounted for 42.6% market share in 2024, owing to its superior gas impermeability, chemical resistance, and suitability for sterile pharmaceutical packaging. Butyl rubber stoppers are widely used in injectable drug vials and biologics, supporting consistent demand from pharmaceutical manufacturers. EPDM Rubber follows, driven by durability and cost efficiency, while Silicone Rubber is gaining traction due to high-temperature stability and compatibility with sensitive formulations. Rising injectable drug production and stringent packaging standards continue to drive product innovation across rubber types.

- For instance, West Pharmaceutical Services supplies laminated chlorobutyl stoppers used with Pfizer’s multi-dose vaccine vials to maintain container closure integrity under cold-chain conditions.

By Application

By application, Pharmaceuticals dominated the Sleeve Rubber Stoppers market with a 58.4% share in 2024, supported by increasing injectable drug volumes, vaccine manufacturing, and stringent contamination-control requirements. Sleeve rubber stoppers are critical for maintaining sterility and preventing drug interaction, making them indispensable in parenteral packaging. The Biotechnology segment is expanding steadily due to growth in biologics and biosimilars, while the Chemical Industry and Food and Beverage segments contribute moderate demand, primarily for sealing and containment applications. Regulatory compliance and rising healthcare investments remain key growth drivers across applications.

- For instance, Datwyler supplies coated chlorobutyl stoppers for large‑volume vaccine and insulin vials, designed to minimize extractables and ensure compatibility with complex biologic formulations.

By End-User

Among end-users, Pharmaceutical Companies held the largest share of 61.2% in 2024, driven by large-scale drug manufacturing, global vaccine distribution, and increasing adoption of prefilled syringes and vials. Continuous investments in sterile packaging solutions and compliance with international pharmacopeia standards support sustained demand from this segment. Research Laboratories represent a growing share due to increased clinical research activity, while Chemical Manufacturers and Food and Beverage Companies contribute incremental demand for secure sealing solutions. Expansion of pharmaceutical production capacity globally remains the primary driver for end-user segment growth.

Key Growth Drivers

Rising Demand for Injectable and Parenteral Drug Packaging

The increasing global demand for injectable and parenteral drugs is a primary growth driver for the Sleeve Rubber Stoppers market. The rising prevalence of chronic diseases, growing vaccination programs, and expansion of biologics and biosimilars production are significantly increasing the need for sterile pharmaceutical packaging components. Sleeve rubber stoppers ensure container-closure integrity, prevent contamination, and maintain drug stability throughout storage and transportation. Pharmaceutical manufacturers are increasingly adopting high-quality elastomeric stoppers to comply with stringent sterility and safety standards. In addition, the growing use of prefilled syringes and ready-to-use vial systems further boosts demand. Expansion of pharmaceutical manufacturing capacities in emerging economies also supports sustained market growth.

- For instance, Pfizer and BioNTech’s COVID-19 vaccine Comirnaty, supplied in multi‑dose vials requiring elastomeric closures, surpassed 4 billion doses shipped globally by 2023, underscoring the scale of injectable packaging demand.

Stringent Regulatory and Quality Compliance Requirements

Strict regulatory frameworks governing pharmaceutical packaging are driving adoption of advanced sleeve rubber stoppers. Regulatory authorities mandate rigorous testing for contamination control, extractables, leachables, and container-closure integrity. Sleeve rubber stoppers offer superior sealing performance and chemical resistance, making them suitable for critical drug applications. Pharmaceutical companies increasingly collaborate with packaging suppliers to develop compliant stopper solutions tailored to evolving regulations. Continuous investments in cleanroom manufacturing, quality assurance systems, and validated processes further reinforce market growth. Compliance-driven demand encourages manufacturers to innovate in materials and designs while maintaining consistent quality. This regulatory emphasis ensures stable, long-term demand for high-performance sleeve rubber stoppers.

- For instance, the U.S. FDA requires parenteral container-closure systems to meet 21 CFR Part 211 and relevant USP <1207> guidance on container-closure integrity testing for sterile injectables, compelling drug manufacturers to qualify high‑performance elastomeric stoppers for critical products

Expansion of Biopharmaceutical and Biotechnology Industries

The rapid expansion of biopharmaceutical and biotechnology industries is strongly supporting the Sleeve Rubber Stoppers market. Biologics, vaccines, and advanced therapies require packaging solutions that offer high purity, low permeability, and minimal interaction with sensitive formulations. Sleeve rubber stoppers, particularly those made from butyl and silicone rubber, meet these critical requirements. Increased investment in biotechnology research, clinical trials, and contract manufacturing is generating consistent demand for specialized stopper solutions. Growth in personalized medicine and complex biologic formulations further amplifies the need for reliable closure systems. As biopharmaceutical pipelines expand globally, demand for high-quality sleeve rubber stoppers continues to rise.

Key Trends & Opportunities

Growing Adoption of High-Purity and Coated Rubber Stoppers

A major trend in the Sleeve Rubber Stoppers market is the growing adoption of high-purity and coated rubber stoppers. Pharmaceutical manufacturers increasingly prefer fluoropolymer-coated and low-extractable stoppers to minimize drug interactions and enhance safety. These advanced stoppers improve chemical inertness, reduce particulate contamination, and support longer shelf life for sensitive formulations. Rising production of biologics and injectable drugs is accelerating this shift toward premium stopper solutions. Manufacturers are investing in advanced coating technologies and material innovations to meet evolving pharmaceutical requirements. This trend creates opportunities for product differentiation, premium pricing, and long-term supply agreements with pharmaceutical companies.

- For instance, Datwyler’s coated Omniflex and other high-purity elastomer components are positioned specifically for biotech and high-value injectable drugs, emphasizing very low extractables and particulate levels to meet stringent quality expectations.

Increasing Pharmaceutical Manufacturing in Emerging Markets

Emerging markets present significant growth opportunities for the Sleeve Rubber Stoppers market due to rapid expansion of pharmaceutical manufacturing. Countries in Asia-Pacific, Latin America, and the Middle East are investing heavily in domestic drug production to meet growing healthcare demand. Government incentives, favorable policies, and export-oriented strategies are driving the establishment of new pharmaceutical facilities. As injectable drug and vaccine production increases, demand for reliable closure systems rises accordingly. Global packaging suppliers are expanding regional manufacturing and distribution networks to capture these opportunities. This trend supports volume growth, cost optimization, and stronger partnerships with regional pharmaceutical manufacturers.

- For instance, India hosts around 3,000 drug companies and roughly 10,500 manufacturing units, with over 2,000 WHO-GMP-approved facilities supporting large-scale production of generics and injectables

Key Challenges

Volatility in Raw Material Prices

Fluctuating raw material prices represent a major challenge for the Sleeve Rubber Stoppers market. Variations in the cost of natural rubber, synthetic elastomers, and petroleum-based inputs directly affect production expenses and profit margins. Supply chain disruptions, geopolitical instability, and environmental factors impacting rubber production contribute to pricing volatility. Manufacturers often struggle to pass increased costs to pharmaceutical customers due to long-term supply contracts and pricing pressures. This challenge necessitates efficient procurement strategies, supplier diversification, and cost management practices. Smaller manufacturers face greater margin pressure, making raw material price instability a persistent risk across the market.

Lengthy Validation and Regulatory Approval Processes

Lengthy validation and regulatory approval processes pose another significant challenge for the Sleeve Rubber Stoppers market. Pharmaceutical packaging components must undergo extensive testing for extractables, leachables, and compatibility before approval. Any change in material composition or design often requires revalidation, increasing development timelines and costs. This limits flexibility and slows innovation for manufacturers. Additionally, pharmaceutical companies prefer established suppliers with proven compliance records, creating barriers for new entrants. Managing regulatory complexity while maintaining product innovation and operational efficiency remains a critical challenge for sleeve rubber stopper manufacturers globally.

Regional Analysis

North America

North America held the largest share of the Sleeve Rubber Stoppers market at 34.8% in 2024, driven by a strong pharmaceutical manufacturing base, high injectable drug consumption, and stringent regulatory standards. The presence of leading pharmaceutical and biotechnology companies in the United States and Canada supports sustained demand for high-quality closure systems. Extensive vaccine production, biologics development, and adoption of prefilled syringes further strengthen market growth. Continuous investments in advanced drug delivery systems and packaging innovation reinforce regional leadership. Strict compliance with FDA and pharmacopeial requirements continues to drive the adoption of premium sleeve rubber stoppers across the region.

Europe

Europe accounted for 28.6% of the Sleeve Rubber Stoppers market in 2024, supported by a well-established pharmaceutical industry and strong regulatory oversight. Countries such as Germany, France, Switzerland, and the United Kingdom are key contributors due to high biologics production and vaccine manufacturing. Emphasis on quality, sustainability, and patient safety drives demand for advanced elastomeric stoppers. Growth in contract manufacturing organizations and research activities further supports market expansion. Compliance with European Medicines Agency standards and increasing investment in injectable drug pipelines continue to sustain steady demand for sleeve rubber stoppers across the region.

Asia-Pacific

Asia-Pacific captured 24.3% market share in 2024 and is the fastest-growing region in the Sleeve Rubber Stoppers market. Rapid expansion of pharmaceutical manufacturing in China, India, South Korea, and Japan is a key growth driver. Increasing domestic production of injectables, vaccines, and generics, supported by government initiatives, fuels demand for reliable packaging components. Rising healthcare expenditure and growth of biotechnology research further strengthen the market. Cost-effective manufacturing and growing export-oriented pharmaceutical production attract global packaging suppliers, positioning Asia-Pacific as a critical growth hub for sleeve rubber stopper manufacturers.

Latin America

Latin America held 7.1% of the Sleeve Rubber Stoppers market in 2024, driven by expanding pharmaceutical production in Brazil, Mexico, and Argentina. Increasing demand for injectable drugs, improving healthcare infrastructure, and rising government support for local drug manufacturing contribute to regional growth. Multinational pharmaceutical companies are strengthening their presence through regional manufacturing and partnerships, increasing demand for compliant packaging components. Although the market remains smaller compared to developed regions, improving regulatory frameworks and rising investments in vaccine and biologics production are expected to support steady growth.

Middle East & Africa

The Middle East & Africa region accounted for 5.2% market share in 2024, supported by gradual expansion of pharmaceutical manufacturing and healthcare infrastructure. Countries such as Saudi Arabia, the UAE, and South Africa are investing in domestic drug production to reduce import dependence. Growing vaccination programs and rising demand for injectable therapies drive the need for secure closure systems. While market penetration remains moderate, improving regulatory alignment and foreign investment in pharmaceutical facilities are creating new opportunities. Long-term growth is supported by healthcare modernization initiatives and increasing focus on local pharmaceutical self-sufficiency.

Market Segmentations:

By Product Type

- Butyl Rubber

- EPDM Rubber

- Natural Rubber

- Silicone Rubber

- Others

By Application

- Pharmaceuticals

- Biotechnology

- Chemical Industry

- Food and Beverage

- Others

By End-User

- Pharmaceutical Companies

- Research Laboratories

- Chemical Manufacturers

- Food and Beverage Companies

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The Sleeve Rubber Stoppers market features a consolidated competitive landscape characterized by the presence of established pharmaceutical packaging and elastomer manufacturers with strong global footprints. Key players such as West Pharmaceutical Services, Inc., AptarGroup, Inc., Datwyler Holding Inc., Nipro Corporation, Saint-Gobain Performance Plastics, DWK Life Sciences GmbH, and VWR International, LLC focus on delivering high-purity, regulatory-compliant stopper solutions for injectable and biologic drug applications. These companies emphasize material innovation, coated elastomer technologies, and stringent quality assurance to meet evolving pharmaceutical standards. Strategic investments in cleanroom manufacturing, capacity expansion, and long-term supply agreements with pharmaceutical companies strengthen market positioning. Regional players such as Jiangsu Best New Medical Material Co., Ltd. and Shandong Pharmaceutical Glass Co., Ltd. enhance competition through cost-efficient production and strong domestic presence. Continuous product customization and global expansion remain central to sustaining market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Aptar Pharma continued its global expansion by opening a new expanded R&D Center in Le Vaudreuil and Val-de-Reuil, France enhancing its research and development capabilities for innovative drug delivery solutions, including rubber stoppers and related injectable packaging components.

- In July 2025, Aptar Pharma acquired the clinical trial materials manufacturing capabilities of Mod3 Pharma, strengthening its service offerings across formulation, fill-finish, and material science solutions that support early-stage drug programs a strategic step that can enhance its broader rubber closure and stopper product ecosystem.

- In January 2025, West Pharmaceutical Services introduced Daikyo PLASCAP® Ready-to-Use Validated (RUV) closures in a new nested format, a product offering that integrates vial closures with an integrated stopper solution showcased at Pharmapack and designed to support advanced therapy containment needs.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Sleeve Rubber Stoppers market will experience steady demand supported by continued growth in injectable and parenteral drug production.

- Expansion of biologics, biosimilars, and vaccine pipelines will increase the need for high-performance and contamination-free closure systems.

- Pharmaceutical companies will increasingly adopt high-purity and coated rubber stoppers to minimize extractables and leachables.

- Regulatory emphasis on container-closure integrity will strengthen long-term demand for validated and compliant stopper solutions.

- Growth in prefilled syringes and ready-to-use vial systems will support wider adoption of sleeve rubber stoppers.

- Asia-Pacific will remain the fastest-growing region due to expanding pharmaceutical manufacturing capacity and export-oriented production.

- Manufacturers will invest in advanced materials, automation, and cleanroom facilities to enhance product consistency and scalability.

- Strategic collaborations between stopper suppliers and pharmaceutical companies will increase for customized packaging solutions.

- Sustainability initiatives will encourage the development of eco-friendly and recyclable elastomer formulations.

- Competitive intensity will increase as regional players expand globally while established companies focus on innovation and quality leadership.