Market Overview

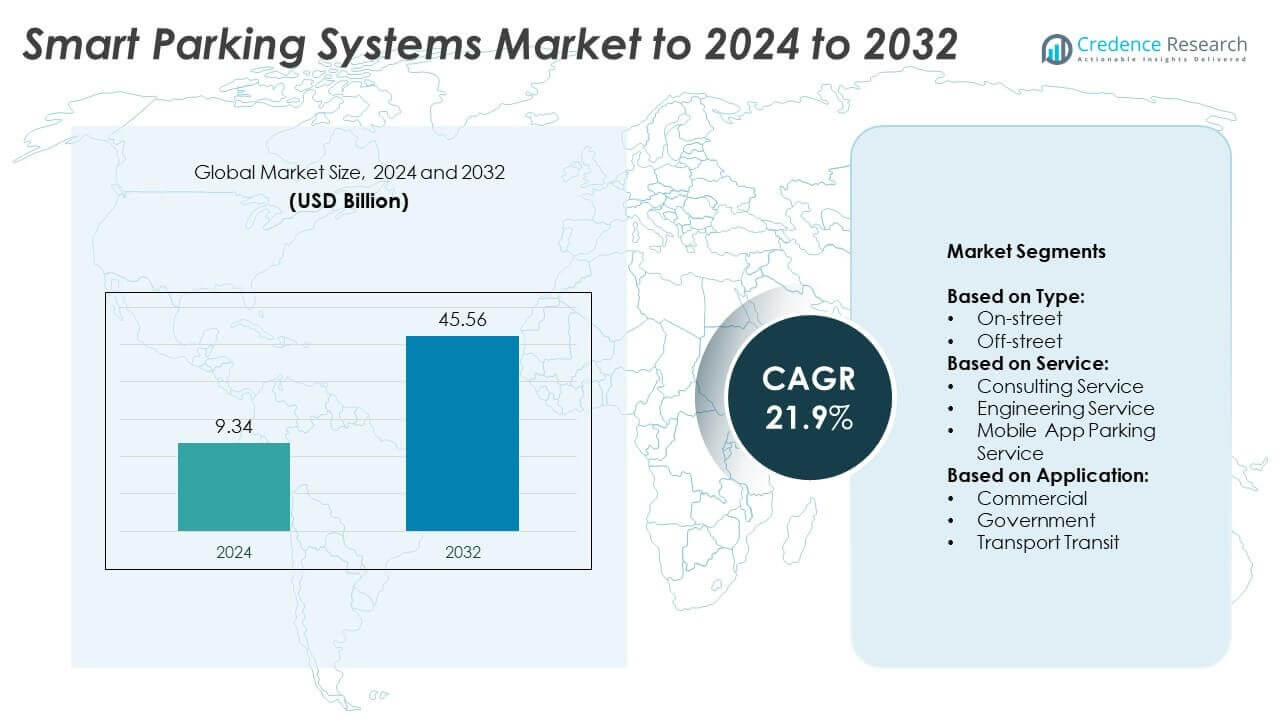

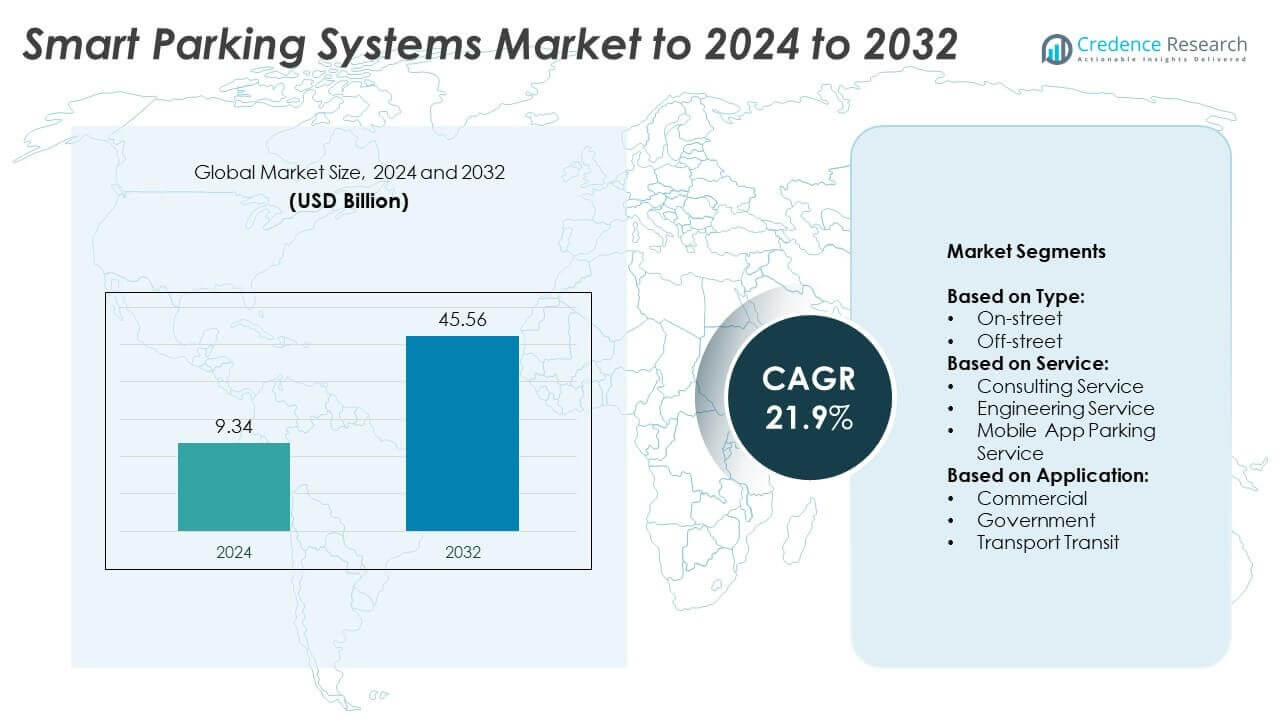

Smart Parking Systems Market size was valued USD 9.34 billion in 2024 and is anticipated to reach USD 45.56 billion by 2032, at a CAGR of 21.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Parking Systems Market Size 2024 |

USD 9.34 Billion |

| Smart Parking Systems Market, CAGR |

21.9% |

| Smart Parking Systems Market Size 2032 |

USD 45.56 Billion |

The smart parking systems market is shaped by leading players including Flowbird, BMW AG (ParkNow GmbH, Parkmobile LLC), Amano McGann, Inc., gtechna, Amco S.A., Cisco Systems, Inc., CivicSmart, Inc., Altiux Innovations, Deteq Solutions, Continental, and Park+. These companies drive growth through IoT-enabled platforms, mobile app services, and integration with electric vehicle charging infrastructure. Strategic partnerships with municipalities and private operators strengthen their presence in urban mobility ecosystems. Regionally, North America commanded the largest share at 35% in 2024, supported by advanced infrastructure, strong adoption of smart city projects, and high vehicle ownership, making it the leading market for smart parking solutions.

Market Insights

- The smart parking systems market was valued at USD 9.34 billion in 2024 and is projected to reach USD 45.56 billion by 2032, expanding at a CAGR of 21.9%.

- Rising urbanization, growing vehicle ownership, and government-backed smart city programs are driving strong adoption of smart parking solutions across developed and developing regions.

- Key trends include integration with electric vehicle charging infrastructure, growth of mobile app-based services, and deployment of IoT and AI technologies for real-time parking management.

- The market is highly competitive, with global players focusing on strategic partnerships, advanced digital platforms, and secure cloud-based solutions to strengthen their market presence.

- North America led with 35% share in 2024, followed by Europe at 28% and Asia Pacific at 25%; the off-street segment dominated with over 65% share, supported by large-scale deployments in airports, malls, and commercial complexes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The off-street segment dominated the smart parking systems market in 2024, holding over 65% share. This dominance comes from large deployments in shopping malls, airports, and corporate complexes where structured parking facilities are essential. Rising urbanization and the expansion of multi-level parking garages support demand for off-street solutions. Off-street systems enable better monitoring through sensors and automation, which reduces congestion and improves space utilization. Increasing investments in integrated payment systems and real-time availability tracking further fuel adoption, while on-street solutions continue gaining traction in smart city initiatives.

- For instance, in 2022 ParkMobile processed 113 million transactions, up 33 % from 2021.

By Service

Mobile app parking services led the market, capturing more than 50% share in 2024. The rapid rise of smartphone penetration and preference for digital convenience are primary drivers. Mobile apps provide real-time parking availability, secure payment options, and navigation support, enhancing user experience. These services are widely adopted in urban centers and transit hubs where instant information is crucial. Engineering services remain significant in system design and infrastructure integration, while consulting services add value through strategic planning. However, the scalability and user-friendliness of mobile app services ensure their market leadership.

- For instance, the city of Nice has engaged in smart mobility initiatives, including a project with Urbiotica to improve parking management. In a case study involving a “pay-per-place” system, 4,500 Urbiotica U-Spot sensors and 570 kiosks were deployed in Nice.

By Application

The commercial segment accounted for the largest share, exceeding 55% in 2024. Shopping malls, office complexes, and entertainment centers rely heavily on smart parking to manage high vehicle inflows. Rising demand for seamless customer experiences and reduced waiting times supports adoption. Commercial operators invest in advanced systems that integrate automated billing, occupancy sensors, and license plate recognition to maximize revenue and efficiency. Government initiatives remain vital in deploying smart parking for urban planning, while transport transit applications grow rapidly due to smart mobility projects, but commercial remains the most dominant application area.

Key Growth Drivers

Rapid Urbanization and Rising Vehicle Ownership

The growth of urban populations and increasing vehicle ownership remain the strongest driver for smart parking systems. Congested cities face critical challenges in managing limited parking spaces. Smart systems optimize space utilization through automation, sensors, and real-time tracking. Growing adoption in metropolitan areas is supported by smart city initiatives, especially in North America and Asia Pacific. Municipal bodies and private developers invest heavily in digital infrastructure, making urbanization and vehicle growth a key growth driver for sustained adoption.

- For instance, the United Nations reported that over half (55%) of the global population lived in urban areas in 2022, a figure projected to rise to 70% by 2050.

Government Initiatives and Smart City Programs

Government-backed smart city programs significantly fuel demand for smart parking systems. Investments in intelligent transport systems, sustainability targets, and emissions reduction policies encourage adoption. Cities deploy connected parking infrastructure to reduce traffic congestion and improve air quality. Programs in Europe and Asia emphasize digital parking solutions integrated with broader mobility frameworks. Subsidies and public-private partnerships further accelerate implementation, highlighting government support as a key growth driver for smart parking adoption worldwide.

- For instance, India’s Smart Cities Mission, which aimed to develop 100 cities, had completed 94% of its 8,067 sanctioned projects by May 9, 2025. The total investment for these projects amounted to approximately ₹1,64,368 crore, encompassing various funding sources.

Advancements in IoT and Connected Technologies

Integration of IoT, AI, and cloud-based platforms in parking solutions drives innovation and scalability. IoT-enabled sensors provide real-time occupancy data, while AI supports predictive analytics for demand forecasting. Mobile app integration enhances customer experience with secure payments and navigation features. Cloud connectivity allows seamless integration with urban mobility platforms and EV charging infrastructure. These advancements improve operational efficiency and revenue generation, making technological innovation a key growth driver in the smart parking systems market.

Key Trends & Opportunities

Integration with Electric Vehicle (EV) Ecosystems

The rising adoption of electric vehicles creates opportunities for EV-integrated parking systems. Smart parking spaces equipped with EV charging stations cater to growing consumer demand for convenience and sustainability. Governments and private players are increasingly collaborating to install charging-enabled smart parking infrastructure. This integration not only meets EV owner needs but also supports environmental goals. Expanding EV infrastructure within parking systems represents a major trend and opportunity for long-term market expansion.

- For instance, Smart Parking (NZ / UK / Australia) deployed over 50,000 sensors globally to power real-time analytics in parking systems

Expansion of Mobility-as-a-Service (MaaS) Platforms

Smart parking systems are increasingly integrated into MaaS platforms, providing seamless end-to-end mobility solutions. Users can book parking slots in advance through mobile applications linked to ride-sharing and public transport networks. This integration reduces last-mile connectivity challenges while enhancing customer convenience. As cities push for connected mobility ecosystems, the adoption of MaaS-enabled parking services grows. This expansion of MaaS integration highlights a key trend and opportunity for the market’s future growth.

- For instance, eleven-x installed 4,200 SPS-X smart parking sensors in Arlington County, Virginia, across two corridors.

Key Challenges

High Implementation and Maintenance Costs

The high capital investment required for deploying smart parking infrastructure remains a major barrier. Installation of IoT sensors, automation systems, and connectivity solutions demands significant funding, which limits adoption in developing economies. Furthermore, ongoing costs related to system upgrades, maintenance, and data security add to operational expenses. For smaller operators, these financial challenges hinder large-scale deployment. Thus, high costs act as a key challenge in expanding smart parking solutions globally.

Data Privacy and Security Concerns

Smart parking systems depend heavily on connected devices, cloud platforms, and mobile applications. This reliance increases risks of cyberattacks, unauthorized access, and misuse of user data. Growing concerns about privacy and security compliance create hesitation among end-users and governments. Ensuring secure communication, encrypted payments, and data protection requires continuous investment in cybersecurity measures. Without addressing these risks, consumer trust could be undermined. Data privacy and security therefore represent a key challenge for market scalability.

Regional Analysis

North America

North America led the smart parking systems market with a 35% share in 2024. The region benefits from advanced infrastructure, early technology adoption, and strong government initiatives supporting smart city projects. The United States drives most demand, with large-scale deployments in metropolitan areas and airports. High vehicle ownership and increasing congestion in urban centers encourage investment in off-street and mobile app-based parking systems. Public-private partnerships and integration of EV charging infrastructure further strengthen market growth, positioning North America as a leading region in the adoption of advanced smart parking technologies.

Europe

Europe accounted for 28% of the smart parking systems market in 2024. The region’s leadership in sustainable mobility and stringent environmental regulations drive adoption of connected parking systems. Countries such as Germany, the UK, and France invest heavily in smart city infrastructure, supporting digital solutions for traffic management and emissions reduction. High urban density and advanced automotive sectors encourage demand for integrated parking technologies. Integration with electric vehicle charging infrastructure is a notable trend, as Europe accelerates toward green mobility targets. The region remains a strong contributor to global adoption of smart parking solutions.

Asia Pacific

Asia Pacific held a 25% share of the smart parking systems market in 2024. Rapid urbanization, growing middle-class populations, and high vehicle ownership rates drive strong demand. Countries such as China, Japan, and India lead adoption with large-scale smart city initiatives and government-backed investments. Rising congestion in mega-cities accelerates the need for mobile app-based parking services and IoT-enabled monitoring systems. Technology providers expand aggressively across the region, leveraging high smartphone penetration. With increasing EV adoption and infrastructure development, Asia Pacific emerges as one of the fastest-growing regions for smart parking systems deployment.

Latin America

Latin America captured a 7% share of the smart parking systems market in 2024. The region’s growth is supported by urban expansion and traffic congestion in cities such as São Paulo, Mexico City, and Buenos Aires. Governments and private operators invest in mobile app parking services and off-street solutions to improve efficiency. Limited budgets and infrastructure gaps, however, restrict large-scale deployments. Brazil and Mexico dominate regional adoption, driven by growing demand for digital mobility solutions. Despite challenges, Latin America presents opportunities for future smart parking growth through gradual infrastructure modernization and smart city initiatives.

Middle East and Africa

The Middle East and Africa represented 5% of the smart parking systems market in 2024. Gulf countries such as the UAE and Saudi Arabia invest heavily in smart city development and digital mobility platforms. Projects in Dubai and Riyadh include smart parking as part of broader urban innovation strategies. Africa’s adoption is slower due to infrastructure limitations, though South Africa shows early initiatives in connected mobility. Integration with EV infrastructure and tourism-driven demand in Gulf nations create growth opportunities. Although holding a smaller share, the region shows potential for gradual expansion in smart parking systems.

Market Segmentations:

By Type:

By Service:

- Consulting Service

- Engineering Service

- Mobile App Parking Service

By Application:

- Commercial

- Government

- Transport Transit

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The smart parking systems market is highly competitive, with leading players such as Flowbird, BMW AG (ParkNow GmbH, Parkmobile LLC), Amano McGann, Inc., gtechna, Amco S.A., Cisco Systems, Inc., CivicSmart, Inc., Altiux Innovations, Deteq Solutions, Continental, and Park+ actively shaping the landscape. Companies focus on expanding product portfolios through advanced IoT-enabled solutions, mobile app-based services, and integration with electric vehicle charging infrastructure. Strategic collaborations with city authorities and private operators are common to strengthen presence in urban centers. Continuous investment in artificial intelligence and cloud platforms enhances predictive analytics, improving operational efficiency and user convenience. Firms are also prioritizing data security and scalable architectures to address growing concerns around privacy and system reliability. Emerging markets present opportunities for expansion, prompting vendors to adopt localized strategies. The competition is further intensified by rising government-backed smart city projects, encouraging innovation and differentiation in offerings to maintain market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Flowbird

- BMW AG (ParkNow GmbH, Parkmobile LLC)

- Amano McGann, Inc.

- gtechna

- Amco S.A.

- Cisco Systems, Inc.

- CivicSmart, Inc.

- Altiux Innovations

- Deteq Solutions

- Continental

- Park+

Recent Developments

- In 2025, Continental presented a window projection solution for parked vehicles At CES 2025. This technology can display information like a car’s charging level on its windows, helping drivers identify available EV spots.

- In 2025, Flowbird announced that it would become part of the EasyPark family in Sweden. This move merged Flowbird’s hardware and services with EasyPark’s app, offering customers a wider array of digital parking and mobility services.

- In 2023, Park+ partnered with Airtel Payments Bank to launch a FASTag-based smart parking solution at Varanasi’s Lal Bahadur Shastri Airport in India.

Report Coverage

The research report offers an in-depth analysis based on Type, Service, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The smart parking systems market will expand rapidly with increasing smart city initiatives.

- Rising urbanization will continue to drive demand for off-street parking solutions.

- Mobile app-based services will gain dominance due to high smartphone penetration.

- Integration with electric vehicle charging will become a standard feature.

- Artificial intelligence and IoT will enhance predictive analytics for parking demand.

- Government policies on reducing congestion will support large-scale deployments.

- Public-private partnerships will accelerate infrastructure investment in key cities.

- Data security and privacy will remain critical areas of innovation.

- Emerging economies will adopt smart parking as urban infrastructure improves.

- Seamless integration with mobility-as-a-service platforms will create new growth opportunities.