| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Soil Moisture Sensor Market Size 2024 |

USD421.24 Million |

| Soil Moisture Sensor Market, CAGR |

14.68% |

| Soil Moisture Sensor Market Size 2032 |

USD 1,254.07 Million |

Market Overview:

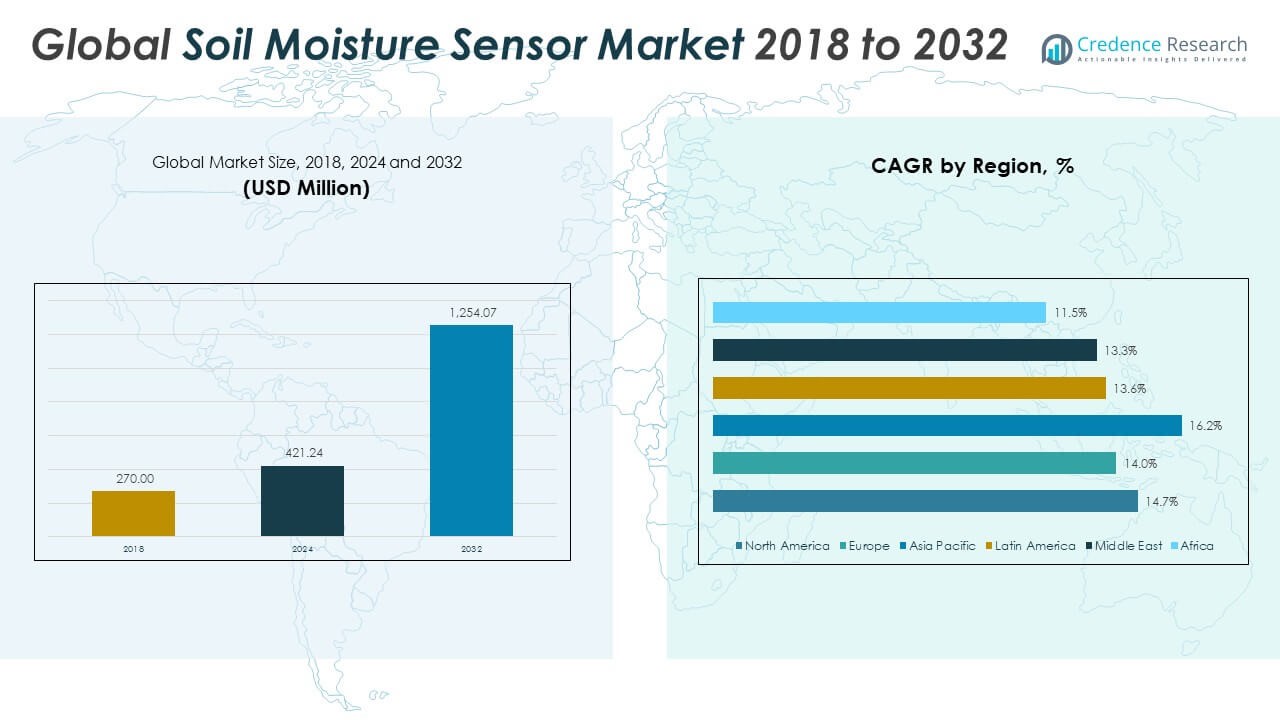

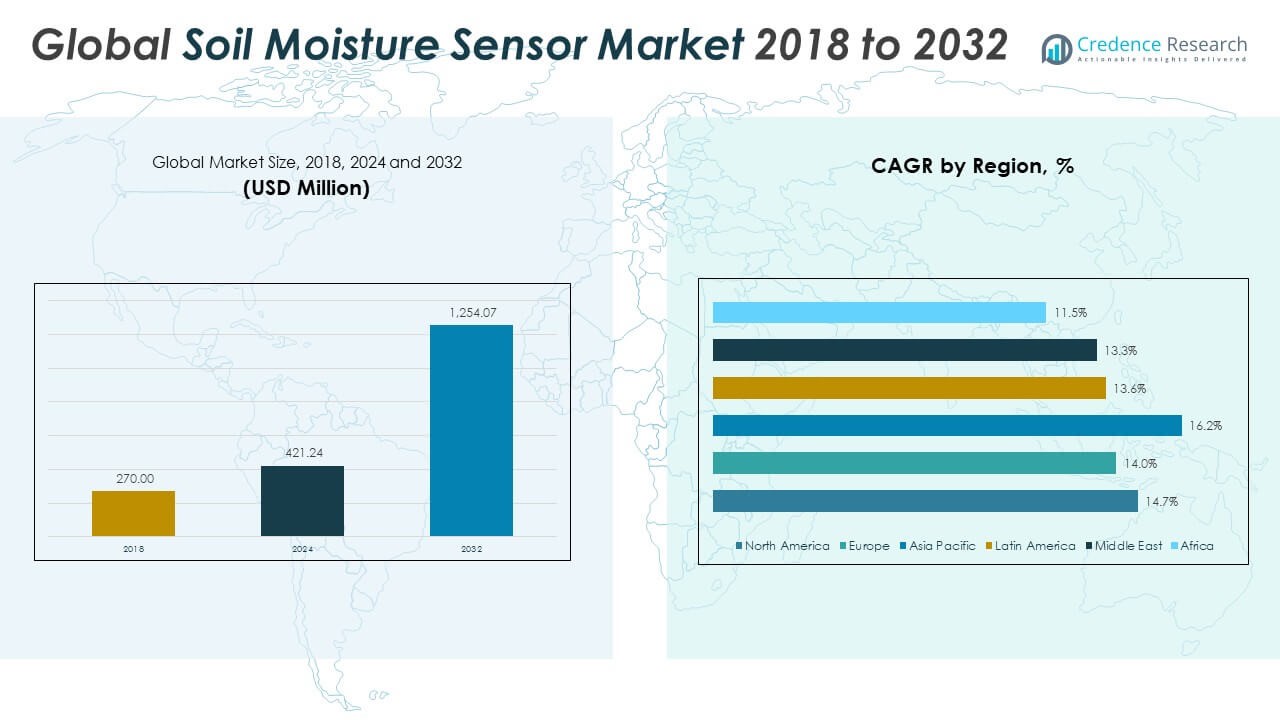

The Global Soil Moisture Sensor Market size was valued at USD 270.00 million in 2018 to USD 421.24 million in 2024 and is anticipated to reach USD 1,254.07 million by 2032, at a CAGR of 14.68% during the forecast period.

The primary growth driver for the soil moisture sensor market is the widespread adoption of precision agriculture techniques, which rely on data-driven decisions to maximize crop yield and resource efficiency. Farmers are increasingly deploying soil moisture sensors to monitor real-time soil conditions, allowing for optimized irrigation scheduling and reduced water waste. These technologies help conserve water, lower energy use, and improve crop productivity, aligning with global sustainability goals. The integration of IoT, wireless communication, and cloud-based data platforms is making sensor systems more accessible, scalable, and user-friendly. This has resulted in broader acceptance not only among large-scale commercial farms but also among small and medium-scale growers. In addition, climate change has elevated concerns about water scarcity and erratic weather patterns, compelling governments and regulatory bodies to promote smart irrigation systems through subsidies and policy incentives. Other contributing factors include the rising cost of freshwater, increasing awareness of soil health, and growing use of remote sensing technologies in environmental and scientific applications.

From a regional standpoint, North America holds the largest market share. The region benefits from early adoption of precision agriculture, strong government support for sustainable farming practices, and a well-established agricultural technology infrastructure. The United States leads within North America due to high awareness levels and the presence of leading manufacturers. Europe follows as the second-largest market, driven by strict environmental regulations, active promotion of smart irrigation, and expanding use of sensors in commercial landscaping and sports turf management. The Asia Pacific region represents the fastest-growing market segment, fueled by rising food security concerns, expanding agricultural modernization programs, and increasing deployment of affordable sensor technologies in countries such as India, China, Japan, and Australia. Rapid urbanization, coupled with government-funded initiatives focused on water management and climate resilience, is accelerating adoption across Southeast Asia. Latin America is also witnessing steady growth as precision farming begins to gain momentum in countries like Brazil and Argentina. Meanwhile, the Middle East and Africa are emerging markets where soil moisture sensors are gaining traction in arid regions for water conservation and efficient irrigation of high-value crops.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Insights:

- The Global Soil Moisture Sensor market was valued at USD 270.00 million in 2018, reached USD 421.24 million in 2024, and is projected to hit USD 1,254.07 million by 2032, growing at a CAGR of 14.68%.

- Precision agriculture is the primary growth driver, with farmers using sensors to optimize irrigation, improve yields, and conserve water.

- Government incentives and smart farming programs in the U.S., EU, China, and India are expanding adoption, especially among small and mid-sized farms.

- Integration with IoT, wireless networks, and cloud platforms enhances sensor utility, enabling real-time monitoring and remote farm management.

- Non-agricultural sectors such as landscaping, sports turf, and urban infrastructure are increasingly adopting soil moisture sensors for efficient water use.

- High initial costs, limited technical support, and weak distribution networks challenge adoption in smallholder and rural markets.

- North America leads in market share, while Asia Pacific is the fastest-growing region due to rising food demand and government-backed agricultural modernization.

Market Drivers:

Rising Global Water Scarcity Accelerates Smart Irrigation Adoption:

The increasing pressure on global water resources has made water conservation a top priority across agricultural economies. Soil moisture sensors play a critical role in monitoring water levels and enabling optimized irrigation scheduling. Farmers and irrigation managers now prioritize efficient water usage due to declining water tables and stricter regulations. The Global Soil Moisture Sensor Market is gaining momentum as it addresses these challenges with precision-based technologies. These sensors help reduce over-irrigation, minimize water runoff, and improve crop yields. Their deployment also supports national water conservation programs in both developed and developing regions.

- For instance, The Toro Company reported that its Precision Soil Sensor technology helped reduce water usage by over 30 million gallons annually across commercial agricultural deployments in 2023, directly supporting large-scale water conservation efforts.

Government Subsidies and Agricultural Digitalization Stimulate Demand:

Public policies are directly encouraging the integration of digital technologies in farming. Government subsidies, incentive programs, and research initiatives support sensor adoption, especially among small and mid-sized farms. Smart agriculture initiatives in the U.S., EU, China, and India include funding provisions for soil monitoring systems. The Global Soil Moisture Sensor Market benefits from this institutional backing, which lowers the adoption barrier and drives awareness. National agricultural extension services also promote these technologies through training and demonstration projects. These coordinated efforts strengthen market penetration at the ground level.

- For instance, in 2022, the U.S. Department of Agriculture awarded $10 million in grants to support the deployment of soil moisture sensors and related digital technologies on more than 500,000 acres of farmland, benefiting thousands of small and medium-sized farms nationwide.

Growing Use of Sensor Data in Agri-Decision Platforms:

The integration of soil moisture sensors with cloud platforms and farm management software is expanding. Data collected through these sensors is now part of broader analytics used for decision-making in crop planning, irrigation timing, and input application. The Global Soil Moisture Sensor Market benefits from this ecosystem approach, where real-time insights support yield optimization. The compatibility of sensors with GPS, drones, and weather stations has made them integral to smart farm operations. This shift toward data-driven agriculture is transforming how land is managed and monitored. The trend continues to push demand for interconnected, accurate sensing solutions.

Increased Commercial Landscaping and Sports Turf Management Use:

Outside agriculture, commercial and institutional users are also adopting soil moisture sensors. Facilities managing golf courses, parks, stadiums, and public landscapes are deploying sensors to ensure efficient irrigation and turf health. The Global Soil Moisture Sensor Market is seeing a surge in demand from urban landscaping managers seeking sustainability and reduced water bills. Public utilities and city governments are using sensor-based solutions in smart city frameworks. These applications highlight the technology’s adaptability and help broaden the customer base. The demand from non-agricultural sectors contributes meaningfully to revenue diversification.

Market Trends:

Integration of Wireless and Low-Power Connectivity Technologies:

Manufacturers are embedding Bluetooth, LoRaWAN, Zigbee, and cellular modules into soil moisture sensors. These wireless technologies enable real-time data transmission across wide farm areas. The Global Soil Moisture Sensor Market is aligning with the broader IoT trend to offer scalable and remotely manageable solutions. Battery-powered sensors with long lifespans are now in high demand among users managing vast agricultural fields. Low-power, wide-area networks are especially useful in remote and rugged environments. This shift enhances deployment flexibility and operational reliability.

- For instance, Sentek Technologies launched its Drill & Drop Bluetooth soil moisture probe in 2023, enabling wireless data collection across over 1,000 hectares of Australian farmland, with battery life exceeding 5 years per unit.

Emergence of Subscription-Based Sensor-as-a-Service Models:

Companies are introducing subscription and leasing models to ease adoption costs and expand customer access. These service models bundle hardware, cloud access, data analytics, and technical support. The Global Soil Moisture Sensor Market is gradually moving toward recurring revenue streams as hardware commoditization increases. Farmers and municipalities prefer predictable costs and maintenance-free usage. This model supports long-term relationships between manufacturers and end users. It also enables real-time system upgrades and monitoring.

- For instance, CropX Technologies reported in 2024 that over 10,000 farms globally had adopted its subscription-based soil sensor service, which includes hardware, analytics, and remote support, resulting in more than 1 million acres under active soil moisture monitoring.

Miniaturization and Custom Sensor Form Factors for Niche Crops:

Vendors are investing in compact, crop-specific sensors that suit diverse soil depths and types. The Global Soil Moisture Sensor Market is expanding into vineyards, orchards, greenhouses, and vertical farms that require precision at plant level. Miniaturized sensors provide detailed root-zone data, which is critical for crops with specific moisture needs. Custom calibration for soil texture and salinity is becoming standard in advanced offerings. This customization improves accuracy and market relevance across crop types. It also drives adoption in specialty and high-value agricultural operations.

Increased Focus on Data Analytics and Predictive Modeling Integration:

Sensor data is being combined with AI-driven analytics to forecast irrigation needs and detect anomalies. The Global Soil Moisture Sensor Market is evolving into a data intelligence market, where raw readings are processed into actionable insights. Predictive models guide decisions under changing weather or crop growth phases. Real-time dashboards and mobile interfaces now deliver updates to users in the field. This trend reflects the industry’s focus on decision support rather than just data collection. The emphasis is on productivity, efficiency, and automation.

Market Challenges Analysis:

High Upfront Costs and Limited Access Among Small Farmers:

Despite the long-term benefits, initial hardware and setup costs remain a barrier to adoption for smallholders. Many farmers in emerging economies find sensor solutions financially out of reach without subsidies or cooperative programs. The Global Soil Moisture Sensor Market faces resistance in regions with low digital penetration or weak support infrastructure. Limited access to training and after-sales service further slows adoption in remote rural areas. High import duties or inconsistent distribution networks also contribute to cost inefficiencies. Without targeted financial interventions, the market may struggle to reach its full potential in key agricultural regions.

Sensor Accuracy Limitations and Data Calibration Issues:

Field performance of soil moisture sensors can vary significantly across soil types, weather conditions, and calibration settings. The Global Soil Moisture Sensor Market must address concerns related to inconsistent readings and misinterpretation of data. End users often require technical expertise to configure sensors for specific soil textures, compaction levels, or salinity. Errors in data interpretation can lead to incorrect irrigation decisions, negating potential efficiency gains. Maintenance challenges, such as sensor fouling or battery failure, add to reliability concerns. These technical limitations need improvement to build confidence and sustain market growth.

Market Opportunities:

Rising Adoption of Climate-Smart Agriculture Globally:

Sustainability commitments are pushing governments and agribusinesses to invest in technologies that optimize inputs and reduce environmental footprints. The Global Soil Moisture Sensor Market stands to gain from rising demand for precision tools that support carbon reduction and climate adaptation goals. Large farming groups, cooperatives, and export-oriented producers are adopting soil monitoring systems as part of ESG compliance frameworks. These shifts create multi-country growth opportunities.

Expansion Potential in Non-Agricultural Smart Infrastructure Projects:

Smart city programs are integrating environmental monitoring tools into water management systems, public landscaping, and urban farming. The Global Soil Moisture Sensor Market could scale rapidly if city planners, utilities, and public agencies continue to embed sensors in infrastructure projects. These applications extend market reach beyond agriculture into urban technology ecosystems.

Market Segmentation Analysis:

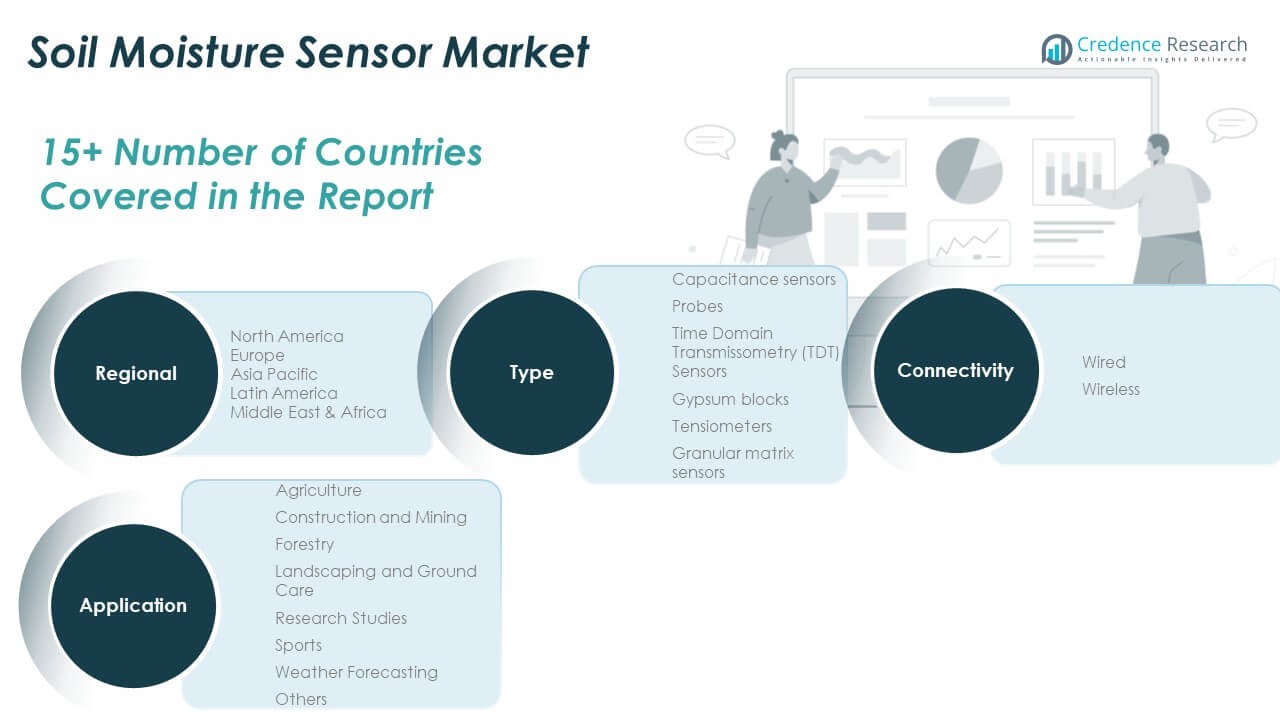

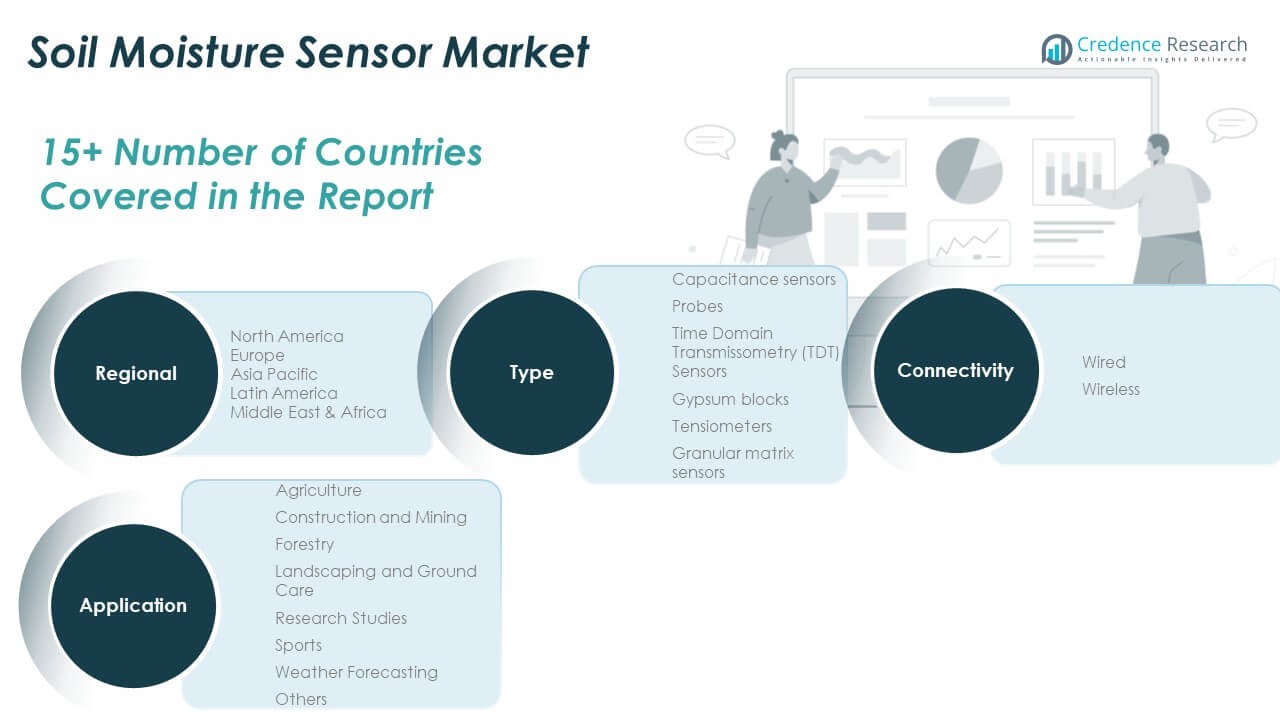

By Type

The Global Soil Moisture Sensor Market includes six major sensor types. Capacitance sensors lead the segment due to their low cost, digital compatibility, and ease of integration. Probes are widely used in precision farming to assess moisture levels directly in the root zone. Time Domain Transmissometry (TDT) sensors are preferred in high-accuracy applications like academic research and advanced farming systems. Gypsum blocks and tensiometers continue to serve traditional irrigation management needs. Granular matrix sensors are valued for their stability in long-term field deployments and soil variability studies.

- For instance, METER Group reported shipping over 50,000 capacitance-based soil moisture sensors in 2023, supporting precision agriculture projects in more than 80 countries.

By Application

Agriculture holds the largest share in the Global Soil Moisture Sensor Market, driven by rising demand for water-efficient farming. Construction and mining use these sensors to assess ground moisture for structural safety and excavation planning. Forestry applies them for ecosystem monitoring and climate impact assessments. Landscaping and ground care segments adopt sensors to optimize irrigation in parks, golf courses, and lawns. Research institutions use sensors for soil science and environmental studies. Sports field management deploys them to maintain optimal turf conditions. Other applications include controlled environments like greenhouses and vertical farms.

- For instance, Agriculture remains the largest application segment, with more than 60% of total demand for soil moisture sensors. These sensors are also increasingly used in construction, environmental monitoring, landscaping, and sports turf management.

By Connectivity

The market is segmented into wired and wireless systems. Wired sensors are preferred for their reliability and cost-effectiveness in fixed setups. Wireless sensors are gaining popularity due to ease of installation, scalability, and real-time monitoring capabilities. The Global Soil Moisture Sensor Market is shifting toward wireless solutions integrated with IoT platforms, especially in large-scale agricultural operations and remote monitoring scenarios.

Segmentation:

By Type

- Capacitance Sensors

- Probes

- Time Domain Transmissometry (TDT) Sensors

- Gypsum Blocks

- Tensiometers

- Granular Matrix Sensors

By Application

- Agriculture

- Construction and Mining

- Forestry

- Landscaping and Ground Care

- Research Studies

- Sports

- Weather Forecasting

- Others

By Connectivity

By Region

- North America

- Europe

- UK, France, Germany, Italy, Spain, Russia, Rest of Europe

- Asia Pacific

- China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific

- Latin America

- Brazil, Argentina, Rest of Latin America

- Middle East

- GCC Countries, Israel, Turkey, Rest of Middle East

- Africa

- South Africa, Egypt, Rest of Africa

Regional Analysis:

North America

The North America Soil Moisture Sensor Market size was valued at USD 101.20 million in 2018 to USD 156.02 million in 2024 and is anticipated to reach USD 463.88 million by 2032, at a CAGR of 14.7% during the forecast period. North America holds the largest market share, contributing nearly 37% of global revenue in 2024. The region benefits from early adoption of precision agriculture and strong policy support for sustainable irrigation. The United States leads regional demand with advanced infrastructure and established agri-tech players. Farm cooperatives, state incentives, and water-use regulations support deployment. It maintains leadership through innovation, research, and strong manufacturer presence.

Europe

The Europe Soil Moisture Sensor Market size was valued at USD 77.63 million in 2018 to USD 116.80 million in 2024 and is anticipated to reach USD 330.14 million by 2032, at a CAGR of 14.0% during the forecast period. Europe accounts for about 28% of global share. Strict environmental regulations and strong emphasis on resource efficiency are key market drivers. Countries such as Germany, France, and the Netherlands promote sensor adoption through public funding and research programs. Demand spans both agriculture and landscaping. It benefits from high awareness, structured subsidy systems, and climate-smart agricultural policy alignment.

Asia Pacific

The Asia Pacific Soil Moisture Sensor Market size was valued at USD 59.67 million in 2018 to USD 97.66 million in 2024 and is anticipated to reach USD 323.93 million by 2032, at a CAGR of 16.2% during the forecast period. Asia Pacific is the fastest-growing region, with 23% market share in 2024. Agricultural modernization in India, China, and Southeast Asia is increasing demand. National water-use optimization programs and smart farming initiatives drive growth. Affordable sensor offerings and mobile integration support rural deployment. It presents strong long-term growth opportunities across both developed and developing markets.

Latin America

The Latin America Soil Moisture Sensor Market size was valued at USD 16.47 million in 2018 to USD 25.44 million in 2024 and is anticipated to reach USD 70.06 million by 2032, at a CAGR of 13.6% during the forecast period. Latin America contributes around 6% of global revenue. Brazil and Argentina lead in adopting soil moisture sensors across large farms. Growing awareness of irrigation efficiency is creating demand. Regional governments support pilot programs to improve water conservation. It is gradually strengthening distribution and training networks to support broader uptake.

Middle East

The Middle East Soil Moisture Sensor Market size was valued at USD 10.50 million in 2018 to USD 15.37 million in 2024 and is anticipated to reach USD 41.39 million by 2032, at a CAGR of 13.3% during the forecast period. The Middle East holds about 3.6% market share in 2024. Countries like Israel and the UAE drive innovation in agri-tech due to arid conditions. Sensors are used in high-value crop farming and greenhouse operations. Food security initiatives encourage investment in smart irrigation. It remains a niche market with technology-led demand.

Africa

The Africa Soil Moisture Sensor Market size was valued at USD 4.54 million in 2018 to USD 9.94 million in 2024 and is anticipated to reach USD 24.67 million by 2032, at a CAGR of 11.5% during the forecast period. Africa represents 2.4% of global share but shows emerging potential. NGOs and governments are promoting pilot deployments in drought-prone regions. Limited infrastructure and affordability challenges restrict rapid expansion. Smallholder-focused, mobile-compatible solutions are gaining traction. It remains an early-stage market with long-term opportunity for scalable, cost-effective technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- The Toro Company

- METER Group, Inc. USA

- Campbell Scientific, Inc.

- Stevens Water Monitoring Systems Inc.

- IMKO Micromodultechnik GmbH

- Irrometer Company, Inc.

- Delta-T Devices Ltd

- GroPoint

- Sentek

- Spectrum Technologies, Inc.

- Acclima, Inc.

- Smartrek Technologies Inc.

- Caipos GmbH

- Spiio

- Plaid Systems LLC

Competitive Analysis:

The Global Soil Moisture Sensor Market is highly competitive, with a mix of established players and emerging innovators. Key companies such as The Toro Company, METER Group, Campbell Scientific, and Stevens Water Monitoring Systems lead through diversified product portfolios and strong global distribution networks. It features competition based on sensor accuracy, connectivity options, durability, and integration with IoT platforms. Manufacturers focus on developing cost-effective, wireless, and data-driven solutions tailored for agriculture, landscaping, and environmental monitoring. Smaller firms like Spiio, Acclima, and Caipos GmbH are gaining traction with specialized technologies targeting niche applications. Strategic partnerships, product launches, and regional expansion remain core growth strategies. The market continues to witness innovation in sensor miniaturization, cloud-based analytics, and AI-enabled decision support tools. Competitive intensity is rising with increasing demand from both developed and emerging regions, pushing players to invest in localization, technical support, and adaptive pricing strategies to gain market share.

Recent Developments:

- In March 2024, Campbell Scientific broke ground on an 82,000-square-foot manufacturing facility in Logan, Utah. This expansion, the largest in the company’s history, is set to be completed in late spring 2025 and will significantly increase manufacturing capabilities for environmental sensors and instrumentation. Additionally, in December 2023, Campbell Scientific launched the Aspen™10 IoT Edge Device, designed for seamless sensor-to-cloud connectivity with integrated solar power and cellular data transmission.

- In January 2025, IMKO Micromodultechnik GmbH showcased its TRIME-PICO 32 Soil Moisture Sensor at bauma Munich 2025, a leading international trade fair for construction and environmental technology. The TRIME-PICO 32 is designed for high-precision soil moisture measurement in challenging field conditions.

Market Concentration & Characteristics:

The Global Soil Moisture Sensor Market demonstrates moderate market concentration, with a few dominant players accounting for a significant share while numerous regional and niche firms contribute to competitive diversity. It features a mix of multinational manufacturers and specialized startups focused on precision agriculture and environmental monitoring. The market is characterized by steady innovation, high technical differentiation, and growing demand for wireless, real-time, and IoT-integrated solutions. Product customization, sensor accuracy, and software compatibility remain key purchasing factors. It is price-sensitive in emerging regions but prioritizes performance and reliability in developed markets. Standardization and regulatory support influence product development and adoption patterns.

Report Coverage:

The research report offers an in-depth analysis based on type, application, and connectivity. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for precision agriculture will continue to drive sensor adoption across large and mid-sized farms.

- Advancements in wireless connectivity and IoT integration will expand remote monitoring capabilities.

- Climate change and water scarcity will increase regulatory pressure for efficient irrigation systems.

- Sensor prices are expected to decline, improving accessibility for smallholder and developing-region farmers.

- Public funding and smart farming subsidies will enhance market penetration in Asia, Africa, and Latin America.

- New applications in landscaping, sports turf, and smart cities will diversify end-user segments.

- Integration with AI-driven platforms will enable predictive analytics for soil and crop health.

- Manufacturers will focus on miniaturized, low-power sensors for greenhouse and vertical farming.

- Regional expansion by global players will intensify competition and improve product availability.

- Ongoing partnerships between agri-tech firms and research institutions will accelerate product innovation.