Market Overview

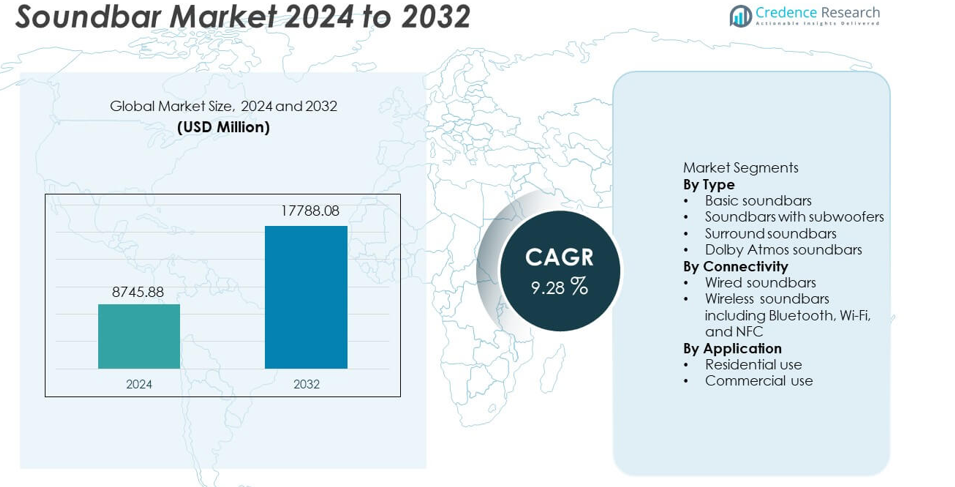

The Soundbar Market reached USD 8,745.88 million in 2024 and is projected to grow to USD 17,788.08 million by 2032, registering a CAGR of 9.28% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Soundbar Market Size 2024 |

USD 8,745.88 million |

| Soundbar Market, CAGR |

9.28% |

| Soundbar Market Size 2032 |

USD 17,788.08 million |

The top players in the Soundbar market include Samsung Electronics, Sony Corporation, Bose Corporation, LG Electronics, Yamaha Corporation, Panasonic Corporation, Vizio Inc., Harman International, JBL, and Philips Electronics, each strengthening their position through advanced audio engineering and smart connectivity features. These companies drive competition with wide product portfolios targeting varied price segments and user needs. Asia Pacific leads the market with a 29% share due to strong smart TV adoption and rising consumer spending, followed by North America with a 33% share supported by high demand for premium entertainment systems. Europe holds a solid 27% share driven by growing preference for wireless and compact audio solutions.

Market Insights

- The market reached USD 8,745.88 million in 2024 and will grow at a CAGR of 9.28 percent through 2032.

- Demand strengthens due to rising home entertainment upgrades and strong interest in immersive audio, with Dolby Atmos soundbars holding a 36 percent share.

- Wireless soundbars gain traction as users prefer seamless connectivity and multi-room audio systems, supported by growing smart TV adoption and digital streaming trends.

- Competition intensifies as global brands expand product portfolios and enhance acoustic performance, while price pressure and compatibility limitations restrain some market segments.

- North America leads with a 33 percent share, followed by Europe at 27 percent and Asia Pacific at 29 percent, while residential applications dominate the market with a 71 percent share supported by higher spending on modern home audio solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Basic soundbars, soundbars with subwoofers, surround soundbars, and Dolby Atmos soundbars shape the market. Dolby Atmos soundbars hold the largest share at 36% due to strong demand for immersive home entertainment. Premium households prefer advanced multi-channel formats, which enhance depth and clarity in compact setups. Growth in streaming platforms supports adoption of cinematic sound systems. Surround soundbars also gain traction as consumers look for easy installation and high audio performance. Entry-level units remain relevant in cost-sensitive regions, but premium formats lead global demand. Rising focus on compact home theatre solutions strengthens this segment’s dominance.

- For instance, Samsung’s HW-Q990C integrates an 11.1.4-channel layout with a 656-watt output and four up-firing drivers, enabling true overhead sound reproduction in compact living rooms.

By Connectivity

Wired and wireless soundbars form the key connectivity categories, with wireless models including Bluetooth, Wi-Fi, and NFC seeing the fastest growth. Wireless soundbars dominate the segment with a 58% share due to the shift toward cable-free home entertainment systems. Users prefer seamless pairing with TVs and smart devices, which supports adoption across urban markets. Wi-Fi soundbars gain traction as multi-room audio and smart home ecosystems expand. Wired units remain stable in institutional settings, but wireless integration remains the primary growth driver. Rapid smart TV penetration further lifts demand for connected soundbars.

- For instance, Sony’s HT-A7000 supports Bluetooth 5.0, dual-band Wi-Fi, and HDMI eARC, while processing audio through a 7.1.2 channel system with built-in beam tweeters and up-firing speakers for stable low-latency wireless playback.

By Application

Residential and commercial use define the application landscape, with residential installations capturing the largest share at 71%. Home entertainment upgrades drive strong adoption as consumers invest in enhanced audio for streaming, gaming, and music. Compact designs and easy setup encourage replacement of traditional speaker systems. Commercial demand rises in hospitality, retail, and office environments where clear audio improves guest engagement and communication. Growth in premium housing and rising disposable incomes reinforce residential dominance. Expanding smart home adoption continues to push demand for integrated sound solutions within living spaces.

Key Growth Drivers

Rising Demand for Immersive Home Entertainment

Growing consumer focus on enhanced home entertainment drives strong adoption of advanced soundbars. Households upgrade viewing setups to match high-resolution TV performance, which boosts demand for richer and more immersive audio output. Compact soundbars replace multi-speaker systems due to easier installation and space savings in modern homes. Increased streaming activity also raises expectations for cinema-like audio experiences. Premium features such as spatial sound, adaptive tuning, and enhanced clarity strengthen appeal across urban markets. These factors position immersive audio demand as a major driver of long-term market expansion.

- For instance, LG’s S95QR soundbar delivers a 9.1.5-channel configuration with five up-firing speakers and a total output of 810 watts, enabling overhead sound mapping and clearer dialogue across large living spaces.

Integration with Smart TVs and Connected Ecosystems

Soundbars gain strong traction as smart TV penetration rises across global markets. Consumers prefer unified entertainment ecosystems where soundbars seamlessly pair with TVs, streaming devices, and voice assistants. Bluetooth and Wi-Fi connectivity support smooth device integration, which improves user convenience. Brands focus on compatibility with major operating systems to enhance cross-device performance. Growing adoption of smart homes increases demand for audio products that fit within automated environments. This alignment between connected ecosystems and audio enhancement fuels steady market growth.

- For instance, Sony’s HT-A5000 supports HDMI eARC, integrates with BRAVIA XR TVs, and uses multiple built-in speakers including up-firing and front-facing drivers to sync TV audio processing with soundbar output.

Product Innovation and Feature Advancement

Manufacturers invest heavily in advanced acoustic technologies to strengthen product value. Features such as virtual surround sound, AI-driven sound optimization, low-latency gaming modes, and enhanced bass systems improve user experience across entertainment formats. Slim and modular designs appeal to space-constrained households and modern interior preferences. Companies expand premium lineups to target consumers seeking high-fidelity audio without complex setups. Continuous innovation supports frequent product refresh cycles and expands adoption across both entry-level and premium segments. These advancements drive strong competitive differentiation in the market.

Key Trends & Opportunities

Expansion of Wireless and Multi-Room Audio Systems

Demand for wireless soundbars continues to rise as users shift away from cable-dependent audio setups. Multi-room functionality supported by Wi-Fi enhances user control and streaming flexibility across different zones in a home. Brands integrate smart assistants to enable hands-free operation and deeper ecosystem engagement. The trend supports strong opportunities for companies offering advanced wireless standards and seamless app-based management. Growth in smart speakers also complements multi-room soundbar adoption. This expanding wireless ecosystem presents a major opportunity for long-term market penetration.

- For instance, the Sonos Arc integrates with the Sonos S2 app, enables synchronized playback across many connected speakers, and uses multiple amplified drivers to deliver room-filling spatial sound.

Growing Adoption in Commercial and Hospitality Environments

Commercial spaces such as hotels, lounges, retail stores, and conference centers adopt soundbars to improve audio clarity and enhance guest experience. Compact designs reduce installation complexity while delivering strong output for presentations and ambient sound use. Hospitality brands invest in modern entertainment systems to support premium room offerings and customer satisfaction. Offices implement soundbars for conferencing and collaborative workspaces. These settings present expanding opportunities as businesses upgrade communication and entertainment infrastructure. This trend broadens soundbar demand beyond residential applications.

- For instance, Bose Professional’s Videobar VB1 integrates six beam-steering microphones, four loudspeakers, and supports USB and HDMI connectivity, enabling clear voice pickup across meeting rooms measuring up to 6 meters in length.

Key Challenges

High Competition and Price Pressure

Intense competition among global and regional brands places significant pressure on pricing strategies. Companies face challenges in balancing innovation with affordability as consumers compare features across similar models. Low-cost alternatives from emerging manufacturers create further strain on premium brands. The rapid pace of product launches also shortens lifecycle value, which affects profitability. Maintaining differentiation through technology upgrades and sound quality becomes essential. These competitive dynamics pose a strong challenge for long-term margin stability.

Compatibility and Performance Limitations Across Devices

Soundbars often face compatibility issues with diverse TV models, streaming devices, and operating systems. Variations in audio codecs, latency levels, and connectivity standards affect user experience, especially for advanced features like spatial sound. Inconsistent performance across brands reduces adoption in certain markets. Consumers expect seamless plug-and-play functionality, which increases pressure on manufacturers to meet wider compatibility demands. These technical constraints remain a major challenge in ensuring consistent product performance across global ecosystems.

Regional Analysis

North America

North America holds a strong position in the market with a 33% share driven by high adoption of home entertainment systems and strong demand for premium audio products. Consumers invest in advanced soundbars that pair with large-screen smart TVs, which boosts replacement and upgrade cycles. Streaming platforms influence users to improve audio quality for movies and gaming. Retailers expand product availability through bundled TV–soundbar offerings. The region benefits from strong brand presence and high spending capacity. Growing smart home penetration further supports wider adoption across both urban and suburban households.

Europe

Europe captures a 27% share supported by steady adoption of wireless soundbars and rising preference for minimalist audio solutions. Consumers prioritize compact designs that fit modern living spaces while delivering enhanced clarity and immersive sound. Growth in OTT streaming raises the need for premium home audio upgrades. Eco-friendly product demand also influences manufacturer strategies in key countries. Expanding retail channels and strong penetration of smart TVs support consistent sales momentum. Commercial use across hospitality and retail settings adds further traction to regional demand, reinforcing Europe’s solid position.

Asia Pacific

Asia Pacific leads global expansion with a 29% share fueled by rising urbanization and strong consumer interest in affordable home entertainment upgrades. Demand grows rapidly in markets with rising disposable incomes and fast smart TV adoption. Local and global brands compete with diverse product ranges, which accelerates penetration across mid-range households. Wireless connectivity features attract younger consumers seeking convenient streaming integration. E-commerce platforms strengthen access to advanced models. Expanding residential construction and modern apartment living support continuous market growth across the region.

Latin America

Latin America accounts for a 6% share supported by gradual adoption of smart TVs and rising interest in compact audio enhancements. Consumers shift toward wireless soundbars due to ease of installation and improved streaming performance. Retail expansion improves availability of global brands, while online channels attract price-sensitive buyers. Urban households invest in home entertainment upgrades as digital content consumption increases. Economic fluctuations create demand shifts, but targeted promotional strategies help maintain steady sales. Commercial adoption grows in hospitality and retail venues seeking cost-effective audio solutions.

Middle East & Africa

The Middle East & Africa region holds a 5% share driven by growing investment in premium home entertainment systems across urban centers. Rising adoption of smart TVs encourages consumers to pair advanced audio solutions for improved clarity and depth. Retail and online channels expand product reach, especially in Gulf countries. Hospitality and commercial sectors adopt soundbars to enhance guest engagement and presentation quality. Price sensitivity in some African markets influences demand patterns, but mid-range models gain steady traction. Expanding digital media consumption supports ongoing market development across diverse economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type

- Basic soundbars

- Soundbars with subwoofers

- Surround soundbars

- Dolby Atmos soundbars

By Connectivity

- Wired soundbars

- Wireless soundbars including Bluetooth, Wi-Fi, and NFC

By Application

- Residential use

- Commercial use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the market is shaped by major companies such as Samsung Electronics, Sony Corporation, Bose Corporation, LG Electronics, Yamaha Corporation, Panasonic Corporation, Vizio Inc., Harman International, JBL, and Philips Electronics, which drive innovation through advanced acoustic engineering and smart connectivity features. Leading brands expand portfolios to serve budget, mid-range, and premium segments, strengthening their global footprint. Strategic collaborations with smart TV makers enhance device compatibility and improve user experience. Companies invest in AI-driven tuning, multi-room audio, and sleek form factors to meet evolving consumer expectations. E-commerce channels increase competitive intensity by enabling faster adoption and stronger price transparency. Product differentiation, strong brand equity, and broad distribution networks continue to determine long-term leadership in the market.

Key Player Analysis

Recent Developments

- In August 2025, Samsung Electronics launched its 2025 soundbar lineup with AI sound features and new adaptive designs in India. The range includes flagship HW-Q990F and HW-QS700F models with AI tuning and Wireless Dolby Atmos.

- In September 2023, Bose Corporation announced the Bose Smart Ultra Soundbar with immersive Dolby Atmos, AI Dialogue Mode balancing, and spatial audio enhancements powered by TrueSpace technology.

Report Coverage

The research report offers an in-depth analysis based on Type, Connectivity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as consumers upgrade home entertainment systems for better audio quality.

- Wireless and smart-connected soundbars will gain stronger adoption across global markets.

- Dolby Atmos and advanced spatial audio formats will drive premium segment growth.

- Integration with smart TVs and smart home ecosystems will influence buying decisions.

- Compact and slim designs will attract urban households seeking space-saving solutions.

- Commercial adoption will expand in hospitality, retail, and corporate environments.

- AI-based sound optimization will enhance user experience and support product differentiation.

- Partnerships between TV brands and audio manufacturers will strengthen distribution reach.

- Sustainability-focused materials and energy-efficient designs will influence product development.

- E-commerce channels will drive higher sales, especially in price-sensitive regions.