| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Feminine Hygiene Products Market Size 2023 |

USD 478.80 Million |

| Spain Feminine Hygiene Products Market, CAGR |

5.3% |

| Spain Feminine Hygiene Products Market Size 2032 |

USD 762.70 Million |

Market Overview:

Spain Feminine Hygiene Products Market size was valued at USD 478.80 million in 2023 and is anticipated to reach USD 762.70 million by 2032, at a CAGR of 5.3% during the forecast period (2023-2032).

Several factors are propelling the growth of the feminine hygiene products market in Spain. Heightened consumer awareness about personal hygiene and health has led to increased demand for innovative and sustainable products. Urbanization and higher disposable incomes are also contributing to the demand for premium and innovative menstrual solutions. Moreover, government initiatives, such as health awareness campaigns, are reducing stigma and encouraging the adoption of modern products. The market is also witnessing a shift towards eco-friendly and reusable feminine hygiene products, driven by sustainability concerns among consumers. Manufacturers are responding with organic cotton-based products, biodegradable packaging, and toxin-free formulations. Additionally, the influence of social media and influencers promoting body positivity and menstrual wellness is shaping consumer behavior.

Within Spain, regional initiatives are playing a significant role in shaping the feminine hygiene products market. For instance, Catalonia has implemented a pioneering women’s health initiative that offers reusable menstruation products for free to approximately 2.5 million women, girls, transgender, and nonbinary individuals. This program aims to guarantee menstrual equity and reduce environmental waste. Such regional programs not only address menstrual poverty but also promote the adoption of sustainable menstrual products, thereby influencing market dynamics at the regional level. Other regions are also exploring similar models, indicating a nationwide shift toward inclusivity and environmental responsibility. These local government actions are expected to set a precedent and drive policy changes throughout Spain, fostering long-term market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Spain Feminine Hygiene Products market was valued at USD 478.80 million in 2023 and is projected to reach USD 762.70 million by 2032, with a CAGR of 5.3% during the forecast period.

- The global feminine hygiene products market, valued at USD 23,490.00 million in 2023, is projected to reach USD 43,917.35 million by 2032, growing at a CAGR of 7.2% from 2023 to 2032.

- Increased consumer awareness about health and hygiene is fueling demand for innovative, sustainable products, particularly in urban areas with higher disposable incomes.

- A significant shift toward eco-friendly and reusable product, such as menstrual cups and organic cotton pads, is being driven by growing environmental concerns and sustainability initiatives.

- Government initiatives like Catalonia’s program, which provides free reusable menstrual products to millions, are enhancing menstrual equity and promoting environmentally friendly alternatives.

- Regional disparities exist in product adoption, with Madrid and Catalonia leading in market share, followed by steady growth in Andalusia, Valencia, and other regions.

- Despite the growing demand for premium and eco-friendly options, price sensitivity remains a challenge, particularly in rural areas and among lower-income consumers.

- Cultural taboos and limited awareness in specific demographics still restrict the widespread acceptance of modern and sustainable menstrual products in certain parts of Spain.

Market Drivers:

Rising Health Awareness and Hygiene Education

The growing awareness surrounding personal health and hygiene is significantly driving the demand for feminine hygiene products in Spain. As public health campaigns and educational initiatives proliferate, women are becoming more informed about menstrual hygiene management and the health risks associated with poor hygiene practices. For example, Article 10 of Spain’s Organic Law 2/2010 requires educators to approach menstruation with a gender perspective and pay special attention to eliminating myths and stereotypes that generate menstrual stigma. This awareness is translating into increased adoption of sanitary pads, tampons, panty liners, and intimate care products. Furthermore, the inclusion of menstrual hygiene in school curricula and community outreach programs has helped normalize discussions around menstruation, reducing stigma and encouraging proactive hygiene practices among younger generations.

Shifting Consumer Preferences Towards Sustainable Solutions

Environmental consciousness is reshaping consumer preferences in Spain’s feminine hygiene market. With rising concerns over plastic waste and product safety, consumers are increasingly opting for eco-friendly alternatives such as reusable menstrual cups, organic cotton pads, biodegradable tampons, and washable cloth pads. This transition aligns with broader global trends favoring sustainability and has prompted many brands to reformulate products and invest in green packaging solutions. Government and NGO-led initiatives advocating for low-waste lifestyles further support this shift, pushing manufacturers to innovate and cater to a more eco-conscious audience that values both efficacy and environmental responsibility.

Economic Growth and Increased Disposable Income

Economic development and rising disposable incomes across urban and semi-urban areas have contributed to greater spending on personal care products, including feminine hygiene items. With higher income levels, consumers are more inclined to purchase premium and specialized products that offer added comfort, skin safety, and advanced protection. For instance, the Spain menstrual hygiene products market includes a range of product types such as pantyliners, tampons, towels and pads, and feminine wipes, distributed through supermarkets, hypermarkets, pharmacies, and increasingly via e-commerce platforms. These may include products with herbal extracts, dermatologically tested variants, or individually packaged items for portability and convenience. Moreover, online retail platforms and subscription models have made these premium products more accessible, offering consumers a broader range of choices at competitive prices.

Government Policies and Regional Equity Initiatives

Government support and regional policies have played a vital role in accelerating the growth of the feminine hygiene products market in Spain. The Catalan government’s initiative to distribute free reusable menstrual products to over two million individuals stands as a landmark policy promoting menstrual equity and sustainability. Such measures not only address financial barriers but also stimulate behavioral change toward more sustainable consumption. These localized efforts are expected to influence national-level policies, setting a precedent for other regions and encouraging collaborative efforts between public authorities and private players to enhance product availability, affordability, and education across the country.

Market Trends:

Growth of Reusable Menstrual Products

Spain is experiencing a growing acceptance of reusable menstrual products, reflecting a rising consciousness around sustainability and long-term cost savings. For example, the Catalan government introduced a significant initiative in late 2023 by distributing reusable menstrual care products free of charge through pharmacies across the region, aiming to promote menstrual equity and reduce waste. Products such as menstrual cups and reusable cloth pads are gaining popularity among environmentally aware consumers who seek alternatives to disposable hygiene products. These products are praised for their durability, minimal waste generation, and skin-friendly materials such as medical-grade silicone. This trend is also being influenced by educational initiatives and social media advocacy that promote sustainable menstruation practices.

Expansion of E-commerce Channels

The digitalization of the retail sector has had a significant impact on the feminine hygiene market in Spain. Increasing numbers of consumers are turning to online platforms for their personal care needs due to the convenience, broader product range, and discreet purchasing experience. E-commerce has also enabled niche and eco-conscious brands to reach a wider audience, thus encouraging market diversification. The growing preference for subscription-based models and doorstep delivery services is further streamlining the consumer purchasing journey.

Private Label Brands Gaining Traction

Private label brands offered by major retailers are becoming increasingly prominent in Spain’s feminine hygiene space. Supermarket chains and pharmacy retailers are expanding their own product lines, offering cost-effective and reliable alternatives to traditional brands. For instance, companies like COHITECH (Cotton High Tech S.L.) specialize in private label feminine hygiene products made from organic and natural cotton, enabling retailers to customize products to meet specific consumer needs and sustainability standards. These private labels have improved their product quality and packaging, gaining consumer trust in the process. As a result, established brands are being challenged to innovate and differentiate themselves in a more competitive retail environment.

Emphasis on Sustainable and Organic Products

Spanish consumers are showing a clear preference for products that align with environmental and health-conscious values. There is a visible shift toward products made from organic cotton, free from synthetic fragrances and harmful chemicals. This trend is supported by increased transparency in labeling and a rise in consumer awareness regarding the health and environmental impact of feminine hygiene products. Brands are responding with product innovations that emphasize biodegradability, ethical sourcing, and eco-friendly packaging, contributing to a more sustainable industry landscape.

Market Challenges Analysis:

Cultural Taboos and Limited Awareness in Specific Demographics

Despite advancements in awareness and education, cultural stigmas around menstruation continue to act as a restraint in certain segments of the Spanish population. For instance, a 2023 national survey of over 4,000 participants in Spain found that many declared not having received sufficient information on menstruation prior to menarche, particularly regarding how to physically manage it. These taboos often discourage open conversations and limit access to accurate information, particularly among older generations and marginalized communities. As a result, many individuals may lack the confidence or knowledge to adopt modern or sustainable feminine hygiene products. This ongoing cultural sensitivity poses a challenge for market players aiming to penetrate deeper into rural or traditionally conservative regions, where product adoption remains relatively slow.

Price Sensitivity and Accessibility Issues

The higher cost of premium and sustainable feminine hygiene products is another critical challenge. Organic, reusable, and chemical-free options often come at a higher price point, making them less accessible to consumers with limited disposable income. While there is growing demand for eco-friendly alternatives, affordability remains a concern for a large portion of the population. Additionally, access to such products may be limited in smaller towns and non-urban areas, where retail variety is restricted. This price sensitivity restricts mass adoption and prevents some consumer segments from transitioning away from lower-cost, traditional products. Addressing this challenge will require strategic pricing, subsidies, or partnerships with public institutions to ensure equitable product availability across regions.

Market Opportunities:

The feminine hygiene products market in Spain presents substantial opportunities driven by the increasing demand for sustainable and health-conscious alternatives. As consumers become more informed about the environmental impact of traditional disposable products, they are actively seeking organic, biodegradable, and reusable options. This shift provides a strong foundation for companies to innovate and expand their product portfolios with eco-friendly offerings such as menstrual cups, reusable pads, and organic cotton tampons. Brands that focus on transparency in ingredients, ethical sourcing, and environmental responsibility stand to gain a competitive edge. Additionally, the rise in digital platforms offers an ideal avenue for reaching environmentally aware consumers, especially through targeted marketing and subscription-based services that emphasize convenience and customization.

Another promising area lies in the growing role of governmental and regional support for menstrual equity. Programs like Catalonia’s initiative to distribute free reusable menstrual products highlight the potential for public-private partnerships to create socially impactful business models. By collaborating with educational institutions and public health organizations, market players can contribute to awareness campaigns while expanding brand visibility. There is also untapped potential in addressing the specific needs of diverse demographic groups, including teenagers, menopausal women, and individuals in underserved areas. By offering affordable, culturally sensitive, and high-quality solutions, companies can broaden their consumer base and reinforce long-term customer loyalty. This evolving landscape offers a strategic opening for both established players and new entrants to reshape the market through innovation, inclusivity, and sustainability.

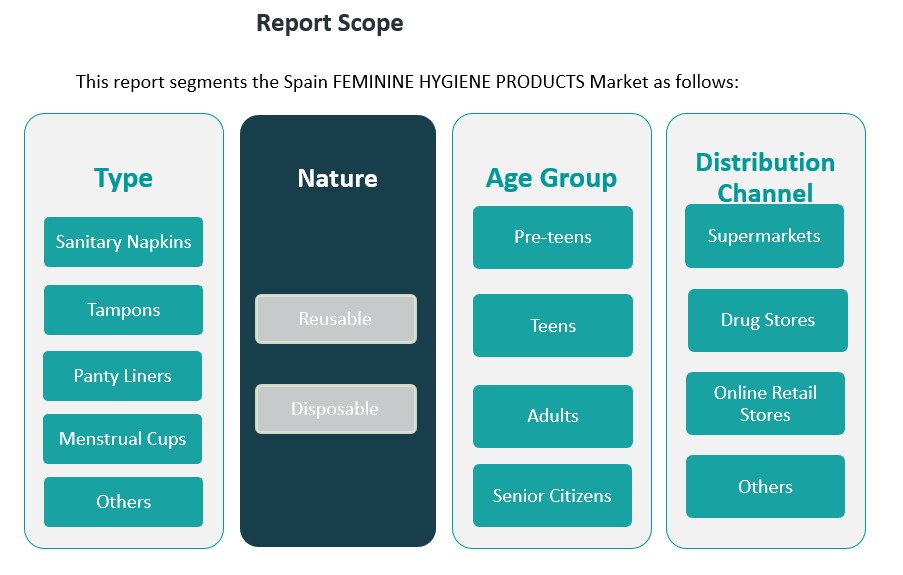

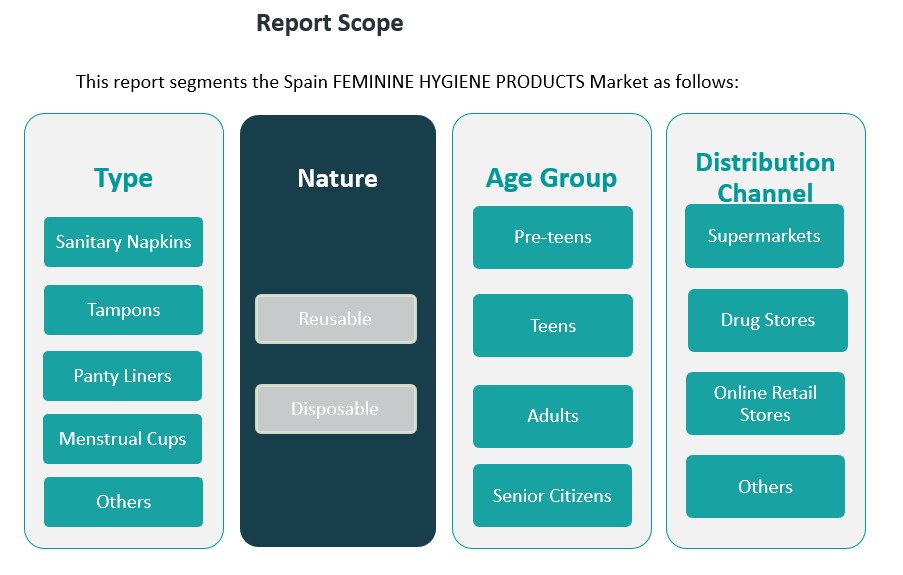

Market Segmentation Analysis:

The Spanish feminine hygiene products market is divided into several key segments, each catering to specific consumer needs and preferences.

By Type, the market includes various product categories. Sanitary Napkins dominate the market, offering different sizes and absorbencies for daily protection. Tampons are commonly used for active users due to their convenience and discretion. Panty Liners are preferred by consumers for light flow days or as additional protection in combination with other products. Menstrual Cups are gaining traction for their eco-friendly appeal and cost-effectiveness over time. Additionally, the Others segment includes intimate wipes, menstrual underwear, and other accessories that enhance overall menstrual hygiene.

By Nature, products are classified as Reusable or Disposable. Reusable products such as menstrual cups and cloth pads are becoming increasingly popular due to the growing awareness of environmental sustainability and the long-term cost benefits. On the other hand, Disposable products like sanitary napkins, tampons, and panty liners still hold the largest market share, as they provide convenience and comfort to consumers who seek hassle-free solutions.

By Age-Group, the market is segmented into several categories. Pre-teens and Teens typically use products designed for lighter flow and discreet protection. The Adults group represents the largest consumer segment, with a broad range of products catering to varying needs, including both regular and eco-friendly options. Senior Citizens, due to age-related health issues, generally require specialized products like incontinence pads that provide comfort and security.

By Distribution Channel, the market is dominated by Supermarkets and Drug Stores, which offer a wide variety of feminine hygiene products to consumers. Online Retail Stores have seen significant growth, driven by the convenience of shopping from home and the increasing trend towards e-commerce. Other distribution channels, such as pharmacies and specialized health stores, cater to niche markets and specific consumer needs.

Segmentation:

By Type

- Sanitary Napkins

- Tampons

- Panty Liners

- Menstrual Cups

- Others

By Nature

By Age-Group

- Pre-teens

- Teens

- Adults

- Senior Citizens

By Distribution Channel

- Supermarkets

- Drug Stores

- Online Retail Stores

- Others

Regional Analysis:

The feminine hygiene products market in Spain is influenced by regional variations in consumer preferences, economic factors, and accessibility to products. As the demand for such products increases across the country, the market shows distinct regional characteristics. The major regions contributing to the market’s growth include Madrid, Catalonia, Andalusia, and Valencia, each playing a vital role in shaping the overall market dynamics.

Madrid and Catalonia are the dominant regions in Spain’s feminine hygiene products market. Together, they account for a significant portion of the market share, primarily due to their high population density, urbanization, and disposable incomes. These regions exhibit a higher purchasing power, which translates into the increased demand for premium and organic products. Madrid, as the capital city, is home to numerous retail outlets, supermarkets, and pharmacies, contributing to the widespread availability of feminine hygiene products. The region also benefits from higher consumer awareness and a more extensive distribution network, which is crucial for the market’s growth.

Andalusia, the largest autonomous community in Spain, shows steady growth in the feminine hygiene products sector. This region has a growing middle-class population, coupled with an increasing focus on women’s health and hygiene. Though Andalusia’s market share is slightly smaller compared to Madrid and Catalonia, the demand for eco-friendly and sustainable feminine hygiene products is on the rise. Rural areas within Andalusia contribute to a slower, yet consistent, adoption of these products, driven by changing societal norms and the expanding availability of retail outlets.

Valencia follows as another prominent region, benefiting from a moderate growth rate in the feminine hygiene market. The region’s demand is primarily driven by the younger demographic, which is more inclined toward organic and environmentally friendly options. Valencia’s market share is growing steadily, driven by increased awareness campaigns on menstrual health and the rising popularity of reusable products such as menstrual cups and cloth pads.

The market in the Basque Country and Galicia is more niche, with a relatively lower share but increasing interest in eco-conscious products. The adoption of organic and sustainable feminine hygiene products is growing, with regional retailers and local brands focusing on the environmental impact of their product offerings.

Key Player Analysis:

- Johnson & Johnson

- Procter & Gamble

- Kimberly-Clark

- Essity Aktiebolag

- Kao Corporation

- Daio Paper Corporation

- Unicharm Corporation

- Premier FMCG

- Ontex

- Hengan International Group Company Ltd

- Drylock Technologies

- Natracare LLC

- First Quality Enterprises, Inc

- Ontex Segovia

Competitive Analysis:

The Spain feminine hygiene products market is highly competitive, with both multinational brands and local players vying for market share. Leading global brands such as Procter & Gamble (with its Always and Tampax brands), Kimberly-Clark (Huggies, Kotex), and Johnson & Johnson (Carefree) dominate the traditional product segments of sanitary pads, tampons, and pantyliners. These companies benefit from strong brand recognition, extensive distribution networks, and significant marketing investments. However, local brands and eco-conscious entrants are increasingly carving out a niche. Brands like Organyc and EcoPeriod cater to the growing demand for organic and sustainable products, offering organic cotton pads and menstrual cups. Additionally, private-label products from supermarkets like Mercadona and Carrefour are gaining popularity due to their cost-effectiveness and quality. The market is seeing innovation, with manufacturers exploring new materials, biodegradable options, and subscription-based services, creating an increasingly diverse competitive landscape.

Recent Developments:

- In November 2024, Essity Aktiebolag made a significant investment in Spain by inaugurating a new production line at its Puigpelat (Tarragona) facility. This new line, which cost 24 million euros, was commissioned at the end of 2023 and is dedicated to producing Tena and Orly’s branded incontinence products. Importantly, Essity announced plans to launch two additional production lines in 2025 at the same site, with one specifically focused on feminine care products for the Spanish and broader European markets.

- In March 2024, the Catalonia region in Spain launched a pioneering public health initiative called “My period, my rules,” which provides free reusable menstruation products to all women, girls, transgender, and nonbinary people who menstruate. The program, managed by the Catalan public health system, enables approximately 2.5 million eligible individuals to receive one menstrual cup, one pair of period underwear, and two packages of cloth pads at local pharmacies at no cost.

Market Concentration & Characteristics:

The Spanish feminine hygiene products market is characterized by a moderate level of concentration, with leading international brands holding a significant share, while private labels and regional initiatives are gaining prominence. Procter & Gamble (P&G), with its brands Always and Tampax, and Kenvue Inc. (formerly Johnson & Johnson), with its Carefree and O.B. brands, are among the dominant players in the market. These companies benefit from strong brand recognition, extensive distribution networks, and significant marketing investments. However, the market is witnessing a shift as private label brands offered by major retailers, such as Mercadona and Carrefour, are gaining market share due to their cost-effectiveness and quality. This trend is particularly evident in the sanitary protection segment, where private labels are increasingly preferred by price-sensitive consumers. The market is also experiencing a diversification in product offerings, driven by changing consumer preferences towards sustainability and health-conscious choices. There is a growing demand for organic, biodegradable, and reusable products, such as menstrual cups and organic cotton pads. This shift is prompting both established brands and new entrants to innovate and expand their product portfolios to cater to these emerging consumer needs. Additionally, the rise of e-commerce platforms has transformed the retail landscape, providing consumers with greater access to a wider range of products and brands, thereby intensifying competition and encouraging further innovation in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Nature, Age-Group and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for eco-friendly and sustainable products is expected to rise, driven by growing environmental concerns and consumer preference for organic materials.

- Reusable products like menstrual cups and period underwear will see increased adoption due to their cost-effectiveness and reduced environmental impact.

- Online retail will continue to expand, offering greater convenience, wider product choices, and subscription models to meet consumer needs.

- Private label products are anticipated to gain further market share as consumers seek affordable alternatives without compromising quality.

- Government programs and policies promoting menstrual equity are likely to expand, increasing product accessibility and adoption in underserved areas.

- Regional initiatives in places like Catalonia may set a national precedent for government-led menstrual hygiene programs.

- Digital health and wellness apps integrating period tracking will influence consumer purchasing decisions and product use.

- Consumer awareness of menstrual health and hygiene will continue to grow, reducing stigma and fostering openness around menstruation.

- The market for personalized and niche products, including those for sensitive skin and specific health needs, will expand.

- Innovation in packaging, particularly biodegradable and recyclable options, will become a key differentiator for brands.