Market Overview:

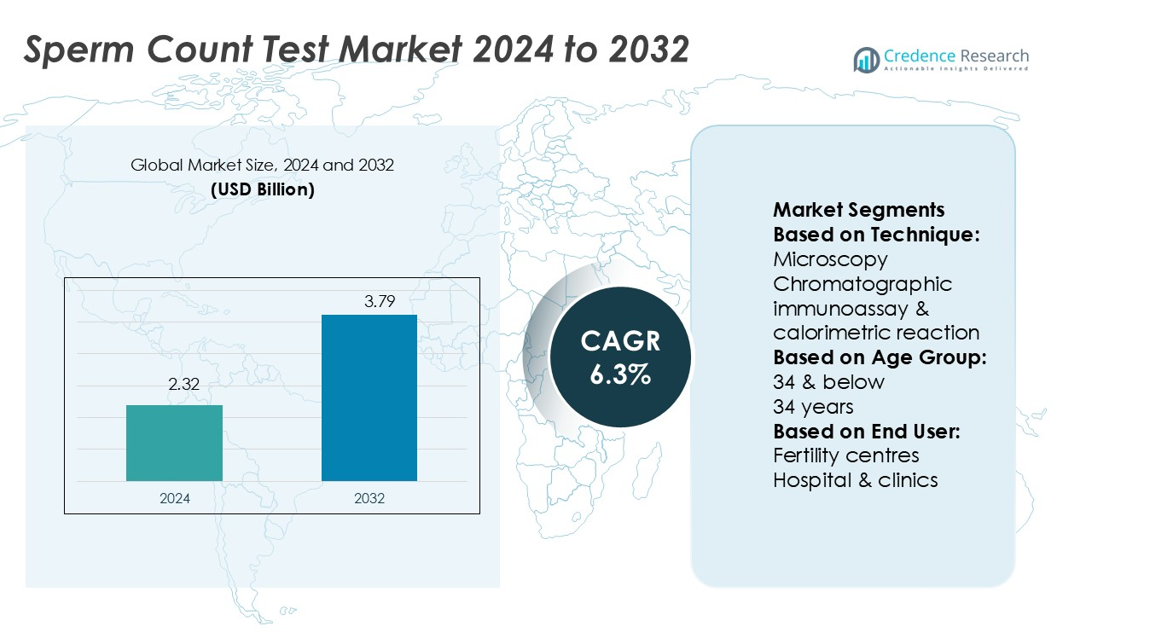

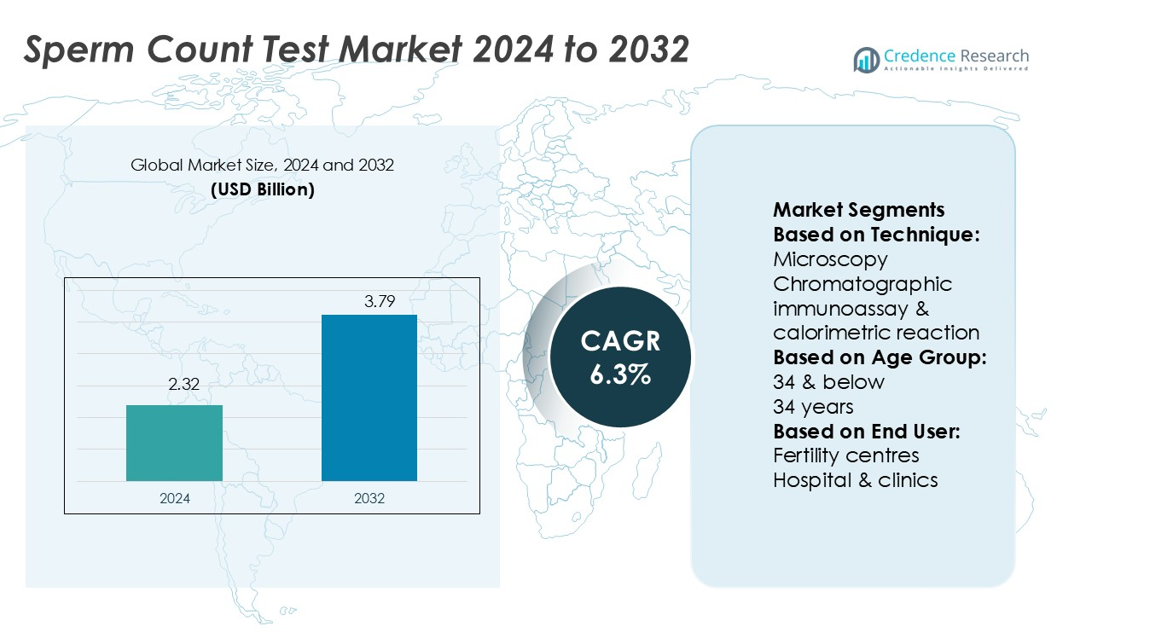

Sperm Count Test Market size was valued USD 2.32 billion in 2024 and is anticipated to reach USD 3.79 billion by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sperm Count Test Market Size 2024 |

USD 2.32 billion |

| Sperm Count Test Market, CAGR |

6.3% |

| Sperm Count Test Market Size 2032 |

USD 3.79 billion |

The sperm count test market is driven by key players such as HalotechDNA, Endo International plc, Intas Pharmaceuticals Ltd., Bayer AG, ASKA Pharmaceutical Co., Ltd., Merck KGaA, AdvaCare Pharma, Andrology Solutions, CaerusBiotech, and CinnaGen Co., each focusing on expanding diagnostic capabilities through advanced microscopy, DNA fragmentation testing, and smartphone-based solutions. These companies strengthen their presence through innovation, product diversification, and strategic collaborations with fertility centers and healthcare providers. North America leads the global market with a 34% share, supported by advanced healthcare infrastructure, high awareness of male infertility, and strong adoption of both clinical and at-home sperm testing solutions.

Market Insights

- The sperm count test market was valued at USD 2.32 billion in 2024 and is projected to reach USD 3.79 billion by 2032, growing at a CAGR of 6.3%.

- Rising infertility cases, lifestyle-related reproductive issues, and growing awareness of male fertility health are driving demand for advanced diagnostic solutions across clinical and at-home testing.

- Smartphone-based kits and AI-enabled digital imaging represent key trends, offering privacy, convenience, and accuracy, while partnerships with fertility centers and telehealth platforms expand adoption.

- Market growth faces restraints from limited accuracy in low-cost test kits and social stigma surrounding male infertility, which restricts early diagnosis in several regions.

- North America leads the market with 34% share, followed by Europe at 28% and Asia Pacific at 22%, while microscopy accounts for 45% of segment share as the dominant testing technique supported by strong clinical preference.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technique

Microscopy dominates the sperm count test market with a 45% share. This method remains the gold standard due to its precision in evaluating sperm motility, morphology, and concentration. Demand is reinforced by its wide adoption in laboratories and fertility centers where accuracy is critical for diagnostic decisions. Smartphone-based techniques are gaining momentum, but their adoption is limited to personal convenience testing. The growth of microscopy is supported by continuous advancements in imaging systems and automated analysis software, which enhance reliability and reduce operator dependency.

- For instance, HalotechDNA’s HALO-sperm manufacturer instructions recommend counting a minimum of 300 to 500 spermatozoa per sample to accurately determine the DNA fragmentation index (DFI).

By Age Group

The 34 years and below segment holds the largest market share at 38%. Rising infertility rates in younger couples and increased awareness of reproductive health drive demand in this group. Men in this age bracket often undergo testing earlier in their fertility journey, boosting the need for reliable diagnostic solutions. Age-related decline in sperm quality further highlights early detection importance, encouraging proactive testing. Broader access to fertility centers and growing lifestyle-related reproductive issues also reinforce dominance of this segment within the market.

- For instance, Intas has over 300 projects in its R&D pipeline.The focus is on biosimilars, added-value medicines (differentiated formulations), and “first-to-market / early-patent expiry launch” opportunities.

By End-user

Fertility centers lead the market with a 42% share, driven by rising cases of infertility treatments and assisted reproductive technologies. These centers rely on advanced sperm analysis methods to support IVF and ICSI procedures, ensuring accurate sperm selection. Hospitals and clinics follow closely, supported by integration of reproductive health services into general diagnostics. The dominance of fertility centers is fueled by the growing demand for specialized testing, availability of skilled professionals, and patient preference for targeted treatment pathways that improve conception outcomes.

Market Overview

Rising Infertility Rates

The sperm count test market is driven by the global rise in male infertility, attributed to lifestyle changes, stress, smoking, and obesity. Declining sperm quality has increased demand for diagnostic solutions to identify reproductive health issues at early stages. Fertility centers and hospitals rely heavily on sperm analysis to guide treatment decisions, especially in assisted reproductive technologies. This trend supports higher adoption of both laboratory-based and at-home testing solutions, positioning sperm count tests as an essential tool in infertility management.

- For instance, Bayer reports 5,860 million R&D spending (before special items).The company employs about 15,900 scientists globally at R&D sites focused on health or agriculture.

Advancements in Diagnostic Technologies

Technological innovation strengthens the market by offering accurate and user-friendly sperm testing solutions. Automated microscopy systems and smartphone-based kits provide reliable results with minimal operator error. Integration of AI and digital imaging tools enhances diagnostic precision, making sperm analysis faster and more accessible. These innovations improve adoption among healthcare providers and consumers, supporting the shift toward self-testing and remote diagnostics. The technological advancements not only expand accessibility but also increase trust in non-invasive and convenient fertility testing solutions worldwide.

- For instance, NYU Langone study of more than 700 patients, PGTai 2.0 delivered a 13% relative increase in ongoing pregnancy and live birth rates compared to standard NGS and first-generation AI methods.

Growing Awareness of Reproductive Health

Increasing awareness campaigns by healthcare providers and fertility organizations encourage men to undergo early fertility assessments. This shift reflects rising acceptance of sperm health as a critical factor in conception planning. Educational initiatives and online platforms provide easy access to information and testing kits, reducing stigma around male fertility testing. Rising healthcare expenditure and proactive health monitoring also support this growth. Awareness-driven demand boosts the use of both professional diagnostic services and home-based test kits, strengthening the overall market expansion.

Key Trends & Opportunities

Shift Toward At-Home Testing

A major trend in the sperm count test market is the growing preference for at-home testing kits. Smartphone-based solutions with connected apps allow men to monitor fertility discreetly and conveniently. This trend caters to privacy-conscious consumers while reducing dependency on clinical visits. At-home testing opens opportunities for manufacturers to integrate digital health platforms, enabling remote consultations with healthcare professionals. Rising e-commerce penetration and growing demand for personalized healthcare services provide strong growth potential for companies offering home-based diagnostic kits.

- For instance, Sperm Meter creates a uniform smear of 10 microns (µm) thickness for neat semen samples (no dilution). Graticule grid has 100 squares, each square being 100 µm. Counting sperms in 10 squares allows estimation of concentration in millions per millilitre (× 10⁶/mL).

Integration of Digital Health Platforms

The integration of sperm count tests with telehealth services presents new opportunities for the market. Digital connectivity enables seamless sharing of test results with fertility specialists, supporting personalized treatment pathways. AI-driven applications enhance sperm analysis by offering data interpretation and predictive fertility insights. This trend aligns with the wider digital health ecosystem, where remote monitoring and virtual consultations are gaining adoption. Companies investing in digital-enabled sperm count solutions can strengthen market presence and appeal to tech-savvy consumers seeking integrated fertility support.

- For instance, SpermCheck Fertility is an over-the-counter immunodiagnostic device that uses two test strips: one calibrated to flag sperm concentrations ≥ 2 × 10⁷ sperm/mL and the other for ≥ 5 × 10⁶ sperm/mL.

Key Challenges

Limited Accuracy of Low-Cost Kits

A key challenge lies in the limited accuracy and reliability of low-cost sperm test kits. Many at-home solutions lack advanced diagnostic features, leading to inconsistent results that reduce trust among consumers. Misinterpretation of results may delay medical consultation and affect treatment outcomes. This challenge forces manufacturers to balance affordability with accuracy, as healthcare professionals continue to favor laboratory-based testing. Improving quality standards and ensuring regulatory compliance remain crucial for sustaining consumer confidence in at-home sperm count solutions.

Social Stigma and Lack of Awareness

Despite growing acceptance, social stigma and cultural barriers still limit widespread sperm count testing. Many men hesitate to undergo fertility evaluation due to embarrassment or misconceptions about male infertility. In several regions, awareness about the importance of sperm health remains low, delaying diagnosis and treatment. This challenge restricts market penetration, particularly in developing economies. Overcoming these barriers requires stronger awareness campaigns, targeted education initiatives, and greater involvement of healthcare providers to normalize male fertility testing in reproductive health discussions.

Regional Analysis

North America

North America leads the sperm count test market with a 34% share, supported by advanced healthcare infrastructure and high awareness of reproductive health. The U.S. dominates regional growth due to the rising prevalence of infertility and strong adoption of advanced diagnostic technologies. Fertility centers and hospitals widely use microscopy and automated systems, while at-home smartphone-based kits also see strong demand. Favorable insurance coverage and ongoing awareness campaigns further encourage early fertility testing. The presence of leading diagnostic companies and active investment in digital health platforms consolidates North America’s dominant position in the global market.

Europe

Europe accounts for 28% of the sperm count test market, driven by increasing infertility rates and growing acceptance of male reproductive health testing. Countries like Germany, the U.K., and France spearhead adoption, supported by well-established fertility clinics and government initiatives addressing declining birth rates. The region has shown strong demand for both clinical diagnostics and at-home sperm testing kits, particularly among younger populations. Favorable reimbursement policies and integration of advanced imaging technologies strengthen adoption. Rising lifestyle-related reproductive challenges continue to fuel market growth, ensuring Europe remains the second-largest regional contributor to global sperm count testing.

Asia Pacific

Asia Pacific holds a 22% share of the sperm count test market, supported by rising infertility cases linked to stress, lifestyle changes, and pollution. China, India, and Japan drive regional demand with expanding healthcare infrastructure and increasing fertility awareness. Rapid urbanization and government-supported fertility programs further promote sperm count testing adoption. Smartphone-based kits are gaining popularity due to affordability and convenience in densely populated markets. Growing investments in fertility centers and higher disposable incomes contribute to market expansion, positioning Asia Pacific as a fast-growing region with significant untapped potential in sperm diagnostic solutions.

Latin America

Latin America captures 9% of the sperm count test market, driven by growing awareness of infertility and increased availability of fertility clinics. Brazil and Mexico lead demand, supported by rising adoption of assisted reproductive technologies. However, limited access to advanced diagnostic tools and affordability issues restrain wider market penetration. At-home testing kits are gradually gaining acceptance, especially among younger populations seeking convenient solutions. Awareness campaigns by healthcare providers and expanding private fertility services play a crucial role in boosting demand, making the region a steadily emerging contributor to global sperm count test adoption.

Middle East & Africa

The Middle East & Africa represent 7% of the sperm count test market, constrained by limited healthcare infrastructure and cultural barriers surrounding male infertility. Countries like South Africa and the UAE show stronger adoption due to improving fertility services and medical tourism. Awareness about sperm health remains low in several parts of the region, restricting early diagnosis. However, increasing investments in private fertility clinics and growing acceptance of reproductive health testing provide opportunities for gradual growth. Demand for affordable, easy-to-use at-home kits is expected to expand adoption in underserved markets within this region.

Market Segmentations:

By Technique:

- Microscopy

- Chromatographic immunoassay & calorimetric reaction

By Age Group:

By End User:

- Fertility centres

- Hospital & clinics

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of The Sperm Count Test Market players such as HalotechDNA, Endo International plc, Intas Pharmaceuticals Ltd., Bayer AG, ASKA Pharmaceutical Co., Ltd., Merck KGaA, AdvaCare Pharma, Andrology Solutions, CaerusBiotech, and CinnaGen Co. The sperm count test market is defined by strong innovation, expanding product portfolios, and increasing focus on both clinical and at-home testing solutions. Companies are investing in advanced microscopy systems, DNA fragmentation tests, and AI-enabled smartphone kits to enhance accuracy and convenience. Strategic collaborations with fertility centers and healthcare providers strengthen market positioning, while expansion into emerging regions supports wider adoption. Affordability and reliability remain central themes, driving manufacturers to balance innovation with cost-effectiveness. Continuous R&D efforts and digital integration ensure growing competition, with emphasis on meeting rising global demand for fertility diagnostics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- HalotechDNA

- Endo International plc

- Intas Pharmaceuticals Ltd.

- Bayer AG

- ASKA Pharmaceutical Co., Ltd.

- Merck KGaA

- AdvaCare Pharma

- Andrology Solutions

- CaerusBiotech

- CinnaGen Co.

Recent Developments

- In May 2025, ReproNovo raised in Series A funding to advance its pipeline of treatments for reproductive health and women’s health issues. This funding will support the development of two key compounds.

- In March 2025, FDA granted marketing authorization to the first at-home test for chlamydia, gonorrhea, and trichomoniasis, strengthening preventive pathways for infertility.

- In March 2024, Future Generali India Insurance launch ‘Health PowHER’, a product designed exclusively for women healthcare at various stages of their lives. There will be various treatments offered by the product, and one of the treatments will be infertility treatment.

- In February 2024, Lupin, a major global pharma company, launched Ganirelix Acetate Injection. It is a single-dose prefilled syringe indicated for inhibiting premature luteinizing hormone (LH) surges in women who undergo ovarian hyperstimulation

Report Coverage

The research report offers an in-depth analysis based on Technique, Age Group, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sperm count tests will increase with rising global infertility cases.

- At-home testing kits will gain stronger adoption due to convenience and privacy.

- AI and digital imaging will enhance accuracy and reduce operator dependency.

- Smartphone-based solutions will expand in emerging markets with growing connectivity.

- Fertility centers will remain leading users, driven by IVF and assisted reproduction growth.

- Awareness campaigns will encourage early male fertility testing across regions.

- Regulatory focus will strengthen quality standards for at-home test kits.

- Partnerships with digital health platforms will integrate remote fertility monitoring.

- Emerging economies will offer growth opportunities with expanding healthcare infrastructure.

- Competition will intensify as companies invest in innovation and affordability.