Market Overview

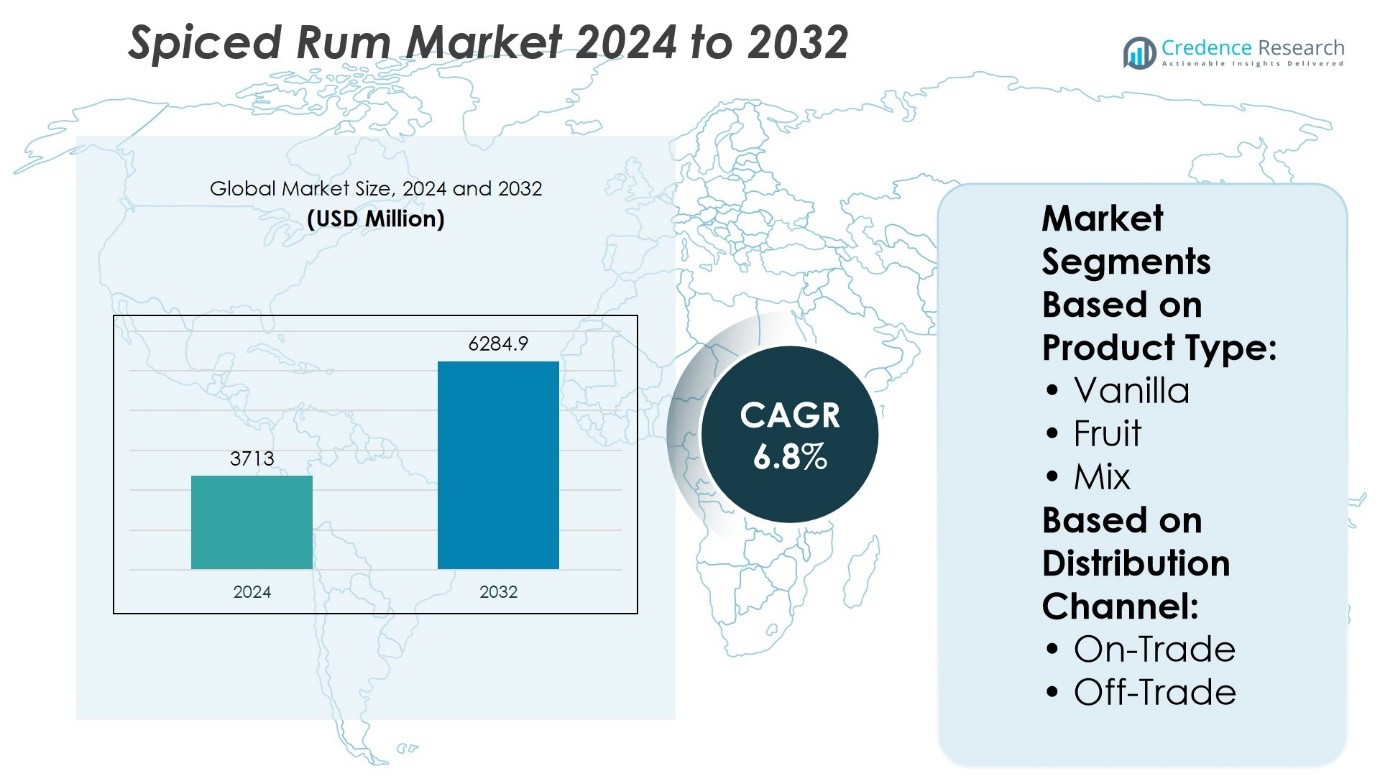

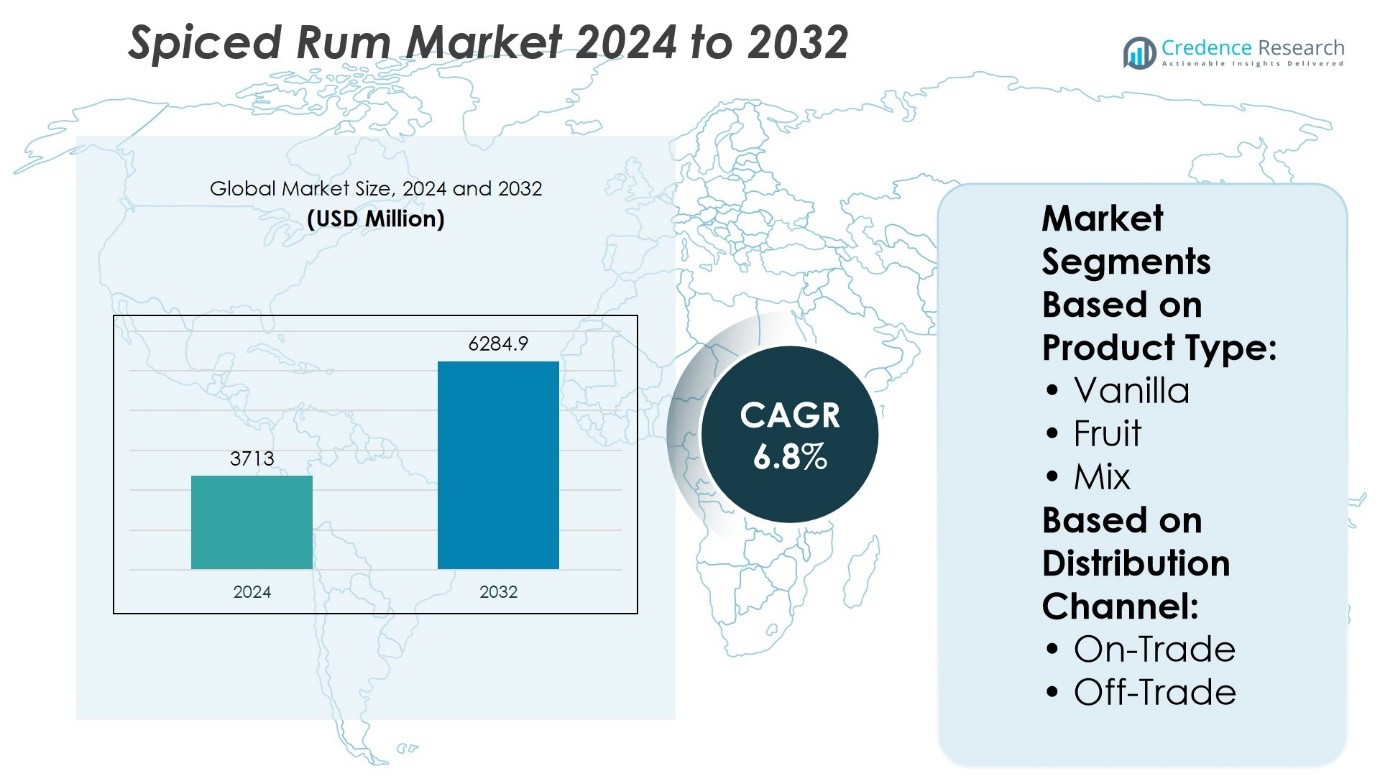

Spiced Rum Market size was valued at USD 3713 million in 2024 and is anticipated to reach USD 6284.9 million by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spiced Rum Market Size 2024 |

USD 3713 Million |

| Spiced Rum Market, CAGR |

6.8% |

| Spiced Rum Market Size 2032 |

USD 6284.9 Million |

The Spiced Rum Market grows on the back of rising consumer interest in flavoured and premium spirits, supported by the expansion of cocktail culture and mixology. It benefits from product innovation, including unique spice blends, seasonal editions, and craft small-batch offerings that appeal to diverse demographics. Increasing demand in emerging markets, coupled with the rise of e-commerce and on-trade promotions, strengthens market reach. Sustainability initiatives and eco-friendly packaging enhance brand appeal, while collaborations with hospitality venues and mixologists drive visibility. Evolving consumer preferences for authenticity, quality, and convenience continue to shape market trends and long-term growth potential.

The Spiced Rum Market has strong geographical presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with North America holding the largest share followed by Europe. Growth in Asia Pacific is driven by rising urbanization and evolving consumer tastes, while Latin America benefits from established rum traditions. Key players include Diageo, Bacardi Limited, Tanduay Distillers, Havana Club (Pernod Ricard), Maine Craft Distilling, Altitude Spirits, HEAVEN HILL BRANDS, SUNTORY HOLDINGS LIMITED, Don Q Rum, and SAZERAC CO, INC.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Spiced Rum Market was valued at USD 3713 million in 2024 and is expected to reach USD 6284.9 million by 2032, at a CAGR of 6.8%.

- Rising consumer interest in flavored and premium spirits drives market growth, supported by the popularity of cocktail culture and mixology.

- Product innovation with unique spice blends, seasonal editions, and craft small-batch variants strengthens consumer appeal across demographics.

- Competition is shaped by global brands with extensive distribution networks and regional producers offering artisanal, locally inspired products.

- Regulatory restrictions on alcohol sales and advertising, along with fluctuating raw material supply, pose challenges to expansion.

- North America holds the largest share, followed by Europe, while Asia Pacific sees strong growth from urbanization and evolving tastes, and Latin America benefits from traditional rum culture.

- Key players focus on sustainability initiatives, eco-friendly packaging, and collaborations with hospitality venues to enhance market presence.

Market Drivers

Rising Global Demand for Flavoured and Premium Spirits

The Spiced Rum Market benefits from growing consumer interest in distinctive flavor profiles and premium alcoholic beverages. Demand strengthens in markets where younger demographics seek variety beyond traditional spirits. Consumers value its unique blend of spices, which offers a differentiated taste compared to standard rum. Premium segments see innovation in cask finishes, natural ingredient sourcing, and limited-edition releases. It attracts enthusiasts willing to pay more for authenticity and quality. Distribution through duty-free outlets, specialty liquor stores, and online platforms expands its reach. Global cocktail culture continues to reinforce the category’s relevance.

- For instance, in 2023, the global consumption of spiced rum exceeded 140 million liters, with the United States alone consuming over 40 million liters, demonstrating a significant.

Expansion of Cocktail Culture and On-Trade Consumption

The Spiced Rum Market gains momentum from the rising popularity of cocktails in bars, restaurants, and resorts. Bartenders incorporate it into signature drinks, enhancing flavor complexity and appeal. Its versatility supports both tropical and winter-themed recipes, making it a year-round menu staple. Tourism destinations promote spiced rum-based cocktails to align with local heritage and experiences. Collaborations between distillers and mixologists result in new drink concepts that drive repeat purchases. On-trade promotions, tasting events, and pairing menus strengthen brand loyalty among urban consumers. This cultural integration elevates awareness and trial rates globally.

- For instance, Captain Morgan ramped up deployment of its Eco SPIRITS Eco TOTE system across on‑trade venues—each 4.5‑liter reusable vessel replaces 900 individual 750‑milliliter bottles over its lifetime.

Product Diversification and Brand Innovation

The Spiced Rum Market grows through targeted product innovation and diversification strategies. Producers introduce new spice blends, aging techniques, and packaging formats to stand out in competitive retail environments. It benefits from consumer interest in craft and small-batch production, which emphasizes story-driven marketing. Collaborations with influencers and lifestyle brands expand its appeal to non-traditional spirit consumers. Ready-to-drink formats featuring spiced rum increase convenience and accessibility. Sustainable packaging and transparent labeling further support brand differentiation. These efforts enable stronger positioning in mature and emerging markets.

Strengthening Distribution Networks and E-Commerce Channels

The Spiced Rum Market experiences growth through expanded distribution and digital sales channels. Strategic partnerships with global distributors secure placement in supermarkets, specialty liquor chains, and hospitality venues. It leverages e-commerce platforms to reach consumers directly, supported by targeted online advertising. Regulatory changes in certain regions now permit direct-to-consumer alcohol sales, increasing accessibility. Seasonal gift packs and exclusive online releases create urgency and boost conversion rates. Logistics improvements ensure consistent product availability in key markets. Broader market penetration allows brands to capture both domestic and export opportunities.

Market Trends

Premiumization and Craft Production Influence

The Spiced Rum Market reflects a clear movement toward premium and craft offerings. Consumers seek products with authentic spice blends, natural ingredients, and small-batch production credentials. It benefits from producers experimenting with aging in specialty casks to enhance flavor complexity. Limited-edition releases create exclusivity and drive collector interest. Distilleries highlight provenance and artisanal methods to differentiate in competitive retail spaces. This focus on quality over volume strengthens brand positioning in both domestic and export markets.

- For instance, Samai Distillery in Cambodia operates traditional handmade 500‑liter copper pot stills, producing around 500 bottles per month as of 2018—each batch meticulously spiced with Mondulkiri wild honey or Kampot pepper for texture and regional authenticity.

Expansion of Flavored Variants and Seasonal Editions

The Spiced Rum Market experiences growth through the launch of diverse flavor profiles and seasonal infusions. Producers incorporate tropical fruits, exotic spices, and dessert-inspired notes to attract varied consumer segments. It enables brands to remain relevant across different consumption occasions. Seasonal editions, tied to holidays or cultural events, boost short-term demand and encourage repeat purchases. Collaboration with chefs and mixologists inspires innovative flavor combinations. Such diversification enhances market visibility and broadens the consumer base.

- For instance, The Kraken Rum introduced a new 50 milliliter (mL) bottle format for its Gold Spiced Rum. This smaller size is designed to be travel-friendly and offers a convenient, lower-cost option for consumers. The 50ml bottles maintain the same 35% ABV (Alcohol by Volume) and flavor profile as the larger bottles, featuring notes of caramel, oak, and banana bread.

Integration into Ready-to-Drink and Cocktail Formats

The Spiced Rum Market gains traction from its integration into ready-to-drink beverages and pre-mixed cocktail solutions. Brands respond to consumer demand for convenience without compromising flavor authenticity. It supports on-the-go consumption in formats such as cans and small bottles. Partnerships with beverage companies extend reach into new retail channels, including supermarkets and convenience stores. Ready-to-drink innovations help introduce spiced rum to audiences who may not consume it traditionally. This trend aligns with the growing global interest in mixology culture.

Emphasis on Sustainable Practices and Ethical Sourcin

The Spiced Rum Market trends toward sustainability, with producers adopting eco-friendly packaging and responsible ingredient sourcing. Brands invest in recyclable materials, biodegradable labels, and reduced-carbon logistics. It aligns with consumer expectations for transparency and environmental responsibility. Certification programs for fair trade spices and sustainably farmed sugarcane gain prominence. Distilleries also explore renewable energy integration in production facilities. This commitment strengthens brand credibility and appeals to environmentally conscious consumers.

Market Challenges Analysis

Intensifying Competition and Brand Differentiation Issues

The Spiced Rum Market faces strong competition from established spirits categories such as whiskey, gin, and flavored vodkas. Global and regional brands compete aggressively for retail shelf space and consumer attention. It becomes challenging for producers to differentiate products in a crowded market with similar flavor profiles. Limited ability to convey unique brand stories in mass-market channels can restrict consumer loyalty. The influx of craft distillers creates further fragmentation, making it harder for brands to stand out. Marketing costs rise as companies invest in promotions, sponsorships, and digital campaigns to capture target audiences. Sustaining a distinct identity remains a critical challenge for long-term growth.

Regulatory Restrictions and Fluctuating Raw Material Supply

The Spiced Rum Market encounters challenges linked to alcohol regulations, advertising restrictions, and taxation policies in different regions. Compliance with varying labeling and distribution rules requires significant investment in operational adjustments. It also faces supply risks due to fluctuations in the availability and cost of key ingredients such as sugarcane and specific spices. Climate variability, trade disruptions, and geopolitical tensions can further impact raw material sourcing. Producers may struggle to maintain consistent flavor quality when ingredient supply changes. Regulatory pressure on alcohol consumption in certain markets adds complexity to expansion strategies. These factors require adaptive supply chain management and strategic sourcing partnerships.

Market Opportunities

Expansion into Emerging Markets and Untapped Consumer Segments

The Spiced Rum Market has significant growth potential in emerging economies where premium spirits consumption is rising. Rising middle-class incomes and exposure to global cocktail culture create favorable conditions for market entry. It can target younger demographics through innovative flavors and modern branding strategies. Tourism-driven regions offer opportunities to position spiced rum as a signature drink linked to local culture. Collaborations with hospitality and entertainment venues can enhance visibility and trial rates. Expanding distribution networks into duty-free retail and specialty liquor outlets can further strengthen brand presence.

Product Innovation and Diversification into New Formats

The Spiced Rum Market can capitalize on consumer demand for unique flavor experiences and convenient formats. Producers have opportunities to introduce limited-edition blends, seasonal infusions, and craft-inspired small-batch releases. It can expand into ready-to-drink cocktails, pre-mixed bottles, and premium canned beverages to reach on-the-go consumers. Incorporating sustainable sourcing and eco-friendly packaging can appeal to environmentally conscious buyers. Partnerships with mixologists, influencers, and culinary brands can drive brand differentiation. This innovation-focused approach can expand the market’s appeal beyond traditional spirit consumers.

Market Segmentation Analysis:

By Product Type

The Spiced Rum Market is segmented into vanilla, fruit, mix, and others, each catering to distinct consumer preferences and usage occasions. The vanilla segment holds a strong appeal due to its smooth flavor profile and versatility in cocktails and standalone consumption. It attracts both traditional rum drinkers and new consumers seeking a balanced taste. Fruit-based variants leverage tropical and seasonal flavors, appealing to younger demographics and those experimenting with mixology. The mix segment combines multiple spices and flavors, offering complexity that appeals to premium spirit enthusiasts. Other variants, including limited-edition and specialty blends, serve niche markets and collectors seeking unique experiences. Innovation in flavor development and small-batch production supports growth across all product categories.

- For instance, Captain Morgan Original Spiced Rum sold approximately 12.9 million 9‑litre cases globally in 2022, which corresponds. This figure represents a significant portion of the global rum market and positions Captain Morgan as a leading brand in the category.

By Distribution Channel

The market is divided into on-trade and off-trade channels, each playing a pivotal role in reaching target audiences. On-trade channels, including bars, restaurants, and hotels, drive brand visibility through curated cocktail menus and promotional events. It allows producers to position products in premium consumption settings and influence customer perceptions. Off-trade channels, such as supermarkets, liquor stores, and e-commerce platforms, contribute significantly to volume sales by offering convenience and broader accessibility. The rise of online alcohol retail creates new opportunities for targeted marketing and direct-to-consumer sales. Seasonal promotions, gift packaging, and exclusive retail editions strengthen off-trade performance. Both channels benefit from partnerships with distributors and retailers to optimize shelf placement and promotional exposure.

- For instance, Bacardi’s Jacksonville bottling plant produces over 9 million 9‑liter cases each year, supplying more than 80 percent of the rum sold domestically.

Segments:

Based on Product Type:

Based on Distribution Channel:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share in the Spiced Rum Market, accounting for approximately 40% of global revenue in 2023. It captures high consumer demand in the U.S. and Canada, where cocktail culture and mixology enjoy significant popularity The presence of strong on-trade channels—bars, lounges, and restaurants—drives frequent consumption and brand visibility. It benefits from a wide product portfolio, including premium and craft spiced rums, supported by effective marketing and distribution networks. Urban consumers and hospitality players consistently demand new flavor innovations and ready-to-drink offerings. The robust infrastructure of duty-free outlets and e-commerce platforms amplifies access across both urban and suburban markets.

Europe

Europe secures roughly 30% of the global Spiced Rum Market, making it the second-largest region in market share Verified Market Reports. It features a well-established spirits culture, with many global rum brands rooted in European markets. It draws from strong tradition in distilling and an active cocktail scene that values artisanal, craft, and premium spiced rum innovations. On-trade venues like pubs and cocktail bars continue to promote experimentation and brand engagement. Main markets—such as the U.K., Germany, and France—invest in product differentiation through limited editions and local flavor adaptations. Cooperative efforts between distillers and mixologists support consumer education and broaden the audience for spiced rum.

Asia Pacific

Asia Pacific commands around 15% of the Spiced Rum Market share, representing a growing regional segment It achieves traction through expanding urban demographics and rising interest among young adult consumers in flavors, cocktails, and spirit experimentation. Countries such as China and India serve as key drivers, with increasing access to international brands and rising demand for premix and ready-to-drink formats Grand View Research. It leverages local cocktail culture and tourism-fueled consumption patterns. Market players target emerging cities with promotional campaigns and localized spirit blends. Wider distribution in supermarkets, modern retail chains, and digital platforms boosts visibility and trial rates in diverse segments.

Latin America, Middle East & Africa

Latin America, Middle East, and Africa together account for the remaining approximate 15% of the global Spiced Rum Market.Latin America benefits from long-standing rum traditions and flavor-rich regional brands, particularly in markets like Venezuela, Colombia, and Brazil Consumers there appreciate spiced profiles and local blends, presenting strong growth potential. Middle East & Africa reflect nascent interest, driven by growing hospitality infrastructure, tourism, and selective liberalization of alcohol policies. It must navigate regulatory constraints and supply chain challenges, yet sees rising demand in urban leisure venues and premium retail outlets. Partnering with local distributors and adapting packaging to regional preferences help stimulate adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Don Q Rum (Estilería Serrallés, Inc.)

- Tanduay Distillers

- Bacardi Limited

- HEAVEN HILL BRANDS

- SAZERAC CO, INC.

- Diageo

- Maine Craft Distilling

- Havana Club (Pernod Ricard)

- Altitude Spirits

- SUNTORY HOLDINGS LIMITED

Competitive Analysis

The Spiced Rum Market features a competitive landscape shaped by Diageo, Bacardi Limited, Tanduay Distillers, Havana Club (Pernod Ricard), Maine Craft Distilling, Altitude Spirits, HEAVEN HILL BRANDS, SUNTORY HOLDINGS LIMITED, Don Q Rum (Estilería Serrallés, Inc.), and SAZERAC CO, INC. The Spiced Rum Market is characterized by intense competition driven by brand heritage, product differentiation, and expansive distribution strategies. Leading producers focus on developing unique spice blends, premium aging processes, and innovative packaging to capture diverse consumer segments. Global brands leverage extensive supply chains and marketing capabilities to maintain dominance across mature and emerging markets, while regional and craft producers emphasize authenticity, small-batch production, and locally sourced ingredients to build niche appeal. Competition increasingly revolves around sustainability initiatives, premiumization trends, and the ability to adapt flavors to evolving consumer preferences. The market’s growth trajectory is influenced by ongoing innovation, strategic partnerships with on-trade and off-trade channels, and the capacity to strengthen brand loyalty through experiential marketing and targeted product launches.

Recent Developments

- In March 2025, Brugal Rum launched the Andrés Brugal Edition 02, the second limited edition in its ultra-premium range, with only 416 bottles available globally. Retailing at USD 3,000 per bottle, it features a blend of four single casks aged in American oak, showcasing flavors of coconut, vanilla, and gentle spice.

- In January 2025, Tanduay Distillers expanded its global brand presence, targeting new markets such as France, Italy, Spain, Denmark, the Nordic Region, and Latin America.

- In October 2024, Diego and a contract logistics company in North America, DHL Supply Chain, announced the incorporation of two fuel cell-powered electric trucks in the U.S. supply chain fleet.

- In March 2023, Bacardi Limited, one of the global companies operating in the alcoholic beverage market, launched its first premium-category spice product, BACARDÍ Caribbean Spiced, aged rum with pineapple, coconut, and spices.

Market Concentration & Characteristics

The Spiced Rum Market demonstrates a moderately concentrated structure, with a few multinational brands holding substantial influence alongside a growing base of regional and craft producers. It reflects strong brand loyalty in established markets, where heritage labels dominate shelf space and on-trade visibility. Global players benefit from extensive distribution networks, premium product portfolios, and sustained marketing investments, while smaller distillers compete through unique flavor innovations, artisanal production methods, and localized branding. The market features high product differentiation, with variations in spice blends, aging techniques, and packaging formats tailored to diverse consumer preferences. It operates in a category driven by lifestyle trends, premiumization, and mixology culture, making product storytelling and brand experience key competitive factors. Seasonal promotions, limited editions, and collaborations with hospitality partners strengthen engagement, while growing interest in sustainable sourcing and eco-friendly packaging influences purchasing decisions. The balance between established global dominance and agile niche competition shapes the sector’s competitive landscape.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium and craft spiced rum will increase in both mature and emerging markets.

- Product innovation will focus on unique spice blends and limited-edition releases.

- Ready-to-drink and pre-mixed formats will expand to capture convenience-driven consumers.

- E-commerce sales channels will gain greater importance for direct-to-consumer distribution.

- Sustainable sourcing and eco-friendly packaging will influence brand competitiveness.

- On-trade partnerships will grow to strengthen brand presence in bars and restaurants.

- Regional flavor adaptations will help brands connect with local consumer preferences.

- Marketing will increasingly leverage storytelling and heritage to build brand loyalty.

- Collaborations with mixologists will drive innovative cocktail applications.

- Growth in tourism and hospitality will boost demand for spiced rum in resort destinations.