Market Overview

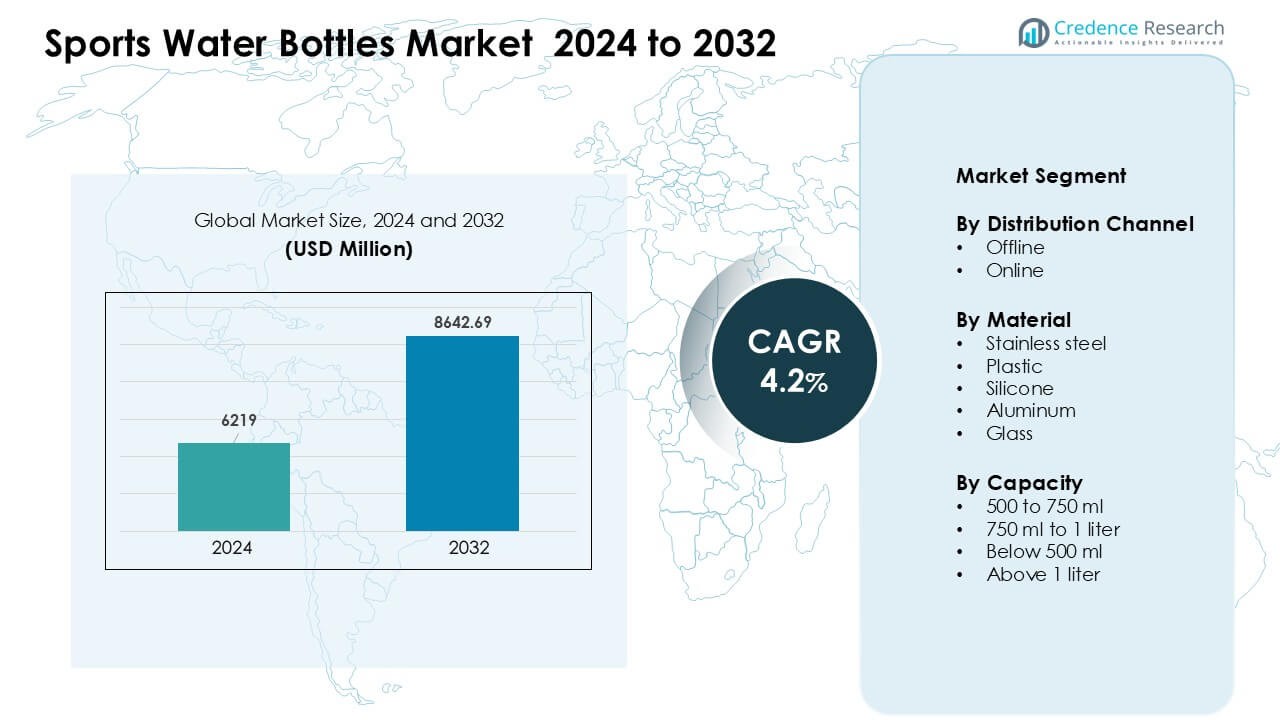

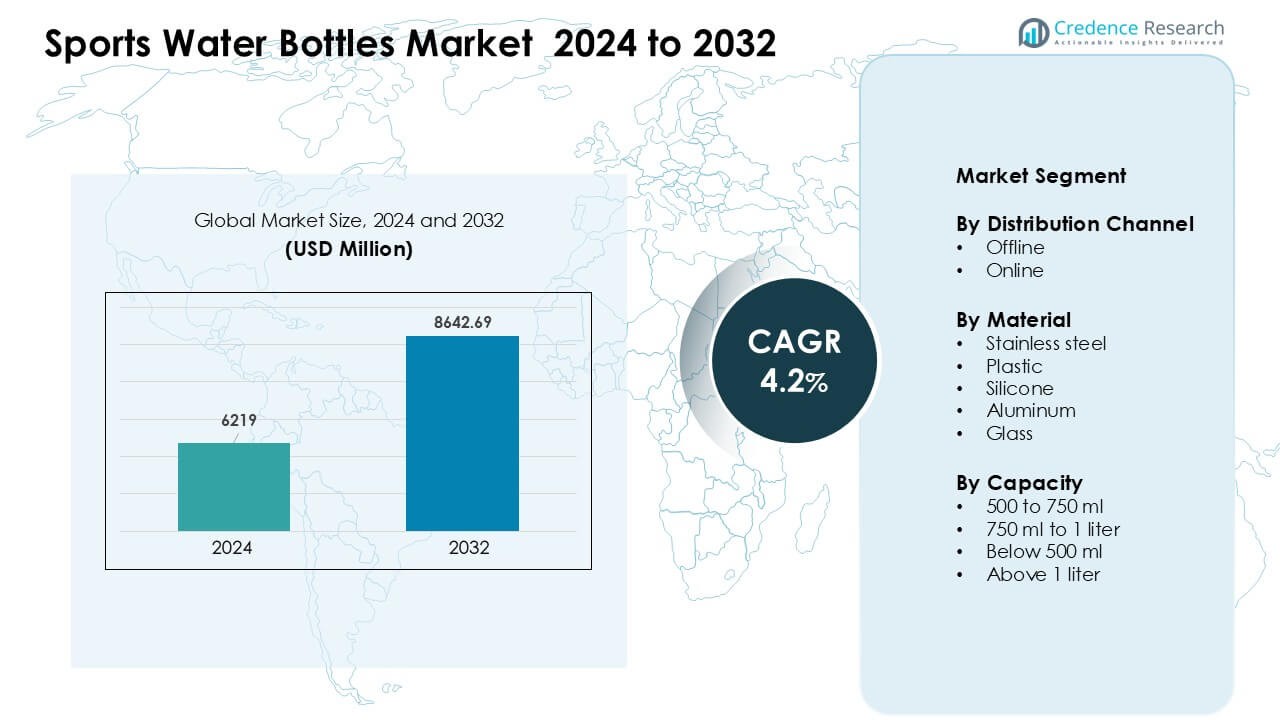

Sports Water Bottles Market was valued at USD 6219 million in 2024 and is anticipated to reach USD 8642.69 million by 2032, growing at a CAGR of 4.2 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sports Water Bottles Market Size 2024 |

USD 6219 Million |

| Sports Water Bottles Market, CAGR |

4.2 % |

| Sports Water Bottles Market Size 2032 |

USD 8642.69 Million |

The Sports Water Bottles Market features strong competition from major players such as Helen of Troy Ltd., Embrava Sports, Newell Brands Inc., HydraPak LLC, MIRA Brands, Borosil Ltd., Everich Commerce Group Ltd., Adidas AG, Klean Kanteen, and Bhalla International. These companies expanded their reach through premium insulated designs, durable materials, and wider distribution across retail and online channels. Many brands focus on eco-friendly products and ergonomic features to attract fitness users and outdoor consumers. North America emerged as the leading region in 2024 with about 37% share, supported by high fitness participation and strong demand for reusable hydration products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sports Water Bottles Market reached USD 6219 million in 2024 and is projected to hit USD 69 million by 2032, growing at a CAGR of 4.2%.

- Rising fitness culture and outdoor sports participation drive higher demand for reusable bottles, led by the 500–750 ml segment with about 41% share.

- Premium insulated bottles and smart hydration features shape major trends, while sustainability pushes consumers toward stainless steel models, which held nearly 47% share.

- Strong competition from Helen of Troy Ltd., Embrava Sports, Newell Brands Inc., HydraPak LLC, and others increases product innovation and price pressure.

- North America led the market with around 37% share in 2024, followed by Europe at 29%, while Asia-Pacific grew fastest due to expanding fitness adoption and rising middle-income buyers.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Distribution Channel

Offline stores led the distribution channel segment in 2024 with about 63% share. Many buyers preferred in-store purchases due to product feel, design checks, and faster access. Sports shops and hypermarkets gained strong footfall from fitness users who wanted trusted brands. Offline channels also expanded premium shelf space for insulated and metal bottles, which pushed higher sales. Rising interest in outdoor sports supported this lead, as many buyers chose quick replenishment from nearby stores. Online channels grew fast due to wider choice and strong price deals.

- For instance, offline retail (supermarkets, hypermarkets, specialty stores) held around 70% of all reusable water bottle sales worldwide in 2024, reflecting a strong consumer preference for physical inspection of bottles before purchase.

By Material

Stainless steel dominated the material segment in 2024 with nearly 47% share. Many fitness users trusted steel bottles due to durability, insulation, and odor resistance. Brands promoted double-wall designs that kept drinks cold for long hours, which increased demand. Growing worry about plastic waste also pushed more buyers toward metal options. Sports teams and gyms adopted stainless steel bottles in bulk, which boosted wider market reach. Plastic held steady demand for low-cost use, while silicone and glass stayed niche due to weight and break risks.

- For instance, stainless‑steel (metal) bottles accounted for about 42.5% of total reusable water‑bottle demand, making metal the leading material globally that year.

By Capacity

The 500 to 750 ml range held the dominant position in 2024 with around 41% share. This size worked well for workouts, cycling, and daily hydration, which made it a top choice for many users. The range offered a good balance between weight and volume, so athletes could carry it with ease. Brands also released many insulated and flip-top variants in this size, which improved shelf appeal. Larger sizes above 1 liter saw steady growth among hikers, while smaller bottles stayed popular for kids and short sessions.

Key Growth Drivers

Rising Fitness Adoption and Outdoor Activity Growth

Growing interest in fitness, sports, and outdoor routines drives strong demand for sports water bottles. More individuals join gyms, running clubs, cycling groups, and trekking communities, which increases the need for durable and easy-to-carry hydration products. Many buyers now prefer insulated and leak-proof designs that support long sessions in warm weather. Schools and sports academies also push hydration habits, leading to higher repeat purchases. Brands expand into lifestyle segments as people carry bottles to offices and travel. This wider use case supports steady market expansion and encourages new features across material, size, and design categories.

- For instance, the number of fitness facilities worldwide was on average up by nearly 4%, and total gym memberships increased by about 6% between 2023 and 2024, signaling more active consumers likely to use reusable hydration

Shift Toward Sustainable and Reusable Products

Consumers now choose reusable bottles to cut single-use plastic waste, which drives major growth in metal and glass-based sports bottles. The shift fits with global sustainability goals and pushes brands to offer eco-friendly lines with BPA-free materials. Stainless steel and aluminum options gain strong traction due to long life, better insulation, and reduced odor. Many companies promote green packaging and recycling programs, which improves brand awareness and trust. Government rules against disposable plastics also speed adoption across schools, workplaces, and public spaces. This sustainability shift creates long-term demand for premium reusable designs.

- For instance, manufacturers of stainless‑steel bottles reported that insulated double‑wall bottles which maintain beverage temperature for 12–24 hours increasingly dominate new product SKUs, appealing to sustainability‑ and performance‑conscious users.

Product Innovation and Brand Differentiation

Strong innovation boosts market growth as brands compete through advanced features that support hydration needs. Many companies introduce double-wall insulation, smart lids, digital hydration reminders, and ergonomic grips to appeal to active users. Custom prints and athlete-focused shapes help brands target niche sports communities. Collaborations with influencers and sports events also increase visibility and create stronger engagement. New materials such as lightweight alloys and flexible silicone allow more choices for runners and travelers. This steady stream of new designs helps expand the user base and raises replacement demand among frequent buyers.

Key Trends & Opportunities

Rising Demand for Smart Hydration Solutions

Smart water bottles with tracking sensors and hydration alerts emerge as a strong trend. Many users want real-time intake reminders linked to fitness apps, which improves hydration discipline during workouts. Connected bottles offer Bluetooth sync, temperature display, and activity-based suggestions, attracting tech-focused athletes. Corporate wellness programs also adopt such products to encourage healthy habits among employees. As fitness technology becomes mainstream, these smart solutions gain wider reach. This trend offers strong growth opportunities for brands blending digital features with durable bottle designs.

- For instance, one report states that smart water bottles dominate the market, holding approximately 27% of the 2024 market share of the overall smart bottle market.

Expansion of Premium and Customizable Designs

Premium bottles with stylish finishes and personalization options gain momentum as users view hydration products as lifestyle accessories. Matte textures, gradient shades, and laser-engraved names create strong appeal. Gyms, schools, and sports clubs order customized batches for branding, which expands bulk sales. Higher-income consumers also adopt insulated metal bottles for travel and work, boosting premium segment revenue. This rise of aesthetic and functional customization creates clear opportunities for brands that blend quality with personalization.

- For instance, many premium bottle manufacturers now offer insulated stainless‑steel bottles that keep beverages cold for up to 24 hours and hot for up to 12 hours a feature that appeals to professionals carrying bottles to office or travel.

Key Challenges

Supply Chain Volatility in Raw Materials

Fluctuating prices of stainless steel, aluminum, and high-grade plastics create supply chain stress. Many manufacturers face unstable sourcing and higher production costs, which affect pricing and margins. Global shipping delays also slow delivery for brands depending on international suppliers. Smaller companies struggle to maintain steady inventory due to rising procurement risk. These disruptions limit production planning and slow innovation cycles. Managing raw material volatility remains a core challenge for industry players.

Intense Market Competition and Price Pressure

The market faces high competition from global brands, private labels, and low-cost manufacturers. Many companies offer similar designs, which increases price-based competition and reduces brand loyalty. Online marketplaces further amplify discount-driven sales, forcing established players to reduce margins. New entrants imitate popular features, making differentiation harder. Premium brands struggle to balance innovation costs with accessible pricing. This rising competitive pressure remains a major challenge that limits long-term profitability.

Regional Analysis

North America

North America held about 37% share in the Sports Water Bottles Market in 2024, supported by high fitness awareness and strong adoption of reusable metal bottles. Many users joined gyms, outdoor sports, and cycling groups, which boosted steady demand. Premium insulated steel bottles gained wide traction due to long cooling performance. Brands expanded retail presence through sporting stores and online platforms, improving reach across the U.S. and Canada. Rising sustainability programs in schools and workplaces also pushed consumers toward BPA-free and eco-friendly options, strengthening regional sales growth.

Europe

Europe accounted for nearly 29% share in 2024, driven by strong sustainability habits and wide acceptance of reusable bottles. Many buyers avoided single-use plastics due to strict environmental rules across the region. Stainless steel and glass bottles gained popularity, especially among office workers and outdoor hobbyists. Sports clubs and cycling communities also increased bulk demand for durable, insulated models. Growing tourism and travel culture supported higher sales of lightweight designs. Expanding e-commerce platforms enabled fast product reach across Germany, the U.K., France, Italy, and Nordic countries.

Asia-Pacific

Asia-Pacific captured about 24% share in 2024 and showed strong growth potential due to rising fitness adoption and expanding middle-income populations. Many buyers joined gyms and running groups, which boosted sales of affordable plastic and premium steel bottles. Urban consumers preferred insulated models for hot climates, increasing demand in India, China, Japan, and Southeast Asia. Local manufacturers offered low-cost designs that attracted large volumes. Rising school hydration programs and outdoor sports events further pushed market expansion. E-commerce growth helped brands reach younger buyers quickly.

Latin America

Latin America held close to 6% share in 2024, driven by expanding sports culture and growing interest in wellness. Countries such as Brazil, Mexico, and Argentina showed rising purchases of lightweight plastic bottles due to affordability. Fitness centers, football clubs, and outdoor groups encouraged the use of reusable hydration products. Warmer climates increased demand for insulated models, especially during travel and adventure sports. Online platforms gained traction and improved product access in urban areas. Sustainability awareness continued to rise, supporting long-term adoption of reusable designs.

Middle East & Africa

The Middle East & Africa region accounted for around 4% share in 2024, supported by warm climates that increased daily hydration needs. Users preferred insulated bottles that kept drinks cool for long periods, leading to steady demand. Outdoor sports, gym activities, and travel habits grew in cities like Dubai, Riyadh, and Johannesburg. Affordable plastic bottles maintained volume sales, while premium steel designs gained interest among fitness users. Retail expansion in malls and online marketplaces improved access. Rising sustainability awareness also pushed consumers toward reusable options.

Market Segmentations:

By Distribution Channel

By Material

- Stainless steel

- Plastic

- Silicone

- Aluminum

- Glass

By Capacity

- 500 to 750 ml

- 750 ml to 1 liter

- Below 500 ml

- Above 1 liter

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Sports Water Bottles Market features strong activity from global brands, regional manufacturers, and emerging niche players that target fitness-focused consumers. Leading companies such as Helen of Troy Ltd., Embrava Sports, Newell Brands Inc., HydraPak LLC, MIRA Brands, Borosil Ltd., Everich Commerce Group Ltd., Adidas AG, Klean Kanteen, and Bhalla International expanded their portfolios with insulated steel bottles, lightweight travel designs, and BPA-free materials. Many brands focused on premium finishes, leak-proof lids, and durable construction to strengthen product appeal. Partnerships with gyms, sports clubs, and outdoor retailers enhanced visibility across key markets. E-commerce channels also supported rapid growth by offering wide assortments and customization options, increasing brand reach among younger users. Sustainability-driven innovation remained central, pushing companies to introduce recyclable materials and long-life designs.

Key Player Analysis

- Helen of Troy Ltd.

- Embrava Sports

- Newell Brands Inc.

- HydraPak LLC

- MIRA Brands

- Borosil Ltd.

- Everich Commerce Group Ltd.

- Adidas AG

- Klean Kanteen

- Bhalla International

Recent Developments

- In January 2025, Helen of Troy Ltd. built extra Hydro Flask inventory and moved to diversify sourcing to brace for potential U.S. tariff impacts and supply-chain uncertainty; the company called out weaker consumer demand and tightened retail inventory in its fiscal updates around this period.

- In September 2024, Helen of Troy Ltd. (Hydro Flask brand) launched a refreshed Hydro Flask brand campaign and new product drops (including Travel Bottle additions and limited-edition/colorway releases), leaning into cultural moments to drive engagement.

- In 2024, Newell Brands (Contigo) launched a limited-edition Contigo x Ally Love water-bottle/tumbler collection (Ally Love named Contigo’s Chief Hydration Officer / collaborator) a branded-collaboration push of limited-edition colorways and special packaging to stimulate demand in the hydration category.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Distribution Channel, Material, Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for reusable bottles will rise as fitness habits grow worldwide.

- Stainless steel models will gain more traction due to durability and insulation.

- Smart hydration bottles will expand as tech adoption increases among athletes.

- Brands will focus on sustainable materials to meet rising eco-friendly expectations.

- Customizable and premium designs will gain popularity among lifestyle buyers.

- E-commerce sales will accelerate as online platforms offer wider choices.

- Partnerships with gyms and sports events will strengthen brand visibility.

- Lightweight travel-friendly bottles will see higher demand from outdoor users.

- Competition will intensify as new entrants offer low-cost and stylish options.

- Growth in Asia-Pacific will speed up as fitness participation continues to rise.

Market Segmentation Analysis:

Market Segmentation Analysis: