Market Overview

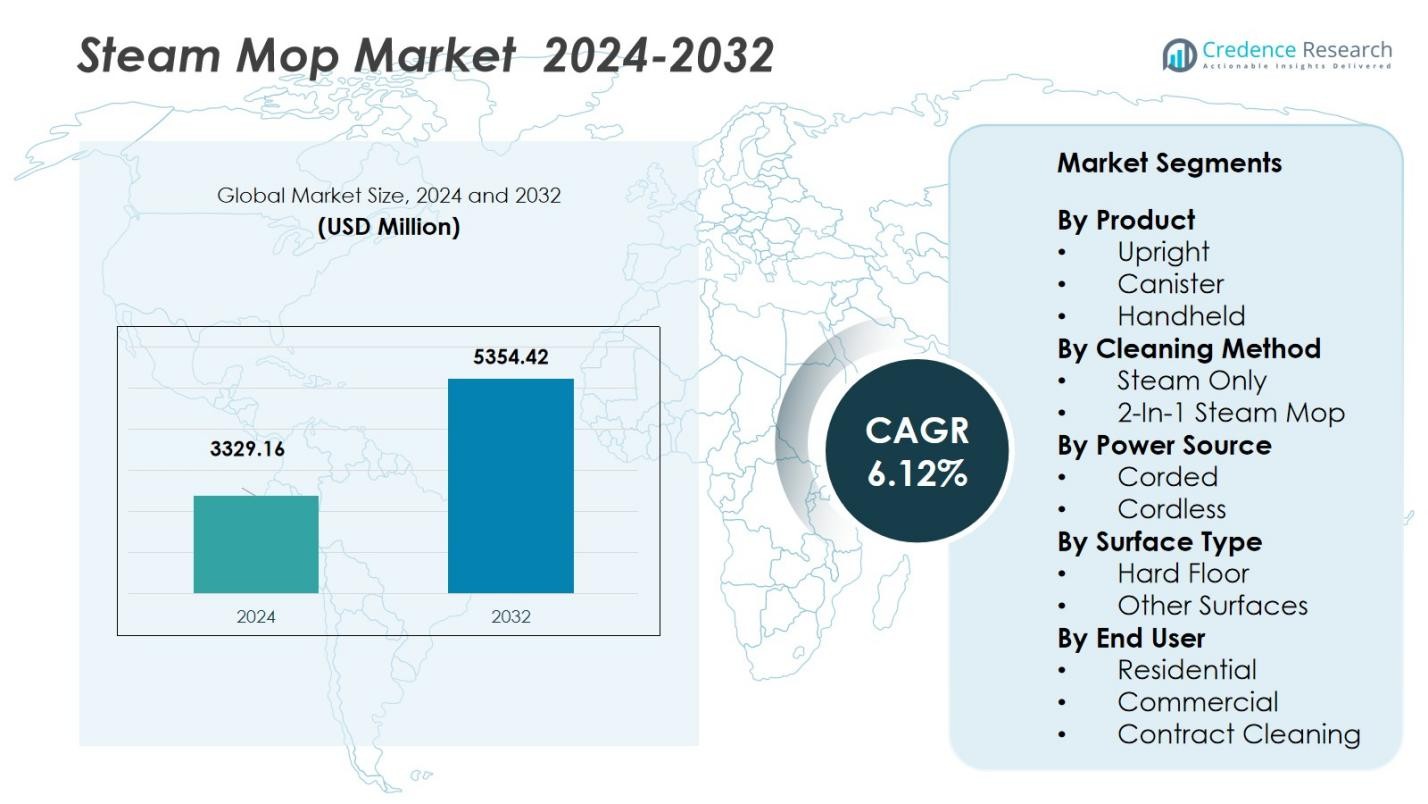

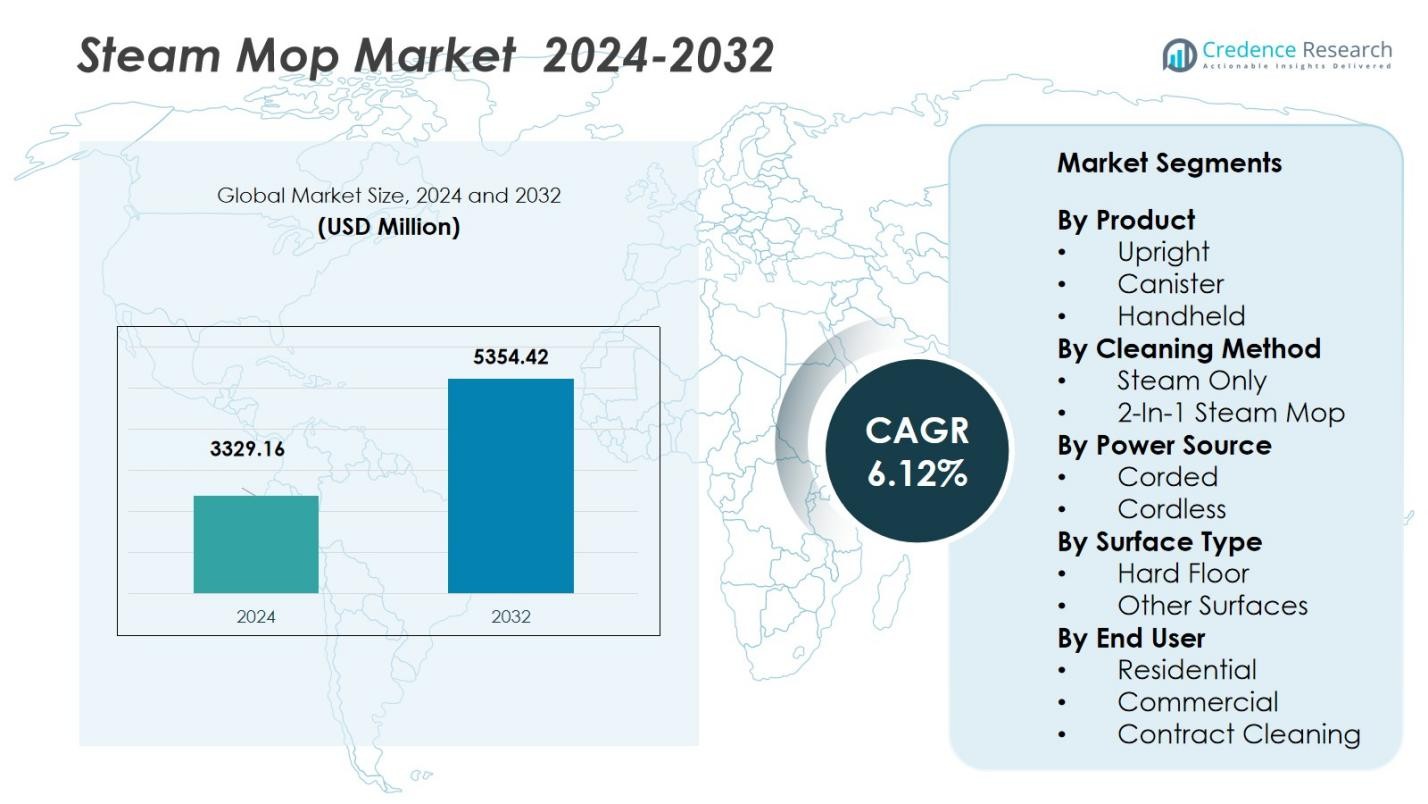

The Steam Mop Market size was valued at USD 3,329.16 Million in 2024 and is anticipated to reach USD 5,354.42 Million by 2032, at a CAGR of 6.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Steam Mop Market Size 2024 |

USD 3,329.16 Million |

| Steam Mop Market, CAGR |

6.12% |

| Steam Mop Market Size 2032 |

USD 5,354.42 Million |

The Steam Mop Market features prominent companies including BLACK+DECKER, Eureka Forbes, light‑n‑easy, Wagner SprayTech, SALAV USA, Dupray, Vornado Air, Ladybug and POLTI Spa driving product innovation and market expansion. These firms are leveraging advanced features such as rapid‑heat boilers, multifunction attachments, cordless mobility and eco‑friendly design to strengthen their footprint globally. Regionally, North America dominates with a 40% market share supported by high consumer awareness and strong retail infrastructure. Europe follows with a 30% share, led by eco‑conscious consumers and stringent hygiene regulations. Asia Pacific holds approximately 23%, driven by rising urbanisation, increasing disposable incomes and growing acceptance of modern cleaning technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Steam Mop Market size was valued at USD 3,329.16 Million in 2024 and is projected to reach USD 5,354.42 Million by 2032, growing at a CAGR of 6.12% during the forecast period.

- Key drivers of market growth include rising consumer demand for convenient, time-saving cleaning solutions and growing awareness of eco-friendly, chemical-free cleaning alternatives.

- Technological advancements, such as smart features, cordless models, and rapid heating systems, are key trends shaping the market’s future.

- The market faces challenges such as high initial costs and limited penetration in developing regions where traditional cleaning methods are more prevalent.

- Regionally, North America leads the market with a 40% share, followed by Europe with 30%. The Asia-Pacific region holds 23%, driven by rising disposable incomes and increasing urbanization. The Latin American and MEA regions represent smaller shares but show potential for future growth.

Market Segmentation Analysis:

By Product:

The product segment of the Steam Mop Market includes Upright, Canister, and Handheld models. Upright steam mops lead the segment with a dominant 58% market share, supported by their ergonomic design, strong suction, and suitability for large surface areas. Their widespread adoption in residential cleaning is fueled by rising preferences for quick, efficient, and user-friendly cleaning tools. Canister and handheld models follow, but their combined share remains lower due to limited capacity and reduced convenience for whole-floor cleaning compared to upright systems.

- For instance, Kärcher’s SC 2 Upright EasyFix steam cleaner is designed specifically for sealed hard floors and is marketed as removing up to 99.999% of coronaviruses and 99.99% of common household bacteria from hard surfaces using high‑temperature steam, illustrating why upright models are favored for hygienic, large‑area floor cleaning.

By Cleaning Method:

The cleaning method segment comprises Steam Only and 2-In-1 Steam Mops. The 2-In-1 Steam Mop segment dominates with a 63% market share, driven by its multifunctional capability that allows users to switch between steaming and traditional mopping. The growing demand for versatile household cleaning equipment strongly supports this segment’s expansion. Steam-only mops retain the remaining share, preferred mainly by users seeking simple, chemical-free sanitization solutions but lacking the multifunctional appeal that fuels the 2-in-1 category’s leadership.

- For instance, Bissell PowerFresh Slim 2233F, a 3-in-1 steam cleaner that transforms from an upright mop to a handheld steamer and extended reach tool

By Power Source:

In the power source category, Corded and Cordless steam mops make up the market structure. Corded steam mops hold a leading 57% market share, primarily due to their continuous steam generation, reliable operation, and suitability for extended cleaning sessions without battery limitations. This makes them the preferred choice in commercial environments and larger homes. Cordless steam mops, accounting for the remaining share, are rapidly growing in popularity due to enhanced mobility and convenience, appealing to consumers seeking flexible and wire-free cleaning solutions.

Key Growth Drivers

Rising Consumer Demand for Convenient Cleaning Solutions

The increasing preference for convenient, time-saving cleaning appliances is a major driver for the growth of the steam mop market. As consumers prioritize efficiency in household chores, steam mops have emerged as an effective solution for quick and thorough cleaning. The demand for user-friendly, easy-to-store, and multifunctional devices has expanded, particularly in busy households. This growing trend toward convenience in cleaning is expected to drive significant market growth, with consumers seeking solutions that minimize effort while maintaining high standards of cleanliness.

- For instance, “SteamForce X1” from GlobeClean Industries is utilized by professional cleaning services to deep-clean extensive surfaces effectively without chemicals, restoring hygiene in luxury homes.

Growing Awareness of Eco-Friendly Cleaning Products

Another significant growth driver is the increasing consumer awareness of eco-friendly and chemical-free cleaning options. Steam mops, which sanitize floors using steam without the need for harsh chemicals, are gaining popularity due to their environmental benefits. Consumers are increasingly turning to steam mops as a safer and more sustainable cleaning alternative, especially in households with young children or pets. This growing eco-consciousness is fueling market demand, with consumers actively seeking products that promote sustainability and reduce the environmental impact of cleaning.

- For instance, the Shark Steam Pocket Mop, praised for its lightweight design and long cord, offers effective cleaning while reducing reliance on chemical cleaners.

Expansion of Residential and Commercial Applications

The steam mop market is also benefitting from the expanding application of steam mops in both residential and commercial settings. In residential markets, the growing number of dual-income households and busy lifestyles have led to an increased demand for time-saving appliances. Commercial sectors, including hospitality and healthcare, are recognizing the efficiency and effectiveness of steam mops for large-scale cleaning tasks. This broadening application base in multiple environments is expected to further fuel market expansion, as steam mops are recognized for their versatility in both home and business cleaning.

Key Trends & Opportunities

Technological Advancements in Steam Mop Features

Technological innovations in steam mop design and functionality present significant opportunities for market growth. The introduction of features such as adjustable steam levels, faster heating times, and integrated filtration systems allows steam mops to cater to a wider range of cleaning needs. Furthermore, advancements in cordless models, offering greater mobility, are reshaping consumer expectations. As technology continues to improve the efficiency and convenience of steam mops, manufacturers can capitalize on these innovations to attract tech-savvy consumers and increase market penetration.

- For instance, Newbealer’s advanced steam mop heats up in just 20 seconds and features three adjustable steam modes, allowing users to control steam intensity for various surfaces efficiently.

Integration of Smart Features and Connectivity

The integration of smart features and connectivity into steam mops is another emerging opportunity in the market. With the rise of smart homes, consumers are increasingly seeking devices that can be connected to mobile apps or home automation systems. Features such as remote control, scheduled cleaning, and performance monitoring through smartphones or voice assistants are gaining traction. This shift towards smart home integration opens up significant growth opportunities for steam mop manufacturers, allowing them to tap into the growing demand for connected home appliances.

- For instance, Agaro’s Alpha Robot Vacuum Cleaner and Mop supports smart app control and voice commands through Alexa and Google Assistant, enabling voice-activated cleaning routines and remote operation.

Key Challenges

High Initial Cost of Steam Mops

One of the major challenges in the steam mop market is the relatively high initial cost of these devices compared to traditional mops. While steam mops offer long-term benefits, such as chemical-free cleaning and time savings, the upfront investment can be a barrier for many price-sensitive consumers. This challenge is particularly pronounced in developing markets, where consumers may opt for more affordable cleaning solutions. Manufacturers will need to address cost concerns through pricing strategies and introducing lower-cost models to widen their consumer base.

Limited Market Penetration in Developing Regions

Despite the growing demand in developed countries, the steam mop market faces challenges in penetrating developing regions. Factors such as low awareness, limited access to advanced cleaning technologies, and economic constraints hinder market expansion. Consumers in emerging economies are often more accustomed to traditional cleaning methods and may be reluctant to invest in new technology without understanding its benefits. Overcoming these barriers will require targeted marketing campaigns, localized product offerings, and education on the advantages of steam mops to encourage adoption in these regions.

Regional Analysis

North America

The North America region commands a market share of 40% in the global steam mop market, owing to heightened consumer awareness of hygiene and a strong preference for chemical‑free cleaning solutions. With dual‑income households growing, time‑sensitive consumers increasingly adopt steam mops for efficient floor care. Additionally, the presence of a robust retail ecosystem online platforms and specialty stores supports rapid product penetration. Commercial establishments in hospitality and healthcare further boost demand. As a result, North America remains the largest regional contributor and key growth driver within the market.

Europe

In Europe, the steam mop market holds 30% of global share, underpinned by rising demand for eco‑friendly cleaning solutions in countries like Germany, the UK and France. European consumers prioritise premium, low‑chemical devices and actively invest in home‑care appliances that meet stringent environmental standards. Additionally, strong regulations on indoor air quality and hygiene in commercial settings propel steam mop usage in B2B segments. Retail chains and online platforms in Europe effectively promote innovations and drive adoption, enabling this region to remain a solid and mature market contributor.

Asia‑Pacific

Asia‑Pacific accounts for 23% of the global steam mop market, driven by increasing urbanisation, rising disposable incomes and greater awareness of modern cleaning technologies. Countries such as China, India and Australia show strong growth potential as households shift toward automated and steam‑based cleaning devices. Several regional manufacturers invest in R&D and expand distribution networks to cater to local preferences. While its share is lower than North America and Europe, Asia‑Pacific is emerging rapidly and expected to play an increasingly influential role in future market expansion.

Latin America

The Latin America region contributes 5% of the global steam mop market, reflecting its current developing‑market status. Growth in this region is stimulated by expanding middle‑class populations, accelerating urbanisation and rising preference for modern household appliances. Brazil, in particular, shows notable adoption of eco‑friendly cleaning solutions. However, market penetration remains constrained by lower per‑capita income and limited retail infrastructure compared to more developed regions. Nonetheless, Latin America presents untapped opportunities for manufacturers seeking to diversify beyond mature markets.

Middle East & Africa

The Middle East & Africa (MEA) region holds 2% of the global steam mop market, driven by increasing hygiene awareness, especially in the Gulf Cooperation Council (GCC) countries and among hospitality sectors. Investment in commercial infrastructure and rising standards of cleanliness in hotels and public buildings are gradually boosting demand. Nevertheless, economic disparities, limited consumer awareness and under‑penetrated retail channels restrict growth. With targeted educational campaigns and infrastructure improvements, MEA offers niche opportunities for steam mop market players seeking early‑mover advantage.

Market Segmentations:

By Product

- Upright

- Canister

- Handheld

By Cleaning Method

- Steam Only

- 2-In-1 Steam Mop

By Power Source

By Surface Type

- Hard Floor

- Other Surfaces

By End User

- Residential

- Commercial

- Contract Cleaning

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis in the steam mop market features key players such as BLACK+DECKER, Eureka Forbes, light‑n‑easy, Wagner SprayTech, SALAV, Dupray and POLTI. These companies vigorously compete on product innovation, distribution reach, and marketing strategies to consolidate market share. Firms emphasise differentiated features such as rapid‑heating boilers, cordless mobility, and multifunctional attachments to appeal to convenience‑seeking consumers. Price competition remains intense especially in mature regions, prompting companies to leverage value‑added services and bundled accessories to retain customers. Strategic collaborations with e‑commerce platforms and expansion into emerging geographies reinforce competitive positioning. Overall, the landscape is characterised by moderate market concentration but high product‑level rivalry and continuous feature escalation.

Key Player Analysis

Recent Developments

- In October 2024, Alfred Kärcher SE & Co. KG expanded its SC‑1/SC steam mop range with new multifunctional models, emphasising compact design and accessory kits.

- In August 2025, LG Electronics introduced a robot vacuum with integrated steam‑mop mode as part of its new cleaning‑appliance lineup at IFA 2025.

- In August 2025, Aterian, Inc. (via its brands including PurSteam) announced the launch of several new products on BestBuy.com (effective 19 Aug 2025) which included steam‑mop items among its home‑appliance SKUs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Cleaning Method, Power Source, Surface Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rapid urbanisation and rising dual‑income households will increase demand for efficient floor‑cleaning devices.

- Growing consumer preference for chemical‑free and eco‑friendly cleaning solutions will boost steam mop adoption.

- Advances in cordless and battery‑powered steam mops will enhance portability and convenience, reshaping product offerings.

- Integration of smart features such as app connectivity and voice control will become more common in steam mop models.

- Manufacturers will expand their presence in emerging markets where awareness of modern cleaning technologies is still low.

- Multi‑surface and multifunction steam mops will gain traction as consumers seek versatile cleaning solutions for mixed flooring types.

- Growth in commercial applications (such as hospitality and healthcare) will increase demand for heavy‑duty steam mop models.

- Increase in online retail and direct‑to‑consumer channels will accelerate product reach and reduce distribution costs.

- Collaborations between appliance brands and home‑cleaning service providers will drive bundled product–service offerings.

- Sustainable design and recyclable materials will become key differentiators as environmental concerns influence purchasing decisions.