| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Supply Chain Management Software Market Size 2024 |

USD 26.63 billion |

| Supply Chain Management Software Market, CAGR |

8.2% |

| Supply Chain Management Software Market Size 2032 |

USD 50.02 billion |

Market Overview:

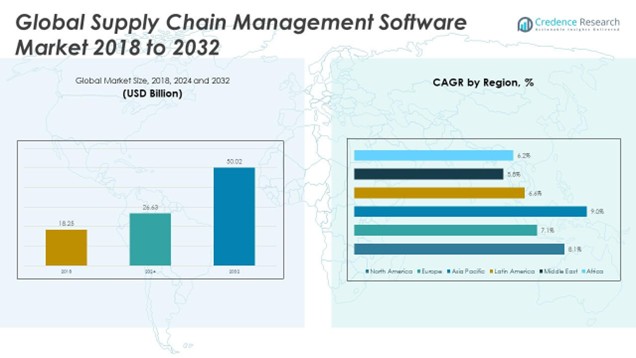

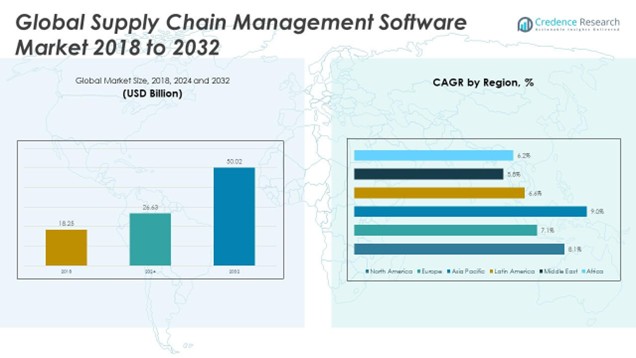

The Global Supply Chain Management Software Market size was valued at USD 18.25 billion in 2018 to USD 26.63 billion in 2024 and is anticipated to reach USD 50.02 billion by 2032, at a CAGR of 8.2% during the forecast period.

The key drivers fueling the growth of the global SCM software market include the acceleration of digital transformation initiatives and the increasing demand for visibility across complex, global supply networks. Enterprises are adopting digital tools to streamline operations and respond to market volatility, particularly in sectors such as manufacturing, retail, healthcare, and logistics. Cloud-based SCM solutions are gaining traction due to their scalability, flexibility, and ability to reduce IT infrastructure costs. The integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) enhances real-time decision-making capabilities and enables predictive analytics, improving demand forecasting and resource planning. The rapid growth of e-commerce is also contributing significantly to software adoption, as retailers and logistics providers seek to manage high transaction volumes and ensure last-mile delivery efficiency.

North America dominates the global supply chain management software market. The region benefits from well-established IT infrastructure, strong adoption of cloud technologies, and the presence of major industry players such as Oracle, SAP, and IBM. The United States leads regional growth, driven by a mature e-commerce sector, continuous innovation, and increased investment in AI-enabled supply chain solutions. Asia Pacific is emerging as the fastest-growing region in the market, fueled by rapid industrialization, expanding logistics networks, and government initiatives to digitize infrastructure. Countries like China, India, Japan, and South Korea are witnessing increased adoption of SCM software as enterprises modernize their supply chains to meet domestic and international demand. Europe also holds a significant share of the market, with growth supported by the region’s focus on sustainable supply chains, stringent regulatory standards, and a growing emphasis on green logistics and circular economy practices. Latin America and the Middle East & Africa are gradually adopting SCM solutions, supported by digital transformation in retail.

Market Insights:

- The Global Supply Chain Management Software market size increased from USD 18.25 million in 2018 to USD 26.63 million in 2024 and is expected to reach USD 50.02 million by 2032, growing at a CAGR of 8.2%.

- Accelerated digital transformation and demand for real-time visibility are key drivers boosting software adoption across global supply networks.

- Cloud-based solutions dominate due to their scalability, lower IT costs, and rapid deployment, especially among SMEs.

- AI, machine learning, and IoT integration enable predictive analytics, helping companies optimize inventory, demand planning, and logistics.

- The rise of e-commerce and multichannel retailing is increasing pressure on supply chains, driving demand for agile, real-time software platforms.

- High implementation costs, integration complexities, and a shortage of skilled professionals present adoption challenges, particularly for smaller enterprises.

- North America leads the market, Asia Pacific shows the fastest growth, and Europe remains strong with a focus on sustainability; Latin America and the Middle East & Africa are gradually adopting SCM solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Digital Transformation and Demand for Operational Visibility

Enterprises are prioritizing digital transformation to modernize legacy systems and improve end-to-end supply chain visibility. This shift enables better control over procurement, inventory, logistics, and order fulfillment. The Global Supply Chain Management Software Market benefits from organizations adopting real-time data platforms to enhance forecasting accuracy and decision-making speed. Businesses require agile solutions that allow them to respond quickly to disruptions and demand shifts. The ability to visualize the entire supply chain improves coordination between suppliers, manufacturers, and distributors. It strengthens resilience and ensures smoother operations in both local and global supply networks.

- BASF, for example, uses AI and machine learning technologies to predict optimal stock replenishment times, resulting in increased visibility into inventory levels and smarter replenishment planning.

Adoption of Cloud-Based Solutions for Scalability and Cost Efficiency

Cloud-based SCM platforms are driving strong demand due to their scalability, cost-effectiveness, and faster deployment. These solutions eliminate the need for extensive hardware investments and reduce maintenance burdens for IT teams. Organizations of all sizes are transitioning to cloud-based software to gain access to updates, integrations, and collaboration tools across global operations. It supports flexible deployment models, enabling companies to tailor software capabilities to specific regional or departmental needs. Small and medium-sized enterprises especially gain value from cloud platforms, which provide enterprise-grade functionality without high capital costs. Cloud adoption also facilitates integration with third-party tools and data sources for greater interoperability.

- SAP’s Integrated Business Planning (IBP) system, for instance, provides cloud-based solutions that offer real-time visibility and collaborative planning, streamlining supply chain activities and optimizing inventory management.

Integration of AI, Machine Learning, and IoT for Predictive Capabilities

Advanced technologies such as artificial intelligence, machine learning, and IoT are transforming supply chain management from reactive to predictive. These technologies enable automated insights, real-time monitoring, and data-driven planning, helping companies to reduce delays, optimize inventory, and avoid stockouts. The Global Supply Chain Management Software Market is evolving to offer predictive analytics that improves production schedules, demand forecasts, and distribution strategies. IoT sensors track goods across the supply chain, while AI enhances dynamic routing and warehouse automation. These capabilities reduce operational inefficiencies and elevate customer service levels. Companies that integrate these technologies gain a competitive edge through smarter, faster supply chain decisions.

Growth of E-commerce and Multichannel Logistics Requirements

The rapid rise of e-commerce is pushing businesses to reconfigure their supply chains to handle greater complexity, faster delivery expectations, and higher volumes. It increases pressure on warehouse operations, transportation planning, and last-mile delivery, all of which require seamless coordination. SCM software addresses these challenges by offering features such as real-time order tracking, automated fulfillment, and flexible shipping logic. Businesses also rely on it to manage multichannel inventory, improve customer experiences, and reduce return rates. The e-commerce sector’s continued expansion strengthens demand for agile, responsive SCM platforms. This trend supports the sustained growth of the market across retail, consumer goods, and logistics sectors.

Market Trends:

AI-Powered Supply Chain Intelligence Gains Momentum

Artificial intelligence is transforming how organizations manage and optimize supply chain operations. Companies are using AI-driven tools for demand forecasting, inventory optimization, and transportation planning. The Global Supply Chain Management Software Market is seeing a sharp rise in predictive analytics capabilities, enabling proactive decision-making. These tools help reduce waste, improve delivery performance, and mitigate disruptions. AI supports dynamic pricing, personalized supply strategies, and automation of repetitive tasks. This trend is pushing vendors to integrate advanced machine learning algorithms into core platforms.

- For instance, C3 AI Inventory Optimization enabled a global discrete manufacturer to achieve over 50% inventory reduction and $100 million in annual savings, while a global electronics distribution company realized a 20% inventory reduction, translating to more than $40 million in working capital reduction within six months.

Increased Demand for End-to-End Supply Chain Visibility

Businesses are prioritizing transparency and traceability across their supply chains to strengthen compliance, reduce risk, and improve efficiency. Organizations are implementing digital twins, control towers, and real-time dashboards to monitor goods movement, supplier performance, and inventory levels. The market is responding to this need with platforms that unify disparate data sources across procurement, production, and distribution. End-to-end visibility helps companies adapt quickly to market fluctuations and regulatory changes. It also supports risk mitigation by identifying bottlenecks and vulnerabilities early. Supply chain managers are adopting these capabilities to drive strategic resilience.

Sustainability and Green Supply Chain Initiatives Shape Product Development

Environmental sustainability has become a key focus across industries, influencing the design and functionality of SCM software. Companies are tracking carbon emissions, optimizing transportation routes for fuel efficiency, and managing waste throughout the supply chain lifecycle. The Global Supply Chain Management Software Market is evolving to include features that support sustainability reporting and circular supply models. It enables businesses to meet regulatory requirements and align with consumer demand for ethical sourcing. Tools that evaluate supplier sustainability performance and reduce environmental impact are gaining widespread adoption. This trend is expected to accelerate with stricter global environmental standards.

Surge in Blockchain Integration for Secure and Transparent Transactions

Blockchain technology is being explored and adopted in supply chain systems to enhance security, trust, and traceability. It enables immutable records of transactions, ensuring transparency in procurement, logistics, and supplier relationships. Companies use blockchain to verify product authenticity, prevent fraud, and streamline customs and compliance processes. The market is integrating blockchain features into core software platforms to improve data accuracy and stakeholder collaboration. It supports smart contracts and automated workflows, reducing manual paperwork and disputes. This development is expanding the scope of SCM platforms into finance, trade, and cross-border logistics.

- For instance, companies like Nestlé use blockchain to provide consumers with transparency about the sourcing and production of their products, ensuring end-to-end traceability and reducing the risk of fraud and counterfeiting.

Market Challenges Analysis:

High Implementation Costs and Integration Complexities Hinder Adoption

Many organizations face budget constraints when implementing enterprise-level SCM software, especially in small and mid-sized enterprises. High initial investment in licensing, infrastructure upgrades, and training deters adoption despite long-term efficiency gains. The Global Supply Chain Management Software Market struggles with integration issues across legacy systems, third-party applications, and diverse operational units. Aligning new platforms with existing workflows often requires extensive customization, increasing deployment time and cost. Organizations with fragmented supply chain processes experience delays and operational disruptions during system transitions. These barriers slow down market penetration in developing economies and across price-sensitive sectors.

- For instance, when L’Oréal rolled out a new SAP supply chain management system, the company reported that the project required significant upfront investment, including extensive infrastructure upgrades and months of staff training, leading to a multi-year implementation timeline.

Data Security Risks and Shortage of Skilled Professionals Limit Efficiency

As companies shift to cloud-based platforms and digital tools, cybersecurity becomes a critical concern. Sensitive supply chain data involving transactions, inventory levels, and vendor relationships must be protected from breaches. The market faces challenges in ensuring data privacy, compliance with regulations, and resilience against cyber threats. A shortage of professionals skilled in data analytics, AI, and SCM software reduces the efficiency of software utilization. It forces organizations to rely heavily on vendor support, which may not always align with internal timelines or goals. These limitations restrict the ability of firms to unlock the full potential of advanced supply chain technologies.

Market Opportunities:

Developing countries are expanding their manufacturing and logistics capabilities, creating new demand for advanced supply chain solutions. Governments in Asia Pacific, Latin America, and Africa are investing in digital infrastructure and industrial modernization. The Global Supply Chain Management Software Market can capitalize on this momentum by offering scalable, cloud-based platforms tailored for regional needs. Vendors that provide localized language support, modular features, and affordable pricing can gain a competitive edge. Expansion in these markets opens opportunities to serve sectors like agriculture, retail, and small-scale manufacturing. These regions present long-term growth potential driven by digital transformation initiatives.

Global disruptions have highlighted the need for supply chains that can adapt to shifting demand, geopolitical risks, and material shortages. Companies are seeking agile software platforms that support scenario planning, supplier diversification, and real-time monitoring. The market has an opportunity to deliver tools that enable rapid decision-making and risk mitigation. AI-driven platforms, IoT-enabled tracking systems, and blockchain applications offer clear value propositions for building resilience. Organizations adopting these technologies aim to improve continuity, reduce operational shocks, and gain strategic advantage. This demand creates a favorable environment for innovation and product development.

Market Segmentation Analysis:

The Global Supply Chain Management Software Market is segmented by solution type, deployment type, enterprise size, and industry vertical.

By solution type, transportation management systems and warehouse management systems lead adoption due to increasing demand for efficient logistics and inventory control. Supply chain planning and procurement and sourcing solutions are also gaining traction as companies focus on cost optimization and supplier coordination. Manufacturing execution systems are critical in production-heavy industries, while the “others” category includes niche solutions for compliance and analytics.

By deployment type, cloud-based platforms dominate the market due to their flexibility, scalability, and lower upfront costs. On-premise solutions continue to serve businesses with strict regulatory or security requirements but are gradually declining in preference.

By enterprise size, large enterprises hold a major share due to their complex operations and higher budgets. SMEs are adopting agile, cloud-based platforms that support growth and reduce operational overhead.

By industry vertical, retail and consumer goods account for a significant portion of the market, driven by omnichannel distribution needs. Manufacturing, healthcare, transportation, and automotive sectors also contribute strongly due to the complexity of their supply chains. Food and beverages and other emerging industries are adopting SCM software to improve traceability, reduce waste, and maintain regulatory compliance. The market reflects growing demand for integrated solutions across all sectors and enterprise sizes.

Segmentation:

By Solution Type

- Transportation Management System

- Warehouse Management System

- Supply Chain Planning

- Procurement and Sourcing

- Manufacturing Execution System

- Others

By Deployment Type

By Enterprise Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- Retail and Consumer Goods

- Healthcare and Pharmaceuticals

- Manufacturing

- Food and Beverages

- Transportation and Logistics

- Automotive

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America Supply Chain Management Software Market size was valued at USD 5.26 billion in 2018 to USD 7.55 billion in 2024 and is anticipated to reach USD 14.24 billion by 2032, at a CAGR of 8.1 % during the forecast period. North America leads the Global Supply Chain Management Software Market, holding a market share of 36.5% in 2024. The region benefits from early adoption of cloud-based platforms, strong presence of major vendors, and well-established IT infrastructure. The United States accounts for the largest share within North America due to its expansive retail and logistics sectors, high e-commerce penetration, and investments in artificial intelligence and data analytics. Organizations in the region prioritize automation and predictive analytics to streamline operations and improve supply chain resilience. Canada supports regional growth through government-backed innovation programs and growing demand in its manufacturing and food distribution sectors. North America continues to drive innovation and early adoption of advanced supply chain technologies.

The Asia Pacific Supply Chain Management Software Market size was valued at USD 6.82 billion in 2018 to USD 10.39 billion in 2024 and is anticipated to reach USD 20.89 billion by 2032, at a CAGR of 9.0% during the forecast period. Asia Pacific represents the fastest-growing region, currently holding a 28.4% market share in 2024. Strong economic expansion, rapid industrialization, and digital infrastructure development in China, India, Japan, and South Korea contribute to rising demand for SCM solutions. Regional governments are supporting smart manufacturing and logistics modernization, while enterprises adopt supply chain platforms to manage complex vendor ecosystems and cross-border logistics. The e-commerce boom across Southeast Asia further accelerates software adoption to handle high transaction volumes and last-mile delivery requirements. It benefits from a large population, rising internet penetration, and increasing investment in cloud computing. This region is expected to gain a larger share over the forecast period.

The Europe Supply Chain Management Software Market size was valued at USD 4.26 billion in 2018 to USD 5.94 billion in 2024 and is anticipated to reach USD 10.36 billion by 2032, at a CAGR of 7.1% during the forecast period. Europe captures 22.1% of the global market share, supported by regulatory emphasis on supply chain transparency and environmental compliance. Countries such as Germany, France, and the United Kingdom are investing in automation and digital twin technologies to increase efficiency and traceability. The Global Supply Chain Management Software Market in Europe is driven by demand from the automotive, pharmaceuticals, and food industries that require strict regulatory compliance and process optimization. Companies in the region prioritize risk management, sustainability tracking, and integration with carbon reporting tools. Cloud adoption is growing, with firms migrating from on-premise legacy systems to more agile platforms. Europe continues to show stable growth with a strong focus on data-driven supply chain performance.

The Latin America Supply Chain Management Software Market size was valued at USD 0.95 billion in 2018 to USD 1.37 billion in 2024 and is anticipated to reach USD 2.31 billion by 2032, at a CAGR of 6.6% during the forecast period. Latin America holds a modest share of the market but shows growing potential, driven by expanding manufacturing activity and logistics modernization. Brazil and Mexico are leading adoption, supported by investments in digital supply chain platforms across retail, food, and automotive sectors. Governments in the region are encouraging digital transformation through public-private partnerships and innovation incentives. Businesses seek SCM software to improve operational efficiency, reduce import-export delays, and manage complex regional distribution networks. Cloud-based deployments are gaining traction due to lower upfront costs and faster implementation.

The Middle East Supply Chain Management Software Market size was valued at USD 0.51 billion in 2018 to USD 0.68 billion in 2024 and is anticipated to reach USD 1.08 billion by 2032, at a CAGR of 5.8% during the forecast period. The Middle East is witnessing steady progress in SCM software adoption, driven by logistics expansion, diversification efforts, and digital infrastructure development. The UAE and Saudi Arabia are at the forefront, with investments in smart warehousing, free trade zones, and customs modernization. Enterprises in retail, oil and gas, and construction are adopting SCM platforms to improve traceability and supply visibility. National strategies such as Vision 2030 are pushing businesses toward automation and efficiency. Cloud technology is gaining traction due to its flexibility and alignment with regional digital transformation goals.

The Africa Supply Chain Management Software Market size was valued at USD 0.45 billion in 2018 to USD 0.70 billion in 2024 and is anticipated to reach USD 1.14 billion by 2032, at a CAGR of 6.2% during the forecast period. Africa is in the early stages of SCM software adoption but presents long-term opportunities across key economies such as South Africa, Kenya, and Nigeria. The need to improve supply chain reliability in agriculture, healthcare, and fast-moving consumer goods is driving demand for digital solutions. Infrastructure challenges persist, but growing mobile connectivity and fintech innovation are supporting digital adoption. Governments and development agencies are investing in logistics hubs and smart transport corridors to support regional trade. Software vendors focusing on affordable, modular, and mobile-compatible platforms are well positioned to enter this emerging market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Oracle

- IBM

- SAP

- Infor

- American Software Inc.

- Manhattan Associates

- Coupa

- Kinaxis

- GEP

- Blue Yonder

- QAD

- Blue Ridge Global

- Ramco

- Sage Africa

Competitive Analysis:

The Global Supply Chain Management Software Market features strong competition among established technology providers and emerging cloud-native vendors. Leading companies such as SAP SE, Oracle Corporation, IBM Corporation, and Manhattan Associates dominate with comprehensive product portfolios and global reach. These firms invest heavily in artificial intelligence, machine learning, and analytics to enhance platform capabilities. New entrants and regional players compete by offering industry-specific features, flexible pricing, and faster implementation timelines. Cloud-native vendors like Kinaxis, Blue Yonder, and Infor are gaining traction by delivering agile, scalable solutions tailored for modern supply chains. It reflects a market where innovation, integration, and customer-centric design determine competitive advantage. Strategic partnerships, acquisitions, and product upgrades remain key approaches for maintaining market leadership and expanding into high-growth regions.

Recent Developments:

- In February 2025, Accenture announced its agreement to acquire Staufen AG, a Germany-based management consulting firm specializing in operational excellence for manufacturing and supply chains. This acquisition, which closed on February 28, 2025, is set to expand Accenture’s capabilities in helping clients-particularly in discrete manufacturing industries such as automotive, aerospace, industrial goods, and medical equipment-optimize their entire value chains.

- In March 2025, Microsoft unveiled its 2025 release wave 1 for Dynamics 365 Supply Chain Management, with new functionalities scheduled for rollout from April to September 2025. The update introduces advanced features such as Copilot-driven demand planning, enhanced manufacturing quality management with digitized records, planning optimization integrating lean manufacturing principles, and improved contract lifecycle and vendor rebate management.

- In January 2025, Oracle introduced new AI-powered logistics and order management capabilities within Oracle Fusion Cloud Supply Chain & Manufacturing (SCM). These enhancements, now available, are designed to increase shipment visibility, lower trade costs, enhance transportation decision-making, and reduce shipment-related emissions, helping organizations optimize the efficiency and sustainability of their global supply chains.

Market Concentration & Characteristics:

The Global Supply Chain Management Software Market is moderately concentrated, with a mix of global technology leaders and niche solution providers competing across diverse industries. It features high barriers to entry due to complex integration requirements, long sales cycles, and the need for domain expertise. Large enterprises prefer established vendors with proven reliability, while small and mid-sized firms seek flexible, cloud-based solutions from agile providers. The market is characterized by rapid innovation, frequent product enhancements, and increasing demand for real-time analytics, automation, and platform interoperability. Vendor differentiation depends on technological capabilities, industry-specific modules, deployment speed, and customer support quality. It continues to evolve with rising customer expectations for transparency, customization, and operational efficiency.

Report Coverage:

The research report offers an in-depth analysis based on Solution Type, Deployment Type, Enterprise Size and Industry Vertical. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Cloud-native platforms will dominate new deployments, driven by demand for scalability and reduced IT overhead.

- AI and machine learning adoption will accelerate to improve forecasting accuracy and decision-making speed.

- Blockchain integration will expand, enhancing supply chain transparency, traceability, and transaction security.

- Demand for real-time visibility and predictive analytics will increase across logistics and procurement operations.

- E-commerce growth will continue to fuel investment in last-mile optimization and multichannel inventory management.

- Sustainability tracking tools will become essential features due to rising regulatory and consumer pressure.

- SMEs will drive adoption of affordable, modular solutions tailored to regional and industry-specific needs.

- Vendor consolidation will rise as major players acquire niche providers to expand capabilities.

- Emerging markets in Asia Pacific, Latin America, and Africa will offer significant growth opportunities.

- Customizable and interoperable platforms will gain preference to support dynamic global supply chains.