Market Overview

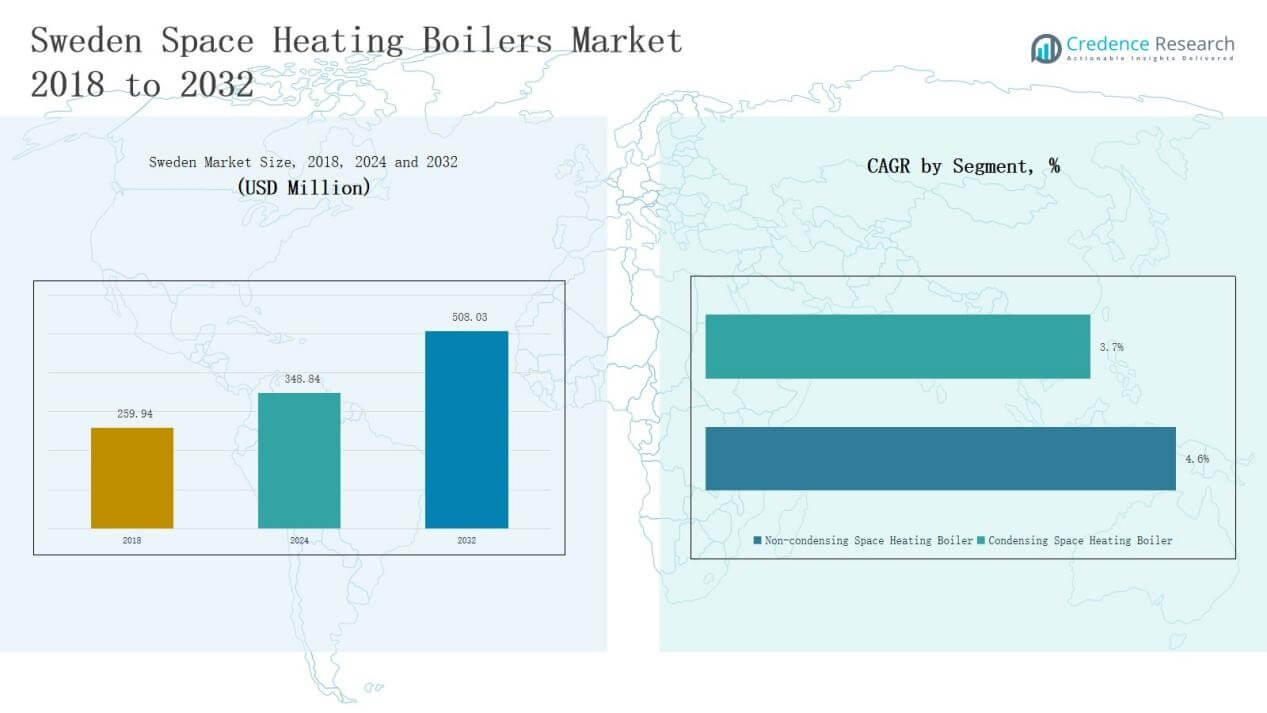

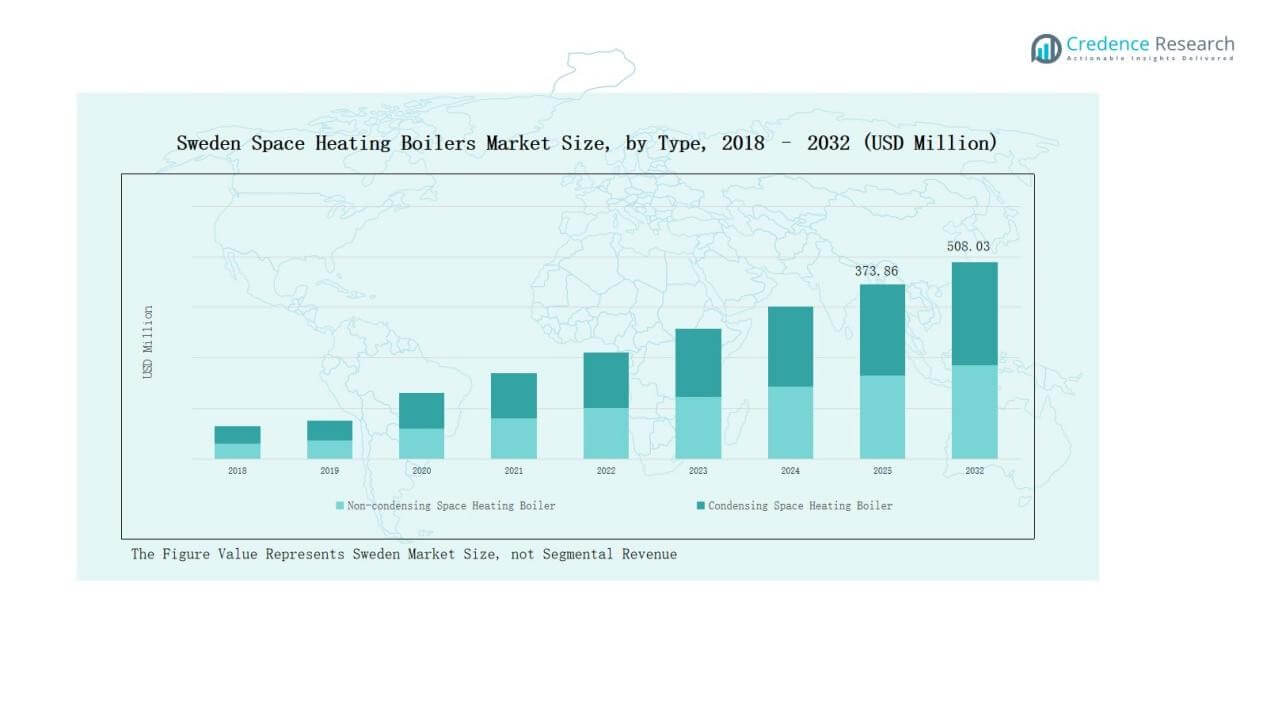

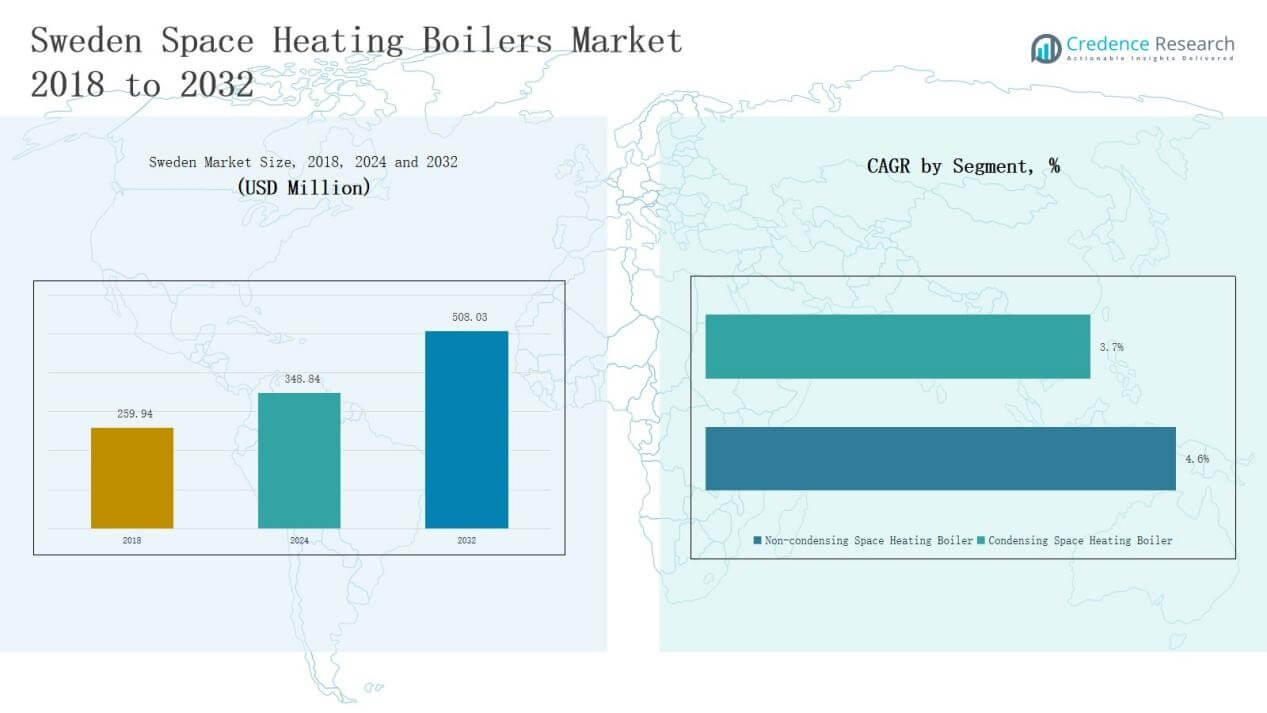

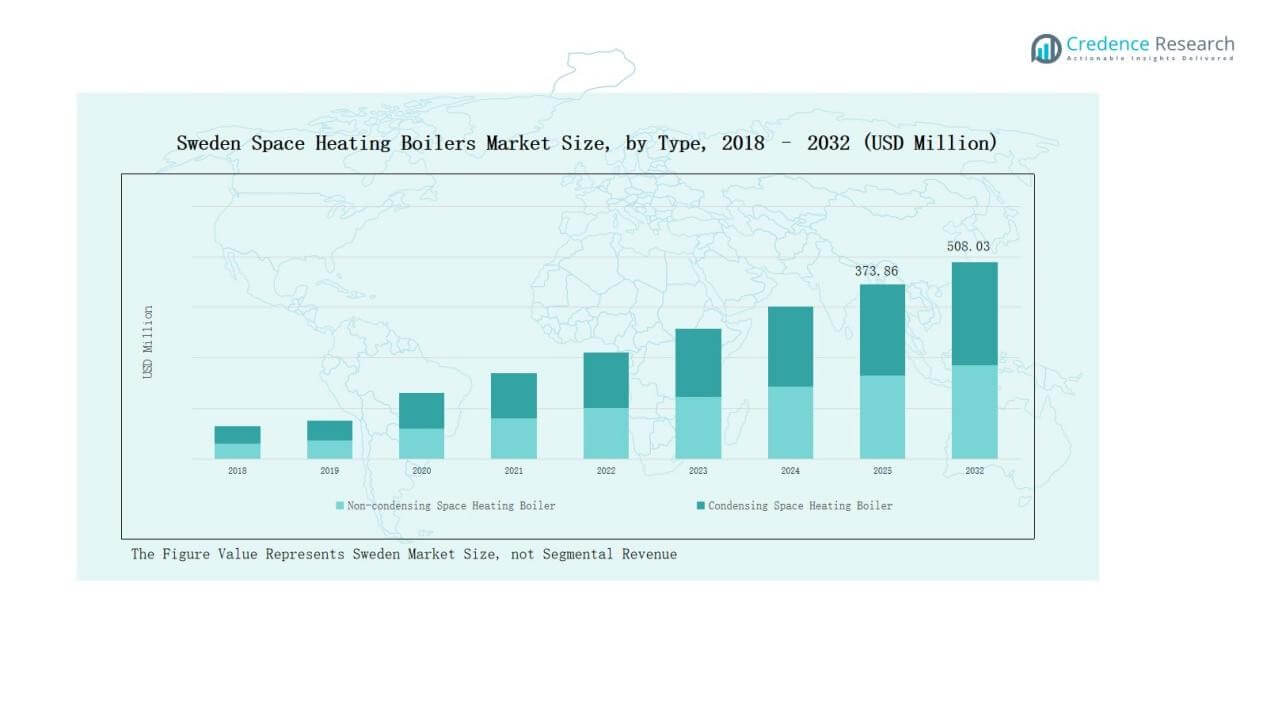

Sweden Space Heating Boilers Market size was valued at USD 259.94 million in 2018 to USD 348.84 million in 2024 and is anticipated to reach USD 508.03 million by 2032, at a CAGR of 4.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sweden Space Heating Boilers Market Size 2024 |

USD 348.84 Million |

| Sweden Space Heating Boilers Market, CAGR |

4.48% |

| Sweden Space Heating Boilers Market Size 2032 |

USD 508.03 Million |

The Sweden Space Heating Boilers Market is characterized by strong competition among domestic and international manufacturers. Leading players such as Nibe Industrier AB, Thermia Värme AB, Malmberg Water AB, Caleffi Nordic, Rika Heating, Benekov, Värmebaronen, Grundfos AB, Dantherm, and Keddy by Nibe drive growth through energy-efficient product portfolios, advanced condensing technologies, and region-specific solutions. Local firms benefit from deep market knowledge and government-backed incentives, while international brands enhance competitiveness with smart and hybrid systems aligned with sustainability goals. Northern Sweden leads the market with 37% share in 2024, supported by its colder climate, reliance on efficient heating, and extensive adoption of district heating networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sweden Space Heating Boilers Market grew from USD 259.94 million in 2018 to USD 348.84 million in 2024 and will reach USD 508.03 million by 2032, expanding at 4.48% CAGR.

- Condensing boilers lead with 69% share in 2024, driven by EU efficiency directives, decarbonization policies, and government incentives for sustainable heating adoption.

- Residential applications dominate with 61% share in 2024, supported by Sweden’s cold climate, district heating networks, and subsidies promoting efficient household systems.

- Gas-fired boilers hold 53% share in 2024, while electric boilers rise with 22% due to Sweden’s renewable electricity expansion and strong net-zero commitments.

- Northern Sweden leads regionally with 37% share in 2024, benefiting from colder winters, strong urban housing demand, and government-backed replacement of outdated heating systems.

Market Segment Insights

By Type

Condensing space heating boilers dominate the Sweden market with nearly 69% share in 2024. Their leadership is driven by strict EU energy efficiency directives and Sweden’s strong decarbonization policies. Consumers and businesses favor condensing models due to lower fuel consumption, reduced emissions, and government-backed incentives for eco-friendly heating upgrades. Non-condensing boilers continue to serve older installations but face declining demand as efficiency standards tighten.

- For instance, Bosch Thermotechnology reported that its condensing gas boilers achieve up to 94% efficiency, aligning with EU Ecodesign regulations.

By Application

The residential segment accounts for about 61% share in 2024, making it the largest application area. High adoption is supported by Sweden’s cold climate, extensive district heating networks, and government subsidies encouraging efficient household heating. Commercial use, holding around 25% share, benefits from modernization of offices and institutional buildings. Industrial applications, at 14%, remain smaller but steady, with investments focused on energy recovery and hybrid boiler systems.

- For instance, NIBE Industrier AB has expanded its range of air-water heat pumps specifically designed for single-family homes, with models such as the NIBE S2125 tailored for Nordic winters.

By Operation

Gas-fired space heating boilers lead with nearly 53% share in 2024, supported by Sweden’s well-established natural gas infrastructure and consumer preference for cost-efficient heating solutions. Electric boilers follow with 22% share, gaining traction due to Sweden’s renewable electricity supply and the country’s net-zero targets. Oil-fired boilers, holding 15%, are gradually declining as carbon taxes discourage fossil fuel reliance. Coal and other categories together account for about 10%, primarily in legacy systems or niche rural applications.

Market Overview

Key Growth Drivers

Rising Demand for Energy Efficiency

The Sweden Space Heating Boilers Market is expanding due to growing emphasis on energy-efficient solutions. Government policies aligned with EU directives strongly promote condensing boilers, which reduce emissions and lower fuel costs. Households and businesses increasingly prefer these systems to meet carbon reduction targets while cutting operational expenses. The availability of subsidies for upgrading heating systems accelerates adoption, making efficiency a decisive factor in purchase decisions and boosting the demand for modern boiler technologies.

- For instance, Viessmann launched its Vitodens 200-W condensing boiler line, featuring a Lambda Pro Plus combustion control system that automatically adjusts for different gas qualities, improving performance and reducing emissions.

Government Incentives and Regulations

Sweden’s regulatory framework acts as a key driver by pushing both residential and commercial sectors toward sustainable heating. Subsidies, tax incentives, and rebates encourage the replacement of outdated oil or coal boilers with eco-friendly alternatives. Stringent building codes require high-performance heating systems in new constructions and renovations. These measures not only ensure compliance but also create a strong pull for condensing and electric boilers. The result is a steadily growing market supported by favorable legislation and consumer benefits.

Cold Climate and Heating Demand

Sweden’s long winters and cold climate remain a fundamental driver of heating demand. Residential homes, commercial facilities, and industries rely heavily on efficient space heating solutions for comfort and productivity. This climatic need ensures stable demand for boilers across regions, with rural areas still depending on mixed fuel options while urban centers shift to gas and electric systems. The continuous need for reliable heating sustains replacement cycles, guaranteeing recurring demand for upgraded boilers that align with evolving energy efficiency standards.

- For instance, IVT (a Bosch Group brand) has expanded its Swedish portfolio of ground-source heat pumps and hybrid boilers, targeting replacement demand as homes switch from oil-based systems to high-efficiency alternatives.

Key Trends & Opportunities

Transition to Renewable Integration

A major trend shaping the Sweden Space Heating Boilers Market is the integration of renewable energy sources. Electric boilers powered by Sweden’s renewable-heavy grid gain momentum as the country pushes for net-zero targets. Hybrid solutions that combine biomass, solar thermal, or heat pumps with condensing boilers are emerging as a viable alternative. This transition offers opportunities for companies to innovate and diversify product portfolios, while customers benefit from sustainable, low-carbon heating choices aligned with long-term climate strategies.

- For instance, NIBE Industrier has introduced boiler–heat pump hybrid systems that allow homeowners to cut direct CO₂ emissions by up to 50%, leveraging Sweden’s growing interest in heat pump adoption.

Digitalization and Smart Boiler Systems

The adoption of smart heating solutions represents another growth opportunity. Consumers and businesses increasingly demand boilers integrated with IoT controls, remote monitoring, and predictive maintenance. These features improve efficiency, lower energy bills, and enhance user convenience. Manufacturers introducing smart-enabled condensing or electric boilers are well-positioned to capture growing demand. This digital shift also aligns with Sweden’s focus on smart homes and sustainable urban living, creating strong prospects for innovation-driven players in the market.

- For instance, Bosch Thermotechnology offers its EasyControl smart thermostat, which connects with condensing boilers and allows users to control heating remotely via a smartphone app. Features like geofencing and individual room scheduling (with additional Smart TRVs) help reduce energy consumption.

Key Challenges

High Upfront Installation Costs

Despite long-term savings, the Sweden Space Heating Boilers Market faces resistance from high initial costs of condensing and electric systems. Households with limited budgets often postpone replacements, especially in rural areas where subsidies are less accessible. The price barrier slows down adoption of advanced boilers, leaving non-condensing or oil-based systems in operation. Manufacturers and policymakers must address affordability concerns through financing options and targeted incentives to ensure wider market penetration of energy-efficient technologies.

Dependence on Natural Gas Supply

Gas-fired boilers dominate the market, but reliance on natural gas poses challenges. Sweden’s supply chain vulnerability, influenced by broader European energy dynamics, exposes consumers to price fluctuations and geopolitical risks. While the shift to renewables is underway, infrastructure still depends heavily on stable gas availability. This dependence makes the sector sensitive to external disruptions and accelerates the urgency for diversification into electric and hybrid boiler systems that reduce exposure to supply constraints.

Regulatory Compliance and Transition Pressure

Stringent EU and national regulations push boiler manufacturers and users toward eco-friendly alternatives. While these regulations support sustainability, they also create compliance challenges for both suppliers and consumers. Companies must continuously innovate to meet efficiency and emission standards, which raises R&D costs. End-users face financial and technical pressure to replace older systems within tight timelines. Balancing regulatory demands with affordability and technological readiness remains a key hurdle for the Sweden Space Heating Boilers Market.

Regional Analysis

Northern Sweden

Northern Sweden holds 37% share in 2024, making it the largest regional market. The region’s colder climate and longer winters sustain strong demand for space heating boilers across residential and commercial sectors. Consumers prefer condensing and gas-fired models due to efficiency and reliability during harsh weather. Government incentives further support replacement of outdated systems with modern boilers. The Sweden Space Heating Boilers Market in this region benefits from dense adoption in urban housing and district heating projects. It continues to attract investment in hybrid and electric boilers to meet emission goals.

Central Sweden

Central Sweden accounts for 34% share in 2024, supported by balanced demand across residential, commercial, and industrial sectors. The region combines urban expansion with established industrial hubs, driving boiler installations for both households and enterprises. Condensing boilers remain the preferred type, supported by policy-driven energy efficiency standards. The Sweden Space Heating Boilers Market here benefits from modernization programs and upgrades in older housing stock. It also shows rising interest in electric boilers as renewable electricity supply expands. Strong infrastructure and government subsidies make Central Sweden a growth-focused region.

Southern Sweden

Southern Sweden holds 29% share in 2024, positioning it as the smallest but steadily growing regional market. The region experiences milder winters compared to the north, but demand remains consistent due to high urban population density. Residential applications dominate, with consumers opting for compact and efficient condensing boilers. The Sweden Space Heating Boilers Market in this region gains from replacement demand in older buildings and new housing developments. Adoption of smart boiler technologies is more visible here, supported by digital infrastructure and sustainable housing initiatives. It continues to evolve with increasing reliance on electric and hybrid models.

Market Segmentations:

By Type

- Non-condensing Space Heating Boilers

- Condensing Space Heating Boilers

By Application

- Residential

- Commercial

- Industrial

By Operation

- Gas-fired Space Heating Boilers

- Electric Space Heating Boilers

- Oil-fired Space Heating Boilers

- Coal

- Others

By Region

- North Sweden

- Central Sweden

- Southern Sweden

Competitive Landscape

The Sweden Space Heating Boilers Market is defined by strong competition between domestic manufacturers and international players. Local companies such as Nibe Industrier AB, Thermia Värme AB, and Värmebaronen maintain leadership through deep market knowledge, energy-efficient portfolios, and strong service networks. These firms benefit from Sweden’s focus on sustainability by offering advanced condensing and electric boilers tailored to regulatory requirements. International brands, including Grundfos AB and Dantherm, strengthen competition by introducing digitalized and hybrid solutions that align with European energy transition goals. Product innovation, compliance with emission standards, and integration of smart technologies remain central strategies. Price competitiveness and government-backed incentives drive replacement demand, creating opportunities for players with scalable solutions. Partnerships with distributors and installers enhance customer reach across regions. The market continues to consolidate around brands that can combine reliability, efficiency, and renewable integration, positioning themselves as long-term providers in Sweden’s evolving heating landscape.

Key Players

Recent Developments

- In July 2025, Valmet secured an order to deliver a biomass-fired boiler and advanced flue-gas treatment system for a combined heat and power facility in Örtofta, Skåne.

- In January 2025, Qvantum, based in Åstorp, Sweden, raised €108 million in Series C funding to expand production of modular heat pumps and strengthen its geographic reach.

- In April 2025, Nevel entered into cooperation with the Municipality of Eda to plan the acquisition of Eda Energi AB, a company operating district heating distribution in Åmotfors.

- In October 2024, Babcock & Wilcox reached an agreement to sell its Swedish boiler business, Babcock & Wilcox Vølund AB, to AUCTUS Capital Partners for approximately $40 million.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Operation and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Condensing boilers will continue to dominate due to efficiency and regulatory support.

- Electric boilers will gain share as Sweden expands renewable electricity generation.

- Hybrid systems combining heat pumps and boilers will see rising adoption.

- Government incentives will accelerate replacement of outdated oil and coal boilers.

- Smart boiler technologies with IoT integration will attract residential and commercial users.

- Rural areas will shift gradually from oil-fired units to cost-efficient gas and electric systems.

- Industrial users will invest in boilers with energy recovery and emission control features.

- Local manufacturers will strengthen positions through sustainable and region-specific solutions.

- International players will expand by offering advanced digital and hybrid heating technologies.

- Sustainability policies will drive continuous innovation in eco-friendly boiler designs.